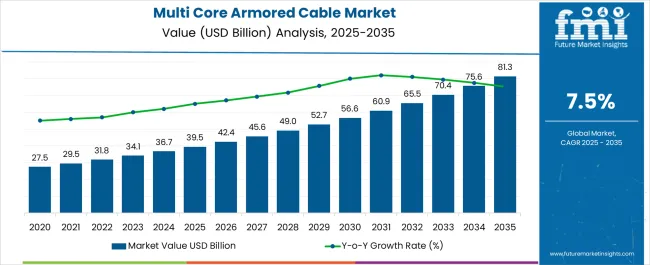

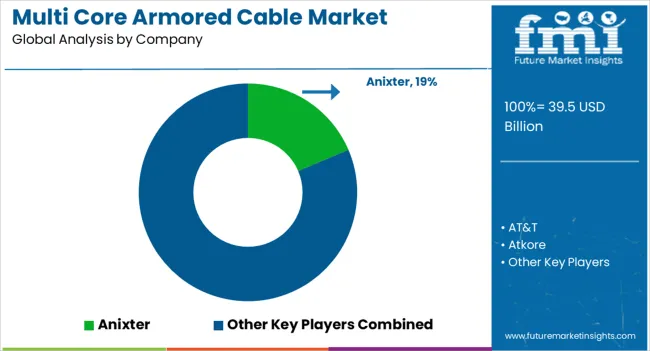

The multi core armored cable market is estimated to be valued at USD 39.5 billion in 2025 and is projected to reach USD 81.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period. A contribution of volume versus price growth analysis highlights the key factors driving the market, with volume growth playing a significant role in the early and middle stages, while price growth contributes more in the later years.

Between 2025 and 2030, the market grows from USD 39.5 billion to USD 56.6 billion, contributing USD 17.1 billion in growth, with a CAGR of 8.0%. This growth is primarily driven by an increase in demand for multi-core armored cables in sectors such as energy, construction, and telecommunications, where high performance and durability are critical.

The volume growth is propelled by infrastructure development, the need for robust cables in renewable energy projects, and the adoption of advanced cable technologies. From 2030 to 2035, the market continues to expand from USD 56.6 billion to USD 81.3 billion, adding USD 24.7 billion in growth, with a slightly lower CAGR of 6.7%. As the market matures, price growth becomes more significant as product differentiation through enhanced features like higher efficiency, improved insulation, and resistance to harsh conditions drives higher value.

Volume growth continues, but price growth accounts for a larger share of the expansion, reflecting the increasing demand for premium and specialized cables. The analysis shows that both volume and price growth are crucial to the market's expansion, with volume dominating in the early years and price growth gaining momentum as the market matures.

| Metric | Value |

|---|---|

| Multi Core Armored Cable Market Estimated Value in (2025 E) | USD 39.5 billion |

| Multi Core Armored Cable Market Forecast Value in (2035 F) | USD 81.3 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The multi core armored cable market is gaining traction due to increasing infrastructure development, heightened focus on industrial safety, and growing demand for secure and reliable cabling in harsh environments. These cables are widely used across energy, utilities, and manufacturing sectors due to their resistance to mechanical stress, chemical exposure, and electromagnetic interference.

Advancements in construction technologies and the push toward modernization of oil, gas, and power infrastructure are further reinforcing their deployment. The shift toward automation in industrial plants and expansion of smart grid installations is accelerating demand for high performance cabling solutions.

The outlook for this market remains strong as industries prioritize operational continuity, safety compliance, and durability under extreme conditions, making armored cables an essential component of modern electrical systems.

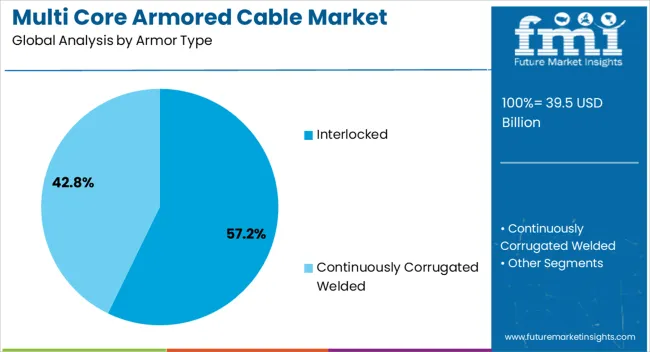

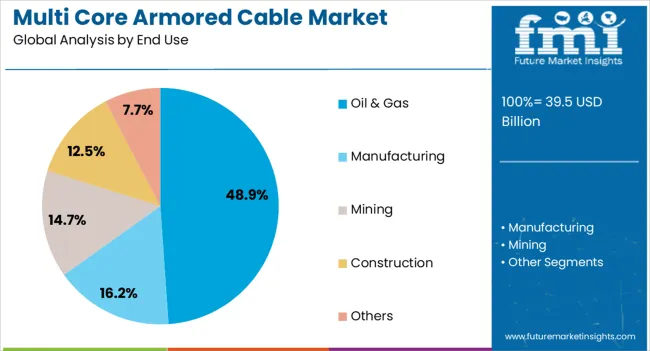

The multi core armored cable market is segmented by armor type, end use, and geographic regions. By armor type, the multi core armored cable market is divided into Interlocked and Continuously Corrugated Welded. In terms of end use, the multi core armored cable market is classified into Oil & Gas, Manufacturing, Mining, Construction, and Others. Regionally, the multi core armored cable industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The interlocked armor type segment is projected to hold 57.20% of total revenue by 2025, positioning it as the leading category within armor type. This dominance is attributed to its superior flexibility, enhanced crush resistance, and ease of installation in confined or complex routing environments.

Interlocked armor cables are preferred in industrial and commercial applications where mechanical protection and adaptability are critical. Their compatibility with both indoor and outdoor installations adds to their utility, especially in high traffic areas or regions prone to physical damage.

The cost effectiveness of interlocked armor compared to other types also supports its widespread use. As industries focus on minimizing maintenance disruptions and maximizing safety, this armor type continues to maintain a strong competitive edge.

The oil and gas segment is expected to account for 48.90% of total market revenue by 2025, establishing itself as the dominant end use category. The increasing need for robust cabling systems in exploration, drilling, refining, and offshore operations is driving this growth.

Harsh environmental conditions and the presence of corrosive agents necessitate durable and highly protected cable solutions, which armored cables provide. The segment’s reliance on uninterrupted communication, control, and power transmission systems further elevates the importance of reliable cabling infrastructure.

Rising investments in oil field development and pipeline projects, particularly in emerging economies, are also contributing to demand. Given the critical nature of operations and the need for safety assurance, the oil and gas industry remains a key driver of growth in the multi core armored cable market.

The multi-core armored cable market is expanding as demand for durable, high-performance cables increases in industries such as construction, telecommunications, and power generation. These cables, featuring multiple conductors and a protective armor, offer enhanced mechanical protection against physical damage and environmental factors, making them ideal for use in harsh environments. With the growing emphasis on reliable and safe electrical transmission, the market is seeing widespread adoption. Advancements in cable technology and the increasing need for complex, multi-conductor solutions in various industries are contributing to the market's growth.

The multi-core armored cable market is primarily driven by the growing demand for safe and reliable electrical transmission solutions. In industries like construction, power generation, and manufacturing, where cables are exposed to physical stress, moisture, and chemicals, armored cables provide essential protection. The multi-core design allows for the transmission of multiple signals or power in a single cable, offering greater efficiency and space savings. As industrial applications become more complex and require higher-capacity electrical systems, the need for multi-core armored cables continues to rise, further driving market expansion.

Despite the advantages, the multi-core armored cable market faces challenges, particularly in terms of high installation costs and technical complexities. Armored cables are typically more expensive than non-armored alternatives, due to the additional materials and processes required for manufacturing. The installation process can also be more complicated, requiring specialized expertise and equipment to handle the cables properly. The weight and rigidity of multi-core armored cables can make them more difficult to manage and install, particularly in tight spaces or in long-distance applications. These factors may hinder adoption, especially in cost-sensitive sectors.

The multi-core armored cable market presents significant opportunities driven by innovations in materials and evolving applications. The development of advanced materials for cable insulation and armor, such as more lightweight and durable polymers, is improving the performance of multi-core armored cables while reducing their weight and installation complexity. The increasing use of these cables in high-demand sectors such as renewable energy, automation, and smart infrastructure is creating new growth opportunities. As industries expand and demand more efficient, robust cable solutions, multi-core armored cables will play a critical role in enabling the transmission of power and data in modern applications.

A key trend in the multi-core armored cable market is the growing adoption of these cables in renewable energy and smart infrastructure projects. As the renewable energy sector, including wind and solar, expands, there is a rising demand for reliable, durable cable solutions that can withstand the environmental challenges associated with these installations. Multi-core armored cables are increasingly used in these settings due to their ability to handle multiple power and signal transmissions while offering enhanced protection against external threats. The rise of smart infrastructure and smart grid systems is driving the demand for multi-core cables capable of supporting complex data and power transmission needs. These trends suggest continued growth in the multi-core armored cable market as industries seek high-performance, versatile solutions for modern energy and infrastructure applications.

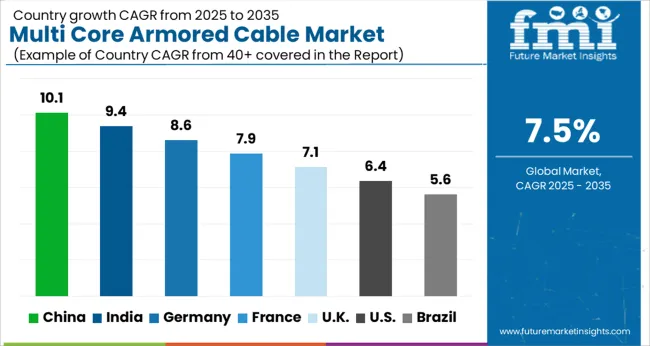

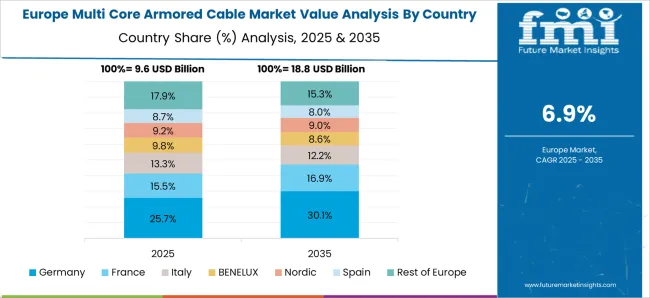

The global multi-core armored cable market is projected to grow at a CAGR of 7.5% from 2025 to 2035, driven by rising demand across various sectors, including construction, energy, and telecommunications. China leads with 10.1% growth, supported by industrialization, infrastructure expansion, and renewable energy investments. India follows at 9.4%, fueled by urbanization, energy infrastructure improvements, and growing industrial demand. France, the UK, and the USA also experience steady growth, driven by government initiatives for grid modernization, renewable energy projects, and increasing demand for secure, high-performance cables in residential and industrial applications. The analysis spans over 40+ countries, with the leading markets shown below.

The multi-core armored cable market in China is projected to grow at a CAGR of 10.1% through 2035. The country’s rapid industrialization, expanding construction and infrastructure sectors, and increasing demand for high-performance power cables in residential, commercial, and industrial applications are driving this growth. With the expansion of renewable energy projects, China is also increasing its investment in electrical infrastructure, which boosts demand for multi-core armored cables for secure and reliable power transmission. Government initiatives supporting energy efficiency and grid modernization further contribute to the market’s expansion, positioning China as a leading player in this sector.

The multi-core armored cable market in India is expected to grow at a CAGR of 9.4% through 2035. The country’s growing industrial and infrastructure sectors, particularly in construction, telecommunications, and energy, are driving the need for reliable and durable power cables. With rapid urbanization, India is witnessing an increasing demand for high-performance cables that offer better protection against external damage. Government initiatives to improve electrical infrastructure and provide reliable power supply across urban and rural areas further fuel the demand for armored cables. The market is also benefiting from a rise in renewable energy projects and power distribution network upgrades.

The multi-core armored cable market in France is expected to expand at a CAGR of 7.9% through 2035. The country’s strong focus on renewable energy, energy efficiency, and infrastructure development drives demand for durable and high-performance power cables. France’s ongoing efforts to modernize its energy grid, coupled with a growing industrial sector, contribute to the increasing need for multi-core armored cables in power transmission and distribution. The market is also supported by stringent regulations requiring the use of secure and reliable electrical infrastructure to ensure safety and performance across both residential and industrial applications.

The multi-core armored cable market in the United Kingdom is projected to grow at a CAGR of 7.1% through 2035. With the country’s ongoing push for infrastructure upgrades, renewable energy projects, and technological advancements, there is a growing demand for high-quality, durable cables that can withstand harsh conditions. The market is being driven by the increasing need for secure and reliable power transmission networks, both in residential and industrial applications. The UK government’s initiatives to reduce carbon emissions and promote energy-efficient infrastructure further enhance the demand for multi-core armored cables in the country.

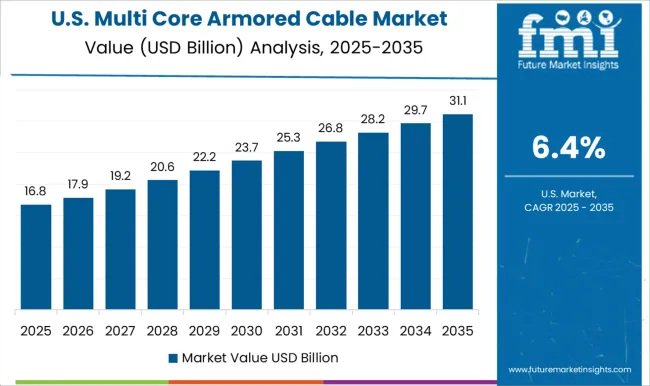

The USA multi-core armored cable market is projected to grow at a CAGR of 6.4% through 2035. With the country’s expanding industrial, commercial, and residential sectors, the demand for durable and high-performance electrical cables is increasing. The rise in construction activities, coupled with ongoing investments in infrastructure, is supporting market growth. The USA also benefits from the ongoing upgrade of its energy grid and the expansion of renewable energy projects, both of which require reliable power transmission systems. The market is supported by technological advancements in cable design and performance, ensuring greater safety and efficiency.

Prysmian Group, Nexans, NKT, LS Cable and System, Sumitomo Electric, and Furukawa Electric anchor global supply with low, medium, and high voltage ranges for utility and industrial use. Southwire and Okonite are recognized across North America for rugged designs suited to harsh environments. Riyadh Cables Group, Ducab, Elsewedy Electric, Hengtong Group, and ZTT serve large EPC projects across the Middle East, Africa, and Asia with steel tape and steel wire armored products. KEI Industries, RR Kabel, Polycab, Finolex Cables, and Havells India support building wire and industrial control needs across India.

Helukabel and Belden address flexible and tray rated requirements in automation heavy plants, while Atkore provides armored constructions for construction and industrial runs. Entities such as AT and T, Anixter, and OmniCable operate as carriers or distributors rather than core OEM producers and should not be positioned as primary manufacturers in this category. Leoni is focused on automotive wiring systems and is not central to general purpose armored cable supply.

| Item | Value |

|---|---|

| Quantitative Units | USD 39.5 Billion |

| Armor Type | Interlocked and Continuously Corrugated Welded |

| End Use | Oil & Gas, Manufacturing, Mining, Construction, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

Prysmian Group, Nexans, NKT, LS Cable & System, Sumitomo Electric, Furukawa Electric, Southwire, Okonite, Atkore, Riyadh Cables Group Company, Ducab, Elsewedy Electric, ZTT, Hengtong Group, KEI Industries, RR Kabel, Polycab, Finolex Cables, Havells India, Helukabel, Belden |

| Additional Attributes | Dollar sales by product type (low-voltage armored cables, medium-voltage armored cables, high-voltage armored cables) and end-use segments (telecommunications, power distribution, construction, industrial, automotive). Demand dynamics are driven by increasing infrastructure development, industrial automation, and the growing need for safe, durable cables in power and energy sectors. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with increasing industrialization, renewable energy adoption, and the need for reliable energy transmission solutions fueling market expansion. |

The global multi core armored cable market is estimated to be valued at USD 39.5 billion in 2025.

The market size for the multi core armored cable market is projected to reach USD 81.3 billion by 2035.

The multi core armored cable market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in multi core armored cable market are interlocked and continuously corrugated welded.

In terms of end use, oil & gas segment to command 48.9% share in the multi core armored cable market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Multiexperience Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Multi Depth Corrugated Box Market Size and Share Forecast Outlook 2025 to 2035

Multilayer Flexible Packaging Market Size and Share Forecast Outlook 2025 to 2035

Multi Attachment Loaders Market Size and Share Forecast Outlook 2025 to 2035

Multi Pocket Holders Market Size and Share Forecast Outlook 2025 to 2035

Multi-Screen Super Glass Market Size and Share Forecast Outlook 2025 to 2035

Multichannel Reagent Reservoir Market Size and Share Forecast Outlook 2025 to 2035

Multi-Functional Point Of Care Testing Market Size and Share Forecast Outlook 2025 to 2035

Multi-layer Film Recycling Market Size and Share Forecast Outlook 2025 to 2035

Multifunctional Household Robot Market Size and Share Forecast Outlook 2025 to 2035

Multistage Ring Section Pumps Market Size and Share Forecast Outlook 2025 to 2035

Multi-photon Microscopic System Market Size and Share Forecast Outlook 2025 to 2035

Multi-axis Truss Robot Market Size and Share Forecast Outlook 2025 to 2035

Multi-Axis PCB Drilling Machine Market Size and Share Forecast Outlook 2025 to 2035

Multi-Modal Biometric Cabin Sensors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Multivitamin-Infused Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Multi Touch Sensing Market Size and Share Forecast Outlook 2025 to 2035

Multiplex PCR Assays Market Size and Share Forecast Outlook 2025 to 2035

Multi-fulcrum Suspension Crane Market Size and Share Forecast Outlook 2025 to 2035

Multiparameter Patient Monitoring Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA