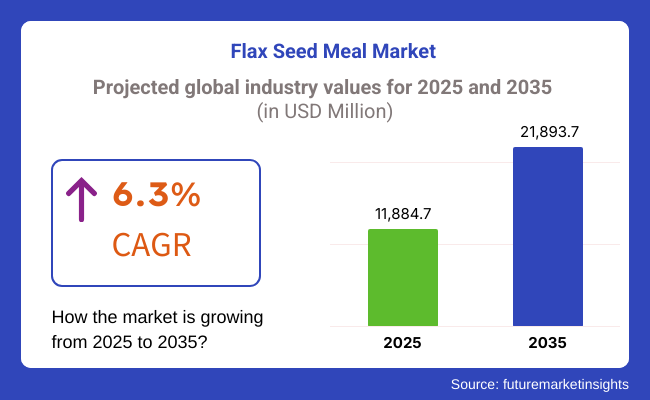

The global flax seed meal market reached USD 11,884.7 million in 2025. Demand for flax seed meal is expected to grow at a 6.3% CAGR between 2025 and 2035, with the industry projected to reach USD 21,893.7 million by the end of 2035.

Growing demand for organic and non-GMO flax seed meal has compelled manufacturers to scale up their production capacities. Taking this into account, companies are developing evolving processing technologies to retain flax seed meal's nutritional properties while enhancing its solubility and use conditions in a range of product formulations. Meals made from cold-milled flax seed or micronized flax seed are gaining audience due to their greater stability and bioavailability of nutrients.

The growing demand for consumer preference for high fiber, protein-rich, and omega-3-enhanced diets across the globe has also fueled the growth of the industry. Flax seed meal is used for functional food and dietary supplement applications for its antioxidant, anti-inflammatory, and digestive health properties, as well as animal feed formulations.

Consumer demand for clean-label and plant-based ingredients is the major driver for this industry growth. Flax seed meal is considered a favorable alternative in vegan, gluten-free, and high-protein food verticals, as consumers are looking for natural sources of fiber and protein. In addition, the demand for flax seed meal in pet food and livestock feed is expanding, driven by rising awareness of animal nutrition and gut health benefits.

Companies are differentiating themselves through product innovation, sustainability initiatives, and expanded retail presence. The firms are differentiating themselves via product innovation, sustainability initiatives, and extended retail reach.

Synergetic partnerships with bakeries, dairy alternatives, and dietary supplements are propelling the demand push for flax seed meal, as the manufacturers are focusing on e-commerce, D2C sales, and private-label partnerships for global distribution. As demand for functional food, organic food, and fortified food continues to increase, the global flax seed meal industry is anticipated to witness growth throughout the next 10 years.

The industry of flax seed meal is experiencing significant growth because of factors like nutritional value, sustainability, and usability. Flax seed meal is gaining popularity in the food & beverage industry because of its fiber, protein, and omega-3 values, and it is a mainstay ingredient in baked food, cereals, and plant-based diets.

The animal feed industry emphasizes high-protein, high-fiber products for improving the health and productivity of livestock. Nutraceutical applications use flax seed meal because of its positive effects on digestive health, heart health, and antioxidant activity, creating demand for organic and non-GMO varieties.

The cosmetics & personal care industry is investigating its use in natural skin care products, anti-aging creams, and moisturizing creams. With a shift in consumer preference towards plant-based, clean-label, and functional food ingredients, the market is likely to grow, with a high focus on quality sourcing, processing technology, and competitive pricing.

The table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) for the global flax seed meal industry. This analysis reveals crucial shifts in performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 6.0% |

| H2 (2024 to 2034) | 6.3% |

| H1 (2025 to 2035) | 6.2% |

| H2 (2025 to 2035) | 6.5% |

Between 2020 and 2024, the industry experienced significant growth, driven by increasing consumer awareness regarding health and wellness, rising demand for plant-based proteins, and the expanding use in animal feed, functional foods, and dietary supplements. Technological advancements in cold-press extraction and organic processing enhanced product quality coming from flax with higher nutritional levels.

Direct consumer sales and online shopping allowed brands to access a larger industry, while government agencies focused on organic certification and quality. Nonetheless, concerns about price volatility, supply chain disruptions, and climate-related issues remained a matter of concern.

Forward-looking to 2025 to 2035, the industry will experience growth led by innovation through precision farming, AI-based supply chain optimization, and technological developments in biotechnological seed enhancement.

The shift towards carbon-neutral, regenerative agriculture will see flax seeds being produced sustainably, with nutritional profiling using AI to enable tailored diet applications. Also in the limelight will be functional foods and fortified foods from flax, following gut benefits, and food items enriched with omega-3.

Demand for other plant-based proteins will also drive flax protein isolates in sports and vegan nutrition. Blockchain-based traceability and smart packaging will increase transparency, promoting consumer confidence.

With AI-sensed analytics sharpening the efficiency of production and cost-effectiveness of automated processing technology, the industry will transform into an optimized, data-driven, sustainable model for varied diets and industrial use.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increasing consumer demand for plant-based, high-protein food and nutrition. | Nutritional personalization by AI fuels demand for precision-formulated foods through the use of flax. |

| Increase in inorganic and cold-pressed flax seed meal to maintain high nutritional density. | Flax seeds with improved nutritional content, yield, and sustainability through biotechnology. |

| Growth of e-commerce and direct-to-consumer models fuels accessibility of flax-based foodstuffs. | Blockchain-based traceability and AI-driven consumer analytics streamline demand forecasting. |

| Growing use of flax seed meal in animal nutrition and functional foods. | Regenerative agriculture and precision farming make flax cultivation sustainable and climate-resilient. |

| Climate uncertainty and supply chain disruptions affect the availability and pricing of flax. | AI-tuned automated supply chain solutions boost resilience and price stability. |

| Increase in regulatory mechanisms for organic certification and quality control. | Smart monitoring of compliance through AI supports traceability, safety, and certification at the automatic level. |

| Improvement in development of high-quality flax protein powder for sport nutrition and plant nutrition. | Innovation technology in plant food is supported through flax protein isolates and bioactives. |

| Cold-press technology supporting quality improvement for oil and meal retention. | Enzymatic processing technology for improving bioavailability and functional applications of flax nutrients. |

| Greater focus on gut health and omega-3 content of flax foods. | AI-driven bioactive flax products are developed for holistic health and medical use. |

| Companies focus on sustainable and green packaging technologies. | Intelligent, bio-based, and dynamic packaging increases consumer interaction and sustainability. |

The flax seed meal market is a niche part of the health and nutrition industry and, thus, is subject to different types of risks. Supply chain instability is a significant issue, as flaxseed production is reliant on desirable weather conditions. Crop losses that droughts, floods, or pests might cause may result in price volatility and subsequent insufficient sales.

The regulatory challenges in this regard are the food safety standards, labeling requirements, and import/export limitations. Various local laws on organic certification and GMO-free labeling have made it difficult for manufacturers to pool the market, and compliance has been at loggerheads.

In addition, the market is pushed by the fact that there are similar alternatives, such as chia seeds, hemp protein, and almond flour. Consumers' attraction to the newest foods in the gluten-free and superfood sector is often short-lived; this can have a direct impact on the demand for flaxseed meal. Besides, the lack of knowledge of concentrated flaxseed meal health advantages with respect to awareness could restrict the company from penetrating the market in the near future.

Price changes in transportation and raw materials are parallel threats tied to the escalating fuel bills and the upheaval in the supply chain. To preserve cost efficiency, manufacturers need to implement logistics optimally and make sure that products are consistently available.

The market is characterized by the presence of both organized and unorganized players, with regional manufacturers playing a crucial role in supply chain dynamics. The market is divided between large-scale, organized manufacturers who focus on high-quality, standardized products and unorganized players who dominate local and bulk supply markets.

The organized segment includes established brands and large-scale processors that emphasize product consistency, organic certifications, and value-added offerings such as cold-milled and fortified flax seed meals.

These companies invest in advanced processing technologies to improve nutrient retention, shelf stability, and bioavailability. The expansion of health-conscious consumers and growing demand for high-fiber, omega-3-rich diets has led to a surge in flax seed meal inclusion in functional foods, sports nutrition, and premium animal feed products.

The unorganized segment consists of small and medium-sized suppliers, primarily operating in flax-producing countries such as Canada, the United States, China, and India. These suppliers cater to bulk sales for livestock feed, bakery applications, and local milling industries.

The lack of product standardization and quality consistency in this segment often limits international trade opportunities. However, cost-effectiveness and availability in large quantities make unorganized players a critical part of the supply chain.

As demand for clean-label, traceable, and organic-certified flax seed meal grows, organized players are gaining a larger market share. At the same time, unorganized suppliers continue to play a key role in raw material supply and bulk exports.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 11.7% |

| India | 3.7% |

| The USA | 21.2% |

| Germany | 5.4% |

| Canada | 33.2% |

China is likely to experience a robust 11.7% CAGR over the period 2025 to 2035 in the market. With increasing health-conscious consumers turning to plant-based diets, demand for flax seed meal is on the rise. It is known to consumers that it is high in health benefits such as omega-3 fatty acids, fiber, and antioxidants.

Hence, it is a highly sought-after ingredient in baked foods, cereals, and nutritional supplements. The demand for growth from the natural and organic food sector powers the market further, boosting the consumption. Government-backed healthy lifestyle policies also facilitate market growth in addition to the shift towards healthy living.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Health Consciousness | Rising consumption of plant foods from consumers. |

| Functional Food Growth | Enhanced use in bakery foods, cereals, and supplements. |

| Government Initiatives | Government initiatives favoring healthy and organic food. |

India's flax seed meal market is estimated to expand at a 3.7% CAGR during 2025 to 2035. The trend is fueled by changing consumption patterns and increasing awareness of health and wellness. The nutritional value of flax seed meal, including omega-3 fatty acids and dietary fiber, appeals to health-conscious consumers.

Indian food companies increasingly use in breads, snacks, and health supplements to meet rising demand. Expansions in consumer markets of middle class with growing disposable incomes enhance the acceptance of health-oriented food products. Further, urbanization and a greater understanding of global food trends drive market expansion in India.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Shifting Food Habits | Enhanced demand for healthier foods and functional foods. |

| Food Industry Adoption | Greater application in snack foods and bakery foods. |

| Economic Progress | Increase in the middle class with augmented expenditure. |

America is the world market leader in flax seed meal, worth USD 2,200 million in 2025, with a projected CAGR of 21.2% from 2035. Plant-based diets and functional foods are gaining popularity among consumers, with a resultant growing demand for flax seed meal. Its nutritional benefits make it an ingredient of choice in baked foods, breakfast cereals, and energy bars.

Emerging health conditions such as cardiovascular ailments and obesity encourage consumers to purchase healthier products. Large food multinationals are switching to novel flax seed meal foods, taking advantage of extensive distribution systems to benefit from higher consumer demand. The availability of an established health food market also aids in its creation.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Plant-Based Diets | Increased demand for organic and functional foods. |

| Health Issues | Growing emphasis on cardiovascular and obesity complications. |

| Industry Innovation | Expenditure on new product launch and distribution. |

Demand in Germany is likely to grow at a 5.4% CAGR during the period 2025 to 2035. Demand is driven by high demand for organic and natural foodstuffs because of rising health consciousness. Flax seed meal is used in Germany's food industry in different food applications such as bread, muesli, and dietary supplements.

Positive regulation of organic and functional food production is beneficial to market expansion. The expansion of the vegan and vegetarian population further drives demand for vegetable protein sources and, hence, increases the use of flax seed meals.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Organic Food Demand | Growing demand for natural products. |

| Functional Food Growth | Growing use in bakery and health foods. |

| Vegan Population | Growing use of plant-based diets. |

Canada leads the global market for flax seed meal with a maximum CAGR of 33.2% during 2025 to 2035. The nation is abundant in the production of flax seeds and is increasing export possibilities. Canadians are health-conscious and like functional foods with nutritional content, including flax seed meals.

The local market witnesses greater demand for plant food in everyday diets. Major food businesses involved in flax commodities propel industry growth. Government support for agriculture and healthy food further fortifies the market.

Growth Factors in Canada

| Key Drivers | Details |

|---|---|

| Strong Domestic Demand | Increased demand for healthy food products produced from flax. |

| Export Opportunities | Expanded production of flax seed meal for export purposes. |

| Government Support | Government regulations promoting agricultural progress. |

| Segment | Value Share (2025) |

|---|---|

| Brown Flax Seed (By Type) | 60% |

By 2025, the brown flax seed segment is predicted to lead the global flax seed meal market with 60% of the overall market share. This dominance is a result of its vast cultivation, low cost, and high nutritional values, which means it is an important raw material for functional food, dietary supplements, and animal feed.

Brown flax seeds are a source of heart, digestion, and inflammation, benefiting nutrients, including fiber, lignans, and omega-3 fatty acids. Its stronger, nuttier flavor further boosts applications, including in baking, plant-based dairy products, and egg replacement products.

Golden flax seeds have also found increasing popularity among health and organic food consumers because of their mild flavor and slightly higher omega-3 content than brown flax seeds. The growing focus on specialty nutrition products has enabled the wider use of such ingredients in premium health foods, gluten-free formulations, and cold-pressed flaxseed oils.

The increasing demand for golden flax seeds in North America and Europe can be attributed to brands focusing on organic and non-GMO claims. Growing consumer awareness of natural health benefits and the expanding plant-based food industry are driving the demand for both brown and golden flaxseeds.

Nevertheless, brown flax will still dominate the market, given larger production volumes, cost-effectiveness, and wider industrial application. With deep investments in progressive milling and grinding technologies, flax seed meal is also already seeing improvements in terms of bioavailability and digestibility, strengthening its position in the rapidly growing plant-based and functional food sectors.

| Segment | Value Share (2025) |

|---|---|

| Bakery & Confectionery (By Application) | 40% |

The bakery & confectionery segment is estimated to be the leading segment for the global flax seed meal industry, 40% in terms of total sales by 2025. As a natural binding agent, flax seed meal is naturally high in fibre and used in a variety of baked goods, including bread, cookies, crackers, breakfast bars, and gluten-free products.

It’s also the plant-based version of an egg replacer, and so it’s a rock-star ingredient in vegan and allergen-free baking. As consumers are looking for heart-healthy, high-protein, functional foods, bakers have started to utilize flax-based ingredients. Show that a few companies like Dave’s Killer Bread and BFree are driving this change, providing health-conscious customers with flax-infused baked goods.

Food and beverage is another substantial portion of the global flax seed meal industry, fuelled by growing consumer interest in plant-based foods, high-fibre products, and omega-3-rich foods. It is increasingly being added to smoothies, plant-based dairy products, soups, sauces, and functional health drinks. Meanwhile, the growing interest in clean-label, organic, and non-GMO ingredients has only expedited its acceptance in both processed and packaged foods.

Also, the sports nutrition and functional beverages sectors are booming, and manufacturers are launching protein-packed and digestive health-focused beverages that leverage benefits from flax seed meal for its omega-3, lignan, and fiber properties. As knowledge about gut function and safety for heart diets grows, interest in flax-based formulations on food and beverages will thrive as flax continues to claim its ground in the functional nutrition world.

The growth of the flax seed meal industry is poised to increase, owing to boosting consumer demand for plant-based nutrition, functional foods, and omega-3-rich dietary alternatives. The increasing ascendancy of vegan-and-gluten-free diets, in addition to growing applications in bakery, animal feed, and nutritional supplements, accelerates expansion.

Industry leaders, such as Archer Daniels Midland (ADM), Cargill, AgMotion, Linwoods Health Foods, and Bioriginal, maximize shares owing to strong distribution networks, product diversification, and quality certifications. These firms are investing in innovations for processing and value-added flax-based products, as consumer demand is constantly changing. Start-ups and niche suppliers introduce their offerings with organic, non-GMO, and sustainable sourcing strategies to attract health-conscious consumers.

Industry evolution revolves around advances in cold milling technology, better packaging solutions for prolonged shelf life, and fortified flaxseed products. Also, strategic partnerships with food manufacturers, advancements in e-commerce, and direct-to-consumer sales channels serve as the major competitive drivers.

In terms of strategic factors, sustainability, product purity, and nutritional innovations are paramount as companies differentiate their offerings through high-fiber, protein-enhanced, and minimally processed flaxseed meal products. In an era of stringent regulatory scrutiny on food labeling and health claims, the more transparent their sourcing is, along with organic certifications or superior processing techniques, the better the competitive edge that will lie with these firms in this evolving industry.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Archer Daniels Midland (ADM) | 18-22% |

| Cargill, Incorporated | 15-18% |

| AgMotion, Inc. | 10-14% |

| Linwoods Health Foods | 8-12% |

| Bioriginal Food & Science Corp. | 6-10% |

| Other Players | 30-40% |

| Company Name | Key Offerings & Industry Focus |

|---|---|

| Archer Daniels Midland (ADM) | Bulk flaxseed meal processing with an emphasis on bulk supply to food and feed uses. Emphasizes sustainability and supply chain integration. |

| Cargill, Incorporated | Creatively developed flax-containing ingredients for food, beverages, and nutritional supplements. Diversifying organic and cold-milled flaxseed products. |

| AgMotion, Inc. | Wholesale and bulk trading of flaxseed and flax meal, well represented in the North American and international marketplace. |

| Linwoods Health Foods | Specializes in premium health foods, fortified flaxseed foods, and superfood mixes with omega-3 and fiber enrichment. |

| Bioriginal Food & Science Corp. | Offers specialty and organic flaxseed foods for functional food producers and dietary supplement industries. |

Key Company Insights

Archer Daniels Midland (18-22%)

The industry leader with some very strong vertically integrated flaxseed processing and global supply chain strength.

Cargill (15-18%)

Organic and high-quality flaxseed meal solutions for the food, beverage, and supplement industries are being developed.

AgMotion (10-14%)

Very strong in bulk flax trading, meeting most of the demand with applications in large quantities of food and feed.

Linwoods Health Foods (8-12%)

Specialize in consumer health products, fortified flaxseed meal, and inventive superfood blends.

Bioriginal (6-10%)

Provide premium organic flax solutions with a very heavy focus on functional nutrition.

Other Key Players (30-40% Combined)

The flax seed meal industry is segmented into golden flax seed and brown flax seed, with increasing demand for nutrient-dense varieties in food, beverages, and supplements.

The industry is divided into food and beverages, food additives, bakery & confectionery, egg replacement foods, and pet food, with bakery applications gaining strong traction in global markets.

The industry is categorized into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and The Middle East & Africa.

The global flax seed meal industry is projected to grow at a CAGR of 6.3% from 2025 to 2035, driven by increasing demand for plant-based nutrition, functional foods, and dietary supplements.

By 2035, the global flax seed meal industry is expected to reach approximately USD 21,893.7 million, supported by its expanding applications in food, bakery, and animal nutrition.

The bakery & confectionery segment is expected to grow the fastest, as flax seed meal is increasingly used as a gluten-free, fiber-rich alternative in bread, cookies, and protein bars.

Rising health awareness, growing demand for high-fiber and omega-3-rich diets, increasing use in vegan and gluten-free formulations, and expanding pet food applications are key growth drivers.

Leading players in the industry include Archer Daniels Midland Company, Cargill Incorporated, AgMotion Inc., Linwoods Health Foods, Bioriginal Food & Science Corp., and CanMar Foods Ltd.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flax-Based Protein Market Growth – Industry Applications 2025 to 2035

Flax Protein Market Insights - Demand & Industry Growth 2025 to 2035

Flax Fiber Bottle Market Analysis – Growth & Forecast 2025-2035

Flax Milk Market Growth – Dairy-Free Alternatives & Industry Demand 2024-2034

Flaxseed Gum Market Size and Share Forecast Outlook 2025 to 2035

Flaxseeds Market – Growth, Demand & Nutritional Benefits

Seed Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Seed Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Seed Biostimulants Market Size and Share Forecast Outlook 2025 to 2035

Seed Health Market Size and Share Forecast Outlook 2025 to 2035

Seed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Seed Coating Material Market Analysis - Size, Share, and Forecast 2025 to 2035

Seed Packaging Market Analysis – Growth & Forecast 2025 to 2035

Seed Binders Market Analysis - Size, Share & Forecast 2025 to 2035

Market Share Breakdown of Seed Cracker Manufacturers

Seed Polymer Market

Seed Testing Services Market Growth – Trends & Forecast 2018-2028

Teaseed Cake Market – Trends & Forecast 2025 to 2035

The Linseed Oil Market is Analysis by Nature, Product Type, Application, and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA