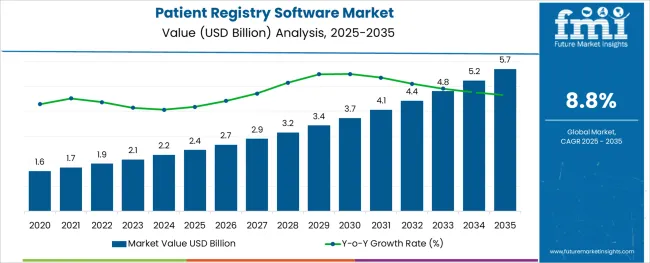

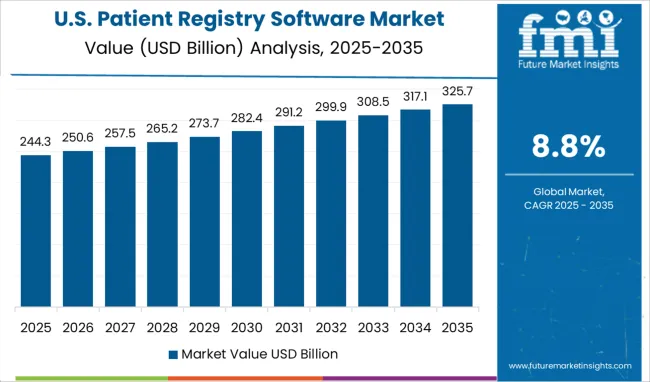

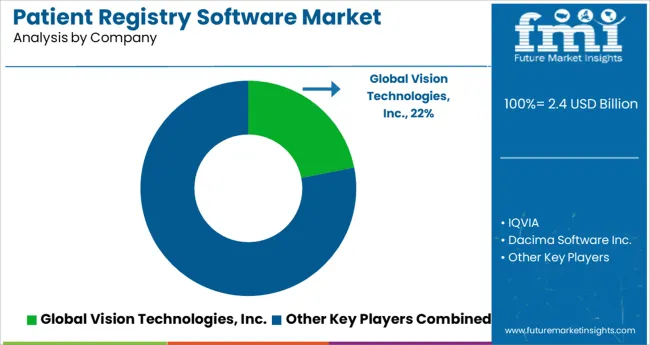

The Patient Registry Software Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 5.7 billion by 2035, registering a compound annual growth rate (CAGR) of 8.8% over the forecast period.

The patient registry software market has gained significant momentum in recent years, driven by the growing emphasis on data-driven healthcare management, population health monitoring, and outcome-based reimbursement models. Rising healthcare digitization initiatives, coupled with regulatory mandates for improved patient data collection and reporting, have propelled the adoption of registry software across multiple care settings.

This technology has become critical in enhancing clinical research, managing chronic disease registries, and optimizing resource allocation for healthcare providers and public health agencies. The market is poised for steady growth, supported by increasing demand for interoperable, cloud-based solutions capable of integrating data from electronic health records, laboratory systems, and wearable health devices.

Future expansion will be underpinned by rising investment in personalized medicine, expansion of disease-specific registries, and the growing involvement of governments and non-profit organizations in public health surveillance programs. The ability of patient registry software to facilitate real-time patient tracking, improve research quality, and support evidence-based decision-making continues to strengthen its market positioning globally.

The market is segmented by Type, Disease Area, and End User and region. By Type, the market is divided into Public Domain and Commercial. In terms of Disease Area, the market is classified into Diabetes, Cardiovascular, Cancer Patient, Rare Disease/Orphan Disease, and Other Chronic Disease. Based on End User, the market is segmented into Governments and Commercial Use. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

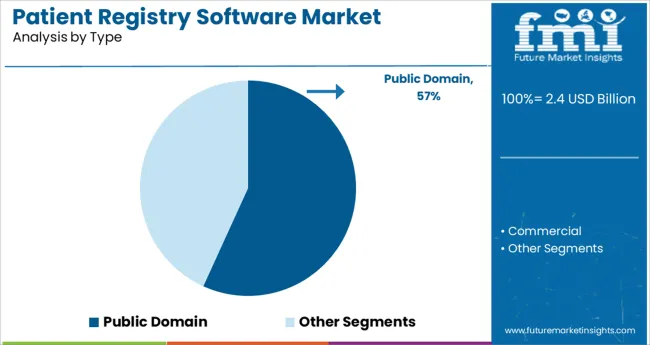

The public domain segment held a commanding 56.8% market share within the patient registry software market, driven by heightened adoption from government health agencies, research organizations, and non-profit public health initiatives. This segment’s growth has been strongly supported by increased funding allocations for national health programs and disease surveillance systems, particularly in managing chronic and rare diseases.

Public domain registry platforms are often developed and operated by government entities to improve data transparency, facilitate policy formulation, and support population-wide health monitoring efforts. Their widespread deployment is further accelerated by rising emphasis on open-access databases that promote collaborative research and cross-border disease management programs.

The public domain segment continues to benefit from a growing number of initiatives aimed at enhancing healthcare infrastructure, particularly in middle- and low-income countries where health data availability remains fragmented. Over the coming years, continuous investments in digital public health infrastructure and integration with national health data networks are expected to secure this segment’s dominant position within the market.

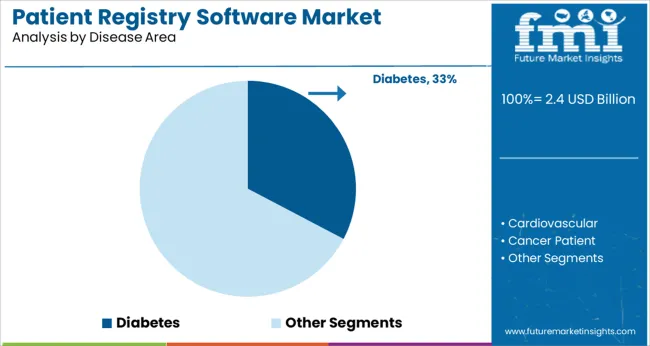

The diabetes segment emerged as the market leader within the disease area category, capturing 32.7% of the total patient registry software market share. The persistent global rise in diabetes prevalence, combined with the chronic and high-cost nature of disease management, has intensified the need for specialized patient registry solutions capable of tracking clinical outcomes, medication adherence, and comorbidity patterns.

This segment’s growth is further fueled by government health initiatives focused on preventive care, early intervention, and long-term patient monitoring. Healthcare providers and research institutions have increasingly adopted diabetes registries to support large-scale epidemiological studies and improve clinical care models.

Additionally, advancements in remote patient monitoring technologies and integration with wearable devices have enabled real-time data collection and improved patient engagement in self-management programs. Future growth within this segment will be driven by rising investments in personalized diabetes care pathways, expanding clinical trial activity for novel therapeutics, and heightened public awareness regarding the importance of long-term disease registries in improving population health outcomes.

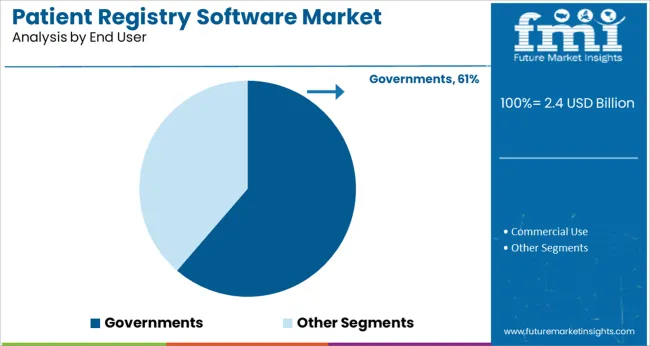

Within the end user category, the governments segment dominated the patient registry software market with a substantial 61.3% market share, reflecting its pivotal role in public health data management and policy development. The segment’s prominence is largely attributed to extensive deployment of national health registries aimed at disease surveillance, vaccination tracking, chronic disease management, and monitoring of healthcare delivery outcomes.

Government agencies are increasingly prioritizing the implementation of interoperable registry platforms to enhance health data accessibility, improve healthcare resource planning, and support evidence-based policymaking. Additionally, rising public health concerns such as emerging infectious diseases, non-communicable disease burden, and demographic shifts toward aging populations have intensified registry software adoption by public health authorities.

Collaborative initiatives between government bodies and healthcare providers to standardize patient data collection and reporting have further strengthened this segment’s market position. Continued investment in e-health infrastructure modernization and regulatory frameworks mandating patient data reporting are expected to maintain this segment’s leadership in the coming years.

Increasing adoption of EHRs in the healthcare sector is expected to be the key factor benefitting the global patient registry software market during the forecast period. Growing initiatives by the various government to implement strategies to lessen regulatory and administrative responsibilities on healthcare providers are expected to play a salient role in driving demand for EHRs in the healthcare sector thereby, benefitting the patient registry software market.

For instance, on December 13, 2020, the USA introduced Cures Act, which aims to enhance medical product development and offer innovative and advanced medical technology. Such initiatives are expected to drive the demand for EHRs, thus, benefitting the market during the assessment period.

With the incorporation of AI into electronic health record solutions, the market is expected to experience a notable expansion. Various players are aiming to incorporate the technology in the EHRs through voice recognition capabilities.

For example, a physician can access a voice-based HER solution to analyze a patient’s last recorded medical reports. In October 2020, various scripts along with Northwell Health inked an agreement to produce the next-generation electronic health record. The initiative is expected to support massive revenue generation, thereby, fuelling the market expansion in the coming time.

Over the last few years, there has been a rise in demand for EHRs in various countries. This can be attributed to the growing demand for robust health information technology, which is important to achieve fine-quality services at affordable prices.

The increasing application of EHRs in the healthcare sector helps in result management, analyze health information and data, and decision support, which is anticipated to strengthen the market in the forecast period.

The emergence of cloud-based EHR software is expected to offer significant market opportunities during the assessment period. Such solutions offer more advanced and developed approaches. Moreover, the installation expenses for the system are cheaper than the client server-based systems. Also, such methods eliminate the requirement for in-house maintenance, which is expected to offer significant opportunities to the patient registry software market.

Other benefits offered, such as; low-cost maintenance, low licensing, cheaper start-up cost, and wider accessibility are other salient factors that can offer various avenues of opportunities to the market in the forecast period. Moreover, these solutions do not demand any major capital investment for hardware and offer swift data transfer between enterprises. Owing to such benefits, the demand for cloud-based software is expected to witness considerable opportunities in the coming time.

Concerns associated with data privacy and security are expected to impact the market negatively in the forecast period. The breach of data can result in the exposure of confidential details of a large number of patients. Moreover, there have been various cases of data breaches.

About one-third of data breaches lead to medical identity theft, principally because of a lack of internal control over patient information, conventional policies, and a dearth of personnel expertise. As per the Identity Theft Resource Center, the USA recorded about 1.473 breaches in 2020, a rise of 17% against 2020.

There has been a reluctance in adopting modern solutions, and enterprises yet rely on paper paper-based solutions. Small and rural areas continue to use conventional paper-based registry methods. Also, several hospitals do not encourage the application of such approaches owing to the lack of expertise and various costs included in the implementation of such software.

In April 2025, the GHT Coeur Grand Est. Hospitals, a Northeast France-based healthcare institute, had to disconnect all outgoing and incoming Internet connections after they suffered from a cyberattack that resulted in the theft of administrative and patient data.

Based on type, the global patient registry software market can be segmented into public domain registry software and commercial registry software. As per the analysis, the commercial registry software is expected to lead the market in the assessment period. The segment is projected to expand at a CAGR of 9.3% from 2025 to 2035.

The growth of the segment can be attributed to the rapid adoption of electronic health records and various other HCIT solutions in healthcare institutions. Various regulatory bodies are encouraging the adoption of HER solutions to enhance the delivery of healthcare services, which is anticipated to strengthen the segment in the forecast period.

Based on the disease area, the diabetes registry segment is anticipated to dominate the market in the forecast period. The segment is projected to flourish at a CAGR of 9.3% from 2025 to 2035. The growth of the segment can be attributed to the rising number of diabetic patients across the globe. As per the World Health Organization, about 422 million across the globe suffer from diabetes.

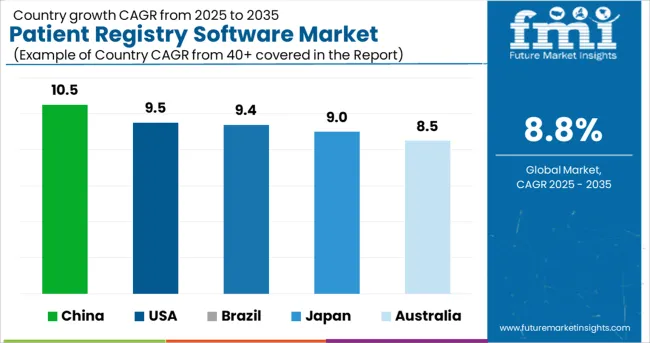

| Country | Projected CAGR |

|---|---|

| USA | 9.5% |

| Brazil | 9.4% |

| China | 10.5% |

| Japan | 9% |

| Australia | 8.5% |

According to the latest reports by FMI, the North American patient registry software market is expected to dominate the market during the forecast period. The analysis reveals that the region is projected to be dominated by the USA, with a CAGR of 9.5% from 2025 to 2035. The USA is likely to garner USD 5.7 Billion by 2035.

The growth of the region can be attributed to the expanding target population along with the growing prevalence of diseases. Moreover, favorable initiatives taken by the government are likely to propel the market in the region. Players in the region are taking various efforts to make patient registry software clinical research-friendly and user-interactive software. In August 2020, IQVIA announced a web-based solution for the enlistment of clinical trial information.

APAC is anticipated to be the fastest-growing region during the forecast period. As per the analysis, the region is projected to expand at a significant CAGR from 2025 to 2035. China is expected to lead the market, flourishing at a growth rate of 10.5% during the forecast period. Japan is expected to expand at the second-highest CAGR of 9% during the said period of assessment.

On the other hand, India and South Korea have been recognized with some lucrative opportunities. The growing need to eliminate medical errors and increased diagnostics errors are expected to play a significant role in driving the market in the region.

Also, growing awareness about the benefits of EHRs, development in healthcare systems, and rising medical tourism in APAC are other important factors propelling the market in the assessment period. In addition, the implementation of favorable initiatives by the government is expected to augment the market size in the region. In May 2020, the government of South Korea made an investment of USD 1.6 Million to develop AI systems that would analyze a patient’s medical registry for better diagnostics. Similarly, in 2020, Fujifilm established FUJIFILM VET Systems in Japan to enhance the adoption of the cancer registry software.

Key players in the global patient registry software market include Dacima Software Inc., Evado eClinical Solutions, IQVIA, Global Vision Technologies Inc., and Invitae. Recent Developments among key players are:

The global patient registry software market is estimated to be valued at USD 2.4 billion in 2025.

It is projected to reach USD 5.7 billion by 2035.

The market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types are public domain and commercial.

diabetes segment is expected to dominate with a 32.7% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Patient-Controlled Analgesia Pumps Market Size and Share Forecast Outlook 2025 to 2035

Patient Transportation Market Size and Share Forecast Outlook 2025 to 2035

Patient Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Patient Positioning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring Accessories Market Size and Share Forecast Outlook 2025 to 2035

Patient Self-Service Kiosks Market Size and Share Forecast Outlook 2025 to 2035

Patient Recliners Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Patient Transport Services Market Size and Share Forecast Outlook 2025 to 2035

Patient Engagement Platforms Market Size and Share Forecast Outlook 2025 to 2035

Patient Positioning System Analysis by Product Type and by End User through 2035

Patient Lateral Transfer Market - Innovations, Demand & Forecast 2035

Patient Identification Wristbands Market Analysis – Size, Trends & Forecast 2025 to 2035

Patient Hygiene Aids Market – Demand & Forecast 2024 to 2034

Patient Portal Market – Growth & Forecast 2024-2034

Patient-Controlled Injectors Market

Patient Health Management Market

Patient Monitoring Pods Market

Outpatient Clinics Market Trends and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA