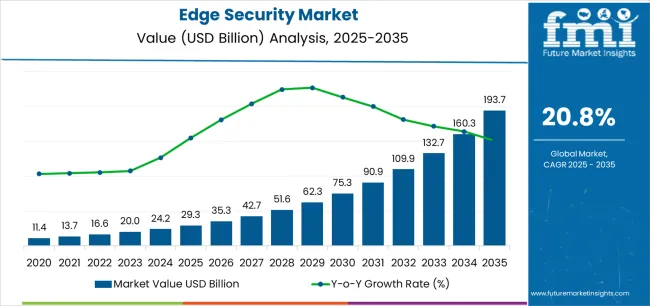

The Edge Security Market is estimated to be valued at USD 29.3 billion in 2025 and is projected to reach USD 193.7 billion by 2035, registering a compound annual growth rate (CAGR) of 20.8% over the forecast period.

The edge security market is expanding rapidly as enterprises shift toward distributed computing environments and cloud-native applications. Growth is driven by the proliferation of IoT devices, remote work adoption, and the rising need for localized data protection. Edge security solutions enable threat detection and policy enforcement closer to data generation points, reducing latency and enhancing compliance.

The market benefits from increasing cybersecurity awareness, stringent data protection regulations, and advancements in AI-driven analytics for real-time monitoring. Organizations across sectors are investing in scalable, integrated security frameworks to safeguard edge networks from emerging threats.

With edge computing deployments accelerating in telecommunications, manufacturing, and smart city infrastructures, the demand for robust security frameworks is expected to rise substantially. The outlook remains strong as enterprises pursue zero-trust architecture adoption and network decentralization strategies.

| Metric | Value |

|---|---|

| Edge Security Market Estimated Value in (2025 E) | USD 29.3 billion |

| Edge Security Market Forecast Value in (2035 F) | USD 193.7 billion |

| Forecast CAGR (2025 to 2035) | 20.8% |

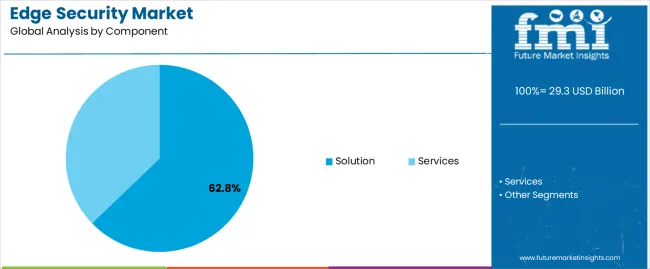

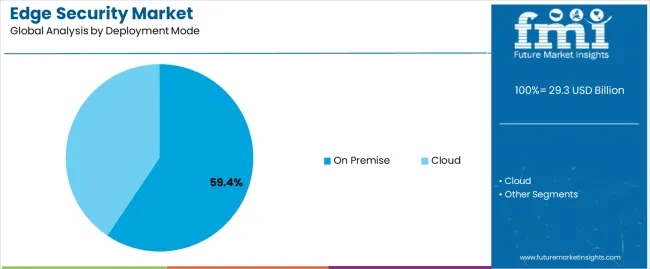

The market is segmented by Component and Deployment Mode and region. By Component, the market is divided into Solution and Services. In terms of Deployment Mode, the market is classified into On Premise and Cloud. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solution segment dominates the component category, holding approximately 62.8% share of the edge security market. This segment’s leadership is driven by the increasing adoption of integrated security suites offering endpoint protection, firewall management, and network threat intelligence. Organizations prefer comprehensive solutions that provide unified visibility across distributed edge environments.

The growth of hybrid infrastructures and multi-cloud ecosystems has reinforced demand for scalable, software-based edge security frameworks. Continuous innovation in AI-powered analytics and automated incident response capabilities further strengthens adoption.

With cyberattacks becoming more sophisticated, enterprises are prioritizing proactive threat mitigation through solution-oriented deployments. The segment is expected to maintain its leadership as businesses modernize their IT architectures and align with regulatory data protection mandates.

The on-premise segment leads the deployment mode category with approximately 59.4% share, reflecting enterprises’ continued preference for direct control over security infrastructure. This dominance is supported by concerns regarding data sovereignty, compliance requirements, and latency-sensitive operations.

On-premise edge security deployments enable real-time monitoring, reduced external dependency, and enhanced customization based on internal IT frameworks. The segment is particularly strong among large organizations managing critical data in sectors such as finance, defense, and manufacturing.

Despite the growing adoption of cloud-based security models, the need for robust, localized protection ensures sustained relevance for on-premise setups. With ongoing investments in private networks and hybrid architectures, the on-premise segment is projected to retain a significant market share during the forecast horizon.

The scope for edge security rose at a 25.9% CAGR between 2020 and 2025. The global market is anticipated to grow at a moderate CAGR of 21.9% over the forecast period 2025 to 2035.

The market experienced steady growth during the historical period from 2020 to 2025, driven by emergence of edge computing, which gained traction as organizations sought to process data closer to the source of generation to reduce latency and bandwidth usage. The adoption of edge computing architectures created a demand for edge security solutions to protect distributed infrastructure and sensitive data.

The proliferation of IoT devices across various industries contributed to the expansion of the edge security market. IoT devices generate massive amounts of data and are susceptible to security vulnerabilities, driving the need for robust security measures at the edge to mitigate risks associated with unauthorized access and data breaches.

Looking ahead to the forecast period from 2025 to 2035, the market is expected to witness significant growth. The integration of AI and machine learning technologies into edge security solutions is expected to enhance threat detection capabilities and automate incident response workflows. AI driven security analytics enable organizations to identify anomalous behavior patterns and proactively mitigate emerging threats in real time.

The rollout of 5G networks is anticipated to accelerate the adoption of edge computing and IoT devices, creating new opportunities and challenges for edge security providers. 5G networks enable faster data transmission rates and lower latency, facilitating real time communication and data processing at the edge.

The increased connectivity and expanded attack surface introduced by 5G networks require robust security measures to safeguard critical infrastructure and sensitive data.

The deployment of 5G networks enables faster data transmission and lower latency, making edge computing more feasible and efficient. It also introduces new security challenges that need to be addressed to protect sensitive data transmitted over 5G networks.

Edge computing environments are inherently complex and fragmented, comprising diverse hardware platforms, operating systems, and networking protocols. The heterogeneity of edge infrastructure complicates the deployment and management of security solutions, leading to interoperability challenges and increased implementation costs.

The below table showcases revenues in terms of the top 5 leading countries, spearheaded by Korea and Japan. The countries are expected to lead the market through 2035.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 22.2% |

| China | 22.5% |

| The United Kingdom | 23.0% |

| Japan | 23.1% |

| Korea | 24.0% |

The edge security market in the United States expected to expand at a CAGR of 22.2% through 2035. The United States faces a growing cybersecurity threat landscape characterized by sophisticated cyberattacks, including malware, ransomware, phishing, and supply chain attacks.

Organizations require robust edge security solutions to detect, mitigate, and respond to emerging cyber threats effectively, as adversaries target distributed edge environments to exploit vulnerabilities and exfiltrate sensitive data. Edge security solutions leverage advanced technologies such as artificial intelligence, machine learning, and behavioral analytics to detect and mitigate security incidents in real time, enhancing overall security posture and resilience.

Many organizations in the United States leverage cloud services for scalable, cost effective, and flexible computing resources. Edge security solutions that integrate seamlessly with cloud services and platforms enable organizations to extend their existing security controls to edge computing environments, ensuring consistent security posture and compliance across hybrid cloud deployments.

Integration with cloud services such as AWS, Azure, and Google Cloud Platform enables organizations to leverage the scalability, reliability, and agility of cloud computing environments for edge security deployments.

The edge security market in the United Kingdom is anticipated to expand at a CAGR of 23.0% through 2035. The country has stringent regulatory requirements governing data protection, privacy, and cybersecurity. Regulatory frameworks such as the General Data Protection Regulation mandate organizations to implement robust security controls and risk management practices to protect sensitive data and ensure compliance with regulatory requirements.

Edge security solutions help organizations achieve compliance with regulatory mandates by providing encryption, access controls, audit logging, and incident response capabilities tailored to edge computing environments.

The country is known for its innovation and leadership in cybersecurity technologies. The United Kingdom based cybersecurity companies and research institutions drive innovation in edge security solutions, developing cutting edge technologies and best practices to address evolving cybersecurity threats and requirements in distributed edge environments.

Continuous innovation and research initiatives fuel the growth of the edge security market in the country, enabling organizations to enhance security posture, mitigate cyber risks, and protect critical assets and data at the edge.

Edge security trends in China are taking a turn for the better. A 22.5% CAGR is forecast for the country from 2025 to 2035. China is experiencing rapid adoption of edge computing technologies across various industries, including manufacturing, telecommunications, healthcare, and smart cities.

Edge computing enables organizations to process and analyze data closer to the source of generation, reducing latency, enhancing performance, and enabling real time decision making. The demand for edge security solutions to protect distributed edge environments increases correspondingly, as edge computing deployments proliferate.

China leads in the deployment of Internet of Things devices across industrial, commercial, and residential settings. IoT devices generate vast amounts of data that require protection against cybersecurity threats. Edge security solutions provide essential capabilities such as device authentication, data encryption, and threat detection to secure IoT deployments and safeguard sensitive data.

The edge security market in Japan is poised to expand at a CAGR of 23.1% through 2035. Japan is at the forefront of innovation in autonomous vehicles and mobility solutions. The development and deployment of autonomous vehicles rely on edge computing and IoT technologies to process sensor data, make real time decisions, and ensure safe and efficient transportation.

Edge security solutions are essential for securing connected vehicles, infrastructure, and mobility services, mitigating cybersecurity risks and ensuring passenger safety in the evolving transportation landscape.

The country is a global leader in manufacturing and industrial automation, with a strong emphasis on Industry 4.0 initiatives and digital transformation in the manufacturing sector. Industrial IoT solutions leverage edge computing and sensor technologies to monitor, analyze, and optimize industrial processes, enhancing productivity, efficiency, and competitiveness.

Edge security solutions are critical for protecting industrial assets, data integrity, and operational continuity in the face of evolving cyber threats targeting industrial control systems and critical infrastructure.

The edge security market in Korea is anticipated to expand at a CAGR of 24.0% through 2035. Korea boasts one of the most advanced telecommunications infrastructures globally, with high speed internet connectivity and widespread 5G network coverage.

The rollout of 5G networks enables faster data transmission rates, lower latency, and higher bandwidth, making it feasible to deploy edge computing and IoT applications at scale. The high connectivity infrastructure provides a conducive environment for the growth of edge security solutions, which play a crucial role in protecting data and devices in distributed edge environments.

Korea is investing heavily in smart city initiatives and urban development projects aimed at enhancing sustainability, efficiency, and quality of life for its citizens. Smart city projects leverage edge computing and IoT technologies to collect, analyze, and act on data from various sensors and devices deployed throughout urban areas.

Edge security solutions play a critical role in securing smart city infrastructure, ensuring data privacy, and protecting against cyber threats in interconnected urban environments.

The below table highlights how solution segment is projected to lead the market in terms of component, and is expected to account for a CAGR of 21.6% through 2035. Based on deployment mode, the cloud segment is expected to account for a CAGR of 21.4% through 2035.

| Category | CAGR through 2035 |

|---|---|

| Solution | 21.6% |

| Cloud | 21.4% |

Based on component, the solution segment is expected to continue dominating the edge security market. Organizations require real time threat detection and response capabilities to defend against emerging cyber threats targeting edge computing environments.

Edge security solutions leverage advanced technologies such as artificial intelligence, machine learning, and behavioral analytics to detect and mitigate security incidents in real time, enhancing overall security posture and resilience.

Edge security solutions offer scalability and flexibility to accommodate diverse deployment scenarios and evolving security requirements. Organizations can deploy security controls such as firewalls, intrusion detection/prevention systems, and secure gateways at the edge to protect against a wide range of cyber threats while ensuring minimal impact on performance and user experience.

In terms of deployment mode, the cloud segment is expected to continue dominating the edge security market. Cloud based edge security solutions offer centralized management and control capabilities, enabling organizations to deploy, configure, and monitor security controls across distributed edge environments from a single management console.

Cloud based management platforms streamline security operations, reduce administrative overhead, and ensure consistent enforcement of security policies across edge deployments. Cloud based edge security solutions enable rapid deployment and provisioning of security controls across distributed edge environments, reducing time to market and accelerating digital transformation initiatives.

Organizations can leverage cloud based deployment models to deploy security updates, patches, and new features seamlessly across geographically dispersed edge locations, ensuring timely protection against emerging cyber threats.

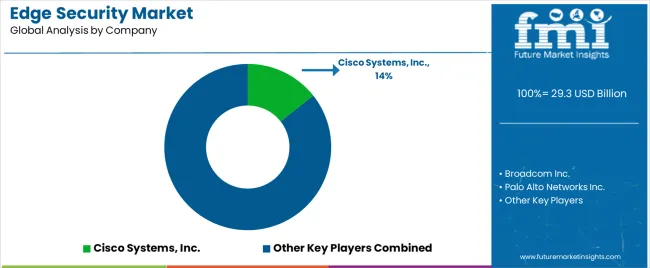

The competitive landscape of the edge security market is dynamic and evolving, characterized by the presence of established cybersecurity vendors, emerging startups, and a growing focus on innovation to address the unique security challenges posed by edge computing environments.

The demand for robust edge security solutions has surged, intensifying competition among industry players, as organizations increasingly adopt edge computing architectures.

Key Market Developments

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 29.3 billion |

| Projected Market Valuation in 2035 | USD 193.7 billion |

| Value-based CAGR 2025 to 2035 | 20.8% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Component, Deployment Mode, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Broadcom Inc.; Cisco Systems, Inc.; Palo Alto Networks Inc.; Check Point Software Technologies Ltd.; Fortinet Inc.; Zscaler Inc.; Cloudflare Inc.; F5 Networks; Citrix Systems Inc.; Forcepoint LLC |

The global edge security market is estimated to be valued at USD 29.3 billion in 2025.

The market size for the edge security market is projected to reach USD 193.7 billion by 2035.

The edge security market is expected to grow at a 20.8% CAGR between 2025 and 2035.

The key product types in edge security market are solution and services.

In terms of deployment mode, on premise segment to command 59.4% share in the edge security market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Security Service Edge Market Size and Share Forecast Outlook 2025 to 2035

Edge Banders Market Size and Share Forecast Outlook 2025 to 2035

Edge AI for Smart Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Edge Bending Machine Market - Trends & Forecast 2025 to 2035

Edge Server Market Trends – Growth & Forecast 2025 to 2035

Leading Providers & Market Share in Edge Protector Manufacturing

Edge AI Market Trends – Growth, Demand & Forecast through 2034

Edge Data Centers Market

Hedge Shears Market Size and Share Forecast Outlook 2025 to 2035

Wedge Wire Screen Market Size and Share Forecast Outlook 2025 to 2035

Wedge Boots Market Growth - Trends & Demand Forecast to 2025 to 2035

Hedge Trimmers Market Growth - Trends & Forecast 2025 to 2035

Wedge Pressure Catheters Market

5G Edge Cloud Network and Services Market Size and Share Forecast Outlook 2025 to 2035

Knowledge Management Software Market Size and Share Forecast Outlook 2025 to 2035

Warm Edge Spacer Market Size and Share Forecast Outlook 2025 to 2035

Foam Edge Protectors Market Size and Share Forecast Outlook 2025 to 2035

Assessing Foam Edge Protectors Market Share & Industry Insights

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA