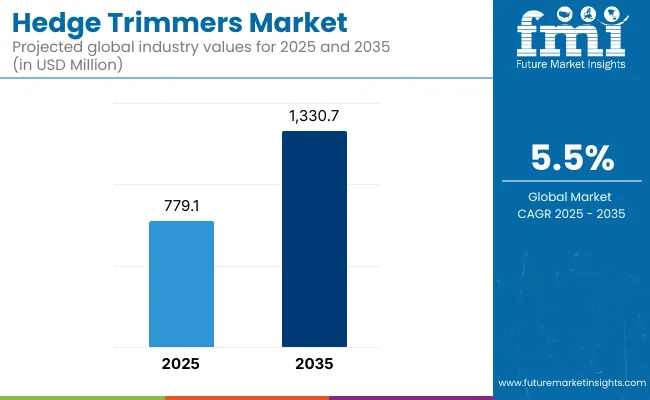

The hedge trimmers market is poised for consistent growth between 2025 and 2035, driven by increasing demand for landscape maintenance across residential, commercial, and municipal applications. The market is projected to grow from a valuation of USD 779.1 million in 2025 to reach USD 1,330.7 million by 2035, expanding at a compound annual growth rate (CAGR) of 5.5%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 779.1 million |

| Industry Value (2035F) | USD 1,330.7 million |

| CAGR (2025 to 2035) | 5.5% |

This growth is promising when there is a growing focus towards aesthetically pleasing landscaping, increasing green infrastructure projects and towards efficient gardening tools for sustainable farming.

The hedge trimmer market is being revolutionized by enhancement in electrification and ergonomics design features. Battery-powered hedge trimmers and blowers are becoming more widely accepted as a lighter, quieter, more environmentally friendly alternative to gas engines-powered hedge trimmers. Urbanization and the construction of smart cities can stimulate the demand for investment in green space and increase of public green space.

Due to the DIY gardening boom and increased awareness of backyard aesthetic in the residential sector, ownership of the hedge trimmer is much higher. In commercial and municipal sectors too, landscape services providers are embracing new technology in many cases due to the need for increased productivity and cost reduction. The market is experiencing the impact of technological advances, such as dual-sided blades, longer reach trimmers, and lower noise operations.

In North America, the hedge trimmers market is already matured, technical primitives and receive strong satisfaction from residential and commercial landscape end market. USA really powers demand regionally, with the usual DIY attitude and urban landscaping.

Gas powered hedge trimmers are being replaced with battery-powered ones this a function of more stringent environmental standards like California’s zero-emission compliance, but also a new way of thinking about how we do landscaping.

Landscaping companies are also spending more money on ergonomic tools, in addition to battery-operated tools, for more efficiency. Overall, consumer sustainability initiatives, rising disposable income, and the regulatory/compliance structure is driving the adoption of lower noise tooling, which is shifting the trend towards electric/battery-powered hedge trimmers across all consumer segments.

Stringent environmental laws have been introduced in countries across western Europe, especially Germany, France, and the UK, which is favorable for the European market for hedge trimmers. Overall, in response to consumer preference and increasing regulation, these nations are transitioning toward a fleet of low-emission, low-noise garden tools for residential and municipal gardening.

So gardening is a fairly well established cultural practice, for the people in the residential space, and municipal and other entrepreneurial local governmental are spending an increasing amount of coin on landscape maintenance and planting in public green space.

Germany is still a major source of hedge trimmer production, leading technological advancement and much of the export throughout Europe. Smart devices like robots are in high demand in the gardening industry in Denmark until 2035, environmental friendliness in the greenkeeping sector, government backing for green gardening methods, and robust distribution networks will all drive growth in the enticing European hedge trimmer market from a variety of other perspectives.

The hedge trimmers market can be segmented into Europe, North America, Latin America, Asia-Pacific and Middle East & Africa (MEA). ProcessChina, India and Japan, among others, are allocating more resources toward urban greening initiatives and smart city development, which will need more landscape maintenance.

Price is one consideration by customers relative to the West, but increased availability along with cheaper electric, battery-operated trimmers is leading adoption, particularly for the residential segment. Local production capacity in China has further reduced costs and improved access.

Japan makes some precision gardening stuff, also a naturally higher and more precise tendency trimmer. Growing middle-class demographics, government neighborhood beautification projects and increasing awareness towards environmental solutions is boosting this market growth factors.

The Rest of the World includes Latin America, Middle East and Africa very small markets, but steadily growing for hedge trimmers. Latin America we see a lot more urban landscaping initiatives, particularly in Brazil and Mexico, garden lovers, but plants and seeds are very expensive and hydroponic lighting access is never guaranteed.

Landscaping maintenance is an institution in Middle Eastern mega cities like Dubai and Riyadh among commercial and luxury residential developers and there is still scope for high efficiency tools demand here.

In Africa, it's also gaining traction, as late adopters come on board as more infrastructure is developed, and the modern landscaping and infrastructure landscape becomes more interesting. In ROW market positive development has been found, attributed of developing economies and institutional investments on green infrastructure projects.

Environmental Regulations and Emission Standards

Increasing adoption of stringent environmental law standards, particularly concerning gas hedge trimmers, acts as one of the significant restraints experienced in the hedge trimmers marketplace. In North America and other markets across Europe, for instance, mounting air and noise pollution pressures have already resulted in stricter emissions and cleanliness regulations for gas-powered landscaping equipment.

California’s phased ban on landscape equipment, including gas-powered trimmers, which has put a large burden of compliance on the manufacturers and service providers reliant on gas-powered machines to perform their businesses.

The compliance burdens redesign and R&D (the required redesign) and redistribute the supply chain too. Because these regulations did not apply in those developing markets, compliance burdens ultimately fell on consumers in the buying stage, so businesses are in a slower position to cross the transition toward possessing products which violates the EU market because everybody, even though there are compliance issues, is already in a place of a fragmented industry across regions.

Battery Limitations and Performance Concerns

Although battery power hedge trimmers are gaining traction, they still face performance limitations, especially in professional and commercial applications. The economy and torque that battery models don’t offer is one reason many landscapers prefer gas-powered trimmers.

Battery duty cycles continue to be a sore point, one made worse by the reality of timeworn batteries, protracted charging times and limited cutting power in high-usage settings. In the areas where the electricity supply or replacement parts are not reliable, the usage of battery-powered tools is reversed.

But the price of high-capacity batteries for cordless models leaves them unloved in the value-based sections of retailers’ offerings. Unless battery technology comes on leaps and bounds, these limitations will hold back conversions of gasoline to electric-powered models in heavy-duty use cases.

Technological Advancements in Battery and Smart Features

The market for hedge trimmers is expected to grow significantly as battery technology and smart features continue to develop. The latest high-capacity lithium-ion batteries with rapid charging have led to greater run time for charged batteries, delivering better performance versus the equivalent gas-powered unit, and as such, cordless hedge trimmers are now coming to rival their gas-powered brothers on an ever-greater scale.

Intelligent technology is enhancing aspects of user experience and operational efficiencies, from mobile apps that provide performance monitoring to automated blade angle adjustment to energy management systems. It was tempting for household clients hoping for support and for company users wanting improved efficiency.

Manufacturers that invest in the development of power, precision and connectivity will be rewarded, attracting new segments of the market, even as consumers will increasingly be looking long term and prioritizing utility and eco-friendliness, and being able to show differentiation in an increasingly competitive space.

Expansion in Emerging Markets and Green Infrastructure

With the clinching of urbanization, middle-class population, and investment in public landscaping and smart city projects, hedge trimmer manufacturers can also take advantage of emerging markets. Asian Pacific countries, Latin America, and many countries in Africa were investing significant funding for the improvement of green spaces in the entire city, commercial regions, and neighborhood.

Demand for the effective landscaping tools is further driven by the government initiatives such as achieving environmental sustainability targets, Beautification Projects and infrastructural modernization investments.

Growing consumer interest towards external looks of the property, and the use of modern gardening techniques will also increase the popularity of hedge trimmers more so electric and battery-operated solutions that are in synergy with global sustainability drive. Hedge trimmer manufacturers should really consider entering these markets as there is an opportunity for sustainable growth, especially if they are willing to localize their product and pricing strategy.

The hedge trimmers market was on a steady growth path in the period 2020 to 2024, propelled by strong demand for efficient landscaping power tool, especially in urban and suburban residential landscape environments.

There have been an ever-increasing number of battery-powered and electric models available, and an interest in gardening and better outdoor spaces as a result of COVID-19 upended the hedge-trimmer terrain. The move toward regulation of noise pollution and emissions was also likely to drive people toward converting gradually to quieter and less polluting tools rather than gas-powered equipment.

From 2025 to 2035, the hedge trimmers market is expected to undergo a substantial conversion. The key transformations encompass the increasing augmentation of smart trimmers with AI-enabled technologies, a wider adoption of lightweight and ergonomic shapes, and an increased motivation towards the sustainability and recyclability of elements of components. Increasing residential landscaping globally presents an opportunity for hedge trimmer manufacturers.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stringent emissions regulations are gradually forcing the automotive world electric versions of everything from the family car to the supercar particularly in Europe and North America. |

| Technological Advancements | Improvements in battery life and the integration of brushless motors led to installations that were easier to manipulate and operated over longer run times. |

| Industry-Specific Demand | Mostly driven by home residential users during a COVID-19 home improvement boom and landscaping companies in the local area. |

| Sustainability & Circular Economy | Early approaches to recyclable packaging and emissions reduction; rising enthusiasm for electric models. |

| Market Growth Drivers | Booming DIY gardening, skyrocketing homeownership, growing landscape aesthetic trend, assistive battery technology. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter environmental regulations, including bans on gas-powered garden tools in some jurisdictions; expansion of sustainability requirements. |

| Technological Advancements | Emergence of AI-enabled trimmers, auto-shutoff features, and integration with smart garden systems; emphasis on tool connectivity. |

| Industry-Specific Demand | Rise in municipal landscaping contracts, large-scale commercial landscaping projects, and premium residential gardening solutions. |

| Sustainability & Circular Economy | Foster circular design, recyclable / easy materials, energy-efficient charging solutions, and lower lifecycle goods costs. |

| Market Growth Drivers | Expanding green infrastructure, smart landscaping tools, eco-conscious consumer behavior, and growth of electric garden equipment market. |

Trimming tools for hedges in the USA market is on the rise owing to a rising concern for landscaping for residential properties, growth in spending on outdoor beautification, and expansion of the market for commercial lawn care services firms. Natural gas hedge trimmers, water-powered hedge trimmers, and other portable versions are proving fast to adapt to recent trends, which prioritize ease of use, less maintenance, and sustainability.

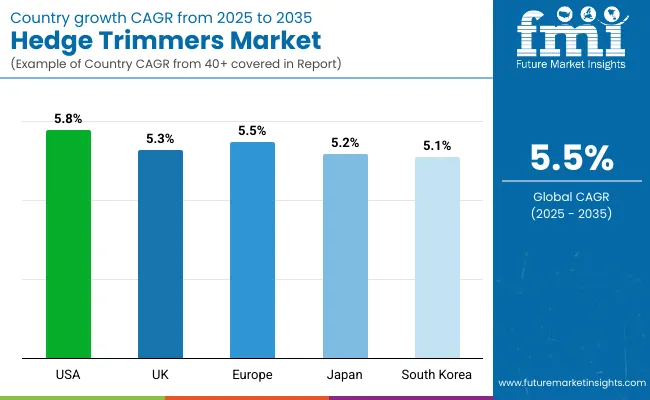

The DIY home improvement culture along with smart landscaping tools is another trend supporting market growth. Commercial sectors, including municipal landscaping, and property management of residential real estate, are also boosting use of the tools. Demand from the gas-powered model to electric models is shifting based on sustainability concerns. The US Hedge Trimmers Market is expected to grow at a CAGR of 5.8% during the forecasted period, i.e., 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.8% |

The UK hedge trimmers market is characterized by strong home gardening culture, increasing interest in sustainability, and compact outdoor power tools are in demand. People with private gardens in urban areas have begun to use lightweight, quieter, battery-operated trimmers with greater frequency.

Government is driving environmentally friendly power tools among policymakers, and supporting green initiatives offers cities product uptake. Millennials have also increasingly been taking on do-it-yourself landscaping and garden design.

Manufacturers are offering options like ergonomically designed and cordless-powered tools for gardening in small spaces and urban environments. Based on this, sales of hedge trimmers in the UK are forecasted to grow positively, with a projected compound annual growth rate (CAGR) of 5.3% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.3% |

The European Union market for hedge trimmers is expected to continue growing at a steady pace, driven by the market's regulatory focus on eco-design standards and sustainable landscaping practices, as well as high consumer awareness of environmental factors. Germany, France and the Netherlands are the Centers of Demand for garden equipment owing are residential gardening culture is in those countries. The expansion in the market is also fueled by urban green space and commercial landscaping projects.

The EU energy efficiency directives and sustainability objectives has nicely matched with the demand for battery-powered and robotic hedge trimmers. The hedge trimmers market in the European Union is anticipated to create an absolute dollar opportunity of USD 470.1 Million, with a CAGR of 5.5% and a projected revenue size of USD 2.5 Billion during 2025 to 2035.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.5% |

The hedge trimmers market in Japan is changing due to urban greening initiatives, space-efficient garden design, and a demographic shift to an aging population. There is a strong emergence of cordless electric trimmers that are compact, lightweight, and low-noise garden tools as demand is rising among residential users.

For residential users, ergonomic versions are preferred, which are useful for small gardens and limited access. Cities continue to invest in tools to help with landscape maintenance and management, particularly of public green spaces. Home and professional applications of automation/robotics technology become more acceptable and popular instead of traditional ones.

An increasing interest in low-maintenance equipment among older homeowners will also drive demand. These features are also seen in the hedge trimmers market and the hedge trimmers market is projected to grow at a CAGR of 5.2% between 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

South Korea is slowly growing with increasing interest in gardening at home, caring and maintaining of the public parks and recycling, sustainable (eco-friendly) linked developments for more environmentally friendly design in urban planning. Public demand advantages battery-powered hedge trimmers for the popular energy source and because they fit more business and energy clean plan.

Younger homeowners seem most interested in integrated smart technology solutions for garden tools that balance performance attributes with sustainable characteristics. Municipal investment in landscaping and green belt beautification is tending to bolster the readiness of the public sector to engage on lower-emitting, more efficient products. Based on these consumer patterns and trends, the hedge trimmer market in South Korea is anticipated to grow at a cumulative annual growth rate (CAGR) of 5.1% and register revenue of USD 125.2 Million by the year 2030.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

The most popular hedge trimmers are straight-blade, with blade lengths of 47 to 56 cm, since they are a good compromise between reach and maneuverability. These trimmers are popular among residential and light commercial customers for general trimming and maintenance use. Growth in this segment will be supported by the consumer trend of preferring small to medium gardens and ease of use.

This size of blade, couple of manufacturers and brand names have carried the cordless, battery-powered model to the end and this also helps the section. This segment is a key contributor in Europe, North America, and other markets where buyers want structured landscaping and hedge trimmers closer to reach. In urban and metropolitan areas, many residential users prefer electric hedge trimmers in this size range to comply with noise and emission standards, likely sustaining growth within this segment.

Hedge trimmers with blade lengths longer than 56 cm are now gaining popularity among commercial and heavy-duty users, as they allow large hedges to be trimmed more quickly and effectively. These types of models enable professional landscapers, or facility gardeners to complete jobs in less time with yard work management, which helps improve productivity.

These bigger models do need a greater skill when using them, but the working experience of these have gone up with ongoing innovations in ergonomic design and anti-vibration technology on today’s designs. The growing of the larger models is a growth trend seen in larger countries with more extensive amounts of greenery and commercial landscaping like the USA, Germany and the UK.

The residential segment is the dominant segment in the hedge trimmers market with an increasing momentum toward DIY landscaping, new suburb developments and overall consumer interest in outdoor aesthetics.

This portion continues to witness property holders that hold several natural and finishing devices, portraying the supportable part of a cutting-edge way of life or propensity. This category of hedge trimmers includes usually electric or battery-powered versions that have extra safety features and lighter designs for casual users.

Ongoing consumer demand is expected in these more developed areas, including North America and Western Europe, for both new and existing homes as a result of stable housing markets, eco-friendly gardening tendencies and e-commerce retailing or affordable pricing from major brand manufacturers.

The commercial sector is growing steadily, driven by demand from landscaping firms, government agencies, and facility maintenance companies. These users care about durability, running time, and cutting, and they usually opt for a longer blade or a pro-grade battery or gas-powered construction.

Urban regulatory issues around noise ordinances and emissions standards have resulted in cumulative shift toward quieter and cleaner electric trimmers. The tools are also expensive to acquire and maintain, especially for large fleets.

But motor technology has advanced to brushless motors, coupled with interchangeable battery systems that make commercial-grade trimmers better performing and more economical, and offer the opportunity for adoption in the USA market, as well as Germany, Japan and Australia.

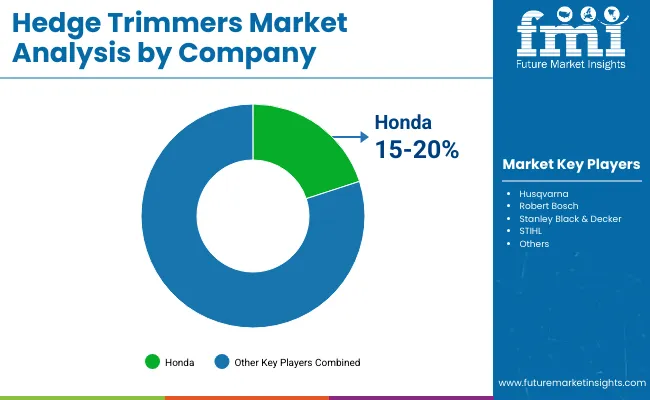

Increasing interest in residential and commercial gardening and landscaping is fueling steady market growth of hedge trimmers in the global market. Some of the market leaders are Honda, Husqvarna, Robert Bosch, Stanley Black & Decker, and STIHL, and they typically have an emphasis on technology and sustainability. In The market there is trend such as more battery powered and eco-friendly solution comes and it shows that the market is responding to custumers’ demand of eco-friendly products.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Honda | 15-20% |

| Husqvarna | 12-18% |

| Robert Bosch | 10-15% |

| Stanley Black & Decker | 8-12% |

| STIHL | 5-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Honda | Makes heavy-duty, gasoline-powered hedge trimmers, recognized for long engine life and low emissions. Emphasized ergonomic designs and fuel efficiency. Widespread coverage across Asia and Europe. |

| Husqvarna | Provides an extensive range of electric and battery-powered hedge trimmers. Pioneers in intelligent integration and sustainable innovations. Aimed at both homeowners and professionals. |

| Robert Bosch GmbH | Experts in the field of lightweight and cordless hedge trimmers and working under the brand name Bosch Garden Tools. Focuses on user friendly features such as anti-blocking systems and low noise. |

| Stanley Black & Decker | Provides consumer-oriented hedge trimmers under the Black+Decker and DeWalt brands. Focuses on compact design, safety features, and value-for-money products for residential use. |

| STIHL | Manufactures premium electric and gas-powered hedge trimmers for contractors. Known for precise blades, sophisticated anti-vibration systems, and extended operational lifetime. |

Key Company Insights

Honda

Honda has a monopoly on hedge trimmer variety, it is especially true for gasoline-powered hedge trimmers with amazing performance. Honda products are known for being durable and having great fuel economy and emissions, which is an important factor for Honda's products to be designed and catered to.

This makes Honda hedge trimmers an investment for the professional landscaper and serious gardener. Honda's emphasis on ergonomics, starting, and noise control have become very user comfort attractive features.

Honda has been big in Asia and Europe for a long time, and they keep building their dealer and aftermarket support in North America. They are conducting research and development in terms of meeting strict initiatives against climate change and looking into hybrid and other cleaner engine options.

Husqvarna

Husqvarna is the world leader in battery and two-stroke powered hedge trimmers for the environmentally-conscious. Long-standing history of making outdoor power equipment, the manufacturer's focus has shifted towards sustainability and they have a range of electric trimmers built around battery-powered features that reduce noise, offer lighter weight advantages, and drop emissions.

It is targeting end-users in residential settings, as well as professional landscapers, with a heavy emphasis on integrating smart technology into the products, including Bluetooth technology, and monitoring their performance through apps on consumers’ mobile devices.

Beyond electric power dominance, Husqvarna boasts proper protection attributes for the operator, e. g. the vibration-lowering, decreased-time procedure, or the blade brake with proper blade management. Husqvarna has strong distribution and supply ahead of its competition in the North American and European sales of battery and electric power equipment, allowing the company to carry a high place of the top line of the market hike.

Robert Bosch GmbH

Robert Bosch garden tools leads the way in advanced hedge trimmer technology, design and consumer experience. Their cordless electric hedge trimmers are lightweight and quiet with enabling battery management systems for optimal performance ideal for urban gardening and small to mid-sized properties.

Bosch have the best Anti Block system right now and its Ergonomics concepts take away a lot of pain when cutting. Bosch hedge trimmers are especially popular in Europe where compact, low-noise, and eco-observant products are considered at the highest level. Bosch invests heavily in R&D, integrating smart diagnostics and augmenting rates of charge (via battery packs) into their products. Sustainability is a key focus for Bosch when planning the product line and their hedge trimmers continue to be heralded for both energy efficient operation and the design of recyclable components.

Stanley Black & Decker

The Black Decker and DeWalt names under which Stanley Black & Decker markets products for DIY homeowners and professional users. Their line of hedge trimmer products covers a variety of corded, cordless, and hybrid electric hedge trimmers designed with budget-friendly customers in mind as well as beginner ease and safety.

Black Decker manufactures trimmers that are sold at retail in North America and Europe, such as at Home Depot, Lowe's, or Amazon. More professional-grade products are built under the DeWalt label for landscaping specialists, featuring rugged, heavy-duty construction, brushless motors and extended battery life. Stanley Black & Decker has made significant investments in product design and user experience, resulting in strong growth in the residential landscaping space.

STIHL

STIHL is best known for its rugged, professional-grade hedge trimmers aimed at the professional landscaping market. They are offered with gas or battery-electric power, good torque, ergonomic design and blade technology. Anti-vibration systems, tool-free adjustments, and durable, heavy-use blades are the primary features of STIHL hedge trimmers.

STIHL is known for performance and contractors and municipalities are fiercely loyal to the STIHL brand and its equipment. STIHL also have up their investment into battery technology. Newer variation battery hedge trimers provide more gut power and torque compared to older gas-powered fashions and fewer emissions. STIHL is working to become a leader in the vast international world supported by robust dealers and service networks. This allows STIHL to carry the brand's association of quality and reliability into the hedge trimmer category.

In terms of Blade Length, the industry is divided into Up to 46 cm, 47 to 56 cm, Above 56 cm

In terms of Application, the industry is divided into Residential, Commercial

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Hedge Trimmers market is projected to reach USD 779.1 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.5% over the forecast period.

By 2035, the Hedge Trimmers market is expected to reach USD 1,330.7 million.

The 47 to 56 cm segment is expected to dominate the market, due to its optimal balance of cutting efficiency, maneuverability, and suitability for residential and commercial landscaping, offering versatility for various hedge sizes.

Key players in the Hedge Trimmers market include Honda, Husqvarna, Robert Bosch GmbH, Stanley Black & Decker, STIHL

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hedge Shears Market Size and Share Forecast Outlook 2025 to 2035

Electric Hedge Trimmer Market Insights Demand, Size & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA