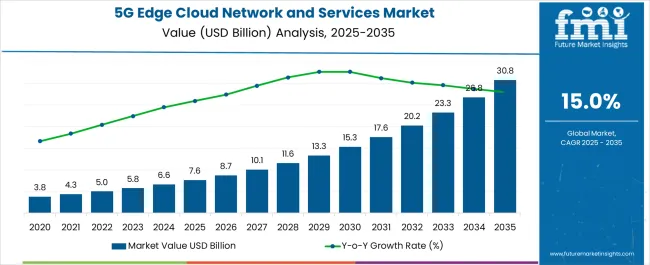

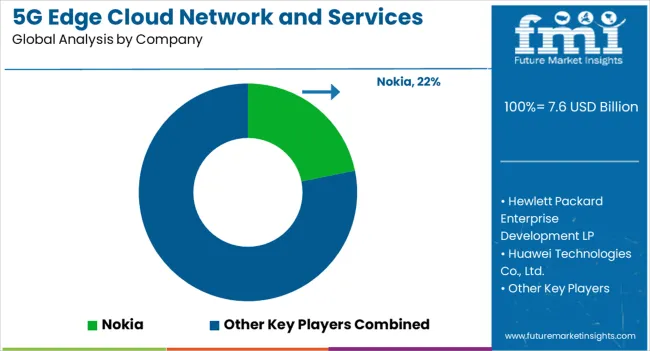

The 5G Edge Cloud Network and Services Market is estimated to be valued at USD 7.6 billion in 2025 and is projected to reach USD 30.8 billion by 2035, registering a compound annual growth rate (CAGR) of 15.0% over the forecast period.

| Metric | Value |

|---|---|

| 5G Edge Cloud Network and Services Market Estimated Value in (2025 E) | USD 7.6 billion |

| 5G Edge Cloud Network and Services Market Forecast Value in (2035 F) | USD 30.8 billion |

| Forecast CAGR (2025 to 2035) | 15.0% |

The 5G edge cloud network and services market is advancing rapidly as enterprises and industries increasingly adopt low latency, high bandwidth solutions to power digital transformation. The convergence of 5G and edge computing is enabling real time analytics, seamless IoT integration, and mission critical applications across manufacturing, healthcare, and automotive sectors.

Investment in network infrastructure, supported by government initiatives and telecom partnerships, is strengthening deployment. The need for faster data processing closer to the source is also accelerating adoption, reducing dependency on centralized cloud infrastructure and improving operational efficiency.

As organizations prioritize automation, connected devices, and intelligent applications, the market outlook remains highly positive with expanding opportunities for hardware innovation, scalable software solutions, and industry specific service models.

The hardware segment is expected to account for 54.20% of total revenue by 2025 within the solution category, making it the leading segment. This dominance is supported by the significant demand for physical infrastructure including servers, routers, and base stations that enable 5G edge deployment.

Hardware investment has been prioritized to support ultra low latency applications, high capacity data processing, and seamless connectivity across distributed networks. As service providers and enterprises scale edge infrastructure, reliable and high performance hardware has become the foundation for next generation digital services.

The critical role of hardware in establishing robust edge ecosystems has reinforced its leadership position in this market.

The large enterprises segment is projected to contribute 62.70% of market revenue by 2025 within the enterprise size category, positioning it as the most prominent segment. This share is driven by the ability of large organizations to invest in advanced 5G edge infrastructure, integrate AI powered analytics, and deploy complex IoT ecosystems.

Large enterprises are increasingly adopting edge computing to enhance operational efficiency, ensure data security, and deliver immersive customer experiences. Their access to significant capital resources and established partnerships with telecom providers has accelerated deployment at scale.

These factors have solidified the dominance of large enterprises in the adoption of 5G edge cloud network and services.

The automotive industry segment is anticipated to hold 47.50% of market revenue by 2025 under the industry category, making it the leading vertical. Growth in this segment is being propelled by the rapid evolution of connected vehicles, autonomous driving technologies, and advanced driver assistance systems.

The integration of 5G edge networks enables real time vehicle to everything communication, predictive maintenance, and enhanced passenger safety. Automotive manufacturers are leveraging edge computing for data intensive applications such as smart navigation, in vehicle entertainment, and fleet management.

The rising demand for highly reliable and ultra responsive networks has positioned the automotive sector as the leading adopter of 5G edge cloud network and services.

With technological advancements, enterprises are finding themselves in a highly complex networking marketplace. As tides of data continue to rise, enterprises are looking to transform using virtualization and automation features to enhance the scale and economic feasibility of experiences that they wish to create.

Enterprises must manage their mobile devices, applications, and communication and collaboration platforms in order to maintain connectivity across geographies, teams and departments.

Significant rise in number of smartphones in use across the globe will encourage enterprise and consumers to procure 5G technology services. Some lucrative 5G-enabled use cases include ultra-HD video, autonomous driving, Virtual Reality (VR), Augmented Reality (AR), and Artificial Intelligence (AI).

The high demand for advanced 5G applications and Internet of Things (IoT), among other technical enhancements, are estimated to propel the procurement of 5G edge cloud network and services during the forecast period.

Wireless networking market has recorded noteworthy growth over the past years with introduction of wireless mobility enabled smart devices. Continuous rise in subscribers and new use cases of wireless networking and communication technologies is creating opportunities for growth of the global 5G edge cloud network and services market.

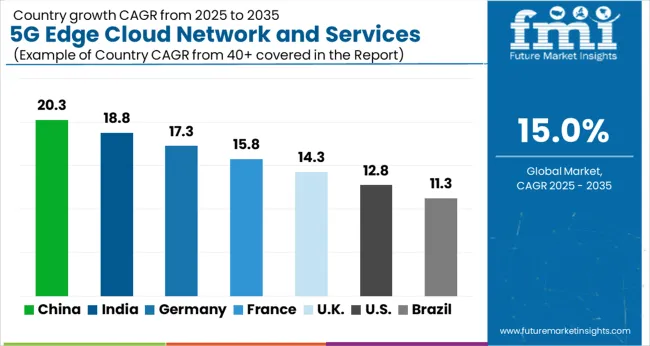

5G edge cloud network and services market in North America is leading all other regional markets on a global level. This dominance may be owed to high presence of well-established networking solutions and service providers in the region. These vendors are continuously investing in research and development of 5G technology.

The market is Europe is estimated to record one of the strongest growth rates during the forecast period. Investments made by national government to complement the deployment of 5G technology for applications in public sectors is propelling the adoption of 5G edge cloud network and services in Europe.

Advancements in 5G technology for automotive and smart transportation are playing a key role in propelling the adoption of 5G edge cloud network and services in European economies.

Some of the key vendors in the global 5G edge cloud network and services market are

The 5G Edge Cloud Network and Services market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, and inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators, and governing factors, along with market attractiveness as per segment. The market report also maps the qualitative impact of various market factors on market segments and geographies.

The global 5g edge cloud network and services market is estimated to be valued at USD 7.6 billion in 2025.

The market size for the 5g edge cloud network and services market is projected to reach USD 30.8 billion by 2035.

The 5g edge cloud network and services market is expected to grow at a 15.0% CAGR between 2025 and 2035.

The key product types in 5g edge cloud network and services market are hardware, platforms and services.

In terms of enterprise size, large enterprises segment to command 62.7% share in the 5g edge cloud network and services market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

5G Solid State Switches Market Size and Share Forecast Outlook 2025 to 2035

5G Gain Block Amplifier Market Size and Share Forecast Outlook 2025 to 2035

5G Driver Amplifier Market Size and Share Forecast Outlook 2025 to 2035

5G Millimeter Wave RF Transceiver Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

5G in Healthcare Market Analysis Size and Share Forecast Outlook 2025 to 2035

5G Temperature-Compensated Crystal Oscillator (TCXO) Market Size and Share Forecast Outlook 2025 to 2035

5G Remote Surgery System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

5G Telemedicine Platform Market Size and Share Forecast Outlook 2025 to 2035

5G Industrial IOT Market Size and Share Forecast Outlook 2025 to 2035

5G IoT Market Size and Share Forecast Outlook 2025 to 2035

5G in Defense Market Size and Share Forecast Outlook 2025 to 2035

5G Automotive Grade Product Market Size and Share Forecast Outlook 2025 to 2035

5G Enterprise Market Size and Share Forecast Outlook 2025 to 2035

5G Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

5G RAN Market Size and Share Forecast Outlook 2025 to 2035

5G Security Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

5G technology market Analysis by Technology Type, Application, Vertical, and Region – Growth, trends and forecast from 2025 to 2035

5G System Integration Market Insights - Demand & Growth Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA