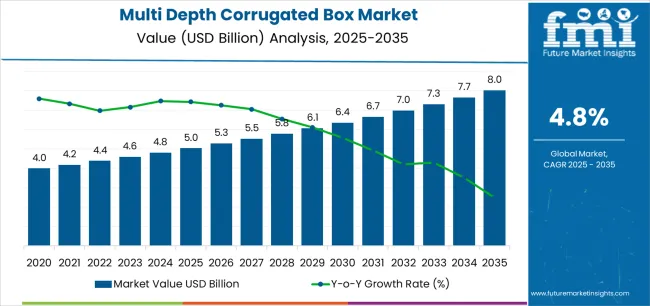

The Multi Depth Corrugated Box Market is estimated to be valued at USD 5.0 billion in 2025 and is projected to reach USD 8.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The multi depth corrugated box market is experiencing steady expansion driven by rising demand for flexible and cost-efficient packaging solutions across logistics, e-commerce, and industrial sectors. Increasing focus on product protection, reduced shipping costs, and sustainability is encouraging widespread adoption. Manufacturers are optimizing material usage and design customization to enhance load-bearing capacity while minimizing environmental impact.

Current dynamics reflect strong utilization in shipping and warehousing operations, with demand further supported by the surge in global trade and retail distribution. Regulatory emphasis on recyclable packaging materials is accelerating the shift toward eco-friendly corrugated formats.

The future outlook remains positive as ongoing automation in packaging processes and advancements in board composition enhance efficiency and performance Growth rationale is centered on expanding end-use applications, improved manufacturing standards, and the ability of multi depth boxes to provide adjustable storage and shipment flexibility, ensuring sustained market penetration across diverse industries.

| Metric | Value |

|---|---|

| Multi Depth Corrugated Box Market Estimated Value in (2025 E) | USD 5.0 billion |

| Multi Depth Corrugated Box Market Forecast Value in (2035 F) | USD 8.0 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

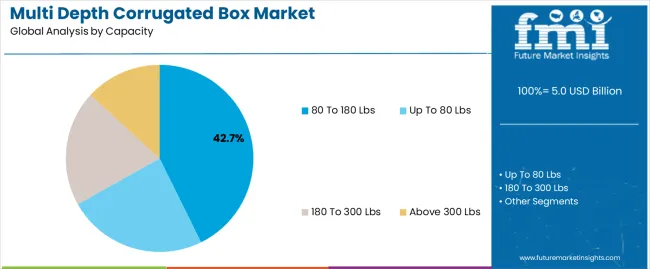

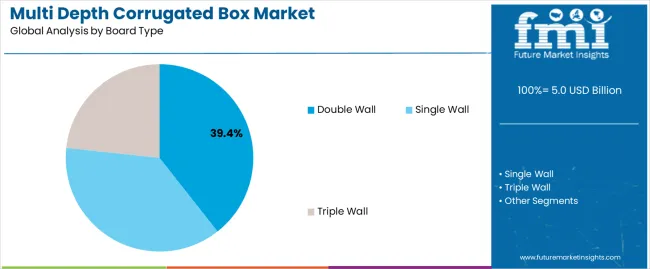

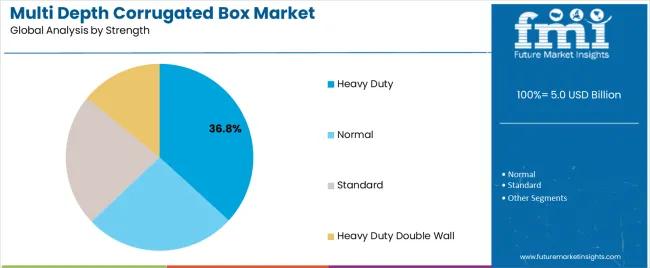

The market is segmented by Capacity, Board Type, Strength, and End Use and region. By Capacity, the market is divided into 80 To 180 Lbs, Up To 80 Lbs, 180 To 300 Lbs, and Above 300 Lbs. In terms of Board Type, the market is classified into Double Wall, Single Wall, and Triple Wall. Based on Strength, the market is segmented into Heavy Duty, Normal, Standard, and Heavy Duty Double Wall. By End Use, the market is divided into Food & Beverages, Consumer Electronics, Home Care & Personal Care, Textiles, Glassware & Ceramics, Automotive, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 80 to 180 lbs segment, holding 42.70% of the capacity category, has maintained its dominance due to its suitability for a broad range of shipping and industrial packaging requirements. Its widespread use is attributed to its balance between lightweight structure and high strength, enabling efficient transportation without compromising product safety.

Manufacturers have optimized fluting and adhesive compositions to achieve superior compression resistance, supporting large-scale distribution and export packaging needs. The segment’s share has been reinforced by rising logistics volumes, increasing adoption by e-commerce companies, and growing use in consumer goods packaging.

Enhanced durability and stacking stability have further solidified its preference among industrial users, ensuring consistent market growth supported by scalability and material efficiency.

The double wall segment, representing 39.40% of the board type category, leads the market due to its superior cushioning strength and ability to handle heavy or fragile goods. It offers increased rigidity and puncture resistance, making it ideal for long-distance transportation and storage in demanding environments.

Technological improvements in corrugation processes and adhesive application have improved overall performance and cost-efficiency. Industrial users prefer double wall boxes for bulk packaging and heavy-duty applications, reinforcing sustained demand.

The segment’s growth has been further supported by the shift toward higher protection standards in logistics and manufacturing sectors Its continued adoption is expected to be driven by durability, strength consistency, and environmental compliance, ensuring steady contribution to market expansion.

The heavy-duty segment, accounting for 36.80% of the strength category, has emerged as the leading segment due to its robust structure and ability to withstand high stacking loads. Its dominance is supported by extensive use in automotive, machinery, and chemical product shipments where structural integrity is essential.

Enhanced material engineering, including improved kraft liner quality and reinforced fluting, has elevated performance and reliability. The segment’s adoption has been bolstered by increased export activities and the need for packaging that ensures protection under varied climatic and handling conditions.

Growing integration of strength testing and digital load simulation during design stages has further improved consistency and quality These advancements, combined with expanding industrial applications, are expected to sustain the heavy-duty segment’s leadership within the multi depth corrugated box market.

The global demand for the multi depth corrugated box market was estimated to reach a valuation of USD 4 billion in 2020, according to a report from Future Market Insights (FMI). From 2020 to 2025, the multi depth corrugated box market witnessed significant growth, registering a CAGR of 4.1%.

| Historical CAGR from 2020 to 2025 | 4.1% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 5% |

The development of smart packaging solutions incorporating RFID (Radio Frequency Identification) technology was a milestone in the multi depth corrugated box market. These boxes improved supply chain visibility and logistical efficiency by enabling real time inventory tracking. The market for multi depth corrugated box is expected to grow in the future due to these factors:

Increasing Demand for Sustainable Packaging and Flourishing E Commerce to Boost Sales

Growing consumer desire for eco friendly packaging options is one of the main factors propelling the multi depth corrugated box market. Concerns about the environment are driving companies to adopt eco friendly products and procedures. This trend is supported by corrugated boxes with recyclable materials, which are fueling market expansion.

The expanding e commerce scene is a major driver of the multi depth corrugated box market. The rise of e commerce demands flexible packaging options that can effectively handle a wide variety of product lines for flawless delivery experiences. Because corrugated boxes can be made to any depth, they are the ideal solution for meeting this need and expanding the market.

Volatility in Raw Material Prices to Impede the Market Growth

The fluctuation of raw material prices, which affects manufacturing profit margins and production costs, is one major impediment. Complying with strict laws around waste management and packing materials is also difficult.

The market is vulnerable to recessions, which can have an impact on consumer purchasing habits and the need for packaged products. Intense competition within an industry drives down prices and limits innovation, which limits the capacity of key players to make profit.

This section focuses on providing detailed analysis of two particular market segments for multi depth corrugated box, the dominant sales channel and the significant end use. The two main segments discussed below are the e retail and food service.

| Sales Channel | E Retail |

|---|---|

| Market Share in 2025 | 38% |

In 2025, the e retail sales channel segment is likely to gain a market share of 38%. They are adaptable, supporting a broad variety of product sizes and satisfying the various demands of online merchants. Their robust design guarantees that goods are kept safe in transit, which raises client satisfaction. The fact that they are adjustable corresponds with the constantly shifting needs of e commerce logistics. The growing inclination towards eco friendly packaging alternatives renders corrugated boxes a desirable option, propelling their integration in e retail transactions.

| End Use | Food Service |

|---|---|

| Market Share in 2025 | 35% |

In 2025, the food service segment is anticipated to acquire 35% market share. The customizable design and protective qualities of multi depth corrugated boxes make them an ideal choice for food service packaging. With depths that can be adjusted, they hold a wide range of foods well, preserving their freshness and avoiding deterioration while in transit.

Their robust design guarantees product integrity, which is essential for maintaining food safety and quality. Corrugated boxes are frequently constructed from sustainable materials, which is in line with the growing need of the food service industry for environmentally responsible packaging options.

This section will go into detail on the multi depth corrugated box markets in a few key countries, including the United States, the United Kingdom, China, Japan and South Korea. This part will focus on the key factors that are driving up demand in these countries for multi depth corrugated box.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| The United States | 4.8% |

| The United Kingdom | 3.9% |

| China | 5.5% |

| Japan | 5.5% |

| South Korea | 4.9% |

The United States multi depth corrugated box ecosystem is anticipated to gain a CAGR of 4.8% through 2035. The ongoing growth of online shopping creates a demand for adaptable packaging solutions that can accommodate a wide range of product sizes, enabling the use of multi depth corrugated boxes in effective shipping and delivery procedures.

Growing consumer and company knowledge of environmental issues forces companies to give eco friendly packaging choices top priority. Multi depth corrugated boxes support sustainability objectives and are more widely used in the market since they are frequently constructed from recycled materials and are recyclable.

The multi depth corrugated box market in the United Kingdom is expected to expand with a 3.90% CAGR through 2035.

The diverse retail landscape in the country, which includes both large chains and small independent businesses, requires packaging solutions that can accommodate a wide range of needs and product types.

This makes multi depth corrugated boxes an adaptable choice for packaging applications in a variety of sectors and retail formats.

The multi depth corrugated box ecosystem in China is anticipated to develop with a 5.5% CAGR from 2025 to 2035. Rapid industrialization and manufacturing expansion in China create a high need for packaging solutions, such as multi depth corrugated boxes, to support the regional growing export oriented economy and domestic consumption.

The rapid growth of China's e commerce industry, which is being driven by their increased digitization and internet penetration, creates a huge demand for effective packaging solutions that can be customized, such as multi depth corrugated boxes, to enable the delivery of a variety of goods to customers across the country.

The multi depth corrugated box industry in Japan is anticipated to reach a 5.5% CAGR from 2025 to 2035. Japan has one of the most elderly populations, which has resulted in an increase in demand for home delivery services and specific packaging solutions for senior clients. This is opening up possibilities for innovative features like ergonomic handles and easy open designs in multi depth corrugated boxes.

Japan is renowned for its exacting attention to workmanship and quality. This need for perfection extends to packing materials, promoting the use of high quality multi depth corrugated boxes. It provides exceptional durability, protection, and attractiveness while fulfilling the stringent standards of Japanese consumers and enterprises.

The multi depth corrugated box ecosystem in South Korea is likely to evolve with a 4.90% CAGR during the forecast period.

The robust export driven economy of South Korea, especially in sectors like electronics, automobiles, and cosmetics, drives up the need for dependable and adaptable packaging options like multi depth corrugated boxes.

This will guarantee the secure delivery of commodities to global markets, fostering the expansion of the sector.

Key players in the multi depth corrugated box market are actively pursuing a number of initiatives in an effort to hold onto or improve their market shares. Their primary focus is innovation, as they introduce novel designs and materials to effectively suit a wide range of packaging demands. They have a strong emphasis on sustainability, creating environmentally friendly solutions to meet legal and customer requirements.

To improve manufacturing processes, increase efficiency, and save costs, they invest in technology. To increase market reach and capabilities, strategic alliances and acquisitions are sought for. All things considered, these companies place a high value on technical innovation, sustainability, and agility in order to prosper in the cutthroat multi depth corrugated box market. The key players in this market include:

Significant advancements in the multi depth corrugated box market are being made by key market participants, and these include:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5% from 2025 to 2035 |

| Market value in 2025 | USD 4.8 billion |

| Market value in 2035 | USD 7.7 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Capacity, Board Type, Strength, End Use, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

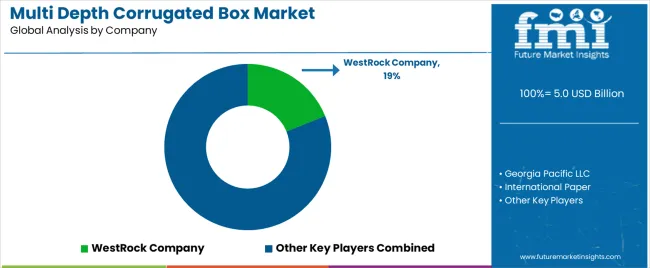

| Key Companies Profiled | Georgia Pacific LLC; International Paper; DS Smith Packaging Limited; Oji Holdings Corporation; Pratt Industries Inc.; Acme Corrugated Box Co. Inc.; Great Little Box Company Ltd.; AD Incorporated Of Milwaukee; WestRock Company; Smurfit Kappa Group Plc; Uline Inc. |

| Customization Scope | Available on Request |

The global multi depth corrugated box market is estimated to be valued at USD 5.0 billion in 2025.

The market size for the multi depth corrugated box market is projected to reach USD 8.0 billion by 2035.

The multi depth corrugated box market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in multi depth corrugated box market are 80 to 180 lbs, up to 80 lbs, 180 to 300 lbs and above 300 lbs.

In terms of board type, double wall segment to command 39.4% share in the multi depth corrugated box market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Multichannel Electrochemical Workstation Market Size and Share Forecast Outlook 2025 to 2035

Multi Colored LED Beads Market Size and Share Forecast Outlook 2025 to 2035

Multi-Drug/Combination Injectable Market Forecast and Outlook 2025 to 2035

Multiplex Sepsis Biomarker Panels Market Size and Share Forecast Outlook 2025 to 2035

Multiplex Protein Profiling Market Size and Share Forecast Outlook 2025 to 2035

Multihead Weighers Market Size and Share Forecast Outlook 2025 to 2035

Multi-Cloud Networking Market Forecast Outlook 2025 to 2035

Multispectral Camera Market Size and Share Forecast Outlook 2025 to 2035

Multi-functional Packaging Market Size and Share Forecast Outlook 2025 to 2035

Multiplex Biomarker Imaging Market Forecast and Outlook 2025 to 2035

Multichannel Order Management Market Forecast and Outlook 2025 to 2035

Multiexperience Development Platform Market Forecast and Outlook 2025 to 2035

Multilayer Flexible Packaging Market Size and Share Forecast Outlook 2025 to 2035

Multi Attachment Loaders Market Size and Share Forecast Outlook 2025 to 2035

Multi Pocket Holders Market Size and Share Forecast Outlook 2025 to 2035

Multi-Screen Super Glass Market Size and Share Forecast Outlook 2025 to 2035

Multichannel Reagent Reservoir Market Size and Share Forecast Outlook 2025 to 2035

Multi-Functional Point Of Care Testing Market Size and Share Forecast Outlook 2025 to 2035

Multi-layer Film Recycling Market Size and Share Forecast Outlook 2025 to 2035

Multifunctional Household Robot Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA