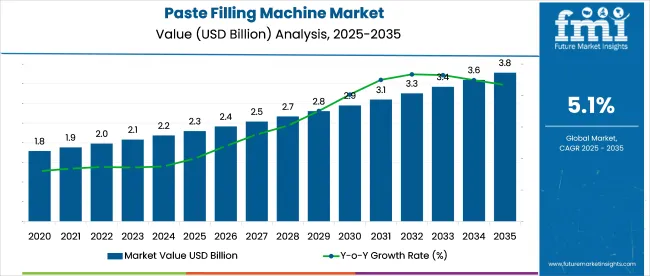

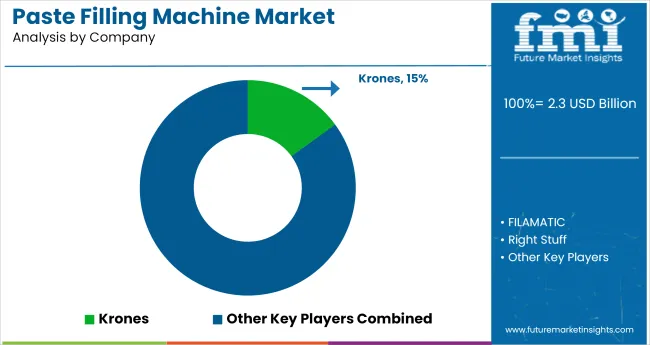

In 2025, the paste filling machine market is likely to be valued at USD 2.3 billion and is anticipated to reach USD 3.8 billion by 2035, growing at a CAGR of 5.1% during the forecast period.

Quick Stats of Paste Filling Machine Market

Demand is increasing across food and beverages, pharmaceuticals, cosmetics, and chemicals as manufacturers seek automated solutions for handling viscous materials.

These machines offer precise dosing, reduce material waste, and improve line efficiency. As operational accuracy and cost control remain key priorities, paste filling systems are becoming essential assets in modern processing environments, supporting both throughput optimization and quality consistency.

The paste filling machine market holds a relatively niche but growing share within its parent markets. In the packaging machinery industry, it accounts for 8-12%, driven by demand for liquid and semi-solid packaging. In the stainless steel & metal fabrication industry, paste fillers represent 5-7%, as they require high-quality, corrosion-resistant materials.

The food & beverage industry contributes 15-20% of demand, given extensive use in sauces, dressings, and dairy. In pharmaceuticals & cosmetics, it holds 10-15%, focusing on precision filling for creams and gels.

The industrial automation & robotics industry allocates 3-5% to paste filling systems, as they integrate sensors and PLCs for efficiency. While not dominant, this market is expanding due to automation trends, hygiene standards, and rising F&B and pharma needs, with a projected CAGR of 5.1%.

In June 2025, strong growth was observed in the North American paste filling machine industry, driven by advancements in technology and increased demand across industries such as food and beverage, pharmaceuticals, cosmetics, and chemicals. The industry is pivotal in supporting packaging and processing sectors, ensuring the precise, hygienic, and efficient filling of semi-solid and viscous products.

The industry has also adapted to emerging needs, including customized and small-batch production models, as well as the integration of automation and data analytics into paste filling processes. These developments position the North American industry as a key driver of innovation, meeting evolving consumer and industrial needs worldwide.

The industry is witnessing significant investment in technologies that offer accuracy, versatility, and ease of operation. Growing applications across food, pharma, cosmetics, and industrial pastes are driving interest in semi-automatic machines, piston filling systems, and machines configured to handle thick pastes, engineered for high-viscosity environments with low product waste.

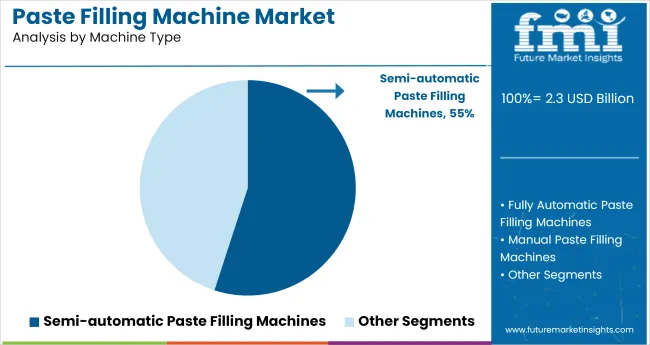

Semi-automatic filling machines comprise 55% of global installations, driven by their operational simplicity, low capital requirement, and high adaptability. These machines are favored in food, cosmetics, and pharmaceutical settings with production scales of 1,000 to 10,000 units/day.

Operators in emerging markets prefer foot pedal or timer-actuated systems due to their manual control and reduced training requirements. Equipment flexibility supports container types from 10 ml tubes to 1.5 L jars. The fill accuracy ranges between ±1% to ±2%, which meets compliance in non-sterile applications.

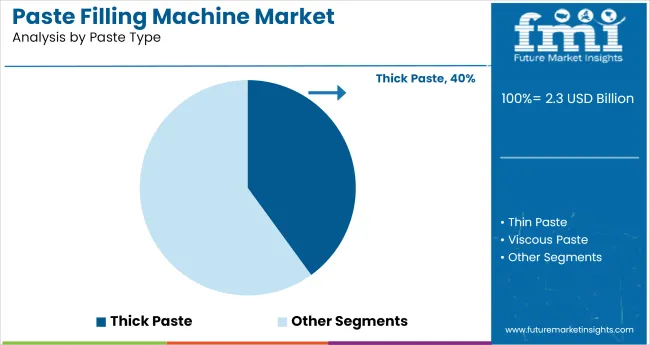

Machines optimized for thick pastes account for 40% of demand due to wide application in lotions, pharmaceutical ointments, adhesives, and sauces. These products often feature variable viscosities between 20,000-100,000 cP, requiring specialized filling systems equipped with agitators, pressure assist, or hopper heaters.

Such setups reduce fill-time delays and clogging, especially for particulate-rich formulations. Jacketed hopper systems help maintain product consistency throughout filling operations, reducing waste and batch rejection. High-viscosity paste fillers operate at speeds of 15-60 fills per minute depending on nozzle diameter and pump force.

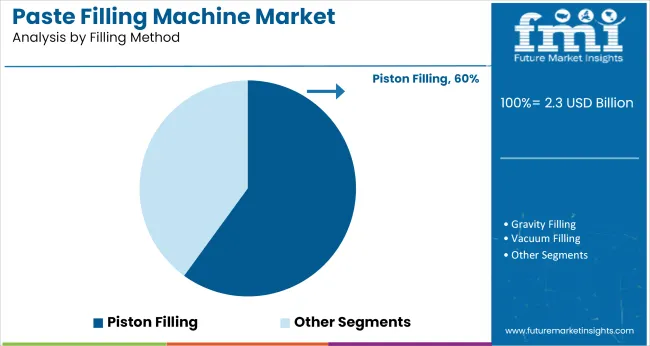

Piston filling systems represent 60% of installed machines due to their volumetric control, robust design, and multi-viscosity handling capabilities. They are particularly effective in personal care and industrial fluid segments, where products such as sanitizers, hand creams, or adhesives require precision under ±0.5% fill variance.

Piston fillers operate by drawing paste into a cylinder and discharging it based on set volume, supporting fill volumes from 10 ml to over 5 L. Many models feature quick-change pistons, no-drip fill heads, and servo-driven controls, offering high flexibility across container sizes. These systems are often integrated into semi- or fully-automated lines with throughput reaching 80-120 containers per minute.

Creams and pastes hold a 59% share of end-use deployment, driven by the demand for skin care products, OTC pharmaceuticals, and food spreads. These materials often have viscosities ranging from 25,000 to 150,000 cP, requiring piston-driven or pressure-assisted fillers.

Typical product applications include face creams, gels, antiseptic pastes, or edible spreads packaged in 15-500 ml containers. Filling equipment in this segment must maintain clean dosing, prevent bacterial ingress, and minimize air entrapment. Machines compatible with Clean-In-Place (CIP) or Sterilize-In-Place (SIP) systems are increasingly preferred.

The industry is influenced by the rising complexity of viscous product formulations and the demand for faster, more precise, and hygienic filling systems. While technological innovation is driving adoption, manufacturers also face operational constraints related to cost, cleaning, and product versatility.

Demand for Precision and Versatility is Driving Configuration Shifts Paste filling system buyers in the cosmetics, pharma, and condiments segments are phasing out manual fillers in favor of semi-automatic or piston-based units with programmable dosing.

Servo-actuated models with memory-set profiles now account for 41% of new installations in South Korea, France, and UAE. Firms like Accutek and Wuhan Songke report a 13% increase in demand for multi-viscosity adaptable lines in 2024 to 2025. Heat- and air-sensitive products such as aloe-based gels, medicated creams, and egg-based sauces now require integrated speed modulation and real-time fill compensation to minimize shear degradation and entrapped air, preserving shelf stability.

Cleaning and Changeover Downtime Restrains Multi-Product Flexibility Residual paste build-up in valves, nozzles, and hoppers continues to disrupt batch sequencing across lines filling multiple SKUs. Operators switching between personal care and food-grade pastes reported an average 34-minute cleaning delay per changeover in Q1 2025.

CIP-enabled systems remain financially out of reach for many SME processors in Kenya, Vietnam, and Argentina. Dongguan Sammi and Guangzhou Lienm introduced quick-release nozzle heads in late 2024, aiming to simplify disassembly by 27%, but complete automation of cleaning remains rare outside of large-scale FMCG operations.

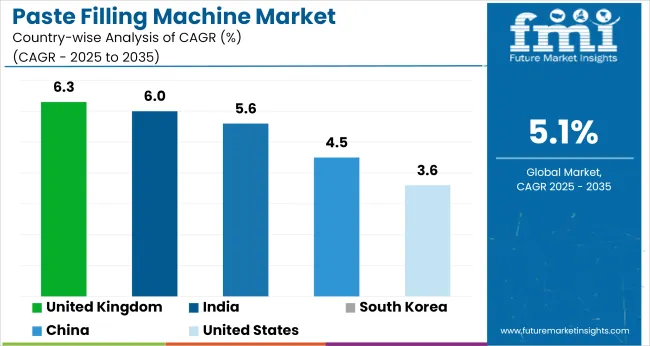

| Countries | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.3% |

| India | 6.0% |

| South Korea | 5.6% |

| China | 4.5% |

| United States | 3.6% |

Global demand for paste filling machines is projected to grow at a 5.1% CAGR from 2025 to 2035. Among five tracked countries, the United Kingdom (OECD) records the highest growth at 6.3%, followed by India (BRICS) at 6.0% and South Korea (OECD) at 5.6%. These outperform the global baseline by +24%, +18%, and +10%, respectively.

China (BRICS) posts 4.5%, while the United States (OECD) trails at 3.6%, reflecting a gap of -12% and -29%. Higher growth in the UK and India aligns with demand for high-speed filling lines and integration across multi-viscosity product lines. The USA underperforms due to slower replacement cycles, while China’s below-average rate stems from legacy gravity-fill systems and delayed adoption of precision metering technologies.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference

In the United States, the paste filling machine market is set to grow at a compound annual growth rate of 3.6% over the 2025 to 2035 period, reflecting stable yet innovation-dependent demand. Precision dosing, servo-driven technologies, and hygienic design compliance are critical in shaping equipment upgrades.

Sectors like personal care, OTC pharmaceuticals, and condiments are driving adoption of semi-automatic and fully automated units configured for high throughput and viscosity adaptability.

The United Kingdom is expected to experience yearly growth averaging 6.3% from 2025 to 2035 in the paste filling machine market. Demand is strongly linked to regulatory shifts around traceability, clean-label packaging, and allergen-free manufacturing environments. Local and EU-wide food safety laws continue to influence machine configurations, favoring modular, electronically controlled equipment.

India’s paste filling machinery segment is forecasted to expand at an average annual rate of 6.0% throughout 2025 to 2035, led by capacity upgrades among food processors and pharmaceutical manufacturers. Regional filling equipment makers are scaling output to meet rising demand for customizable units suited for small to medium batches. Equipment with PLC-based automation, variable fill heads, and inline integration features is witnessing strong traction.

China is anticipated to record a CAGR of 4.5% through 2035, as domestic production focuses on high-volume automation with low operating cost. Adoption is highest in the condiment, personal care, and adhesive sectors where viscosity variation and packaging diversity demand flexible machine design.

Chinese OEMs are scaling R&D around servo filling, HMI-enabled controls, and vertical form-fill-seal system integrations. Export-grade filling lines with multi-nozzle arrays and volumetric precision are gaining traction in international supply chains.

South Korea is poised to achieve an annualized growth rate of 5.6% from 2025 to 2035 in its paste filling machine industry. The market is driven by digitized control systems, smart manufacturing practices, and high demand for pharmaceutical-grade accuracy.

As cleanroom standards evolve, there is elevated interest in peristaltic fillers and aseptic packaging systems. Korean manufacturers are enhancing OEE (Overall Equipment Effectiveness) through predictive maintenance features and remote diagnostics.

The paste filling machine industry features a mix of established leaders and emerging innovators. Major players like Krones, FILAMATIC, and All-Fill’s dominate with advanced automated filling systems, offering high precision and efficiency. These companies focus on extensive research and development to create solutions that meet the needs of various sectors such as food, pharmaceuticals, and cosmetics.

For example, Krones has introduced cutting-edge automated filling technologies that significantly enhance production speed and accuracy. Emerging companies like Neostarpack and Taizy Automatic are gaining traction by providing cost-effective and flexible filling solutions, targeting smaller businesses and regional markets with a strong focus on affordability and customization.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.3 billion |

| Projected Market Size (2035) | USD 3.8 billion |

| CAGR (2025 to 2035) | 5.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Machine Type Segmentation | Semi-Automatic Paste Filling Machines, Fully Automatic Paste Filling Machines, Manual Paste Filling Machines |

| Paste Type Segmentation | Thick Paste, Thin Paste, Viscous Paste, Non-Newtonian Paste |

| Filling Method Segmentation | Piston Filling, Gravity Filling, Vacuum Filling, Pressure Filling |

| End-Use Segmentation | Food and Beverage Industry (Sauces, Ketchup, Mayonnaise, Mustard, Dressings), Pharmaceutical Industry (Ointments, Gels, Creams & Pastes), Cosmetics Industry (Lotions, Shampoos, Hair Conditioners, Toothpastes, Facial Masks), Chemical Industry (Adhesives, Sealants, Lubricants, Paints, Coatings) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East & Africa (MEA) |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players Influencing the Industry | Taizy Automatic, Zhejiang Youlian Machine Manufacture Co., Ltd, Krones, FILAMATIC, Right Stuff, VTOPS, Qualipak Machinery, Neostarpack, Altrimex, All-Fill's. |

| Additional Attributes | Dollar sales by machine type, paste type, and filling method, growing demand for packaging in the food and beverage sector, innovations in filling technologies for pharmaceutical and cosmetic applications, trends in automation and efficiency in paste filling processes, and regional variations in market demand based on industry needs. |

Semi-automatic paste filling machines, fully automatic paste filling machines, and manual paste filling machines.

Thick paste, thin paste, viscous paste, and non-Newtonian paste.

Piston filling, gravity filling, vacuum filling, and pressure filling.

Food and beverage (including sauces, ketchup, mayonnaise, mustard, dressings), pharmaceuticals (ointments, gels, creams), cosmetics (lotions, shampoos, conditioners, facial masks, toothpastes), chemical (adhesives, sealants, lubricants, paints, coatings), and others.

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East & Africa (MEA).

The industry is expected to reach USD 3.8 billion.

It is projected to grow at CAGR of 5.1%.

Semi-automatic machines lead with a 55% share.

Thick pastes account for 40% of the usage.

Creams & pastes in pharma and cosmetics represent 59% of end-use demand.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cup Filling Machines Market Forecast and Outlook 2025 to 2035

Box Filling Machine Market from 2025 to 2035

Drum Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wine Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Tube Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Tube Filling Machine Manufacturers

Spice Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Filling and Sealing Machine Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Bottle Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Capsule Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Granule Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Aerosol Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Market Share Breakdown of Capsule Filling Machine Manufacturers

Syringe Filling Machine Market from 2024 to 2034

Milk Pasteurization Machines Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Sanitizer Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filling Machine Market Analysis - Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA