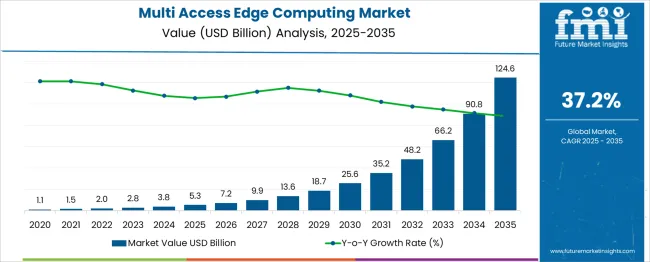

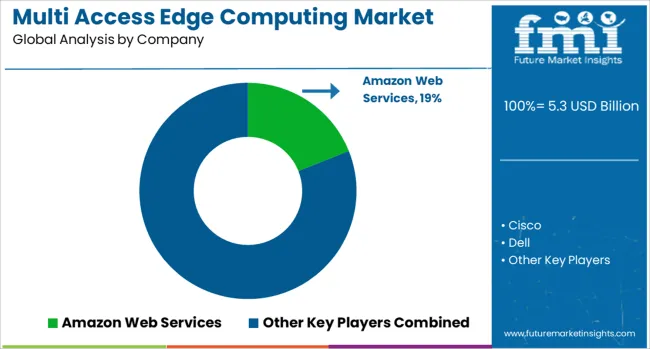

The Multi-Access Edge Computing Market is estimated to be valued at USD 5.3 billion in 2025 and is projected to reach USD 124.6 billion by 2035, registering a compound annual growth rate (CAGR) of 37.2% over the forecast period. The cumulative growth trend forms an exponential curve rather than a linear accumulation path. From 2025 to 2029, the total value increased from USD 5.3 billion to USD 25.6 billion, contributing only 20.5% of the decade’s overall gain. However, the following five years generated 79.5% of the value, indicating an accelerating phase of adoption. This asymmetric curve shape implies that value creation has been backloaded, driven by demand from telco infrastructure upgrades and latency-sensitive industrial applications. The steep incline beyond 2030 reveals a shift from pilot-phase deployments to scaled implementations across sectors such as autonomous logistics, smart grids, and real-time analytics. The total value added in just the final three years (USD 58.4 billion) surpasses the entire cumulative market size from 2025 to 2030. This reflects stronger commercial integration of edge computing into hybrid-cloud ecosystems and industry 4.0 frameworks. With computing shifting closer to endpoints, the market has transitioned from exploratory spending to enterprise-scale infrastructure rollout, solidifying a steep, momentum-driven accumulation trajectory.

| Metric | Value |

|---|---|

| Multi-Access Edge Computing Market Estimated Value in (2025 E) | USD 5.3 billion |

| Multi-Access Edge Computing Market Forecast Value in (2035 F) | USD 124.6 billion |

| Forecast CAGR (2025 to 2035) | 37.2% |

The multi-access edge computing market is expanding rapidly as enterprises, telecom operators, and cloud providers seek to reduce latency, optimize bandwidth, and deliver real-time processing at the network edge. MEC enables localized data handling, facilitating critical applications in autonomous systems, AR/VR, and industrial automation.

The proliferation of IoT devices, combined with the demand for seamless user experiences in smart cities and Industry 4.0 environments, has strengthened the strategic need for edge computing. Investment in 5G infrastructure has further accelerated MEC deployments, supported by growing alliances between hyperscalers and telecom companies to jointly develop cloud-native edge solutions.

The market outlook remains strong as MEC transitions from proof-of-concept to production, with edge-native applications gaining commercial traction in retail, healthcare, and transportation. Future growth is expected to stem from API standardization, edge orchestration innovations, and AI-driven network optimization, enhancing scalability and cost-efficiency across distributed architectures.

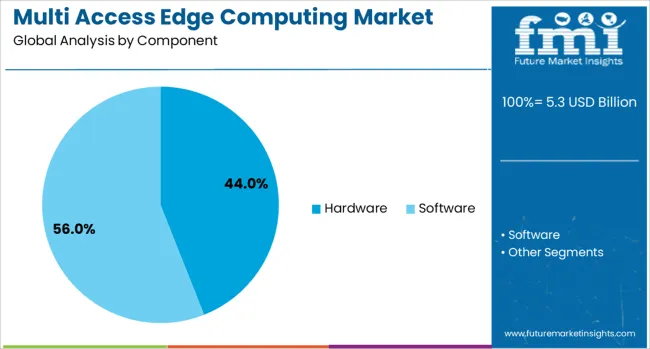

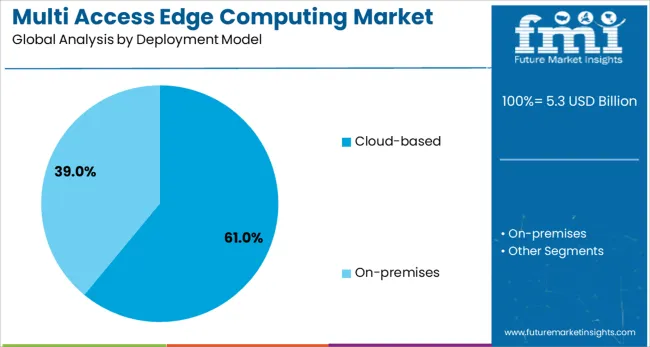

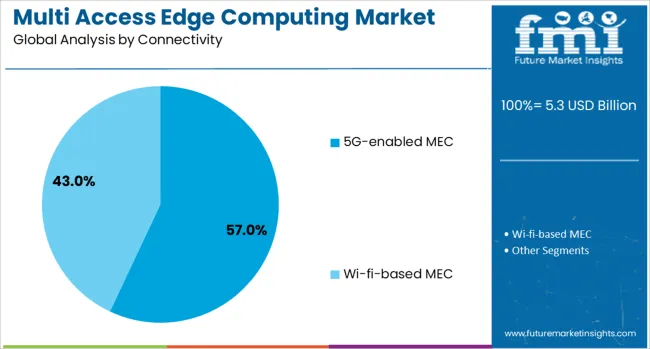

The multi-access edge computing market is segmented by component, deployment model, connectivity, application, end user, and geographic regions. The multi-access edge computing market is divided into Hardware and Software components. In terms of the deployment model, the multi-access edge computing market is classified into Cloud-based and On-premises. The multi-access edge computing market is segmented into 5G-enabled MEC and Wi-Fi-based MEC. The multi-access edge computing market is segmented into Real-time data processing, Network optimization, IoT and smart applications, Content delivery, and others. The end users of the multi-access edge computing market are segmented into Telecommunications, Retail, Manufacturing, Healthcare, Transportation & logistics, Government, and others. Regionally, the multi-access edge computing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

By component, hardware is expected to account for 44.00% of total market share in 2025, establishing it as the leading segment. This dominance is being shaped by the high capital expenditure required to deploy edge nodes, micro data centers, and on-premise edge servers.

Hardware forms the physical foundation for real-time data processing and is essential for supporting diverse MEC workloads with low latency and high availability. The rise in AI inference workloads and container-based applications at the edge is driving demand for purpose-built hardware with GPU and FPGA integration.

In sectors like manufacturing and energy, where environmental ruggedization and local compute capacity are critical, edge hardware adoption remains integral. As MEC continues to scale, hardware investments are being prioritized to meet growing demands for decentralized infrastructure performance, energy efficiency, and secure local processing.

Cloud-based deployment models are projected to capture 61.00% of the market share in 2025, making this the most prominent segment. This lead is being driven by the increasing preference for elastic, software-defined edge solutions that can be managed centrally but executed locally.

Enterprises are leveraging cloud-native orchestration tools and containerized workloads to ensure operational agility and lower upfront costs. Cloud-based MEC allows for faster rollout, seamless updates, and integration with AI/ML services, offering scalability for dynamic edge applications.

Strategic collaborations between telecom operators and hyperscale cloud providers are enabling edge computing to be deployed closer to end-users through distributed cloud nodes. As use cases such as video analytics, telemedicine, and immersive media continue to scale, cloud-based models offer the flexibility and interoperability required to support evolving edge computing ecosystems.

By connectivity, 5G-enabled MEC is anticipated to dominate the market with a 57.00% share in 2025. This dominance is being driven by 5G’s ultra-low latency and high-bandwidth capabilities, which are essential for unlocking the full potential of edge computing.

5G-enabled MEC supports real-time applications such as autonomous vehicles, remote surgery, and industrial robotics by facilitating data processing within milliseconds at the edge. The integration of MEC with 5G network slicing allows customized quality-of-service (QoS) for vertical-specific applications, creating new monetization opportunities for service providers.

Moreover, the ongoing global rollout of standalone 5G networks is accelerating MEC adoption, as operators deploy edge nodes in close proximity to base stations. The convergence of 5G and MEC is seen as a foundational pillar for next-gen digital infrastructure, enabling a future of connected intelligence across diverse sectors.

Expansion in the multi-access edge computing market has been driven by demand for reduced latency across applications like factory automation, streaming, and smart infrastructure. Growing pressure on centralized cloud systems has shifted enterprise focus toward distributed computing at network edges. Telecom providers have deployed edge infrastructure alongside 5G rollout to enable localized data handling. Data privacy needs and time-sensitive applications continue to influence adoption. Enterprise workloads across transport, healthcare, and retail have been shifted to edge nodes to optimize responsiveness and performance.

Growth in demand for latency-sensitive applications has strengthened the case for MEC deployment across industries. Use cases such as automated guided vehicles, live video surveillance, and extended reality have depended on localized compute environments to reduce reliance on core networks. Telecom providers have enabled MEC integration within 5G networks to handle workload surges during peak usage. Enterprises processing real-time data streams from sensors, machines, or customer interfaces have benefited from decentralized compute. In logistics, smart warehousing and fleet coordination have been improved using edge-based data processing. Edge computing has delivered network resilience during outage-prone conditions in distributed operations.

Deployment of MEC infrastructure has been supported through collaboration between telecom carriers and cloud solution providers. Edge servers have been integrated into base station sites to reduce data transfer times and enhance performance for real-time services. Virtualization and containerization of workloads have enabled efficient orchestration of resources at edge nodes. Retailers and financial institutions have tested micro-data centers for customer analytics and fraud detection. In industrial environments, edge platforms have supported predictive maintenance and machine coordination. Integration of MEC with SDN and NFV has allowed dynamic traffic handling, providing stable performance in bandwidth-variable environments.

Scalability of MEC deployments has been limited by the fragmented nature of existing telecom and IT infrastructure. Integration challenges have emerged as enterprises seek to combine edge capabilities with legacy systems. Hardware availability at suitable locations has created bottlenecks for continuous rollout. Lack of a unified standard for MEC architecture across vendors has made cross-platform compatibility difficult. Regulatory constraints related to localized data processing in healthcare and finance have slowed rollout in compliance-intensive sectors. Operational challenges have also emerged in managing multiple edge environments

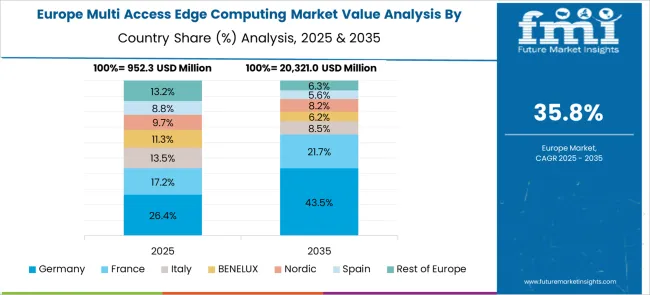

Edge computing has been applied in urban mobility, immersive retail, and energy grid coordination. In North America, the market has evolved toward advanced retail analytics and autonomous transport applications. European deployments have centered around industrial IoT and automotive testbeds. Asia Pacific economies have adopted MEC to support real-time gaming, crowd management, and smart infrastructure services. Public sector investments in disaster response and surveillance have driven experimentation with edge deployments in emerging markets. MEC has been positioned to serve as a key component in future 6G and satellite-integrated networks, expanding its relevance in remote and mobile scenarios.

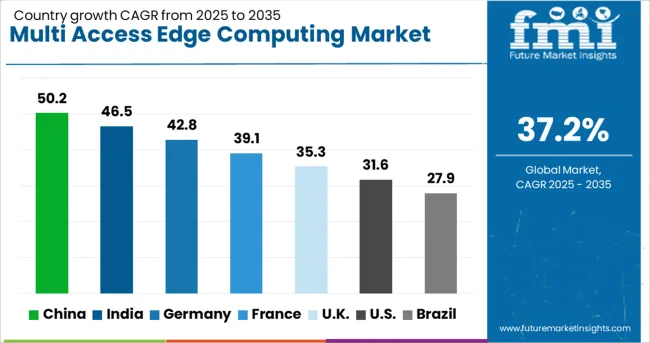

| Country | CAGR |

|---|---|

| China | 50.2% |

| India | 46.5% |

| Germany | 42.8% |

| France | 39.1% |

| UK | 35.3% |

| USA | 31.6% |

| Brazil | 27.9% |

Global demand for Multi Access Edge Computing is projected to grow at a CAGR of 37.2% from 2025 to 2035. China leads at 50.2%, followed by India at 46.5% and Germany at 42.8%, reflecting premiums of +35%, +25%, and +15% above the global rate. The United Kingdom and United States remain below baseline at 35.3% and 31.6%, registering gaps of –5% and –15%. Rapid 5G infrastructure expansion, AI workload decentralisation, and real-time analytics in edge nodes are driving regional variances. ASEAN markets have focused on latency reduction for manufacturing and AR applications, while OECD nations have advanced private 5G for enterprise edge computing. Hardware virtualisation, containerised applications, and high-frequency data routing are being integrated into telecom and cloud service deployments across primary nodes.

China is projected to lead the global Multi Access Edge Computing market with a CAGR of 50.2%, surpassing the global rate by 35%. Government-backed 5G build-outs across Tier 1 and Tier 2 cities have accelerated distributed computing node installations. Real-time industrial automation in Shenzhen and Chengdu has shifted edge integration into factory floors. Telecom providers have partnered with hardware OEMs to scale GPU-enabled edge servers. Autonomous mobility tests have incorporated MEC-based V2X communication platforms for urban traffic control systems. Strategic investments in hybrid AI pipelines are advancing regional experimentation with edge-native inference tools.

India is forecast to achieve a CAGR of 46.5% between 2025 and 2035 in the Multi Access Edge Computing space, placing it 25% above the global baseline. Key activity is concentrated in Bengaluru, Hyderabad, and Pune, where smart city initiatives have activated real-time sensor networks. Telecom firms have accelerated trials for standalone 5G integration with containerised MEC platforms. Enterprises in logistics and video surveillance are adopting decentralised analytics to reduce cloud backhaul costs. Edge-integrated CDN systems are now being tested across OTT service providers in southern states. Private-sector demand has shifted toward modular edge frameworks with onboard AI accelerators.

Germany is anticipated to record a CAGR of 42.8% for Multi Access Edge Computing through 2035, exceeding the global average by 15%. Industrial automation in Baden-Württemberg and Bavaria has supported integration of edge-enabled predictive maintenance in manufacturing. Telecom consortiums are deploying 5G MEC nodes with container orchestration layers tailored for low-latency use. Smart grid management and intelligent mobility pilots are incorporating digital twin frameworks running on edge hardware. Regulatory alignment with EU digital governance is enabling faster scale-up of edge security protocols across commercial networks.

United Kingdom is projected to grow at a CAGR of 35.3% in the Multi Access Edge Computing sector, 5% below the global trend. Demand is anchored in logistics, public transit, and smart surveillance systems. Data centre expansions near London and Birmingham are enabling localised MEC hosting with reduced network hops. AI edge use cases are being trialled for crowd management, emergency response, and video stream optimisation. Telecom regulators have encouraged low-latency frameworks for private campus networks, supporting adaptive bandwidth control and real-time analytics. Regional edge partnerships are forming across telecom, AI startups, and academic institutions.

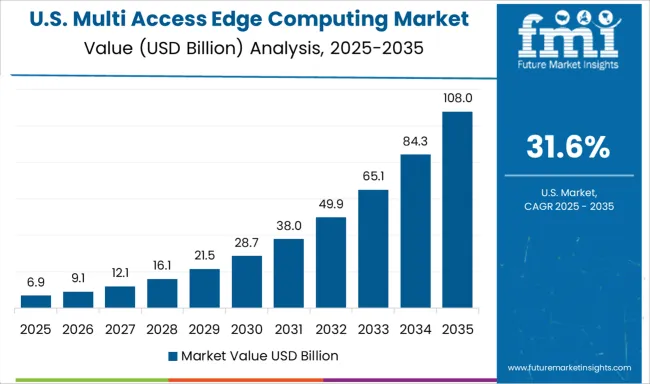

United States is expected to grow at a CAGR of 31.6% from 2025 to 2035 in the Multi Access Edge Computing market, trailing the global rate by 15%. Uptake is being driven by industrial IoT, autonomous vehicle testing, and defence-oriented applications. Adoption has been strongest in Texas and California, where edge platforms are embedded into supply chain and robotics environments. Network slicing and microservice deployment have been hindered by fragmented state-level infrastructure support. Edge computing pilots have expanded across retail and healthcare sectors, focusing on localised AI inference for real-time decision-making. Edge data orchestration remains uneven outside top-tier markets.

The Multi-Access Edge Computing (MEC) market has seen intensified competition among global technology vendors focused on reducing latency and decentralizing data processing. Amazon Web Services and Microsoft Azure have led the shift toward edge-native cloud infrastructure, leveraging their extensive cloud ecosystems to integrate edge computing within existing enterprise workflows. Intel and HPE have concentrated on enabling hardware and microdata center platforms optimized for telecom edge deployments, supporting virtualized RAN (vRAN) and AI at the edge. Huawei and Nokia have maintained momentum in Asia and Europe by collaborating with telecom operators to deploy MEC nodes at 5G base stations, enhancing real-time applications in smart manufacturing and connected mobility.

Dell and Cisco have positioned themselves through modular edge infrastructure and software-defined networking that supports containerized edge workloads. Cross-industry use cases like augmented reality (AR), real-time analytics, and video surveillance have driven demand. Competition now centers around orchestration compatibility, edge AI capability, security compliance, and integration with Open RAN and 5G core infrastructure. Investment in zero-touch provisioning, AI workload acceleration, and network slicing for edge services is shaping vendor differentiation and long-term value creation within this market.

Between 2023 and 2025, the Multi Access Edge Computing (MEC) market expanded with strong momentum across telecom, automotive, and industrial sectors. The rise of 5G networks enabled broader deployment of MEC nodes for real-time data processing in smart factories, autonomous vehicles, and immersive media. South Korea and Japan advanced commercial trials supporting low-latency enterprise systems, while Europe integrated MEC into digital manufacturing. In the US, mobile operators scaled up edge data centers to support AI workloads, content streaming, and mission-critical applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.3 Billion |

| Component | Hardware and Software |

| Deployment Model | Cloud-based and On-premises |

| Connectivity | 5G-enabled MEC and Wi-fi-based MEC |

| Application | Real-time data processing, Network optimization, IoT and smart applications, Content delivery, and Others |

| End User | Telecommunications, Retail, Manufacturing, Healthcare, Transportation & logistics, Government, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amazon Web Services, Cisco, Dell, HPE, Huawei, Intel, Microsoft Azure, and Nokia |

| Additional Attributes | Dollar sales by solution (hardware, software, services) and vertical (IT/telecom, automotive, healthcare), demand driven by 5G and IoT, North America leads with fast APAC growth, innovation in real time edge AI and orchestration platforms, environmental impact via reduced data center loads, and emerging use cases in autonomous vehicles, smart cities, and telemedicine applications. |

The global multi-access edge computing market is estimated to be valued at USD 5.3 billion in 2025.

The market size for the multi-access edge computing market is projected to reach USD 124.6 billion by 2035.

The multi-access edge computing market is expected to grow at a 37.2% CAGR between 2025 and 2035.

The key product types in multi-access edge computing market are hardware, _edge servers, _network equipment, _iot devices, software, _edge orchestration software, _edge analytics software, _security software and _others.

In terms of deployment model, cloud-based segment to command 61.0% share in the multi-access edge computing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Edge Bead Remover (EBR) Market Size and Share Forecast Outlook 2025 to 2035

Edge Security Market Size and Share Forecast Outlook 2025 to 2035

Edge Banders Market Size and Share Forecast Outlook 2025 to 2035

Edge AI for Smart Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Edge Bending Machine Market - Trends & Forecast 2025 to 2035

Edge Server Market Trends – Growth & Forecast 2025 to 2035

Leading Providers & Market Share in Edge Protector Manufacturing

Edge AI Market Trends – Growth, Demand & Forecast through 2034

Edge Data Centers Market

Hedge Shears Market Size and Share Forecast Outlook 2025 to 2035

Wedge Wire Screen Market Size and Share Forecast Outlook 2025 to 2035

Wedge Boots Market Growth - Trends & Demand Forecast to 2025 to 2035

Hedge Trimmers Market Growth - Trends & Forecast 2025 to 2035

Wedge Pressure Catheters Market

5G Edge Cloud Network and Services Market Size and Share Forecast Outlook 2025 to 2035

Fog Computing Market

Knowledge Management Software Market Size and Share Forecast Outlook 2025 to 2035

Warm Edge Spacer Market Size and Share Forecast Outlook 2025 to 2035

Foam Edge Protectors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA