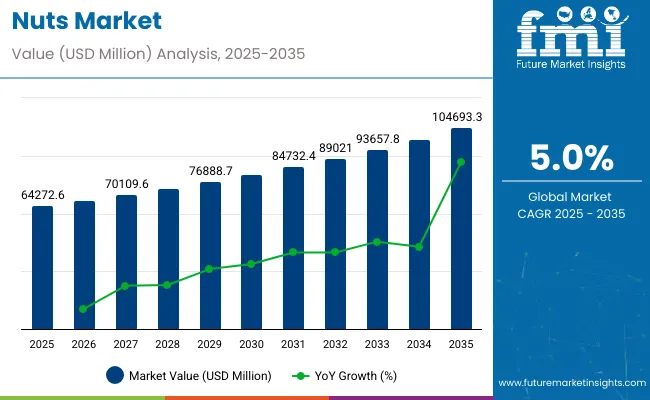

Between 2025 and 2035, the global market for nuts is expected to witness accelerated growth, increasing from USD 64,272.6 million to USD 104,693.3 million at a CAGR of 5.0%. This expansion is being propelled by the increasing consumer inclination toward nutrient-dense snacks, rising popularity of plant-based diets, and the elevated role of nuts in clean-label and functional food formulations.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 64,272.60 million |

| Projected Market Value (2035F) | USD 104,693.3 million |

| Value-based CAGR (2025 to 2035) | 5.00% |

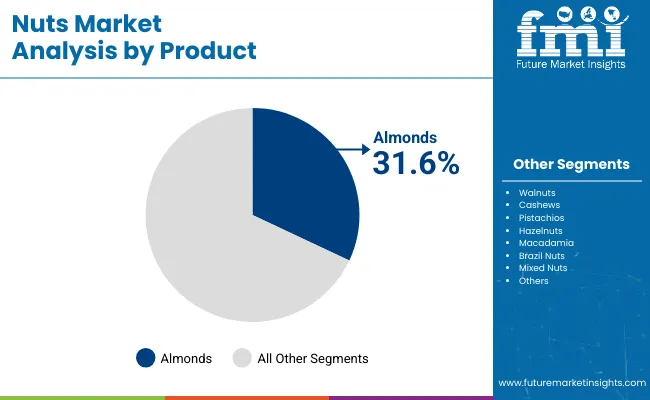

Almonds have secured their dominant role in the market due to their wide application range, from bakery and dairy alternatives to sports nutrition products. Meanwhile, food processors continue to integrate nuts into value-added offerings to meet evolving health and indulgence preferences.

The marketplace is witnessing transformation driven by multiple dynamics. Growth is being steered by heightened awareness around heart health, protein intake, and sustainable eating habits, placing nuts at the forefront of healthy snacking. However, supply chain complexities and fluctuating raw nut prices, due to weather impacts and geopolitical constraints, are acting as limiting factors.

Consumer trends reflect rising interest in plant-forward and keto-compatible products, with nuts providing a high-protein, low-carb base. Industry players are expanding portfolios with roasted, flavored, and coated variants while also exploring newer nut types and processing techniques to boost differentiation and shelf appeal.

Future expansion is expected to be sustained by the demand for high-quality ingredients in plant-based beverages, spreads, and confectionery applications. By 2025, the food processing sector is expected to account for over 43% of market share, and this trend will intensify by 2035 as manufacturers capitalize on the clean-label and functional food momentum.

The rise in popularity of vegan lifestyles, coupled with innovations in value-added nut-based ingredients, is expected to bolster long-term growth across both emerging and developed regions.

The global nuts market features extensive international trade driven by varying production capacities and consumer demand across regions. Nuts such as almonds, walnuts, cashews, pistachios, and hazelnuts are widely traded commodities with major exporters and importers shaping the market dynamics.

Per capita consumption of nuts varies widely across regions due to differences in dietary habits, income levels, and cultural preferences. Generally, developed countries show higher consumption rates driven by increased health awareness and disposable income. In these regions, nuts are often incorporated into daily diets as snacks, ingredients in baked goods, and components of health-focused meals. The growing popularity of plant-based and Mediterranean diets further boosts nut consumption. Conversely, in developing regions, consumption tends to be lower due to limited availability, higher prices, and less awareness of nuts’ health benefits.

Almonds are widely sold due to their high nutritional value, versatile uses, and strong consumer demand across food, beverage, and personal care industries. Rich in protein, healthy fats, fiber, vitamins, and minerals, almonds are considered a superfood and are especially popular among health-conscious consumers.

They are used in a wide range of products such as snacks, bakery items, dairy alternatives (like almond milk), cereals, and confectionery. Their crunchy texture and mild flavor make them suitable for both sweet and savory applications.

In addition, almonds have gained popularity in plant-based diets, keto-friendly foods, and gluten-free products, further expanding their market. They are also valued for their long shelf life and ease of storage and transport, making them ideal for global trade. As awareness of healthy eating continues to rise, demand for almonds remains strong in both developed and emerging markets.

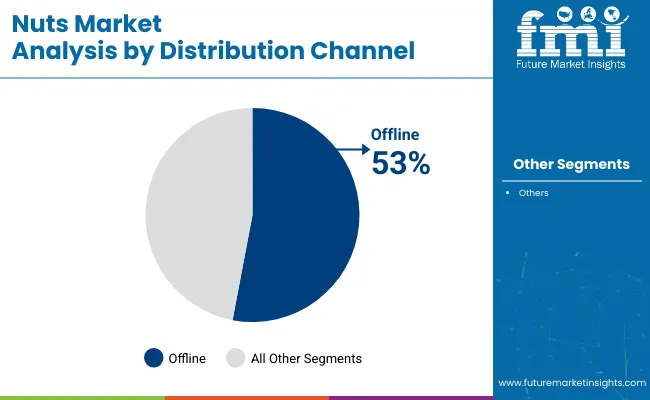

Nuts are sold majorly through offline channels due to consumer preference for freshness, quality inspection, and bulk buying options. Many shoppers prefer to see, smell, and sometimes sample nuts before purchasing, especially in regions where loose or unpackaged formats are common.

Grocery stores, supermarkets, and specialty dry fruit outlets offer a tactile and trust-based shopping experience that online channels may not fully replicate.

Offline markets also allow for immediate purchase without waiting for delivery, which is important for perishable or premium-priced items like nuts. Additionally, traditional retail is more accessible in regions with limited e-commerce infrastructure.

As per FMI analysis, consumers are looking more and more toward premium and specialty nuts as a result of high disposable incomes and changing preferences for taste. Tastes such as Macadamia, Brazil nuts, and flavored or coated almonds are being purchased more by consumers, particularly those in the urban areas seeking gourmand snacks. Exotic seasonings used in artisanal and small-batch roasted nuts, including truffle, matcha, and chili-lime, are now in vogue.

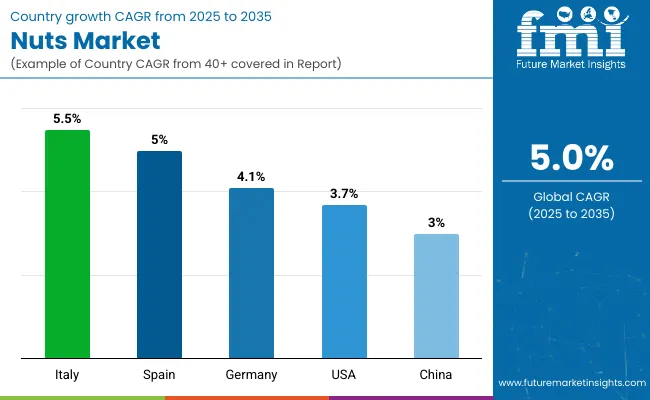

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 3.7% |

| Germany | 4.1% |

| China | 3.0% |

| Spain | 5.0% |

| Italy | 5.5% |

The United States nut market is projected to grow at a CAGR of 3.7% during 2025 to 2035. Rising cafes and bakeries in the United States will drive the market in the United States. Nuts are integral ingredients in baked goods, desserts, and artisanal candies.

With health-conscious awareness in the American consumer's psyche, nut-based protein bars, energy snacks, and organic nut blends have grown in popularity. Almonds, walnuts, and cashews are now becoming staple items for everyday consumption as the western world turns more and more toward plant-based diets and alternative sources of protein.

Growth in mergers and acquisitions, the expected way since 4.1% CAGR would prevail from 2025 to 2035. Companies in Germany pick up as many start-ups possible to upgrade their stakes in this premium nut market. Organics and special products like Naughty Nuts, also acquired by Bulgarian Smart Organic look for acquiring and merging.

Recently, almonds, cashews, and walnuts have been a part of functional foods and dietary supplements, therefore high demand has been observed in the market. Higher recognition regarding health benefits for cardiovascular and cognitive stature boosts up the sale of nuts in Germany.

China is anticipated to experience CAGR of 3.0% during the period of 2025 to 2035 for the nuts market. Demand is expected to surge for macadamia nuts. The nut, which is highly healthy and easy to consume as a snack, is increasing market size.

Consumer integration of nuts into their diet is rising since the richness of nuts with proteins, fiber, and healthy fats has increased the demand for it. Its usage in bakery and confectionery products is also increasing, particularly in premium desserts and festive sweets. Nut-based packaged snacks such as trail mixes and nut bars are growing fast in China owing to the busy urban lifestyle.

The market in Spain is likely to grow at a 5.0% CAGR between 2025 and 2035, primarily driven by the tremendous growth in the production of almonds in the country. The country is adding very high areas to almond cultivation and is likely to add more than 16,000 new hectares to the market.

Organic nuts, especially almonds and hazelnuts, are sought after by health-conscious consumers. This includes an increase in nuts use within the bakery, confectionery, and dairy industries, which positively impact sales in Spain. Other positive factors driving the market are plant-based diets and natural protein sources preferences.

The market is expected to be growing at 5.5% CAGR in the years between 2025 and 2035 based on the growth of health benefit awareness. One of the principal consumers of Italy is hazelnuts and almonds, whose consumption has increased incrementally over time. Recently, the demand for protein bars and nut-based snack foods has risen as a more healthy substitute compared to the common snack foods.

While functional food manufacturers are opting for nuts as part of their product lines, they would also attract health-conscious consumers. Italian confectionery is increasingly using nuts in chocolate and dessert preparations, which will help in increasing the market size.

The nut market in India is expected to grow between 2025 and 2035 with the rise in consumption of nut-based sweets and snacks.. Demand for nut-enriched protein bars and energy snacks increases among the fit enthusiasts and professionals. Festivals are now being complemented with almond, cashew, and pistachio-sweet confections.

Companies are launching innovation nut-based products in the categories of confectionery that adapts changing demands of the market. For example, Kookie Jar launched a caramelized nuts and honey-flavored Diwali special dessert in November 2023, which reflects an increased use of nuts in the food culture in India.

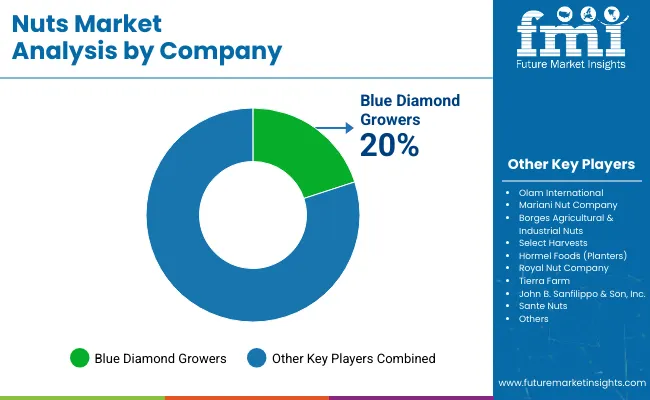

The global nut industry is dominated by a few of the players that have significant ownership positions across the majority of the production, processing, and distribution chain. Nuts are grown worldwide; however, because Tier 1 companies hold supply chains in which they vertically integrate, because of proprietary breeding practices, and have large retail relationships, these Tier 1 players have significant sway.

The concentration of the almond industry is mostly in California. Firms, for example, Blue Diamond Growers, take center stage processing and exporting it. Advanced agriculture techniques, rigid quality control mechanisms, and the largest global network of distribution establish standards for an industry like the firms of Blue Diamond. Analogous to that, large-scale corporations controlling the pistachio industry have their grip on supplies with vertically integrated operations from growing to retail packaging.

Cashews are mainly produced in Vietnam, India, and Africa, relying on a few major processors for shelling and refining to maintain quality and adhere to international standards. Hazelnuts, which are mainly grown in Turkey, are also largely controlled by a few processing firms that have supply contracts with the large multinational food and confectionery companies for long-term supply.

Strategic investments in research and development enable Tier 1 companies to increase productivity, manage climate risks, and develop new varietals that are optimized for higher yields and pest resistance. Advanced logistics further solidifies the position of industry leaders through temperature-controlled storage and just-in-time shipping to ensure consistent supply to major retailers.

The market is highly competitive in 2024, where key players, such as Mondelez International and Olam Group, innovated their portfolios. In this regard, Mondelez introduced new flavors and healthier options to meet the growing demand for snacks that match consumer health trends, while Olam Group emphasized organic and sustainably sourced almonds, responding to the rising preference of consumers for ethical products.

Companies such as Hormel Foods and Kraft Heinz also made strategic moves. For instance, Hormel acquired a local almond-based snack brand for enhancing its presence in the marketplace, while Kraft Heinz tied up with a health-focused startup to develop nut spreads based on plants. Sustainability has become one of the primary differentiators of the industry with Diamond Foods in the lead; it invested significantly in eco-friendly packaging and brought down its carbon footprint.

Treehouse Foods also got an edge in competition by sourcing nuts through regenerative agricultural practices, which appeals to the environmentally conscious consumer.

BSS crossed the USD 1 billion mark in sales for the first time in its history during fiscal year 2024. Net sales grew 6.7% to USD 1.07 billion. In the first quarter of fiscal year 2025, net sales grew 18.0% to USD 276.2 million.

The nuts market is expected to grow at 5.0% CAGR during the study period.

The factor is rising demand for premium nuts.

Peanut is being widely bought in the country owing to its rising demand among consumers who are willing to pay more for premium products.

Prominent players include Diamond Foods, Inc., Mariani Nut Company, and others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Soy Nuts Market Size and Share Forecast Outlook 2025 to 2035

Fox Nuts Market – Growth, Demand & Snack Innovations

Tree Nuts Market

Cashew Nutshell Liquid Market Size and Share Forecast Outlook 2025 to 2035

Edible Nuts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Donuts Market Analysis by Yeast doughnuts, Cake doughnuts and Other Variants Through 2035

Hickory Nuts Market

Demand for Nuts as snacks and ingredients in US Analysis - Size, Share & Forecast 2025 to 2035

Self-Locking Nuts Market

Loose-fill Peanuts Market Size and Share Forecast Outlook 2025 to 2035

Demand for Edible Nuts in EU Size and Share Forecast Outlook 2025 to 2035

Biodegradable Packing Peanuts Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA