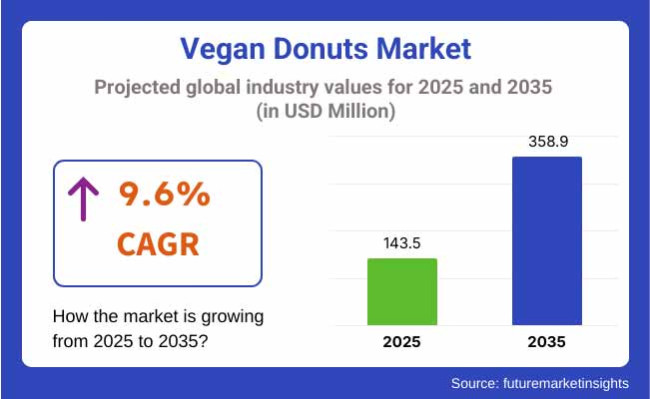

Global vegan donut market accounted for USD 120.4 million in 2023. Yearly growth of 5.8% in demand of vegan donuts in 2024 implies that global market will be worth USD 143.5 million in 2025. Foreign sales will grow at 9.6% CAGR from 2025 through 2035 and will total USD 358.9 million by 2035.

Greater use of eggless, plant-based, and dairy-free baked goods fueled demand for vegan donuts. Individuals choosing the clean, green, and humane food now choose the plant food, and the donuts are no different. Increased technology applied in supplying more and newer varieties of plant foods, for example, the application of aquafaba (liquid in chickpeas) as an egg substitute as well as the use of oat or almond milk applied in the batter, helped producers to provide similar taste and texture in the donuts.

Up-market bakery chains and food mass-manufacturers are benefiting from the trend. Dunkin' and Krispy Kreme have launched plant-based donuts in select markets for growing numbers of flexitarian and health-conscious consumers recently. Small, independent vegan baker shops and food start-ups are benefiting from growing consumer demand for organic, gluten-free, and naturally sweetened foods.

Aside from this, online shopping portals and on-demand shopping portals are also offering vegan donuts, which are easily available. On-demand online shopping websites and online shopping websites are also making customers feel at ease by offering them facilities to order newly prepared baked plant-based food items to be delivered to huge numbers of customers. The integration of moral production, taste discovery, and ease of access is also going to drive the vegan donut market to high growth during the next decade.

Consumers have been some of the most tenacious drivers of quickly growing demand for vegan desserts growth in consumer health-consciousness and environmental and ethical awareness. Cleaner-baking trends like organic, non-GMO, and fair-trade ingredients have been another driver within the market. Consumers are paying for cleaner products with better taste and texture but not clean-label.

Below is the comparison of six-month CAGR fluctuation in the base year (2024) and the current year (2025 of the global vegan donuts market. The comparison shows broad differences in performance and depicts realization trends in revenues, thus providing stakeholders with a sense of growth trend for the year. Bi-annual period H1, i.e., January to June. The latter half, i.e., July to December is H2.

| Particular | Value CAGR |

|---|---|

| H1 | 9.0% (2024 to 2034) |

| H2 | 9.2% (2024 to 2034) |

| H1 | 9.4% (2025 to 2035) |

| H2 | 9.6% (2025 to 2035) |

The firm will expand during the first half (H1) of 2025 to 2035 phase with a CAGR of 9.4%, and during the second half (H2) of the same phase with a still greater CAGR of 9.6%. For the next phase, from H1 2025 to H2 2035, the CAGR will increase at a higher rate. During H1 2025, the market increased by 40 BPS and during H2 2025, company growth was 20 BPS based on the analysis currently.

Even with ongoing product innovations, investment in the production of plant-based food products keeps rising, consumer trends change, but still, the vegan donuts market will certainly experience revolutionary growth in the next decade. As these companies continue to innovate recipes to capture the big and growing consumer market, the company will see record growth in product quality, distribution trends, and overall consumer penetration. Clean-label foods, sustainability, and technology integration in food preparation will also continue to boost popularity of vegan donuts globally.

Vegan donut market is moving ahead unabated as it has the support of growing demand for plant-based, egg-free, and dairy-free bakery foods. The market can be segmented between organised and unorganised and features dominated structure consisting of mixed large industrial scale bakery units and small artisanal units.

Organized category comprises mass plant-based bakery brands, specialty plant-based food producers, and pre-packaged, fresh plant-based donut selling private label producers. Krispy Kreme (plant-based series), Dunkin' (plant-based series offered in certain areas), Rubicon Bakers, Donut Friend, and Whole Foods (private label) are the prominent companies in this category.

They are high-end, allergen-free items that comprise plant-based milk, aquafaba, flaxseed, and substitute eggs. Organized players are thoroughly covered in European, North American, and Asian-Pacific markets with plant-based baked food demand continuously increasing. They are already well-established to possess market channels, production economies of scale, and supply chain management.

A significant expenditure is incurred on organics, gluten-free, and health alternatives by players to retro-fit clean-label and health-focused consumers. As food delivery businesses increased in number along with online shopping, large firms now connect a larger number with online orders, vegetarian specialty restaurants, and baking stalls within shopping malls. They also focus on ethical purchasing as well as procuring of raw material packaging as well as sustaining.

Unorganised Market, Open market encompasses freestanding vegan bakeries, donut stalls, and in-home bakers who provide just-made, homemade vegan donuts. They may be spotted in farmers' markets, public markets, food festivals, and upscale vegan bakeries with gourmet toppings, specialty flavorings, and artisanal appeal.

Unorganised players have no organised manufacturing strength and distribution and hence cannot scale up above local markets. They do, however, gain loyal consumers seeking new, novel, and preservative-free offerings. Some brand names are growing by surfing on social media promotion, direct-to-consumer sales, and tie-ups with vegan-friendly cafes. As demand for plant desserts continues to grow y-o-y, organized players will dominate mass retail and online, while unorganized players will grow at the expense of premiumisation, personalisation, and word-of-mouth.

Move to Clean-Label, Allergen-Free Vegan Donuts

Shift: As the desire for healthy hedonism grows, consumers want clean-label vegan donuts that are also allergen-free, for shoppers with sensitivities to dairy, egg, soy, nut and gluten Consumers want short ingredient lists with no hydrogenated oils, artificial flavors or preservatives. It has become especially widespread among Millennials, Gen Z and parents looking for safer treats for children, increasing the demand for these products in North America, Europe and Oceania.

Strategic Response: Karma Baker, a USA-based company, saw a 17% increase from direct-to-consumer sales through their website after rapidly expanding their line of gluten-free, soy-free vegan donuts made for organic almond flour, coconut sugar, and flax eggs.

Borough 22, a gluten-free vegan bakery in the UK, rolled out baked, not fried, donuts with natural ingredients, including maple syrup and oat milk, yielding a 12 percent increase in health food store partnerships. Australian brand OMG! Music jangle in wellness-driven cafes found a permanent place and 9% boost in national distribution donuts (no added sugar vegan). These developments are transforming vegan donuts into decadent treats without sin.

Artisan flavours and aesthetic appeal: Premiumisation

Shift: Consumers desire high-end, artisanal vegan donuts that provide unusual flavor profiles, upscale ingredients, and things to share on media. The trend is inspired by urban foodies and Gen Z consumers who prefer experience-based eating and are willing to shell out more cash for handmade excellence and Instagram-ready designs. Flavors such as lavender earl grey, matcha pistachio, salted caramel pretzel, chai latte and hibiscus rose are making inroads in boutique cafes, artisanal bakeries and pop-up shops.

Strategic Response: At USA-based Dun-Well Doughnuts, for example, the introduction of a seasonal artisanal line - which features flavors like pumpkin spice chai and blueberry basil - has helped achieve 15 percent growth in online pre-orders and in walk-in sales.

Alluding to these trends in topping-care for the Bakery in Canada, a small artisanal shop called Bloomers Bakery found that using edible flowers, gold dust (powder-form gold used to decorate everything from cakes to martinis), they saw a 10% increase using influencer-driven marketing. The Japanese brand Mr. Donut introduced limited edition vegan mochi donuts in flavors such as yuzu and black sesame, helping to drive a 7% increase in foot traffic from both tourists and locals. This premiumization strategy makes vegan donuts luxury confections, not merely ethical alternatives.

Increased Popularity for Vegan Donuts in Conventional Chains and QSRs

Shift: Plant-based diets have entered the mainstream, prompting quick-service restaurants (QSRs) and coffee chains to find ways to offer vegan donut options on their menus, responding to consumer demand for inclusivity and plant-based access. It represents the transition from niche vegan bakeries to mass-market availability - especially in drive-thu locations, airport kiosks and convenience stores. It speaks to the popularity of convenient, packable vegan indulgence.

Strategic Response: Dunkin’ launched vegan donut pilot programs in select USA locations, partnering with plant-based ingredient suppliers, leading to an 8% uplift in plant-based products. Pret A Manger, a UK coffee giant, introduced vegan jam-filled donuts in all its stores, which helped the chain achieve double-digit growth in afternoon snack sales.

In Germany, for example, BackWerk launched vegan Berliner donuts with fruit-based fillings and increased its footfall from plant-based consumers by 12%. These chains are pushing vegan donuts into the mainstream by prioritizing availability and convenience.

Functional Ingredients for Health-Conscious Consumers

Shift: Informed health consumers are looking to their guilty-pleasure snacks for functional benefits, and that’s driving the rising of vegan donuts infused with superfoods, adaptogens and alternative sweeteners. And to set products apart with wellness value, ingredients such as matcha, turmeric, spirulina, maca, activated charcoal and MCT oil are being utilized. This has become trendy with fitness freaks, young professionals and biohackers searching for energy-boosting or immune-supporting treats.

Strategic Response: Erin McKenna’s Bakery NYC created a turmeric latte vegan donut made with coconut milk and cinnamon, which is said to have anti-inflammatory properties; when it was promoted, online orders via health-focused platforms increased 13 percent. L. A.-based Donut Friend created a matcha spirulina donut topped with a cashew glaze, which is catching on in wellness cafes and yoga studios, causing a 9 percent increase in B2B orders.

The general food market also reaped the benefits of collaboration, including Plant Café Seoul in South Korea, which launched vegan charcoal donuts filled with probiotics and drew the attention of K-beauty and wellness lovers, giving cross-category sales a 10% boost. These brands exploit health-meets-indulgence demand.

Sustainable Packaging and Environmental Communication

Shift: Eco-conscious consumers are embracing brands with sustainable packaging and eco-friendly business practices Whether in plastic-free wrappers, biodegradable boxes or compostable delivery packaging, the zero-waste movement is spilling into how vegan donuts are packaged, marketed and delivered brands. Europeans, Canadians, and urban Americans are particularly sensitive to carbon neutral delivery and local sourcing transparency.

Strategic Response: A Portland-based donut store, Doe Donuts, changed all their packaging to be compostable, and eliminated usage of plastic. They received media coverage on the topic, and saw a 15 percent increase in sustainability-minded customers as a result. Crosstown Doughnuts, based in the UK, introduced carbon-neutral delivery throughout London for its vegan doughnut box sets, which increased e-commerce sales by 11%.

In France, VG Pâtisserie worked with local organic farms for its ingredients and used reusable containers for deliveries, driving a 9% increase in subscriptions for regular delivery of donuts. These brands are not just making purchases, but are behind brand loyalty with their values of sustainability consumer.

The following table shows the estimated growth rates of the top five territories. These markets are set to experience high consumption through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| USA | 9.3% |

| Germany | 10.1% |

| China | 9.5% |

| Japan | 9.0% |

| India | 10.4% |

As a result the USA demand for vegan donuts is experiencing a surge, given the growing consumer appetite for plant-based and dairy-free baked goods. As more health conscious and flexitarian consumers take on the trend, food manufacturers are experimenting with new formulations of non-dairy milk, flaxseeds and natural sweeteners.

It’s never been easier to get vegan donuts-in supermarkets, at specialty vegan bakeries, and online. Also, the clean-label trend is encouraging brands to prioritize organic, non-GMO, and preservative-free ingredients which is ultimately increasing consumer trust and driving sales. Rise in vegan fast-food chains and independent bakeries support the market growth.

Germany is one of the largest markets for plant-based food, and a vegan donut was a huge success with health and ethical consumers alike. With the emphasis on sustainability and environmental consciousness throughout the country, and by extension, the world, purchasing decisions are evolving, forcing bakeries and retailers alike to release plant-based and organic varieties of even donuts.

Large supermarket chains and specialty stores developed their ranges of vegan products so that now it is easier to find dairy-free and egg-free donuts. Regulatory frameworks also promoting plant-based food labeling have also supported the growth of this market. The growth of high-end and gourmet vegan donuts, with novel flavors and nutrient-dense components, is so driving growth within Germany.

The increasing interest in having vegan donuts was enabled by the increased urbanization of China and their increasing exposure to Western bakery trends. The continued rise of plant-based eating among younger generations has led to strong growth for innovative bakery products that embrace healthier eating habits.

E-commerce platforms have emerged as vital players in broadening market access, while a growing consumer demand for plant-based indulgent snacks is driving growth. Plant-based eating is fast-tracking vegan bakery products due to the government initiatives encouraging plant-based eating and increasing emphasis on dairy consumption reduction. Chinese bakeries are joining in the mix with local flavors to appeal to customers, which can only increase the demand for vegan donuts.

Japan’s bakery industry is highly innovative, and the rising demand for plant-based sweets has led to the growth of vegan donuts. There’s heavy emphasis on texture and taste, so the country has produced excellent vegan substitutes that closely mimic traditional donuts. To cater to the growing flexitarian demand, convenience stores, premium bakeries and dessert cafés are adding plant-based donuts to their menu.

Various clean-label trends and use of functional ingredients like matcha, black sesame, superfoods also sets Japanese vegan donuts apart in the market. The country’s stringent food safety standards also play a role in consumer trust and widespread adoption.

| Segment | Value Share (2025) |

|---|---|

| Yeast Doughnuts (By Product) | 55.2% |

Yeast doughnuts also hold top spot in the vegan donuts market, because of the airy fluffy texture of the dough, which closely resembles a normal doughnut. These doughnuts are leavened by natural fermentation with yeast, which makes them soft and airy: a favored texture for many consumers. With an increase in demand for non-dairy products, bakeries and food manufacturers have been addressing this profitable opportunity, creating yeast-raised post-doughnut with non-dairy milk, egg substitutes, and plant-based fats to mimic the richness found in classic recipe.

A significant market driver for this segment's growth is the increasing demand for fresh, bakery-style doughnuts. Many artisan bakeries and specialty vegan dessert shops have jumped on the bandwagon and sell a range of yeast-based, fried vegan doughnuts in flavors ranging from vanilla-glazed to chocolate-dipped to fruit-filled.

The yeast doughnuts, with their lower density and fewer calories than cake doughnuts, appeal to the health-conscious consumer segment. Further, diverse dietary needs mean that many brands have broadened their products, which now include organic and gluten-free for niche dietary needs.

This segment has been further propelled by foodservice providers and fast-food chain introducing yeast-based vegan doughnuts in their racks. From specialty cafes to plant-based bakeries to grab-and-go areas in grocery stores, all of which have brought them into the hands of more consumers.

Given the ongoing field of plant-based bofse and plant-based fooding malt-free whoppers, plant-based bakchie, plant-based whoppers, and all that yeast donuts for me, as the malabeet legacy grows, will make the trip down a hundred sunny dough polls, a thousand sunny dough polls, a million sunny dough units priceless.

| Segment | Value Share (2025) |

|---|---|

| E-Commerce (By Distribution Channel) | 42.8% |

Food & Beverage The key raw material used to manufacture vegan donuts is increase in e-commerce sales in these products is likely make the vegan donuts product market in high growth. Due to the rise of digital over-the-counter shopping, as well as direct-to-consumer (DTC) brand models, the online retail infrastructures have turned into one of the highest supported purchasing channels for almost all things plant-based, including doughnuts. E-commerce has the potential to be more suited to niche and specialty dietary needs, which is one of its primary assets.

Yes, we love being able to find traditional vegan doughnuts at your local shops, as well as gluten-free, organic, and even sugar-free vegan doughnuts available at various online stores that offer online ordering. Peel away the packaging, and consumers can easily browse various brands, weigh up nutritional information and choose products that suit their dietary preferences.

The segment has also been driven by subscription-based services and online bakeries. Most of the newer plant-based bakeries are online only, serving up fresh, hand-crafted doughnuts that come right to your door. Brands can thereby create lasting customer relationships through targeted marketing, promotion, and loyalty programs.

Social media and influencer marketing also significantly contribute to e-commerce sales. Food bloggers and social media influencers for the vegan lifestyle often promote for purchase online innovative plant-based products such as doughnuts. In addition, targeted digital advertising and search engine optimization (SEO) strategies further aid in grabbing the attention of a wider audience.

The vast growth of matching services such as large online merchants and food delivery is another reason why e-commerce is booming. Storefronts like Amazon, Instacart and specialty vegan marketplaces offer same-day delivery, streamlining the process for consumers who want their animal-free cookies closer than ever.

The Vegan Donuts Market is rapidly growing due to the increasing health concerns among the consumers which has shifted their preference towards herbal products contributing towards the growth of the Vegan Donuts Market. By providing plant-based sustainability donut lines that closely match the consistency and taste of their conventional donut counterparts, these brands have greatly increased consumer interest.

These companies have managed to accommodate the rising demand for vegan-friendly desserts by utilizing dairy-free milk, egg replacements, and natural sweeteners. Faced with the competition, companies are rolling out new flavors and premium ingredients on a constant basis.

Healthier options range from gluten-free donuts to low-sugar and high-protein vegan donuts, these target health-conscious consumers. Furthermore, producers are creating attractive packaging designs and employing eco-friendly materials to satisfy sustainability-conscious purchasers.

For instance:

Market segmented into Yeast Doughnuts and Cake Doughnuts.

Market segmented into E-commerce and Offline. Offline sales further segmented into Vitamins & Supplements Stores, Retail and Departmental Stores, Supermarkets, Vegan Fairs, and Others.

Market segmented into North America, Latin America, Europe, Asia Pacific (APAC), and the Middle East & Africa (MEA).

The global vegan donuts market is projected to grow at a CAGR of 9.6% during the forecast period.

The market is estimated to reach approximately USD 358.9 million by 2035.

The baked vegan donuts segment is expected to witness the fastest growth due to rising consumer demand for healthier, low-fat dessert options.

Key growth drivers include increasing adoption of plant-based diets, growing preference for dairy- and egg-free baked goods, and expanding availability in retail and foodservice channels.

Leading companies in the market include HP Hood (Planet Oat), Unilever, Danone S.A., Cado, Bliss Unlimited, LLC, Daiya Foods Inc. & Alternative Foods

Figure 1: Global Market Value (US$ Million) by Flavor Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Flavor Type, 2018 to 2033

Figure 9: Global Market Volume (MT) Analysis by Flavor Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Flavor Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Flavor Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 13: Global Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 16: Global Market Attractiveness by Flavor Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Flavor Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Flavor Type, 2018 to 2033

Figure 27: North America Market Volume (MT) Analysis by Flavor Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Flavor Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Flavor Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 31: North America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 34: North America Market Attractiveness by Flavor Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Flavor Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Flavor Type, 2018 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Flavor Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Flavor Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Flavor Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Flavor Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Flavor Type, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Flavor Type, 2018 to 2033

Figure 63: Europe Market Volume (MT) Analysis by Flavor Type, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Flavor Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Flavor Type, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 67: Europe Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 70: Europe Market Attractiveness by Flavor Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: East Asia Market Value (US$ Million) by Flavor Type, 2023 to 2033

Figure 74: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 75: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: East Asia Market Value (US$ Million) Analysis by Flavor Type, 2018 to 2033

Figure 81: East Asia Market Volume (MT) Analysis by Flavor Type, 2018 to 2033

Figure 82: East Asia Market Value Share (%) and BPS Analysis by Flavor Type, 2023 to 2033

Figure 83: East Asia Market Y-o-Y Growth (%) Projections by Flavor Type, 2023 to 2033

Figure 84: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 85: East Asia Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Flavor Type, 2023 to 2033

Figure 89: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) by Flavor Type, 2023 to 2033

Figure 92: South Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 93: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia Market Value (US$ Million) Analysis by Flavor Type, 2018 to 2033

Figure 99: South Asia Market Volume (MT) Analysis by Flavor Type, 2018 to 2033

Figure 100: South Asia Market Value Share (%) and BPS Analysis by Flavor Type, 2023 to 2033

Figure 101: South Asia Market Y-o-Y Growth (%) Projections by Flavor Type, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 103: South Asia Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 104: South Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 105: South Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 106: South Asia Market Attractiveness by Flavor Type, 2023 to 2033

Figure 107: South Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 108: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 109: Oceania Market Value (US$ Million) by Flavor Type, 2023 to 2033

Figure 110: Oceania Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 111: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 114: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Oceania Market Value (US$ Million) Analysis by Flavor Type, 2018 to 2033

Figure 117: Oceania Market Volume (MT) Analysis by Flavor Type, 2018 to 2033

Figure 118: Oceania Market Value Share (%) and BPS Analysis by Flavor Type, 2023 to 2033

Figure 119: Oceania Market Y-o-Y Growth (%) Projections by Flavor Type, 2023 to 2033

Figure 120: Oceania Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 121: Oceania Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 122: Oceania Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 123: Oceania Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 124: Oceania Market Attractiveness by Flavor Type, 2023 to 2033

Figure 125: Oceania Market Attractiveness by Sales Channel, 2023 to 2033

Figure 126: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 127: MEA Market Value (US$ Million) by Flavor Type, 2023 to 2033

Figure 128: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 132: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: MEA Market Value (US$ Million) Analysis by Flavor Type, 2018 to 2033

Figure 135: MEA Market Volume (MT) Analysis by Flavor Type, 2018 to 2033

Figure 136: MEA Market Value Share (%) and BPS Analysis by Flavor Type, 2023 to 2033

Figure 137: MEA Market Y-o-Y Growth (%) Projections by Flavor Type, 2023 to 2033

Figure 138: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 139: MEA Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 140: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 141: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 142: MEA Market Attractiveness by Flavor Type, 2023 to 2033

Figure 143: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Flavor Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Flavor Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Flavor Type, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Flavor Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Flavor Type, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Flavor Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Flavor Type, 2018 to 2033

Table 22: Europe Market Volume (MT) Forecast by Flavor Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: Europe Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Flavor Type, 2018 to 2033

Table 28: East Asia Market Volume (MT) Forecast by Flavor Type, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: East Asia Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 31: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: South Asia Market Value (US$ Million) Forecast by Flavor Type, 2018 to 2033

Table 34: South Asia Market Volume (MT) Forecast by Flavor Type, 2018 to 2033

Table 35: South Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 36: South Asia Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 39: Oceania Market Value (US$ Million) Forecast by Flavor Type, 2018 to 2033

Table 40: Oceania Market Volume (MT) Forecast by Flavor Type, 2018 to 2033

Table 41: Oceania Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 42: Oceania Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Flavor Type, 2018 to 2033

Table 46: MEA Market Volume (MT) Forecast by Flavor Type, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: MEA Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Powder Market Analysis - Size, Share, and Forecast 2025 to 2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

Vegan Casing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Vegan Vitamins and Supplements Market – Growth & Demand 2025 to 2035

Analysis and Growth Projections for Vegan Fast-Food Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA