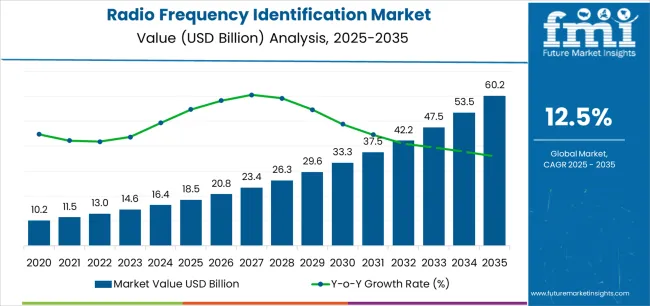

The Radio Frequency Identification Market is estimated to be valued at USD 18.5 billion in 2025 and is projected to reach USD 60.2 billion by 2035, registering a compound annual growth rate (CAGR) of 12.5% over the forecast period.

The radio frequency identification (RFID) market is expanding rapidly. Growth is being driven by the increasing need for real-time tracking, automation, and supply chain visibility across industries. Current market dynamics reflect strong adoption in logistics, retail, and manufacturing sectors, supported by technological advancements that have improved tag performance, read range, and data accuracy.

Demand is further strengthened by digital transformation initiatives that prioritize asset traceability and inventory management efficiency. The future outlook is shaped by broader integration of RFID systems into Internet of Things (IoT) frameworks and smart infrastructure projects. Regulatory emphasis on product authenticity, safety, and efficient resource management is also accelerating deployment.

Growth rationale is based on the technology’s ability to deliver operational transparency, minimize human error, and enhance productivity Continued cost optimization of RFID components, combined with scalable cloud-based analytics solutions, is expected to sustain steady market expansion and broaden adoption across both industrial and commercial applications.

| Metric | Value |

|---|---|

| Radio Frequency Identification Market Estimated Value in (2025 E) | USD 18.5 billion |

| Radio Frequency Identification Market Forecast Value in (2035 F) | USD 60.2 billion |

| Forecast CAGR (2025 to 2035) | 12.5% |

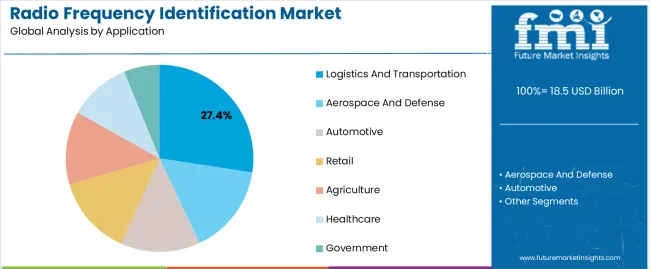

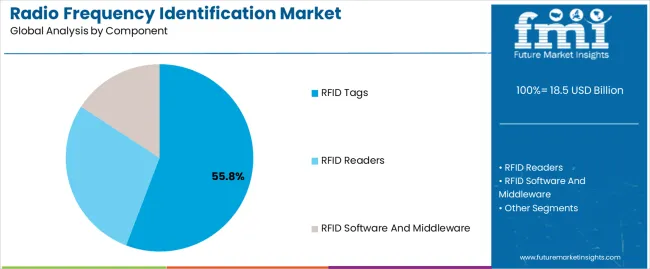

The market is segmented by Application and Component and region. By Application, the market is divided into Logistics And Transportation, Aerospace And Defense, Automotive, Retail, Agriculture, Healthcare, and Government. In terms of Component, the market is classified into RFID Tags, RFID Readers, and RFID Software And Middleware. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The logistics and transportation segment, accounting for 27.40% of the application category, has been leading due to its critical role in optimizing supply chain operations and ensuring end-to-end visibility. Adoption has been reinforced by growing demand for asset tracking, automated warehouse management, and real-time shipment monitoring.

RFID technology has been instrumental in reducing operational inefficiencies by enabling seamless identification and data capture across large-scale logistics networks. The segment’s growth has been supported by government and enterprise-level digital logistics initiatives aimed at improving freight accuracy and reducing transit losses.

Integration of RFID with global positioning systems and advanced analytics has further improved traceability and route optimization As cross-border trade and e-commerce volumes expand, the logistics and transportation segment is expected to maintain its leading position, supported by continuous innovation in long-range and ruggedized RFID solutions.

The RFID tags segment, representing 55.80% of the component category, has dominated the market owing to their extensive utilization across retail, healthcare, manufacturing, and logistics industries. Demand growth is being propelled by cost reductions in tag manufacturing and improvements in durability, storage capacity, and data transmission speed.

The segment’s leadership is attributed to its scalability and compatibility with both active and passive RFID systems, enabling broad applicability across asset tracking and authentication functions. Continuous advancements in printed electronics and miniaturization technologies have expanded use cases in high-density and high-temperature environments.

Additionally, sustainability-driven innovations, including recyclable and biodegradable tag materials, are enhancing environmental compliance As organizations accelerate automation and adopt digital inventory management systems, the RFID tags segment is expected to sustain its market dominance and drive technological evolution across the global RFID ecosystem.

| Leading Component | RFID Tags |

|---|---|

| Value Share (2025) | 28.60% |

The RFID tags segment is expected to acquire a market share of 28.60% in 2025. Over the forecast period, this segment is anticipated to expand based on:

| Leading Application | Retail |

|---|---|

| Value Share (2025) | 21.60% |

The retail sector is excessively using RFID technology. In 2025, this sector is projected to obtain 21.60%. Key factors driving segment growth are:

| Countries | Forecast CAGR (2025 to 2035) |

|---|---|

| The United States | 10.10% |

| Germany | 1.70% |

| Japan | 2.00% |

| China | 13.70% |

| Australia and New Zealand | 16.70% |

The radio frequency identification (RFID) market in the United States is projected to register a CAGR of 10.1% through 2035. Such promising growth trajectory of this market is driven by:

The China radio frequency identification market is set to expand at a CAGR of 13.7% through 2035. The radiofrequency identification (RFID) market dynamics are driven by factors like:

RFID technology market in Germany to record a growth rate of 1.7% through 2035. Factors contributing to the market’s growth are as follows:

The Australia and New Zealand RFID market is projected to expand at a CAGR of 16.7% from 2025 to 2035. The market is being catalyzed by:

The Japan radio frequency identification (RFID) market is expected to register a 2% CAGR through 2035. Key factors that are promoting market growth are as follows:

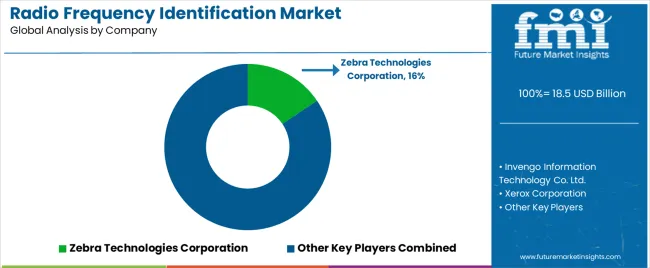

Key players are finding significant growth in the RFID market. This can be attributed to the rising market competition and the international presence of premium RFID solutions. Key players in the market are concentrating on research and development activities to introduce distinct products, thus expanding their product portfolios.

Market players are expected to invest in acquisitions, mergers, and collaborations to have an upper hand in the market. Industry participants are customizing their services and products to resolve unique challenges and leverage opportunities presented by certain sectors. This targeted approach is expected to allow companies to serve niche markets.

Market contenders are collaborating with government agencies, industry associations, and research institutions to foster standardization efforts, knowledge sharing, and the development of new applications for RFID technology. This is broadening market awareness and facilitating wider adoption.

Latest Developments in the Radio Frequency Identification Market

The global radio frequency identification market is estimated to be valued at USD 18.5 billion in 2025.

The market size for the radio frequency identification market is projected to reach USD 60.2 billion by 2035.

The radio frequency identification market is expected to grow at a 12.5% CAGR between 2025 and 2035.

The key product types in radio frequency identification market are logistics and transportation, aerospace and defense, automotive, retail, agriculture, healthcare and government.

In terms of component, rfid tags segment to command 55.8% share in the radio frequency identification market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Printed Chipless RFID Radio Frequency Identification Market Size and Share Forecast Outlook 2025 to 2035

Radiopharmaceutical Market Forecast and Outlook 2025 to 2035

Radio-Fluoroscopy Systems Market Size and Share Forecast Outlook 2025 to 2035

Radiosynthesis Equipment Market Size and Share Forecast Outlook 2025 to 2035

Radiotherapy Positioning Devices Market Size and Share Forecast Outlook 2025 to 2035

Radioactive Iodine Ablation Therapy Market Size and Share Forecast Outlook 2025 to 2035

Radiometric Detectors Market Size and Share Forecast Outlook 2025 to 2035

Radiopharmaceutical Logistics Market Analysis Size and Share Forecast Outlook 2025 to 2035

Radiography Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Radiology Information System RIS Market Size and Share Forecast Outlook 2025 to 2035

Radioimmunoassay Market Growth - Trends & Forecast 2025 to 2035

Radiotherapy Patient Positioning Accessories Market Trends – Forecast 2025 to 2035

Radiographic Film Processor Market Analysis – Size, Share & Forecast 2025 to 2035

Radiotherapy Device Market is segmented by External Beam Radiation Therapy Device and Internal Beam Radiation Therapy Device from 2025 to 2035

Radiotherapy-Induced Oral Mucositis Treatment Market Analysis – Growth & Forecast 2024-2034

Radiotherapy Motion Management Market

Radiography-Fluoroscopy Combo System Market

Radiolucent Wrist Fixator Market

Radioimmunotherapy Treatment Market

Radiofrequency (RF) Ablation System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA