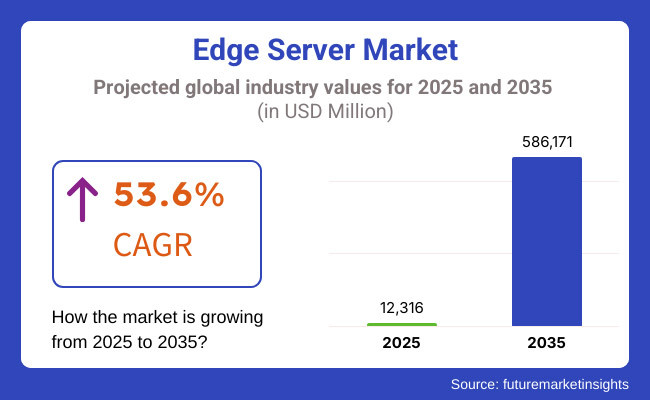

Global edge server market is expected to grow at a CAGR of 53.6% from 2025 to 2035 owing to the increasing demand for low-latency data processing, enhanced network efficiency, and adoption of edge computing technologies. Edge servers are becoming increasingly demanded as Internet of Things (IoT) technologies are adopted rapidly, 5G networks are deployed in large scales, and low-latency data processing is required.

These servers enable rapid server processing by pushing compute to the edge of the network, minimizing latency and boosting network performance. For autonomous vehicles, smart cities, industrial automation, and processing analytics in real-time, this is more so important.

With edge computing rapidly expanding in industries to help them process large volumes of data created at the edge of networks, edge servers are becoming critical. Moreover, artificial intelligence (AI) and machine learning (ML) functionality are being incorporated into edge servers, allowing them to analyse data at the source, this technology helps to alleviate pressure on data centres and cloud infrastructure.

Edge servers are also enjoying some growth in the market due to growing capacity 5G infrastructure which requires distributed and localized data processing to allow for rapid and efficient communication.

The increasing need for real-time, secure and efficient data processing across a range of industries underlies the expected advancement in the market's growth rate, suggesting a growth rate of 53.6% CAGR from 2025 to 2035. Edge server solutions are being used by all major industry players such as telecommunications, healthcare, manufacturing, and retail this helps them establish a foundation for digital transformation in line with modern technologies in this way.

North America has the leading edge server market, driven predominantly by major tech firms (Google, Amazon, and Microsoft), advanced network infrastructure, and high adoption of 5G technology. We are seeing a surge of demand for edge computing solutions in sectors, ranging from telecommunications, healthcare, and hospitality to retail, in Southeast Asia.

The increasing number of IoT devices combined with the requirement for real-time data processing in dark industries such as autonomous vehicles and smart cities are expected to drive demand for edge servers. In addition, the turnover of the 5G networks will drive edge server commerce as it provides improved and ultra-fast data transit around the perimeter.

In Europe, the edge server market is growing steadily, primarily due to the high levels of regulation regarding data privacy and security, as well as the requirements around latency. Developed nations with intelligent manufacturing lines, smart city projects, and major 5G infrastructure investments such as Germany, the UK, and France are at the forefront of edge computing adoption.

Edge computing focuses on processing data closer to the source rather than sending it to a data centre, which invites the development of smart computers, AI and ML. Additionally, edge servers are being increasingly used by European companies to optimize operational efficiency, decrease data transmission latency, and support critical infrastructure systems.

During the forecast period, the edge server market in the Asia-Pacific (APAC) region is expected to grow at the highest rate. This expansion is driven by the industrialization, urbanization, and technology across developing countries as China, India, Japan, and South Korea. The expanding IoT ecosystem along with the large-scale implementation of 5G networks further accelerates the adoption of edge computing solutions throughout the region.

Being home of some of the biggest manufacturing and technology providers, APAC is also a key market for the deployment of edge servers. In addition, will alarm the need for the edge server in light of the growing number of brilliant city activities, independent frameworks, and savvy fabricating arrangements in the district.

Challenges

Regulatory Compliance and High Initial Costs

The Edge server market is confronted with one of the main challenges in the form of regulatory compliance related to data processing and security. In addition, operating edge servers (which often pick up sensitive data across many industries) in compliance with local and international data protection laws like the General Data Protection Regulation (GDPR) in Europe or California Consumer Privacy Act (CCPA) in California can prove challenging. Additionally, edge servers may necessitate dedicated infrastructure investments, making for a substantial initial outlay.

This proves difficult for SMEs who do not have the funds to invest in such services. It's also a challenge due to the complexities of integrating edge servers within existing IT infrastructure and cloud platforms. Further, one could have Edge Servers having to add one more layer to the other security measures taken at a cloud level to the distributed data processing systems or have to keep making sure there are no cyber threats.

Opportunities

Increasing Need for Low-Latency Data Processing and Rise of 5G

The increasing need for edge computing across industries is driving demand for edge servers, as they allow for real-time data processing and lower latency. In addition, the proliferation of 5G technology is driving this trend as well by providing fast and reliable communication between edge servers and devices. With the rising number of connected devices, the necessity for decentralized data processing to decrease congestion and improve efficiency becomes increasingly important.

Edge servers process data closer to its point of origin, facilitating faster decision-making for autonomous vehicles, smart cities, industrial automation, and healthcare monitoring, among others. This opens doors for edge server providers to create tailored solutions aimed at these high-demand, low-latency scenarios. Additionally, the rise of IoT devices and smart environments contribute to the growth of the edge server market as well.

The period from 2020 to 2024 experienced considerable changes in the edge server market as 5G infrastructure deployment and IoT devices continued to proliferate. Companies were investing more and more on edge computing to process the tremendous amount of data being generated by connected devices. But legal problems&rdquo with regard to cost, complexity, and security contributed to prevent certain organizations from adopting edge computing solutions completely.

Notably, the edge server market during the period of advancements in AI, machine learning and 5G technologies from 2025 to 2035 expects significant alterations. Real-time data analytics with AI integration and seamless connectivity with cloud systems will be prominent features of edge servers.

To the third point, this will push the adoption of fully autonomous systems and smart devices especially in the areas of healthcare, manufacturing and transportation. The increasing focus on curbing network congestion and improving energy efficiency will drive the need for edge servers in numerous industries.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with data privacy regulations and cybersecurity standards. |

| Network and Infrastructure Trends | Expansion of 5G networks and the increasing number of IoT devices. |

| Industry Adoption | Initial adoption of edge servers in telecommunications, healthcare, and smart cities. |

| Power and Energy Efficiency | Edge computing focused on optimizing network efficiency. |

| Market Competition | Presence of traditional server manufacturers with limited focus on edge solutions. |

| Market Growth Drivers | Rise of connected devices and IoT applications. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter data governance regulations, with mandatory adoption of low-latency and secure edge computing solutions. |

| Network and Infrastructure Trends | Dominance of 5G and 6G networks with advanced edge computing integration for real-time data processing. |

| Industry Adoption | Widespread adoption of edge servers across multiple industries, including autonomous systems and robotics. |

| Power and Energy Efficiency | Strong emphasis on energy-efficient, low-latency edge computing solutions powered by sustainable energy sources. |

| Market Competition | Emergence of specialized edge computing providers and the integration of AI, IoT, and block chain technologies. |

| Market Growth Drivers | Surge in demand for low-latency, high-performance edge computing solutions to support autonomous systems, real-time analytics, and AI. |

With the increasing ADAS (Advanced Driver Assistance Systems), and smart infrastructure deployments, 5G-powered edge computing, and AI-driven real-time processing, the USA edge server market is showing a strong growth. Significant sectors like self-driving cars, healthcare, and industrial IoT are already pouring money into edge computer solutions, favouring supported by regulatory improvements on data security.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 54.1% |

With the rising demand for decentralized cloud computing and IoT-based innovations, edge servers are rapidly being adopted in the UK The country is investing in AI-powered edge networks to aid in sectors such as logistics, smart cities and finance, and regulatory bodies stressing data privacy and cybersecurity.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 53.6% |

European Edge server market is growing at a decent pace, driven by government supported initiatives in AI, IoT and 5G deployment. Key drivers include restrictions that ensure data sovereignty and network sovereignty, and industry, such as automotive (autonomous vehicles) and manufacturing.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 53.8% |

Japan's edge server market is capable of growing fast and demand is booming with robotics, AI-driven automation and smart cities. Growing use of ultra-low latency networks for industrial automation and real-time analytics in healthcare and retail has also stimulated market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 53.7% |

Proliferation of smart infrastructure projects combined with aggressive 5G rollout puts South Korea ahead of the curve when it comes to edge computing adoption. Telecom titans and AI companies are advancing edge-native AI and intelligent transportation systems as the country&rsquos technological ecosystem grows.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 54.0% |

With more organizations utilizing edge infrastructure to deliver real-time processing, low-latency applications and decentralised data storage, hardware and platform segments rule the edge server market. These nodes boost computing efficiency, strengthen data security, and increase network efficiency, which makes them integral for telecom operators, cloud-based service providers, and industrial automation companies.

Hardware solutions have accounted for the largest and fastest-growing consumer segment in the edge server industry, providing high-performance computing power to enable data processing at the edge of the network. By leveraging edge hardware instead of traditional cloud architectures, real-time analytics can be performed at the source of the data, resulting in lower latency and bandwidth charges which in turn drive operational efficiency improvements in most industries.

Market adoption has been driven by increased demand for specialized edge server hardware such as AI-enabled processors and ruggedized computing units. Industry-scale enterprises running AI-driven applications and industrial automation systems continue to make significant investments in purpose-built hardware for edge computing deployments. According to research, more than 60% of businesses leveraging edge computing focus on hardware infrastructure to enable data collection seamlessly whilst also improving network reliability.

Increasing presence of compact modular edge hardware in the market with ultra-compact form factor, energy-efficient processing units, and integrated cooling mechanisms has propelled the growth of market for cost-effective implementation across industries.

At the same time, the use of AI-assisted edge computing technologies, including deep learning accelerators and advanced workload and application distribution, can streamline the way technologies are integrated and deployed to boost efficiency and automation over edge computing deployments.

Although it leverages the benefits of low-latency data processing and data sovereignty, the hardware segment is faced with several challenges including high initial deployment costs and security vulnerabilities. Still, new developments in AI-backed cybersecurity and software-defined edge networking are enhancing efficiency, security, and scalability, guaranteeing growth in the market.

Organizations increasingly seek from vendors the platforms instead of point solutions needed to bridge the cloud by extending edge workloads up on the cloud or being able to intelligently manage them on-premises especially with the advent of edge workloads at the edge of the cloud and their management. Unlike traditional hardware stand-alone solutions, edge computing platforms provide central control and AI-based automation for distributed computing in seamless integrated fashion.

As customers seek to improve operational efficiency, the demand for scalable edge computing platforms, such as AI-driven orchestration engines and multi-cloud edge management solutions, are driving adoption. According to studies, more than 55% of enterprises using edge computing depend on platform solutions that enhance application performance whilst automating workloads.

The emergence of AI-enabled edge orchestration platforms with predictive analytics used for edge resource optimization and automated network service provisioning has been a key factor auguring the market expansion.

By 2023, the transition to specialized edge platforms, with 5G-optimized edge networking and autonomous vehicle edge management solutions, led to unprecedented market optimization and customized computing architectures for use cases across the spectrum.

While it does have advantages around centralized edge management and AI-driven automation, the platform segment suffers interoperability issues with legacy IT systems and multi-cloud orchestration complexity. That said, advancements in no-code edge computing tools and AI-driven platform automation will help make it faster and easier for enablers to on-board, and will contribute to further growth.

Major drivers for the market are the autonomous vehicles and gaming application segments where real-time decision-making and ultra-low latency computing are critical for next-generation mobility and entertainment experiences.

Edge computing plays an essential role in the functioning of autonomous vehicles, as they require massive quantities of raw sensor data processing, real-time AI-based decision-making and secure navigation. While cloud computing centralizes the data, edge servers allow autonomous vehicles to remain independent without relying solely on centralized data centres, thus providing instant responsiveness and reliability.

A growing need for real-time sensor fusion and automated navigation in AI-enabled vehicle-to-everything or V2X communication has triggered autonomous mobility's embrace of edge computing, according to ABI Research. More than 70% of next-generation autonomous vehicle platforms have integrated edge computing for AI inference and data processing, studies show.

While it has benefits for real-time AI processing capabilities and ultra-low latency communication, autonomous vehicles has some drawbacks with costly infrastructure setup and cybersecurity vulnerabilities. But new developments in mobility and AI-led mobility orchestration and decentralized vehicular data protection are making strides to be better secured and scalable, and allow for continued growth.

The demand for ultra-low latency has seen edge computing adoption thrive in gaming applications, especially among cloud gaming platforms and eSports providers. The game rendering under the edge computing environment is a built-up that due to the distance of the data processing closer to the player, breaking the traditional centralized gaming architecture, improving the gaming performance.

Increasing adoption of edge computing has been driven by the growing demand for cloud gaming services that include AI-based game physics processing, as well as real-time multiplayer synchronization. Over 65% of cloud gaming platforms are said to use edge servers to reduce latency sensitive gameplay, according to studies.

Growing market expansion is driven by the introduction of 5G-enabled edge gaming, with AI-based player matchmaking and ultra-responsive mobile gaming experiences.However, the gaming segment serves inherent drawbacks like the necessity for infrastructure spending and security threats of cloud based processing, even though it has its apparent benefits in real-time gaming reactivity, scalability for cloud gaming, etc. But emerging block chain-powered gaming authentication techniques and AI-powered gaming latency prediction solutions will drive the performance and experience such that edge-enabled gaming apps will continue to expand.

Market growth is driven by the growing demand for low-latency computing, the swift rollout of 5G networks, and the continuing expansion of IoT ecosystems. Some of the major industry players are concentrating on the edge computers powered by the AI-based technology, and energy-efficient server architectures as well as high performance, low-latency hardware solutions.

Major players like cloud service providers, telecoms, and hardware manufacturers are all driving new technology around next-gen, AI-powered edge analytics, real-time processing of data, and the use of all the current edge infrastructure to support a wide range of edge use cases.

Market Share Analysis by Key Players & Edge Server Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Dell Technologies | 20-24% |

| Hewlett Packard Enterprise (HPE) | 15-19% |

| Lenovo Group Ltd. | 10-14% |

| Cisco Systems, Inc. | 8-12% |

| NVIDIA Corporation | 6-10% |

| Other Edge Server Providers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Dell Technologies | The company has pioneered AI-optimized edge servers, higher data security, real-time analytics, and scalable hybrid cloud solutions. |

| Hewlett Packard Enterprise (HPE) | Focuses on energy-efficient edge computing, AI-powered workload automation, and 5G-enabled server solutions. |

| Lenovo Group Ltd. | Provides edge servers with AI acceleration, rugged designs for industrial IOT, and scalable edge-to-cloud connectivity. |

| Cisco Systems, Inc. | Concentrates on AI-powered edge networks, latency sensitive computing for smart cities, and secure edge server architecture. |

| NVIDIA Corporation | Provides real-time AI inferencing, GPU-accelerated edge servers, and AI-enhanced autonomous system processing. |

Key Market Insights

Dell Technologies (20-24%)

Dell Technologies, a leader in edge computing solutions, offers advanced, AI-optimized edge servers for high-performance and secure, real-time data processing enabling industrial automation and telecom workloads at the edge.

Hewlett Packard Enterprise (HPE) (15&ndash19%)

Hewlett Packard Enterprise (HPE) focuses on energy-efficient and sustainable edge server solutions with AI-trained workloads that can be workloads across 5G-enabled infrastructure and hybrid edge-cloud enterprise applications.

Lenovo Group Ltd. (10-14%)

Lenovo offers high performance edge computing options, such as AI accelerated, ruggedized industrial IoT servers and scalable edge storage for real time analytics.

Cisco Systems, Inc. (8-12%)

Cisco delivers AI-driven edge networking with solutions for secure, high-scalability edge computing to support smart cities, IoT deployments and 5G-enabled real-time data processing.

NVIDIA Corporation (6-10%)

As a powerhouse in accelerating GPU for edge, NVIDIA pioneered AI across a wide range of applications from real-time inferencing to AI analytics and autonomous edge computing.

Other Key Players (30-40% Combined)

Several emerging companies, cloud service providers, and hardware manufacturers contribute to next-generation edge server innovations, AI-powered computing advancements, and low-latency data processing, including:

The overall market size for the edge server market was USD 12,316 Million in 2025.

The edge server market is expected to reach USD 586,171 Million in 2035.

The demand for edge servers is expected to rise due to the expansion of iot ecosystems, increasing adoption of 5G networks, growing reliance on real-time data processing, and rising deployment in AI-driven applications such as autonomous vehicles and smart cities. Additionally, industries are increasingly shifting toward decentralized computing to enhance data security and reduce latency.

The top 5 countries driving the development of the edge server market are the USA, China, Germany, Japan, and South Korea.

Autonomous Vehicles and Gaming Applications are expected to command a significant share over the assessment period, driven by the need for ultra-low latency computing, enhanced AI processing, and real-time data analytics at the network edge.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 17: Global Market Attractiveness by Component, 2023 to 2033

Figure 18: Global Market Attractiveness by Application, 2023 to 2033

Figure 19: Global Market Attractiveness by End User, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 37: North America Market Attractiveness by Component, 2023 to 2033

Figure 38: North America Market Attractiveness by Application, 2023 to 2033

Figure 39: North America Market Attractiveness by End User, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 77: Europe Market Attractiveness by Component, 2023 to 2033

Figure 78: Europe Market Attractiveness by Application, 2023 to 2033

Figure 79: Europe Market Attractiveness by End User, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Component, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 99: South Asia Market Attractiveness by End User, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Component, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Component, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 139: Oceania Market Attractiveness by End User, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Component, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 157: MEA Market Attractiveness by Component, 2023 to 2033

Figure 158: MEA Market Attractiveness by Application, 2023 to 2033

Figure 159: MEA Market Attractiveness by End User, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Edge Security Market Size and Share Forecast Outlook 2025 to 2035

Edge Banders Market Size and Share Forecast Outlook 2025 to 2035

Edge AI for Smart Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Edge Bending Machine Market - Trends & Forecast 2025 to 2035

Leading Providers & Market Share in Edge Protector Manufacturing

Edge AI Market Trends – Growth, Demand & Forecast through 2034

Edge Data Centers Market

Hedge Shears Market Size and Share Forecast Outlook 2025 to 2035

Wedge Wire Screen Market Size and Share Forecast Outlook 2025 to 2035

Wedge Boots Market Growth - Trends & Demand Forecast to 2025 to 2035

Hedge Trimmers Market Growth - Trends & Forecast 2025 to 2035

Wedge Pressure Catheters Market

5G Edge Cloud Network and Services Market Size and Share Forecast Outlook 2025 to 2035

Knowledge Management Software Market Size and Share Forecast Outlook 2025 to 2035

Warm Edge Spacer Market Size and Share Forecast Outlook 2025 to 2035

Foam Edge Protectors Market Size and Share Forecast Outlook 2025 to 2035

Assessing Foam Edge Protectors Market Share & Industry Insights

Paper Edge Protector Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Key Players & Market Share in the Paper Edge Protectors Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA