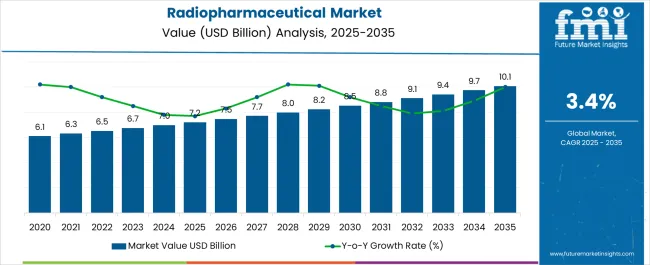

The Radiopharmaceutical Market is estimated to be valued at USD 7.2 billion in 2025 and is projected to reach USD 10.1 billion by 2035, registering a compound annual growth rate (CAGR) of 3.4% over the forecast period.

The radiopharmaceutical market is experiencing strong growth, supported by the increasing prevalence of cancer, cardiovascular disorders, and neurological conditions that demand advanced diagnostic and therapeutic solutions. Radiopharmaceuticals are being widely adopted due to their ability to provide precise imaging, early detection, and targeted therapy, which enhances patient outcomes while reducing overall treatment costs. The market is benefiting from continuous innovation in molecular imaging, advancements in nuclear medicine, and improvements in radioisotope production technologies.

Growing investments in healthcare infrastructure and collaborations between pharmaceutical companies and research institutions are further accelerating adoption. The rising demand for personalized medicine is also fueling growth, as radiopharmaceuticals allow for tailored treatment plans and improved monitoring of therapeutic responses. Regulatory support for expanding diagnostic applications and the increasing establishment of cyclotron and reactor facilities worldwide are enhancing accessibility.

As awareness regarding the clinical benefits of radiopharmaceuticals continues to grow, the market is poised for long-term expansion, particularly in oncology and cardiology The integration of AI-based imaging and precision therapies is expected to further transform this field, ensuring continued innovation and adoption in the coming years.

| Metric | Value |

|---|---|

| Radiopharmaceutical Market Estimated Value in (2025 E) | USD 7.2 billion |

| Radiopharmaceutical Market Forecast Value in (2035 F) | USD 10.1 billion |

| Forecast CAGR (2025 to 2035) | 3.4% |

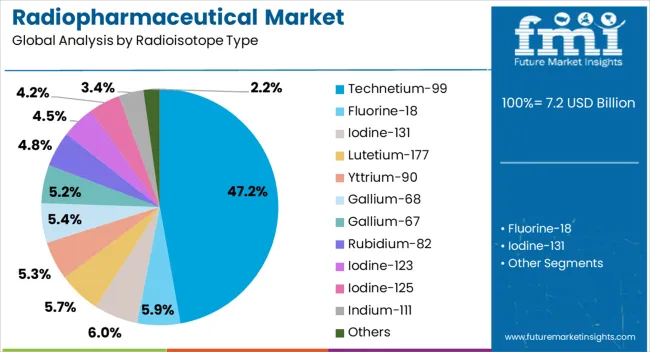

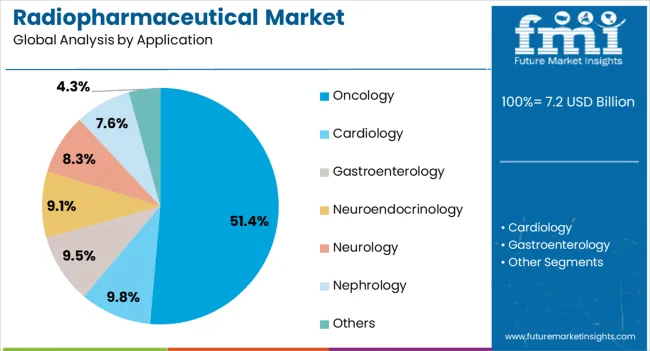

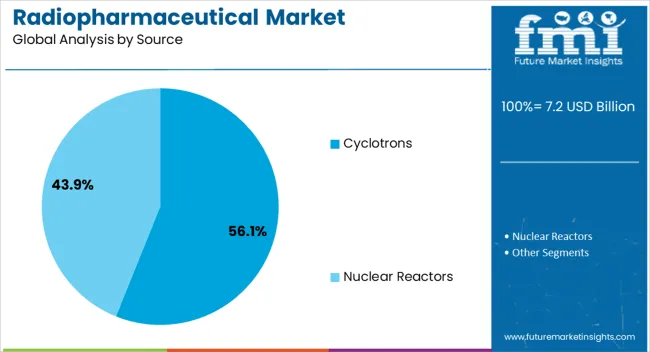

The market is segmented by Radioisotope Type, Application, Source, and End User and region. By Radioisotope Type, the market is divided into Technetium-99, Fluorine-18, Iodine-131, Lutetium-177, Yttrium-90, Gallium-68, Gallium-67, Rubidium-82, Iodine-123, Iodine-125, Indium-111, and Others. In terms of Application, the market is classified into Oncology, Cardiology, Gastroenterology, Neuroendocrinology, Neurology, Nephrology, and Others. Based on Source, the market is segmented into Cyclotrons and Nuclear Reactors. By End User, the market is divided into Hospitals, Diagnostic Imaging Centers, Ambulatory Surgical Centers, and Cancer Research Institute. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Technetium-99 radioisotope type is projected to account for 47.2% of the radiopharmaceutical market revenue share in 2025, positioning it as the dominant isotope. This strong market share is driven by its widespread use in diagnostic imaging procedures, particularly in nuclear cardiology and oncology. Technetium-99’s favorable physical properties, including its short half-life and optimal gamma energy emission, make it highly effective for single-photon emission computed tomography, which is widely used in hospitals and diagnostic centers globally.

Its broad clinical applications, cost-effectiveness, and availability through established supply chains reinforce its leadership. Continuous advancements in generator technology are further improving efficiency and accessibility. The high demand for non-invasive imaging solutions in cardiovascular and cancer care supports the continued growth of this segment.

Moreover, the increasing focus on early disease detection and the expansion of nuclear medicine facilities worldwide are ensuring consistent adoption As healthcare systems emphasize precise diagnostic outcomes, Technetium-99 is expected to maintain its strong position in the radiopharmaceutical landscape.

The oncology application segment is expected to capture 51.4% of the radiopharmaceutical market’s revenue share in 2025, underscoring its role as the leading therapeutic area. Rising cancer incidence rates globally are creating strong demand for radiopharmaceuticals that can provide both diagnostic and therapeutic benefits. Oncology-focused radiopharmaceuticals are essential for tumor localization, staging, monitoring treatment response, and in some cases delivering targeted radiation therapy directly to cancer cells.

The ability to combine diagnostic imaging with therapeutic intervention is supporting improved survival outcomes and personalized treatment planning. Radiopharmaceuticals in oncology also benefit from expanding research into novel radioisotopes and radioligand therapies, which are being integrated into precision oncology programs. The growing emphasis on early cancer detection, coupled with the expansion of cancer care facilities in emerging markets, is boosting accessibility and adoption.

As new therapies enter clinical practice and regulatory approvals increase, oncology is expected to remain the dominant application segment The rising burden of cancer and the demand for targeted treatment solutions ensure that radiopharmaceuticals will remain central to oncology care strategies.

The cyclotrons source segment is anticipated to hold 56.1% of the radiopharmaceutical market revenue share in 2025, making it the leading production source. Cyclotrons are being increasingly utilized due to their ability to produce a wide variety of short-lived radioisotopes required for advanced diagnostic and therapeutic procedures. The decentralized production model offered by cyclotrons enhances supply chain efficiency and reduces reliance on nuclear reactors, which often face operational and regulatory challenges.

Their capability to provide on-demand and localized isotope production ensures greater accessibility for hospitals and diagnostic centers, particularly in regions with growing demand for nuclear medicine. Technological advancements in compact and cost-effective cyclotron systems are further driving adoption. Governments and private healthcare providers are investing significantly in expanding cyclotron networks to strengthen radiopharmaceutical supply infrastructure.

The rising demand for positron emission tomography imaging, combined with expanding clinical applications of radiopharmaceuticals, is reinforcing the dominance of cyclotrons as a production source As global demand for reliable isotope availability increases, cyclotrons are expected to maintain their leadership in shaping the radiopharmaceutical supply chain.

Technetium-99, a metastable nuclear isomer of technetium-99, is one of the most commonly used isotopes in medical imaging. It is accounted to hold a share of 47.20% in the radiopharmaceutical market.

| Attributes | Details |

|---|---|

| Radioisotope | Technetium-99 |

| Market Share (2025) | 47.20% |

| Attributes | Details |

|---|---|

| Application | Oncology |

| Market Share (2025) | 51.40% |

Asian countries are set to become some of the lucrative markets for radiopharmaceuticals in the coming future. The growth rates for these countries have been jotted down below. Huge population, government policies, the prevalence of chronic diseases, such as cancer, and rising medical tourism are some of the main reasons for this growth.

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 5.40% |

| Malaysia | 3.90% |

| Indonesia | 3.70% |

| Thailand | 3.20% |

| Spain | 2.90% |

The Indian radiopharmaceutical industry is slated to grow at a healthy CAGR of 5.40% for the forecasted period.

Malaysia is one of the most lucrative markets for radiopharmaceuticals. For the period of 2025 to 2035, the market is very likely to grow at a CAGR of 3.90%.

The Indonesian market for radiopharmaceuticals is set to grow at a sluggish CAGR of 3.70% through 2035.

The Thai radiopharmaceutical market also has a promising future like the other Asian countries. It is very much likely to progress at 3.20% CAGR through 2035.

The Spanish market for radiopharmaceuticals is accounted to grow at a CAGR of 2.90% for 2025 to 2035.

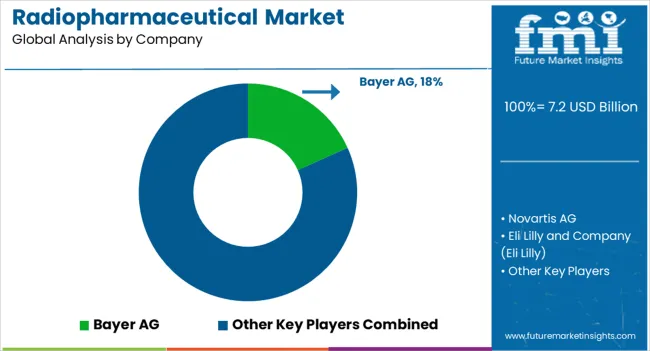

The market for radiopharmaceuticals is still in its nascent stages with very few companies dominating the international marketplace. However, with medical advancements and the proliferation of these methodologies in the medical world, the requirement of radiopharmaceuticals will soon experience a drastic surge. This will provide excellent opportunities for new players to enter the market.

Some of the prominent companies in the market are Bayer AG, Bracco Imaging S.p.A., Cardinal Health, Inc., Eli Lilly and Company (Eli Lilly), Curium Pharma, Lantheus Holdings, Inc., Novartis AG, Nordion (Canada) Inc., etc. These companies provide radiopharmaceuticals to healthcare facilities such as hospitals, ambulatory surgical centers, clinics, specialty hospitals, etc.

Innovation and keeping up with the latest medical technology are the key components in this market. This is the reason why, these companies are found to be investing millions of dollars in the development of novel radiopharmaceuticals with better efficiency.

Besides this, collaborative efforts with government bodies are also being carried out to make the offering more affordable, feasible, and easily available, especially in developing and underdeveloped parts of the world.

Recent Developments

The global radiopharmaceutical market is estimated to be valued at USD 7.2 billion in 2025.

The market size for the radiopharmaceutical market is projected to reach USD 10.1 billion by 2035.

The radiopharmaceutical market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in radiopharmaceutical market are technetium-99, fluorine-18, iodine-131, lutetium-177, yttrium-90, gallium-68, gallium-67, rubidium-82, iodine-123, iodine-125, indium-111 and others.

In terms of application, oncology segment to command 51.4% share in the radiopharmaceutical market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Radiopharmaceutical Dispensing System Market Size and Share Forecast Outlook 2025 to 2035

Radiopharmaceutical Logistics Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA