The Europe Food Testing Services market is set to grow from an estimated USD 8,197.9 million in 2025 to USD 15,405.9 million by 2035, with a compound annual growth rate (CAGR) of 6.5% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 8,197.9 million |

| Projected Europe Value (2035F) | USD 15,405.9 million |

| Value-based CAGR (2025 to 2035) | 6.5% |

The European food testing services market is expected to grow remarkably based on the rationale of stringent food safety regulations, a rise in the concern among customers regarding the quality of food products, and a multifaceted food supply chain.

As the complications related to foodborne illnesses and contamination incidents continue to surface, governments and food manufacturers have resorted to massive amounts of their budgets on food testing services to be in compliance with these safety standards and to keep consumer trust. The sector is currently characterized by the fast introduction of new analytical techniques and automation, one of the consequences of which is improvement in the accuracy, efficiency, and reliability of food testing services.

Besides being a regulatory requirement, food testing services are also essential for addressing the dynamics of dietary trends, such as vegetable and novel foods, besides ensuring the safety of dietary supplements and animal feed. The adoption of state-of-the-art technologies such as next-generation sequencing (NGS), polymerase chain reaction (PCR), and chromatography have shifted the sector as the outcomes are now quicker and more precise.

Major players in the European market are forming more and more alliances with independent testing providers and widening their in-house food safety plans in a bid to maintain product integrity and demonstrate international quality standards adherence.

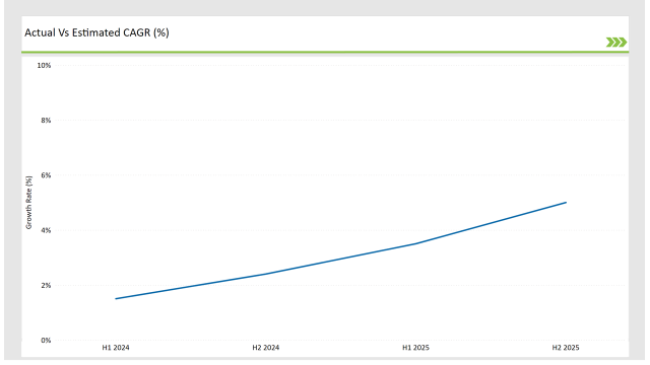

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Food Testing Services market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 1.5% |

| H2(2024 to 2034) | 2.4% |

| H1(2025 to 2035) | 3.5% |

| H2(2025 to 2035) | 5.0% |

H1 signifies period from January to June, H2 Signifies period from July to December For the European Food Testing Services market, the sector is predicted to grow at a CAGR of 1.5% during the first half of 2024, with an increase to 2.4% in the second half of the same year.

In 2025, the growth rate is anticipated to slightly decrease to 3.5% in H1 but is expected to rise to 5.0% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-24 | Sustainability Initiatives-Eurofins Scientific announced the launch of an eco-friendly food testing facility in France, utilizing renewable energy sources to reduce carbon emissions in analytical operations. |

| March-24 | Product Launches-SGS introduced a rapid multi-residue pesticide detection system tailored for European food safety standards, enhancing testing capabilities for dairy and meat products. |

| February-24 | Expansion of Testing Infrastructure-ALS Limited expanded its microbiology and food authenticity testing laboratories in Spain, catering to the rising demand for plant-based food verification. |

| January-24 | Strategic Partnerships-Bureau Veritas collaborated with major European food manufacturers to develop AI-driven food traceability solutions, ensuring compliance with novel food regulations. |

Europe's Stringent Food Safety Regulations on the Rise

A primary force affecting the European food testing services industry is the shifting food safety regulations enacted by the European Food Safety Authority (EFSA) and national food safety agencies. In light of the growing concerns about foodborne illnesses, product recalls, and cross-contamination, compliance with even stricter measures of the regulatory chain is becoming the main target for food manufacturers and suppliers.

Many companies such as Eurofins Scientific and SGS have turned to the development of higher-level testing solutions, which assist companies in their compliance with new regulations namely strict pesticide residue limits, and microbiological monitoring in dairy and meat products.

A dominant trend is the incorporation of block chain technology in food traceability, the possibility of real-time tracking of contamination and better recall efficiency are parts of its functionality. When new food products, for instance, alternative proteins and plant-based substitutes were developed regulatory bodies were demanding new tests for product safety and transparency.

Progresses in Food Testing Technologies for Improving Efficiency

In Europe, the food testing services landscape is being transformed by the rapid development of analytical and automation technologies. It is worth noting that the latest applications like next-generation sequencing (NGS), polymerase chain reaction (PCR), and high-performance liquid chromatography (HPLC) are currently improving the accuracy and the pace of pollutant detection.

For instance, ALS Limited is the first company to launch an AI-based system that carries out the analysis in real-time by detecting pathogens which means that food manufacturers can react quickly and cut down on product withdrawals.

Automation in food testing laboratories is also leading to faster sample processing and data analysis. The recent debut of AI-integrated food safety analytics by SGS is a quintessential case of how robotic sample handling and automated quality assurance can considerably lower human error and enhance accuracy.

The technological advancements are cutting down on testing costs, boosting performance, and making food testing services more accessible for small and medium-sized enterprises (SMEs).

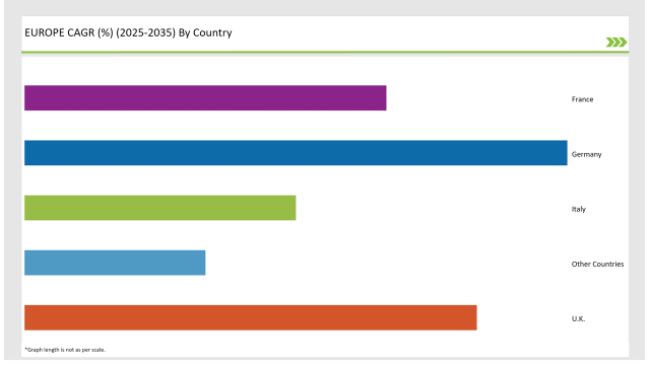

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Country | Market Share (%) |

|---|---|

| Germany | 30% |

| Italy | 15% |

| UK | 25% |

| France | 20% |

| Other Countries | 10% |

Germany, owing to its meticulously structured food safety mechanism and profound regulatory structure, is ranked at the top of the food testing laboratory services market in Europe. Additionally, the country has the most hi-tech food testing laboratories in Europe such as Eurofins Scientific and Bureau Veritas which provide state-of-the-art engineering and facilities for the dairy, meat, and processed food industries.

Due to the increased focus on food integrity, Germany has shown a corresponding demand for food fraud detection and ingredient verification services. The rapid growth of plant-based and alternative protein markets has driven the requirement for novel food testing methods. On one hand, plant-based diets are gaining popularity; on the other hand, it has become mandatory as per the regulations to test meat-free food products more than the traditional ones in order to make the food safe and the labelling true.

Moreover, Germany has become a front-runner in automatized testing systems, being the first to leverage traditional methods of testing like bacteria growth-rate tests and chemical tests as well as newly introduced tools like block chain-integrated traceability systems for more effective food safety measures.

France is a highly cherished and influential name in the service of the goods sector across Europe, whose notable ethnic culture is gastronomy backed with quality. The country includes diverse food service outlets starting from Michelin-starred restaurants to lively bistros that drive the demand for high-quality kitchen equipment and innovative cooking methods. The chefs in France mostly adopt complicated food cooking methods employing vacuum and molecular gastronomy devices which increases the sales of the suppliers of such equipment to a new level.

Sustainability is a major issue in France with a broader view of the environment and making devices that use less energy. The government initiatives on using food more sustainably and therefore, doubling the investment in equipment that will do so have eased the way for this.

In addition, ghost kitchens and food deliveries have emerged which create a new horizon for the hardware suppliers to adjust their products to the different kinds of consumers. As the market evolves, French manufacturers are systematically pursuing the path of technology through clever instalments on their machines which reduce energy consumption and offer a simpler user application.

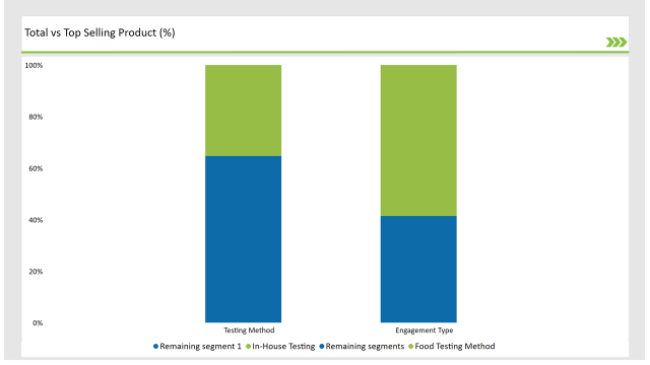

% share of Individual Categories Testing Method and Engagement Type in 2025

| Main Segment | Market Share (%) |

|---|---|

| Testing Method (Food Testing Method) | 35.3% |

| Remaining segments | 64.7% |

Food testing methods hold the highest market stake, encapsulating microbiological testing, allergen screening, chemical analysis, and heavy metal detection. Major companies like SGS and Eurofins Scientific are integrating block chain traceability into food testing, keeping the transparency of the supply chain and bettering the management of recalls.

The meat and dairy industries are the ones that make use of high microbiology skills for the detection of bacterial pathogens such as Salmonella, Listeria, and E. coli thus preventing foodborne illness outbreaks that would otherwise happen. Furthermore, plant-based and alternative proteins are an area of novel technology surrounded by regulations, thus, quick food testing is the device that makes it grow so fast with the help of companies like ALS Limited that do the necessary analyses of the safety of the next-generation food products.

| Main Segment | Market Share (%) |

|---|---|

| Engagement Type (In-House Testing) | 58.6% |

| Remaining segments | 41.4% |

In-house testing is on the rise in food manufacturers as the big fish are sinking a lot into the installation of their quality control labs. It is reported that companies like Nestlé and Danone have acquired their food safety and testing units, real-time monitoring, and robotic data analysis technologies to cope with costs and make them more efficient at work, therefore, diminishing dependency on outside providers.

Although in-house testing is within their grasp and helps them with contaminant detection, shelf-life studies, and allergen verification, independent third-party testing laboratories are still vital for regulatory compliance, certification, and specialized analytical services.

Bureau Veritas and Intertek are still up to their tailor-cut testing solutions for small and medium-sized food manufacturers that have to comply with nose-min EU food safety standards and international export norms.

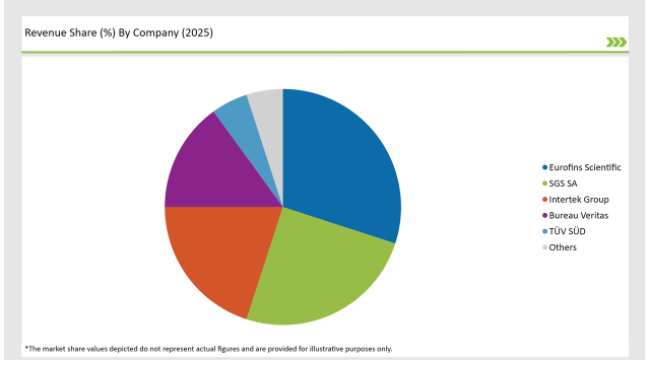

2025 Market share of Europe Food Testing Services manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Eurofins Scientific | 30% |

| SGS SA | 25% |

| Intertek Group | 20% |

| Bureau Veritas | 15% |

| TÜV SÜD | 5% |

| Others | 5% |

The market for food testing services in Europe is somewhat consolidated with key players like Eurofins Scientific, SGS, Bureau Veritas, ALS Limited, and Intertek who are leading the industry. These companies are using technological advancements, laboratory network expansion, and strategic alliances for the purpose of increasing their footprint throughout Europe. For example, Eurofins Scientific has gone for the latest analytical technology and increased its microbiology testing facilities in Germany and the Netherlands.

On the other side, SGS has put to use AI-integrated food safety analytics, which has led to improvements in the detection of pathogens in real time. On top of that, ALS Limited has added a part to its expertise on food authenticity testing directed to the challenge of food fraud and mislabelling.

As per Testing Method, the industry has been categorized into Dairy Products Testing Methods, Dietary Supplements Testing Methods, Food Testing Methods, Meat Testing Analysis, Plant Based, and Novel Food Testing Methods, and Animal Feed Testing Methods.

As per Engagement Type, the industry has been categorized into In House/ Captive Testing and Analytics Services, and 3rd Party/ Independent Testing and Analytics Service Providers.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Food Testing Services market is projected to grow at a CAGR of 6.5 % from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 15,405.9 million.

Key Key factors driving the European food testing services market include stringent food safety regulations and increasing consumer awareness regarding food quality and safety. Additionally, the rise in foodborne illnesses and the demand for transparency in food supply chains are further propelling market growth.

Germany, France, Italy, Netherlands and UK are the key countries with high consumption rates in the European Food Testing Services market.

Leading manufacturers include Eurofins Scientific, SGS SA, Intertek Group, Bureau Veritas, and TÜV SÜD known for their innovative and sustainable production techniques and a variety of product lines.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Europe Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA