The patient handling equipment market is expanding steadily, driven by the rising incidence of chronic illnesses, a growing aging population, and the global increase in hospital admissions. Industry publications and healthcare infrastructure reports have highlighted increased investment in advanced patient mobility solutions aimed at reducing caregiver injury and enhancing patient safety.

Hospital systems are incorporating technologically advanced handling equipment to comply with international safety standards and reduce the risk of musculoskeletal disorders among healthcare workers. Additionally, rising healthcare expenditure in both developed and emerging regions has enabled healthcare providers to invest in integrated patient support systems across care settings.

Demand for patient-centric care models, along with improved training protocols for equipment use, has further stimulated adoption. The future of the market is expected to benefit from product innovations in automated lifting devices, sensor-integrated hospital beds, and AI-enabled patient monitoring platforms. Segmental growth is being led by Medical Beds as the foundational equipment in clinical care environments, Critical Care settings due to the high complexity of patient needs, and Hospital Bed Accessories for their role in enhancing patient comfort, safety, and caregiver efficiency.

| Metric | Value |

|---|---|

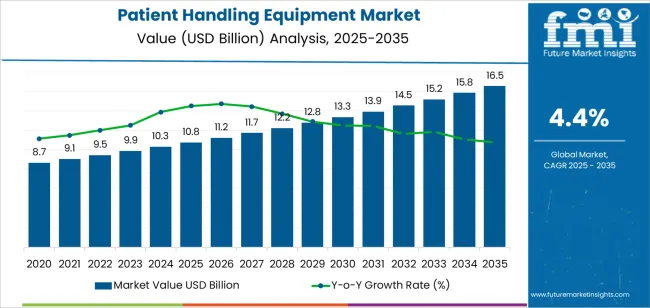

| Patient Handling Equipment Market Estimated Value in (2025 E) | USD 10.8 billion |

| Patient Handling Equipment Market Forecast Value in (2035 F) | USD 16.5 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The market is segmented by Product Type, Type of Care, Accessories, and End User and region. By Product Type, the market is divided into Medical Beds, Wheelchairs and Scooters, Ambulatory Aid Devices, Bathroom Safety Equipment, and Others. In terms of Type of Care, the market is classified into Critical Care, Bariatric Care, Fall Prevention, Wound Care, and Others. Based on Accessories, the market is segmented into Hospital Bed Accessories, Stretcher Accessories, Lifting Accessories, Transfer Accessories, and Evacuation Accessories. By End User, the market is divided into Hospitals, Home Care Settings, Elderly Care Facilities, Orthopaedic Care, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

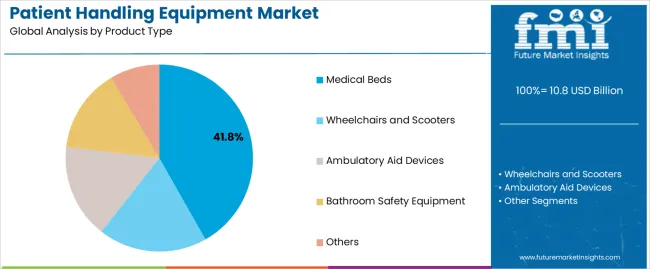

The Medical Beds segment is projected to account for 41.8% of the patient handling equipment market revenue in 2025, securing its position as the leading product type. Growth in this segment has been driven by the fundamental role medical beds play in inpatient and long-term care management.

Hospitals and care facilities have adopted advanced bed systems equipped with adjustable positioning, pressure redistribution surfaces, and integrated patient monitoring capabilities to improve outcomes and prevent complications such as pressure ulcers. Industry announcements and hospital procurement data have pointed to increased demand for ICU and bariatric beds to accommodate rising critical care admissions.

Furthermore, the aging population has necessitated the expansion of long-term care infrastructure, further supporting demand. Medical beds also serve as the central platform for supporting a range of accessories, reinforcing their importance in comprehensive patient handling systems. With rising focus on ergonomic design and electronic integration, the Medical Beds segment is expected to continue leading the market in terms of utility and revenue contribution.

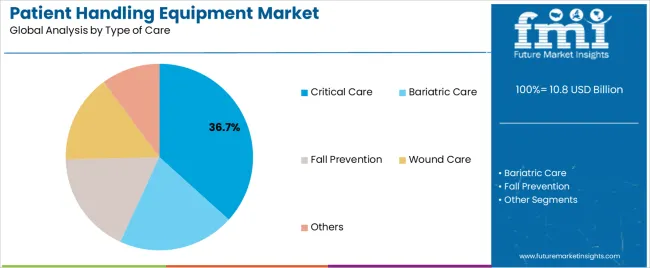

The Critical Care segment is projected to contribute 36.7% of the patient handling equipment market revenue in 2025, emerging as the primary type of care application. Growth of this segment has been driven by the rising number of patients requiring intensive monitoring and life-support interventions.

Intensive care units and high-dependency wards have increasingly adopted specialized handling equipment to safely reposition patients, minimize complications from immobility, and enable rapid response during medical emergencies. Hospital infrastructure reports have highlighted increased investment in critical care beds, transfer systems, and ceiling lifts to support staff safety and operational efficiency.

The need for highly responsive care environments has led to the integration of smart bed features and automated mobility aids within ICUs. Additionally, post-operative and trauma care has reinforced the demand for reliable patient handling systems capable of managing complex cases. With critical care representing one of the most resource-intensive areas in healthcare, this segment is anticipated to maintain its market prominence in the near future.

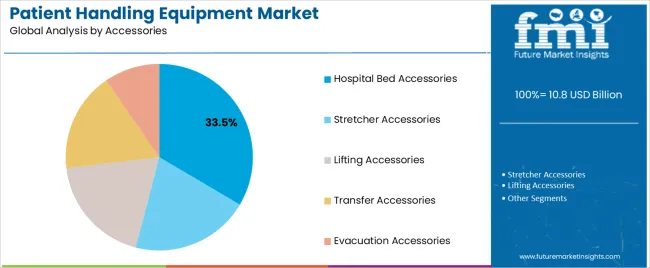

The Hospital Bed Accessories segment is forecasted to account for 33.5% of the patient handling equipment market revenue in 2025, establishing it as the leading category within accessories. Growth of this segment has been driven by the continuous enhancement of patient comfort, safety, and care delivery associated with accessory components.

Hospitals have increasingly procured items such as side rails, overbed tables, IV poles, and electronic bed controls to optimize workflow and patient experience. Equipment upgrades and retrofitting projects have been prominent in both public and private healthcare facilities, reflecting the importance of maintaining adaptable and responsive patient handling systems.

Additionally, accessories that promote infection control, improve mobility support, and assist with therapeutic positioning have gained traction. Product announcements from medical equipment suppliers have also revealed innovation in modular designs and digital connectivity features in accessories, contributing to wider market adoption. As healthcare providers focus on value-based care and facility modernization, the Hospital Bed Accessories segment is expected to sustain robust growth through ongoing demand and product evolution.

Technological advancements have led to the development of more efficient and user-friendly equipment, including motorized lifts and automated transfer devices.

These innovations improve patient comfort and safety while reducing the physical strain on caregivers. The growing emphasis on patient-centered care and enhancing the quality of life for both patients and caregivers further propels the market growth.

The increasing healthcare expenditure in developing countries is expanding the adoption of modern patient handling equipment. Government initiatives aimed at improving healthcare infrastructure and patient safety are also significant drivers.

The expansion of home healthcare services and the growing trend of outpatient care support the market by necessitating portable and easy-to-use patient handling solutions. These factors collectively ensure robust growth for the patient handling equipment market.

Healthcare organizations are exploring rental and leasing options for patient handling equipment to reduce upfront costs and optimize resource utilization. This trend is particularly prominent in regions with budget constraints or fluctuating patient volumes.

The integration of telehealth technologies with patient handling equipment allows for remote monitoring of patient's vital signs and movements, enabling healthcare providers to deliver timely interventions and support virtual consultations.

Manufacturers are prioritizing user training and education initiatives to ensure the safe and effective use of patient handling equipment. Comprehensive training programs and instructional materials help healthcare professionals and caregivers develop proficiency in equipment operation and best practices.

Radio-frequency identification (RFID) technology and tracking systems are being integrated into patient handling equipment to enable real-time asset tracking, inventory management, and equipment maintenance scheduling. This enhances operational efficiency and reduces the risk of lost or misplaced equipment.

With the growing prevalence of obesity in the USA, there is an increased demand for bariatric patient handling equipment. Products designed to support higher weight capacities, such as reinforced beds and heavy-duty lifts, are becoming more common in healthcare settings.

Rising arthritis issues to impact of aging population on the patient handling equipment market in the United States to drive the market. As the baby boomer generation continues to age, there is a significant rise in the number of elderly individuals requiring medical care.

This demographic shift leads to a higher prevalence of mobility-related issues and chronic conditions, necessitating the use of advanced patient handling equipment to ensure safe and effective care.

Stringent occupational safety regulations aimed at protecting healthcare workers. The Occupational Safety and Health Administration (OSHA) mandates guidelines to minimize the risk of musculoskeletal injuries among healthcare professionals.

Compliance with these regulations compels healthcare facilities to invest in modern patient handling equipment, such as lifts and transfer devices, to ensure worker safety and reduce injury rates.

Government initiatives aimed at improving healthcare infrastructure and access play a crucial role in market expansion. Significant investments in building and upgrading healthcare facilities, along with policies to enhance medical technology availability, drive the adoption of patient handling equipment.

The government’s focus on expanding healthcare services in rural and underserved areas also boosts demand for these tools, ensuring that advanced care reaches a broader population.

The growing middle class and increasing disposable incomes contribute to market growth as well. More individuals can afford better healthcare services and home care solutions, leading to higher demand for patient handling equipment.

Furthermore, the expansion of health insurance coverage in China ensures that a larger portion of the population can access advanced medical care, further propelling the market.

Another critical driver is the stringent health and safety regulations in the UK The Health and Safety Executive (HSE) mandates strict guidelines for manual handling in healthcare settings to prevent injuries among healthcare workers. Compliance with these regulations necessitates the use of advanced patient handling equipment, thereby boosting market demand.

These regulations are enforced to ensure the safety of both patients and healthcare providers, encouraging the adoption of modern handling solutions.

The increasing focus on patient-centered care is another important growth driver. Healthcare providers in the UK are prioritizing the quality of care and patient experience, leading to greater demand for high-quality patient handling equipment.

Investments in healthcare infrastructure and the modernization of existing facilities further contribute to market growth. Additionally, government initiatives and funding for healthcare improvements support the adoption of advanced medical equipment, including patient handling solutions.

Wheelchairs and scooters significantly contribute to the growth of the patient handling equipment market by enhancing mobility for individuals with physical impairments.

These devices provide essential support for elderly and disabled patients, allowing them to navigate daily activities independently. The increasing aging population and prevalence of chronic conditions such as arthritis and diabetes drive the demand for these mobility aids.

The convenience and additional functionalities offered by smart wheelchairs and scooters appeal to both users and caregivers. For instance, remote monitoring enables caregivers to track the patient's condition and location, providing peace of mind and ensuring timely intervention if needed.

This integration of technology meets the growing demand for advanced and user-centric healthcare solutions, making mobility aids more attractive and indispensable.

Bariatric care is significantly driving the patient handling equipment market due to the unique needs and challenges posed by obese patients.

With the global rise in obesity rates, healthcare facilities are facing an increasing demand for specialized equipment designed to safely and comfortably handle bariatric patients. This includes heavy-duty patient lifts, wider beds and wheelchairs, and reinforced transfer aids.

Manufacturers are responding to this demand by developing innovative solutions tailored to the specific requirements of bariatric care, such as higher weight capacities and enhanced stability. As healthcare providers prioritize patient safety and dignity, the bariatric care segment continues to fuel growth and innovation within the patient-handling equipment market.

In the patient handling equipment market, players are showcasing robust performance driven by growing healthcare infrastructure, technological advancements, and increasing demand for patient comfort and safety. Key players are continually innovating to introduce ergonomic designs, lightweight materials, and advanced features like electric-powered lifts and mobility aids.

Additionally, there's a rising focus on enhancing efficiency and reducing caregiver injuries, prompting investments in smart patient-handling solutions. With a strong emphasis on user-friendly designs and compliance with safety regulations, players are competing to capture larger market shares and expand their global presence in this vital healthcare segment.

In March 2025, Joerns Healthcare, a vertically integrated provider of healthcare services and equipment to USA post-acute care, is refocusing all of its resources on the sales and service of medical equipment.

The Joerns Company continues to lead in post-acute care, wound care, and patient handling. With its rich 134-year history of offering quality products and services, Joerns Healthcare will become a standalone enterprise in the USA capital market.

In terms of product, the market includes wheelchairs and scooters, medical beds, ambulatory aid devices, bathroom safety equipment, and others.

Types of care provided by patient handling equipment are categorized into bariatric care, fall prevention, critical care, wound care, and others.

In terms of accessories, the market is segmented into stretcher accessories, hospital bed accessories, lifting accessories, transfer accessories, and evacuation accessories.

The end use industries include hospitals, home care settings, elderly care facilities, orthopedic care, and others.

As per region, the industry is divided into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East and Africa.

The global patient handling equipment market is estimated to be valued at USD 10.8 billion in 2025.

The market size for the patient handling equipment market is projected to reach USD 16.5 billion by 2035.

The patient handling equipment market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in patient handling equipment market are medical beds, wheelchairs and scooters, ambulatory aid devices, bathroom safety equipment and others.

In terms of type of care, critical care segment to command 36.7% share in the patient handling equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Goat Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Drum Handling Equipment Market

Patient Positioning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sheep Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sludge Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Manure Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Material Handling Equipment Market Growth - Trends & Forecast 2025 to 2035

Storage And Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Marine Waste Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tire and Wheel Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cargo Handling Equipment Market

Automated Material Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Material Handling Equipment Market

Patient-Matched Orthopedic Guides Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Patient-Controlled Analgesia Pumps Market Size and Share Forecast Outlook 2025 to 2035

Patient Transportation Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring Accessories Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Patient Self-Service Kiosks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA