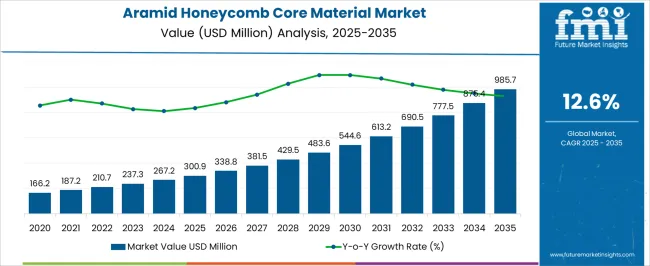

The Aramid Honeycomb Core Material Market is estimated to be valued at USD 300.9 million in 2025 and is projected to reach USD 985.7 million by 2035, registering a compound annual growth rate (CAGR) of 12.6% over the forecast period.

The aramid honeycomb core material market is advancing steadily, supported by the growing demand for lightweight, high-strength materials in aerospace, automotive, and defense industries. Aramid honeycomb structures provide excellent mechanical performance, thermal stability, and resistance to fatigue, making them ideal for demanding structural applications.

Increasing emphasis on fuel efficiency and emission reduction has intensified the adoption of lightweight composites in transportation sectors. The market is further strengthened by continuous technological improvements in manufacturing processes, enabling higher precision and cost efficiency.

Expanding use in high-performance sporting goods and industrial applications has broadened the market scope. With rising investments in next-generation aircraft and electric mobility, aramid honeycomb core materials are expected to remain a critical component in advanced engineering design.

| Metric | Value |

|---|---|

| Aramid Honeycomb Core Material Market Estimated Value in (2025 E) | USD 300.9 million |

| Aramid Honeycomb Core Material Market Forecast Value in (2035 F) | USD 985.7 million |

| Forecast CAGR (2025 to 2035) | 12.6% |

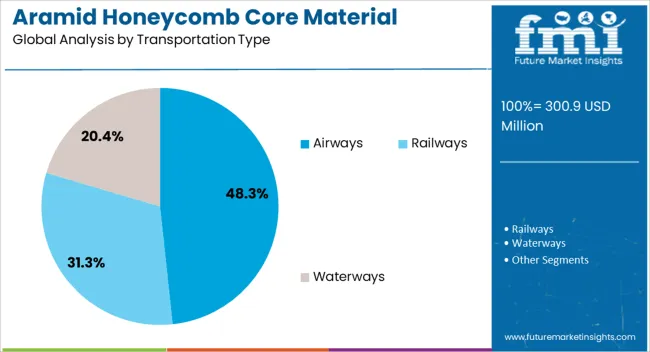

The market is segmented by Type, Application, and Transportation Type and region. By Type, the market is divided into Nomex and Others. In terms of Application, the market is classified into Exterior and Interior. Based on Transportation Type, the market is segmented into Airways, Railways, and Waterways. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Nomex segment dominates the type category with approximately 62.4% share, owing to its superior fire resistance, high tensile strength, and low weight characteristics. Nomex honeycomb materials are extensively used in aircraft interiors, structural panels, and aerospace components requiring stringent safety compliance.

The segment benefits from well-established production infrastructure and supply chain reliability. Its compatibility with multiple resin systems enhances design flexibility, further supporting adoption in both commercial and defense applications.

Continuous product optimization aimed at improving cost efficiency and sustainability has reinforced its position in global markets. With rising aircraft manufacturing and retrofitting activities, the Nomex segment is anticipated to sustain its leadership in the foreseeable future.

The exterior segment holds approximately 54.7% share of the application category, driven by increasing utilization of aramid honeycomb materials in aircraft fuselage, flaps, and fairings. The lightweight yet durable structure of aramid cores enhances fuel efficiency and performance stability under high stress conditions.

Their superior weather and corrosion resistance make them suitable for exterior components exposed to environmental extremes. Growing adoption in both commercial and military aircraft manufacturing has supported this segment’s expansion.

As the aviation industry continues to prioritize lightweighting to meet emission and performance standards, the exterior segment is expected to remain a primary growth driver within the market.

The airways segment leads the transportation type category with approximately 48.3% share, underpinned by the strong demand for advanced composites in the aerospace industry. Aramid honeycomb cores provide excellent structural efficiency, reducing aircraft weight while maintaining rigidity and impact resistance.

Their widespread application across civil, defense, and cargo aircraft reinforces the segment’s prominence. Increasing production rates of narrow-body and wide-body aircraft, along with retrofitting activities for existing fleets, continue to drive consumption.

With continuous expansion in global air travel and ongoing innovation in aircraft material technologies, the airways segment is expected to maintain its leading role in market growth.

The United States and the United Kingdom are expected to reach heights in their respective regions. Top companies known for their market presence, innovation, and strategic initiatives are stirring growth in these regions.

Within Asia Pacific, Japan, China, and South Korea are projected to robustly lift the regional market’s position. Specific factors like regulatory shifts, changing consumption patterns, and the use of leading aramid technology are complementing market growth.

| Countries | Forecasted CAGR (2025 to 2035) |

|---|---|

| United States | 12.70% |

| United Kingdom | 13.90% |

| China | 13.30% |

| Japan | 13.80% |

| South Korea | 15.10% |

The United States is anticipated to grow at a CAGR of 12.70% through 2035. The market in the United States is forecasted to surpass USD 985.7 million by 2035. Sales of aramid honeycomb core materials are likely to rise due to the following reasons:

The aramid honeycomb core material market in the United Kingdom is forecasted to accumulate USD 35.5 million, recording a CAGR of 13.9% through 2035. Given below are the top-most factors that support the regional market growth:

Manufacturers and suppliers of aramid honeycomb core material in China are projected to generate net sales of USD 141.7 million by 2035, thus giving tight competition to the United States market. The market is anticipated to expand at a CAGR of 13.3% through 2035. Key factors that propel market growth are:

The market in Japan is projected to amass net sales worth USD 91.5 million by 2035. Throughout the forecast period, the market is anticipated to expand at a CAGR of 13.8%. Behind this impressive growth, the following factors are expected to lead the market:

The South Korean aramid honeycomb core material market is projected to account for a revenue of USD 52.7 million by 2035. Throughout this period, the market is anticipated to register a staggering CAGR of 15.1%. The top growth-inducing factors are:

| Attributes | Details |

|---|---|

| Top Type | Nomex |

| CAGR (2025 to 2035) | 12.5% |

The nomex market segment is projected to register a CAGR of 12.5% through 2035. Key factors driving the segment’s growth are:

| Attributes | Details |

|---|---|

| Top Application | Interior |

| CAGR (2025 to 2035) | 12.3% |

The interior segment is projected to register an impressive CAGR of 12.3% through 2035. Given below are the top factors that are propelling the segment’s growth:

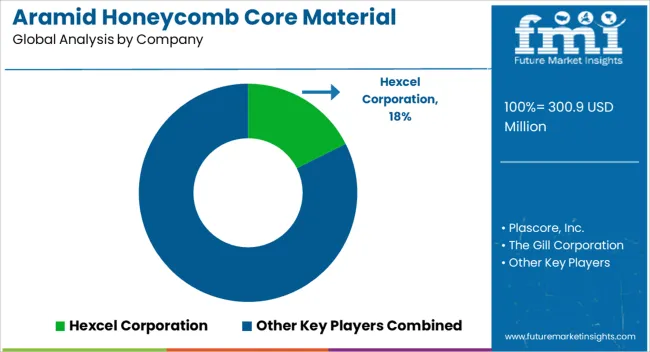

The market is driven by surging demand for high-performance and lightweight materials, which offers lucrative opportunities to key players who can adapt and innovate to meet these demands.

In line with this, players are investing in modern manufacturing techniques that allow for stronger, lighter, and more cost-efficient honeycomb cores.

Industry participants are expanding beyond traditional markets such as aerospace to capture industries like marine, automotive, and construction, where demand for aramid honeycomb core material is consistently rising. Players are entering emerging markets with significant growth potential, especially in Asia Pacific, to increase their sales.

Key companies are building their reputation by highlighting the product’s unique advantages and showcasing successful applications to lure new customers. Market players are developing strong relationships with customers and assisting in technical support to attract new customers while maintaining the old ones.

Latest Developments in the Aramid Honeycomb Core Material Market

The global aramid honeycomb core material market is estimated to be valued at USD 300.9 million in 2025.

The market size for the aramid honeycomb core material market is projected to reach USD 985.7 million by 2035.

The aramid honeycomb core material market is expected to grow at a 12.6% CAGR between 2025 and 2035.

The key product types in aramid honeycomb core material market are nomex and others.

In terms of application, exterior segment to command 54.7% share in the aramid honeycomb core material market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Honeycomb Core Materials Market Size and Share Forecast Outlook 2025 to 2035

Honeycomb Aluminum Foil Market Size and Share Forecast Outlook 2025 to 2035

Aramid Flame Retardant Webbing Market Size and Share Forecast Outlook 2025 to 2035

Core Plate Varnishes Market Size and Share Forecast Outlook 2025 to 2035

Material Rack Correction Machine Market Size and Share Forecast Outlook 2025 to 2035

Material Shrinkage-reducing Agents Market Size and Share Forecast Outlook 2025 to 2035

Material Handling Integration Market Size and Share Forecast Outlook 2025 to 2035

Material-Based Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Material Tester Market Growth – Trends & Forecast 2025 to 2035

Aramid Fiber Market Size, Growth, and Forecast 2025 to 2035

Material Handling Equipment Market Growth - Trends & Forecast 2025 to 2035

Competitive Overview of Honeycomb Packaging Market Share

Honeycomb Packing Paper Market Analysis – Growth & Trends 2024-2034

Material Handling Monorails Market

Core Drill Automatic Feeding Machine Market

Core Banking Solution Market Report – Growth & Forecast 2017-2027

Biomaterial Tester Market Size and Share Forecast Outlook 2025 to 2035

Biomaterial In Surgical Mesh Market Size and Share Forecast Outlook 2025 to 2035

Biomaterial Market Analysis – Size, Share & Forecast 2025 to 2035

Woodcore Access Floor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA