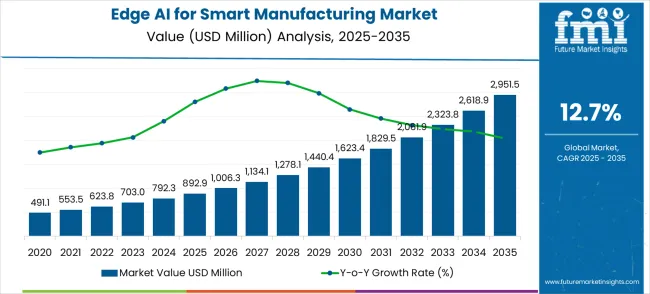

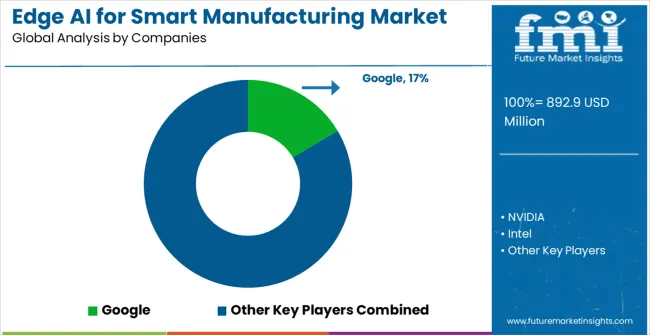

The edge AI for smart manufacturing market is growing at USD 892.9 million in 2025 to USD 2,951.5 million by 2035 at a CAGR of 12.7%, demonstrates strong growth momentum over the forecast period. Early-stage growth from 2025 to 2027 (USD 892.9 million to USD 1,134.1 million) reflects the gradual adoption of edge computing solutions in industrial automation and predictive maintenance. From 2028 to 2032, revenue escalates sharply from USD 1,278.1 million to USD 2,061.9 million, highlighting widespread implementation of AI-driven smart manufacturing applications. The final period, 2033 to 2035, exhibits sustained acceleration to USD 2,951.5 million, underpinned by scaling deployments, integration with IoT networks, and rising demand for real-time production optimization.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 892.9 million |

| Market Forecast Value (2035) | USD 2,951.5 million |

| Market Forecast CAGR | 12.7% |

Between 2025 and 2028, the market increases from USD 892.9 million to USD 1,278.1 million, indicating a moderate yet stable growth trajectory. Incremental annual gains of USD 100–150 million are driven by initial adoption of edge AI in high-value manufacturing segments, such as automotive and electronics. The market momentum during this phase is fueled by pilot deployments, demonstration of efficiency improvements, and gradual investments in AI-enabled industrial processes. While growth remains steady, the pace is constrained by infrastructure readiness, integration challenges, and the cautious investment approach of early adopters.

From 2029 to 2035, revenue surges from USD 1,440.4 million to USD 2,951.5 million, signaling a strong acceleration in market momentum. Annual increments increase progressively, reflecting the scaling of edge AI across broader manufacturing segments and geographies. Advancements in AI algorithms, widespread integration with IoT networks, and heightened demand for predictive analytics drive this phase. Market growth is compounded by increased regulatory support for industrial digitization and operational efficiency mandates. The late-stage momentum highlights critical periods where deployment intensity and technology adoption converge, resulting in substantial revenue contributions and demonstrating the market’s high potential for long-term expansion.

The edge AI for smart manufacturing market is poised for rapid growth, driven by automation, real-time analytics, and quality optimization. By 2035, these pathways together unlock USD 2.95–3.0 billion in incremental revenue opportunities.

Edge AI enables real-time monitoring of machines, predicting failures before downtime occurs. High adoption in automotive manufacturing lines can reduce operational costs and improve uptime. Near-term opportunity: USD 0.8–1.0 billion

AI-driven insights streamline production workflows, enhance energy efficiency, and reduce scrap in electronics and semiconductor fabs. Manufacturers can optimize throughput and operational efficiency. Expected pool: USD 0.7–0.9 billion

Edge AI detects deviations in production processes, identifying defects or irregularities in real-time, especially in food & beverage operations. Reduces recalls, improves safety, and enhances product quality. Incremental pool: USD 0.5–0.7 billion

Automated visual inspection powered by Edge AI ensures compliance with strict standards in pharmaceuticals and medical device manufacturing. Enhances precision and reduces human error. Opportunity pool: USD 0.6–0.8 billion

Smart sensors and AI-driven analytics optimize equipment assembly and reduce production bottlenecks. Particularly impactful in heavy machinery plants and industrial equipment manufacturing. Revenue pool: USD 0.4–0.6 billion

Combining Edge AI with Industrial IoT platforms enhances connectivity, predictive analytics, and workflow automation across multi-site manufacturing. Supports scalable smart factory deployment. Opportunity pool: USD 0.3–0.5 billion

Edge AI optimizes energy usage, monitors emissions, and reduces environmental impact in manufacturing facilities. Aligns with regulatory compliance and corporate sustainability goals. Revenue potential: USD 0.2–0.4 billion

Edge AI feeds data into digital twins for simulation, planning, and optimization, enabling faster decision-making and product lifecycle management. Smaller but disruptive segment. Opportunity pool: USD 0.15–0.3 billion

Market expansion is being supported by the rapid increase in Industry 4.0 adoption worldwide and the corresponding need for intelligent manufacturing equipment that provides superior operational efficiency and real-time decision-making capabilities. Modern manufacturing facilities rely on consistent production quality and predictive maintenance to ensure optimal operational performance including automotive plants, electronics fabs, and pharmaceutical facilities. Even minor production inefficiencies can require comprehensive process adjustments to maintain optimal manufacturing standards and operational performance.

The growing complexity of manufacturing requirements and increasing demand for high-productivity solutions are driving demand for Edge AI equipment from certified manufacturers with appropriate performance capabilities and technical expertise. Manufacturing companies are increasingly requiring documented operational efficiency and system reliability to maintain production quality and cost effectiveness.

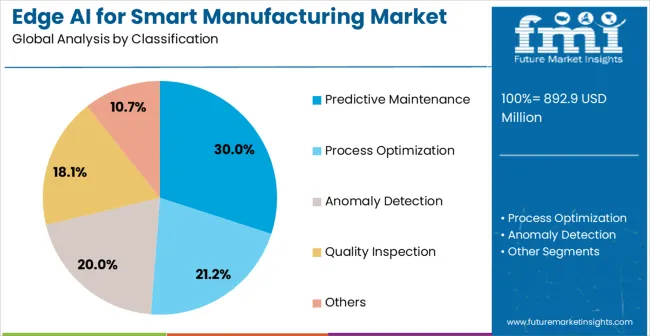

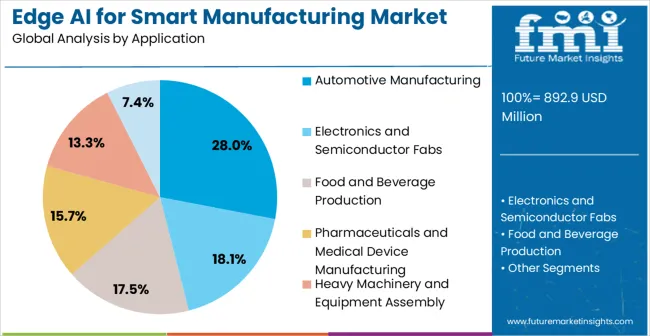

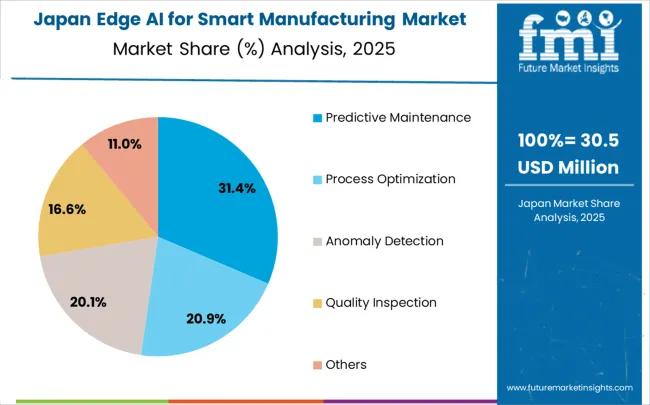

The market is segmented by solution type, application, and region. By solution type, the market is divided into Predictive Maintenance, Process Optimization, Anomaly Detection, Quality Inspection, and Others. Based on application, the market is categorized into Automotive Manufacturing, Electronics and Semiconductor Fabs, Food and Beverage Production, Pharmaceuticals and Medical Device Manufacturing, Heavy Machinery and Equipment Assembly, and Others.

The predictive maintenance segment is projected to capture around 30% of the edge AI for smart manufacturing market in 2025, establishing itself as the leading solution category. Demand is fueled by AI-driven maintenance systems that enable real-time failure prediction, reducing unplanned downtime and operational costs. Manufacturers across automotive, electronics, and heavy industries increasingly adopt predictive maintenance to extend equipment life, enhance production efficiency, and minimize repair expenditures. These systems analyze sensor data, historical performance, and equipment behavior using advanced machine learning algorithms to anticipate potential failures. The segment benefits from growing awareness of proactive maintenance strategies that optimize asset utilization and prevent costly interruptions. Availability of sophisticated AI platforms, cloud-based analytics tools, and comprehensive monitoring solutions strengthens the market position of predictive maintenance offerings. Broad applicability across industrial sectors, combined with measurable cost savings and productivity gains, ensures continued demand and reinforces predictive maintenance as a critical investment for manufacturers seeking competitive advantages.

The automotive manufacturing segment is expected to represent around 28% of edge AI for smart manufacturing demand in 2025, making it the most significant application sector. Growth is driven by the automotive industry’s need for precision, quality assurance, and operational efficiency across complex production lines. Edge AI solutions are used for real-time defect detection, automated quality inspection, and process optimization, ensuring high standards in assembly operations. Increasing electric vehicle production, advanced driver assistance systems, and smart vehicle technologies further enhance reliance on AI-powered manufacturing solutions. Automotive facilities benefit from reduced production waste, improved equipment effectiveness, and consistent product quality, supporting regulatory compliance and cost efficiency. Adoption of intelligent manufacturing systems aligns with digital transformation initiatives, enabling automotive plants to integrate predictive analytics, machine learning, and automated decision-making for optimized operational performance. Edge AI adoption provides essential capabilities for competitiveness, product quality assurance, and long-term efficiency in automotive production operations.

The edge AI for smart manufacturing market is advancing rapidly due to increasing industrial automation and growing recognition of AI-powered manufacturing advantages over traditional systems. However, the market faces challenges including higher initial implementation costs, need for specialized technical expertise, and varying technology adoption rates across different manufacturing sectors.

The growing development of advanced edge computing systems is enabling real-time data processing with improved performance characteristics and reduced latency. Enhanced computing technologies and optimized AI algorithms provide superior manufacturing insights while maintaining operational efficiency requirements. These technologies are particularly valuable for large manufacturing operators who require reliable system performance that can support extensive production operations with consistent results.

Modern Edge AI manufacturers are incorporating advanced quality inspection features and automated defect detection systems that enhance production efficiency and product reliability. Integration of advanced machine learning algorithms and optimized sensor technologies enables superior quality control and comprehensive manufacturing oversight capabilities.

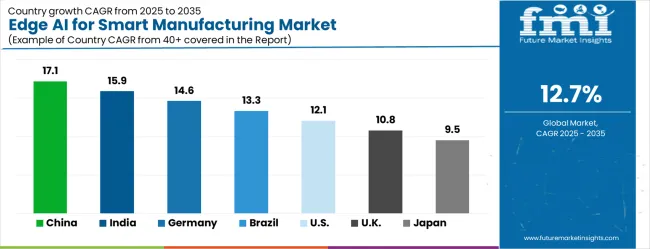

| Country | CAGR (2025-2035) |

|---|---|

| China | 17.1% |

| India | 15.9% |

| Germany | 14.6% |

| Brazil | 13.3% |

| United States | 12.1% |

| United Kingdom | 10.8% |

| Japan | 9.5% |

The Edge AI for smart manufacturing market is growing rapidly, with China leading at a 17.1% CAGR through 2035, driven by strong manufacturing sector expansion and increasing adoption of intelligent production systems. India follows at 15.9%, supported by rising industrial automation and growing awareness of AI-powered manufacturing solutions. Germany grows steadily at 14.6%, integrating AI technology into its established manufacturing infrastructure. The United Kingdom is projected to expand at 10.8% CAGR, driven by modernization of existing manufacturing lines and adoption of AI-driven quality and process optimization solutions. Japan demonstrates stable growth at 9.5% CAGR, emphasizing precision manufacturing, robotics integration, and incremental efficiency improvements through advanced edge AI applications.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

The Edge AI for smart manufacturing market in China is projected to grow at a CAGR of 17.1% through 2035, supported by expansion of intelligent manufacturing infrastructure and increasing adoption of AI-powered production solutions. China is exceeding other regions in implementing smart factory initiatives as automotive, electronics, and heavy machinery facilities integrate edge computing systems to enhance operational efficiency and production quality. Global and domestic technology providers are competing to deliver innovative solutions tailored to high-demand manufacturing zones. Government digitalization programs are further accelerating adoption, while competition with India and Japan is intensifying in advanced industrial AI deployment. Industrial modernization programs are enabling manufacturing networks to meet performance, safety, and efficiency targets at scale.

The Edge AI for smart manufacturing market in India is expected to expand at a CAGR of 15.9% through 2035, fueled by industrial sector development, automation adoption, and growing awareness of intelligent manufacturing benefits. India is emerging as a key market for AI-enabled production solutions, with domestic and international suppliers competing on performance, affordability, and customization. Manufacturing facilities are gradually adopting Edge AI systems to optimize production, improve quality, and reduce operational downtime. Competition between India and China is evident in automotive and electronics production sectors, with technology providers aiming to demonstrate reliability and efficiency. Industrial modernization and professional training programs are strengthening technical capabilities, enabling effective system utilization across diverse manufacturing facilities.

The Edge AI for smart manufacturing market in Germany is forecasted to grow at a CAGR of 14.6% through 2035, supported by strong emphasis on industrial innovation, automation, and high-quality manufacturing standards. Germany is growing as a European hub for advanced AI production systems, with manufacturers integrating edge computing solutions to optimize efficiency and operational reliability. Domestic technology providers compete with global suppliers for automotive, electronics, and industrial applications requiring precision and performance. Regional competition with France encourages innovation and customization. Investments in industrial automation and operator certification programs are enhancing adoption of advanced AI technologies, enabling Germany to maintain leadership in smart manufacturing and operational excellence.

The Edge AI for smart manufacturing market in Brazil is projected to grow at a CAGR of 13.3% through 2035, driven by industrial modernization, facility upgrades, and growing awareness of AI production advantages. Brazil is emerging as a key Latin American market for intelligent manufacturing systems, with domestic and international suppliers competing on performance, durability, and cost-efficiency. Industrial facilities are integrating Edge AI systems to optimize operations, improve production quality, and meet evolving market demands. Competition with Mexico is notable for advanced AI adoption in automotive and electronics manufacturing. Facility modernization and workforce development programs are supporting the adoption of AI systems, improving operational efficiency and manufacturing standards.

The Edge AI for smart manufacturing market in the United States is forecasted to grow at a CAGR of 12.1% through 2035, supported by established manufacturing sectors, operational efficiency initiatives, and adoption of AI-driven production systems. The United States is advancing Edge AI deployment in automotive, electronics, and industrial sectors, with domestic and global providers competing to deliver scalable and reliable solutions. Facility modernization and professional training programs are enabling standardized workflows, improved production quality, and optimized operational performance. Competition with Germany and Japan is driving innovation in high-tech manufacturing applications. Industrial networks are increasingly leveraging Edge AI to achieve consistency, efficiency, and safety across diverse production environments.

The Edge AI for smart manufacturing market in the United Kingdom is projected to grow at a CAGR of 10.8% through 2035, supported by established industrial sectors and increasing adoption of intelligent production systems. The United Kingdom is emphasizing deployment of advanced AI technologies in automotive, electronics, and industrial applications to improve operational performance, reliability, and quality. Domestic technology providers are competing with global suppliers, particularly Germany, to provide innovative and certified solutions for manufacturing facilities. Industrial modernization programs and professional training initiatives are enhancing workforce expertise and facility integration capabilities, supporting broader adoption of smart manufacturing systems across the country.

The Edge AI for smart manufacturing market in Japan is forecasted to grow at a CAGR of 9.5% through 2035, driven by technological innovation, advanced manufacturing techniques, and quality-focused production strategies. Japan is emerging as a global leader in precision-engineered Edge AI systems, integrating intelligent automation in automotive, electronics, and industrial manufacturing. Domestic suppliers dominate the market, creating a competitive environment for foreign entrants. Japan is competing with China and Germany in high-performance industrial AI adoption. Investments in professional development programs and system integration support operational efficiency, innovation, and quality assurance across manufacturing networks, ensuring strong market growth.

The Edge AI for smart manufacturing market in Europe is projected to grow from USD 197.2 million in 2025 to USD 588.6 million by 2035, registering a CAGR of 11.6% over the forecast period. Germany is expected to remain the largest national market with 24.8% share in 2025, rising sharply to 32.4% by 2035, supported by strong Industry 4.0 initiatives, predictive maintenance adoption, and advanced automotive and industrial automation infrastructure. The United Kingdom follows with 15.1% in 2025, inching up to 15.8% by 2035 as AI-driven quality inspection and process automation gain momentum across diverse manufacturing sectors. France accounts for 11.8% in 2025, easing slightly to 10.4% by 2035, reflecting steady but mature AI adoption across aerospace and automotive industries.

Italy holds 10.9% in 2025, moderating to 7.7% by 2035 as adoption stabilizes within machinery and manufacturing hubs. Spain represents 8.0% in 2025, dipping to 7.0% by 2035, reflecting selective uptake of AI in electronics and automotive manufacturing. BENELUX countries contribute 10.9% in 2025, easing to 10.7% by 2035, while the Nordic region accounts for 8.0% in 2025, softening to 7.0% by 2035, reflecting steady integration into advanced manufacturing clusters. The rest of Europe (Eastern Europe and other emerging markets) collectively accounts for 20.3% in 2025, moderating to 16.0% by 2035, supported by expanding AI-driven modernization programs in emerging manufacturing economies.

The Edge AI for smart manufacturing market is defined by competition among specialized technology companies, semiconductor manufacturers, and industrial automation solution providers. Companies are investing in advanced AI algorithm development, edge computing optimization, hardware performance improvements, and comprehensive service capabilities to deliver reliable, efficient, and cost-effective manufacturing solutions.

Google offers comprehensive AI solutions with established cloud computing expertise and machine learning capabilities. NVIDIA provides specialized edge computing hardware with focus on performance reliability and AI processing efficiency. Intel delivers cost-effective computing solutions with emphasis on accessibility and industrial-grade operation. Qualcomm Technologies specializes in semiconductor solutions with advanced edge computing integration.

Siemens offers industrial automation equipment with comprehensive service support capabilities. Edgeimpulse Inc delivers established AI development solutions with advanced edge computing technologies. Hailo provides specialized AI processing equipment with focus on performance optimization. Ambarella International, Ceva Inc, STMicroelectronics, Infineon, and Lattice Semiconductor offer specialized manufacturing expertise, hardware reliability, and comprehensive product development across global and regional market segments.

| Items | Values |

|---|---|

| Quantitative Units | USD 892.9 million |

| Solution Type | Predictive Maintenance, Process Optimization, Anomaly Detection, Quality Inspection, Others |

| Application | Automotive Manufacturing, Electronics and Semiconductor Fabs, Food and Beverage Production, Pharmaceuticals and Medical Device Manufacturing, Heavy Machinery and Equipment Assembly, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Google, NVIDIA, Intel, Qualcomm Technologies, Siemens, Edgeimpulse Inc, Hailo, Ambarella International, Ceva Inc, STMicroelectronics, Infineon, Lattice Semiconductor |

The global edge AI for smart manufacturing market is estimated to be valued at USD 892.9 million in 2025.

The market size for the edge AI for smart manufacturing market is projected to reach USD 2,951.5 million by 2035.

The edge AI for smart manufacturing market is expected to grow at a 12.7% CAGR between 2025 and 2035.

The key product types in edge AI for smart manufacturing market are predictive maintenance, process optimization, anomaly detection, quality inspection and others.

In terms of application, automotive manufacturing segment to command 28.0% share in the edge AI for smart manufacturing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Edge Bead Remover (EBR) Market Size and Share Forecast Outlook 2025 to 2035

Edge Security Market Size and Share Forecast Outlook 2025 to 2035

Edge Banders Market Size and Share Forecast Outlook 2025 to 2035

Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Edge Bending Machine Market - Trends & Forecast 2025 to 2035

Edge Server Market Trends – Growth & Forecast 2025 to 2035

Leading Providers & Market Share in Edge Protector Manufacturing

Edge Data Centers Market

Edge AI Market Trends – Growth, Demand & Forecast through 2034

Hedge Shears Market Size and Share Forecast Outlook 2025 to 2035

Wedge Wire Screen Market Size and Share Forecast Outlook 2025 to 2035

Wedge Boots Market Growth - Trends & Demand Forecast to 2025 to 2035

Hedge Trimmers Market Growth - Trends & Forecast 2025 to 2035

Wedge Pressure Catheters Market

5G Edge Cloud Network and Services Market Size and Share Forecast Outlook 2025 to 2035

Knowledge Management Software Market Size and Share Forecast Outlook 2025 to 2035

Warm Edge Spacer Market Size and Share Forecast Outlook 2025 to 2035

Foam Edge Protectors Market Size and Share Forecast Outlook 2025 to 2035

Assessing Foam Edge Protectors Market Share & Industry Insights

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA