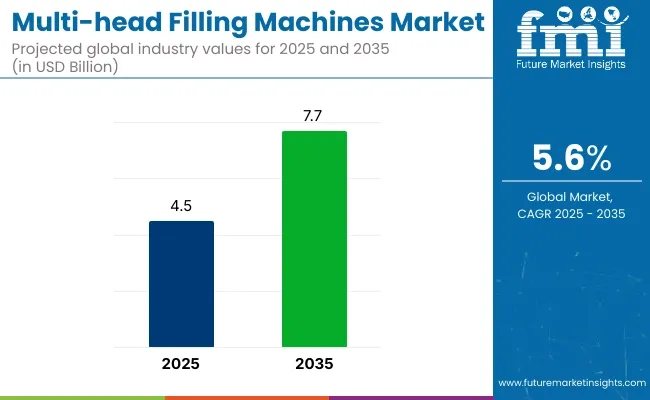

The multi-head filling machines market is projected to expand from USD 4.5 billion in 2025 to USD 7.7 billion by 2035, registering a CAGR of 5.6% over the forecast period. Sales in 2024 reached USD 4.2 billion, underscoring the sector's resilience and growing demand across food and beverage, pharmaceutical, and cosmetics industries. This growth is attributed to the increasing need for high-speed, precision-driven, and automated filling solutions that enhance production efficiency and meet stringent quality standards.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 4.5 Billion |

| Projected Market Size in 2035 | USD 7.7 Billion |

| CAGR (2025 to 2035) | 5.6% |

Multi-head filling machines are predominantly utilized for their ability to handle a diverse range of products, including liquids, pastes, powders, and granular materials. KHS expands its service portfolio in November 2024 with reliable filling of lightweight cans. In order to meet the growing demands of the beverage industry, KHS is continuously further modernizing its service solutions.

The latest option addresses the challenges of filling thin-walled cans and maintains a high level of efficiency in line and machine operation. Since the spring KHS has been successfully testing its new conversion kits for lightweight cans with various customers - and the feedback is extremely positive. “Our tests confirm the efficiency and durability generated by this conversion,” Andreas Krieg says KHS’ wet section technical support department says. Based on these results, KHS’ new retrofit is officially available with immediate effect.

The shift towards sustainable and efficient manufacturing practices is influencing the multi-head filling machines market. Manufacturers are focusing on developing machines that are energy-efficient, reduce material wastage, and are compatible with recyclable packaging materials. Innovations include the integration of IoT-enabled monitoring, smart dispensing controls, and predictive maintenance solutions to enhance production efficiency and operational reliability. These advancements align with global sustainability goals and regulatory requirements, making multi-head filling machines an attractive option for environmentally conscious businesses.

The multi-head filling machines market is poised for significant growth, driven by increasing demand in food & beverage, pharmaceutical, and personal care industries. Companies investing in automation, sustainable materials, and innovative designs are expected to gain a competitive edge. As global supply chains expand and environmental regulations become more stringent, the adoption of multi-head filling machines is anticipated to rise, offering cost-effective and eco-friendly packaging solutions.

Liquid filling machines are projected to lead the product type segment of the multi-head filling machines market with an estimated 36.7% market share by 2025, supported by their widespread use in food & beverage, pharmaceuticals, cosmetics, and chemical industries. These machines are engineered to handle a range of viscosities from water-thin liquids to thicker syrups offering precise and hygienic dispensing for mass production.

Multi-head configurations enhance speed and throughput by simultaneously filling multiple containers, significantly reducing cycle times for high-volume lines. Liquid filling machines also support various dosing mechanisms, including gravity, piston, and servo-controlled fillers, which accommodate both free-flowing and semi-viscous products.

Advancements in clean-in-place (CIP) systems, anti-drip nozzles, and tool-less changeovers are increasing demand in regulated sectors where hygiene and efficiency are critical. Additionally, automation and IoT integration are enabling real-time monitoring of fill levels, accuracy, and machine health-boosting productivity and compliance.

With e-commerce and private-label manufacturing driving demand for smaller SKUs and quick-change production lines, liquid multi-head fillers offer unmatched flexibility and performance. Their dominance is further reinforced by their compatibility with PET, glass, and pouch formats, making them a cornerstone of modern liquid packaging operations.

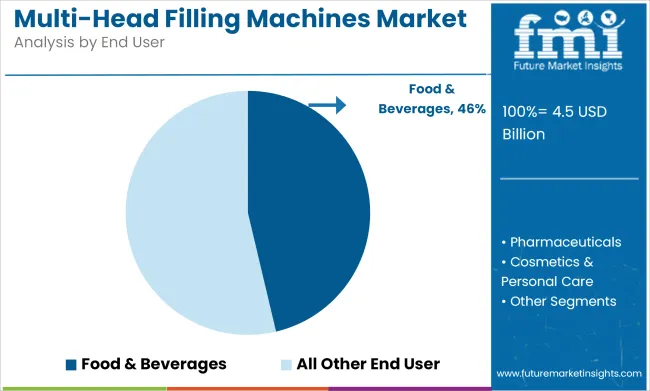

By end-use industry, the food & beverage sector is projected to account for nearly 46.3% of the total demand for liquid filling machines by 2025, making it the dominant segment. This is due to the rising global consumption of bottled water, juices, dairy products, sauces, edible oils, and alcoholic beverages-all of which require efficient, contamination-free, and high-speed filling solutions.

The growing emphasis on hygiene, product consistency, and extended shelf life has encouraged food and beverage manufacturers to adopt multi-head liquid filling machines that offer precision dosing, high throughput, and compliance with global food safety standards. Machines equipped with clean-in-place (CIP) systems and stainless-steel contact parts have become standard in dairy, soft drinks, and ready-to-eat liquid food packaging facilities.

Also the industry is witnessing a shift toward flexible packaging formats such as pouches, cartons, and PET bottles, requiring adaptable filling machines capable of handling a variety of container types and sizes. To meet fluctuating demand and reduce operational downtime, leading producers are investing in machines with quick changeover capabilities and automated control systems, including vision-based quality inspection and servo-driven filler heads.

The surge in demand for sustainable and functional beverages-such as plant-based drinks, nutritional shakes, and reduced-sugar formulations is also contributing to the increasing adoption of advanced filling lines that ensure consistent quality and efficient production. Consequently, the food & beverage industry will continue to remain the largest and fastest-evolving user of liquid filling machines throughout the forecast period.

Challenges

Opportunities

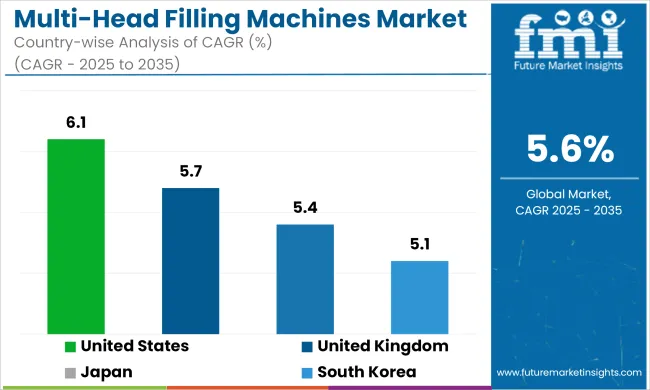

The USA dominates the multi-head filling machines market due to increasing demand for high-speed, accurate, and automated filling solutions across industries such as food & beverages, pharmaceuticals, and cosmetics. The shift toward production efficiency, coupled with stringent FDA regulations on packaging hygiene and accuracy, is driving innovation in multi-head filling machines with advanced sensors, servo-driven technology, and real-time monitoring capabilities.

Companies are investing in AI-powered filling automation, IoT-integrated monitoring systems, and high-precision dosing mechanisms to enhance productivity, reduce material waste, and ensure regulatory compliance. Additionally, sustainability initiatives promoting reduced packaging waste and energy-efficient machinery are encouraging manufacturers to develop eco-friendly multi-head filling solutions with intelligent control systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.1% |

The UK multi-head filling machines market is expanding steadily as businesses prioritize automation, sustainability, and compliance with strict regulatory frameworks such as the UK Food Standards Agency and GMP (Good Manufacturing Practices). The increasing need for precise dosing, minimal waste, and quick-changeover functionalities is driving demand for intelligent, servo-controlled multi-head fillers.

Companies are adopting AI-driven weight-based filling technology, volumetric dosing, and digital twin simulations to optimize production efficiency. Additionally, innovations in clean-in-place (CIP) and hygienic filling technologies are enhancing machine reliability and reducing downtime. The rise of flexible and modular filling systems that cater to small and large-scale production is further strengthening the UK market for multi-head filling machines.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.7% |

Japan’s multi-head filling machines market is witnessing steady growth, driven by the country’s high standards in automation, precision engineering, and technological advancements in robotics. The demand for compact, efficient, and energy-saving filling machines in the pharmaceutical, personal care, and beverage industries is fostering innovation. Companies are developing high-speed multi-head fillers with AI-powered defect detection, ultra-precise flow control, and intelligent dosing algorithms to improve product consistency and reduce wastage.

Additionally, Japan’s emphasis on hygiene and sustainability is pushing manufacturers to integrate advanced sterilization techniques, automated weight-checking systems, and non-contact filling technologies into multi-head filling machines. The transition towards smart factories and digitalized production lines is further accelerating the adoption of intelligent filling solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

South Korea’s multi-head filling machines market is growing rapidly due to the increasing demand for fast, accurate, and automated filling systems in the food processing, pharmaceutical, and industrial chemicals sectors. Government policies supporting advanced manufacturing, Industry 4.0, and sustainability initiatives are driving investments in next-generation multi-head filling equipment.

Companies are focusing on hybrid servo-driven fillers, automated viscosity control, and real-time production analytics to enhance operational efficiency. Additionally, advancements in intelligent control systems, smart sensors, and blockchain-based quality tracking are optimizing machine performance and regulatory compliance. The growing shift toward high-speed, low-maintenance, and multi-format filling machines is further strengthening the South Korean market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

The multi-head filling machines market is influenced by rising demand in food & beverage, pharmaceuticals, cosmetics, and industrial packaging. The market is witnessing innovation through new smart filling technologies, such as real-time volume adjustment, IoT-enabled performance monitoring, and AI-powered defect detection, addressing concerns about efficiency, waste reduction, and compliance with stringent regulatory standards.

Additionally, advancements in servo-driven filling nozzles and automated weight calibration systems are further shaping industry trends. The rising preference for energy-efficient, high-speed, and precision-based multi-head filling solutions is also contributing to market growth. Furthermore, increased investments in automated quality control, lean manufacturing practices, and AI-integrated process optimization are improving product efficiency and expanding market opportunities.

Companies are also exploring hybrid filling solutions that integrate volumetric and gravimetric dosing technologies for enhanced usability. Additionally, collaborations between filling machine manufacturers and industry-specific solution providers are driving the development of customized multi-head filling solutions tailored to diverse industry needs.

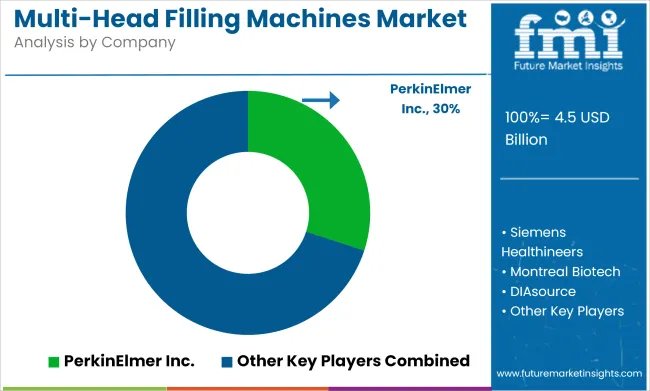

Krones AG (12-16%)

Krones leads in high-performance multi-head filling machines, emphasizing sustainability and innovation in automated filling solutions.

Tetra Pak (8-12%)

Tetra Pak is a dominant player, offering aseptic, precision-based multi-head filling solutions for food, beverage, and dairy industries.

Syntegon Technology GmbH (6-10%)

Syntegon enhances its portfolio with AI-driven, high-speed multi-head filling systems optimized for pharmaceutical and personal care products.

Ronchi Mario S.p.A. (4-8%)

Ronchi strengthens its market presence with sustainable, energy-efficient multi-head filling machines tailored for cosmetics and household products.

Accutek Packaging Equipment Companies (3-7%)

Accutek focuses on innovative, cost-effective multi-head filling machines with IoT-enabled remote diagnostics and smart automation.

Other Key Players (45-55% Combined)

Several specialty multi-head filling machine manufacturers contribute to the expanding market. These include:

The overall market size for the Multi-Head Filling Machines Market was USD 4.5 Billion in 2025.

The Multi-Head Filling Machines Market is expected to reach USD 7.7 Billion in 2035.

The market will be driven by increasing demand from food & beverage, pharmaceutical, and cosmetics industries. Innovations in AI-powered filling systems, IoT-integrated performance monitoring, and improvements in precision-based dosing mechanisms will further propel market expansion.

Key challenges include high initial investment costs, maintenance complexities, and integration with existing production lines. However, advancements in automated cleaning systems, self-adjusting filling mechanisms, and predictive maintenance solutions are addressing these concerns and supporting market growth.

North America and Europe are expected to dominate due to strong investments in manufacturing automation, regulatory compliance requirements, and high adoption of smart filling technologies. Meanwhile, Asia-Pacific is experiencing rapid growth driven by industrialization, increasing food processing facilities, and rising demand for high-speed packaging solutions.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Filling and Sealing Machine Market Size and Share Forecast Outlook 2025 to 2035

Filling Fats Market Size, Growth, and Forecast for 2025 to 2035

Industry Share Analysis for Fillings and Toppings Companies

Box Filling Machine Market from 2025 to 2035

Cup Filling Machines Market from 2025 to 2035

Drum Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wine Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Tube Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Tube Filling Machine Manufacturers

Vial Filling and Capping Machines Market

Paste Filling Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Liquid Filling Machine Market Demand & Technological Innovations 2024-2034

Bottle Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Granule Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Denture Filling Materials Market Size and Share Forecast Outlook 2025 to 2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Syringe Filling Machine Market from 2024 to 2034

Reagent Filling Systems Market Analysis – Growth & Forecast 2024-2034

Capsule Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA