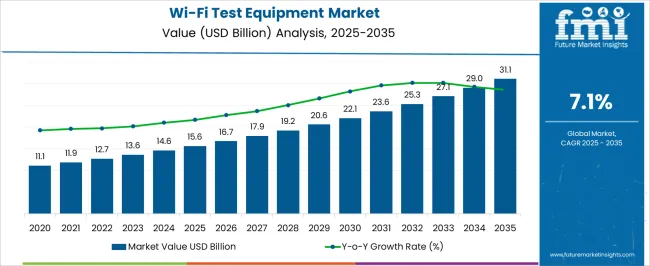

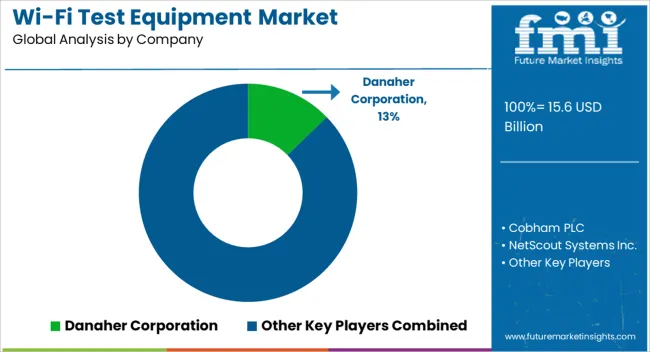

The Wi-Fi Test Equipment Market is estimated to be valued at USD 15.6 billion in 2025 and is projected to reach USD 31.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period.

| Metric | Value |

|---|---|

| Wi-Fi Test Equipment Market Estimated Value in (2025 E) | USD 15.6 billion |

| Wi-Fi Test Equipment Market Forecast Value in (2035 F) | USD 31.1 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

The Wi-Fi test equipment market is expanding steadily, supported by the rapid adoption of high-speed wireless technologies and the growing complexity of communication networks. Industry updates and company disclosures have emphasized the importance of advanced testing solutions to validate performance, security, and interoperability across diverse Wi-Fi standards, including Wi-Fi 6 and Wi-Fi 7. The proliferation of connected devices in both consumer and enterprise environments has created heightened demand for reliable Wi-Fi testing to ensure seamless user experience.

Research investments by technology providers have focused on enhancing throughput measurement, latency analysis, and coverage optimization, fueling product innovation in this space. Additionally, the increasing deployment of smart infrastructure, IoT ecosystems, and cloud-based services has underscored the need for comprehensive Wi-Fi validation tools.

Future growth is expected to be driven by the integration of artificial intelligence into testing solutions, real-time analytics, and the expansion of 5G-to-Wi-Fi interoperability assessments. Segmental momentum is anticipated to be led by desktop Wi-Fi test equipment, R&D applications, and adoption among large enterprises due to their infrastructure needs and scale of operations.

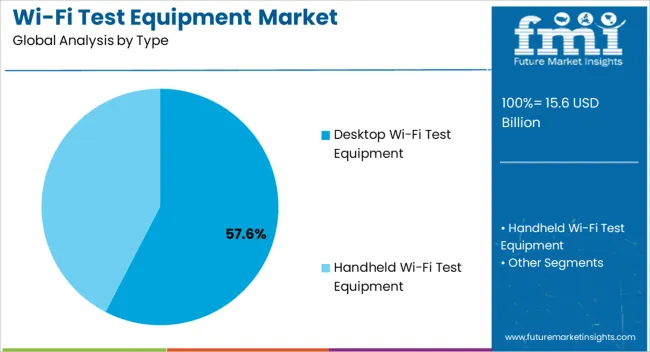

The Desktop Wi-Fi Test Equipment segment is projected to contribute 57.60% of the market revenue in 2025, maintaining its position as the dominant type. Growth in this segment has been influenced by the precision, stability, and comprehensive testing capabilities that desktop systems provide compared to portable alternatives. These systems have been widely used for advanced testing scenarios, including throughput, spectral efficiency, and interference analysis, which require stable laboratory conditions.

Reports from technology developers have noted that desktop platforms are preferred in environments where long-term testing, simulation, and certification are critical. The ability to integrate with other laboratory instruments and provide scalable testing options has further reinforced their adoption.

As Wi-Fi standards continue to evolve and become more complex, desktop Wi-Fi test equipment is expected to remain indispensable for ensuring compliance, reliability, and performance validation.

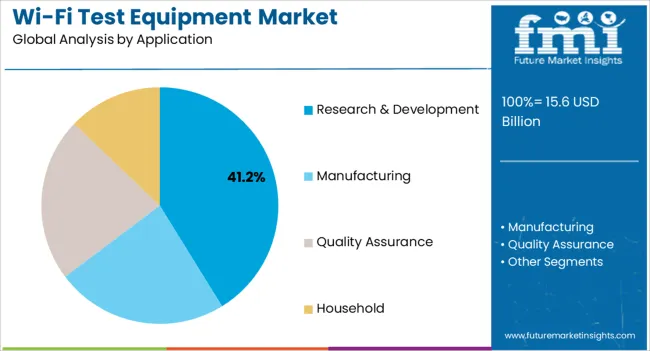

The Research & Development segment is projected to account for 41.20% of the Wi-Fi test equipment market revenue in 2025, reflecting its critical role in product innovation and technology advancement. R&D teams in technology firms, chipset manufacturers, and academic institutions have relied heavily on Wi-Fi testing solutions to validate new protocols and ensure seamless device connectivity. Industry publications and company reports have indicated significant investments in R&D facilities to accelerate the commercialization of Wi-Fi 6E and Wi-Fi 7 technologies.

These efforts have been reinforced by growing demand for enhanced spectrum utilization, reduced latency, and improved device coexistence in dense environments. Moreover, research labs and development centers have required advanced test equipment to simulate real-world conditions and validate emerging use cases such as AR/VR and industrial IoT.

With continued innovation driving the wireless ecosystem, the Research & Development segment is expected to sustain its leadership in application adoption.

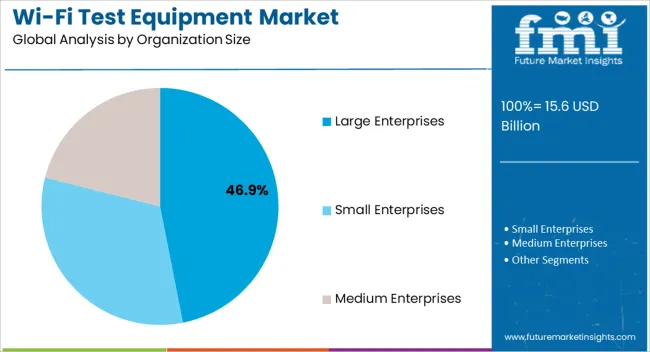

The Large Enterprises segment is projected to contribute 46.90% of the Wi-Fi test equipment market revenue in 2025, securing its place as the leading organizational size category. Growth in this segment has been driven by the large-scale deployment of Wi-Fi infrastructure in corporate campuses, manufacturing facilities, and data-intensive industries. Large enterprises have prioritized advanced test equipment to ensure network stability, cybersecurity compliance, and uninterrupted connectivity for mission-critical operations.

Investor updates and corporate reports have highlighted growing IT infrastructure budgets among large organizations, enabling investment in high-precision testing systems. Furthermore, large enterprises have increasingly incorporated Wi-Fi testing into their digital transformation strategies to support IoT device integration and hybrid work models.

The scale of operations and the necessity of maintaining reliable, secure wireless connectivity have positioned large enterprises as consistent demand drivers, ensuring that this segment maintains its leading role in the market.

There are certain entry barriers like lack of technological advances in developing and developed countries, which has not allowed the wi-fi test equipment market to grow to its potential. The test time of the wi-fi test equipment is quite low, because of which there might be issues of reduced efficiency.

North America, which currently has a market share of 36% and is the leading market, is expected to dominate the market during the forecast period.

Increased adoption of Wi-Fi test equipment by small and medium enterprises is expected to drive the Wi-Fi test equipment market. A rapid increase in the usage of electronic devices is also expected to drive the market in the region.

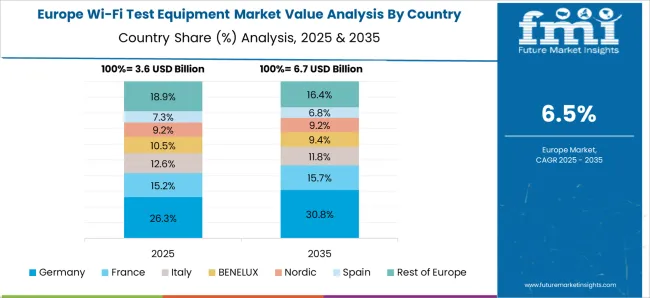

Europe, which currently has a market share of 24%, is expected to be one of the most significant markets for Wi-Fi test equipment.

Increased focus on data security along with the growth of the IoT industry in this region is expected to drive the wi-fi test equipment market. Rapid technological advancements in this region are also expected to surge the market for Wi-Fi test equipment.

These tools can be used to help companies not only guarantee their items but also to incorporate them into product development as well as assurance procedures. Wi-Fi Test Suite open-source parts are made accessible to the market to help promote the Wi-Fi Alliance's scalability and quality agenda. Wi-Fi Test Suite supports technological evolution by adapting to a wide range of distinct, diverse, and cutting-edge gadgets. The quality assurance segment is likely to grow rapidly in the future years.

With raid developments happening in the electronics and IoT industry, the start-up community in the Wi-Fi test equipment market is actively pursuing innovative ways to make internet connections more accessible. Some of the start-ups are Meter, Plume, eero, and Celona.

These start-ups are mainly focusing on making the internet using Wi-Fi test equipment omnipresent, just like air and water. These companies are also working on a full-stack approach that combines hardware, software, and operations so that any company can function seamlessly on a reliable network.

Some of the key players in the Wi-Fi test equipment market are Danaher Corporation, Cobham PLC, NetScout Systems Inc., Viavi solutions Inc., Spirent Communications, and Ixia.

With the developments shaping up across industries, and these industries looking for more options for effective Wi-Fi solutions such as Wi-Fi troubleshooting, Wi-Fi modem tester, Wi-Fi adapter tester, Wi-Fi compliance tester. All the major players are now focusing on increasing their operations either through mergers and acquisitions or by setting up new factories in various parts of the world. This will ensure that these major players continue providing seamless Wi-Fi service to their clients.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 7.5% from 2025 to 2035 |

| Wi-Fi Test Equipment Market Valuation as on 2025 | USD USD 15.6 billion |

| Wi-Fi Test Equipment Market Anticipated Forecast Value (2035) | USD USD 31.1 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Type, Application, Organization Size, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia; Middle East & Africa |

| Key Countries Profiled | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Danaher Corporation; Cobham PLC; NetScout Systems Inc.; Viavi solutions Inc.; Spirent Communications; Ixia. |

| Customization & Pricing | Available Upon Request |

The global Wi-Fi test equipment market is estimated to be valued at USD 15.6 billion in 2025.

The market size for the Wi-Fi test equipment market is projected to reach USD 31.1 billion by 2035.

The Wi-Fi test equipment market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in Wi-Fi test equipment market are desktop Wi-Fi test equipment and handheld Wi-Fi test equipment.

In terms of application, research & development segment to command 41.2% share in the Wi-Fi test equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Video Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Drug Testing Equipment Market

Steel Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Metal Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Glass Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Shear Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Stress Tests Equipment Market Size and Share Forecast Outlook 2025 to 2035

Blood Testing Equipment Market Growth - Trends & Forecast 2025 to 2035

Motor Testing Equipment Market - Growth & Demand 2025 to 2035

Test and Measurement Equipment Market Size and Share Forecast Outlook 2025 to 2035

Mortar Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fabric Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Rubber Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Military Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA