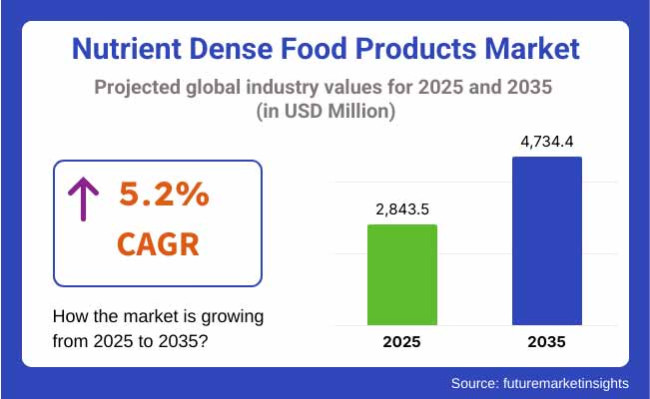

2022 size of market for nutrient dense food products is USD 2,467.5 million. Size of market of nutrient dense food products increased annually in 2023 and 2024, therefore, the size of market will be USD 2,843.5 million by 2025. Global sales between 2025 to 2035 will be in 5.2% CAGR and worth of sales of each year USD 4,734.4 million by 2035.

Increased interest in wellness and health has been the key market growth driver for high-nutrient foods. There is shifting demand for more-nutrient foods, and this is where demand originates. Consumers who are health-conscious seek superfoods, fortified foods, and whole foods, and they are extremely trendy.

Other than that, food companies are introducing new food products composed of foods rich in nutrients such as quinoa, chia seeds, kale, and blueberries to address changing nutritional needs of the consumers. Increasing demand for vegan and plant-based diets also drives demand for food rich in nutrients.

Convenience foods like prepared foods, snack bars, and packaged drinks that are fiber enriched are being utilized by retailers to address consumers with busy life styles. KIND Snacks and RXBAR are two companies which have been reaping the rewards of this trend through the offering of high protein and high fiber snack foods.

Moreover, consumer demand based on sustainability and health-oriented clean-label and organic are also propelling product innovation within the industry. Thrive Market and Daily Harvest are a few such prominent ones with organic, non-GMO, and sustainable food for dealing with consumer concerns regarding sustainability and genuineness. Synergized as a whole, convenience, health, technology, and sustainability are pushing the marketplace of nutrition-dense foods towards boom growth.

Consumer preference has moved full circle towards functional foods led by growing awareness for preventive health and immunity. Industry players have taken the cue to launch products with added vitamins, minerals, probiotics, and antioxidants. Trends are especially vigorous in urban markets, where the convenience nutrition imperative is fueling growth.

The below table portrays a comparative comparison of the six-month CAGR variation between the base year (2024) and the financial year (2025) in the business of global nutrient-dense food items. The contrast portrays significant deviations in performance and reflects revenue realization patterns, hence allowing stakeholders to better understand the growth pattern within the year. The first six months, or H1, are January to June. The second six months, H2, are July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.3% |

| H2 (2024 to 2034) | 4.7% |

| H1 (2025 to 2035) | 5.0% |

| H2 (2025 to 2035) | 5.2% |

During the first half (H1) of the years 2025 to 2035, growth would be 5.0% CAGR and, again further on, growth would be a little higher 5.2% rate during the second half (H2) of the decade. Continuing to the next period, H1 2025 up to H2 2035, CAGR would remain at 5.0% during the first half and increase to slightly 5.2% during the second half. During the first half (H1), the industry has witnessed a rise of 30 BPS while in the second half (H2), business has witnessed a decline of 20 BPS.

There is a competitive set of firms in Tier 1, which are large in leadership, revenue, and extensive market presence. They all possess high brand value and spend heavily on advertising and R&D.

Nestlé is among them, with efficiencies globally, it has been able to bring about an enormous array of nutrient-rich foods such as fortified breakfast cereals, infant nutrition, and functional beverages in markets. Another top company is Kerry Group, which is world-famous for its innovative taste and nutrition solutions to the growing need for nutrient-dense food and beverage products worldwide.

Tier 2 includes brands with less revenue than Tier 1 but have good market presence as well.For example, Glanbia plc has built a good reputation in the sports and performance nutrition category with high-protein and essential nutrient-dense products. Amara Beverage is another one, which is engaged in nutritionally dense functional beverages for health-oriented consumers seeking clean label and high-performance products.

They compete on niche, premium, and differentiation platforms by employing distinctive products and brand loyalty attracting such customers seeking something more than common food but instead health-positive, nutrient-dense food.

Tier 3 consists of new entrants and tiny players as fashionable brands in the oversaturated nutrient food market. These companies possess no distribution, yet their innovative and innovative business model and point of sale, local or online, have a way of propelling them to expand rapidly.

Examples are Nutrient Dense Foods LLC, making a variety of minimally processed high-nutrient foods for health-conscious consumers. The firms are also launching brands on social media and direct selling to keep pace with larger companies.

Trend Towards Functional Snacking

Shift: Market for high-value snacking foods is further evolved because consumers look for foods with added convenience and additional health value. Health-conscious consumers, particularly millennials and Gen Z, demand snacks providing additional health benefits through improved immunity, digestion, mental sharpness, and energy. It is being triggered by increased wellness, physical health, and active lifestyles with demand for convenient but healthy foods.

Functional snacking is the most popular theme of interest in Europe and North America today with consumers shunning calorie-empty treats to rather use protein-enriched, fiber-enriched, probiotic-enriched, vitamin-enriched, and adaptogen-dosed ones. Plant-based snack food that is clean-label and made with fewer handling steps and generic ingredients are also on the rise. The big brands are being Weathered out through functional snacking innovation.

Strategic Response: General Mills launched Protein Bars with probiotics and prebiotics in its Nature Valley brand, capitalizing on gut health consciousness, with 12% sales growth in the USA RXBAR launched RXBAR A.M., with oats, egg whites, and nuts that delivers sustained energy, propelling 10% growth in its breakfast bar functional category.

Graze introduced Superfood Bites in Europe-bite-sized portion control food made with nutrient-dense foods such as chia seeds, goji berries, and flax-to generate 15% online retail sales growth. Such launches are typical of how icon brands are not only talking about nutrition but disrupting snacking culture by introducing convenience-driven, healthier, and functional food to the consumer that resonates with today's consumer.

Growth in Plant Protein-Rich Foods

Shift: There is a plant-based food trend going on around the globe, and in food with high demand, plant protein-rich foods are witnessing record growth. Flexitarians, sports people, and green consumers are replacing plant protein for animal protein intentionally due to health, environmental, and moral grounds.

Asian-Pacific, Latin American, and North American markets alike are all witnessing record growth rates of consumption of plant protein due to environmental conscience over the contribution of animal agriculture as well as digestive, health, and cholesterol problems.

These are being led by the likes of pea protein, soy, chickpea, and lentils and being included in formulation with snacks, ready meals, and soft drinks. Shoppers increasingly want these foods to be rich in protein content without compromise on taste or clean-label acceptability.

Strategic Response: Industry leaders are making it a reality. Danone launched its Alpro Protein beverage brands in the UK and Germany, with 20g of protein per serving made from soy and pea protein, and driving their plant-based business 9% higher in the first quarter. In Latin America, NotCo, the plant-based disruptor, launched protein-fortified snack bars and plant-based dairy-alternative beverage portfolios fortified with chickpea and lentil protein and gained 7% of Brazil's plant-based category within a year.

In the United States, Oatly launched Oatgurt Protein, plant-protein-enriched dairy-free yogurt alternative, and achieved a 14% sales growth in its category among healthy consumers looking for dairy-free protein sources. Such efforts demonstrate how companies are embracing plant-protein innovation to address healthy, ethical, and sustainable food consumption.

Fortified Micronutrient Soft Drinks

Shift: Post-pandemic consumption reversed the trend of people's demand for fortified beverages with key micronutrients like Vitamin D, C, B-complex, magnesium, and zinc. The consumer views these nutrients as providing immunity protection, energy boost, stress management, and mental edge that is a health-protective action.

The consumer is substituting traditional sweet colas and caffeine-rich energy drinks with functional beverages that enhance health, energy, and hydration. The trend is gaining traction in the USA, UK, and India, where one-timer nutrition is being taken in the form of liquid convenience. Fortified water, juices, teas, and coconut waters are fast becoming the low-calorie, low-sugar, but nutrient-rich customer preference for hydration.

Strategic Response: Cola giants are riding this wave by introducing nutrient-enriched products. PepsiCo provided muscle to its Propel Immune Support brand with berry-flavored beverages that were Vitamin C and Zinc enriched, which resulted in a 13% North American sales boost.

Tata Consumer Products in India introduced Himalayan Vitamin Water, a line of premium fortified water, with magnesium and B-vitamins, which recorded 11% market growth in the half-year. Vita Coco has rolled out Vita Coco Boosted, coconut water with added electrolytes and B6/B12 vitamins, to welcome Europe's healthy, active shoppers with 10% category value growth.

These product introductions demonstrate the manner in which marketers are placing health-promoting nutrients into every day convenient beverage format, taking wellness mainstream and putting it within reach of mass market.

Growth of Nutrient-Dense Meal Kits and Ready Meals

Shift: Busy shoppers are increasingly going for convenience healthy meals which are time-positive but health-negative. There is a huge RTC and RTE foods trend which arrives fortified with natural nutrients like high-protein, whole-grain, and superfood inclusions, particularly in urbanized North America, Europe, and East Asia.

It has also been driven by home-based working, insufficient time to spend on food preparation, and greater focus on healthy nutrition. Consumers are moving away from ultra-processed dinner meals and towards food that has open nutritional content, understandable labels, and frequently plant or allergy-sensititve ingredients.

Strategic Response: Power brands are recreating ready meal and meal kit options based on nutrition, taste, and ease.Nestlé Fresh launched a Fit Range of high-protein, low-carb, and low-calorie ready meals that recorded 16% subscription growth in the USA Gousto launched Nutrient-Dense Recipes on the platform of foods like quinoa, lentils, and kale with required vitamins provided as supplements in the UK and achieved a 12% sales increase among health-conscious customers.

Oisix launched Wellness Meal Kits for specific health targets in Japan-heart health and weight management-on the platform of pre-measured, nutrient-dense foods. Kit sales increased 9% in the first quarter. Such tactical action shows how leading players are focusing on the demand for healthy convenience foods in order to ensure the consumers adhere to nutritional targets without lengthy preparation but get the flavor and well-sustained nourishing food.

The following table shows the estimated growth rates of the top five territories. These countries are poised to exhibit strong consumption of nutrient-dense food products through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 4.3% |

| Germany | 4.6% |

| China | 5.7% |

| Japan | 4.9% |

| India | 6.2% |

Nutrient-dense food in clean-label standing, highlighting whole, recognizable foods and less processing, is appealing to USA consumers in the United States. Demand for functional ingredients such as plant protein, omega-3 fatty acids, probiotics, and adaptogens is propelling innovation through segments from snacking bars to dairy alternatives. Increased activity levels also spurred expansion for convenience and meal replacement including RTD smoothies and portable protein drinks.

USA companies are addressing this challenge by being transparent with regards to sourcing and sustainability, largely attributing to non-GMO, organic, and regenerative agriculture. RXBAR and Orgain represent both product lines of super-wholesome product launches adding fresh health claims to familiar product lines, fueling a 10% surge in sales of clean-label products by 2024.

Further, FDA's changing expectations around fortification with nutrients and health claim statements are stimulating innovation, as is expanding retail buying through digital commerce, with more consumers entering into relationships with niche high-nutrient products. Growing aging populations are also fueling demand for specially developed products with emphasis on bone, cognitive, and immune health-reflecting growing diversification of high-nutrient product development in the USA

Germany's high-nutrient foods health food market is booming as consumers interested in health seek fortified and plant-based foods for daily eating. Iron-, calcium-, and vitamin-enriched bakery products, dairy-free alternatives, and meat alternatives enriched with iron, calcium, and vitamins are at the forefront of demand.

German consumers are especially environmentally conscious and look for organic, regional products and recyclable packaging, in line with EU Green Deal aspirations. Alnatura and dmBio brands have thus changed to include superfoods like chia, flaxseed, and ancient grains backed by natural nutritional boosts.

This has accounted for an 8% rise in foodstuffs with enhanced sales of nutrients' quality in 2024 alone. In addition, the emergence of functional ingredients and acceptance of novel foods is supported by European Food Safety Authority (EFSA) approval.

Greater trend of flexitarianism in Germany also supports healthier and nutrient-rich plant products, especially among young people. Ongoing expansion of health food store web sites and meal box subscription companies providing fortified, clean-label meal kits contributes to market penetration in urban centers.

Food safety concerns, urbanization, and growing health consciousness fuel China demand for nutrient-rich foods. Convenience and health lead consumers to choose fortified dairy, functional beverages, and protein snacks. Domestic giants Yili and Mengniu provide healthy food in traditional flavours, whereas international players add lines of functional foods.

Online platforms enhance availability and information delivery, fueling growth. Government support under the "Healthy China 2030" initiative also encourages development of fortified foods. An increasing ageing population also adds pressure on demand for ingredients for bone and immunity, making China a rapidly evolving market for high-nutrient solutions.

| Segment | Value Share (2025) |

|---|---|

| Sports Nutrition (By Application) | 28.7% |

The wellness-oriented lifestyle and fitness culture are driving the demand for functional and nutritionally fortified drinks, especially in the sports nutrition category. The drinks, normally fortified with proteins, amino acids, vitamins, and electrolytes, are being used by athletes, coaches, and more and more mass consumers seeking wellness support.

Ready-to-drink protein drinks and sports drinks are particularly favored since they are convenient to drink, providing hydration, muscle repair, and energy in go forms. Shear brands like Muscle Milk and Gatorade extended their lines of high-nutrition drinks by launching plant proteins and low sugar levels in accordance with clean-label and wellness trend trends.

The pull is not only performance but also to stay healthy overall, and the products are being used as meal replacement or exercise recovery. Functional beverages are positioned broadly with forceful promotion in energy, endurance, and recovery among urban working professionals and youth. Long-term category and trend building are being propelled by trends such as shelf-stable packaging, green bottles, and revitalizing taste such as berry and tropical fruit flavors.

| Segment | Value Share (2025) |

|---|---|

| Protein (By Ingredients) | 28.9% |

Global concern for fitness, weight management, and muscle rehabilitation has fueled astronomical demand for protein-enriched nutrient-dense food products. Protein, the most critical macronutrient, is no longer the reserve of sports nutrition; it now permeates legacy categories like breakfast cereals, dairy, snacks, and even beverages.

Functional foods firms are responding to this trend by creating foods on the basis of whey, casein, soy, pea, and rice proteins to cater to the demand for variety in the taste of consumers, i.e., vegan and allergen groups. Food firms such as Nestlé, Kellogg's, and General Mills have introduced high-protein cereals, bars, and yogurts with a prominent labeling of protein per serving to sell to health-conscious consumers.

Convenience of using protein powders and ready-to-consume protein shakes has also facilitated adoption, most notably from busy professionals and competitive athletes who require post-workout recovery foods. Fortification with protein also enhances satiety and hence becomes a bestseller among weight management and diabetic foods.

Improved protein extraction and flavor masking have allowed manufacturers to add proteins without compromising taste or texture, a vital factor in consumer acceptability. Vegetable protein has also been adopted with the shift towards clean label and sustainable sourcing by sustainability and health-seeking consumers.

Demand for proteins is also on the rise in the pet food segment, where high-protein and premium pet food dominates. Growing awareness of protein as an integral part of health and well-being and convenience, protein remains the most sought-after ingredient in nutritional foods, accounting for most of the growth to 2035.

Nestlé, General Mills, and Danone are some of the giants dominating the market for high-nutrient food products with active product innovation, active brand building, and health-oriented innovation. The giants have been able to meet the needs of the consumers by providing diversified high-nutrient foods that are enriched with target proteins, vitamins, minerals, and functional ingredients.

Their well-established long-term R&D pipelines have helped them to come up with in-house proprietary brands for targeting niche segments like protein-enriched yogurts, vitamin-enhanced beverages, and high-fiber breakfast cereals for meeting specific nutritional needs like weight management, muscle recovery, and digestive health.

Thus, they are in a position to grow their customer base as well as establish a niche of their own separate from the entrants. Apart from that, sustainability and clean-labeling were the drivers of product trust building.

The companies are spending large on responsible sources, low-processing, and transparent-labeling towards trying to keep the impending environmental and health crisis at bay. Strategic buying and selling off and partnering with start-ups under functional foods and plant-based foods category enabled them to innovate and portfolio diversify.

For instance:

As per application, the industry has been categorized into Frozen Food, Bakery, Infant Formula, Confectionery, Breakfast Cereals, Beverages, Sports Nutrition, Dairy Products, and Pet Food.

This segment is further categorized into Minerals, Vitamins, Protein, Carbohydrates, Amino Acids, Anti-oxidants, and Fibers.

This segment is further categorized into Online and Offline Sales Channels.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The global industry is estimated at a value of USD 2,843.5 million by 2025.

Some of the leaders in this industry include Nutrient Dense Foods LLC , Crystal River Organics , Amara Beverage , Nutrient Foods , Nutri Fusion , Nestlé S.A. and others.

The Asia Pacific region is projected to hold a revenue share of 36.8% over the forecast period.

The industry is projected to grow at a forecast CAGR of 5.2% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Phytonutrients Market Analysis by Product Type, Application and Region through 2035

Micronutrient Powders Market Trends – Growth & Industry Forecast 2025-2035

Crop Nutrient Management Market

Plant Nutrient Testing Equipment Market

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Crop Micronutrient Market Insights - Precision Farming & Yield Optimization 2025 to 2035

At-Home Micronutrient Testing Industry Share, Size, and Forecast 2025 to 2035

Sulfur-Based Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Secondary Nutrients Market Size and Share Forecast Outlook 2025 to 2035

Condensed Whey Market Size and Share Forecast Outlook 2025 to 2035

Goldenseal Market

Condenser Cleaners Market

Vegan Condensed Milk Market Analysis by Skimmed, Part skimmed, Sweetened and Other Types Through 2035

V Type Fin Condenser Market Size and Share Forecast Outlook 2025 to 2035

Synchronous Condenser Market Growth - Trends & Forecast 2025 to 2035

V Type Air Cooled Condenser Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condenser Market Size and Share Forecast Outlook 2025 to 2035

Teff Products Market

Detox Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algae Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA