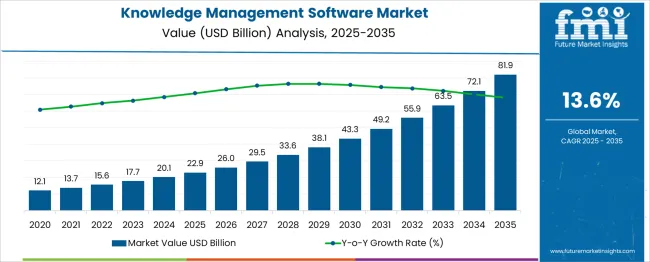

The global knowledge management software market is likely to grow from USD 22.9 billion in 2025 to approximately USD 81.9 billion by 2035, recording an absolute increase of USD 59.0 billion over the forecast period. This translates into a total growth of 257.9%, with the market forecast to expand at a CAGR of 13.6% between 2025 and 2035. The market size is expected to grow by nearly 3.6X during the same period, supported by increasing digital transformation initiatives, rising demand for collaborative work environments, and growing focus on organizational knowledge preservation and sharing.

Between 2025 and 2030, the knowledge management software market is projected to expand from USD 22.9 billion to USD 43.3 billion, resulting in a value increase of USD 20.4 billion, which represents 34.6% of the total forecast growth for the decade. This phase of growth will be shaped by accelerating digital workplace transformation, increasing adoption of remote and hybrid work models, and growing need for efficient knowledge sharing across distributed teams. Organizations are investing heavily in knowledge management solutions to capture, organize, and leverage institutional knowledge for improved productivity and innovation.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 22.9 billion |

| Forecast Value in (2035F) | USD 81.9 billion |

| Forecast CAGR (2025 to 2035) | 13.6% |

From 2030 to 2035, the market is forecast to grow from USD 43.3 billion to USD 81.9 billion, adding another USD 38.6 billion, which constitutes 65.4% of the ten-year expansion. This period is expected to be characterized by widespread adoption of artificial intelligence and machine learning capabilities in knowledge management platforms, integration of advanced analytics and automation features, and development of intelligent content discovery and recommendation systems. The growing focus on data-driven decision making and the need for seamless knowledge transfer in aging workforces will drive demand for sophisticated knowledge management solutions with enhanced search capabilities and personalized user experiences.

Between 2020 and 2025, the knowledge management software market experienced accelerated growth, driven by the global shift toward remote work, digital transformation acceleration, and increased focus on organizational resilience. The market evolved as organizations recognized the critical importance of effective knowledge management in maintaining business continuity and competitive advantage. The COVID-19 pandemic particularly highlighted the need for robust knowledge sharing platforms that could support distributed teams and preserve institutional knowledge during periods of workforce disruption.

Market expansion is being supported by the increasing recognition of knowledge as a strategic organizational asset and the corresponding demand for sophisticated platforms that can capture, organize, and leverage institutional knowledge effectively. Modern enterprises are increasingly focused on breaking down information silos, improving collaboration, and ensuring that critical knowledge is accessible to the right people at the right time. The growing complexity of business operations and the need for rapid decision-making are driving adoption of knowledge management solutions that can provide instant access to relevant information and expertise.

The acceleration of digital transformation initiatives across industries is creating unprecedented demand for knowledge management platforms that can integrate with existing enterprise systems and workflows. Organizations are seeking solutions that can automatically capture knowledge from various sources, including documents, conversations, and collaborative activities, while providing intelligent search and discovery capabilities. The rising importance of employee onboarding, training, and knowledge transfer in today's dynamic work environment is also contributing to increased adoption of comprehensive knowledge management platforms across different organizational sizes and sectors.

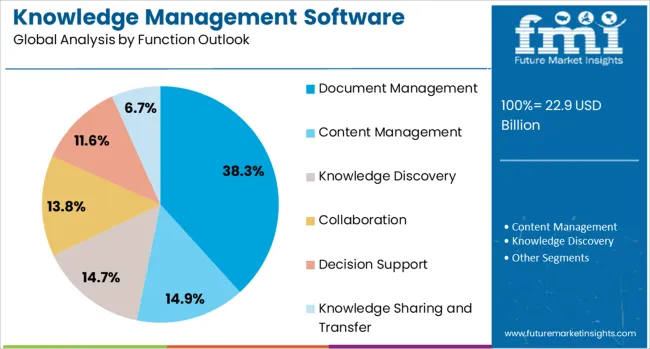

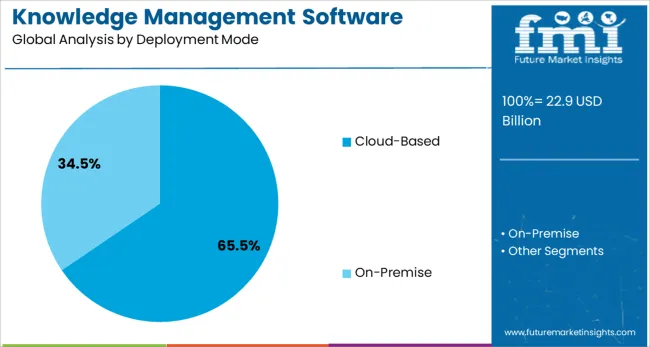

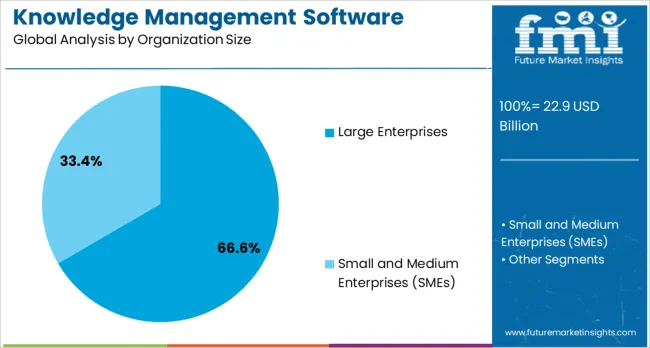

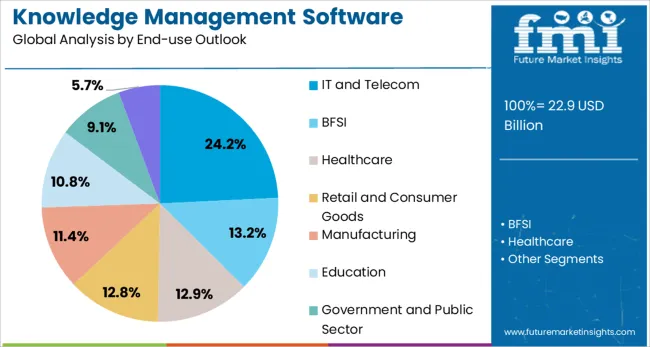

The market is segmented by component, deployment mode, function, organization size, end-use, and region. By component, the market is divided into software and services (professional services and managed services). Based on deployment mode, the market is categorized into cloud-based and on-premise solutions. In terms of function, the market is segmented into document management, content management, knowledge discovery, collaboration, decision support, and knowledge sharing and transfer. By organization size, the market is classified into large enterprises and small and medium enterprises (SMEs). By end-use, the market is divided into IT and telecom, BFSI, healthcare, retail and consumer goods, manufacturing, education, government and public sector, and others. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The document management function is projected to account for 38.3% of the knowledge management software market in 2025, reinforcing its position as the foundational capability for organizational knowledge systems. Document management serves as the cornerstone of knowledge management by providing structured storage, organization, and retrieval of critical business documents and information assets. Organizations increasingly recognize that effective document management is essential for regulatory compliance, operational efficiency, and knowledge preservation.

This function addresses the growing challenge of managing exponentially increasing volumes of digital content while ensuring version control, access security, and searchability. Advanced document management capabilities, including automated categorization, metadata extraction, and intelligent tagging, are becoming standard requirements for modern knowledge management platforms. The integration of AI-powered document analysis and content extraction features is further enhancing the value proposition of document management solutions, making them indispensable for organizations seeking to transform unstructured information into actionable knowledge assets.

Cloud-based deployment is projected to represent 65.5% of knowledge management software demand in 2025, highlighting the strong preference for scalable, flexible, and cost-effective knowledge management solutions. Organizations are gravitating toward cloud-based platforms for their ability to provide instant scalability, reduce infrastructure costs, and enable seamless access from anywhere, which is particularly important in today's distributed work environment. Cloud deployment offers automatic updates, enhanced security features, and integration capabilities that are essential for modern knowledge management initiatives.

The segment benefits from the growing confidence in cloud security and the recognition that cloud-based knowledge management platforms can provide better disaster recovery, data backup, and business continuity capabilities than on-premise solutions. Cloud platforms enable organizations to leverage advanced AI and machine learning capabilities without significant upfront investments in specialized hardware or technical expertise. As organizations continue to embrace hybrid and remote work models, cloud-based knowledge management solutions provide the flexibility and accessibility required to maintain effective knowledge sharing and collaboration across distributed teams.

Large enterprises are forecasted to contribute 66.6% of the knowledge management software market in 2025, reflecting their complex knowledge management requirements and substantial resources for implementing comprehensive knowledge management initiatives. Large organizations typically have vast amounts of institutional knowledge, complex organizational structures, and diverse knowledge sharing needs that require sophisticated platforms with advanced features and integration capabilities. These enterprises often deal with multiple departments, geographic locations, and diverse knowledge domains that necessitate robust knowledge management solutions.

The segment is characterized by demand for enterprise-grade features, including advanced security controls, custom workflows, extensive integration capabilities, and scalable architecture that can support thousands of users. Large enterprises also require comprehensive analytics and reporting capabilities to measure the effectiveness of their knowledge management initiatives and demonstrate return on investment. The growing focus on knowledge retention in large organizations, particularly as experienced employees retire, is driving investment in sophisticated knowledge capture and transfer solutions that can preserve critical institutional knowledge and expertise.

The IT and telecommunications sector is projected to account for 24.2% of the knowledge management software market in 2025, driven by the industry's heavy reliance on technical knowledge, rapid technology evolution, and complex problem-solving requirements. IT and telecom organizations require sophisticated knowledge management capabilities to manage technical documentation, troubleshooting guides, code repositories, and best practices that are essential for service delivery and innovation. The sector's focus on continuous learning and skill development also drives demand for knowledge sharing platforms that can facilitate expertise transfer and collaborative problem-solving.

This segment benefits from the industry's early adoption of digital technologies and comfort with cloud-based solutions, making IT and telecom organizations natural early adopters of advanced knowledge management platforms. The growing complexity of IT infrastructure, cybersecurity challenges, and the need for rapid incident resolution are creating strong demand for knowledge management solutions that can provide instant access to relevant technical information and expert guidance. As IT and telecom organizations continue to expand their service offerings and embrace emerging technologies, the need for effective knowledge management becomes increasingly critical for maintaining competitive advantage and operational excellence.

The knowledge management software market is advancing rapidly due to increasing digital transformation initiatives and growing recognition of knowledge as a strategic asset. The market faces challenges including user adoption barriers, integration complexity with legacy systems, and concerns about information security and privacy. Innovation in artificial intelligence, automation capabilities, and user experience design continues to influence product development and market expansion patterns.

The incorporation of AI and ML technologies is transforming knowledge management platforms by enabling intelligent content discovery, automated tagging and categorization, and personalized knowledge recommendations. AI-powered features such as natural language processing, semantic search, and predictive analytics are enhancing the ability of knowledge management systems to understand context, identify relationships between information, and proactively surface relevant knowledge to users. These technologies are also enabling automated knowledge extraction from various sources, including documents, emails, and collaboration platforms.

Modern knowledge management software vendors are prioritizing user experience design to overcome traditional adoption challenges and ensure widespread organizational acceptance. Platforms are incorporating consumer-grade interfaces, mobile responsiveness, and social collaboration features that make knowledge sharing feel natural and engaging. The integration of gamification elements, personalized dashboards, and intelligent notifications is helping organizations drive user engagement and encourage active participation in knowledge management initiatives.

Organizations are increasingly demanding analytics capabilities that can measure the effectiveness and impact of their knowledge management investments. Advanced platforms are incorporating analytics features that can track knowledge usage patterns, identify knowledge gaps, measure collaboration effectiveness, and demonstrate the business value of knowledge management initiatives. These capabilities are helping organizations optimize their knowledge management strategies and justify continued investment in these platforms.

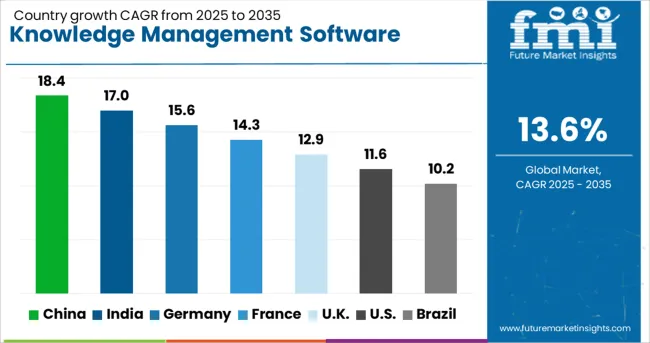

| Countries | CAGR (2025-2035) |

|---|---|

| India | 17% |

| China | 18.4% |

| Brazil | 10.2% |

| Germany | 15.6% |

| France | 14.3% |

| UK | 12.9% |

| USA | 11.6% |

The knowledge management software market is experiencing robust growth globally, with China leading at an 18.4% CAGR through 2035, driven by massive digital transformation investments, government digitization initiatives, and growing focus on innovation management. India follows at 17%, supported by its expanding IT services sector and growing knowledge-based industries. Germany shows strong growth at 15.6%, emphasizing manufacturing knowledge management and Industry 4.0 initiatives. France records 14.3% growth, focusing on knowledge management in luxury brands and professional services. The UK demonstrates 12.9% growth, driven by financial services and consulting sectors. The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from knowledge management software in China is projected to exhibit exceptional growth with a CAGR of 18.4% through 2035, driven by massive digital transformation initiatives across state-owned enterprises and private corporations. The country's focus on becoming a knowledge-based economy and its investments in artificial intelligence and automation are creating unprecedented demand for sophisticated knowledge management platforms. Major Chinese corporations are implementing comprehensive knowledge management systems to support their global expansion and complex supply chain operations.

Revenue from knowledge management software in India is expanding at a CAGR of 17%, supported by the country's position as a global IT services hub and growing focus on knowledge-intensive industries. Indian IT companies and business process outsourcing firms are investing heavily in knowledge management platforms to improve service delivery, capture best practices, and enhance client collaboration. The country's large pool of knowledge workers and growing startup ecosystem are creating strong demand for collaborative knowledge sharing solutions.

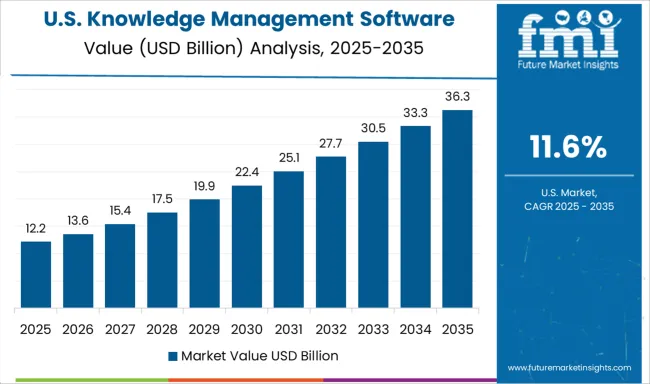

Demand for knowledge management software in the USA is projected to grow at a CAGR of 11.6%, supported by advanced AI integration requirements and sophisticated analytics capabilities. American organizations are leading the adoption of next-generation knowledge management platforms that incorporate machine learning, natural language processing, and predictive analytics. The focus on knowledge-driven decision making and the need for competitive intelligence are driving investments in comprehensive knowledge management ecosystems.

Revenue from knowledge management software in Germany is projected to grow at a CAGR of 15.6% through 2035, driven by the country's manufacturing leadership and Industry 4.0 initiatives. German manufacturers are implementing sophisticated knowledge management systems to capture and transfer technical expertise, support continuous improvement initiatives, and enable efficient knowledge sharing across global operations. The country's focus on engineering excellence and quality management is creating demand for specialized knowledge management solutions.

Revenue from knowledge management software in France is projected to grow at a CAGR of 14.3% through 2035, supported by strong demand from luxury brands, consulting firms, and financial services organizations. French companies are investing in knowledge management platforms that can support brand heritage preservation, client relationship management, and service excellence initiatives. The country's focus on cultural and intellectual property preservation is driving adoption of comprehensive knowledge management solutions.

Revenue from knowledge management software in the UK is projected to grow at a CAGR of 12.9% through 2035, driven by strong demand from financial services, consulting, and professional services organizations. British companies are implementing knowledge management solutions to support regulatory compliance, risk management, and client service excellence. The country's position as a global financial center is creating demand for sophisticated knowledge management capabilities that can support complex decision-making processes.

Revenue from knowledge management software in Brazil is projected to grow at a CAGR of 10.2% through 2035, supported by expanding digital economy initiatives and growing technology adoption across various sectors. Brazilian organizations are increasingly recognizing the importance of knowledge management for competitive advantage and operational efficiency. The country's large and diverse economy is creating demand for knowledge management solutions that can support complex organizational structures and multi-location operations.

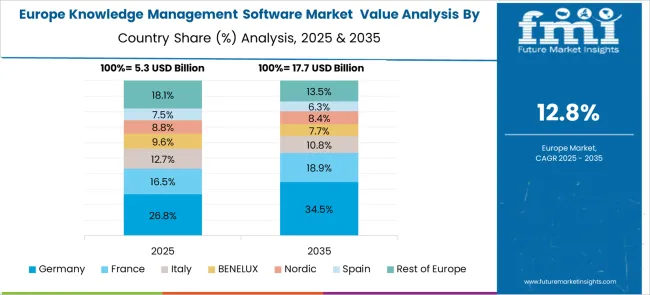

The European knowledge management software market demonstrates sophisticated development across major economies with Germany leading through its precision engineering excellence and advanced enterprise software capabilities, supported by companies like Microsoft Corporation and Atlassian Corporation pioneering comprehensive knowledge management solutions with focus on manufacturing applications while emphasizing Industry 4.0 integration and operational efficiency. The UK shows strength in financial services and regulatory compliance, with companies specializing in knowledge management platforms that meet strict data protection standards and provide consistent knowledge sharing outcomes for professional services.

France contributes through companies delivering integrated collaboration solutions and content management systems for luxury brands and consulting applications. Italy, Spain, and Nordic countries demonstrate growth in specialized knowledge management solutions for traditional industries and premium business applications. The market benefits from stringent EU data protection regulations, established enterprise software infrastructure, and growing focus on digital transformation methods and cloud-based knowledge solutions. Strong engineering capabilities and focus on innovation position Europe as a key center for advanced knowledge management technologies requiring superior performance, regulatory compliance, and data security across diverse organizational applications.

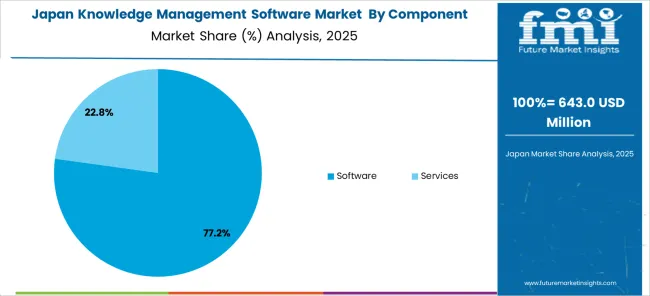

The Japanese knowledge management software market demonstrates steady growth driven by precision enterprise focus, advanced digital transformation technologies, and organizational preference for high-quality knowledge systems that ensure superior information consistency and compliance throughout business operations. Companies like Microsoft Corporation and other international suppliers establish presence through cutting-edge knowledge management technologies that align with Japan's sophisticated enterprise culture and stringent quality standards while incorporating IoT integration and smart workplace capabilities. The market emphasizes automated knowledge capture systems, precision document management excellence, and collaborative innovations that reflect Japanese organizational precision and attention to detail in information management processes.

Growing investment in digital workplace technologies supports intelligent knowledge systems with real-time monitoring, predictive analytics, and optimized information access for enhanced operational efficiency. Japanese organizations prioritize system reliability, consistent knowledge outcomes, and user experience efficiency, creating opportunities for premium knowledge management solutions that deliver exceptional performance and long-term organizational value across manufacturing, technology, and professional services requiring the highest information management standards.

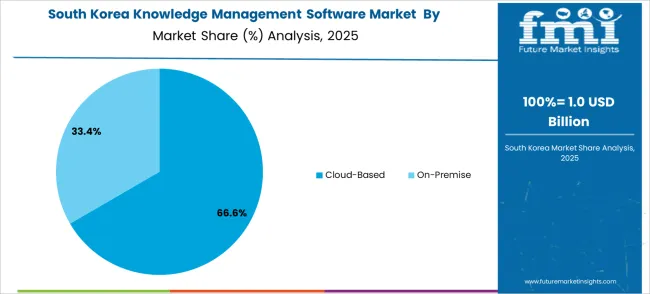

The South Korean knowledge management software market shows emerging growth potential driven by expanding technology industry, increasing adoption of digital workplace technologies, and growing organizational demand for efficient knowledge sharing requiring sophisticated and collaborative information management solutions. The market benefits from South Korea's technological advancement capabilities and increasing focus on digital competitiveness that drives investment in modern knowledge management platforms meeting international quality standards and collaborative requirements. Korean organizations increasingly adopt automatic knowledge capture modes, advanced document management systems, and integrated collaboration platforms to improve organizational efficiency and information consistency while ensuring knowledge security compliance.

Growing influence of Korean technology companies in global markets supports demand for sophisticated knowledge management solutions that ensure operational excellence while maintaining cost-effectiveness and system reliability. The integration of smart workplace principles and advanced enterprise technologies creates opportunities for intelligent knowledge systems with IoT connectivity, predictive maintenance capabilities, and real-time collaboration optimization. Rising digital workplace awareness and organizational modernization drive adoption of advanced knowledge management solutions that combine operational efficiency with comprehensive information governance across diverse business applications.

The knowledge management software market is characterized by intense competition among established enterprise software vendors, specialized knowledge management providers, and emerging AI-powered platforms. Companies are investing in artificial intelligence integration, user experience enhancement, mobile capabilities, and industry-specific solutions to deliver comprehensive, accessible, and effective knowledge management platforms. Product innovation, strategic partnerships, and market expansion are central to strengthening competitive positions and expanding market presence.

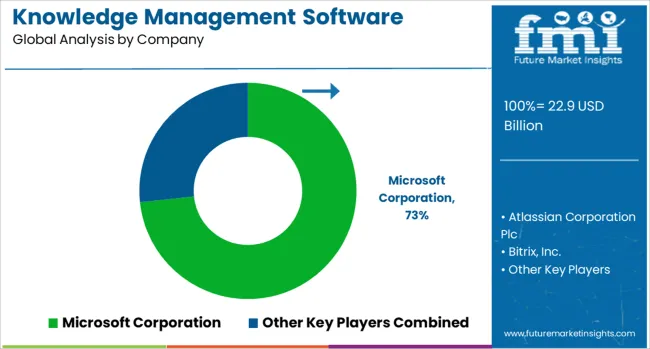

Microsoft Corporation leads the market with a 7.3% global value share, leveraging its comprehensive Microsoft 365 ecosystem and SharePoint platform to provide integrated knowledge management capabilities. The company's strong enterprise presence and continuous innovation in AI and collaboration tools position it as a dominant force in the knowledge management space. Atlassian Corporation Plc holds a significant position through its Confluence platform, which has become synonymous with team collaboration and knowledge sharing in technology organizations.

Bitrix Inc. provides comprehensive business collaboration platforms with integrated knowledge management capabilities, focusing on small and medium enterprises. Bloomfire Inc. specializes in knowledge sharing and social collaboration platforms designed for enterprise knowledge management needs. Document360 (Kovai.co) offers specialized documentation and knowledge base solutions primarily targeting software companies and technical teams. eXo Platform SAS provides open-source collaboration and knowledge management platforms with strong customization capabilities.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 22.9 Billion |

| Component | Software, Services (Professional Services, Managed Services) |

| Deployment Mode | Cloud-Based, On-Premise |

| Function | Document Management, Content Management, Knowledge Discovery, Collaboration, Decision Support, Knowledge Sharing, and Transfer |

| Organization Size | Large Enterprises, Small and Medium Enterprises (SMEs) |

| End-Use | IT and Telecom, BFSI, Healthcare, Retail and Consumer Goods, Manufacturing, Education, Government and Public Sector, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Microsoft Corporation, Atlassian Corporation Plc, Bitrix Inc., Bloomfire Inc., Document360 (Kovai.co), eXo Platform SAS, Guru Technologies Inc., Helpjuice Inc., Igloo, Inc., M-Files Corporation |

| Additional Attributes | Market size by deployment model and pricing strategy, regional adoption trends, competitive landscape analysis, buyer preferences for cloud versus on-premise solutions, integration capabilities with enterprise systems, innovations in AI and machine learning, user experience design, and industry-specific customization options |

The global knowledge management software market is estimated to be valued at USD 22.9 billion in 2025.

The market size for the knowledge management software market is projected to reach USD 81.9 billion by 2035.

The knowledge management software market is expected to grow at a 13.6% CAGR between 2025 and 2035.

The key product types in knowledge management software market are software, services, professional services and managed services.

In terms of deployment mode, cloud-based segment to command 65.5% share in the knowledge management software market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Cash Management Services Market – Trends & Forecast 2025 to 2035

CAPA Management (Corrective Action / Preventive Action) Market

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Exam Management Software Market

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Labor Management System In Retail Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Stool Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Power Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA