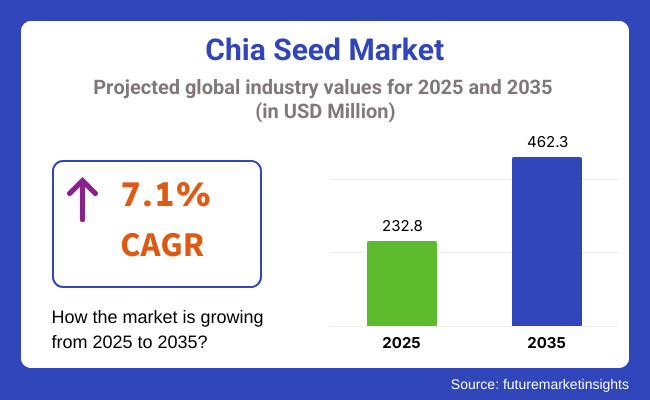

The global chia seed market is projected to grow from USD 232.8 million in 2025 to USD 462.3 million by 2035, reflecting a compound annual growth rate (CAGR) of 7.1%.

This expansion is underpinned by chia seeds’ reputation as a nutrient-dense superfood, rich in omega-3 fatty acids, fiber, antioxidants, and plant-based protein. As consumer preferences shift toward functional and clean-label food choices, chia seeds have become a core ingredient in a wide range of health-focused applications, including fortified beverages, high-fiber snacks, dairy alternatives, and supplement formulations.

Demand for chia seeds is increasingly fueled by the plant-based nutrition movement and heightened awareness around digestive and cardiovascular health. This positions chia as both a preventive and performance-oriented ingredient. Organic chia seeds dominate the market landscape, accounting for 55% of global sales in 2025.

Their growth is supported by consumers seeking pesticide-free, sustainably farmed, and ethically sourced options. Producers are responding by adopting certified organic farming techniques, investing in traceable supply chains, and forming partnerships with fair-trade networks-particularly in Latin America and Africa.

From a regional perspective, North America continues to lead, with the USA market expected to surpass USD 51 million by 2025. Meanwhile, Asia Pacific is gaining momentum, led by markets like Japan, which is forecasted to grow at a 7.5% CAGR as consumers in the region increasingly embrace functional ingredients within minimalist, low-calorie formats. Europe remains a stronghold for premium and organic chia consumption, with innovation seen in the bakery and on-the-go nutrition space.

On the supply side, scalability remains a focus. While chia cultivation has traditionally been concentrated in Paraguay, Bolivia, and Mexico, newer production hubs are emerging in Kenya and India to support regional sourcing strategies and mitigate export bottlenecks. Simultaneously, manufacturers are upgrading processing technologies to enhance shelf life, improve milling outcomes, and ensure consistent nutritional profiles.

Looking ahead, the chia seed market is poised to benefit from the broader regulatory alignment around functional food claims, including heart health and gut microbiome benefits. As labeling standards and scientific substantiation frameworks mature, chia-based products are expected to gain stronger positioning across both retail and foodservice channels. Overall, the decade ahead will see chia seeds transform from a niche superfood to a foundational ingredient within everyday wellness-driven diets.

The following table provides a comparative analysis of the semi-annual growth trajectory for the global chia seed market over a ten-year period. This evaluation offers valuable insights into growth trends, revenue generation, and market expansion, allowing stakeholders to gauge performance fluctuations. The first half of the year (H1) covers January to June, while the second half (H2) spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 6.6% |

| H2 (2024 to 2034) | 7.1% |

| H1 (2025 to 2035) | 6.8% |

| H2 (2025 to 2035) | 7.3% |

From 2024 to 2034, the market demonstrated steady growth, with a notable CAGR in both halves of the year. Moving into the 2025 to 2035 period, the CAGR is projected to follow a similar trend, reflecting increased consumer demand for natural, plant-based nutrition. The first half of 2025 to 2035 is expected to show a rise in growth, followed by sustained expansion in the latter half. In H1, the sector experienced an increase of 20 BPS, while in H2, a slight increase of 20 BPS was observed, reflecting market stabilization.

Organic chia seeds are projected to maintain dominance with a 55% market share in 2025, supported by a strong CAGR of 7.4% through 2035. This leadership reflects their resonance with health-conscious consumers and sustainability-focused food brands.

The segment’s momentum is largely built on the convergence of clean-label advocacy and environmental ethics. Organic chia seeds have emerged as a strategic anchor for product developers seeking to balance nutrient density with natural integrity.

Their chemical-free cultivation and traceable origins align with evolving retail and regulatory expectations around transparency, especially in developed economies. Moreover, the organic claim acts as a decisive trust lever in plant-based innovation, where chia’s omega-3, fiber, and antioxidant content are spotlighted.

Producers are expected to deepen integration with fair-trade certified farms and invest in low-impact agricultural techniques, ensuring compliance with tightening organic certification standards. The margin dynamics are also favorable-organic chia seeds often command a premium price point, enabling downstream players to position SKUs within the higher-value functional and wellness space.

Looking ahead, this segment will not only drive volume but also define the storytelling foundation for new launches. With continued investment in supply chain integrity and consumer education, organic chia is set to lead the market’s transition from niche superfood to mainstream dietary staple.

Conventional chia seeds are anticipated to account for approximately 45% of global sales in 2025, with a forecast CAGR of 6.7% through 2035. While overshadowed in growth rate by organic counterparts, this segment remains vital to the category’s global scalability and affordability.

Conventional chia seeds continue to serve as the economic backbone of the market, particularly in price-sensitive regions such as Latin America, Southeast Asia, and parts of Eastern Europe. Their broad accessibility and stable supply chains enable mass-market food and beverage brands to formulate functional offerings without compromising on cost-efficiency. Despite mounting scrutiny around pesticide use and environmental impact, the segment benefits from economies of scale and robust agronomic knowledge in high-yield producing countries like Paraguay and Bolivia.

This segment also anchors B2B supply in industrial applications such as bakery mixes, nutraceutical pre-blends, and dairy-alternative formulations, where label claims prioritize functionality over certification. Moving forward, innovation in residue-reduction techniques and sustainability metrics-including water-efficient farming-will be critical to defending its market share against premium-positioned organic variants.

Ultimately, while consumer narratives shift toward purity and provenance, conventional chia seeds are expected to retain their role as the category’s commercial workhorse, sustaining baseline demand and driving adoption in new, cost-conscious markets.

Evolving Pricing Strategies for Conventional and Premium Chia Products

Price dynamics in the global chia seed market are undergoing distinctive changes as conventional and organized products are taking different trajectories. Conventional chia seeds, traditionally supplied through conventional channels, are priced competitively to attract price-sensitive customers.

However, the development of organic and premium chia products has led to higher prices to cover better quality, certification costs, and sustainable farming practices. With consumers preferring health qualities and ethical origin, the premium market still drives premium pricing.

In addition, market players are embracing dynamic pricing mechanisms by application, whereby such products as chia-flavored beverages, functional foods, and superfood mixtures traditionally have a premium price compared to raw chia seeds. The diversified pricing makes mass-market buyers manageable and high-end healthy buyers, thereby enabling companies to penetrate the markets on a greater level and experience consistent revenue growth.

Expansion of Ready-to-Eat Chia-Based Products

Heightened convenience demand has been a critical force behind the growth of ready-to-eat chia-based food. Today, particularly in urban, consumers are switching from raw materials to pre-packed, highly wholesome foods that require less preparation time.

This has resulted in new and innovative applications of chia, such as ready-to-eat puddings, energy bars infused with chia, and breakfast blends for on-the-go use. Functional beverages with added chia seeds like smoothies and milk substitutes are also gaining ground as health-conscious consumers seek protein-based, naturally occurring products.

The trend is most evident within younger demographics prioritizing nutrition combined with convenience. The sector is responding with the production of products with more shelf life, improved texture, and intensified flavors to meet the needs of consumers who have a busy lifestyle and are eager to enjoy quick yet healthy meals.

Regional Adaptation and Market Growth Strategies

Global chia seed business is seeing tailor-made regional market growth strategies with manufacturers addressing diverse consumer tastes, dietary behaviors, and regulatory requirements. In Europe and North America, where wellness and health culture dominates, the market is biased towards sustainable and organically produced chia seeds.

Meanwhile, in emerging markets in Asia and Latin America, price and availability are major drivers of demand, leading to demand for traditional, low-cost chia products. Additionally, regional adaptation entails product form adaptation, such as flavored chia beverages in the Western market or chia grain blends in markets where staple grains serve as a nutritional emphasis. By participating in this regional strategy, chia seed farmers are reaching new markets and further contributing to continued growth in the world market.

Innovative Packaging Strategies to Enhance Consumer Appeal

Packaging is one of the up-and-coming buzzwords of 21st Century business, perhaps Meyer, Malkani, and Matsuki will create innovative packaging strategies to further draw consumers in. The most dominant trend poised to redefine the chia seed market is packaging innovation, as manufacturers emphasize convenience and sustainable packaging and shelf life.

In response to growing pressure from environmentally aware consumers to cut down on plastic use, manufacturers are opting for biodegradable, reusable, and recyclable packaging. Also, ready-to-eat or resealable forms of product packaging are gaining traction, conforming to hectic lifestyles and keeping products away from wastage as well.

Sophisticated packaging techniques like QR codes that enable traceability of origin together with nutritional information are also fast emerging as a key marketing opportunity. These technologies enhance the consumer's experience and support global sustainability, placing the brands in a booming marketplace with increased sensitivity for going green.

The global chia seeds market comprises a mix of regional players, organized manufacturers, and unorganized suppliers. The market is moderately fragmented; the major players have utilized various strategies such as product quality, certification levels, and price points.

Regional Players: Regional actors have a conviction in the international market of chia seed, specifically within the chia production areas especially in Latin America, where Argentina, Paraguay, and Bolivia are major exporters. Regional actors focus on regional and domestic markets that sell raw chia seeds to food processors, distributors, and retail outlets. In developing markets, local brands often focus on cost-conscious consumers by selling traditional chia seeds at low prices.

Organized Market: The organized sector comprises large-scale manufacturers and suppliers owning a share of the global chia seed distribution. These companies invest in advanced processing techniques, greener sourcing, g, and organic certification to maintain global quality standards.

They cater to growing market demand from health food manufacturers, like companies that make functional things to eat and drink. Most professional players additionally enhance their presence via e-commerce & retail collaborations, which ensure penetration in wider markets.

Unorganized Market: The unorganized market consists of smallholder farmers, independent traders, and informal suppliers who create localized networks. These entities often sell whole, unprocessed chia seeds, occasionally despite not meeting strict global regulatory standards.

Dispersed and untethered players breed price disparities - when affordability is a primary motivator of price-sensitive markets. However, weak scalability and lack of product differentiation often reduce their sustainable market share.

Market structure is evolving - with more consolidation happening between larger companies while regional/unorganized players still serve niche consumer bases.

| Country | United States |

|---|---|

| Market Volume (USD Million) | 51.0 |

| CAGR (2025 to 2035) | 6.7% |

| Country | Japan |

|---|---|

| Market Volume (USD Million) | 29.0 |

| CAGR (2025 to 2035) | 7.5% |

| Country | India |

|---|---|

| Market Volume (USD Million) | 22.0 |

| CAGR (2025 to 2035) | 5.3% |

| Country | Germany |

|---|---|

| Market Volume (USD Million) | 20.0 |

| CAGR (2025 to 2035) | 6.0% |

| Country | United Kingdom |

|---|---|

| Market Volume (USD Million) | 18.0 |

| CAGR (2025 to 2035) | 5.6% |

The United States is anticipated to be the largest market globally with an estimated value of over USD 51 million in 2025, expanding at a CAGR of 6.7% from 2025 to 2035. The market is expected to grow owing to rising consumer awareness about the health benefits of chia seeds, which include omega-3 fatty acids, fiber, and antioxidants.

This has caused chia seeds to be added to many food items, such as cereals, snacks, and drinks, as demand for plant-based, gluten-free products increases. The trend towards clean-label and organic products has also encouraged manufacturers to produce certified organic chia seeds, providing an impetus to market growth. Factors such as the increase of e-commerce platforms have also enabled chia seeds to reach a wider demographic geographically across the country.

The chia seed market in Japan is projected to grow at a healthy CAGR of 7.5%, with revenues estimated at USD 29 Million by 2025. The Japanese food market has been witnessing a growing trend towards health and wellness products, and chia seeds have become increasingly popular in this market segment due to their favorable nutritional profile.

As for food, chia seeds are often added to traditional Japanese food and modern food such as smoothieshie or energy bars. Additionally, the health-conscious aged population of Japan is looking for food products that help them stay healthy, thus fueling the demand for chia seeds. Through partnerships between local food producers and overseas chia commodity traders, chia-based innovations have been localized to meet domestic tastes.

India's chia seed market is projected to reach a volume of USD 22 million by 2025, growing at a CAGR of 5.3% during 2025 to 2035. This surge in growth is primarily attributed to the rise of the middle-class icon and the rising health consciousness among consumers. Chia seeds are used as a protein and dietary fiber source and are becoming part of the traditional Indian diet - in beverages and bakery products.

India the native land of the vegetarian community is contributing further to the actual demand for plant-based superfoods including chia Seeds. Also, the various government initiatives to promote healthy eating habits coupled with the rising organized retail sector have further increased the availability of chia seeds to customers in urban and semi-urban areas.

Entering 2024, the global chia seed space is set for substantial growth as people get more aware of health benefits and the demand for vegetarian nutrition increases. The market is moderately fragmented, with the presence of a few market players who focus on product innovation, the efficient supply of sustainable products, and an increase in distribution networks to establish a footprint in the market.

To satisfy the consumer demand for organic and non-GMO products, businesses are investing in organic certification and quality assurance. Moreover, strategic partnerships and acquisitions dominate where businesses look to reinforce their supply chains and expand their product portfolios.

The growth of e-commerce platforms has also provided companies a way to reach a larger customer base, addressing the rising demand for chia seeds in diverse applications including food and beverages, dietary supplements, and personal care products.

Recent Developments

As consumer demand for high-quality chia seeds grows, companies constantly seek to innovate to meet these needs and maintain a competitive edge, as shown by these advancements.

The market is segmented into organic and conventional chia seeds.

Chia seeds are categorized by color into black, white, and brown varieties.

The market includes whole chia seeds, ground chia seeds, chia seed oil, and other forms.

Applications encompass the food and beverages sector, including packed chia, nutritional bars, bakery and snacks, breakfast cereals, beverages, and others; the personal care products and cosmetics sector; the animal feed and pet food sector; nutritional and dietary supplements; and other end-use applications.

The market is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic countries, Russia and Belarus, and the Middle East & Africa.

The global chia seed market is expected to grow at a compound annual growth rate (CAGR) of 7.1% between 2025 and 2035.

The market is projected to reach a value of USD 462.3 million by 2035.

The food and beverages sector is anticipated to be the fastest-growing segment, driven by increasing consumer demand for health-oriented products.

Key factors include rising health consciousness, increasing demand for plant-based nutrition, and the versatile application of chia seeds in various industries.

Leading companies include The Chia Company, Benexia Europe S.A., Glanbia Nutritionals, Inc., Mamma Chia LLC, Navitas Organics, and Bob's Red Mill Natural Foods, Inc.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Origin, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Origin, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Colour, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Colour, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Form, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by End-Use Application, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Origin, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Origin, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Colour, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Colour, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Form, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by End-Use Application, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Origin, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Origin, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Colour, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Colour, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Form, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by End-Use Application, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Origin, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Origin, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Colour, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Colour, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Form, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by End-Use Application, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Origin, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Origin, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Colour, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Colour, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Form, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by End-Use Application, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Origin, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Origin, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Colour, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Colour, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Form, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by End-Use Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Origin, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Colour, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Origin, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Origin, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Origin, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Origin, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Colour, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Colour, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Colour, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Colour, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by End-Use Application, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 26: Global Market Attractiveness by Origin, 2023 to 2033

Figure 27: Global Market Attractiveness by Colour, 2023 to 2033

Figure 28: Global Market Attractiveness by Form, 2023 to 2033

Figure 29: Global Market Attractiveness by End-Use Application, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Origin, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Colour, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Origin, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Origin, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Origin, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Origin, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Colour, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Colour, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Colour, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Colour, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by End-Use Application, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 56: North America Market Attractiveness by Origin, 2023 to 2033

Figure 57: North America Market Attractiveness by Colour, 2023 to 2033

Figure 58: North America Market Attractiveness by Form, 2023 to 2033

Figure 59: North America Market Attractiveness by End-Use Application, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Origin, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Colour, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Origin, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Origin, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Origin, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Origin, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Colour, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Colour, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Colour, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Colour, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by End-Use Application, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Origin, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Colour, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End-Use Application, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Origin, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Colour, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Origin, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Origin, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Origin, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Origin, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Colour, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Colour, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Colour, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Colour, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by End-Use Application, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 116: Europe Market Attractiveness by Origin, 2023 to 2033

Figure 117: Europe Market Attractiveness by Colour, 2023 to 2033

Figure 118: Europe Market Attractiveness by Form, 2023 to 2033

Figure 119: Europe Market Attractiveness by End-Use Application, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Origin, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Colour, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Origin, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Origin, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Origin, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Origin, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Colour, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Colour, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Colour, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Colour, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by End-Use Application, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Origin, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Colour, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Form, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by End-Use Application, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Origin, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Colour, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Form, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Origin, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Origin, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Origin, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Origin, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Colour, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Colour, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Colour, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Colour, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by End-Use Application, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 176: MEA Market Attractiveness by Origin, 2023 to 2033

Figure 177: MEA Market Attractiveness by Colour, 2023 to 2033

Figure 178: MEA Market Attractiveness by Form, 2023 to 2033

Figure 179: MEA Market Attractiveness by End-Use Application, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chiari Malformation Treatment Market Analysis & Forecast for 2025 to 2035

Chia-based Protein Market

Telepsychiatry Market Size and Share Forecast Outlook 2025 to 2035

Endobronchial Ultrasound Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Paediatric Neuropsychiatric Disorders Treatment Market

Seed Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Seed Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Seed Biostimulants Market Size and Share Forecast Outlook 2025 to 2035

Seed Health Market Size and Share Forecast Outlook 2025 to 2035

Seed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Seed Coating Material Market Analysis - Size, Share, and Forecast 2025 to 2035

Seed Packaging Market Analysis – Growth & Forecast 2025 to 2035

Seed Binders Market Analysis - Size, Share & Forecast 2025 to 2035

Market Share Breakdown of Seed Cracker Manufacturers

Seed Polymer Market

Seed Testing Services Market Growth – Trends & Forecast 2018-2028

Teaseed Cake Market – Trends & Forecast 2025 to 2035

The Linseed Oil Market is Analysis by Nature, Product Type, Application, and Region from 2025 to 2035

Rapeseed Protein Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA