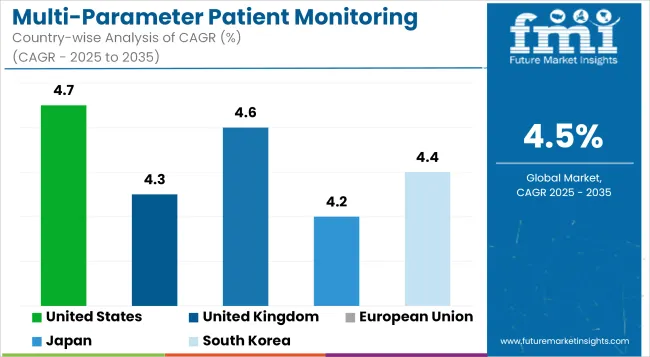

The global multi-parameter patient monitoring market is estimated to be valued at USD 5.1 billion in 2025 and is projected to reach USD 8.6 billion by 2035, registering a compound annual growth rate of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 5.1 Billion |

| Market Value (2035F) | USD 8.6 Billion |

| CAGR (2025 to 2035) | 4.5% |

The multi-parameter patient monitoring market is witnessing steady growth driven by the rising prevalence of chronic conditions, aging populations, and demand for continuous physiological monitoring across care settings.

Hospitals and ambulatory facilities are investing in integrated monitoring platforms that combine parameters such as ECG, SpO2, blood pressure, and respiratory rate to improve clinical decision-making and patient safety.

The expansion of high-acuity and step-down care units, coupled with the shift toward value-based care models, has accelerated adoption of advanced monitors capable of supporting early warning scores and predictive analytics. Manufacturers have prioritized connectivity and interoperability enhancements to integrate monitoring data with electronic health records and clinical information systems.

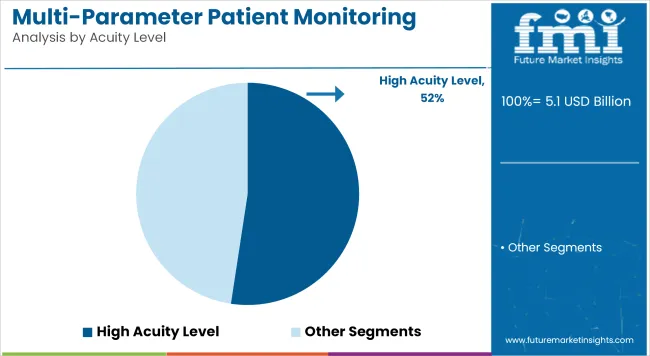

Product Analysis: High Acuity Level Monitors

High Acuity Level Monitors dominated this segment with a revenue share of 52.4%. This reflects their key role in intensive and critical care environments. Demand has been driven by the rising incidence of sepsis, respiratory failure, and cardiac events requiring continuous, multi-parameter monitoring.

Hospitals have prioritized high-acuity systems capable of supporting advanced analytics, customizable alarms, and integration with centralized command centers. Regulatory mandates emphasizing patient safety and early deterioration detection have further reinforced investments in this segment.

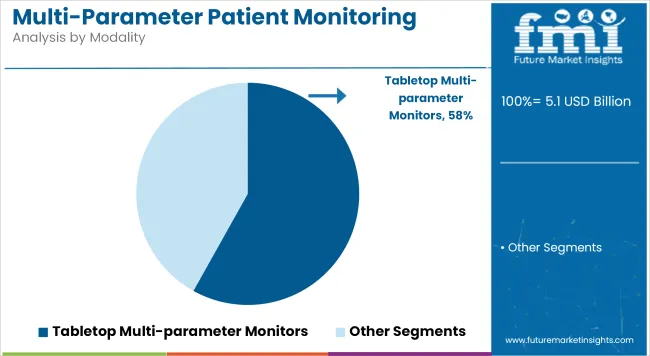

Modality Analysis: Table top Multi-Parameter Monitors

Table top Multi-Parameter Monitors is estimated to hold a revenue share of 58.1% which is attributed to their widespread utilization in both high-acuity and perioperative settings. Their adoption has been driven by the ability to track multiple parameters reliably while offering user-friendly interfaces and compatibility with hospital IT infrastructure.

Clinicians have favored tabletop monitors for their high-resolution displays, battery backup capabilities, and standardized workflows that facilitate timely interventions. The segment has also benefited from technological enhancements supporting data transmission, trend analysis, and integration with tele-ICU platforms.

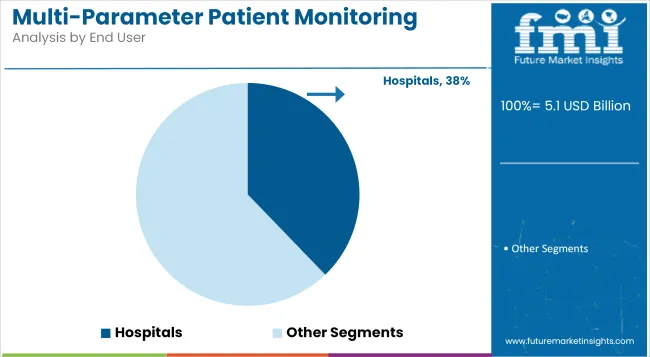

End User Analysis: Hospitals

Hospitals accounts for a revenue share of 37.8%, highlighting their pivotal role in driving multi-parameter monitor procurement. This segment is reinforced by high patient throughput, complex case management needs, and the imperative to comply with safety and quality mandates.

Hospitals have consistently invested in centralized monitoring stations and interoperable systems to enable continuous surveillance and early intervention across critical and step-down care units. The increasing adoption of telemetry and remote monitoring capabilities has further strengthened hospital demand.

Cost and Complexity

The high cost of advanced and multi-parameter monitoring systems is one of the major hurdles facing the multi-parameter patient monitoring market. Smaller facilities may be financially incapable of acquiring such technologies. Integration of multiple monitoring systems and their data analysis introduce operational challenges in clinical settings.

Technological Advancements and Homecare

There are promising opportunities in user-friendlier, cheaper, and portable multi-parameter monitoring solutions, particularly for homecare and remote monitoring. As the health sector switches into home settings, the demand for personal patient monitoring devices that provide real-time data on various health parameters is likely to increase; the growth of cloud-based platforms, AI-based data analytics, and wearable technology is likely to be responsible for market growth through better patient care and improved healthcare outcomes.

Chronic diseases lie in a key component of the multi-parameter patient monitoring market in the USA along with advancement in medical technology and an increasing aging population. These devices are being taken up by hospitals and healthcare systems for the betterment of patient care and the efficiency of hospital operations in monitoring vital signs at real-time. Rendition could be made for the USA as a leader among countries that offer excellent advancements in terms of patient monitoring set to progress beyond the bounds of wearables and wireless devices.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.7% |

United Kingdom’s multi-parameter patient monitoring is one of the countries benefiting from improved government programs in health infrastructure, especially in the NHS. Continuous patient monitoring is always on demand, especially in critical care and intensive care units (ICUs). Home care and telehealth have been emerging markets for the introduction of wearables, which further adds to their expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.3% |

In the European Union market, healthcare quality improvement and cost-cutting have gained increasing importance among the member states. There is an extensive use of Multi-parameter monitoring devices in hospitals and outpatient setups for ensuring patient safety and timely intervention. Wireless technology advances along with EHR integration are likely to increase the acceptance of these technologies within the EU.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.6% |

Multi-parameter patient monitoring devices in Japan can grow with the rapidly increasing number of seniors and growing incidences of lifestyle diseases. The Japan healthcare system has been known for automating healthcare processes and currently adopting innovative monitoring devices to upgrade patient care and lower the readmission rates. Besides, the government policies in Japan targeted to improve elderly care through advanced medical technologies have further enhanced market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

Progressively, the healthcare systems have been using advanced monitoring systems in hospitals and healthcare facilities in South Korea. The market for multi-parameter monitoring devices is therefore growing steadily due to the adoption of smart health solutions, such as wearable and remote monitoring systems. High-quality healthcare programs set forth by the government, coupled with an upsurge in demand for home healthcare solutions, spur the market even more.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

Companies are investing in AI-driven algorithms to enable early detection of patient deterioration and reduce adverse events. Partnerships with hospital networks and health IT vendors are expanding interoperability and facilitating the development of comprehensive monitoring ecosystems. Additionally, training programs and service offerings are being scaled to support adoption and optimize clinical workflows.

Key Development

In 2024, Midmark Corp. has launched new Midmark Multiparameter Monitors for animal health. Designed with decades of clinical experience, these monitors offer integrated safety features and user-friendly capabilities to help veterinary teams navigate anesthetic procedures more efficiently, enhancing care delivery and safety.

In 2025, Cardinal Health has launched the Kendall DL™ Multi System in the USA This new multi-parameter, single-patient use monitoring system provides continuous monitoring of cardiac activity, blood oxygen, and temperature via one connection point. Designed for seamless patient transport from admission to discharge, it aims to enhance clinician workflows, ensure reliable monitoring for optimal care, and maximize hospital value.

The overall market size for the multi-parameter patient monitoring market was USD 5.1 billion in 2025.

The market is expected to reach USD 8.6 billion in 2035.

The demand will be driven by the increasing aging population, rising chronic disease prevalence, the need for continuous patient monitoring, and technological advancements in healthcare monitoring systems.

The top 5 contributing countries are the United States, Germany, Japan, the United Kingdom, and France.

The vital sign monitoring segment is expected to lead, driven by its wide applications in critical care settings and the demand for continuous monitoring.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Patient-Controlled Analgesia Pumps Market Size and Share Forecast Outlook 2025 to 2035

Patient Transportation Market Size and Share Forecast Outlook 2025 to 2035

Patient Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Patient Positioning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Patient Self-Service Kiosks Market Size and Share Forecast Outlook 2025 to 2035

Patient Recliners Market Size and Share Forecast Outlook 2025 to 2035

Patient Transport Services Market Size and Share Forecast Outlook 2025 to 2035

Patient Engagement Platforms Market Size and Share Forecast Outlook 2025 to 2035

Patient Registry Software Market Size and Share Forecast Outlook 2025 to 2035

Patient Positioning System Analysis by Product Type and by End User through 2035

Patient Lateral Transfer Market - Innovations, Demand & Forecast 2035

Patient Identification Wristbands Market Analysis – Size, Trends & Forecast 2025 to 2035

Patient Hygiene Aids Market – Demand & Forecast 2024 to 2034

Patient Portal Market – Growth & Forecast 2024-2034

Patient-Controlled Injectors Market

Patient Health Management Market

Patient Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring Accessories Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring Pods Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA