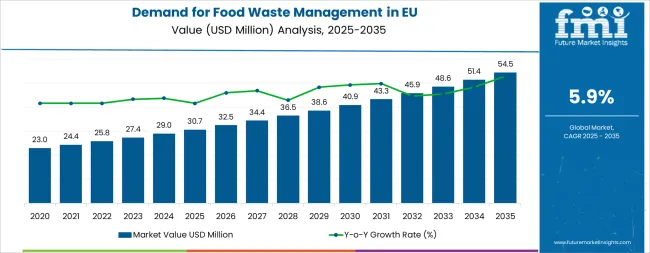

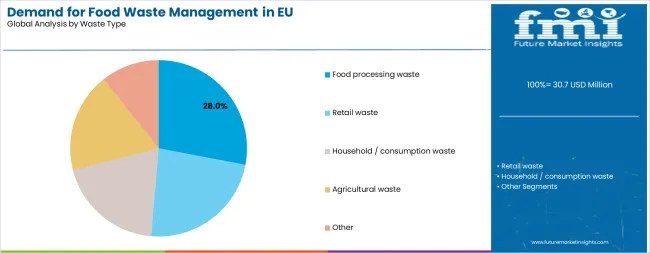

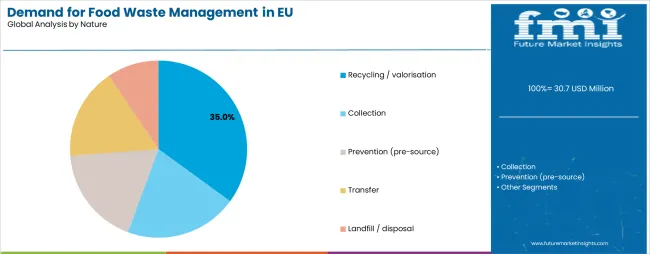

The European food waste management industry is projected to grow from USD 30.7 million in 2025 to USD 54.5 million by 2035, advancing at a CAGR of 5.9%. The recycling/valorisation segment is expected to lead sales with a 35% share in 2025, while food processing waste is anticipated to account for 28% of the waste type segment.

European Union food waste management sales are projected to grow from USD 30.7 million in 2025 to approximately USD 54.5 million by 2035, recording an absolute increase of USD 23.8 million over the forecast period. This translates into total growth of 77.5%, with demand forecast to expand at a compound annual growth rate (CAGR) of 5.9% between 2025 and 2035. The overall industry size is expected to grow by nearly 1.8X during the same period, supported by the strengthening regulatory frameworks for waste reduction, increasing corporate sustainability commitments, and developing infrastructure across recycling, composting, and anaerobic digestion facilities throughout European operations.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 30.7 million |

| Market Forecast Value (2035) | USD 54.5 million |

| Forecast CAGR (2025-2035) | 5.9% |

Between 2025 and 2030, EU food waste management demand is projected to expand from USD 30.7 million to USD 40.8 million, resulting in a value increase of USD 10.1 million, which represents 42.4% of the total forecast growth for the decade. This phase of development will be shaped by strengthening EU regulatory frameworks, including waste reduction targets, increasing corporate adoption of circular economy principles, and growing investment in waste processing infrastructure across member states. Service providers are expanding their technological capabilities to address evolving requirements for food waste tracking, valorisation technologies, and integrated waste management solutions.

From 2030 to 2035, sales are forecast to grow from USD 40.8 million to USD 54.5 million, adding another USD 13.7 million, which constitutes 57.6% of the overall ten-year expansion. This period is expected to be characterized by further development of digital waste tracking platforms, integration of advanced valorisation technologies converting food waste into high-value products, and expansion of circular economy business models connecting waste generators with resource recovery facilities. The growing emphasis on zero-waste initiatives and increasing regulatory penalties for landfill disposal will drive demand for comprehensive food waste management services.

Between 2020 and 2025, EU food waste management sales experienced steady expansion at a CAGR of 5.8%, growing from USD 23.2 million to USD 30.7 million. This period was driven by the initial implementation of EU waste framework directives, growing corporate sustainability reporting requirements, and increasing awareness of food waste's environmental and economic impacts. The industry developed as specialized waste management companies and traditional waste processors recognized the commercial potential of food waste valorisation. Infrastructure investments, technological innovations in organic waste processing, and regulatory compliance requirements began establishing the foundation for comprehensive food waste management systems.

Industry expansion is being supported by the strengthening European Union regulatory frameworks targeting food waste reduction across the entire supply chain and the corresponding demand for professional waste management services with proven environmental and economic benefits. Modern food manufacturers, retailers, and hospitality operators rely on specialized food waste management services to achieve regulatory compliance, meet corporate sustainability targets, and convert waste disposal costs into resource recovery opportunities, driving demand for solutions that deliver measurable waste diversion, transparent reporting, and valorisation outcomes. Even moderate sustainability commitments, such as corporate social responsibility initiatives, investor ESG requirements, or brand reputation management, can drive comprehensive adoption of professional food waste management to demonstrate environmental stewardship and operational efficiency.

The growing awareness of food waste's climate impact and increasing recognition of organic waste's greenhouse gas emissions when landfilled are driving demand for valorisation services from certified processors with appropriate environmental credentials and regulatory compliance. Regulatory authorities are increasingly establishing mandatory reporting requirements for food waste generation, implementing landfill diversion targets, and enforcing penalties for non-compliance to accelerate circular economy transitions. Scientific studies and lifecycle assessments are providing evidence supporting food waste valorisation's environmental advantages and economic viability, requiring specialized collection logistics, processing infrastructure, and standardized protocols for converting food waste into compost, biogas, animal feed, and bio-based materials.

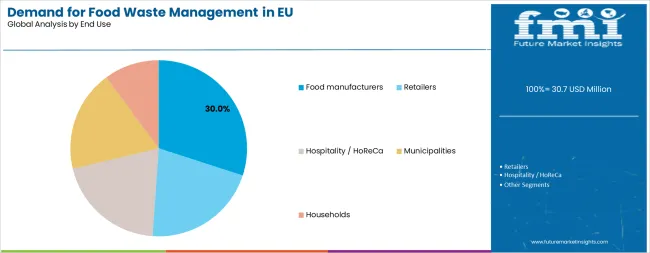

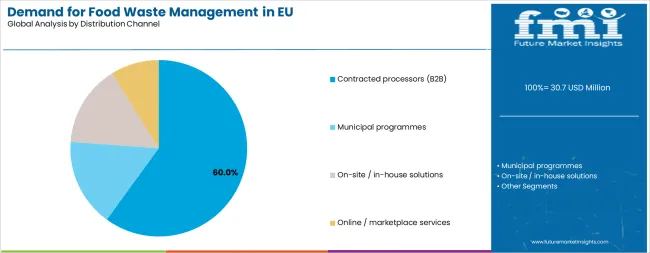

Sales are segmented by service/process type, waste type, end-use application, distribution channel, service nature, and country. By service/process, demand is divided into recycling/valorisation, composting, anaerobic digestion, and landfill diversion/other. Based on waste type, sales are categorized into food processing waste, retail waste, household/consumption waste, agricultural waste, and other. In terms of end-use application, demand is segmented into food manufacturers, retailers, hospitality/HoReCa, municipalities, and households. By distribution channel, sales cover contracted processors (B2B), municipal programmes, on-site/in-house solutions, and online/marketplace services. By service nature, sales are classified into prevention, collection, transfer, recycling/valorisation, and landfill/disposal. Regionally, demand covers Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

Food processing waste is positioned to represent 28% of total food waste management demand across European operations in 2025, maintaining this substantial share through 2035, reflecting the segment's dominance as the largest and most consistent waste stream within commercial food waste generation. This considerable share directly demonstrates that food manufacturing and processing facilities represent the primary source of concentrated, consistent food waste volumes requiring professional management services, including vegetable trimmings, meat processing byproducts, dairy waste, and production line rejects.

Modern food processors increasingly view waste management as integral to operational efficiency rather than a disposal problem, driving demand for integrated services that optimize waste segregation, maximize valorisation rates, and provide transparent documentation supporting sustainability reporting and regulatory compliance. The segment benefits from concentrated waste generation at centralized facilities, relatively homogeneous waste streams enabling efficient processing, and established business relationships between processors and waste management providers, facilitating long-term service contracts.

The segment's stable share reflects proportional growth across all waste type categories, with food processing waste maintaining its leading position as the primary commercial waste stream throughout the forecast period.

Food manufacturers are expected to control 30% of total European food waste management sales in 2025, maintaining this position through 2035, reflecting the critical importance of the manufacturing sector's compliance with evolving waste regulations and corporate sustainability commitments. European food manufacturers consistently demonstrate strong demand for professional waste management services that provide comprehensive solutions, including on-site segregation support, scheduled collection logistics, processing documentation, and sustainability reporting data supporting corporate disclosures.

The segment provides essential baseline demand for waste management services, with large-scale manufacturers operating multiple facilities requiring consistent service delivery, transparent pricing, and reliable processing capacity guaranteeing continuous operations without waste accumulation disruptions. Major European food manufacturers, including Nestlé, Unilever, Danone, and regional processors, have systematically integrated waste management into operational sustainability programs, often establishing corporate waste reduction targets, zero-waste-to-landfill commitments, and circular economy partnerships with waste management providers.

The segment's stable share reflects balanced growth across all end-use categories, with food manufacturers maintaining their dominant position as the primary commercial clients driving professional waste management service demand throughout the forecast period.

Contracted B2B processors are positioned to contribute 60% of total European food waste management sales in 2025, declining slightly to 55% by 2035, representing specialized waste management companies providing outsourced services to commercial and industrial clients. These contracted services successfully deliver professional expertise, processing infrastructure access, and regulatory compliance assurance while enabling clients to focus on core business operations without developing in-house waste management capabilities.

Contracted processors serve food manufacturers, retail chains, hospitality groups, and commercial foodservice operations that prioritize reliable service delivery, regulatory compliance, and transparent reporting over capital investment in proprietary waste management infrastructure. The segment derives significant competitive advantages from established processing facilities, specialized collection logistics, and comprehensive service portfolios spanning multiple waste streams and valorisation pathways.

However, the segment experiences slight share erosion as alternative channels, including on-site/in-house solutions and digital marketplace platforms, capture incremental share, reflecting large organizations' increasing investment in proprietary waste management systems and emerging technology platforms connecting waste generators with processors. By 2035, contracted processors are projected to hold a 55% share, down from 60% in 2025, as on-site solutions expand from 12% to 15% and online marketplace services grow from 8% to 12%.

Recycling and valorisation services are strategically positioned to contribute 35% of total European sales in 2025, increasing to 40.0% by 2035, representing the transformation of food waste into valuable products rather than disposal. These valorisation services successfully deliver environmental benefits, economic value creation, and regulatory compliance while supporting circular economy principles increasingly mandated across European Union member states.

Valorisation services encompass industrial composting producing soil amendments, anaerobic digestion generating biogas and digestate, animal feed ingredient processing, and emerging technologies converting food waste into bio-based chemicals and materials. The segment derives significant competitive advantages from proven environmental performance, revenue generation potential through recovered products, and strong regulatory support through waste hierarchy frameworks prioritizing valorisation over disposal.

The segment's increasing share through 2035 reflects strengthening regulatory frameworks penalizing landfill disposal, improving valorisation technology economics, and growing corporate demand for waste solutions supporting circular economy commitments and zero-waste targets.

EU food waste management sales are advancing steadily due to strengthening regulatory frameworks targeting waste reduction, growing corporate sustainability commitments driven by investor ESG requirements, and increasing awareness of food waste's environmental and economic impacts. However, the industry faces challenges, including high capital requirements for processing infrastructure limiting entry, inconsistent waste quality affecting valorisation efficiency, and economic sensitivity to commodity prices for recovered products including compost and biogas. Regulatory enforcement consistency and technology cost reduction remain central to industry development.

The rapidly accelerating development of digital waste tracking platforms is fundamentally transforming food waste management from opaque disposal services to transparent, data-driven solutions enabling comprehensive waste monitoring, valorisation verification, and sustainability reporting. Advanced technology platforms featuring IoT sensors, blockchain verification, and real-time dashboards allow waste generators to monitor collection schedules, track waste volumes, verify processing outcomes, and generate automated sustainability reports supporting corporate disclosures and regulatory compliance. These digital innovations prove particularly transformative for multi-site organizations requiring consolidated waste data, retail chains implementing corporate sustainability targets, and manufacturers seeking supply chain transparency supporting circular economy commitments.

Major waste management providers invest heavily in proprietary technology platforms, third-party software integrations, and mobile applications targeting customer engagement and service optimization, recognizing that transparency and data accessibility directly influence client retention and service differentiation. Technology platforms enable predictive analytics identifying waste reduction opportunities, optimizing collection routing, reducing transportation costs and emissions, and providing audit trails supporting regulatory inspections and sustainability certifications.

Modern food waste management providers systematically incorporate advanced valorisation technologies that maximize resource recovery value and expand processing capabilities beyond traditional composting and anaerobic digestion. Strategic integration of insect farming converting food waste into protein feed, enzymatic processing producing bio-based chemicals, and hydrothermal carbonization generating biochar enables providers to position comprehensive valorisation portfolios addressing diverse waste streams and maximizing economic returns from organic waste processing. These technological innovations prove essential for growth, as traditional composting and basic anaerobic digestion face financial constraints and capacity limitations that advanced technologies help overcome.

Companies implement pilot programs testing emerging technologies, establish strategic partnerships with technology providers, and invest in modular processing facilities enabling rapid deployment and technology adaptation as conditions and regulatory requirements evolve. Providers leverage technology diversification in marketing campaigns, client presentations, and sustainability communications, positioning advanced valorisation as differentiators supporting premium service pricing and long-term client partnerships.

European food waste management providers increasingly expand service portfolios beyond collection and processing to include waste prevention consulting, source reduction programs, and operational optimization services targeting waste generation minimization. This upstream expansion enables providers to position comprehensive waste management partnerships where service value derives from prevention and reduction expertise rather than processing volumes alone, aligning provider incentives with client sustainability goals and regulatory priorities emphasizing waste hierarchy compliance. Prevention services prove particularly attractive to large food manufacturers and retail chains implementing corporate waste reduction commitments and seeking expert guidance on operational changes, staff training, and process optimization.

The development of waste auditing services, employee training programs, and ongoing consulting relationships expands provider value propositions beyond transactional waste collection toward strategic partnerships addressing entire waste management hierarchies from prevention through valorisation. Providers collaborate with sustainability consultants, operational efficiency experts, and technology vendors to deliver integrated solutions that reduce waste generation, optimize segregation, and maximize valorisation outcomes, supporting client commitments and regulatory compliance.

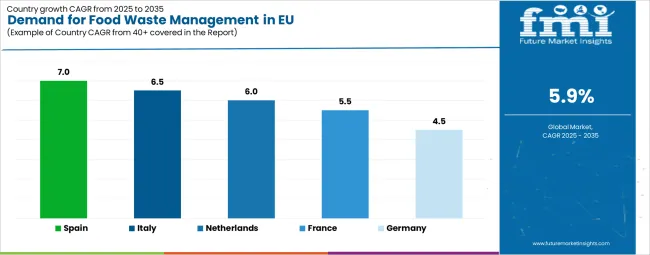

| Country | CAGR % |

|---|---|

| Spain | 7.0% |

| Rest of Europe | 6.6% |

| Italy | 6.5% |

| Netherlands | 6% |

| France | 5.5% |

| Germany | 4.5% |

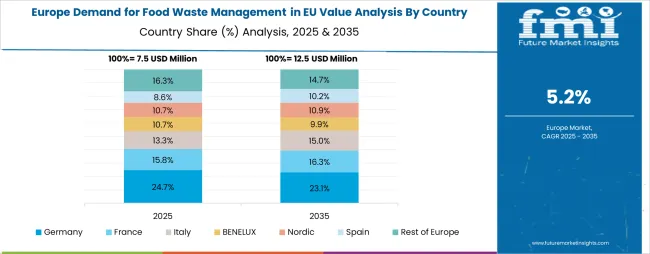

EU food waste management sales demonstrate varied growth across major European economies, with Spain leading expansion at 7.0% CAGR through 2035, driven by regulatory modernization and infrastructure development from a lower baseline. Germany maintains leadership through established waste management infrastructure and mature regulatory frameworks. France benefits from evolving regulations and corporate sustainability adoption. Italy leverages regulatory strengthening and organic waste valorisation investment. Spain shows exceptional growth supported by infrastructure development and regulatory enforcement acceleration. The Netherlands emphasizes circular economy leadership and advanced processing technologies. Overall, sales show moderate regional development reflecting gradual regulatory strengthening and infrastructure expansion across EU member states.

Revenue from food waste management in Germany is projected to exhibit moderate growth with a CAGR of 4.5% through 2035, driven by well-established waste management infrastructure, mature regulatory frameworks, and comprehensive circular economy implementation across industrial and municipal sectors. Germany's sophisticated waste management industry and internationally recognized leadership in recycling and resource recovery are supporting steady demand growth for food waste valorisation services across manufacturing, retail, and foodservice sectors.

Major waste management providers, including Remondis, Veolia, SUEZ, and specialized organic waste processors, maintain extensive processing infrastructure throughout Germany, offering comprehensive services spanning collection, sorting, composting, anaerobic digestion, and emerging valorisation technologies. German demand benefits from stringent regulatory enforcement, substantial corporate commitment to sustainability reporting, and established infrastructure supporting high waste diversion rates that limit dramatic growth potential but ensure stable, mature conditions.

Revenue from food waste management in France is expanding at a CAGR of 5.5%, substantially supported by evolving regulatory frameworks, including strengthening waste reduction targets and mandatory organic waste separation requirements for commercial generators. France's growing corporate sustainability adoption among food manufacturers and retail chains is systematically driving demand for professional waste management services, supporting environmental commitments and regulatory compliance.

Major waste management providers, including SUEZ, Veolia, and regional operators, progressively expand food waste processing capacity and service territories to serve growing commercial demand. French sales particularly benefit from regulatory modernization following the EU Waste Framework Directive implementation, with mandatory organic waste separation for businesses generating specified volumes, creating baseline service demand. Urban centers, including Paris, Lyon, and Marseille, lead adoption with concentration of commercial waste generators, established collection logistics, and available processing infrastructure.

Revenue from food waste management in Italy is growing at a robust CAGR of 6.5%, fundamentally driven by regulatory modernization, increasing investment in organic waste processing infrastructure, and growing awareness of food waste's environmental and economic impacts. Italy's traditional challenges with waste management infrastructure are driving substantial investment in modern processing facilities, creating growth opportunities as regulatory enforcement strengthens and corporate adoption increases.

Major waste management providers and regional municipal operators strategically invest in composting facilities, anaerobic digestion plants, and collection logistics infrastructure to address regulatory requirements and growing service demand. Italian sales particularly benefit from EU-driven regulatory modernization forcing infrastructure development and service professionalization, with northern regions including Lombardy, Veneto, and Emilia-Romagna leading adoption through advanced infrastructure and strong regulatory enforcement.

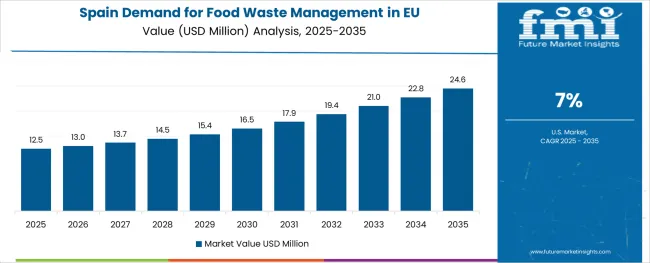

Demand for food waste management in Spain is projected to grow at the highest CAGR of 7.0% among major European operations, substantially supported by regulatory strengthening, infrastructure development from lower baseline capacity, and increasing corporate adoption of sustainability commitments. Spanish food waste management is experiencing a modernization phase with regulatory enforcement acceleration, infrastructure investment, and growing awareness driving development from relatively early-stage conditions.

Major waste management providers and regional authorities systematically invest in organic waste processing infrastructure, with new composting facilities, anaerobic digestion plants, and collection systems expanding service availability across urban and industrial centers. Spain's substantial food manufacturing sector, including processing, canning, and export-oriented agriculture, creates significant commercial waste volumes requiring professional management as regulatory enforcement strengthens and disposal alternatives diminish.

Demand for food waste management in the Netherlands is expanding at a CAGR of 6.0%, fundamentally driven by advanced circular economy implementation, comprehensive waste management infrastructure, and strong environmental consciousness supporting high valorisation rates and innovative processing technologies. Dutch waste management exemplifies European best practices with minimal landfill disposal, extensive organic waste valorisation, and progressive policies supporting resource recovery and circular economy business models.

Netherlands sales significantly benefit from well-developed infrastructure, including widespread anaerobic digestion capacity, advanced composting facilities, and emerging technologies including insect farming and biochemical conversion, combined with regulatory frameworks incentivizing valorisation and penalizing disposal. Dutch food manufacturers, retailers, and hospitality operators demonstrate strong commitment to waste reduction and valorisation, viewing waste management as integral to corporate sustainability strategies and operational efficiency rather than regulatory compliance obligations.

EU food waste management sales are projected to grow from USD 30.7 million in 2025 to USD 54.5 million by 2035, registering a CAGR of 5.9% over the forecast period. Spain is expected to demonstrate the strongest growth trajectory among major operations with a 7.0% CAGR, supported by strengthening regulatory enforcement, growing corporate sustainability adoption, and expanding processing infrastructure. Italy follows with a 6.5% CAGR, attributed to regulatory modernization and increased investment in organic waste valorisation. The Netherlands contributes with a 6.0% CAGR, driven by advanced circular economy infrastructure and strong environmental consciousness.

Germany, while maintaining the largest share at 24.0% in 2025, is expected to grow at a more moderate 4.5% CAGR, reflecting maturity and established waste management infrastructure. France follows with a 5.5% CAGR, supported by regulatory evolution and growing corporate adoption. The Rest of Europe region holds 20.0% share, encompassing Nordic countries, Eastern Europe, and other EU member states with emerging food waste management systems, and is projected to grow at a 6.6% CAGR.

EU food waste management sales are defined by competition among multinational waste management companies, regional processors, and specialized organic waste service providers. Companies are investing in digital tracking platforms, advanced valorisation technologies, processing infrastructure expansion, and sustainability communication to deliver comprehensive, transparent, and environmentally responsible food waste management solutions. Strategic partnerships with food manufacturers, retail chain contracts, and municipal programme participation are central to strengthening position.

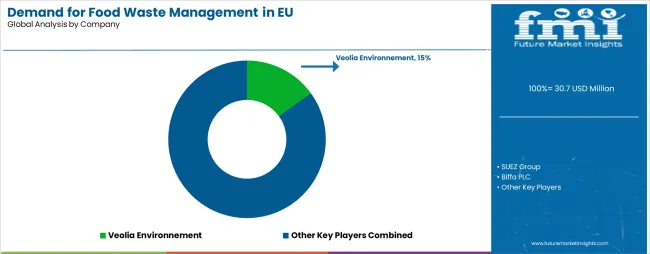

Major participants include Veolia Environnement with an estimated 18% share, leveraging its comprehensive waste management portfolio, extensive European processing infrastructure, and integrated circular economy solutions spanning collection, processing, and resource recovery. Veolia benefits from multinational scale, established client relationships with major food manufacturers and retail chains, and the ability to provide consistent service delivery across multiple European operations, supporting clients' pan-European activities.

SUEZ Group holds approximately 12% share, emphasizing advanced technology integration, including biogas production facilities, digital waste tracking platforms, and smart collection systems optimizing logistics efficiency and environmental performance. SUEZ's success in positioning technology-enabled solutions and biogas valorisation creates differentiation opportunities and premium service positioning, supported by strong presence in French and broader European operations.

Biffa PLC accounts for roughly 8% share through its established presence in UK municipal contracts and commercial waste management services, with limited but growing EU participation following Brexit adjustments. The company benefits from expertise in organic waste processing, established infrastructure, and relationships with major commercial clients requiring reliable food waste management services.

Remondis SE & Co. KG represents approximately 7% share, supporting growth through extensive German processing capacity, comprehensive service portfolio, and strong regional presence across Central Europe. Remondis leverages manufacturing scale, established client relationships within the German food industry, and the ability to provide integrated waste management solutions spanning multiple waste streams beyond organic materials.

Other companies and regional providers collectively hold 55% share, reflecting the highly fragmented nature of European food waste management sales, where numerous regional operators, municipal service providers, specialized organic waste processors, and emerging technology companies serve local operations, specific industry segments, and niche valorisation applications. This fragmentation provides opportunities for differentiation through specialized processing technologies (insect farming, biogas upgrading, compost certification), regional expertise, industry-specific solutions, and innovative business models connecting waste generators with resource recovery applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 54.5 million |

| Service/Process Type | Recycling/Valorisation, Composting, Anaerobic Digestion, Landfill Diversion/Other |

| Waste Type | Food Processing Waste, Retail Waste, Household/Consumption Waste, Agricultural Waste, Other |

| End-use/Application | Food Manufacturers, Retailers, Hospitality/HoReCa, Municipalities, Households |

| Distribution Channel | Contracted Processors (B2B), Municipal Programmes, On-site/In-house Solutions, Online/Marketplace Services |

| Service Nature | Prevention (Pre-source), Collection, Transfer, Recycling/Valorisation, Landfill/Disposal |

| Forecast Period | 2025-2035 |

| Base Year | 2025 |

| Historical Data | 2020-2024 |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Veolia Environnement, SUEZ Group, Biffa PLC, Remondis SE & Co. KG, Regional processors |

| Report Pages | 180+ Pages |

| Data Tables | 50+ Tables and Figures |

| Additional Attributes | Dollar sales by service/process type, waste type, end-use application, distribution channel, and service nature; regional demand trends across major European operations; competitive landscape analysis with established waste management companies and emerging specialized providers; regulatory framework analysis for EU waste directives and member state implementation; integration with circular economy initiatives and sustainability certification programs; innovations in valorisation technologies and digital tracking platforms; adoption across food manufacturing, retail, and hospitality sectors; supply chain optimization strategies; and penetration analysis for commercial and municipal food waste management across European operations. |

The global demand for food waste management in EU is estimated to be valued at USD 30.7 million in 2025.

The market size for the demand for food waste management in EU is projected to reach USD 54.5 million by 2035.

The demand for food waste management in EU is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in demand for food waste management in EU are recycling, composting, anaerobic digestion and landfill diversion / other.

In terms of waste type, food processing waste segment to command 28.0% share in the demand for food waste management in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Waste Management Market Analysis - Size, Share, and Forecast 2025 to 2035

Demand for Products From Food Waste in Western Europe - Size, Share and Forecast Outlook 2025 to 2035

Food Waste Shredder Market Size and Share Forecast Outlook 2025 to 2035

Food Waste Disposal Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Waste Composting Machine Market Size and Share Forecast Outlook 2025 to 2035

Food Waste-Derived Protein Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Europe Food Service Equipment Market Outlook – Size, Trends & Forecast 2025–2035

Europe Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

Europe Food Emulsifier Market Trends – Growth, Demand & Forecast 2025–2035

Europe Food Stabilizers Market Analysis – Size, Share & Forecast 2025–2035

Comprehensive Analysis of Food Premix Market by Form, Ingredient Type, End-Use Application and Function Type through 2035

E-Waste Management Market Growth - Trends & Forecast 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Comprehensive Analysis of Europe Pet Food Supplements Market by Nature, Form, Pet Type and Distribution Channel through 2035

Europe Superfood Powder Market Analysis – Size, Share & Forecast 2025-2035

Europe Frozen Food Market Trends – Growth, Demand & Forecast 2025–2035

Fish Waste Management Market Analysis by Source and End Use Industry Through 2035

Fast-Food Reusable Market Growth – Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA