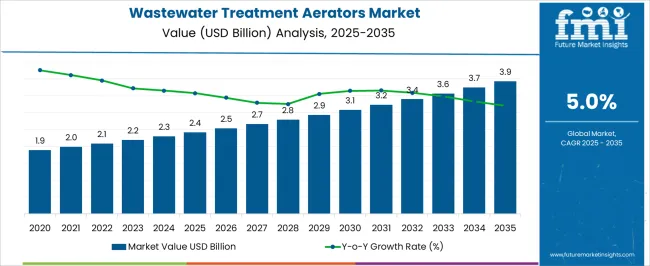

The wastewater treatment aerators market is expected to grow from USD 2.4 billion in 2025 to USD 3.9 billion by 2035, representing a CAGR of 5.0%. This growth corresponds to an absolute dollar opportunity of USD 1.5 billion over the decade. The increasing need for efficient wastewater management across municipal and industrial facilities supports expansion. Companies can leverage this predictable growth by enhancing production, optimizing distribution channels, and improving service networks. Early investments in market presence and customer relationships allow stakeholders to position themselves strategically to capture a meaningful share of the expanding market.

Over the next ten years, the USD 1.5 billion opportunity highlights a steady and attractive growth trajectory for the wastewater treatment aerators market. By 2035, demand will be driven by both replacement of older equipment and new installations across multiple sectors. The CAGR of 5.0% indicates consistent revenue expansion, enabling firms to scale operations and strengthen regional presence.

Businesses can focus on aligning sales, service, and distribution strategies with market demand to maximize returns. The absolute growth potential provides a clear incentive for companies to maintain long-term operational efficiency while capitalizing on the expanding market opportunity.

| Metric | Value |

|---|---|

| Wastewater Treatment Aerators Market Estimated Value in (2025 E) | USD 2.4 billion |

| Wastewater Treatment Aerators Market Forecast Value in (2035 F) | USD 3.9 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

In the early growth phase of the wastewater treatment aerators market, revenue expands gradually from USD 2.4 billion in 2025, reflecting a CAGR of 5.0%. Growth during this period is primarily driven by initial installations in municipal and industrial wastewater facilities. Companies focus on building distribution networks, establishing service support, and cultivating customer relationships to ensure steady demand. The absolute dollar opportunity in this phase is moderate, allowing firms to test strategies, optimize operations, and respond to market feedback.

Early growth provides a stable foundation for scaling, enabling businesses to refine offerings before entering the more competitive late growth phase. In the late growth phase, approaching 2035 and a market size of USD 3.9 billion, the wastewater treatment aerators market experiences accelerated revenue capture due to broader adoption and replacement of older systems. Market strategies shift toward scaling production, expanding regional presence, and leveraging established customer networks. The absolute dollar opportunity in this stage is significant, representing most of the USD 1.5 billion growth over the decade. Companies benefit from operational efficiencies and stronger brand recognition, ensuring the 5.0% CAGR translates into profitable, sustained growth.

The wastewater treatment aerators market is expanding rapidly, driven by global mandates for sustainable wastewater management and stricter regulatory frameworks targeting water pollution. Municipalities and industries are investing heavily in energy-efficient aeration systems to improve treatment capacity, enhance effluent quality, and reduce operating costs.

Technological advancements in diffuser design, sensor-based control systems, and hybrid aeration models have significantly improved oxygen transfer efficiency. Governments are also promoting decentralized treatment infrastructure in developing regions, further boosting adoption.

With rising urbanization and climate change-driven water stress, efficient wastewater treatment is becoming a priority, positioning aerators as critical components in both new installations and plant upgrades.

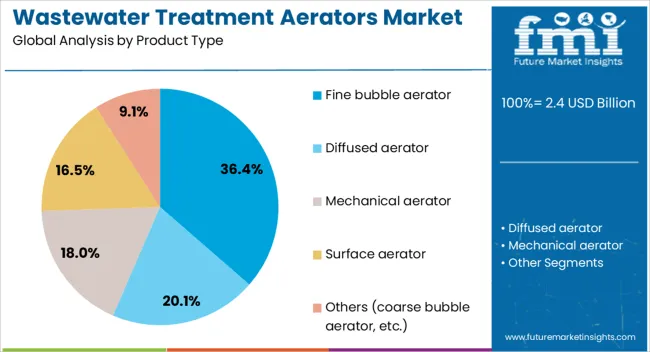

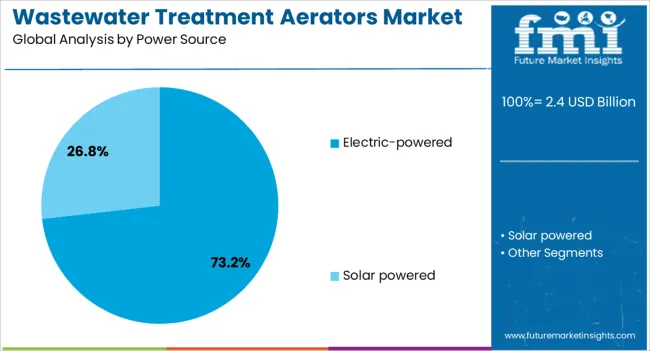

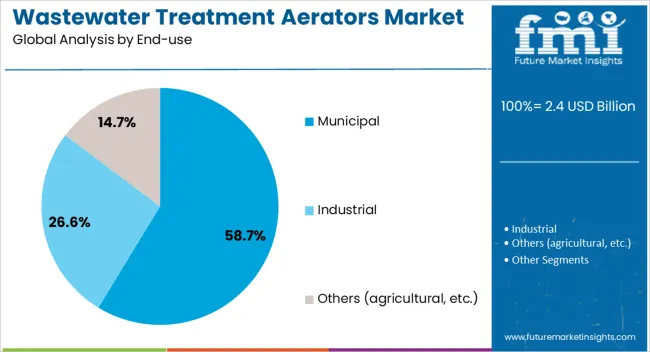

The wastewater treatment aerators market is segmented by product type, power source, end-use, distribution channel, and geographic regions. By product type, wastewater treatment aerators market is divided into Fine bubble aerator, Diffused aerator, Mechanical aerator, Surface aerator, and Others (coarse bubble aerator, etc.). In terms of power source, wastewater treatment aerators market is classified into Electric-powered and Solar powered. Based on end-use, wastewater treatment aerators market is segmented into Municipal, Industrial, and Others (agricultural, etc.).

By distribution channel, wastewater treatment aerators market is segmented into Direct and Indirect. Regionally, the wastewater treatment aerators industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Fine bubble aerators are projected to contribute 36.4% of the total market revenue in 2025, leading the product type segment. Their high oxygen transfer efficiency, low energy consumption, and uniform distribution of bubbles make them ideal for municipal and industrial biological treatment processes.

These systems are particularly suited for activated sludge and oxidation ditch applications where consistent aeration is required. Their lower maintenance demands, coupled with the ability to retrofit into existing tanks, have accelerated their adoption in both greenfield and brownfield projects.

As treatment plants seek to optimize performance while lowering lifecycle costs, fine bubble aerators are expected to maintain their dominance.

Electric-powered aerators are forecast to command 73.2% of the market share in 2025, making them the leading power source. Their operational reliability, automation compatibility, and energy efficiency are key drivers in large-scale municipal and industrial plants.

With the integration of variable frequency drives (VFDs) and smart control systems, electric-powered models now offer precise aeration control and reduced energy overheads. Additionally, the increasing availability of renewable electricity sources enhances the sustainability profile of electric aerators.

Their widespread compatibility across different tank configurations and treatment stages positions them as the go-to option for modern, scalable wastewater treatment infrastructure.

The municipal sector is expected to dominate the end-use category with a 58.7% share in 2025, driven by urban population growth and the rising need for centralized sewage treatment infrastructure. Governments across regions are investing in new treatment plants and upgrading existing ones to meet stringent discharge standards, particularly for nitrogen and phosphorus removal.

Municipal plants require high-capacity, durable, and energy-efficient aerators to handle large volumes and varied loads, making them a key customer segment. Public-private partnerships, international funding, and urban development projects are further supporting deployment.

As municipalities continue to expand capacity and improve water recycling rates, demand for advanced aeration technologies will remain strong.

The wastewater treatment aerators market is expanding as municipalities, industrial facilities, and wastewater management companies prioritize efficient oxygenation and treatment of sewage and industrial effluents. Aerators improve microbial activity, reduce sludge, and ensure compliance with environmental discharge regulations. Increasing urbanization, industrial expansion, and stricter environmental standards are driving demand for aeration technologies.

Innovations in energy-efficient aerators, including fine bubble diffusers, surface aerators, and mechanical aeration systems, are enhancing performance and reducing operational costs. Manufacturers offering reliable, scalable, and low-maintenance solutions are well-positioned to capture opportunities across municipal, industrial, and commercial wastewater treatment plants globally, while supporting sustainability and water reuse initiatives.

Growth in the wastewater treatment aerators market is challenged by high energy usage and maintenance demands. Aeration systems, particularly mechanical surface aerators, consume significant electricity, which increases operational costs for wastewater treatment plants. Maintenance is critical to prevent wear, fouling, and damage to impellers, diffusers, or motors. Inadequate maintenance can reduce oxygen transfer efficiency, affecting treatment performance and regulatory compliance. Smaller treatment facilities or budget-constrained operations may hesitate to adopt high-capacity or energy-intensive aerators. Manufacturers are addressing these challenges through energy-efficient designs, modular components, and automated monitoring systems to reduce maintenance efforts and operating costs. Optimizing aeration systems for energy and reliability is essential to improve adoption and long-term sustainability.

Market trends are shaped by energy-efficient aerators, automation, and the use of advanced materials. Fine bubble diffusers and low-speed surface aerators reduce power consumption while improving oxygen transfer rates. Integration with sensors, SCADA systems, and IoT platforms allows real-time monitoring, predictive maintenance, and optimized aeration schedules. Use of corrosion-resistant materials, self-cleaning mechanisms, and improved impeller designs enhances durability and operational efficiency. These trends reflect the growing focus on reducing energy costs, minimizing downtime, and improving treatment effectiveness. Facilities adopting intelligent and sustainable aeration solutions can meet environmental compliance requirements while lowering operational expenses, which is driving broader adoption across municipal and industrial wastewater management sectors.

Opportunities arise from the expansion of wastewater infrastructure, increasing industrial effluent management needs, and sustainability initiatives. Rapid urbanization and industrial growth in emerging markets are driving construction of new treatment plants. Stricter discharge regulations in developed regions encourage upgrades and retrofitting of existing systems with efficient aerators. Industries such as food and beverage, chemical processing, pharmaceuticals, and textiles require effective aeration for effluent treatment. Water reuse and environmental sustainability programs further increase demand for high-performance aerators. Companies providing energy-efficient, durable, and easy-to-maintain aeration solutions with strong technical support are well-positioned to capitalize on these opportunities across municipal and industrial wastewater treatment applications globally.

Market growth is restrained by high energy consumption, equipment wear, and complex regulatory compliance. Continuous operation of aerators results in significant electricity usage, increasing operational costs for wastewater treatment plants. Mechanical components such as motors, impellers, and diffusers are prone to corrosion, scaling, and fouling, requiring frequent maintenance and replacements. Compliance with environmental regulations regarding effluent oxygen levels, noise, and emissions adds complexity to system selection and operation. Smaller plants or budget-constrained facilities may delay adopting advanced aerators due to high installation and lifecycle costs. Until energy-efficient designs, corrosion-resistant materials, and simplified compliance solutions are widely implemented, adoption may remain concentrated in larger, well-funded municipal and industrial wastewater treatment operations.

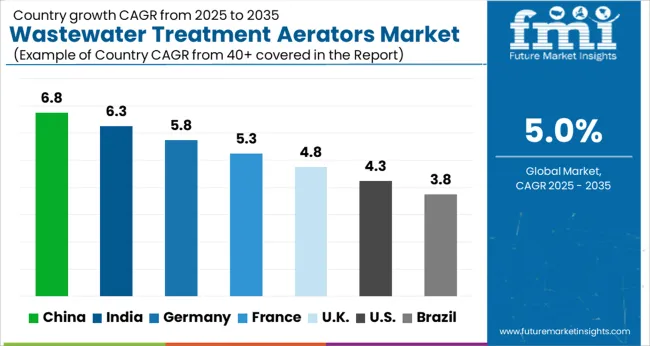

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global wastewater treatment aerators market is projected to grow at a CAGR of 5.0% through 2035, supported by increasing demand across municipal treatment plants, industrial effluent management, and aquaculture applications. Among BRICS nations, China has been recorded with 6.8% growth, driven by large-scale production and deployment in municipal and industrial wastewater facilities, while India has been observed at 6.3%, supported by rising adoption in urban and rural water treatment projects. In the OECD region, Germany has been measured at 5.8%, where production and utilization in industrial wastewater, food processing, and municipal treatment plants have been steadily maintained. The United Kingdom has been noted at 4.8%, reflecting consistent use in municipal and industrial aeration systems, while the USA has been recorded at 4.3%, with production and deployment across municipal, industrial, and aquaculture facilities being steadily increased. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market for wastewater treatment aerators in China is expanding at a CAGR of 6.8%, driven by increasing urbanization, industrial wastewater discharge, and government initiatives to improve water quality. Manufacturers are supplying aeration systems for municipal sewage plants, industrial effluent treatment, and aquaculture facilities. Pilot projects in wastewater treatment plants demonstrate operational benefits including improved oxygen transfer efficiency, enhanced treatment performance, and reduced energy consumption. Collaborations between equipment manufacturers, research institutes, and municipal authorities are contributing to advanced aeration technologies and efficient system design. Rising investment in water infrastructure and environmental compliance continues to drive market growth for wastewater treatment aerators in China.

The market for wastewater treatment aerators in India is growing at a CAGR of 6.3%, supported by industrialization, municipal water management projects, and environmental regulations. Manufacturers are supplying aeration equipment to improve wastewater treatment efficiency in municipal plants, industrial facilities, and aquaculture operations. Government initiatives promoting water quality management, industrial effluent control, and infrastructure development support market adoption. Pilot projects in municipal and industrial facilities demonstrate benefits such as enhanced oxygenation, improved treatment efficiency, and reduced operational costs. Partnerships between technology providers, equipment manufacturers, and research institutes are advancing aeration system design, energy efficiency, and durability. Growing focus on wastewater management and environmental compliance continues to drive growth in India.

The market for wastewater treatment aerators in Germany is recording a CAGR of 5.8%, supported by strict environmental regulations, industrial wastewater management, and municipal sewage treatment. Manufacturers are providing advanced aeration systems to optimize oxygen transfer, reduce energy consumption, and ensure regulatory compliance. Government programs promoting water quality improvement and sustainable industrial practices drive adoption. Pilot deployments in municipal and industrial facilities demonstrate operational benefits including better oxygenation, enhanced treatment efficiency, and cost-effective operation. Collaborations between manufacturers, research centers, and municipalities are improving system design, energy efficiency, and performance reliability. Germany’s focus on sustainable wastewater treatment and environmental compliance sustains market growth.

The market for wastewater treatment aerators in the United Kingdom is growing at a CAGR of 4.8%, driven by municipal and industrial wastewater management requirements. Manufacturers provide aeration systems to optimize oxygen transfer, improve treatment efficiency, and reduce energy costs. Government initiatives supporting water quality management, environmental sustainability, and infrastructure modernization are fostering adoption. Pilot deployments in municipal treatment plants and industrial facilities demonstrate benefits such as enhanced oxygenation, improved performance, and operational reliability. Collaborations between equipment suppliers, research institutes, and municipal authorities improve system design, energy efficiency, and durability. Ongoing efforts to upgrade water treatment infrastructure continue to drive market growth in the United Kingdom.

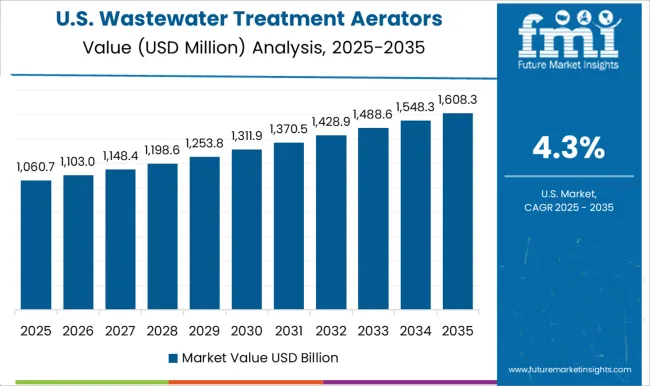

The market for wastewater treatment aerators in the United States is expanding at a CAGR of 4.3%, supported by industrial, municipal, and aquaculture applications. Manufacturers provide aeration systems to enhance oxygen transfer, treatment efficiency, and environmental compliance. Government initiatives promoting sustainable wastewater management, water quality improvement, and industrial effluent control encourage adoption. Pilot projects in municipal and industrial facilities demonstrate operational benefits including optimized oxygenation, energy savings, and improved treatment performance. Collaborations between manufacturers, research institutes, and industrial operators enhance system design, energy efficiency, and durability. Rising investment in water treatment infrastructure continues to drive growth in the United States wastewater treatment aerators market.

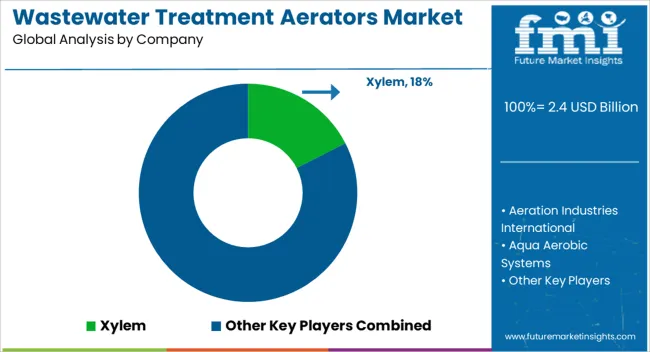

Aeration systems for wastewater treatment are increasingly deployed to improve oxygen transfer efficiency, operational reliability, and energy performance, with suppliers competing on diffuser types, capacity, and integration flexibility. Xylem is positioned as a leading provider, with brochures emphasizing fine- and coarse-bubble aerators, oxygen transfer rates, and installation guidance for municipal and industrial plants. Aeration Industries International and Aqua Aerobic Systems provide submerged and surface aerators, with literature detailing power consumption, durability under continuous operation, and maintenance intervals. Envirotech Systems and GE Water & Process Technologies offer modular aeration units, with brochures highlighting process optimization, energy efficiency, and adaptability to variable loads.

Hach Company and Hydroflo Pumps focus on measurement-integrated aeration, with technical materials presenting control compatibility, flow rates, and aerator sizing guidance. Koch Membrane Systems, Nijhuis Industries, and Pentair supply aerators for high-capacity or specialized applications, with brochures detailing oxygen transfer efficiency, operational limits, and structural specifications. Severn Trent Services, SPX Corporation, and SUEZ Water Technologies & Solutions provide integrated aeration solutions with technical literature highlighting diffuser materials, maintenance procedures, and installation guidelines. Sulzer and Tetra Tech emphasize both energy-efficient and customized solutions, with brochures presenting component durability, installation schematics, and operational benchmarks. Other regional players compete with cost-effective systems, rapid deployment, and tailored designs for smaller municipal or industrial plants.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 Billion |

| Product Type | Fine bubble aerator, Diffused aerator, Mechanical aerator, Surface aerator, and Others (coarse bubble aerator, etc.) |

| Power Source | Electric-powered and Solar powered |

| End-use | Municipal, Industrial, and Others (agricultural, etc.) |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Xylem, Aeration Industries International, Aqua Aerobic Systems, Envirotech Systems, GE Water & Process Technologies, Hach Company, Hydroflo Pumps, Koch Membrane Systems, Nijhuis Industries, Pentair, Severn Trent Services, SPX Corporation, SUEZ Water Technologies & Solutions, Sulzer, and Tetra Tech |

| Additional Attributes | Dollar sales by type including surface aerators, diffused aerators, and brush aerators, application across municipal, industrial, and agricultural wastewater treatment, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising wastewater generation, stringent environmental regulations, and increasing focus on sustainable water management practices. |

The global wastewater treatment aerators market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the wastewater treatment aerators market is projected to reach USD 3.9 billion by 2035.

The wastewater treatment aerators market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in wastewater treatment aerators market are fine bubble aerator, diffused aerator, mechanical aerator, surface aerator and others (coarse bubble aerator, etc.).

In terms of power source, electric-powered segment to command 73.2% share in the wastewater treatment aerators market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wastewater Heavy Metal Treatment Agent Market Size and Share Forecast Outlook 2025 to 2035

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wastewater Treatment Chemical Market Insights - Growth & Demand 2025 to 2035

Bioelectrochemical Systems For Wastewater Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA