The patient identification wristbands market includes non-transferable, wearable ID bands used across healthcare settings to accurately identify patients and ensure safety, traceability, and correct medical administration. These wristbands, available in vinyl, plastic, tyvek, and RFID-integrated formats, play a crucial role in reducing medical errors, enhancing hospital workflows, supporting electronic health records (EHRs), and improving patient security.

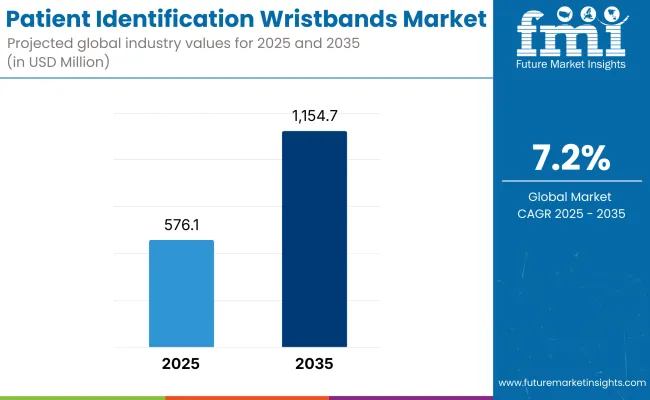

Their adoption spans hospitals, clinics, long-term care facilities, and emergency response units. In 2025, the global patient identification wristbands market is projected to reach approximately USD 576.1 million, and is expected to grow to around USD 1,154.7 million by 2035, reflecting a Compound Annual Growth Rate (CAGR) of 7.2% during the forecast period.

Key Market Metrics

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 576.1 Million |

| Projected Market Size in 2035 | USD 1,154.7 Million |

| CAGR (2025 to 2035) | 7.2% |

This growth is driven by rising healthcare digitization, growing patient safety initiatives, and the expansion of RFID and barcode-based hospital systems that rely on accurate, scannable patient identifiers.

North America is leading the market, primarily in the USA and Canada due to HIPAA compliance, integration of EHR, and high-digitization of hospitals in the region which are boosting the demand for these intelligent patient identification systems. In large chains hospitals, RFID-enabled wristband adoption, barcode-based tracking, and color-coded systems for allergy, fall-risk or special care needs are all proliferating at a remarkable pace.

Europe is a market focused on patients and regulated for safety, requiring standardized patient ID practices in hospitals in Germany, the UK, France, the Netherlands, and elsewhere. The integration of long-lasting tamper-proof wristbands with hospital information systems driven by regulations like EU Patient Data Accuracy and Traceability. The area is also testing green and antimicrobial wristband materials.

Asia-Pacific is witnessing fast adoption, especially in China, India, Japan, and South Korea, with healthcare infrastructure upgradation and high patient volumes. Affordable, barcode-printed wristbands are incorporating hospitals, private hospitals and urban clinics invest in RFID and electronic verification solutions that have boosted patient safety and reduced administrative errors.

Compliance Complexity and Cost Sensitivity in Low-Resource Settings

The patient identification wristbands market continues to face challenges involving standardization of formats of patient data, integrity of printed contents, and aligned with privacy regulations (e.g. HIPAA, GDPR) in health care settings.

Most low- and middle-income countries are still using handwritten or non-digital wristband systems due to cost considerations and non-digitization, leading to inconsistencies in electronic medical records and the higher risk of drug administration errors. There are also issues on the usability path, particularly in emergency or high-volume settings), such as degradation of barcode readability, wristband discomfort, and patient non-compliance.

Smart Healthcare Integration, RFID, and Infection Control Focus

The worldwide shift to patient safety, minimizing errors, and integrating EHRs is creating massive momentum in the market, despite restrictions. The introduction of RFID-enabled, laser-printed, tamper-proof, and antimicrobial-coated wristbands is driving improvements in traceability, data security, and automation of hospital workflows.

Furthermore, increasing demand from pediatric, geriatric, ICU & ambulatory care units, rising outpatient surgery center and -mobile health clinic volumes, is expanding application space. New opportunities are underway with the rollout of wearable patient IDs for chronic disease management, home care and pandemic preparedness.

The market during 2020 to 2024 was also supported by infection control measures (driven by the pandemic) that increased demand for disposable, single-use wristbands and contactless patient tracking solutions. Scannable and RFID-based wristbands were adopted at a low level, particularly in public hospitals and rural clinics, due to a fragmented digital infrastructure.

The multi-functional, cloud-connected and intelligent patient identification platform integrating biometric, wearable technology, and AI-based health data systems in polling regions and hospitals will become the predominant technology for the NGS by 2025 to 2035. As healthcare systems go global and digital, secure, low-stress, and interoperable wristbands will be the center of medication safety, patient flow optimization, and personalized care delivery.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Driven by Joint Commission, NHS Safety Standards, HIPAA compliance |

| Technology Innovations | Use of thermal/laser printing, color-coding, and barcode wristbands |

| Market Adoption | Focused on hospitals, maternity wards, and emergency departments |

| Sustainability Trends | Introduction of latex-free, hypoallergenic, and biodegradable wristbands |

| Market Competition | Led by Zebra Technologies, SATO, PDC Healthcare, Identiv, LaserBand, Barcodes Inc. |

| Consumer Trends | Demand for error reduction, clear print visibility, and skin safety |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion into global standards for biometric authentication, RFID encryption, and pediatric-specific ID protocols |

| Technology Innovations | Growth of NFC/RFID wristbands, biometric-enabled IDs, and antimicrobial, eco-friendly materials |

| Market Adoption | Expansion into home care, mobile clinics, clinical trials, military field hospitals, and disaster relief operations |

| Sustainability Trends | Movement toward recyclable, compostable, and reusable wristband systems with circular supply chains |

| Market Competition | Entry of IoT health-tech firms, telemedicine platforms, and RFID-focused wearable innovators |

| Consumer Trends | Growing preference for contactless, wearable, interoperable, and patient-customizable wristband IDs |

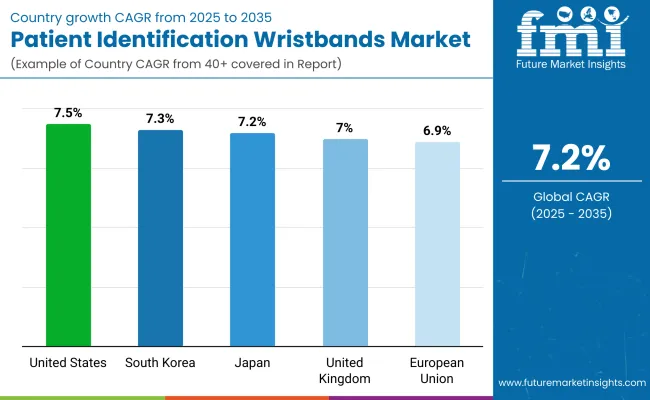

The United States patient identification wristbands share is proliferating owing to experienceing gruelling quality test in hospitals, policy constraints (for instance; The Joint Commission), and sporadic analog patient data. To reduce medication errors and enhance workflow efficiency, hospitals and long-term care facilities increasingly are deploying wristbands that utilize either barcodes or radio-frequency identification (RFID).

In addition, the need for tamper-resistant and allergy- indicating wristbands to support EHR integration and patient- centric model of care is also driving the demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

Increasing healthcare expenditures to improve patient safety, reduce clinical errors, and the adoption of digital technologies by the National Health Service (NHS) are expected to drive the UK Patient Identification Wristbands market. Among NHS trusts, some are deploying smart wristbands with warning signs color-coded, laser-etched print, and patient tracking measures.

Market growth is being driven by the transition to digital hospital settings and the increasing installation of patient wristbands in day surgery, maternity, and paediatrics.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.0% |

The market for EU patient identification wristbands is registering steady growth owing to innovations in healthcare automation, growing number of patients, and EU level rules and regulations for patient safety. Germany, France and the Netherlands are significant users of barcoded and RFID-enabled wristbands.

Even environment-friendly, latex-free materials and multi-lingual features on labels, which are widely used, are now dominating mega hospitals catering to a global clientele.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 6.9% |

The patient identification wristbands market in Japan is the result of Japan's aging population, greater utilization of outpatient surgical facilities, and the greater emphasis placed on accuracy and patient safety. The Japanese healthcare industry requires antimicrobial, hypoallergenic wristbands, which have an extremely long life span and are also very legible in print.

But innovations such as technology integration in eldercare tracking wristbands, mobile syncing, and allergy alerts are driving adoption.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.2% |

The South Korea patient identification wristbands market is growing rapidly on the back of digital health transformation, smart hospital initiatives and increase in the demand for live monitoring of patients.

Hospitals use the latest user’s wristband with NFC, RFID and QR code technology to avoid error in diagnosis and drug delivery. Increased adoption is also being driven by automation and AI in hospital administration.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.3% |

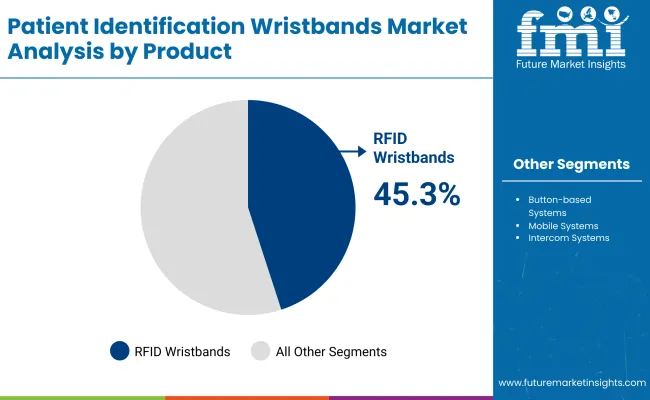

| By Product | Market Share (2025) |

|---|---|

| RFID Wristbands | 45.3% |

The RFID (radio frequency identification) wristbands segment is expected to maintain its leading share of the patient identification wristbands market, accounting for 45.3% of the total demand. Their widespread use comes from their ability to store patient data and transmit it wirelessly, allowing seamless integration into hospital information systems and electronic health records.

An advantage of such a feature is increased patient safety it reduces identification errors, automates administrative activities and increases the accuracy of medical procedures.

RFID wristbands have predominantly been utilized within larger hospitals and healthcare settings due to the high number of patients passing through over a short period of time necessitating an efficient means of tracking and identifying everyone.

The wristbands enable real-time monitoring of patients, track their movements in the facility, and ensure patients receive appropriate medications and treatments. Infection Prevention: RFID technology prevents the need for physical contact when identifying a patient, ultimately decreasing the risk of transmission.

Thermal wristbands are projected to account for a 25.1% share of the market. These wristbands are printed using direct thermal printing technology, allowing for an efficient and cost-friendly printing process that can reliably create high-quality, scannable wristbands on demand. Thermal wristbands are widely used in the hospitals and clinics for temporary identification of patients in emergency rooms and outpatient services, as quick turnaround and instant printing is required.

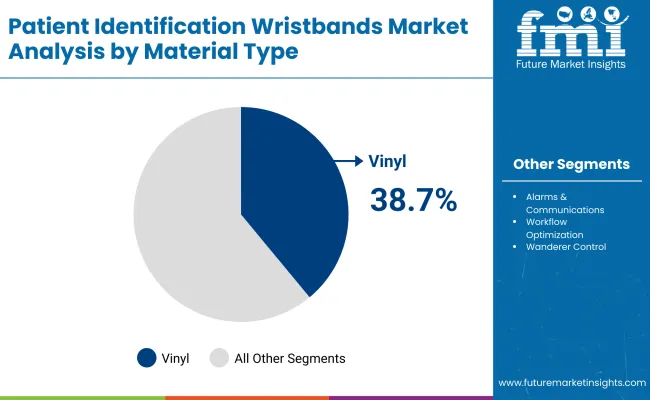

| By Material Type | Market Share (2025) |

|---|---|

| Vinyl | 38.7% |

The patient identification wristbands market is anticipated to be led by the vinyl segment, based on the type of material, with a projected market share of 38.7% till 2035. These characteristics make them ideal for long-term wear in hospital environments, as they are more durable, comfortable, and resistant to stains and chemicals.

They can also for the safe and efficient identification of patients, without any risk of loss of critical information, both in terms of its content and readability by third parties, throughout patients stay in the hospital.

Synthetic wristband are projected to contribute for 22.5% of market share. They last long but flexible enough that they are made of high range synthetic materials. Synthetic wristbands are designed to withstand the rigors of hospital activity from day to day, whilst remaining comfortable to wear for the patient. Their flexibility allows their application across a wide range of health care settings, including inpatient and outpatient settings.

As such, on the basis of material type, vinyl wristbands will hold dominance over the patient identification wristbands market owing to their sturdiness, comfort and suitability over long durations in the healthcare environments. Other materials remain suitable for specific applications in the marketplace; however, the overall movement is towards applications that are based on a combination of strength, patient comfort and affordability.

As the need for accurate patient tracking, safety, and error prevention rises in healthcare systems, the global Patient Identification Wristbands market is experiencing steady growth. wristbands are critical because they play a key role in hospitals, ambulatory surgery centres, long-term care facilities and paediatric units, safely confirming identity, medication history, allergies and timing of treatments.

The market's growth is driven by Digital transformation of hospitals, Barcode & RFID implementation, Regulatory compliance requirements, and Growth of smart hospital infrastructure.

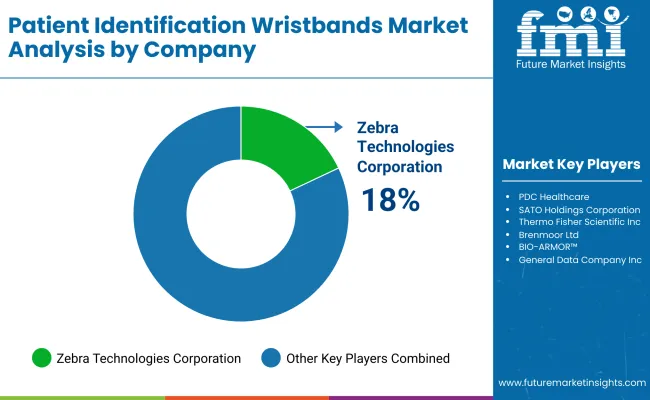

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Zebra Technologies Corporation | 18-22% |

| PDC Healthcare (Brady Corporation) | 14-18% |

| SATO Holdings Corporation | 12-16% |

| Identiv, Inc. | 10-14% |

| Thermo Fisher Scientific Inc. | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Zebra Technologies Corporation | In 2024, Zebra enhanced its Z-Band Fusion™ and UltraSoft wristbands, with RFID integration and antimicrobial coating, supporting EMR systems and real-time patient tracking. |

| PDC Healthcare (Brady Corporation) | As of 2025, PDC launched laser and thermal printable wristbands with tamper-evident and color-coded formats, designed for allergy alerts, maternity wards, and neonatal care. |

| SATO Holdings Corporation | In 2023, SATO introduced environmentally friendly wristbands using linerless and BPA-free materials, optimized for sustainable hospital ID solutions. |

| Identiv, Inc. | In 2024, Identiv debuted NFC-enabled patient wristbands with secure authentication and cloud connectivity, catering to digital hospitals and mobile health systems. |

| Thermo Fisher Scientific Inc. | As of 2023, Thermo Fisher released cryogenic and chemical-resistant ID bands for laboratory, biobank, and clinical trial environments, offering high scan accuracy in extreme conditions. |

Key Market Insights

Zebra Technologies Corporation (18-22%)

Zebra leads the patient identification wristbands market with its durable, RFID-compatible, and scan-optimized wristbands, serving major hospitals and healthcare networks globally.

PDC Healthcare (Brady Corporation) (14-18%)

PDC specializes in customizable, color-coded wristbands with barcode and laser printing options, widely used for safety labeling and risk classification in patient workflows.

SATO Holdings Corporation (12-16%)

SATO offers sustainable and printer-integrated wristbands, targeting value-conscious and eco-friendly hospital systems in Asia-Pacific and Europe.

Identiv, Inc. (10-14%)

Identiv pioneers in smart wristband solutions with contactless capabilities and digital patient authentication, catering to telehealth and mobile care environments.

Thermo Fisher Scientific (8-12%)

Thermo Fisher addresses niche use cases in clinical research and biospecimen handling, providing ultra-durable wristbands for laboratory identification and safety.

Other Key Players (26-32% Combined)

The overall market size for patient identification wristbands market was USD 576.1 million in 2025.

The patient identification wristbands market is expected to reach USD 1,154.7 million in 2035.

Growing focus on patient safety, rising hospital admissions, and increasing adoption of barcode and RFID-enabled wristbands in healthcare settings will drive market growth.

The top 5 countries which drives the development of patient identification wristbands market are USA, European Union, Japan, South Korea and UK.

RFID wristbands expected to grow to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Age Group , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Age Group , 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Age Group , 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 18: Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Age Group , 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 21: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 23: South Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 24: South Asia Market Value (US$ Million) Forecast by Age Group , 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Age Group , 2018 to 2033

Table 30: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 31: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Oceania Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 33: Oceania Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 34: Oceania Market Value (US$ Million) Forecast by Age Group , 2018 to 2033

Table 35: Oceania Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 36: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 38: MEA Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 39: MEA Market Value (US$ Million) Forecast by Age Group , 2018 to 2033

Table 40: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Age Group , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Age Group , 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Age Group , 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Age Group , 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Age Group , 2023 to 2033

Figure 24: Global Market Attractiveness by End User, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Age Group , 2023 to 2033

Figure 29: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Age Group , 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Age Group , 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Age Group , 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 46: North America Market Attractiveness by Product, 2023 to 2033

Figure 47: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 48: North America Market Attractiveness by Age Group , 2023 to 2033

Figure 49: North America Market Attractiveness by End User, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Age Group , 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Age Group , 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Age Group , 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Age Group , 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Age Group , 2023 to 2033

Figure 74: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 78: Europe Market Value (US$ Million) by Age Group , 2023 to 2033

Figure 79: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 80: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 85: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 86: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 87: Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 88: Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 90: Europe Market Value (US$ Million) Analysis by Age Group , 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Age Group , 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Age Group , 2023 to 2033

Figure 93: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 94: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 95: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 96: Europe Market Attractiveness by Product, 2023 to 2033

Figure 97: Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 98: Europe Market Attractiveness by Age Group , 2023 to 2033

Figure 99: Europe Market Attractiveness by End User, 2023 to 2033

Figure 100: Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 103: South Asia Market Value (US$ Million) by Age Group , 2023 to 2033

Figure 104: South Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 105: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: South Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 110: South Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 111: South Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 112: South Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 113: South Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 114: South Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 115: South Asia Market Value (US$ Million) Analysis by Age Group , 2018 to 2033

Figure 116: South Asia Market Value Share (%) and BPS Analysis by Age Group , 2023 to 2033

Figure 117: South Asia Market Y-o-Y Growth (%) Projections by Age Group , 2023 to 2033

Figure 118: South Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 119: South Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 120: South Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 121: South Asia Market Attractiveness by Product, 2023 to 2033

Figure 122: South Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 123: South Asia Market Attractiveness by Age Group , 2023 to 2033

Figure 124: South Asia Market Attractiveness by End User, 2023 to 2033

Figure 125: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 127: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) by Age Group , 2023 to 2033

Figure 129: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 137: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 138: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 139: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 140: East Asia Market Value (US$ Million) Analysis by Age Group , 2018 to 2033

Figure 141: East Asia Market Value Share (%) and BPS Analysis by Age Group , 2023 to 2033

Figure 142: East Asia Market Y-o-Y Growth (%) Projections by Age Group , 2023 to 2033

Figure 143: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Age Group , 2023 to 2033

Figure 149: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: Oceania Market Value (US$ Million) by Product, 2023 to 2033

Figure 152: Oceania Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) by Age Group , 2023 to 2033

Figure 154: Oceania Market Value (US$ Million) by End User, 2023 to 2033

Figure 155: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: Oceania Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 160: Oceania Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 161: Oceania Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 162: Oceania Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 165: Oceania Market Value (US$ Million) Analysis by Age Group , 2018 to 2033

Figure 166: Oceania Market Value Share (%) and BPS Analysis by Age Group , 2023 to 2033

Figure 167: Oceania Market Y-o-Y Growth (%) Projections by Age Group , 2023 to 2033

Figure 168: Oceania Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 169: Oceania Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 170: Oceania Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 171: Oceania Market Attractiveness by Product, 2023 to 2033

Figure 172: Oceania Market Attractiveness by Material Type, 2023 to 2033

Figure 173: Oceania Market Attractiveness by Age Group , 2023 to 2033

Figure 174: Oceania Market Attractiveness by End User, 2023 to 2033

Figure 175: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 176: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 178: MEA Market Value (US$ Million) by Age Group , 2023 to 2033

Figure 179: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 180: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 185: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 186: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 188: MEA Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 189: MEA Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 190: MEA Market Value (US$ Million) Analysis by Age Group , 2018 to 2033

Figure 191: MEA Market Value Share (%) and BPS Analysis by Age Group , 2023 to 2033

Figure 192: MEA Market Y-o-Y Growth (%) Projections by Age Group , 2023 to 2033

Figure 193: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 194: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 195: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 196: MEA Market Attractiveness by Product, 2023 to 2033

Figure 197: MEA Market Attractiveness by Material Type, 2023 to 2033

Figure 198: MEA Market Attractiveness by Age Group , 2023 to 2033

Figure 199: MEA Market Attractiveness by End User, 2023 to 2033

Figure 200: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Positive Patient Identification Market Size and Share Forecast Outlook 2025 to 2035

Patient-Controlled Analgesia Pumps Market Size and Share Forecast Outlook 2025 to 2035

Patient Transportation Market Size and Share Forecast Outlook 2025 to 2035

Patient Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Patient Positioning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring Accessories Market Size and Share Forecast Outlook 2025 to 2035

Patient Self-Service Kiosks Market Size and Share Forecast Outlook 2025 to 2035

Patient Recliners Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Patient Transport Services Market Size and Share Forecast Outlook 2025 to 2035

Patient Engagement Platforms Market Size and Share Forecast Outlook 2025 to 2035

Patient Registry Software Market Size and Share Forecast Outlook 2025 to 2035

Patient Positioning System Analysis by Product Type and by End User through 2035

Patient Lateral Transfer Market - Innovations, Demand & Forecast 2035

Patient Hygiene Aids Market – Demand & Forecast 2024 to 2034

Patient Portal Market – Growth & Forecast 2024-2034

Patient-Controlled Injectors Market

Patient Health Management Market

Patient Monitoring Pods Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA