The global waste management market is projected to grow from USD 1.5 trillion in 2025 to approximately USD 2.5 trillion by 2035, recording an absolute increase of USD 1.01 trillion over the forecast period. This translates into a total growth of 67.6%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.3% between 2025 and 2035. The market size is expected to grow by nearly 1.68X during the same period, supported by the rising urbanization rates globally and increasing demand for comprehensive waste management services across industrial and municipal sectors.

Between 2025 and 2030, the Waste Management market is projected to expand from USD 1.5 trillion to USD 1.91 trillion, resulting in a value increase of USD 410 billion, which represents 40.6% of the total forecast growth for the decade. This phase of growth will be shaped by rising urbanization rates, increasing industrial waste generation requiring specialized collection and disposal services, and growing environmental regulations driving demand for comprehensive waste management solutions. Companies are expanding their service capabilities to address the growing complexity of modern waste streams and regulatory compliance requirements.

From 2030 to 2035, the market is forecast to grow from USD 1.91 trillion to USD 2.5 trillion, adding another USD 600 billion, which constitutes 59.4% of the ten-year expansion. This period is expected to be characterized by expansion of recycling and circular economy initiatives, integration of advanced waste processing technologies, and development of waste management practices across different industrial sectors. The growing adoption of waste-to-energy technologies and comprehensive environmental compliance programs will drive demand for more sophisticated waste management services and specialized technical expertise.

Between 2020 and 2025, the Waste Management market experienced steady expansion, driven by increasing waste generation rates and growing awareness of environmental protection requirements. The market developed as municipalities and industrial facilities recognized the need for professional waste management services to meet regulatory compliance and operational efficiency goals. Environmental agencies and waste generators began emphasizing comprehensive waste management protocols to maintain environmental standards and reduce disposal costs.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.5 trillion |

| Forecast Value in (2035F) | USD 2.5 trillion |

| Forecast CAGR (2025 to 2035) | 5.3% |

Market expansion is being supported by the rapid increase in waste generation rates worldwide and the corresponding need for efficient waste collection, transportation, and disposal services to address growing environmental challenges. Modern industrial operations and urban developments rely on comprehensive waste management systems to ensure proper handling of diverse waste streams while maintaining environmental compliance and operational efficiency. Even minor improvements in waste management processes can result in significant cost savings and environmental benefits for municipalities and industrial facilities.

The growing complexity of waste streams and increasing environmental regulations are driving demand for specialized waste management services from certified providers with appropriate equipment and technical expertise. Environmental agencies are increasingly requiring comprehensive documentation of waste handling processes and disposal methods to maintain regulatory compliance and ensure environmental protection. Waste management specifications and regulatory standards are establishing standardized handling protocols that require specialized equipment and validated disposal capabilities.

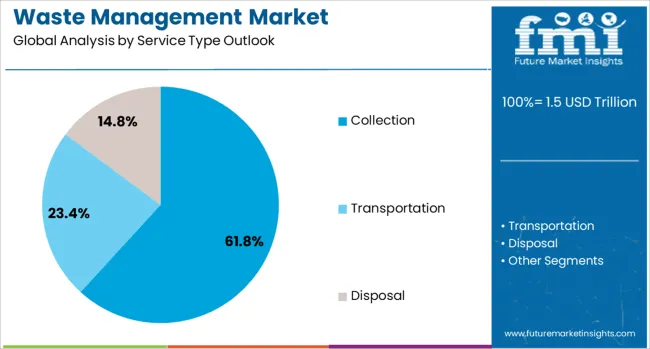

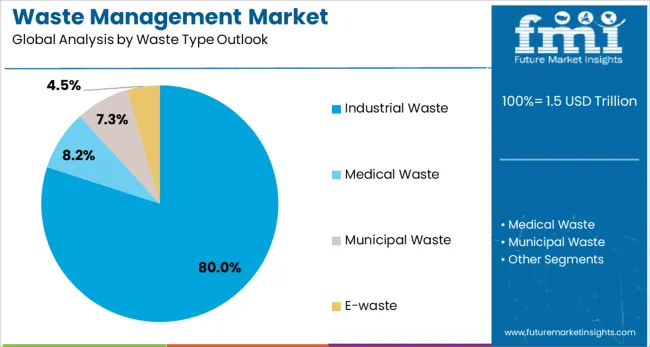

The market is segmented by service type outlook, waste type outlook, and region. By service type outlook, the market is divided into collection, transportation, disposal, and e-waste services. Based on waste type outlook, the market is categorized into industrial waste, medical waste, municipal waste, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Collection services are projected to account for 61.8% of the Waste Management market in 2025. This leading share is supported by the fundamental role of collection services in comprehensive waste management systems and the growing demand for regular waste pickup services across residential, commercial, and industrial sectors. Collection services provide the essential first step in waste management processes, enabling proper segregation and transportation of different waste types to appropriate treatment and disposal facilities. The segment benefits from established collection routes and comprehensive service coverage across urban and rural areas.

Industrial waste is expected to represent 80.0% of waste management demand in 2025. This dominant share reflects the substantial volume of waste generated by industrial facilities and the specialized handling requirements for industrial waste streams. Modern industrial operations produce diverse waste types that require professional management services to ensure regulatory compliance and environmental protection. The segment benefits from increasing industrial production rates and growing focus on waste management practices across manufacturing sectors.

The Waste Management market is advancing steadily due to increasing waste generation rates and growing recognition of the importance of environmental protection. The market faces challenges, including rising disposal costs, the need for continuous infrastructure investment, and varying regulatory requirements across different regions and waste types. Environmental compliance programs and efficiency improvement initiatives continue to influence service development and market adoption patterns.

The growing development of recycling programs and circular economy approaches is enabling increased resource recovery while reducing landfill disposal requirements for municipalities and industrial facilities. Advanced sorting and processing technologies provide improved material recovery rates and support development of secondary raw material markets. These initiatives are particularly valuable for industrial facilities and municipalities that seek to reduce disposal costs while contributing to environmental sustainability goals.

Modern waste management companies are incorporating advanced tracking systems and route optimization technologies that improve collection efficiency and reduce operational costs. Integration of real-time monitoring systems and automated scheduling capabilities enables optimized collection routes and comprehensive service documentation. Advanced technology also supports the development of customized waste management programs for specific customer requirements and regulatory compliance needs.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5 % |

| USA | 4.5% |

| Brazil | 4 % |

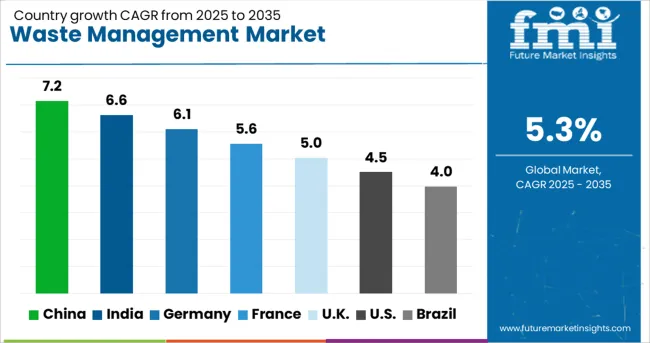

The waste management market demonstrates strong growth patterns across key regions, with China leading at 7.2% CAGR through 2035, driven by expanding urbanization and increasing industrial waste generation requirements. India follows at 6.6%, supported by growing waste management infrastructure investment and regulatory framework development. Germany records 6.1% growth, emphasizing advanced waste processing technologies and circular economy capabilities, while France shows 5.6% expansion through waste management facility modernization programs. The UK demonstrates 5 % growth through environmental regulation compliance initiatives, the USA shows 4.5% driven by infrastructure replacement activities, and Brazil records 4 % supported by waste management infrastructure development efforts.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

Revenue from waste management in China is projected to exhibit the highest growth rate with a CAGR of 7.2% through 2035, driven by rapid urbanization and increasing industrial waste generation requiring comprehensive management services. The country's expanding manufacturing sector and urban development programs are creating significant demand for advanced waste collection, transportation, and disposal systems. Municipal authorities and industrial facilities are establishing comprehensive waste management capabilities to support both environmental compliance and operational efficiency requirements across diverse waste streams.

Government environmental protection programs support establishment of modern waste management facilities that meet environmental standards and waste processing requirements for development. Industrial waste management initiatives facilitate adoption of advanced waste processing technologies that support comprehensive treatment capabilities across major manufacturing regions.

Revenue from waste management in India is expanding at a CAGR of 6.6%, supported by increasing urbanization rates and growing industrial waste generation requiring professional management services. The country's expanding urban population and increasing industrial production are driving demand for efficient waste collection systems and disposal solutions. Municipal corporations and industrial facilities are gradually establishing comprehensive waste management capabilities to serve growing waste generation requirements.

Waste management infrastructure development programs and urban expansion create opportunities for specialized waste management providers that can support diverse waste streams and regulatory compliance requirements. Professional training and technical development programs enhance operational expertise among waste management facilities, enabling comprehensive service delivery that meets quality standards.

Demand for waste management in Germany is projected to grow at a CAGR of 6.1%, supported by the country's focus on circular economy principles and advanced waste processing capabilities. German waste management companies are implementing comprehensive recycling systems that meet stringent environmental standards and resource recovery requirements for industrial and municipal applications. The market is characterized by focus on technological advancement, green practices, and compliance with comprehensive environmental protection regulations.

Waste management industry investments prioritize advanced processing technologies that demonstrate superior resource recovery performance while meeting German environmental quality standards. Professional certification programs ensure comprehensive technical expertise among facility operators, enabling specialized waste processing applications that support diverse waste stream requirements.

Revenue from waste management in France is growing at a CAGR of 5.6%, driven by ongoing waste management facility upgrades and increasing circular economy investments in resource recovery capabilities. The country's established waste management infrastructure and growing focus on recycling applications are creating demand for advanced waste processing systems and optimized collection solutions. Municipal authorities and waste management companies are investing in modern processing technology to support comprehensive waste management programs.

Waste management infrastructure modernization facilitates adoption of advanced processing technologies that support comprehensive waste treatment capabilities across major collection and processing centers. Technical development programs enhance waste management expertise among facility operators, enabling specialized processing procedures that meet evolving environmental requirements.

Market Overview of Waste Management in the UK

Demand for waste management in the UK is expanding at a CAGR of 5 %, driven by continued environmental regulation compliance and waste management innovation activities. The country's established waste management infrastructure and growing investment in waste processing are creating demand for specialized waste management systems and advanced processing capabilities. Waste management companies and municipal authorities are establishing comprehensive waste processing capabilities to maintain regulatory compliance in environmental protection requirements.

Environmental compliance investments prioritize advanced waste management applications that support regulatory requirements while maintaining operational efficiency and cost effectiveness. Industry and regulatory collaboration programs facilitate technology advancement and expertise development that enhance waste management capabilities across processing networks.

Opportunities and Trends in Waste Management in the USA

Demand for waste management in the USA. is expanding at a CAGR of 4.5%, driven by increasing waste management infrastructure replacement and growing focus on standardized collection processes for municipal and industrial applications. Large waste management companies and municipal authorities are establishing comprehensive waste management programs to serve diverse waste generation requirements. The market benefits from regulatory agency requirements for environmental compliance and waste processing documentation following infrastructure modernization activities.

Waste management industry consolidation enables standardized service delivery across multiple collection and processing facilities, providing consistent waste processing quality and comprehensive regulatory compliance throughout service networks. Professional training and certification programs develop specialized technical expertise among facility operators, enabling comprehensive waste management capabilities that support evolving processing requirements.

Revenue from waste management in Brazil is growing at a CAGR of 4 %, driven by increasing waste management infrastructure modernization and growing urban waste generation requiring professional management services. The country's expanding urban population and increasing industrial production are creating opportunities for waste management providers and processing system suppliers. Municipal authorities and waste management companies are gradually integrating advanced waste processing technologies to support comprehensive waste management programs.

Waste management infrastructure modernization facilitates adoption of advanced waste processing technologies that support comprehensive collection and disposal capabilities across major urban and industrial regions. Professional service development programs enhance technical capabilities among waste management facilities, enabling specialized waste processing applications that meet evolving environmental and operational requirements.

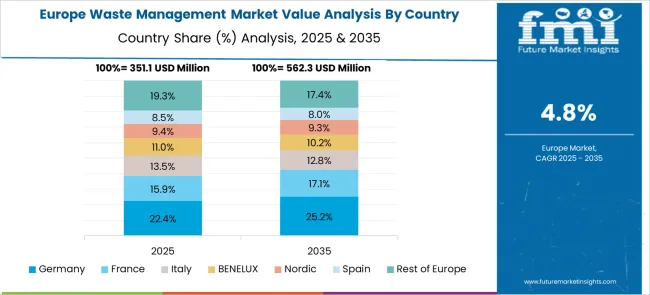

The Waste Management market in Europe is projected to grow steadily over the forecast period, with established waste management infrastructure and environmental regulations driving consistent demand for comprehensive waste services. Germany is expected to maintain market leadership supported by its advanced waste processing capabilities and stringent environmental compliance requirements. The European market demonstrates strong focus on circular economy principles and comprehensive waste management technologies, particularly in industrial waste processing applications and municipal waste collection programs. Germany's leadership position reflects its robust waste management infrastructure and advanced environmental regulations, while France's substantial market presence indicates significant investment in waste processing modernization and recycling capabilities.

European waste management demand patterns show concentration in high-performance processing applications, with collection and disposal services representing dominant service segments across major markets. The region's strict environmental regulatory frameworks and waste management standards drive preference for certified waste management providers, supporting comprehensive service adoption and specialized technical relationships. Germany's industrial waste processing and recycling clusters, France's waste infrastructure modernization programs, and the United Kingdom's environmental compliance activities collectively establish Europe as a critical market for advanced waste management technologies. Regional sustainability initiatives and technical expertise development continue to strengthen European market position in global waste management and environmental protection applications.

The waste management market is defined by competition among specialized waste service providers, environmental services companies, and integrated waste management operators. Companies are investing in advanced collection and processing technologies, waste treatment methods, regulatory compliance capabilities, and comprehensive service portfolios to deliver reliable, cost-effective, and environmentally compliant waste management solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening service capabilities and market presence in the evolving waste management and environmental services landscape.

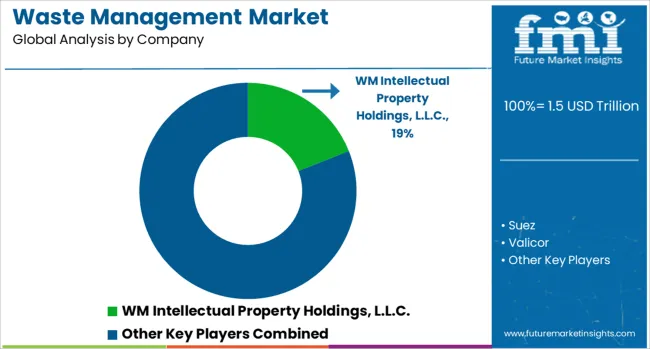

Major players in the market include WM Intellectual Property Holdings L.L.C., recognized for comprehensive waste management services and extensive collection network capabilities. Suez offers specialized waste treatment systems with focus on industrial and municipal applications. Valicor provides diverse waste management solutions for commercial and industrial clients. Veolia emphasizes integrated environmental services and waste processing technologies, while Waste Connections focuses on comprehensive waste collection and disposal services. Additional market participants include Republic Services, Biffa, Clean Harbors Inc., Reworld Holding Corporation, and Daiseki Co. Ltd., each contributing specialized expertise in waste management services and supporting infrastructure for municipal, industrial, and specialized waste processing applications.

| Item | Value |

| Quantitative Units | USD 1.5 trillion |

| Service Type | Collection, Transportation, Disposal |

| Waste Type | Industrial Waste, Medical Waste, Municipal Waste, E-waste |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | WM Intellectual Property Holdings, L.L.C.; Suez; Valicor; Veolia; Waste Connections; Republic Services; Biffa; Clean Harbors, Inc.; Reworld Holding Corporation; Daiseki Co., Ltd. |

| Additional Attributes | Dollar sales by service type and waste type, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established players and emerging service providers, adoption of advanced processing technologies and resource recovery systems, integration with digital waste tracking and management platforms, innovations in waste-to-energy facilities and circular economy initiatives, and development of comprehensive recycling systems with advanced sorting and processing capabilities. |

Collection

Transportation

Disposal

E-waste

Industrial Waste

Medical Waste

Municipal Waste

Others

United States

Canada

Mexico

Germany

United Kingdom

France

Italy

Spain

Nordic

BENELUX

Rest of Europe

China

Japan

South Korea

India

ASEAN

Australia & New Zealand

Rest of South Asia & Pacific

Brazil

Chile

Rest of Latin America

Kingdom of Saudi Arabia

Other GCC Countries

Turkiye

South Africa

Other African Union

Rest of Middle East & Africa

The global waste management market is estimated to be valued at USD 1.5 trillion in 2025.

The market size for the waste management market is projected to reach USD 2.5 trillion by 2035.

The waste management market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in waste management market are collection, transportation and disposal.

In terms of waste type outlook, industrial waste segment to command 80.0% share in the waste management market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Waste Management Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

E-Waste Management Market Growth - Trends & Forecast 2025 to 2035

Food Waste Management Market Analysis - Size, Share, and Forecast 2025 to 2035

Fish Waste Management Market Analysis by Source and End Use Industry Through 2035

Smart Waste Management Market Growth - Trends & Forecast 2025 to 2035

Liquid Waste Management Market

The Medical Waste Management System Market is segmented by Medical Waste Treatment, and Disposable Medical Waste Management from 2025 to 2035

Demand for Food Waste Management in EU Size and Share Forecast Outlook 2025 to 2035

Municipal Solid Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Onshore Drilling Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Containment and Handling Drilling Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Waste Heat Power Generation Boiler Market Size and Share Forecast Outlook 2025 to 2035

Waste Wood Recycling Market Size and Share Forecast Outlook 2025 to 2035

Waste-derived Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Wastewater Heavy Metal Treatment Agent Market Size and Share Forecast Outlook 2025 to 2035

Wastewater Treatment Aerators Market Size and Share Forecast Outlook 2025 to 2035

Waste Heat To Power Market Size and Share Forecast Outlook 2025 to 2035

Waste to Energy Market Growth - Trends & Forecast 2025 to 2035

Waste Recycling Services Market by Application, Product Type, and Region - Growth, Trends, and Forecast 2025 to 2035

Waste Wrap Film Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA