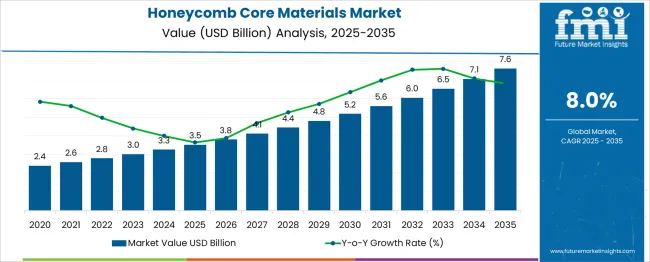

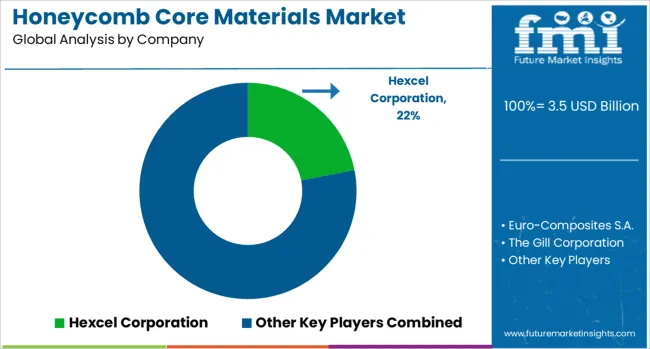

The Honeycomb Core Materials Market is estimated to be valued at USD 3.5 billion in 2025 and is projected to reach USD 7.6 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

| Metric | Value |

|---|---|

| Honeycomb Core Materials Market Estimated Value in (2025 E) | USD 3.5 billion |

| Honeycomb Core Materials Market Forecast Value in (2035 F) | USD 7.6 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The growing need for lightweight, high-strength, and energy-absorbing materials across various industrial applications drives the honeycomb core materials market. These materials are increasingly adopted in sectors such as aerospace, automotive, construction, and packaging, where weight reduction and structural integrity are critical.

Innovations in composite manufacturing and the use of sustainable materials have enhanced product performance and widened adoption across newer end-use verticals. The market is expected to maintain positive momentum as industries continue to emphasize fuel efficiency, load optimization, and cost-effective design solutions.

Increasing investments in transportation infrastructure and the rising demand for eco-friendly and recyclable core structures are also bolstering market growth. Future outlook remains strong, supported by technological advancements in core processing and a shift toward circular material systems in both industrial and consumer goods sectors.

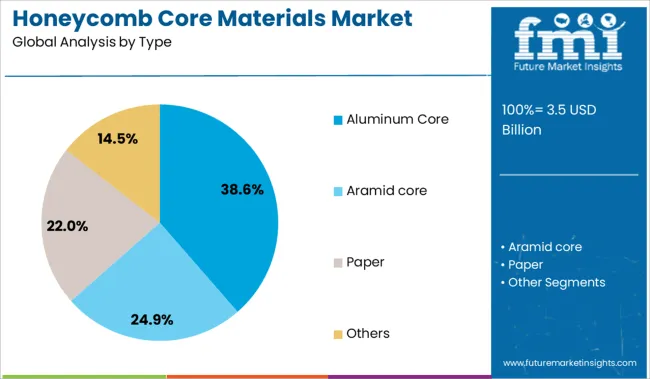

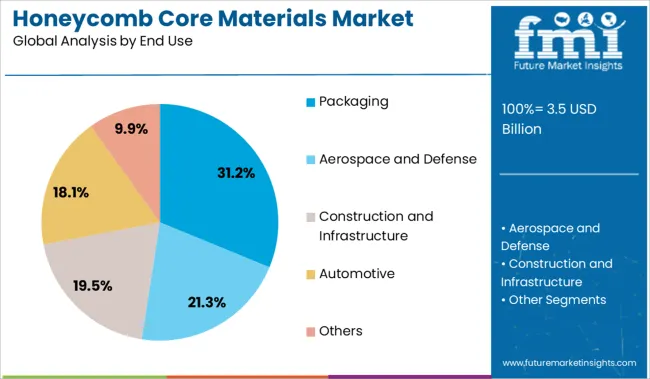

The honeycomb core materials market is segmented by type and end use, and geographic regions. The honeycomb core materials market is divided by type into Aluminum Core, Aramid core, Paper, and Others. In terms of end use, the honeycomb core materials market is classified into Packaging, Aerospace and Defense, Construction and Infrastructure, Automotive, and Others. Regionally, the honeycomb core materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The aluminum core segment leads the market by type with a 38.6% share, attributed to its exceptional strength-to-weight ratio, corrosion resistance, and thermal conductivity. These properties make it a preferred material in demanding applications such as aerospace panels, automotive body parts, and high-performance industrial equipment. The segment benefits from consistent demand for structural cores that can withstand mechanical stress while maintaining low density.

Advances in extrusion and bonding techniques have improved manufacturing efficiency and expanded usage in customized formats. Moreover, aluminum’s recyclability supports sustainability goals, aligning with broader industry efforts to reduce carbon footprints.

The material's adaptability to harsh environments and long service life further enhance its value proposition. Continued innovation in high-precision machining and surface treatments is expected to reinforce the aluminum core’s position as the material of choice across performance-intensive applications.

The packaging segment dominates the end-use category with a 31.2% market share, driven by the rising need for lightweight, shock-absorbent, and sustainable packaging solutions across logistics, consumer goods, and industrial sectors. Honeycomb core materials offer superior cushioning and rigidity, making them ideal for protecting fragile items during storage and transit.

Their structure enables excellent compression strength with minimal material use, reducing overall packaging weight and shipping costs. The segment has gained traction due to growing e-commerce activity and heightened awareness around eco-friendly packaging alternatives.

Manufacturers are focusing on recyclable and biodegradable core variants to align with environmental regulations and customer expectations. As brands prioritize protective performance and cost efficiency, the demand for honeycomb packaging solutions is expected to grow steadily, reinforced by innovations in design customization and hybrid material integration.

Demand for honeycomb core materials is accelerating across aerospace, automotive, construction, and packaging sectors. Sales of aluminum, aramid, and thermoplastic honeycomb cores are expanding rapidly, driven by the need for lightweight, high-strength solutions and sustainability mandates. Asia-Pacific leads adoption, supported by growing manufacturing capacity and infrastructure development.

Demand for honeycomb core materials in aerospace and automotive applications increased notably in 2025 due to the need for lightweight solutions that retain mechanical integrity. Aluminum honeycomb cores are widely deployed in aircraft fuselages, wings, and interior structures, while aramid-based cores such as Nomex offer high strength-to-weight ratios and fire resistance. Automakers are using honeycomb cores in floor panels, headliners, and battery enclosures to reduce vehicle mass and enhance energy efficiency.

Sales of thermoplastic honeycomb cores surged in 2025, especially in the construction and packaging segments. These materials offer recyclability, moisture resistance, and easier thermoforming, making them ideal for modular wall systems, access doors, and raised floors. In packaging, honeycomb cores are used for shock absorption and rigidity in protective containers. Growing sustainability targets and pressure to reduce single-use plastics are increasing the adoption of recyclable honeycomb solutions across these industries.

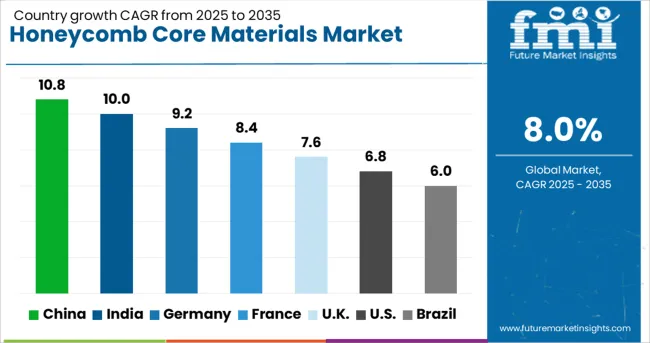

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

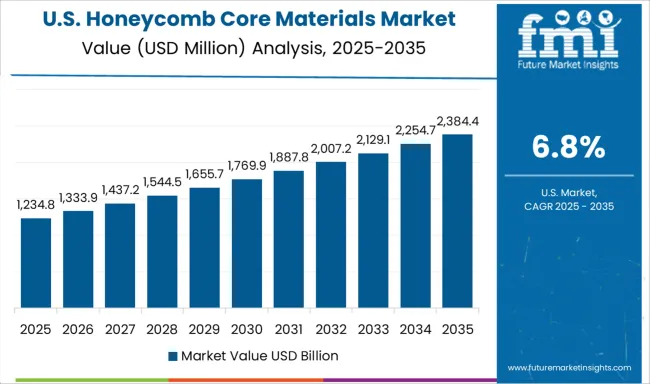

| USA | 6.8% |

| Brazil | 6.0% |

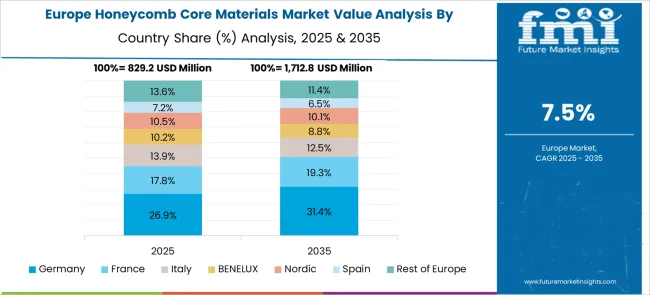

The global market is projected to grow at a CAGR of 8.0% from 2025 to 2035, supported by rising demand for weight-saving materials in mobility, construction, and logistics. China leads with a CAGR of 10.8%, driven by domestic aircraft assembly, space missions, and EV sector expansion. India, at 10.0%, is accelerating due to defense procurement, Make in India incentives, and increased use of lightweight panels in rail and aerospace. Germany is growing at 9.2% as automakers implement honeycomb cores in EV crash safety and structural elements. The United Kingdom, with 7.6% growth, is leveraging these materials in naval systems and architectural retrofits. The United States, at 6.8%, continues to advance applications in military-grade systems and electrified aviation. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is projected to grow at a 10.8% CAGR, led by domestic aircraft manufacturing, space exploration projects, and rapid EV sector expansion. Honeycomb cores are increasingly used in fuselage panels, aerospace interiors, and structural components for lightweight strength. Government-backed programs in commercial and defense aviation amplify demand for high-performance composite cores. Local manufacturers are investing in large-scale production for aluminum and Nomex honeycomb structures to support automotive and wind energy projects. Collaborations between state-owned enterprises and global aerospace firms are driving adoption of fire-resistant and high-load-bearing honeycomb panels.

India is expected to post a 10.0% CAGR, driven by defense procurement programs, Make in India policies, and an uptick in aerospace component manufacturing. Honeycomb cores are gaining traction in military aircraft, rail coaches, and urban transport systems for weight reduction and durability. Defense contractors are investing in localized production to meet offset obligations under procurement contracts. The demand for composite honeycomb structures is increasing in light of EV battery housing and renewable energy blade systems. Partnerships between Indian OEMs and global suppliers are promoting technology transfers for advanced composite applications in both civilian and defense sectors.

Germany is forecast to grow at a 9.2% CAGR, underpinned by advanced applications in automotive crash structures and aerospace engineering. EV manufacturers are incorporating aluminum and thermoplastic honeycomb cores into chassis and body structures to improve rigidity and impact absorption. Aerospace OEMs are deploying lightweight cores in interiors, flooring, and aerodynamic panels to optimize fuel efficiency. German material suppliers are focusing on recyclable honeycomb designs for architectural and industrial markets. Integration with automated fabrication systems ensures consistent quality and cost efficiency, reinforcing Germany’s leadership in precision composite manufacturing for high-performance engineering solutions.

The United Kingdom is projected to grow at a 7.6% CAGR, driven by naval systems, aerospace refurbishments, and retrofitting of heritage architecture. Honeycomb cores are widely adopted in shipbuilding for decking, partitions, and insulation, enhancing structural integrity without adding weight. Demand is also rising in modular building solutions and energy-efficient cladding panels for architectural projects. UK-based defense contractors are investing in next-generation honeycomb materials compatible with composite skins for maritime and aerospace applications. Collaborations with research institutions are enabling breakthroughs in fire-retardant and corrosion-resistant core materials suitable for harsh operating environments.

The United States is expected to post a 6.8% CAGR, supported by extensive applications in military-grade aerospace systems and electrified aviation projects. Defense programs are incorporating honeycomb cores into rotorcraft, UAVs, and missile structures for enhanced performance. Commercial aircraft manufacturers are investing in hybrid honeycomb composites for next-generation airframes targeting weight reduction. Rising focus on urban air mobility and electric aircraft accelerates innovation in thermoplastic honeycomb structures. Domestic producers are scaling output to meet demand from aerospace, defense, and infrastructure sectors, while strategic R&D efforts focus on cores with superior fatigue resistance and impact performance.

Hexcel Corporation leads the global honeycomb core materials market with a significant share, supported by its integrated manufacturing of aerospace-grade composites. Euro-Composites and The Gill Corporation follow with a strong presence in aviation and defense paneling systems. Plascore and Advanced Honeycomb Technologies specialize in engineered cores for rail, marine, and commercial interiors. Corex Honeycomb and HONYLITE serve European and Asian markets with aluminum and polymer-based variants. ACP Composites and Pacific Panels offer customized solutions for medical, energy, and testing environments. EconCore stands out in producing thermoplastic honeycomb cores for automotive and FMCG packaging applications using its proprietary continuous production technology.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.5 Billion |

| Type | Aluminum Core, Aramid core, Paper, and Others |

| End Use | Packaging, Aerospace and Defense, Construction and Infrastructure, Automotive, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hexcel Corporation, Euro-Composites S.A., The Gill Corporation, Plascore, Inc., Advanced Honeycomb Technologies, Corex Honeycomb, HONYLITE, ACP Composites, Pacific Panels, Inc., and EconCore N.V. |

| Additional Attributes | Dollar sales by core material type (aluminum, aramid, thermoplastic, phenolic), application segment (aerospace, automotive, construction, packaging), demand dynamics across lightweighting and structural reinforcement, regional leadership in Asia-Pacific and North America, innovation in recyclable and bio-based cores, and environmental impact via reduced carbon footprint and material efficiency. |

The global honeycomb core materials market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the honeycomb core materials market is projected to reach USD 7.6 billion by 2035.

The honeycomb core materials market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in honeycomb core materials market are aluminum core, aramid core, paper and others.

In terms of end use, packaging segment to command 31.2% share in the honeycomb core materials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Honeycomb Aluminum Foil Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Honeycomb Packaging Market Share

Honeycomb Packing Paper Market Analysis – Growth & Trends 2024-2034

Paper Honeycomb Market Size and Share Forecast Outlook 2025 to 2035

Aramid Honeycomb Core Material Market Size and Share Forecast Outlook 2025 to 2035

Bonding Honeycomb Vibration Isolation Platform Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Honeycomb Panels Market Size and Share Forecast Outlook 2025 to 2035

Core Plate Varnishes Market Size and Share Forecast Outlook 2025 to 2035

Core Drill Automatic Feeding Machine Market

Core Banking Solution Market Report – Growth & Forecast 2017-2027

Woodcore Access Floor Market Size and Share Forecast Outlook 2025 to 2035

Air Core Fixed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Air Core Variable Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Multicore Cables Market

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Multi Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Shell Core Transformer Market Size and Share Forecast Outlook 2025 to 2035

Berry Core Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Paper Core Companies

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA