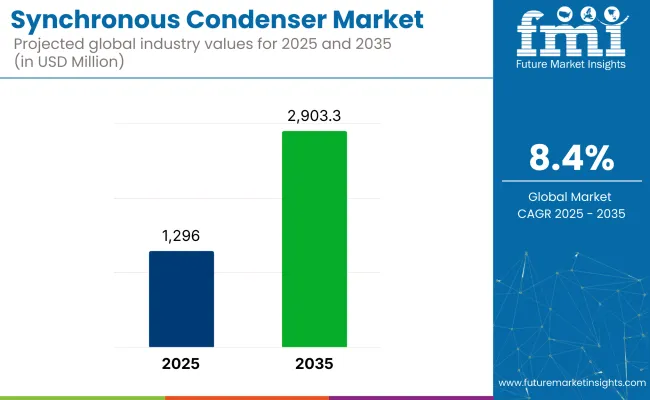

The synchronous condenser market is projected to experience steady growth between 2025 and 2035, driven by increasing demand for grid stability, reactive power compensation, and renewable energy integration. The market is expected to grow from USD 1,296.0 million in 2025 to USD 2,903.3 million by 2035, reflecting a CAGR of 8.4% over the forecast period.

Synchronous condensers have become a key component for the electrical grid to stabilize through the inertia contribution, voltage support, and reactive power compensation, Power System reliability in modern grids is mainly ensured by this mechanism. As the world distances from conventional energy and embraces energy sources like wind and solar, grid operators are now substituting Synchronous condensers with these to decrease power fluctuations, enhance power factor correction, and avoid voltage instability.

The decommissioning of conventional thermal power plants and the increase in distributed energy sources has led to the need for grid stabilization, and as a result, synchronous condensers have become a necessity for modern energy systems. In addition to that, the integration of highly-efficient power electronics, AI-based grid monitoring, and predictive maintenance solutions is another effective factor in the market expansion.

The growing acceptance of renewable energy, the need for solar voltage regulation, and the modernization of power transmission systems are the main drivers of market growth. The necessity of balancing energy sources, such as wind and solar, has pushed utilities to turn to the investment in synchronous condensers to keep working the grid and give it stability.

Moreover, the government projects for green energy integration, smart grid development, and power cable network distribution are the main drivers in the use of synchronous condensers in factories, large power plants, and high-voltage direct current (HVDC) transmission lines. The development of hydrogen-based energy storage and grid-resilient technologies is also opening new market opportunities.

North America is the dominant market for synchronous condensers fueled by electrical grid modernization projects, growth in renewable energy production, and the withdrawal of fossil fuel-based power plants. The United States and Canada are continuously increasing their investments in smart grid infrastructure, large energy storage production, and reactive power compensation technologies to ensure reliable and efficient grid operations.

The closure of traditional coal and nuclear plants has led to the introduction of synchronous condensers by utility companies, who are committed to revitalizing the lost inertia and voltage regulation. Synchronous condensers are further, being in demand in high voltage transmission networks as the amount of wind and solar energy installations grows, in addition, to the federal policies that back them up regarding power system stability.

Europe is registering considerable growth, with Germany, the UK, France, and Italy at the front. The transition towards decarbonization, the decentralization of energy, and the digitalization of grids are the factors shaping energy infrastructure in these countries. The EU’s Renewable Energy Directive and Green Deal policies have led to the investment in grid balancing solutions, power transmission upgrades, and smart substation automation.

Germany, as a front-runner in wind and solar energy adoption, has decided to treat its solar and wind energy-induced grid fluctuations by the incorporation of synchronous condensers. The UK and France are prioritizing high voltage transmission networks' resilience, integration of offshore wind farms in their grids, and dynamic power factor correction, thus the synergy develops with the push of the market.

Asia-Pacific is at the forefront of the fastest-expanding market. The led countries including China, Japan, India, and South Korea led to energy infrastructure enhancement, the generation of wind and solar energy, and smart grid development projects. This region’s population growth, increasing electricity demand, as well as their need for energy security are, at the moment, the main factors driving the need for high-performance synchronous condensers.

China being the number one solar and wind energy producer is far out the most looking into new energy investments and hybrid energy storage systems along with AI-powered energy management systems. Besides, India's efforts in extending the smart grid, renewable energy development along with the government's support in the electrification program are effectively leading to the installation of synchronous condensers in HVDC transmission networks and factories with industrial power.

Japan and South Korea are adopting the compact-sized, AI-integrated synchronous condensers while they are staying upfront with technology developments in energy management systems and grid automation adding value to urban resilience in dense cities and in industrial areas.

Emerging markets such as Brazil, Mexico, Saudi Arabia, and South Africa are rapidly realizing the need for synchronous condensers in grid fortification, renewable energy stabilization, and industrial power reliability. The current trend in the middle east to develop solar energy projects, smart cities, with high-voltage transmission grid deployment, has led to the need for power supply security and reactive power solutions.

Latin America, especially Brazil and Mexico's focus on expanding their wind and hydroelectric power sectors has, in turn, increased the adoption of synchronous condensers for grid stability and energy efficiency. The rise of Africa's off-grid electrification projects, development of industrial power lines, and renewable energy through large solar plants project investments stands as a further significant factor in the industry.

Challenges

High Initial Investment & Maintenance Costs

Synchronous condensers necessitate a high amount of capital for installation, commissioning, as well as integration into the existing power grid. Unlike traditional capacitors, these machines are equipped with moving parts which are responsible for higher operational and maintenance costs. The owner of the long-term plant has to pay not only for regular lubrication and cooling system management but for also component replacement, which in turn, makes it a bit challenging for cost-sensitive power utilities to adopt.

Grid synchronization complexity, site selection, and custom engineering are the main contributory factors of increased installation time and labor costs which, in turn, limit market penetration in developing economies with constrained infrastructure budgets. To tackle these issues, manufacturers' focus is on modular condenser designs, AI-assisted predictive maintenance, and hybrid solutions that integrate synchronous condensers with battery storage.

Integration Challenges with Renewable Energy Systems

Synchronous condensers are the ones which power stability while at the same time, having problems in the integration of such types of machines with the new smart grid, variable renewable energy sources, and decentralized power generation networks. Many of the legacy grid systems need to be modified in switchgear, power control systems, and fault detection mechanisms to accommodate the synchronous condensers that are required, hence, increasing complexity and costs.

Synchronous condensers are being replaced with newer solid-state grid stabilizers, FACTS (Flexible AC Transmission Systems), and battery-based energy storage solutions as utilities move towards flexible and decentralized energy systems. Amid this competitive environment, manufacturers of these synchronous condensers are coming up with digitally controlled, AI-integrated reactive power products, further enhancing the grid structure.

Opportunities

Expansion of Renewable Energy & Smart Grid Networks

With the fast-growing proportion of wind, solar, and hydroelectric power in the energy mix, grid stabilizing technologies such as synchronous condensers are increasingly demanded. Their functionality spans voltage fluctuation mitigation, support of frequency regulation, as well as grid resilience enhancement, thus, deeming them as the fundamental units of power systems of the next generation.

Setting the renewables trajectory and targeting carbon neutrality goals, governments have been backing programs in smart grid technologies, microgrid development, and the modernization of the grid which helps the growth of adopted synchronous condenser. Along with that, the manufacturers are teaming up with energy utilities and grid operators for manufacturing small, efficient condensers which will be high tech with integrated digital commissioning.

Advancements in AI & Digital Grid Monitoring

The application of AI-based analytics, alongside real-time condition monitoring, and IoT-enabled diagnostics has brought big changes in the synchronous condenser technology. Stylish control systems operate the power factor corrective measures, minimize the confusion connected with maintenance downtime, and are able to foresee potential system failures, therefore, improving efficiency.

The utilization of AI through predictive maintenance encourages companies to discover possible faults before they happen and, as a result, reduces operational disruptions. Enterprises that are surfing on cloud-based platforms such as the SCADA (Supervisory Control and Data Acquisition) integration, digital twin modeling, and remote asset management will gain a benefit that is advantageous in the power grid section that is constantly growing and evolving.

With the revolving core of developments in building energy resilience, integration of renewable sources, and extended functionalities of power electronics, the synchronous condenser market is opening the door for manufacturers of energy equipment, power utilities, and smart grid solution providers to exploit unthinkable opportunities worldwide.

The synchronous condenser market registered steady growth from 2020 to 2024, underpinned by increased demand for grid stability, reactive power compensation, and voltage regulation in power transmission networks. The shift to renewable energy sources, particularly wind and solar power, forced the need for synchronous condensers in order to maintain grid reliability.

The decommissioning of traditional fossil fuel power plants resulted in higher investments in the grid infrastructure which further pushed the market's development. Automation technology advancements, energy efficiency improvements, and digital-based monitoring systems have strengthened the performance and trustworthiness of synchronous condensers.

In the years 2025 to 2035, the market is anticipated to have noticeable growth, which will be mainly because of the global energy shift, grid modernization programs, and technology improvements in high-voltage power lines. The relationship of synchronous condensers with smart grid technologies, the digitalization from artificial intelligence, and the inclusion of energy storage will be the core matrix in the evolution of the trade. Additionally, the drive for more sustainable and less carbon-intensive power systems will spur high-growth with synchronous applications both in developed as well as in developing economies.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with grid stability and reactive power compensation standards. |

| Technological Advancements | Digital monitoring systems and automation in synchronous condenser operations. |

| Industry-Specific Demand | High demand from utilities, power generation, and industrial sectors. |

| Sustainability & Circular Economy | Initial efforts in reducing operational losses and improving energy efficiency. |

| Market Growth Drivers | Rising investments in renewable energy and grid modernization. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter regulations for grid reliability, renewable integration, and energy efficiency. |

| Technological Advancements | AI-powered grid management, hybrid solutions integrating energy storage, and improved efficiency designs. |

| Industry-Specific Demand | Expansion into microgrids, offshore wind farms, and next-generation energy infrastructure. |

| Sustainability & Circular Economy | Full-scale adoption of eco-friendly materials, lifecycle sustainability, and carbon-neutral grid solutions. |

| Market Growth Drivers | Increased adoption in energy storage integration, hydrogen-based power grids, and smart cities. |

The United States synchronous condenser market is showing profound growth considering the increasing concentration on energy security, the national grid's modernization, and the incorporation of renewable energy sources. Since the country is turning into a greener energy mix, synchronous condensers are doing the central job in switching off power loads and keeping the grid voltage secured.

The enhancing sharing of solar and wind energy has caused an increment in the required reactive power compensation and the synchronous condensers are being widely raised in support of voltage stability and frequency regulation. Government strategies like the Grid Resilience and Innovation Partnership (GRIP) and the tax incentive program for grid modernization projects further validate this. Additionally, the steel, aluminum, and chemical processing companies are embracing synchronous condensers as they amend power factor and cut down on energy losses to the security of their operation and efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

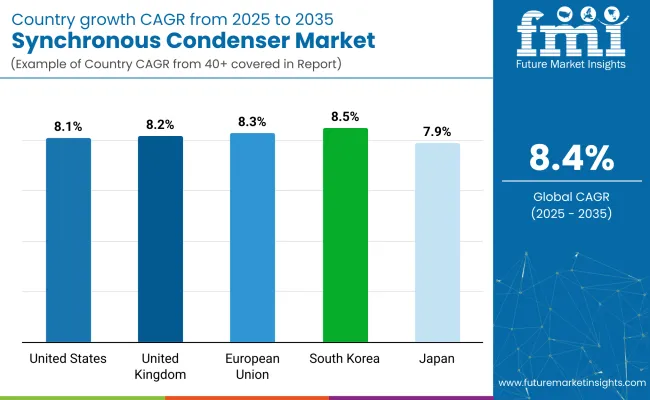

| United States | 8.1% |

The UK synchronous condenser market is expanding as the country speeds up its move toward a low-carbon energy system. The government’s decision to take out coal and natural gas power plants out of circulation has released the demand for voltage regulation and stability in the grid operation which has greatly boosted the industrial requirement for synchronous condensers.

The integration of offshore wind farms, which make significant contributions to the UK’s renewable energy mix, has, in turn, increased the demand for reactive power compensation. Synchronous condensers are the ones being chosen to guarantee stable network operations and avoid drift in the voltage due to the intermittent nature of the renewable forms of energy.

To this end, large-scale battery storage systems are being installed and smart grid programs are being developed to improve grid flexibility, thereby supporting the market's expansion. The rejuvenated power grid infrastructure and energy efficiency demand in the industrial field are also the contributors to market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.2% |

The European Union synchronous condenser market is attracting customers because of the rigorous climate policies, more investments in renewable energy projects, and the necessity of achieving the grid's stability. The EU's plan to attain carbon footprints by 2050 will force the bandwagon of solar and wind farms to move towards the demand of the synchronized controllers to equalize the power fluctuations that such deployment cause.

With the region extending its cross-border electricity networks and interconnections to various national grids, it is synchronous condensers that are heavily drained to secure the boundary for frequency stability and power quality. Transmission network modernization, along with energy storage solutions' integration, is the other main factor driving market development. Besides, electric vehicles that run on electricity and distributed energy generation among the public has made a strong case for voltage regulation, thus helping out with the synchronous condensers.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.3% |

Japan’s synchronous condenser market progresses rapidly, mainly because of the country’s growing concern for energy security and its focus on boosting grid reliability. With the gradual reduction of nuclear energy that followed the Fukushima disaster, Japan has increased its use of solar and wind, thus needing, for stability, synchronous condensers.

The Japanese government has introduced initiatives advocating smart grid technology and synchronous condensers are the ones that get together with battery storage systems for the later to enhance the voltage regulation. What is more, the manufacturing sector has surged ahead in optoelectronics, automotive and semiconductor industries, which require the supply of power that is invariant, thus the market for synchronous condensers experiences the pressure for the items. The project is also supported by programs that upgrade the transmission and distribution power lines.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.9% |

South Korea is quickly emerging as the synchronous condenser market as the organization enhances its environmental sustainability impact, automates installations, and pushes green technologies. The encoder soldering project is backed by the valiant efforts of the government to minimize the reliance on coal while reinforcing the power grid.

The increased number of wind and solar photovoltaic projects means that more and more synchronous condensers are deployed to balance out voltage variability and to ensure a steady power flow. Furthermore, South Korea's industrial sector which includes heavy manufacturing and petrochemicals will rely on only steady quality of power, thus the condensers become a necessity in high-energy-consuming industries. Smart grid initiatives are backed by the government while HVDC projects push the market even further.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.5% |

Latest synchronous condensers are widely in use throughout the power utilities and industrial sectors as they are capable of improving grid stability and reliability. Advancement in power electronics and automation has modern synchronous condensers that are not only more efficient but also have lower maintenance costs and better grid integration capabilities. They provide dynamic voltage support, thus compensating for reactive power fluctuations and helping to maintain a stable power factor.

The soaring penetration of renewable energy sources in different parts of the world, especially in North America and Europe, is another factor pushing the demand for new synchronous condensers. Furthermore, governments and regulatory authorities are promoting the establishment of grid stabilizing infrastructure which goes a long way in supporting the market growth in this area.

Moreover, the increase in energy demands and the emergence of strict law-based power quality measures have made it necessary for the deployment of advanced synchronous condensers which are regarded as one of the main parallel actions for utility and industrial power networks searching for sustainable energy solutions.

The refurbished synchronous condensers are picking up popularity for being an affordable utility and power conditioner choice. The units are mostly the ones reused from disassembled generators, being a green and economically viable replacement for the line of such condensers that are being sent to landfills. Plenty of power utility companies are choosing refurbished condensers, not just to take the most of the resource but also to save capital in the long run.

This segment is likely to be boosted by the increase in the number of retrofitting projects due to the presence of old power infrastructures in developing countries. The refurbishing method also means that the constituent parts have been changed that include efficiencies, reducing costs, making downtime minimal, and thus, bringing them in line with all modern grid requirements making them attractive to grid operators.

With the global energy market moving forward at a rapid pace, refurbished synchronous condensers will remain a crucial part of the equation while achieving affordability for communities where these are the limitations of the economic resources.

Air-cooled synchronous condensers take the lead in having an uncomplicated way of operations and are very low maintenance too. These condensers completely avoid complicated cooling systems, thus, they're made for use in medium-power applications in commercial sectors and industries. Their sleek structure and ease of installation are the main factors responsible for their widespread growth in areas with moderate climates.

Moreover, the air-cooled systems are distant from the possibility of coolant leakage, thus increasing their reliability and operation safety. As the importance of cutting maintenance down and increasing the life-spans of systems is diverted, the air-cooled synchronous condensers demand is rising. The usage of digital monitoring systems in air-cooled arrangements has been beneficial not just for the equipment but the added possibility for real-time diagnostics and predictive maintenance to ensure long-term optimal performance also.

Hydrogen-cooled synchronous condensers have become a common choice in high-power applications as they are good at cooling and also bring in the capacity to handle more reactive power. The excellent thermal conductivity of hydrogen promotes heat dissipation which in turn means less operational loss and better performance.

This climate-enhancing technology has been predominantly adopted by large power utility operators and industrial establishments that aim for stable voltage. Hydrogen-cooled synchronous condensers have also become the sweet choice among the mentioned areas.

The use of hydrogen as the cooling medium makes higher efficiency levels possible, at the same time prolonging the operational age of the systems, and hence incorporating them in areas that handle intense applications mostly. Technology growth in hydrogen-cooled condensers is making safety features better and power management optimal leading to a more extensive footprint on large-scale industrial networks.

The Swivel Couplers market is in a phase of stable development owing to the progressive increase in the market for building, infrastructure, and industrial applications. Swivel couplers, which are also called scaffold swivel clamps, are important parts of scaffolding systems. They enable the flexible linking of the transoms at various angles. Their prevailing market share in housing, business, and industrial construction projects, as well as maintenance and rehabilitation work, led to prodigious growth in the sector.

The urbanization and the increasing necessity for high-rises and modern infrastructure are the major drivers of adopting scaffolding solutions that are fitted with high-tech couplers. The governments of many countries across the globe are laying down safety rules that demand the use of good quality swivel couplers, which will in turn, ensure the safety of workers and the strength of the structure.

Furthermore, development in material science has caused the creation of couplers which are both high-strength and sufficiently resistant to corrosion, as well as being lightweight. Consequently, the market is experiencing sustained development. The leading producers in the industry are directing their energies towards the extension of their distribution channels and the elevation of the cost-effectiveness of their goods as a strategy to go on with their competitiveness.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Layher Holding GmbH & Co. KG | 18-22% |

| HAKI AB | 15-18% |

| PERI Group | 10-14% |

| Kwikstage Scaffolding | 8-12% |

| BrandSafway | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Layher Holding GmbH & Co. KG | A global leader in scaffolding and coupler solutions, known for its high-quality, durable, and safety-compliant products. |

| HAKI AB | Specializes in advanced scaffold systems, including high-performance swivel couplers for construction and industrial applications. |

| PERI Group | Provides innovative scaffolding solutions with a focus on modular designs and enhanced safety features. |

| Kwikstage Scaffolding | Offers cost-effective and versatile scaffolding components, including heavy-duty swivel couplers. |

| BrandSafway | Focuses on industrial and commercial scaffolding solutions, with a strong emphasis on regulatory compliance and worker safety. |

Key Company Insights

Layher Holding GmbH & Co. KG.

Layher is atop in the world in providing scaffolding solutions and its swivel couplers are of top performance and international safety standard compliant. The company emphasizes the importance of the longevity of the product, the new inventions, and the security that is the most important to the customers to keep its edge over competitors.

Layher is actively increasing its operations all over the world since the company is investing in cutting-edge and efficient production and extensive distribution. As a symbol of engineering excellence, Layher offers easily installable and highly adaptable modular scaffolding. The firm has paved the way through the smart construction technology, such as digital monitoring system to be more efficient and safe in the scaffolding systems all over the world.

HAKI AB

HAKI AB is a leading player in the scaffolding and access space, with the swivel couplers that provide fast secure assembly and a high level of security. The company's design on safety, efficiency, and lightweight has rendered HAKI the right choice in construction and industrial sectors.

HAKI is investing in research and development which is intended to heighten the carrying weight and the durability of its scaffolding components. With its stronghold in Europe, HAKI is further securing its future by forming alliances with construction companies in North America and Asia. Further on, the commitment of the company to sustainability led to the use of recyclable materials in its production processes which led to a decrease in environmental impacts.

PERI Group

PERI Group is known for its new ideas in formwork and scaffolding solutions. The firm makes available several types of swivel couplers which focus much on ease of use and structural stability. PERI keeps on placing smart technologies into its scaffolding systems so that they could be safer and more efficient, with a less labor cost.

The company is now also offering digital design tools, so the builders can visualize and optimize scaffolding setups before deploying them. PERI introduced manufacturing processes that are not only waste-free but also energy-efficient. This commitment further led to the reputation of PERI as a quality and reliability custodian, thus making it a partner of choice for large-scale projects in different parts of the globe.

Kwikstage Scaffolding

Kwikstage Scaffolding is a notable entrepreneur in adaptable scaffolding systems, which includes with the help of heavy-duty applications, additional strong swivel couplers. The focus of the company is on cost-saving and flexibility, which makes it a leading bidder of scaffolding solutions that are variable to construction projects site-specific requirements.

Kwikstage continues to adapt and improve its products by employing materials that are of a higher quality which will in turn lead to longer-term scaffolding components. The company's firm commitment to customer service is reflected in its provision of customized solutions that meet the specific needs of contractors and builders. The globalization of its operations into new markets has enabled the firm to repeat its success, and respond to the demand for product quality and safety in the construction business.

BrandSafway

BrandSafway is a company that focuses on the scalping solutions to be safe and in compliance with the regulations set by the industry in place for commercial and industrial applications. The company carries plenty of couplers and among them are swivel couplers, which are the types that meet the high industry benchmarks. The commitment of the company to quality control and customer satisfaction is absolutely what makes it superior on the market.

The company has played a major role in projects involving the modernization of infrastructure as a supplier of scaffolding for buildings, bridges, and plants. Using advanced and scientific manufacturing methods, BrandSafway produces scaffolding items that are guaranteed to provide the highest level of stability and strength even in the harshest conditions. The worker-safety-oriented design has not only led to the protective equipment associated with scaffolding getting better but also to the creation of brand-new safety accessories.

In terms of Product, the industry is divided into New Synchronous Condenser and Refurbished Synchronous Condenser.

In terms of Cooling Type, the industry is divided into Air Cooled, Hydrogen Cooled, and Water Cooled.

In terms of Power Rating, the industry is divided into Less than 50 MVAR, 50 to 80 MVAR, 80 to 100 MVAR, 100 to 150 MVAR, 150 to 200 MVAR, and Above 200 MVAR.

In terms of Starting Method, the industry is divided into Static Frequency Converter, Pony Motors, and Others.

In terms of End Use, the industry is divided into Electrical Power Utilities, Mining, Commercial, and Others.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global synchronous condenser market is projected to reach USD 1,296.0 million by the end of 2025.

The market is anticipated to grow at a CAGR of 8.4% over the forecast period.

By 2035, the synchronous condenser market is expected to reach USD 2,903.3 million.

The electrical power utilities segment is expected to hold a significant share due to the growing demand for grid stability, reactive power compensation, and the increasing integration of renewable energy sources requiring voltage regulation solutions.

Key players in the synchronous condenser market include ABB Ltd., Siemens Energy, Eaton Corporation, General Electric, Voith Group, WEG Industries, and Andritz AG.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Synchronous Motor Market Size and Share Forecast Outlook 2025 to 2035

Synchronous Generator Market Growth - Trends & Forecast 2025 to 2035

Condenser Cleaners Market

Large Synchronous Motor Market Size and Share Forecast Outlook 2025 to 2035

Static Synchronous Compensator (STATCOM) Market Size and Share Forecast Outlook 2025 to 2035

Reflective Condenser Market Size and Share Forecast Outlook 2025 to 2035

V Type Fin Condenser Market Size and Share Forecast Outlook 2025 to 2035

V Type Air Cooled Condenser Market Size and Share Forecast Outlook 2025 to 2035

Horizontal Air Flow Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condenser Market Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Evaporative Condensers in USA Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA