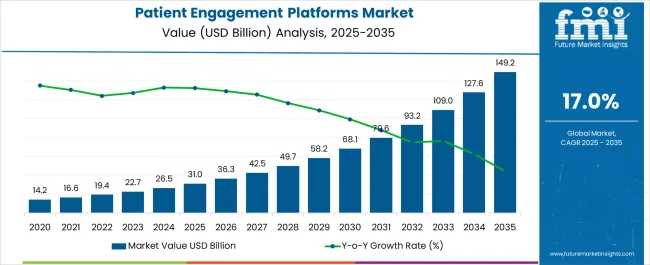

The Patient Engagement Platforms Market is estimated to be valued at USD 31.0 billion in 2025 and is projected to reach USD 149.2 billion by 2035, registering a compound annual growth rate (CAGR) of 17.0% over the forecast period.

| Metric | Value |

|---|---|

| Patient Engagement Platforms Market Estimated Value in (2025 E) | USD 31.0 billion |

| Patient Engagement Platforms Market Forecast Value in (2035 F) | USD 149.2 billion |

| Forecast CAGR (2025 to 2035) | 17.0% |

The patient engagement platforms market is advancing steadily, supported by healthcare digitalization, regulatory mandates, and the growing emphasis on value-based care. Providers are increasingly investing in technology that enhances communication, remote monitoring, and personalized care delivery to improve patient satisfaction and outcomes.

The shift toward outcome-based reimbursement models and population health strategies is reinforcing the adoption of platforms that streamline appointment scheduling, care plan adherence, and education. In parallel, the expansion of telehealth services, wearable integration, and EHR interoperability is reshaping patient-provider interaction models.

Increased focus on preventive care, self-service tools, and chronic condition management has further widened the scope for digital engagement systems. The market outlook remains positive, driven by both policy pressure for data transparency and the need for operational efficiency across care networks.

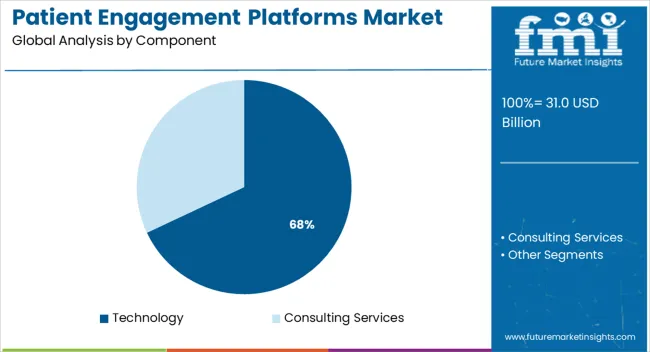

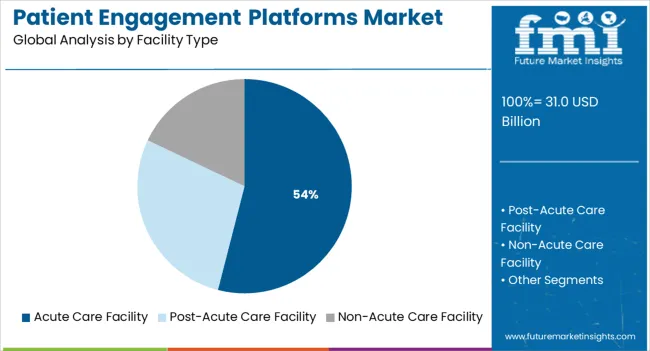

The market is segmented by Component and Facility Type and region. By Component, the market is divided into Technology and Consulting Services. In terms of Facility Type, the market is classified into Acute Care Facility, Post-Acute Care Facility, and Non-Acute Care Facility. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The technology segment is expected to account for 68.0% of the total revenue in the patient engagement platforms market by 2025, establishing it as the leading component. This dominance is being driven by the rapid deployment of integrated digital tools that support real-time patient communication, automated workflows, and behavioral health tracking.

Platforms leveraging artificial intelligence, cloud-based infrastructure, and mobile accessibility are enabling proactive health interventions while reducing administrative burden on providers. The ability to connect electronic health records with patient portals, SMS alerts, and remote monitoring solutions has been instrumental in enhancing user adoption and care coordination.

As hospitals and clinics prioritize scalable, secure, and user-centric technologies, the technology segment continues to anchor platform innovation and investment.

Acute care facilities are projected to hold 54.0% of the market revenue in 2025, making them the leading facility type in the patient engagement platforms space. This leadership is attributed to the high patient throughput, critical care requirements, and complex coordination needs characteristic of acute care settings.

The demand for timely discharge planning, surgical follow-up, medication reconciliation, and real-time symptom tracking has necessitated advanced engagement tools tailored for inpatient environments. Additionally, regulatory pressures to reduce readmission rates and improve Hospital Consumer Assessment of Healthcare Providers and Systems (HCAHPS) scores have led facilities to integrate structured communication and feedback systems.

The availability of institutional funding, IT infrastructure, and staff training resources further positions acute care facilities as primary adopters of comprehensive patient engagement technologies.

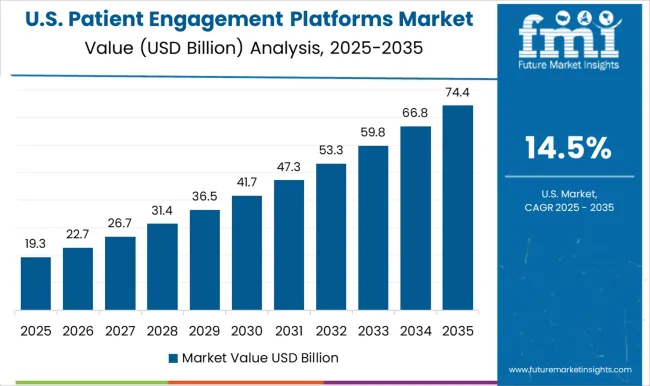

North American countries have made significant investments in developing digital patient engagement platform solutions for patient involvement due to the advantages of having a robust healthcare infrastructure and rapid adoption of clinical and electronic health record (EHR) systems.

This forward transformation by various healthcare Corporations, notably in the United States (USA) and Canada, has aided in placing North America at the leading edge of the global patient engagement platforms market. According to the previous analysis report, the Northwell Health Company of the USA expanded its services in December 2024 by implementing the Playback Health platform at some preferred clinical sites.

In Europe, software companies have successfully established an environment for implementing computer assistance to the elderly population who suffer from a variety of ailments, in addition to patient engagement.

Europe ranks second in the world in regards to providing patient engagement platforms through its well-known National Health Services (NHS) schemes conducted by different countries. The more evolved countries in Europe, such as the United Kingdom (UK), are also attempting to make the healthcare sector utterly paperless to address sustainability apprehensions.

The software solution that serves as the interface between users and healthcare service providers is vital to the success of patient engagement platforms. These solutions, in the pattern of patient engagement mobile apps, permit the efficient transfer of prescription data to patients who reside in remote locations with access to the Internet.

As expected, this segment will produce the greatest growth output for the global market over the next few years. With the expansion of digital consciousness and the declining cost of mobile devices, the consulting services' software sub-segment is estimated to be the largest revenue-generating segment of the worldwide patient engagement platforms market, outpacing the technology segment.

By the end of 2024, the software and hardware segment comprised nearly 80% of the patient engagement mobile health applications market.

As digitization has been introduced in every walk of our lives, healthcare organizations have also started providing online services through various patient engagement platforms, which is a superbly growing market in the present decade.

With the advancement of online services in every sphere of life, healthcare organizations are also increasingly investing in developing patient-engagement mobile health apps for establishing a real-time connection with patients even when they are at home.

A new method of patient engagement has emerged as the most suitable method for maintaining customer satisfaction and trust in the healthcare organization and medical sector as well.

Health engagement platforms are also very essential from the point of view that most of the patients suffering from serious issues cannot visit the hospitals in time. In such times patient engagement platforms relieve the burden of traveling during such a sensitive condition. Healthcare sectors across the world are adopting the implementation of online services as much as possible to provide and strengthen their services for their patients.

With the growing cases of infectious disease to the emergence of novel pathogens and vector-borne diseases, the use of patient engagement platforms has substituted the physical service provided at healthcare facilities and has provided the required impetus for the rapid growth of the patient engagement platforms market across the globe.

A rising proportion of the senior population and an increasing amount of contagious diseases that visit healthcare institutions is a severe issue that has created the demand for online consulting services as a perfect solution for such a situation.

Even the higher cost of healthcare services post the medical surgeries have also positioned digital patient engagement platforms as a relief for the citizens of developed and developing countries alike.

The growing trend of digital communication and data consumption is the major driving factor for higher healthcare engagement platforms in developing regions such as the Asia Pacific and Latin America.

What are the Major Challenges Limiting the Growth of the Patient Engagement Platform Market?

Making patients digitally literate and comfortable with online consulting services will pose a major hurdle for the rapid adoption of digital healthcare engagement platforms in all regions. Also, the availability of sufficient tools and equipment for conducting healthcare procedures for the patient is a major challenge that will be faced by the market players for popularizing the patient engagement platforms software in the area within their domain.

Patients around the world are opting more and more for digital solutions for the consulting service provided by their healthcare institutions which is driving the popularity of patient engagement platforms around the world.

The prominent component for the success of Patient engagement platforms is the software solution that acts as the interface between users and healthcare service providers. These solutions in the form of patient engagement mobile apps enable the efficient transfer of prescription data to the patient living at a remote location with an internet facility.

As evident, this segment is projected to provide the maximum growth output for the global market in the coming years.

With the rise in digital awareness and decreasing cost of mobile devices, the consulting services' software sub-segment is expected to be the highest revenue-generating component of the technology segment of the global patient engagement platforms market.

The software and hardware segment accounted for almost 80% of the patient engagement mobile health applications market by the end of 2024.

In the technology segment, the patient rounding and patient experience survey sub-segments are also essential for the proper development of software solutions for the successful implementation of the best patient engagement platforms within any consumer base.

The technology part of the patient engagement platform market is growing rapidly, adopting the newest scientific advancements and promises of reliable growth following the popularity of consultation services provided by the software segment.

Patient engagement software solutions have evolved over the years and have turned specific in providing various types of facilities as per the requirement. In the present market, pharma patient engagement platforms are dealing in acute care facilities, post-acute care facilities, and non-acute care facilities as well.

Acute hospitals providing services for chronic disease management occupied the largest portion of the total revenue generated by healthcare engagement platforms at about 40% by the end of the year 2024.

Children's hospitals and ambulatory surgery centers are also observed to have a significant contribution to the expansion of the key companies in the market.

Also, the vast amount of research work carried out in the field for the development of the best patient engagement platforms has attracted various academic medical centers and military treatment facilities into the ambit of its market.

Post-acute care facilities provided are growing at a promising rate and are predicted to be the popular segment for patient engagement software companies increasingly trying to attract more users by expanding their services for every type of ailment.

Long-term acute facilities and skilled nursing facilities are expected to be the most promising sub-segments of the post-acute care facility segment for the digital healthcare engagement platforms in the coming days.

In the non-acute segment, physicians' offices and clinics have remained stagnant in their growth given the small patient base and less area of operation in specific locations. However, this segment is expected to generate some significant market for health engagement platforms with an increase in disease burden around the world.

With the advantage of having a robust healthcare infrastructure and early adoption of medical and electronic health record (EHR) systems, the countries of North America have invested highly in developing digital patient engagement platform solutions for involving patients.

This forward movement by a number of Healthcare Corporations, mostly in the United States (USA) and in Canada, to some extent has placed the North American geographic region at the forefront of the global patient engagement platforms market.

In Europe, as well as patient engagement, software companies have succeeded in creating an environment for providing digital assistance to the old age population suffering from several types of ailments.

Europe stands in second position globally in providing patient engagement platforms through its famous National Health Services (NHS) schemes formulated by various countries. The more developed Europe, such as the United Kingdom (UK), is also on the path of turning the healthcare sector totally paperless in accordance with environmental concerns.

Asia Pacific countries are also developing their digital ecosystem very rapidly and have digitized most of their financial activities in the last couple of years. With the advantage of having the highest population count in the countries such as China and India development of patient engagement mobile apps have been a booming industry in recent times.

Also, by recognizing the benefits of digital solutions in the healthcare sector, government organizations are also providing immense opportunities for the development and adoption of healthcare financial engagement platforms by private players.

With the rising economic conditions of the general people, the Asia Pacific geographical region is predicted to be the region with the highest growth potential for patient engagement platforms during the forecast years.

The global market for patient engagement platforms is severely fragmented by the presence of a number of solution-providing companies that range widely in size.

The major players are well equipped with the most advanced technology and software products that provide them an edge over the local players.

The main strategy adopted by these players to capture the digital patient engagement platforms market is to collaborate and partner with renowned healthcare service providers already well-established in the

What are the Most Recent Developments Adopted by the Market Players Influencing the Global Patient Engagement Platforms Market?

The global patient engagement platforms market is estimated to be valued at USD 31.0 billion in 2025.

The market size for the patient engagement platforms market is projected to reach USD 149.2 billion by 2035.

The patient engagement platforms market is expected to grow at a 17.0% CAGR between 2025 and 2035.

The key product types in patient engagement platforms market are technology and consulting services.

In terms of facility type, acute care facility segment to command 54.0% share in the patient engagement platforms market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Patient-Controlled Analgesia Pumps Market Size and Share Forecast Outlook 2025 to 2035

Patient Transportation Market Size and Share Forecast Outlook 2025 to 2035

Patient Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Patient Positioning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring Accessories Market Size and Share Forecast Outlook 2025 to 2035

Patient Self-Service Kiosks Market Size and Share Forecast Outlook 2025 to 2035

Patient Recliners Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Patient Transport Services Market Size and Share Forecast Outlook 2025 to 2035

Patient Registry Software Market Size and Share Forecast Outlook 2025 to 2035

Patient Positioning System Analysis by Product Type and by End User through 2035

Patient Lateral Transfer Market - Innovations, Demand & Forecast 2035

Patient Identification Wristbands Market Analysis – Size, Trends & Forecast 2025 to 2035

Patient Hygiene Aids Market – Demand & Forecast 2024 to 2034

Patient Portal Market – Growth & Forecast 2024-2034

Patient-Controlled Injectors Market

Patient Health Management Market

Patient Monitoring Pods Market

Outpatient Clinics Market Trends and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA