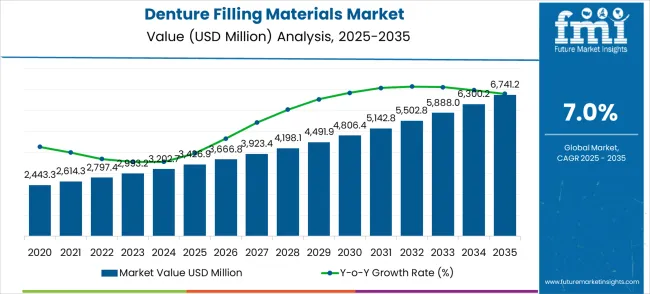

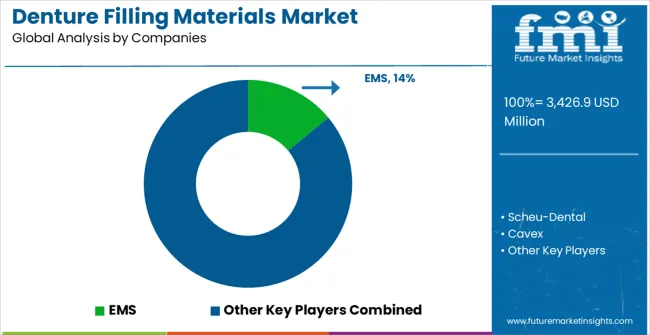

The denture filling materials market is likely to expand from USD 3,426.9 million in 2025 and expand to USD 6,741.2 million by 2035, reflecting a compound annual growth rate (CAGR) of 7%. This growth is driven by the rising prevalence of dental issues, increasing geriatric population, and growing awareness of oral health care. Denture filling materials are essential for prosthetic dentistry, providing durability, aesthetics, and biocompatibility. As demand for high-quality dental restorations rises globally, manufacturers are focusing on advanced materials that offer better strength, color matching, and long-term performance. The market trajectory highlights steady adoption in both developed and emerging regions, reflecting the critical role of denture filling materials in modern dentistry.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3,426.9 million |

| Market Forecast Value (2035) | USD 6,741.2 million |

| Forecast CAGR (2025-2035) | 7.0% |

Year-on-year growth shows a consistent upward trend, with market values increasing from USD 2,443.3 million in 2023 to USD 3,426.9 million in 2025, and continuing to rise steadily over the forecast period. The early phase of growth is largely supported by dental clinics, private practices, and increasing patient awareness, while the latter half benefits from the expansion of dental chains and improved accessibility in emerging markets. Innovations in composite resins, biocompatible polymers, and CAD/CAM-based denture technologies are also contributing to adoption. Strategic collaborations between material manufacturers and dental product suppliers further accelerate market penetration.

Looking ahead, the denture filling materials market is expected to reach USD 4,806.4 million by 2030 and eventually USD 6,741.2 million by 2035, maintaining a CAGR of 7%. Rolling CAGR analysis indicates that growth will remain steady across sub-periods, reflecting consistent adoption and incremental gains driven by both technological innovations and demographic trends. While minor fluctuations may occur due to economic or regulatory changes, the long-term outlook remains positive. Overall, the market demonstrates robust long-term potential, with sustained value accumulation driven by the convergence of aging populations, rising dental care expenditure, and continuous advancements in denture filling technologies.

Market expansion is being supported by the rapidly aging global population and the corresponding increase in dental restoration needs among elderly demographics who require reliable, long-lasting denture solutions. Modern healthcare systems are experiencing unprecedented demand for dental services as populations live longer and maintain higher expectations for quality of life and oral health. The superior durability, biocompatibility, and aesthetic properties of advanced denture filling materials make them essential components in contemporary dental practice where patient satisfaction and long-term clinical success are prioritized.

The growing emphasis on preventive dental care and early intervention strategies is driving demand for high-quality denture filling materials from established manufacturers with proven clinical track records and comprehensive product portfolios. Dental professionals are increasingly investing in premium materials that offer superior handling characteristics, excellent clinical outcomes, and reduced chairside time requirements. Professional education programs and evidence-based dentistry approaches are establishing clinical protocols that favor advanced filling materials with documented performance advantages and patient satisfaction metrics.

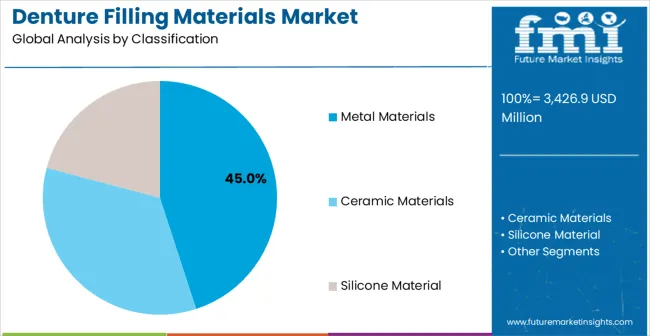

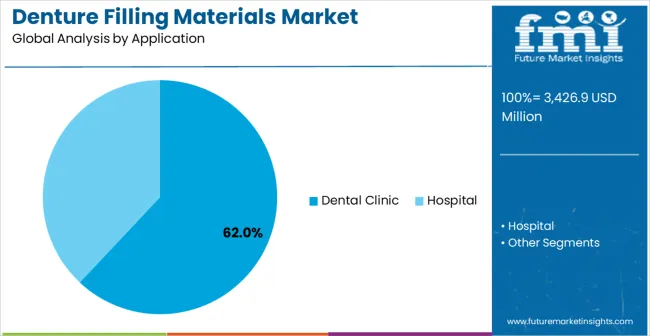

The market is segmented by product type, application, and region. By product type, the market is divided into metal materials, ceramic materials, and silicone materials configurations. Based on application, the market is categorized into hospital and dental clinic settings. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Metal materials configurations are projected to account for 45% of the denture filling materials market in 2025. This leading share is supported by the exceptional durability, strength, and longevity characteristics of metal-based dental materials that provide reliable long-term performance in challenging oral environments. Metal filling materials offer superior mechanical properties and proven clinical success rates, making them preferred choices for posterior restorations and high-stress applications where durability is paramount. The segment benefits from established clinical protocols and extensive professional familiarity with metal material handling and placement techniques.

Advanced metal filling materials incorporate precision alloy compositions, optimized particle sizes, and enhanced surface treatments that maximize bond strength while minimizing galvanic reactions and biocompatibility concerns. These materials have demonstrated consistent performance in long-term clinical studies measuring durability, marginal integrity, and patient satisfaction across diverse patient populations. The dental profession particularly values metal materials for their predictable clinical behavior and ability to withstand the mechanical stresses associated with mastication and parafunctional habits.

The cost-effectiveness and insurance coverage advantages of metal materials make them accessible options for patients across various economic demographics seeking reliable dental restoration solutions. The established supply chains and manufacturing infrastructure for metal dental materials ensure consistent product availability and quality control standards that support widespread clinical adoption.

Dental clinic applications are expected to represent 62% of denture filling materials demand in 2025. This significant share reflects the primary role of private dental practices and specialized dental clinics in providing routine dental restoration services to patients requiring denture adjustments, repairs, and maintenance. Dental clinics provide personalized patient care and specialized expertise in denture fitting and material selection that ensures optimal clinical outcomes. The segment benefits from established patient relationships and comprehensive dental care delivery models that emphasize preventive care and early intervention strategies.

Modern dental clinic environments leverage advanced diagnostic technologies and treatment planning systems that enable precise material selection and optimized treatment protocols for individual patient needs. These clinical settings provide controlled environments for complex dental procedures and offer the flexibility to customize treatment approaches based on patient-specific factors including oral health status, aesthetic preferences, and budget considerations. The established network of dental specialists and general practitioners contributes significantly to market accessibility and professional education about advanced filling materials.

The trend toward comprehensive dental care delivery and patient-centered treatment approaches creates opportunities for dental clinics to provide value-added services including material consultation, warranty programs, and long-term maintenance support. The segment also benefits from insurance coverage patterns and patient financing options that make advanced dental materials more accessible to broader patient populations.

The denture filling materials market is advancing steadily due to aging population demographics and growing awareness of oral health importance in overall wellness and quality of life. However, the market faces challenges including varying regulatory approval timelines across different regions, need for extensive clinical validation of new materials, and cost considerations in healthcare systems with limited dental coverage. Professional education programs and clinical research initiatives continue to influence material adoption and market development patterns.

The growing deployment of 3D printing, CAD/CAM systems, and digital workflow integration is enabling production of custom-fitted denture components with enhanced precision and reduced production timelines. Advanced manufacturing technologies provide better material utilization, consistent quality control, and the ability to create complex geometries that optimize both function and aesthetics. These technologies are particularly valuable for dental laboratories and clinics that require rapid turnaround times and high-precision restorations for demanding clinical applications.

Modern material manufacturers are developing next-generation filling materials that incorporate bioactive compounds, antimicrobial properties, and self-healing capabilities that enhance long-term clinical performance and patient health outcomes. Integration of nanotechnology and advanced polymer chemistry enables creation of materials with optimized mechanical properties, improved aesthetics, and enhanced biocompatibility profiles. Advanced research programs also support development of materials that can adapt to changing oral environments and provide therapeutic benefits beyond simple restoration function.

| Country | CAGR (2025-2035) |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| Brazil | 7.4% |

| United States | 6.7% |

| United Kingdom | 6.0% |

| Japan | 5.3% |

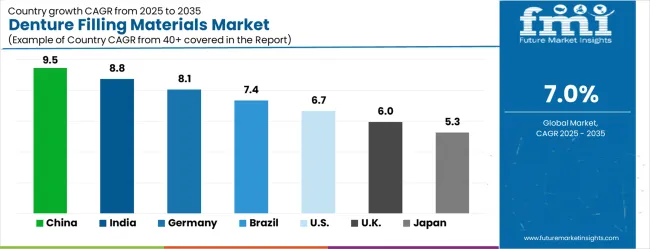

The denture filling materials market is growing rapidly, with China leading at a 9.5% CAGR through 2035, driven by massive aging population, expanding healthcare infrastructure, and increasing dental care accessibility across urban and rural populations. India follows at 8.8%, supported by growing middle-class healthcare spending, expanding dental education programs, and increasing awareness of oral health importance. Germany records strong growth at 8.1%, emphasizing advanced dental technologies, premium material preferences, and comprehensive healthcare system support. Brazil grows steadily at 7.4%, integrating modern dental care delivery models into expanding healthcare infrastructure and leveraging dental tourism opportunities. The United States shows solid growth at 6.7%, focusing on advanced material innovation and comprehensive dental insurance coverage expansion. The United Kingdom maintains steady expansion at 6.0%, supported by NHS dental services and private dental market growth. Japan demonstrates stable growth at 5.3%, emphasizing technological innovation and aging population dental care requirements.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Denture filling materials market in China is projected to exhibit the highest growth rate with a CAGR of 9.5% through 2035, driven by unprecedented aging population demographics, massive healthcare infrastructure expansion, and increasing government investment in dental care accessibility. The country's rapidly expanding middle class and growing health consciousness are creating significant demand for advanced dental restoration services. Major dental equipment manufacturers and material suppliers are establishing comprehensive distribution networks to serve both urban medical centers and rural healthcare facilities.

Denture filling materials market in India is expanding at a CAGR of 8.8%, supported by growing healthcare expenditure, expanding dental education infrastructure, and increasing awareness of oral health importance among urban and rural populations. The country's large population base and improving economic conditions are driving expansion of dental care services. Healthcare providers are investing in modern dental technologies and advanced materials to meet growing patient expectations and clinical standards.

Demand for denture filling materials in Germany is projected to grow at a CAGR of 8.1%, supported by the country's leadership in dental technology innovation, premium healthcare system standards, and comprehensive insurance coverage for dental procedures. German dental professionals are implementing state-of-the-art materials that meet the highest standards for clinical performance and patient satisfaction. The market is characterized by focus on technological advancement, quality excellence, and evidence-based treatment approaches.

Revenue from denture filling materials in Brazil is growing at a CAGR of 7.4%, driven by expanding healthcare infrastructure, growing dental tourism industry, and increasing integration of modern dental care delivery models across public and private healthcare sectors. The country's improving economic conditions and healthcare accessibility are supporting dental care expansion. Healthcare facilities are adopting advanced dental materials to improve service quality and patient satisfaction.

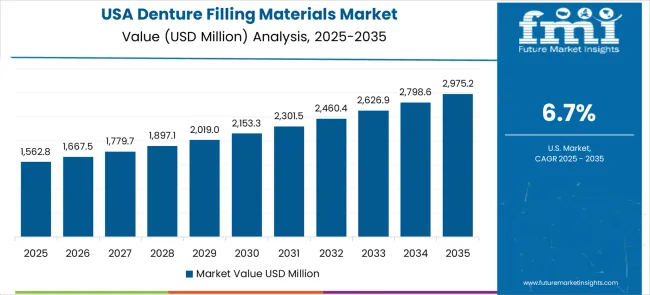

Denture filling materials in the United States is expanding at a CAGR of 6.7%, driven by continued innovation in dental materials science, expanding healthcare coverage for dental services, and growing aging population requiring extensive dental restoration services. American dental professionals are upgrading practices with next-generation materials that provide enhanced clinical outcomes and patient satisfaction. The market benefits from extensive research and development capabilities and established healthcare delivery systems.

Denture filling materials in the United Kingdom is projected to grow at a CAGR of 6.0%, supported by NHS dental service provision, expanding private dental market, and increasing focus on preventive dental care approaches. British dental professionals are investing in quality materials that provide reliable clinical outcomes within both public and private healthcare frameworks. The market is characterized by focus on cost-effectiveness, clinical excellence, and comprehensive patient care delivery.

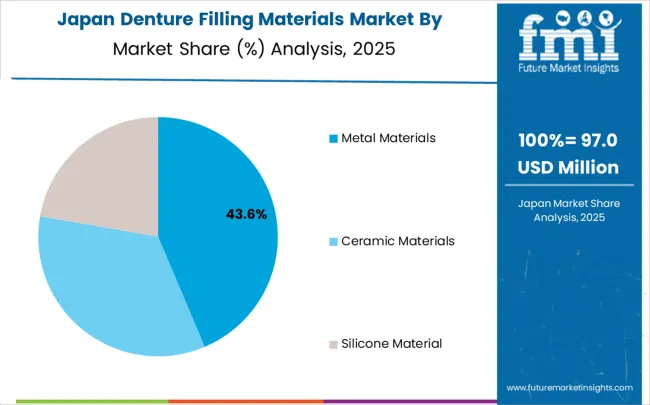

Demand for denture filling materials in Japan is expanding at a CAGR of 5.3%, driven by the country's leadership in dental technology innovation, comprehensive healthcare system for aging populations, and precision approach to dental care delivery. Japanese manufacturers and healthcare providers are developing sophisticated material solutions that incorporate advanced technologies and meet demanding clinical requirements. The market benefits from focus on quality, precision, and comprehensive patient care approaches.

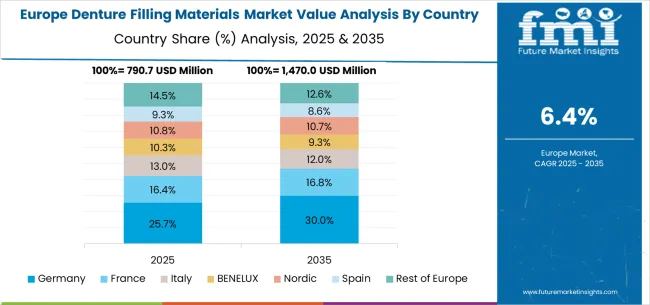

The denture filling materials market in Europe is projected to grow from USD 928.5 million in 2025 to USD 1,805.4 million by 2035, registering a CAGR of 6.9% over the forecast period. Germany is expected to maintain its leadership with a 31.8% share in 2025, supported by its advanced dental technology sector and comprehensive healthcare insurance coverage. The United Kingdom follows with 19.4% market share, driven by NHS dental services expansion and growing private dental market. France holds 17.2% of the European market, benefiting from advanced healthcare infrastructure and aging population dental care requirements. Italy and Spain collectively represent 18.7% of regional demand, with growing focus on dental tourism and healthcare modernization initiatives. The Rest of Europe region accounts for 12.9% of the market, supported by healthcare development in Eastern European countries and Nordic dental care excellence.

The denture filling materials market is defined by competition among established dental material manufacturers, specialized biomaterial companies, and regional dental supply distributors. Companies are investing in advanced material science, clinical research programs, manufacturing quality systems, and professional education initiatives to deliver safe, effective, and clinically-proven denture filling solutions. Strategic partnerships, product innovation, and market expansion are central to strengthening product portfolios and professional relationships.

EMS, operating internationally, offers comprehensive dental equipment and materials with focus on precision engineering, clinical excellence, and professional support services. Scheu-Dental, German manufacturer, provides specialized dental materials with emphasis on quality innovation and European engineering standards. Cavex, Netherlands-based company, delivers advanced dental impression materials with focus on clinical performance and user-friendly applications. DMG offers comprehensive dental material systems with emphasis on research-based innovation and clinical validation.

Henry Schein provides extensive dental supply distribution with focus on practice management support and comprehensive product portfolios. 3M delivers advanced dental materials with emphasis on scientific innovation and global healthcare market leadership. Unitek offers specialized orthodontic materials with focus on clinical excellence and professional education. GC Orthodontics provides comprehensive orthodontic material solutions with emphasis on quality and clinical support.

FORESTADENT, Patterson Dental, American Orthodontics, Dentsply, Ormco, Dentaurum, Dental Morelli, Ivoclar Vivadent, Kulzer, Shofu, Vita Zahnfabrik, and Nobel Biocare offer specialized expertise in dental materials, orthodontic solutions, and comprehensive professional support across global and regional markets.

The denture filling materials market supports oral health advancement, aging population care, dental technology innovation, and comprehensive healthcare delivery. With increasing longevity expectations, growing dental care awareness, and demand for high-quality restoration materials, the sector must balance clinical efficacy, cost accessibility, and regulatory compliance. Coordinated contributions from governments, healthcare bodies, dental manufacturers, healthcare providers, and investors will accelerate the development of advanced, safe, and accessible denture filling material solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 3,426.9 million |

| Classification Type | Metal Materials, Ceramic Materials, Silicone Material |

| Application | Hospital, Dental Clinic |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | EMS, Scheu-Dental, Cavex, DMG, Henry Schein, 3M, Unitek, GC Orthodontics, FORESTADENT, Patterson Dental, American Orthodontics, Dentsply, Ormco, Dentaurum, Dental Morelli, Ivoclar Vivadent, Kulzer, Shofu, Vita Zahnfabrik, Nobel Biocare |

| Additional Attributes | Dollar sales by product type and application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established manufacturers and emerging material innovators, healthcare provider preferences for durability versus aesthetic properties, integration with digital dentistry and 3D printing technologies, innovations in biocompatible materials and smart dental applications for enhanced patient outcomes, and adoption of advanced manufacturing processes with improved quality control and customization capabilities for personalized dental restoration solutions. |

The global denture filling materials market is estimated to be valued at USD 3,426.9 million in 2025.

The market size for the denture filling materials market is projected to reach USD 6,741.2 million by 2035.

The denture filling materials market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in denture filling materials market are metal materials, ceramic materials and silicone material.

In terms of application, dental clinic segment to command 62.0% share in the denture filling materials market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA