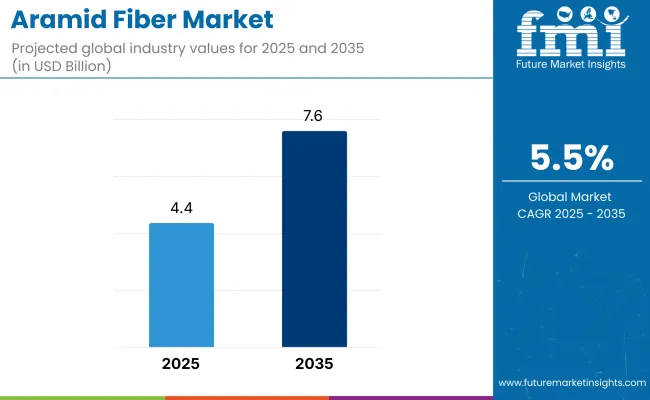

The aramid fiber market is valued at USD 4.45 billion in 2025 and is forecast to reach USD 7.60 billion by 2035, advancing at a 5.5% CAGR.

Within the aramid fiber market, the United States remains the most lucrative country in 2025, buoyed by steady Pentagon procurement of next-generation body armor and high uptake of lightweight composites by Boeing and Lockheed. Meanwhile, China is poised to be the fastest-growing national market through 2035, catalyzed by its “Made in China 2025” program and explosive EV-battery insulation demand.

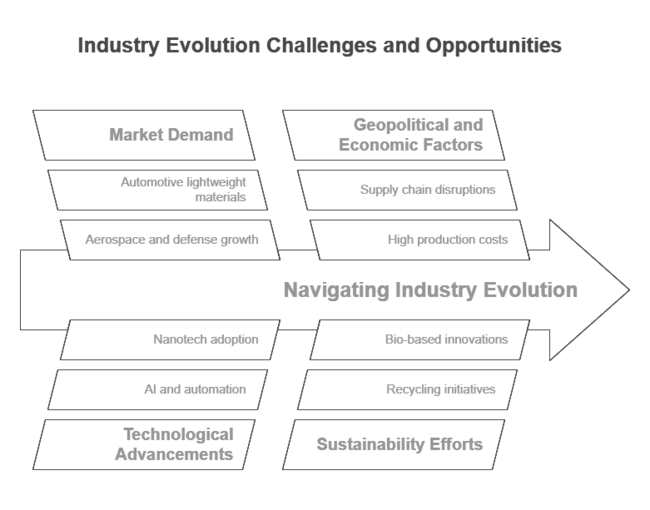

Intensifying workplace-safety mandates, electrification initiatives, and the move toward lightweighting are reshaping the aramid fiber market. Producers emphasize consistent tensile performance, REACH-compliant chemistries, and closed-loop effluent recovery.

Volatile para-xylene prices and high energy intensity restrain margins, pushing manufacturers toward biomass-based precursors and nano-fiber spinning to trim energy use by ~18 percent. Key trends include AI-assisted fiber-diameter control, circular recycling of scrap into short-staple insulation, and blockchain batch tracing for aerospace traceability audits.

Looking ahead, the aramid fiber market will pivot from commodity tonnage to performance-driven, low-carbon formulations. Edge analytics will tune polymerisation in real time, raising conversion yields while lowering caprolactam losses. Bio-based meta-aramid and para-aramid blends are expected in mainstream catalogs by 2030, trimming cradle-to-gate CO₂ by up to 30 percent.

Suppliers that embed scope-3 reporting, meet ISO 14067, and roll out “fiber-as-a-service” leasing to armor integrators are positioned to capture outsized share as defense and EV customers standardise on sustainable, high-strength aramid solutions.

Security agencies worldwide are upgrading to lighter, NIJ III-plus armor, propelling para-aramid demand for ballistic helmets, inserts, and vehicle spall liners. EV-battery makers are also specifying para-aramid paper for high-temperature separators.

Meta-aramid retains volume leadership in heat-resistant apparel and electrical insulation, while copolymers address niche filtration uses. Producers are rolling out recycled para-aramid with QR-coded provenance, accelerating adoption across Europe and South America.

| Product Type | CAGR (2025 to 2035) |

|---|---|

| Para-aramid Fiber | 5.9 % |

Defense and law-enforcement contracts account for more than 40 percent of aramid fiber market revenue and remain the prime adopters of multi-axial fabrics that pair para-aramid with UHMWPE for reduced back-face deformation.

Automotive friction-materials firms follow, integrating aramid pulp into EV brake pads to curb copper particulates. Electrical-insulation grades used in transformers and high-voltage cabling are the next fast-growth cluster, benefiting from grid-modernisation and offshore-wind rollouts.

| Application Segment | CAGR (2025 to 2035) |

|---|---|

| Security & Protection | 5.6 % |

These high-growth niches-ballistics-oriented para-aramid and defense-centric security applications-signal where suppliers should channel R&D, green-chemistry breakthroughs, and integrated supply agreements to maximise share in the aramid fiber market through 2035.

We also expect sizeable growth in the aramid fiber industry in 2025, driven by technological breakthroughs in the protective textiles, aerospace, and automotive sectors. The pursuit of strong, lightweight materials was ever-present, with industries looking at performance efficiencies and approaches to sustainability.

In 2024, industry growth was primarily led by the defense sector, driven by increased procurement of ballistic protection equipment by military forces worldwide. The automotive industry also adopted high-performance fibers with greater enthusiasm, particularly in EVs. These fibers were incorporated into insulating materials for electric vehicle batteries to enhance thermal insulation and fire safety properties. The upward trend is expected to accelerate in 2025 as regulatory agencies implement stricter safety standards.

For the forecast period of 2025 and beyond, the sector will be fueled by a higher investment in research and development, primarily in the area of green and recyclable aramid products. With the Asia-Pacific region being rapidly industrialized and spearheading other major industries such as defense, automotive, and aerospace, the global landscape is estimated to grow at a 5.5% CAGR, also leading to cross-vertical opportunities.

| Country | Key Regulations & Policies |

|---|---|

| United States | Strict National Institute of Justice (NIJ) ballistic protection standards regulate defense and law enforcement equipment. The Environmental Protection Agency (EPA) has also established guidelines for the chemical processing of high-performance fibers to ensure environmental safety. |

| United Kingdom | High-performance protective gear is required by the defense and security export policy. The REACH chemical safety guidelines for fiber production must be adhered to. |

| France | Military applications under defense procurement law necessitate high-strength materials sourced locally. Yes, it includes strict fire resistance standards for aerospace textiles. |

| Germany | In automotive and aerospace applications, DIN standards set specific requirements for material performance and durability. Additionally, the EU Green Deal emphasizes sustainability, pushing manufacturers to adopt eco-friendly and recyclable fiber-based solutions. |

| Italy | High-performance vehicles must use high-temperature-resistant materials in compliance with automotive safety standards. Lightweight ARIMAD composites are a high priority for the defense sector. |

| South Korea | The Korean Industrial Standards (KS) prescribe the use of high-performance fibers for military and firefighting applications in Korea. Strengthened regulations on EV battery safety have led to increased investment in advanced insulating materials. |

| Japan | In the field of protective textiles, stringent new requirements are being developed, such as Japanese Industrial Standards (JIS), which set such requirements as durability and flame resistance. Industrial Quality Control for Aerospace Composites. |

| China | The implementation of the Made in China 2025 policy aims to promote local production of cutting-edge materials, supporting technological self-sufficiency. Additionally, enhanced safety regulations are driving innovation in firefighting gear to improve durability and heat resistance. |

| Australia & New Zealand | Industrial applications of heat-resistant textiles and protective garments: AS/NZS standards about military zeniths, strengthening military-grade material certifications. |

| India | Ballistic-resistant fabrics are increasingly being produced domestically under India's manufacturing initiatives. Defense Production Policy Fire Safety Aramid Fiber Standard by Bureau of Indian Standards (BIS) |

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Heavy demand in the aerospace, defense, and industrial sectors translates to continued growth. | Growth is driven by EVs. Battery insulation, renewable energy, and advanced composites. |

| Supply chain disruptions related to COVID-19 and geopolitical tensions. | More investment should be made in domestic production and raw material security. |

| There has been significant progress in ballistic protection and flame-resistant clothing. | The new high-performance fibers provide additional heat resistance and durability. |

| The company specializes in high-performance materials for both military and aerospace applications. | Growing demand for features and properties of lightweight and high-strength materials is projected to boost the automotive and infrastructure sectors. |

| This marks the beginning of sustainability and recycling efforts. | There are emerging circular economy models and bio-based high-performance fiber innovations. |

| Innovation and production were heavily concentrated in North America and Europe. | Asia-Pacific is emerging as a manufacturing and consumption leader. |

| Cost-sensitive markets prevented widespread adoption due to high production costs. | Broader accessibility is driven by cost optimizations and economies of scale. |

| Conventional manufacturing processes are reliant. | AI, automation, and nanotech adoption to enhance fiber performance. |

High-performance fibers are widely used in industries such as aerospace, automotive, and defense, especially in the United States, which is one of the largest consuming nations. The USA Department of Defense (DoD) funding for ballistic protective materials has vigorously sustained the adoption of these fibers in body armor, helmets, and reinforced military-grade vehicles.

The aerospace industry, driven by companies like Boeing and Lockheed Martin, uses advanced composites in aircraft structures to save weight and add durability. Sustainable development is also at the forefront of the country’s shift toward bio-based and recyclable fiber materials, placing the USA at the top of next-generation fiber technologies. Having a CAGR of 5.4%, the industry in the USA is expected to reach USD 1 billion by 2035.

The consistently growing defense and aerospace sectors in the UK contribute to driving demand. The UK Ministry of Defense purchases large volumes of fiber-reinforced bulletproof vests, helmets, and flame-resistant clothing to protect its soldiers. Furthermore, the country’s strong aviation sector, supported by major players like Rolls-Royce and BAE Systems, is driving regional industry growth.

The production of high-quality technical fibers in the UK is facilitated by stringent safety guidelines from the UK Health and Safety Executive (HSE) and adherence to EU REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) policies. Demand for heat-resistant fibers is expected to increase in high-temperature insulation and battery safety applications due to the UK's growing focus on electric vehicles (EV) and renewable energy solutions.

The defense, aerospace, and automotive industries in France continue to shape the demand landscape. The French military and police forces are placing greater emphasis on high-performance protective equipment, driving significant demand for fiber-based ballistic body armor, tactical apparel, and riot gear.

Moreover, local players such as Renault and Peugeot in the automobile industry are integrating durable fiber materials in high-performance tires and friction materials to enhance vehicle safety and longevity. France's commitment to sustainability and EU green regulations has further fueled innovation in eco-friendly alternatives, establishing the country as a leader in sustainable fiber technology.

Germany accounts for a significant share of the overall consumption, primarily due to its strong automotive, industrial, and defense sectors. Germany's large automotive manufacturers, including BMW, Mercedes-Benz, and Volkswagen, create a strong need for reinforced fiber in tires, friction materials, and lightweight composites to enhance fuel efficiency and vehicle performance. Protective fiber materials are also widely used in the German military for advanced body armor, protective clothing, and vehicle armor.

The aerospace sector (including Airbus and others) also makes heavy use of aramid-based composites to increase aircraft lifetimes and reduce fuel consumption. Germany's strong industrial base also supports the demand for high-temperature insulation, as well as optical fibers and fire-resistant textiles.

The Italian counterpart of the landscape is gaining traction in industries such as defense, automotive, and fashion. Security forces and law enforcement agencies in Italy use bulletproof vests, helmets, and tactical uniforms made of high-strength materials. Italy’s world-class automotive sector, including Ferrari, Lamborghini, and Fiat, integrates reinforced composites in high-performance tires, brake systems, and lightweight vehicle components.

The demand for heat-resistant fabrics used in fire-retardant and protective clothing, especially for industrial workers and firefighters, has also been propelled by Italy’s strong presence in the fields of fashion and textiles. While the aerospace sector is smaller than that of other European countries, the demand for aircraft reinforcement materials still adds to the overall trend.

The industry in South Korea is growing rapidly, with a CAGR of 4.1%, and is forecasted to reach USD 0.57 billion by 2035, driven by its advanced automotive, defense, and electronics sectors. The country’s heavy emphasis on military modernization increases the requirement for ballistic armor, tactical gear, and lightweight military vehicles. Hyundai and Kia are at the forefront of the automotive sector, where high-performance fibers are used in tires, friction materials, and insulation for EV batteries.

Moreover, reinforced optical fibers are vital for high-speed data transmission due to South Korea's development of consumer electronics and 5G infrastructure, contributing to increased sales. In addition, the government is also investing in renewable energy and electric vehicle (EV) infrastructure development, which is driving demand for electrical insulation and power grid applications.

Japan is well-developed, particularly in defense, automotive, and electronics. The country is home to leading high-performance fiber manufacturers, including Teijin and Toray, which export advanced materials for both domestic and international applications. Toyota, Honda, and Nissan dominate Japan's motor industry, integrating specialized fibers into high-tech tires, braking systems, and lightweight car components. Fiber-based protective gear, including bulletproof jackets and fireproof textiles, remains critical for the defense industry. Growing network systems focused on technological innovation and miniaturization are expected to boost demand for specialty fibers in optical cables and electronic components.

Japan's extensive safety legislation and environmental awareness are driving R&D efforts for next-generation sustainable fibers with enhanced recyclability and eco-friendly properties. The industry is anticipated to reach USD 0.67 billion, growing steadily at a 4.5% CAGR by 2035.

We expect China's rapidly expanding automotive, defense, and industrial bases to fuel its rise as the dominant force in high-performance fiber applications. The industry will reach USD 0.94 billion with a CAGR of 5.2% by 2035. The government is also encouraging the local production of advanced materials to reduce reliance on imports as part of its Made in China 2025 program.

The country's massive defense industry is driving enormous demand for ballistic protection and military-grade vehicle reinforcements. China's fast-growing electric vehicle (EV) market, led by companies like BYD and NIO, is driving rapid demand for battery insulation, high-performance tires, and lightweight composites.

Australia and New Zealand’s industry is small but growing steadily, mostly due to defense, firefighting, and industrial applications. Demand for firefighter suits, industrial gloves, and heat-resistant uniforms is rising due to strict safety standards for protective clothing in both countries. As they invest in advanced body armor and tactical gear for military personnel, adoption of high-strength protective materials is increasing in the defense sector.

In addition, the region's emphasis on renewable energy is also driving demand for electrical insulation and high-voltage power transmission solutions. Local production of reinforced composites in Australia and New Zealand is expected to grow as both countries enhance their manufacturing capabilities.

High-performance materials are the preferred choice in India's defense and automotive industries. The government's Make in India program promotes domestic manufacturing of ballistic armor, tactical gear, and other protective apparel for military and law enforcement forces. Companies such as Tata Motors and Mahindra have been integrating advanced composites into high-performance tires and friction materials for the automotive sector.

In addition, the growing power sector is propelling demand for electrical insulation materials. The increasing focus on workplace safety and fire prevention in India is driving the adoption of protective apparel within industrial settings.

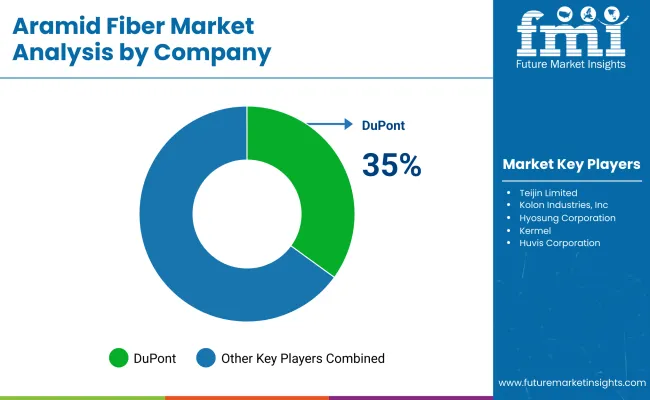

The industry is group-oriented, and a few key players control the global market. Here’s a breakdown of the share in 2024 for the top companies:

The leading company is DuPont de Nemours, Inc. (35%)

DuPont is the world leader in aramid fiber, mainly because of its flagship product, Kevlar. It has solutions for many industries, including defense, automotive, and industrial.

Teijin Limited (25%)

Teijin, a Japanese chemical company, is a significant aramid fiber player that manufactures the Twaron and Technora brands. The firm operates in Asia, Europe, and North America.

Yantai Tayho Advanced Materials Co., Ltd. (15%)

Yantai Tayho Advanced Materials Co., Ltd. has been growing its presence in international scenario.

Kolon Industries, Inc. (10%)

Kolon Industries entered a business alliance with a leading automaker to develop lightweight electric vehicle (EV) aramid fiber composites, aiming to foster innovation and strengthen its position.

Hyosung Corporation (8%)

Kordsa, a global leader in reinforcement technologies, specializes in high-performance materials, including aramid fiber applications for tire reinforcement, composites, and industrial uses.

DuPont is expanding its production

DuPont is expanding its aramid fiber production capacity in the United States. This acquisition will help align its business with its growing portfolio of high-performance materials essential for defense and aerospace applications.

Teijin Starts Production of Eco-Friendly Aramid Fibers

Teijin announces a new line of eco-friendly options. Teijin has constructed its all-new line of eco-conscious aramid products using recycled materials. This innovation caters to the increasing demand for high-performance materials that are environmentally friendly and complement global sustainability objectives.

Kolon Industries: A Long-term Strategic Partnership

Kolon Industries entered into a business alliance with a leading automaker to develop lightweight electric vehicle (EV) aramid composites. By working together, they aim to foster innovation and strengthen Kolon industries’ position.

The sector falls under the specialty chemicals and advanced materials sector, which is closely linked with the defense, aerospace, automotive, electronics, and industrial safety industries. As a high-performance synthetic fiber, Aramid is subject to the macroeconomic demand drivers of the industrial economy, such as industrial expansion, growth in technology, defense spending, and environmental policy.

The global economy, particularly in developing countries like China, India, and Southeast Asia, is driving demand for protective equipment, car reinforcements, and infrastructure materials. Further growth is driven by the rising adoption of electric vehicles (EVs) and renewable energy projects, in which these fibers are used for battery insulation, lightweight composites, and electrical insulation.

Strong growth driven by government spending on defense and security remains, with many countries increasing investments in ballistic protection and tactical warfare. Strict fire safety and workplace regulations mandated in developed economies are driving the consumption of high-performance protective clothing and industrial safety solutions.

Recycling schemes, sustainable production processes, and technological innovation will create new opportunities amid challenges from inflation, supply chain disruption, and volatile prices for raw materials. Growth in the aramid fiber sector will remain relatively stable, with the compound annual growth rate (CAGR) standing at just over 5%-although steady growth in energy-efficient/high-tech applications should support demand through the next decade.

Industries such as defense, aerospace, automotive, and renewable energy that generate employment have huge growth potential in the aramid fibers market. The demand for these lightweight, high-strength, and heat-resistant materials is increasing across various industries, creating new growth opportunities for the landscape.

One of the biggest growth areas is the electric vehicle landscape, where high-performance fibers are being used increasingly in battery insulation, lightweight components, and high-end tires. Producers that invest in bio-based and recyclable advanced fibers will gain a competitive advantage as governments worldwide push toward sustainability and fuel efficiency. In addition to that, the establishment of 5G networks and the installation of fiber optics will create new opportunities for the fiber-reinforced optical cable industry.

Rising military budgets and global tensions are driving demand for new ballistic protection materials in the defense industry. Access is something that we're seeing companies win lucrative long-term government deals around, whether it's next-generation lightweight armor solutions or tailored defense applications. Similarly, industrial safety standards are raising the demand for aramid-based fire-retardant clothing and protective equipment, generating new revenue opportunities.

To leverage such opportunities, companies must constantly diversify their product offerings by investing in R&D, target ing strategic acquisitions of renewable energy companies, automakers, and defense departments, targeting regional expansion to Asia-Pacific and Middle Eastern high-growth sectors, and investing in innovation initiatives to produce differentiated products.

The industry is bifurcated into para-aramid and meta-aramid.

It is fragmented into security & protection, frictional materials, rubber reinforcement, optical fibers, tire reinforcement, electrical insulation, aerospace, and others.

Is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, the Middle East, and Africa.

Tough yet lightweight, aramid fibers are ideal for body armor, helmets, vehicle reinforcement, and so much more, thanks to their incredible balance of ballistic resistance, heat resistance, and durability.

They help provide thermal stability and insulation for EV batteries, which minimizes the chances of fire and enhances the overall performance.

Their low weights but high tensile strength improve aircraft fuel efficiency, structural integrity, and impact resistance, among other things.

While relying on existing ethylene terephthalic acid, research is ongoing for bio-based aramid fibers and improved recycling methods to lower environmental impact.

Manufacturing processes and material formulations are driven by safety, environmental, and chemical compliance laws.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fiber Optic Probe Hydrophone (FOPH) Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Centrifugal Fan Market Size and Share Forecast Outlook 2025 to 2035

Fiber to the Home Market Size and Share Forecast Outlook 2025 to 2035

Aramid Flame Retardant Webbing Market Size and Share Forecast Outlook 2025 to 2035

Fiber Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Lid Market Forecast and Outlook 2025 to 2035

Aramid Honeycomb Core Material Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Collimating Lens Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Duct Wrap Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fiber-Based Blister Pack Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA