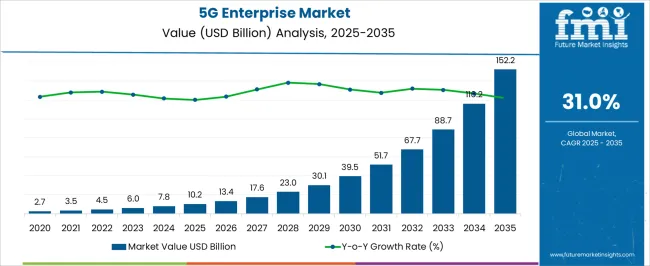

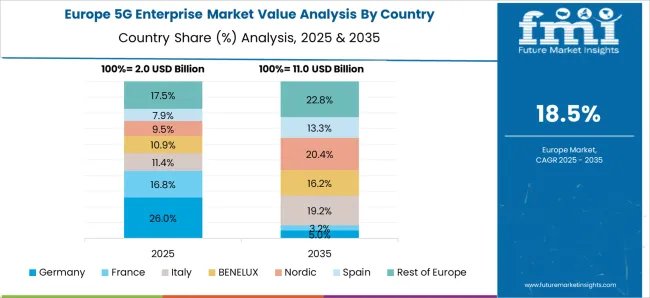

The 5G Enterprise Market, projected to grow from USD 10.2 billion in 2025 to USD 152.2 billion by 2035 at a CAGR of 31.0%, exhibits pronounced regional growth imbalances driven by varying levels of infrastructure readiness, regulatory frameworks, and enterprise adoption. Asia-Pacific is expected to dominate the market owing to its early and aggressive deployment of 5G networks, supported by government initiatives, high-density industrial hubs, and substantial investments in smart manufacturing and IoT integration. The rapid rollout of 5G infrastructure in countries such as China, South Korea, and Japan accelerates enterprise adoption, creating a significant regional market share advantage. Europe is projected to register steady yet moderate growth due to fragmented regulatory policies across member states, longer spectrum allocation processes, and gradual enterprise integration of 5G-enabled applications. While industrial adoption in sectors like automotive, logistics, and healthcare is increasing, infrastructure deployment pace remains slower than Asia-Pacific, resulting in a comparatively lower contribution to overall market growth. North America, led by the United States, is positioned between Asia-Pacific and Europe in terms of growth dynamics. Advanced enterprise ecosystems, strong private sector investments, and early adoption of 5G-enabled digital transformation initiatives drive market expansion. However, spectrum licensing complexities and gradual deployment outside major urban centers contribute to a regional growth lag compared to Asia-Pacific. Asia-Pacific’s proactive deployment and adoption create a dominant market presence, while Europe and North America are expected to expand at slower but sustainable rates, reinforcing the regional growth imbalance in the market.

| Metric | Value |

|---|---|

| 5G Enterprise Market Estimated Value in (2025 E) | USD 10.2 billion |

| 5G Enterprise Market Forecast Value in (2035 F) | USD 152.2 billion |

| Forecast CAGR (2025 to 2035) | 31.0% |

The 5G enterprise market is rapidly expanding as organizations across sectors seek high-speed, low-latency wireless networks to power digital transformation initiatives. Enterprises are increasingly adopting 5G infrastructure to support mission-critical operations, intelligent automation, and secure IoT deployments. The evolution of private cellular networks and dedicated spectrum allocations has enabled companies to build customizable and scalable network environments tailored to their operational needs.

Strong investments in industrial automation, connected logistics, and smart building systems have accelerated demand for enterprise-grade 5G solutions. Technological advancements in mmWave, beamforming, and network slicing are further contributing to enhanced network performance and application-specific configurations.

Enterprises are also prioritizing data sovereignty and network control, driving adoption of infrastructure models that offer both flexibility and reliability As industries move toward AI-powered automation, digital twins, and real-time analytics, the 5G enterprise market is expected to experience sustained growth, with strategic collaborations between telecom operators, cloud vendors, and enterprise integrators playing a crucial role in future deployment models.

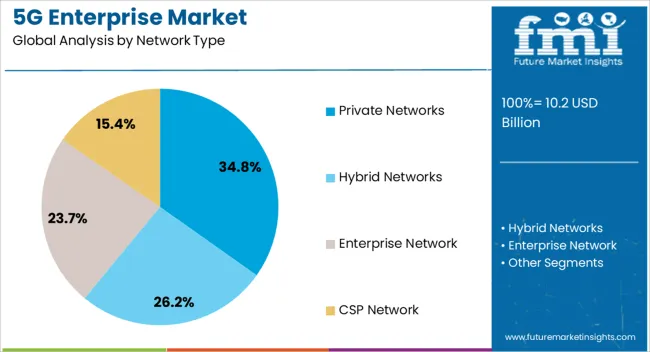

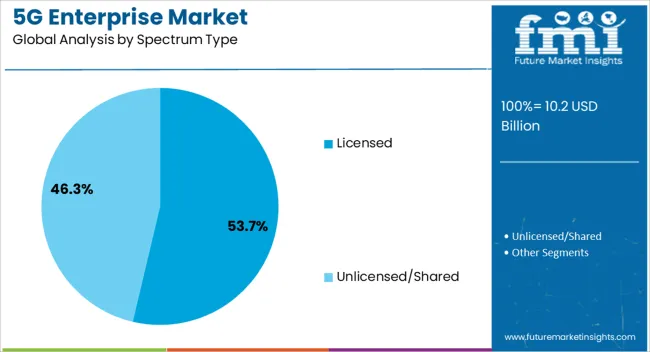

The 5g enterprise market is segmented by network type, infrastructure, spectrum type, frequency band, organization sizevertical, and geographic regions. By network type, market is divided into Private Networks, Hybrid Networks, Enterprise Network, and CSP Network. In terms of infrastructure, market is classified into Access Equipment, Small Cells, NFV, Core Network, SDN, and E-RAN Equipment. Based on spectrum type, market is segmented into Licensed and Unlicensed/Shared. By frequency, market is segmented into Sub-6GHz and mmWave. By organization, market is segmented into Large Enterprises and Small & Medium Enterprises (SMEs). By vertical, market is segmented into BFSI, Manufacturing, Energy & utilities, Retail, Healthcare, Government and public safety, and Others. Regionally, the 5g enterprise industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Private networks are expected to contribute 34.8% of the total revenue share in the 5G enterprise market in 2025, establishing them as the leading network type. The growing demand for secure, dedicated communication infrastructure across manufacturing plants, logistics hubs, and energy facilities has been a key driver behind this growth. Enterprises have increasingly favored private networks for their ability to ensure deterministic performance, data privacy, and integration with industrial control systems.

The segment has benefited from policy reforms enabling enterprises to access local spectrum, combined with vendor-neutral platforms that support multi-vendor interoperability. Use cases such as autonomous operations, real-time machine vision, and remote diagnostics have required consistent network performance that private networks are uniquely positioned to deliver.

The ability to manage latency-sensitive applications and mission-critical workflows within a confined enterprise perimeter has significantly boosted adoption With strong emphasis on operational resilience and control, private networks have become the foundation of next-generation industrial connectivity strategies.

Access equipment is projected to account for 27.9% of the 5G enterprise market revenue in 2025, making it a dominant infrastructure component. The deployment of base stations, small cells, and distributed antenna systems has surged in enterprise environments seeking to enhance indoor and outdoor coverage. This segment's growth has been driven by the requirement for high-density connectivity in facilities such as factories, warehouses, and corporate campuses.

Access equipment has evolved to support multiple frequency bands and carrier aggregation, enabling flexible network architecture for enterprises with diverse needs. The proliferation of edge applications and device-to-cloud integration has increased the dependency on robust access infrastructure to ensure uninterrupted data flow.

The market has also seen rising investment in plug-and-play 5G access solutions that reduce deployment time and operational complexity As enterprises adopt private 5G and hybrid models, access equipment remains a vital enabler of scalable and low-latency enterprise connectivity.

Licensed spectrum is anticipated to represent 53.7% of the total revenue share in the 5G enterprise market in 2025, reflecting its strategic importance in ensuring quality and reliability. Enterprises have increasingly opted for licensed spectrum to secure guaranteed bandwidth, avoid interference, and meet regulatory compliance in sectors such as utilities, finance, and healthcare.

The segment's leadership is supported by telecom providers offering managed 5G services with service-level agreements that are underpinned by exclusive access to licensed bands. Enhanced security, predictable latency, and prioritized network access have made licensed spectrum critical for use cases involving real-time analytics, robotic automation, and critical communications.

The growing availability of shared and localized licenses has allowed enterprises to independently deploy 5G networks while retaining control over performance parameters With national regulators expanding enterprise access to licensed mid-band and mmWave frequencies, the segment is poised for continued growth as enterprise-grade use cases become more bandwidth intensive and quality sensitive.

The market has been shaped by the adoption of next-generation wireless connectivity across multiple industrial and commercial sectors. Enterprises have increasingly leveraged 5G to improve network speed, reduce latency, and enable high-capacity data transfer for applications such as smart manufacturing, autonomous operations, and remote monitoring. Investments in private 5G networks, edge computing, and IoT integration have strengthened market growth. Demand has been further supported by collaborations between network providers, hardware manufacturers, and enterprise service providers to deliver tailored connectivity solutions.

The deployment of 5G in industrial enterprises has been driven by the need for digital transformation and real-time operational insights. Manufacturing, logistics, and energy sectors have been leveraging 5G-enabled devices to monitor equipment, optimize supply chains, and automate processes. High-speed, low-latency connectivity has facilitated the integration of AI-driven analytics, robotics, and augmented reality in industrial workflows. Enterprises have increasingly relied on private 5G networks to ensure security, reliability, and scalability for critical operations. As industries adopt smart factory models and predictive maintenance technologies, 5G connectivity has become essential for sustaining operational efficiency, supporting continuous monitoring, and enabling seamless communication between devices and central systems.

The integration of edge computing and IoT with 5G networks has significantly influenced the enterprise market. Data generated from sensors, devices, and machines has been processed closer to the source, reducing latency and improving decision-making speed. IoT platforms have been enhanced by 5G connectivity, enabling real-time tracking, predictive analytics, and automated responses in enterprise environments. Cloud services and enterprise applications have also been optimized for low-latency communication, allowing seamless deployment of smart solutions. These technological advancements have strengthened operational reliability and scalability, enabling businesses to adopt high-performance systems for asset management, remote monitoring, and industrial automation while reducing dependency on centralized networks.

The expansion of private 5G networks has been a key factor influencing enterprise adoption. Enterprises have prioritized secure, high-bandwidth networks to protect sensitive data and ensure compliance with regulatory requirements. Network slicing and dedicated frequency allocations have enabled enterprises to customize network performance for specific applications. Security features such as encryption, authentication protocols, and real-time monitoring have been integrated to mitigate cyber threats. Telecommunications providers and solution integrators have collaborated with enterprises to design tailored network architectures that combine performance, reliability, and security. These initiatives have reinforced trust in 5G connectivity and driven adoption across mission-critical industrial and commercial operations.

The market has been further strengthened by the development of industry-specific solutions and applications. Sectors such as healthcare, manufacturing, transportation, and smart cities have adopted 5G-enabled platforms to address unique operational challenges. Remote diagnostics, augmented reality-assisted maintenance, and autonomous logistics have been enabled through high-speed wireless connectivity. Vendors have provided customized hardware and software solutions to meet vertical-specific requirements, including latency optimization, device management, and data security. By addressing diverse industry needs, the market has expanded beyond general connectivity solutions into specialized enterprise applications. This targeted approach has reinforced the value of 5G deployment for performance enhancement, operational efficiency, and innovation across multiple enterprise domains.

The market is expected to expand at a CAGR of 31.0% from 2025 to 2035, driven by the adoption of private networks, Industry 4.0 initiatives, and enhanced connectivity solutions across manufacturing, logistics, and healthcare sectors. China leads with a 41.9% CAGR, propelled by large-scale 5G deployments, strong government support, and industrial digitalization. India follows at 38.8%, scaling rapidly through government-backed smart manufacturing and enterprise digitalization programs. Germany, at 35.7%, advances with Industrie 4.0 integration and private 5G network adoption. The UK, growing at 29.5%, focuses on enterprise network innovation and connectivity for critical sectors. The USA, at 26.4%, sees steady growth through private network deployment and integration with cloud and edge computing solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 41.9%, driven by rapid digital transformation across industries. Enterprises are adopting 5G networks to enable high-speed connectivity, low latency, and IoT-enabled automation. Key sectors including manufacturing, logistics, healthcare, and smart cities are increasingly relying on private 5G networks to enhance operational efficiency. Government initiatives supporting 5G infrastructure deployment, combined with robust telecom infrastructure, have accelerated adoption among enterprises. Local technology providers are also collaborating with international vendors to roll out scalable solutions, strengthening the market’s growth trajectory.

India is expected to expand at a CAGR of 38.8% as organizations invest in advanced network infrastructure. Key industries such as IT, manufacturing, healthcare, and smart city projects are implementing 5G-enabled solutions to improve connectivity and automation. Telecom operators are actively deploying private 5G networks tailored for enterprise applications, which supports reduced latency and higher bandwidth. The Indian government’s policy support for digitalization and industrial automation is further catalyzing market growth. The combination of increased enterprise digital adoption and favorable regulatory frameworks positions India as a significant growth market.

Germany’s Market is anticipated to register a CAGR of 35.7%, underpinned by the country’s advanced industrial sector. Manufacturing, automotive, and logistics enterprises are increasingly integrating 5G to enable automation, real-time data analytics, and Industry 4.0 solutions. Strategic investments by telecom providers and government-backed testbeds for 5G enterprise solutions are enhancing deployment opportunities. German enterprises are prioritizing secure and scalable private 5G networks to meet connectivity and operational efficiency needs. Continuous research and innovation in 5G applications for smart factories and intelligent logistics support sustained market expansion.

The United Kingdom is forecast to grow at a CAGR of 29.5% as industries adopt next-generation connectivity solutions. Key sectors such as healthcare, logistics, and smart city infrastructure are increasingly deploying private 5G networks to enable real-time monitoring, IoT automation, and enhanced data transmission. Government initiatives to foster innovation and digital transformation among enterprises support market growth. Partnerships between telecom operators and technology solution providers are facilitating broader 5G adoption across sectors. The combination of infrastructure readiness and strong enterprise demand positions the UK market for sustained expansion in 5G services.

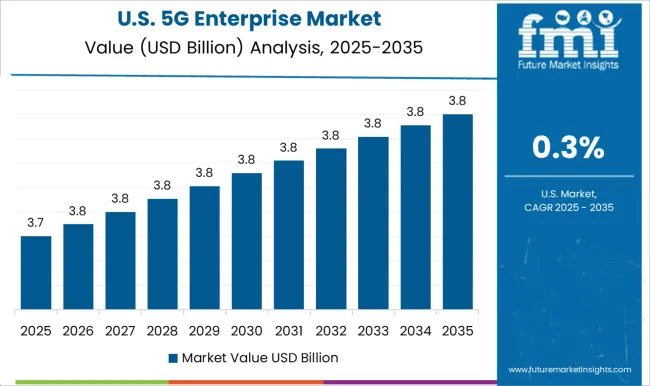

The United States market is expected to progress at a CAGR of 26.4%, with enterprise digital transformation serving as a primary growth driver. Large-scale adoption of smart manufacturing, logistics automation, and cloud-based operations necessitates high-speed 5G networks with low latency. Leading telecom operators are actively rolling out private 5G solutions to meet industry-specific connectivity requirements. Enterprise investment in digital infrastructure, combined with the development of edge computing and IoT-enabled solutions, continues to boost demand. The US market benefits from mature technological ecosystems and a strong focus on innovation in industrial applications.

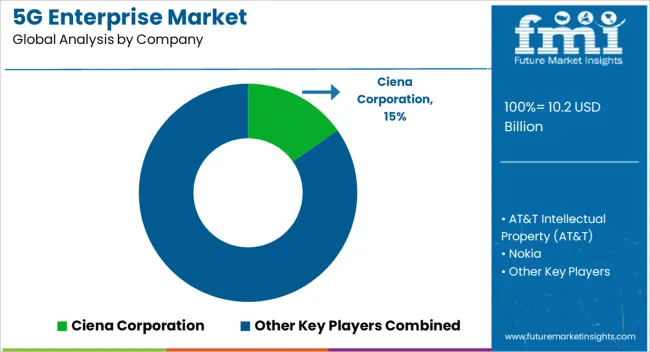

The market is driven by global technology leaders that focus on delivering high-speed, low-latency connectivity for business-critical applications and digital transformation initiatives. Nokia and Ericsson, through Cradlepoint, Inc., provide comprehensive 5G solutions including network infrastructure, private networks, and edge computing integration, enabling enterprises to enhance operational efficiency and scalability. Ciena Corporation contributes with advanced optical networking and transport solutions that support enterprise-wide 5G deployments and secure data transmission. Juniper Networks, Inc. and Hewlett-Packard Enterprise Development LP focus on cloud-native networking and software-defined solutions, offering flexible and programmable 5G platforms that meet diverse enterprise demands.

Telecom operators such as AT&T and Verizon provide enterprise-grade 5G connectivity services, ensuring coverage, reliability, and support for mission-critical applications. Samsung and ZTE extend their capabilities with 5G equipment and integrated solutions, emphasizing industrial automation, smart factories, and IoT adoption. Mavenir and Affirmed Networks, backed by Microsoft Corporation, innovate in virtualized 5G core networks and private network solutions, facilitating faster deployment and enhanced network security. SK Telecom and Fujitsu offer tailored 5G solutions combining network management, analytics, and connectivity optimization. CommScope strengthens the ecosystem through robust infrastructure and cabling solutions, ensuring seamless integration of 5G networks in enterprise environments.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Network Type | Private Networks, Hybrid Networks, Enterprise Network, and CSP Network |

| Infrastructure | Access Equipment, Small Cells, NFV, Core Network, SDN, and E-RAN Equipment |

| Spectrum Type | Licensed and Unlicensed/Shared |

| Frequency Band | Sub-6GHz and mmWave |

| Organization Size | Large Enterprises and Small & Medium Enterprises (SMEs) |

| Vertical | BFSI, Manufacturing, Energy & utilities, Retail, Healthcare, Government and public safety, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ciena Corporation, AT&T Intellectual Property (AT&T), Nokia, Verizon, Juniper Networks, Inc., Hewlett-Packard Enterprise Development LP, SAMSUNG, ZTE, Mavenir (Mavenir plc), Cradlepoint, Inc. (Ericsson), Affirmed Networks (Microsoft Corporation), SK TELECOM CO. LTD. (SK), FUJITSU, and CommScope |

| Additional Attributes | Dollar sales by solution type and industry vertical, demand dynamics across manufacturing, healthcare, and transportation sectors, regional trends in 5G adoption, innovation in network speed, reliability, and security, environmental impact of infrastructure deployment and energy consumption, and emerging use cases in smart factories, remote operations, and connected enterprise applications. |

The global 5g enterprise market is estimated to be valued at USD 10.2 billion in 2025.

The market size for the 5g enterprise market is projected to reach USD 152.2 billion by 2035.

The 5g enterprise market is expected to grow at a 31.0% CAGR between 2025 and 2035.

The key product types in 5g enterprise market are private networks, hybrid networks, enterprise network and csp network.

In terms of infrastructure, access equipment segment to command 27.9% share in the 5g enterprise market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

5G Enterprise Private Network Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

5G in Healthcare Market Analysis Size and Share Forecast Outlook 2025 to 2035

5G Temperature-Compensated Crystal Oscillator (TCXO) Market Size and Share Forecast Outlook 2025 to 2035

5G Remote Surgery System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

5G Telemedicine Platform Market Size and Share Forecast Outlook 2025 to 2035

5G Industrial IOT Market Size and Share Forecast Outlook 2025 to 2035

5G IoT Market Size and Share Forecast Outlook 2025 to 2035

5G in Defense Market Size and Share Forecast Outlook 2025 to 2035

5G Edge Cloud Network and Services Market Size and Share Forecast Outlook 2025 to 2035

5G Automotive Grade Product Market Size and Share Forecast Outlook 2025 to 2035

5G Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

5G RAN Market Size and Share Forecast Outlook 2025 to 2035

5G Security Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

5G in Automotive and Smart Transportation Market by Solution ,Application,Industry , Warehousing & Logistics, Warehousing & Logistics, Public Safety and Others & Region Forecast till 2025 to 2035

5G technology market Analysis by Technology Type, Application, Vertical, and Region – Growth, trends and forecast from 2025 to 2035

5G System Integration Market Insights - Demand & Growth Forecast 2025 to 2035

5G Chipset Market Analysis - Growth & Forecast through 2034

5G Fixed Wireless Access Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA