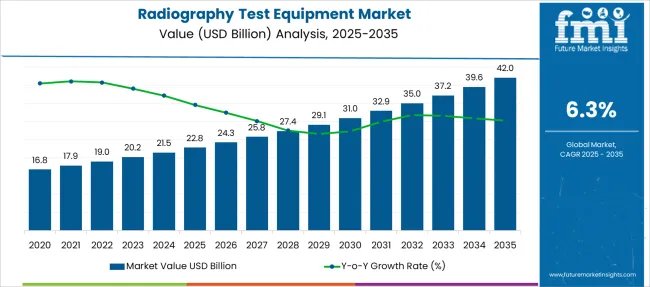

The Radiography Test Equipment Market is estimated to be valued at USD 22.8 billion in 2025 and is projected to reach USD 42.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

| Metric | Value |

|---|---|

| Radiography Test Equipment Market Estimated Value in (2025 E) | USD 22.8 billion |

| Radiography Test Equipment Market Forecast Value in (2035 F) | USD 42.0 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The Radiography Test Equipment market is advancing steadily due to its critical role in ensuring structural integrity, safety compliance, and quality assurance across key industries. The integration of digital imaging, enhanced contrast resolution, and real-time defect detection capabilities has transformed radiography from a manual inspection process into a data-driven diagnostic tool. As industries face increasingly stringent regulatory environments, especially in automotive, aerospace, and energy sectors, radiography test equipment is being deployed to maintain product standards, prevent operational failures, and meet international certification requirements.

Innovations in portable systems, low-dose imaging, and automation have improved operational efficiency while minimizing inspection downtime. Moreover, the adoption of digital radiography and computed radiography is enabling faster turnaround times and remote analysis.

This evolution is expected to gain further traction as manufacturers focus on predictive maintenance and Industry 4.0 integration Global emphasis on non-destructive testing as a risk mitigation and quality assurance measure will continue to propel the market’s growth trajectory across developed and developing economies.

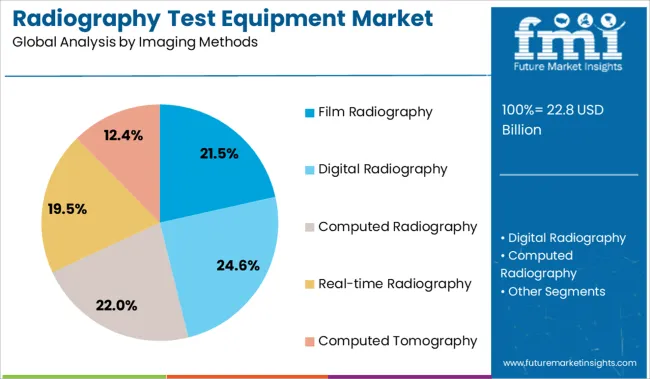

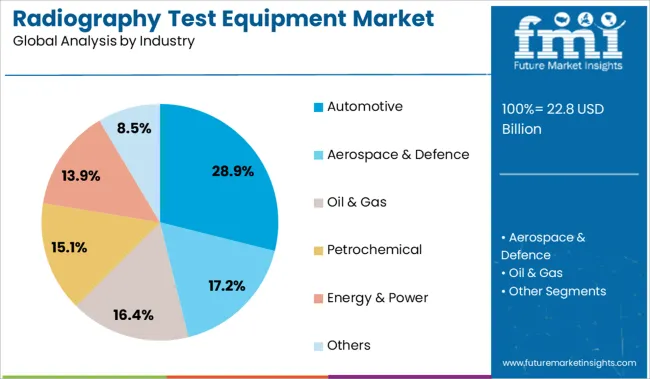

The market is segmented by Imaging Methods and Industry and region. By Imaging Methods, the market is divided into Film Radiography, Digital Radiography, Computed Radiography, Real-time Radiography, and Computed Tomography. In terms of Industry, the market is classified into Automotive, Aerospace & Defence, Oil & Gas, Petrochemical, Energy & Power, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The film radiography segment is projected to account for 21.5% of the total revenue share in the radiography test equipment market in 2025, maintaining a substantial presence despite the growing popularity of digital solutions. Its continued usage is supported by its reliability in detecting fine cracks and flaws in high-resolution detail, especially in materials where ultra-precise imaging is critical.

Industries with legacy inspection processes or where regulatory approvals remain tied to film-based standards have retained film radiography systems due to their proven accuracy and repeatability. Additionally, film radiography does not require complex digital infrastructure, making it a dependable choice in environments where digital integration is limited.

The lower initial equipment cost and long-standing familiarity among technicians have further supported its usage Even as digital alternatives rise, the demand for film radiography remains persistent in high-risk applications requiring archivable physical records and compliance with specific safety certifications, especially in developing regions and conservative industries.

The automotive industry segment is expected to capture 28.9% of the overall revenue share in the radiography test equipment market by 2025, establishing it as the leading end-use sector. The segment’s dominance is being driven by the industry's increasing reliance on radiographic testing for weld inspections, component integrity verification, and lightweight material analysis.

As automotive manufacturers focus on electrification, crash safety, and fuel efficiency, non-destructive testing has become essential for ensuring defect-free assemblies in critical parts such as battery enclosures, castings, and structural welds. Radiography enables precise internal inspection without part destruction, aligning well with lean manufacturing and cost control initiatives.

Furthermore, advancements in automation, robotics integration, and high-throughput testing systems have accelerated adoption in vehicle production lines As compliance with global safety and emission standards becomes more rigorous, radiographic testing is being adopted across the entire automotive value chain, from OEMs to component suppliers, to maintain quality assurance and minimize product recalls.

Radiography test equipment growth lies in demand from aerospace and automotive sectors with safeguards prominent to industry growth. With the prevalence of digitalization over analogue systems, the radiography test equipment market is emerging as a key industry in different verticals.

When a robust concrete structure shows anomalies in the grain direction and strength, the radiography test equipment market is a viable solution for detecting the variations likewise. Safeguards to electrical equipment are also exhibiting diverse growth in the market which adds to the market growth of the radiography testing equipment market.

Swift development in the manufacturing industry in regional markets including Asia Pacific with countries such as India, China, and Japan is driving the radiography test equipment market. The inherent use of radiography equipment in industries such as electronics, pulp and paper, and semiconductors for testing equipment and complying with industrial regulations is driving the radiography test equipment market.

Some prominent industrial bodies such as the Internal Organization for Standardization (ISO) and the American Society of Mechanical Engineering (ASME) have made it mandatory to follow guidelines to maintain instrument safety which drives the growth prospects of the radiography test equipment market.

The primary challenge the radiography test equipment industry faces is the health constraints associated with exposure to radiation. The other constraints include the dearth of skilled technicians and the high cost of radiography test equipment which are major factors causing growth to backfire in the radiography test equipment market.

Asia Pacific is witnessing overpowering industrial activity in the region with a boom in the manufacturing, energy, and power sectors. This has created a rapid penetration in the Asia-Pacific market which is expected to grow at a high CAGR during the forecast period.

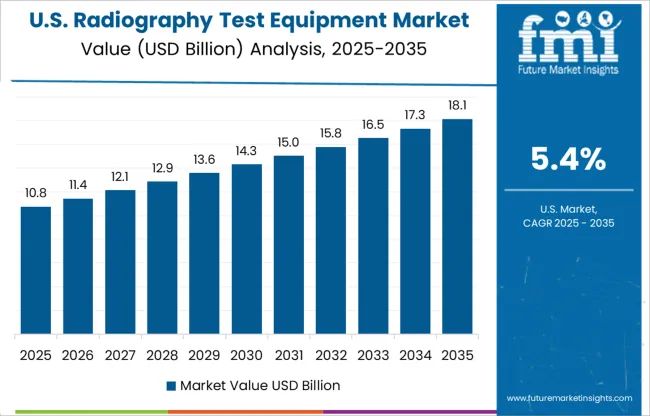

According to Future Market Insights, North America is expected to hold a major market share in terms of value in the radiography test equipment market due to the rapid adoption of radiography test equipment and non-destructive testing technologies across various industries such as automotive and aerospace, and defense. Furthermore, the radiography test equipment market in the region benefits from high access to skilled labor in the United States of America.

Some of the major players covered in the radiography test equipment market report are Siemens Healthcare GmbH, Jones X-Ray, Inc, Konica Minolta Business Solutions India Private Limited, Euroteck Systems, Multi, Inc, MXR Imaging Inc, Desert Health Imaging Technologies, LLC, FUJIFILM Corporation and Koninklijke Philips N.V, Johnson and Johnson Services, Inc., B. Braun Melsungen AG, MedicalTek Co., Ltd., and Solos Endoscopy, among other domestic and global players

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 6.3% from 2025 to 2035 |

| Market Value in 2025 | USD 22.8 billion |

| Market Value in 2035 | USD 42.0 billion |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Kilotons, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Imaging Methods, Industry, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Russia, BENELUX, China, Japan, South Korea, India, ASEAN, Australia & New Zealand, GCC Countries, South Africa, Turkey |

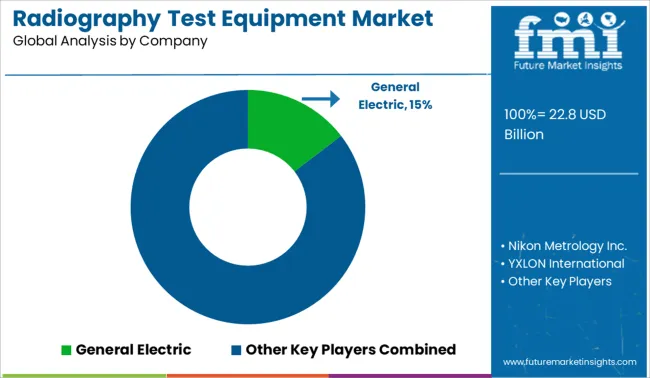

| Key Companies Profiled | General Electric Company; Nikon Metrology Inc.; YXLON International; Olympus Corporation; Hitachi Ltd.; Rigaku Corporation; Carl Zeiss X-Ray Technologies S.r.l; Canon Inc.; North Star Imaging Inc.; Hamamatsu Photonics KK |

| Customization | Available Upon Request |

The global radiography test equipment market is estimated to be valued at USD 22.8 billion in 2025.

The market size for the radiography test equipment market is projected to reach USD 42.0 billion by 2035.

The radiography test equipment market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in radiography test equipment market are film radiography, digital radiography, computed radiography, real-time radiography and computed tomography.

In terms of industry, automotive segment to command 28.9% share in the radiography test equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Video Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wi-Fi Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Drug Testing Equipment Market

Steel Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Metal Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Glass Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Shear Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Stress Tests Equipment Market Size and Share Forecast Outlook 2025 to 2035

Blood Testing Equipment Market Growth - Trends & Forecast 2025 to 2035

Motor Testing Equipment Market - Growth & Demand 2025 to 2035

Test and Measurement Equipment Market Size and Share Forecast Outlook 2025 to 2035

Mortar Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fabric Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Rubber Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA