The Europe Frozen Food market is set to grow from an estimated USD 126,720.5 million in 2025 to USD 201,590.5 million by 2035, with a compound annual growth rate (CAGR) of 4.8% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 126,720.5 million |

| Projected Europe Value (2035F) | USD 201,590.5 million |

| Value-based CAGR (2025 to 2035) | 4.8% |

Throughout 2020 to 2024, the European frozen food market not only overcame obstacles but also enjoyed exemplary growth due to the trends reflected by the customers who desired convenience, the rise in the range of long-shelf-life food, and the introduction of new technologies in freezing.

The fast development of technologies like IQF and cryogenic freezing which result in the increase of product quality and texture as well as the potential of products having more nutrients-makes the frozen food item more appealing to consumers, who are concerned about their health.

Market growth was further fuelled by the increase in private-label frozen food products available in supermarkets/hypermarkets, besides the ever-rising penetration of online retail and direct-to-consumer (DTC) frozen meal delivery services. The European food sector is sustained in its progress by its commitment to sustainability, waste reduction, and top-quality frozen food innovation, therefore, the market is bound to see investment in green packaging, plant-based frozen meals, and high-protein frozen foods solutions. Manufacturers are also channelling funds to the deployment of ultra-low temperature storage, hybrid freezing technology, and AI-powered logistics to enhance supply chain performance and product integrity.

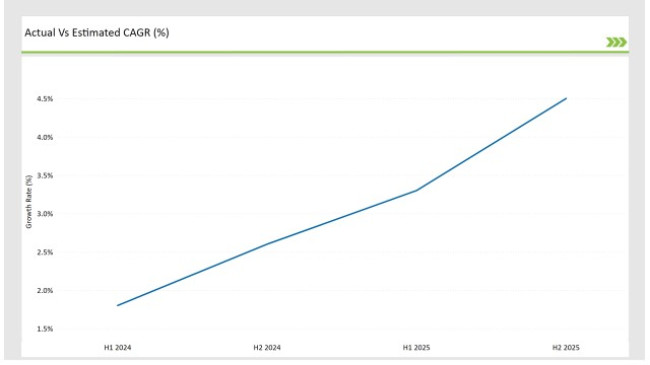

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Frozen Food market. This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 1.8% |

| H2 (2024 to 2034) | 2.6% |

| H1 (2025 to 2035) | 3.3% |

| H2 (2025 to 2035) | 4.5% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Frozen Food market, the sector is predicted to grow at a CAGR of 1.8% during the first half of 2023, with an increase to 2.6% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 3.3% in H1 but is expected to rise to 4.5% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2023 to the first half of 2024, followed by an increase of 20 basis points in the second half of 2024 compared to the second half of 2023.

| Date | Development/M&A Activity & Details |

|---|---|

| April-24 | Product Innovation - Nomad Foods launched a new range of high-protein frozen ready meals targeting fitness-conscious consumers. |

| March-24 | Retail Expansion - Dr. Oetker expanded its frozen pizza portfolio, introducing premium plant-based frozen pizza varieties . |

| February-24 | Strategic Partnerships - Nestlé collaborated with major European retailers to expand its Frozen Lean Cuisine product line . |

| January-24 | Technology Advancements - McCain Foods invested in IQF and blast freezing facilities to improve product freshness and texture. |

AI-IoT Connected Frozen Food Logistics for Rising Productivity

The frozen food branch in Europe is in a state of transition, alongside technological advancements, with artificial intelligence-driven cold chain logistic systems and the Internet of Things monitoring systems being the central reasons for superb supply chain efficiency.

Companies like McCain Foods and Nomad Foods have taken the initiative to use the latest technologies smart sensors and predictive analytics in an initiative to monitor temperature-sensitive frozen food shipments in such a way as to prevent products from spoilage and to be certain that they were shipped in good condition.

AI-powered forecasting tools are also utilized for depicting demand fluctuations and optimizing inventory levels which consequently results in minimizing food waste. Furthermore, AI is also being used in the case of automatic item restocking in stores to better inventory frozen foods and stop stock shortages.

Through the establishment of the end-to-end supply chain transparent, brands are trust-building and boosting their sustainability in this particular sector. The incorporation of smart cold storage techniques and predictive maintenance in the freezing units is also a benefit to the manufacturers in that it reduces the operational cost and, at the same time, allows them to ensure the product quality is always the same.

Plant-Based Frozen Food Innovations that are Riding

The increasing flexitarian and vegan diets have produced significant innovations in frozen plant-based meal solutions, with companies focusing on alternative protein sources and clean-label formulations.

Brands like Green Cuisine and Beyond Meat are utilizing fermented plant proteins, marine algae extracts, and mycoproteins to bring to life plant-based frozen meat products with a better texture and more nutritional value. The new cell-cultured plant proteins and fermentation-based protein production showing new possibilities have enabled frozen foods producers the develop more realistic and more nutritious plant-based alternatives.

Likewise, 3D food printing technologies are being investigated as a way to produce custom-designed plant-based frozen meals specifically tailored to individual dietary preferences and health conditions. The introduction of functional frozen foods with probiotics, adaptogens, and fiber as major ingredients in the market is a quiet innovation that drives shopping toward nutrient-rich, high-performance frozen food offerings.

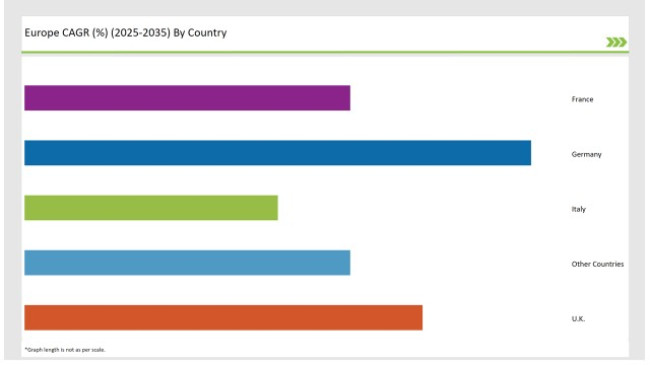

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 28% |

| Italy | 14% |

| UK | 22% |

| France | 18% |

| Other Countries | 18% |

Germany has AI-influenced frozen food retailing at its frontier, converted into smart freezer vending machines and robotic warehouses that are now operating in a multitude of places. For example, currently, companies like Picard and Relex are implementing AI-based automated smart freezers at supermarkets, airports, and urban convenience stores that let customers buy frozen meals contactless and on-demand. Moreover, robotic arms are being introduced in smart frozen food fulfilment centers, which results in more automated order processing for frozen grocery deliveries.

On top of that, the implementation of digital temperature monitoring systems has been driven by Germany's strict food safety regulations, which are being followed by big retailers as a means of monitoring the correct temperatures that the frozen goods are kept at during transport and storage. Retailers are now integrating real-time tracking and automated restocking systems to facilitate efficiency in frozen food logistics.

France's frozen food segment is growing exceptionally, through the high sales of frozen gourmet meals with collaborations between Michelin-starred chefs and premium food brands creating high-quality frozen dishes. Prominent companies like Picard and Thiriet are in the company of Michelin-starred chefs to create frozen entrees, organic frozen delicacies, and gourmet frozen appetizers.

Moreover, the luxury frozen meal section is increasing largely with new products like frozen escargots, foie gras, and fine-dining-inspired frozen meals being introduced in high-end French retailers. Artificial intelligence (AI) is being utilized for providing meal pairing recommendations that have been curated by chefs and meal kits that contain all products needed to cook the chosen dish are completely changing the premium frozen dining experience, which is in line with France's gourmet culinary tradition.

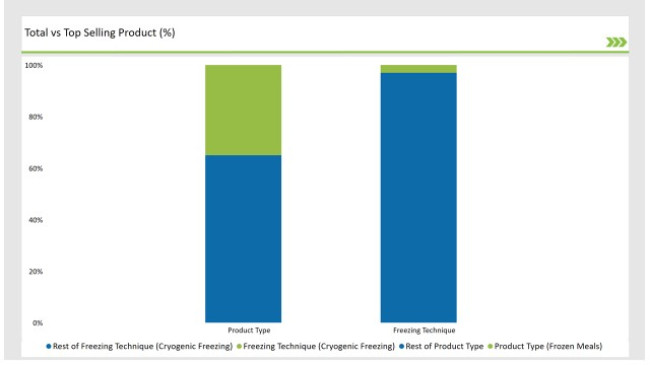

% share of Individual Categories Product Type and Freezing Technique in 2025

| Main Segment | Market Share (%) |

|---|---|

| Product Type (Frozen Meals) | 35% |

| Remaining segments | 65% |

The sales of high-protein frozen meals are soaring well across Europe, as people are going after more nutritious, ready-made food available in the frozen food aisle. Companies like Nomad Foods and Findus are increasing the range of protein-rich highly-coveted frozen ready meals, using legumes that are fortified, plant-based proteins, and lean meats. These meals are made for fitness-conscious individuals, working professionals, and elderly consumers who require easy but calorie-packed food choices.

Another segment is functional frozen foods, in which producers are utilizing superfoods, probiotics, and fibre-rich components in the making of frozen comestible formulations. Gut-health-focused frozen products like probiotic-rich frozen smoothies and fibre-packed frozen breakfast bowls are turning the market category of functional frozen foods upside down.

Firms like Green Cuisine and Beyond Meat are coming up with frozen foods that not only are high in protein but also give new health benefits, which is a big pull for consumers who are looking for immunity-boosting and wellness-focused frozen meals. Also, frozen snacks and bakery items including high-protein frozen waffles, fortified bread, and omega-3-enriched frozen pastries, have taken off.

| Main Segment | Market Share (%) |

|---|---|

| Freezing Technique (Cryogenic Freezing) | 3% |

| Remaining segments | 97% |

The cryogenic freezing that is utilized is the one that is being set as a standard in the food industry, especially in the case of high-value frozen seafood, gourmet frozen dishes, and top bakery products.

Cryogenic freezing which is done using rapid freezing of liquid nitrogen or carbon dioxide, is a process that aids in the more effective preserving of texture, flavour, and nutritional content than normal methods. Companies like Nestlé and Dr.Oetker are putting efforts into cryogenic freezing which they believe will better the quality of their products like frozen pasta dishes, delicate pastries, and seafood.

Apart from these, cryogenic freezing combined with frozen fruits and vegetable preservation is hugely in great demand, as it is the only way to ensure that the foods stay good with fresh taste, their original colour, and high vitamin content. Companies like Ardo and Greenyard have complimented the freezing process with cryogenic techniques in their collection of organic frozen foods, keeping with the trends of clean-label and minimally processed foods.

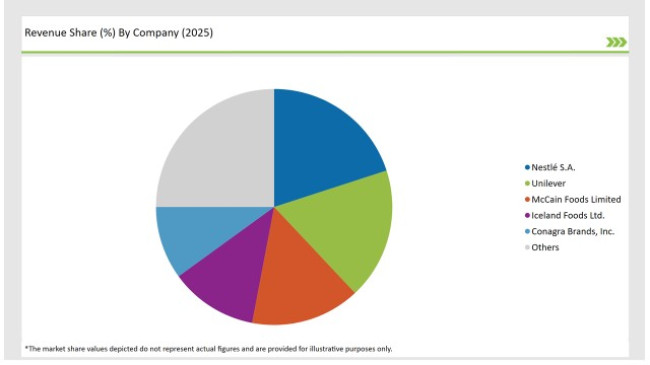

2025 Market share of Europe Frozen Food manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Nestlé S.A. | 20% |

| Unilever | 18% |

| McCain Foods Limited | 15% |

| Iceland Foods Ltd. | 12% |

| Conagra Brands, Inc. | 10% |

| Others | 25% |

Note: The above chart is indicative in nature

The European frozen food market has grown to be so competitive with the entrance of major players such as Nomad Foods, McCain Foods, Nestlé, Dr.Oetker, and Iglo. These companies are spending much money on research & development (R&D) in trying to improve product quality, freezing technology, and sustainable packaging solutions.

The development of AI-driven cold storage monitoring systems and block chain-enabled traceability solutions is also a noteworthy factor that is reshaping the competitive environment by allowing companies to cut down on waste, manage inventory better, and add more transparency.

Additionally, the increasing market of private-label frozen food brands in supermarkets and hypermarkets has come as a controversy for traditional brands to innovate. Retailers like Lidl, Aldi, and Carrefour have already begun launching their premium frozen food ranges which include organic, high-protein, and plant-based items at a low price. Consequently, this has pushed the main frozen food companies to set themselves apart by offering exclusive flavours, frozen meals inspired by different cuisines, and fortified options.

As per Product Type, the industry has been categorized into Frozen Ready Meals, Frozen Seafood & Meat Products, Frozen Snacks & Bakery Products, Frozen Fruits & Vegetables, and Others.

As per Sales Channel, the industry has been categorized into Supermarkets/Hypermarkets, Convenience Stores & Independent Retailers, Online Retail, Food Service/HoReCa, and Others.

As per Freezing Technique, the industry has been categorized into Individual Quick Freezing (IQF), Belt Freezing, Blast Freezing, Plate Freezing, and Cryogenic Freezing.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Frozen Food market is projected to grow at a CAGR of 4.8% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 201,590.5 million.

Key factors driving the Europe frozen food market include the increasing demand for convenient meal solutions among busy consumers and the growing trend of home cooking, which has led to a rise in frozen meal options. Additionally, advancements in freezing technology and a focus on product quality and variety are further enhancing consumer appeal and market growth.

Italy, France, and UK are the key countries with high consumption rates in the European Frozen Food market.

Leading manufacturers include Nestlé S.A., Unilever, McCain Foods Limited, Iceland Foods Ltd., and Conagra Brands, Inc. known for their innovative and sustainable production techniques and a variety of product lines.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Europe Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Europe Winter Tourism Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA