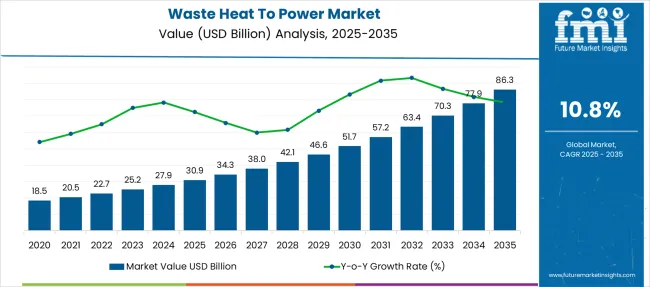

The Waste Heat To Power Market is estimated to be valued at USD 30.9 billion in 2025 and is projected to reach USD 86.3 billion by 2035, registering a compound annual growth rate (CAGR) of 10.8% over the forecast period.

| Metric | Value |

|---|---|

| Waste Heat To Power Market Estimated Value in (2025 E) | USD 30.9 billion |

| Waste Heat To Power Market Forecast Value in (2035 F) | USD 86.3 billion |

| Forecast CAGR (2025 to 2035) | 10.8% |

The waste heat to power (WHP) market is witnessing significant growth as industries prioritize energy efficiency, carbon emission reduction, and cost-effective power generation. The increasing adoption of decarbonization strategies by energy-intensive sectors and stringent environmental regulations are accelerating the deployment of WHP technologies.

Industrial players are investing in energy recovery infrastructure to harness low- and medium-grade waste heat from process streams and convert it into usable electricity. Government-led incentives, policy frameworks promoting energy efficiency, and rising energy costs are strengthening the business case for WHP implementation across sectors such as cement, glass, steel, and refining.

With advances in modular, compact systems and growing interest in distributed power generation, the market is expected to expand further, particularly in emerging economies focused on industrial sustainability and power reliability..

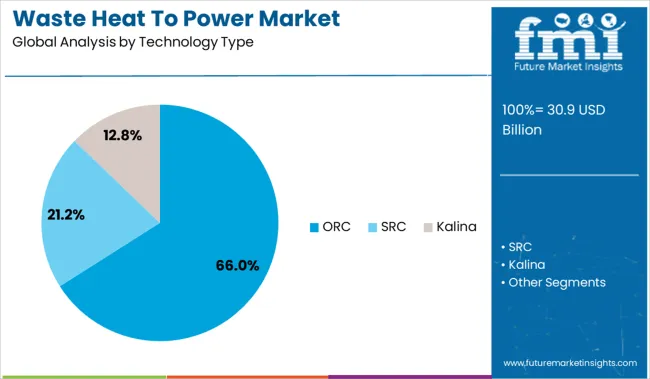

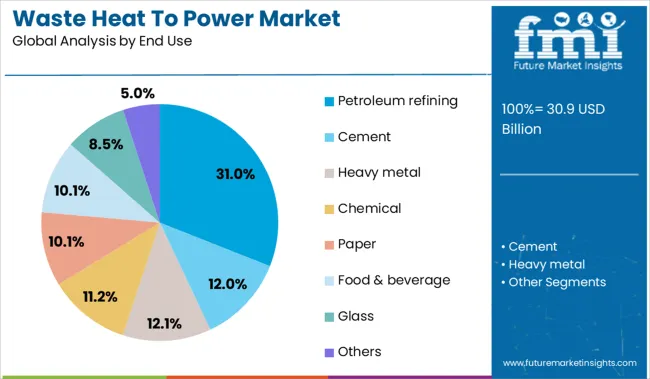

The waste heat to power market is segmented by technology type, end use and geographic regions. By technology type, the waste heat to power market is divided into ORC, SRC, and Kalina. In terms of end use, the waste heat to power market is classified into Petroleum refining, Cement, Heavy metal, Chemical, Paper, Food & beverage, Glass, and Others. Regionally, the waste heat to power industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Organic Rankine Cycle (ORC) technology is projected to hold 66.0% of the total market revenue in 2025, making it the dominant segment by technology type. This leadership is being driven by ORC’s ability to efficiently recover low- to medium-temperature waste heat, which is abundant in many industrial processes.

Its compatibility with a wide range of heat sources, including exhaust gases and geothermal fluids, has broadened its application across multiple sectors. The closed-loop system of ORC enhances operational safety and reliability while reducing maintenance requirements.

Additionally, the flexibility in scaling and the use of environmentally friendly working fluids are aligning well with current sustainability goals. The technology’s ability to integrate with existing heat sources without extensive redesign has made it a preferred choice for retrofitting industrial facilities with energy recovery capabilities..

Petroleum refining is anticipated to contribute 31.0% of the total waste heat to power market revenue in 2025, establishing it as the leading end-use segment. This position is supported by the continuous nature of refinery operations, which generate large volumes of high-temperature waste heat that can be effectively converted to electricity.

With mounting pressure to improve energy efficiency and reduce carbon footprints, refinery operators are actively adopting WHP systems as part of broader ESG and cost-optimization strategies. The integration of WHP technologies within refining units enhances overall plant efficiency while enabling electricity self-generation, which reduces dependence on external power grids.

Furthermore, regulatory directives targeting industrial emissions have encouraged investments in closed-loop recovery systems, making WHP a strategic asset in refinery modernization plans..

Energy conversion efficiency is being enhanced by reclaiming industrial excess heat and converting it into electricity, reducing fuel consumption and operational costs. Systems such as organic Rankine cycle (ORC), steam Rankine, and thermoelectric modules are being used to convert thermal energy streams from manufacturing, steel, cement, and gas turbines. Demand has been reinforced by corporate energy goals, grid offsetting needs, and increasing interest in heat recovery pathways.

WHP systems have been widely adopted by processing plants where waste heat is emitted from boilers, furnaces, gas engines, or exhaust stacks. ORC units have been selected due to their ability to convert low-temperature heat into usable kilowatts without disrupting existing production lines. Steel mills, cement kilns, and chemical reactors have been equipped with heat exchanger networks linked to power generation modules for on-site electricity use or export to local grids. Emissions regulations that penalize flared or vented heat streams have reinforced system deployment. Capital investment has been justified by payback through reduced fuel burn, avoidance of grid purchases, and generation tax incentives. Flexibility in modular skid-mounted systems has allowed retrofitting into existing plants with minimal downtime, accelerating uptake across energy-intensive sectors.

Compact ORC and micro-turbine units are being targeted to smaller heat emitters such as biomass boilers, waste incinerators, and food processing ovens. Partnerships between equipment manufacturers and EPC (engineering, procurement, construction) firms are enabling turnkey heat recovery projects that integrate thermal modelling, control software, and grid interconnection. Remote monitoring platforms are being introduced for performance optimization and fault detection. Emerging opportunities have been found in marine engine exhaust heat recovery and distributed district-energy systems with embedded power generation. Energy-as-a-service business models, where system deployment is financed through power savings, have been piloted to reduce upfront costs for industrial operators. Hybridisation with solar thermal and waste-to-energy assets is being explored to ensure continuous power output and maximize overall system efficiency.

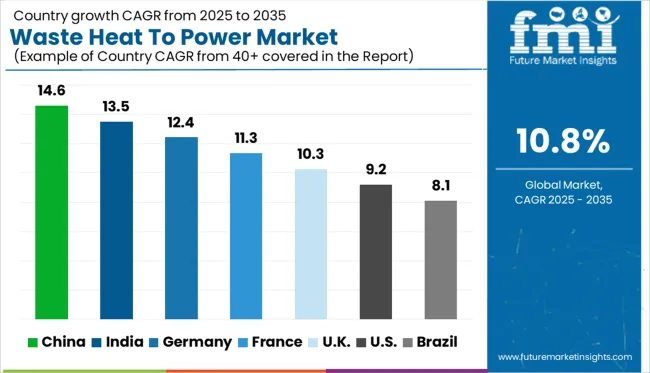

| Country | CAGR |

|---|---|

| China | 14.6% |

| India | 13.5% |

| Germany | 12.4% |

| France | 11.3% |

| UK | 10.3% |

| USA | 9.2% |

| Brazil | 8.1% |

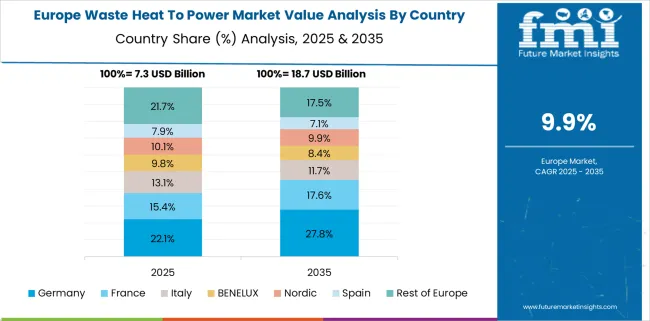

The global waste heat to power market is expected to grow at a 10.8% CAGR from 2025 to 2035, driven by decarbonization goals, energy efficiency mandates, and cost recovery strategies in high-heat industries. China leads with 14.6%, propelled by large-scale steel, cement, and chemical plant retrofits integrating Organic Rankine Cycle (ORC) systems. India follows at 13.5%, with cement clusters and refineries adopting WHP units under emission-linked incentives. Germany posts 12.4%, supported by EU-funded waste energy projects and integration in automotive manufacturing. France grows at 11.3%, prioritizing energy optimization in district heating and incineration plants. The United Kingdom at 10.3% focuses on WHP in glass, metal recycling, and combined heat and power networks, aligning with net-zero targets.

China is projected to grow at a 14.6% CAGR, leading global adoption of WHP systems in energy-intensive sectors such as steel, cement, and petrochemicals. Industrial clusters are deploying Organic Rankine Cycle (ORC) and Kalina Cycle systems for efficient heat recovery and emission reduction. Government-backed energy efficiency policies under the 14th Five-Year Plan incentivize WHP integration across heavy industries. Local OEMs are investing in modular WHP units for retrofitting older plants. Expanding district heating and waste-to-energy projects further support demand. China’s leadership in WHP deployment reinforces its strategy to reduce coal dependency while leveraging residual heat for sustainable electricity generation.

The sale of WHP in India is forecast to expand at a 13.5% CAGR, driven by cement plants, refineries, and metal smelters adopting waste heat recovery systems for cost optimization. Government initiatives like Perform, Achieve and Trade (PAT) under the National Mission on Enhanced Energy Efficiency support WHP deployment across large industrial units. EPC contractors are designing integrated WHP plants for process industries in Gujarat and Odisha. Growing demand for low-carbon cement and steel boosts WHP adoption in kiln lines and blast furnaces. ORC technology is gaining traction for medium-temperature applications in fertilizer and chemical sectors. Industrial clusters are collaborating with private IPPs for distributed WHP generation.

Germany is expected to grow at a 12.4% CAGR, supported by EU climate directives and waste energy optimization in high-value sectors. WHP demand is concentrated in automotive, chemical, and heavy manufacturing plants integrating ORC-based recovery systems for efficiency gains. Public-private partnerships under EU Horizon projects encourage WHP deployment for industrial decarbonization. Power producers and facility managers are focusing on closed-loop WHP systems for process heat recycling. Integration of digital monitoring with WHP units enhances predictive maintenance in continuous production environments. Germany’s strong engineering base positions it as a leader in advanced WHP component development, including high-efficiency heat exchangers and vapor turbines.

France is projected to grow at an 11.3% CAGR, fueled by increased energy recovery initiatives in municipal waste incineration and industrial CHP networks. ORC-based WHP systems are widely used in cement, glass, and chemical sectors to meet EU efficiency benchmarks. Regional utilities are partnering with WHP technology providers to integrate solutions within district heating grids. France’s government mandates emission-linked performance standards that reward WHP installations through green tax incentives. Compact WHP systems are gaining traction in mid-sized industrial facilities where space limitations exist. Collaborative projects under ADEME programs are driving technology upgrades across cement kilns and municipal waste plants.

The United Kingdom is forecast to grow at a 10.3% CAGR, slightly trailing EU peers but supported by strong energy recovery policies. Industrial decarbonization programs prioritize WHP deployment in glass, ceramics, and metal recycling units. ORC systems are being adopted for medium-heat recovery in food processing and combined heat and power (CHP) networks. WHP projects are increasingly integrated with carbon capture and storage (CCS) initiatives to meet net-zero targets. Regulatory emphasis on energy performance certificates accelerates adoption in retrofitted facilities. Partnerships between industrial operators and independent power producers are emerging for shared WHP capacity in multi-tenant industrial parks.

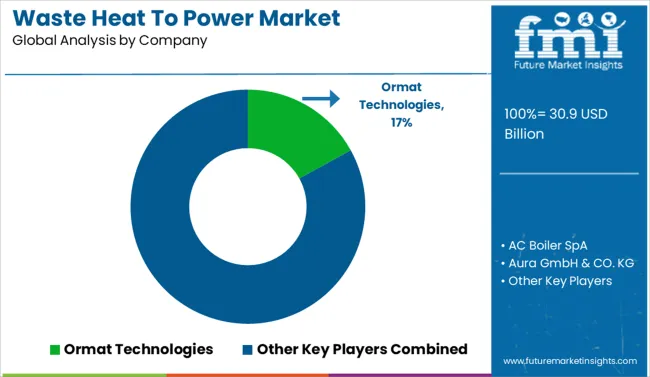

The waste heat to power (WHP) market is dominated by Ormat Technologies, holding a significant market share, driven by its strong portfolio of Organic Rankine Cycle (ORC) systems applied in geothermal, industrial, and waste-heat recovery segments. General Electric (GE) and Siemens Energy provide integrated WHP solutions, combining heat recovery boilers with advanced turbines for large-scale industrial and utility projects. Mitsubishi Heavy Industries and IHI Corporation target heavy industry deployments, leveraging expertise in high-temperature exhaust recovery for steel, cement, and petrochemical applications. Climeon and Exergy International lead in modular ORC units for decentralized and mid-scale industrial WHP projects, enabling flexible deployment in resource-constrained environments. Dürr Group and Cochran Ltd. offer skid-mounted boilers and compact WHP solutions suited for OEM partnerships and retrofit markets. Aura GmbH & Co. KG, AC Boiler SpA, and Rentech Boiler Systems cater to European industrial sectors with custom-engineered WHP packages. Meanwhile, Thermax Ltd, Walchandnagar Industries, and Forbes Marshall spearhead WHP adoption in emerging markets by providing localized manufacturing, installation services, and lifecycle support.

In late 2024, Climeon completed deliveries of six HeatPower 300 waste heat recovery units to be integrated aboard six new A.P. Møller–Maersk 17,200 TEU container vessels, converting engine exhaust heat into sustainable electricity on the high seas.

| Item | Value |

|---|---|

| Quantitative Units | USD 30.9 Billion |

| Technology Type | ORC, SRC, and Kalina |

| End Use | Petroleum refining, Cement, Heavy metal, Chemical, Paper, Food & beverage, Glass, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ormat Technologies, AC Boiler SpA, Aura GmbH & CO. KG, Climeon, Cochran Ltd., Dürr Group, Exergy International Srl, Forbes Marshall, General Electric, IHI Corporation, Mitsubishi Heavy Industries, Ltd., Rentech Boiler System, Siemens Energy, Thermax Ltd, and Walchandnagar Industries Limited |

| Additional Attributes | Dollar sales in the waste heat to power market are driven by Organic Rankine Cycle technology, with key industries like cement and steel leading adoption. North America and Europe lead deployment due to regulations, while Asia-Pacific grows rapidly. OEMs focus on efficiency and innovative materials for sustainable energy recovery. |

The global waste heat to power market is estimated to be valued at USD 30.9 billion in 2025.

The market size for the waste heat to power market is projected to reach USD 86.3 billion by 2035.

The waste heat to power market is expected to grow at a 10.8% CAGR between 2025 and 2035.

The key product types in waste heat to power market are orc, src and kalina.

In terms of end use, petroleum refining segment to command 31.0% share in the waste heat to power market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Waste Wood Recycling Market Size and Share Forecast Outlook 2025 to 2035

Waste-derived Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Wastewater Heavy Metal Treatment Agent Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Waste Recycling Services Market by Application, Product Type, and Region - Growth, Trends, and Forecast 2025 to 2035

Waste Wrap Film Market

Waste to Energy Market Growth - Trends & Forecast 2025 to 2035

Wastewater Treatment Aerators Market Size and Share Forecast Outlook 2025 to 2035

Waste Heat Power Generation Boiler Market Size and Share Forecast Outlook 2025 to 2035

E-Waste Management Market Growth - Trends & Forecast 2025 to 2035

AI Waste Sorting Robots Market Forecast and Outlook 2025 to 2035

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Zero-Waste Packaging Technologies Market Size and Share Forecast Outlook 2025 to 2035

Zero-Waste Refill Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Waste Shredder Market Size and Share Forecast Outlook 2025 to 2035

Food Waste Disposal Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Waste Composting Machine Market Size and Share Forecast Outlook 2025 to 2035

Food Waste-Derived Protein Market Size and Share Forecast Outlook 2025 to 2035

Food Waste Management Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA