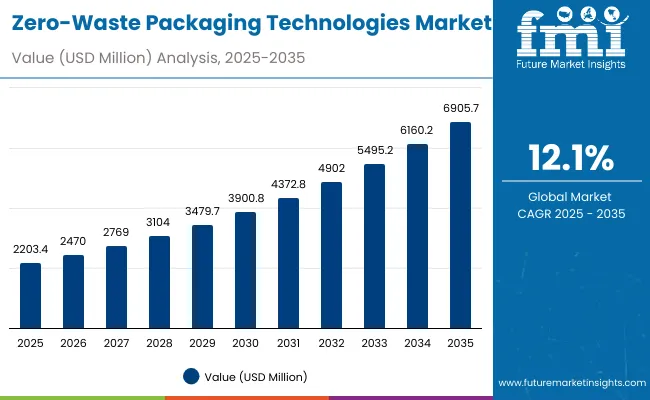

A valuation of USD 2,203.4 million is projected for the Zero-Waste Packaging Technologies Market in 2025, with the figure anticipated to climb to USD 6,905.7 million by 2035. This represents an increase of USD 4,702.3 million, equal to a 212% expansion over the decade. The overall trajectory reflects a CAGR of 12.1%, signaling more than a threefold increase in market size by the end of the forecast horizon.

Zero-Waste Packaging Technologies Market Key Takeaways

| Metric | Value |

|---|---|

| Zero-Waste Packaging Technologies Market Estimated Value in (2025E) | USD 2,203.4 million |

| Zero-Waste Packaging Technologies Market Forecast Value in (2035F) | USD 6,905.7 million |

| Forecast CAGR (2025 to 2035) | 12.10% |

During the initial five-year phase from 2025 to 2030, the market is expected to grow from USD 2,203.4 million to USD 3,900.8 million, contributing USD 1,697.4 million. This period is anticipated to account for 36% of the total decade growth. Momentum in this phase is expected to be fueled by strong adoption of refill pods, dissolvable sachets, and reusable systems across mainstream categories. Others by format, representing 55.6% share, and Others by channel with 53.5% share, are projected to dominate, supported by collaborative retail models and innovative supply-chain integration.

The second half of the decade from 2030 to 2035 is forecasted to contribute USD 3,004.9 million, which equals 64% of total growth, as the market advances from USD 3,900.8 million to USD 6,905.7 million. This acceleration is anticipated to be reinforced by large-scale deployment of loop systems, regulatory pressure on single-use packaging, and the scaling of home-compostable solutions. By 2035, mainstream adoption is expected to consolidate the dominance of Others across both format and channel segments, reflecting strong resilience and long-term sustainability appeal.

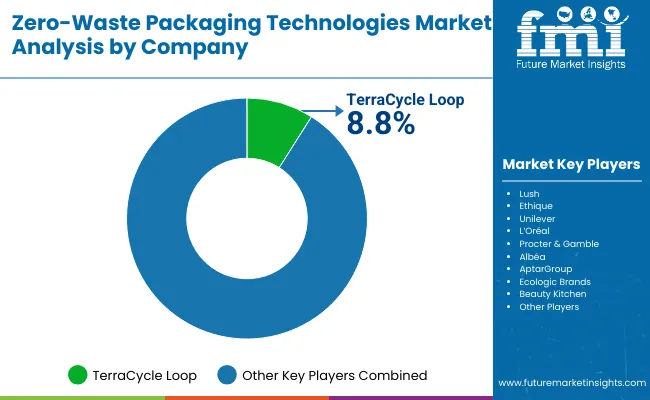

From 2020 to 2024, the groundwork for growth in zero-waste packaging was established as sustainability regulations tightened and consumer expectations for eco-friendly solutions increased. By 2025, the market is projected to reach USD 2,203.4 million, setting the stage for an era of rapid expansion. Competitive dynamics are expected to remain fragmented, with TerraCycle Loop holding 8.8% share while the majority of value is distributed among diversified players.

By 2035, demand is forecasted to climb to USD 6,905.7 million, supported by a CAGR of 12.1%. Asia-Pacific, particularly China and India, is anticipated to deliver the highest growth momentum, while North America and Europe are projected to remain strong innovation hubs. Market advantage is expected to be redefined by ecosystem strength, closed-loop integration, and consumer engagement platforms rather than by packaging formats alone. Traditional packaging approaches are likely to give way to circular models that emphasize scalability, affordability, and measurable sustainability impact.

Growth in the Zero-Waste Packaging Technologies Market is being driven by rising consumer demand for sustainable alternatives and increasing regulatory pressures to reduce single-use plastics. Strong emphasis has been placed on refillable, compostable, and reusable packaging systems, which are being adopted across industries ranging from personal care to food and beverages. Expansion is being reinforced by the adoption of refill pods, dissolvable sachets, and compostable formats that align with evolving circular economy principles.

Innovation in closed-loop supply chains is anticipated to accelerate adoption as major brands incorporate zero-waste solutions into mainstream portfolios. Investment in infrastructure such as in-store refill stations and mail-back systems is being scaled to improve accessibility and consumer convenience. Rapid uptake in Asia-Pacific, particularly in China and India, is expected to reshape competitive positioning, while North America and Europe are projected to act as innovation hubs. Market momentum is anticipated to remain robust as sustainability becomes a core purchasing driver.

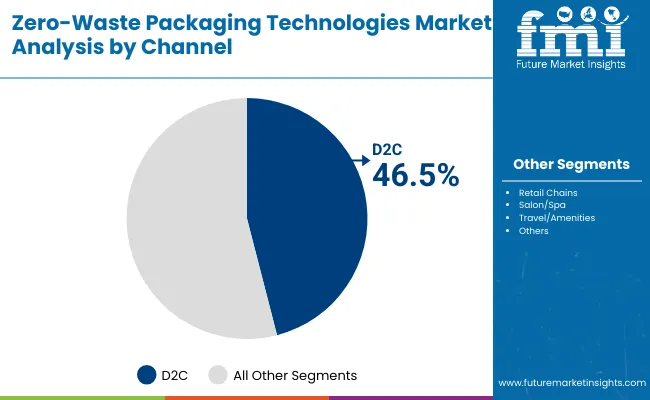

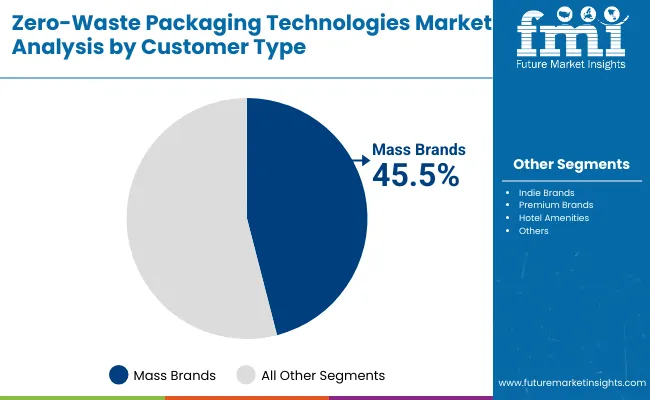

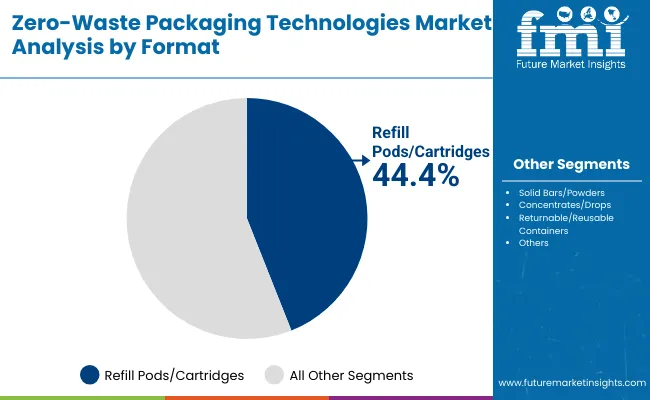

The Zero-Waste Packaging Technologies Market has been segmented across multiple dimensions to highlight adoption trends and identify growth opportunities. Segmentation by channel provides insights into how consumers are accessing zero-waste solutions through direct-to-consumer models and wider distribution networks. Segmentation by customer type examines how mass brands and niche players are embracing sustainability-driven packaging innovation. Segmentation by format explores the growing use of refill systems and alternative packaging types that eliminate waste at source. This structured approach allows deeper understanding of market direction and competitive advantage. Future expansion is expected to be defined by the balance between scale-driven adoption by mainstream brands and innovation-led contributions from smaller players.

| Segment | Market Value Share, 2025 |

|---|---|

| D2C | 46.5% |

| Others | 53.5% |

The channel segment is expected to demonstrate strong diversification, with Others holding 53.5% share in 2025, equal to USD 1,179.6 million. This dominance is anticipated to be supported by extensive partnerships with retailers and supply-chain systems that integrate refill and reuse models. D2C, valued at USD 1,022.2 million, is projected to benefit from brand-controlled consumer experiences, driving deeper engagement and loyalty. Increasing online adoption and direct brand interaction are likely to accelerate D2C growth in the coming years. The long-term outlook suggests that both channels will remain vital, with Others delivering scale advantages while D2C fosters innovation and personalized sustainability experiences.

| Segment | Market Value Share, 2025 |

|---|---|

| Mass brands | 45.5% |

| Others | 54.5% |

The customer type segment is forecasted to be led by Others with 54.5% share in 2025, representing USD 1,201.85 million. This reflects the growing adoption by independent, niche, and premium brands that are prioritizing sustainable identity as a core differentiator. Mass brands are projected to contribute 45.5% (USD 1,000.4 million), supported by their capacity to scale zero-waste solutions across wide consumer bases. Over time, mass brands are expected to drive affordability and accessibility, while Others will sustain innovation and early adoption of new formats. Market balance is likely to shift as mainstream players expand their sustainability commitments, creating an ecosystem where both segments collectively accelerate overall growth.

| Segment | Market Value Share, 2025 |

|---|---|

| Refill pods/cartridges | 44.4% |

| Others | 55.6% |

The format segment is projected to be dominated by Others in 2025, capturing 55.6% share worth USD 1,224.11 million. This growth is anticipated to be driven by diverse formats such as powders, dissolvable sachets, and reusable containers that expand consumer choice while minimizing waste. Refill pods and cartridges are expected to contribute 44.4% (USD 977.8 million), reflecting strong penetration in personal care and household product categories. Increasing consumer familiarity with refill systems is likely to strengthen this segment further over time. The evolution of format choices is expected to redefine packaging norms, with innovation in compostable and reusable options sustaining long-term market adoption.

Adoption of zero-waste packaging is being reshaped by shifting consumer expectations, regulatory frameworks, and technological innovations. While systemic challenges persist in scaling infrastructure and cost efficiency, evolving industry priorities are projected to accelerate the transition toward sustainable, circular packaging ecosystems globally.

Regulatory Convergence on Circular Economy Standards

The driver most significantly shaping this market is regulatory convergence on circular economy principles. Packaging producers are being required to align with extended producer responsibility (EPR) frameworks, mandating lifecycle accountability and measurable waste reduction. Such alignment is anticipated to create standardization across markets, simplifying compliance for global brands while intensifying the need for innovation. Government-led incentives for compostable materials and bans on single-use plastics are expected to accelerate adoption. In this environment, companies that invest in modular packaging systems and closed-loop logistics are forecasted to establish long-term cost advantages, while late adopters risk regulatory penalties and reputational erosion.

Infrastructure Gaps in Refill and Reuse Systems

A major restraint arises from infrastructure gaps that limit refill and reuse adoption at scale. While consumer willingness has strengthened, insufficient accessibility to refill stations and inconsistent reverse logistics systems are constraining widespread usage. The absence of standardized return frameworks across retail networks adds operational complexity and inflates costs. This challenge is particularly acute in emerging markets where infrastructure investment lags behind policy ambitions. Unless these bottlenecks are addressed, scalability will remain uneven, slowing the pace of transition. However, collaboration between packaging innovators, retailers, and municipal systems is projected to be decisive in overcoming this barrier, unlocking untapped growth potential.

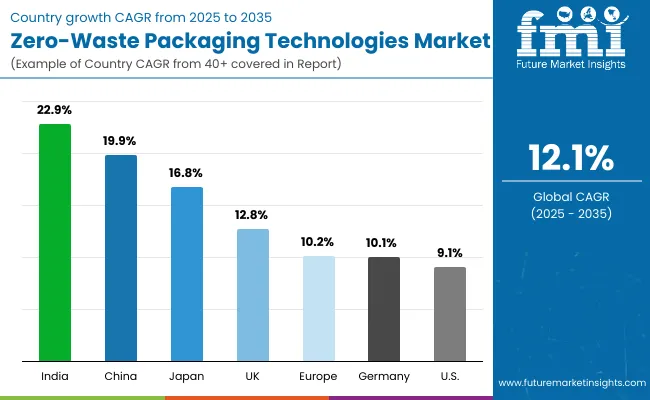

| Countries | CAGR |

|---|---|

| China | 19.9% |

| USA | 9.1% |

| India | 22.9% |

| UK | 12.8% |

| Germany | 10.1% |

| Japan | 16.8% |

The Zero-Waste Packaging Technologies Market demonstrates varied adoption across countries, shaped by policy frameworks, consumer awareness, and infrastructure maturity. Asia-Pacific is forecasted to emerge as the strongest growth hub, anchored by India at a CAGR of 22.9% and China at 19.9% during 2025-2035. India’s trajectory is expected to be powered by regulatory support, heightened consumer acceptance, and the expansion of organized retail networks that are embedding refill and reuse systems into mainstream distribution. China’s growth outlook is reinforced by large-scale government initiatives on sustainability, rapid digitalization of supply chains, and the influence of leading domestic brands embracing zero-waste commitments.

Japan, with a projected CAGR of 16.8%, is anticipated to benefit from advanced recycling infrastructure and consumer-driven demand for premium sustainable packaging solutions. In Europe, the UK and Germany are projected to grow at 12.8% and 10.1% respectively, driven by stringent compliance standards, circular economy directives, and strong participation from multinational consumer goods companies. North America reflects a more moderate trajectory, with the USA expected to grow at 9.1%. Growth in the USA is likely to be led by technology-driven collaborations and corporate sustainability strategies rather than regulatory enforcement. Collectively, these markets illustrate a transition toward global convergence in zero-waste adoption, though at varied speeds.

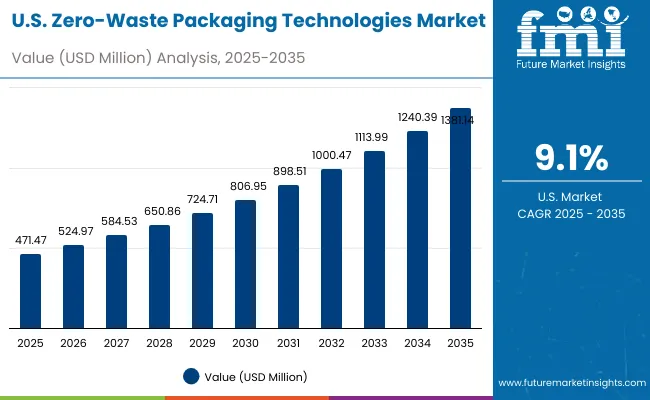

| Year | USA Zero-Waste Packaging Technologies Market (USD Million) |

|---|---|

| 2025 | 471.47 |

| 2026 | 524.97 |

| 2027 | 584.53 |

| 2028 | 650.86 |

| 2029 | 724.71 |

| 2030 | 806.95 |

| 2031 | 898.51 |

| 2032 | 1,000.47 |

| 2033 | 1,113.99 |

| 2034 | 1,240.39 |

| 2035 | 1,381.14 |

The Zero-Waste Packaging Technologies Market in the United States is projected to grow at a CAGR of 11.0%, driven by the scaling of refill systems, reusable containers, and compostable packaging formats. Retail collaborations have recorded consistent year-on-year expansion, particularly among consumer goods companies integrating closed-loop packaging models. The food and beverage sector has been incorporating refillable stations into mainstream outlets, while personal care and household product categories are embedding zero-waste packaging into subscription and direct-to-consumer channels. Innovation is also expanding in e-commerce, where sustainable packaging formats are being integrated to address rising consumer demand for environmentally responsible solutions. Advancements in digital traceability and supply chain automation are creating opportunities for ecosystem partnerships across industries.

The Zero-Waste Packaging Technologies Market in the UK is projected to expand at a CAGR of 12.8% between 2025 and 2035, supported by sustainability commitments and regulatory compliance with circular economy directives. Retailers have been integrating refill stations into mainstream supermarkets, enabling scalable adoption. Premium brands have been adopting reusable and compostable formats to reinforce eco-conscious consumer engagement. E-commerce platforms are expected to accelerate uptake by promoting waste-free delivery systems. Policy enforcement is anticipated to push manufacturers toward eco-friendly innovations, ensuring consistent market growth.

The Zero-Waste Packaging Technologies Market in India is forecasted to grow at the highest rate globally, registering a CAGR of 22.9% from 2025 to 2035. Expansion is being fueled by government-led sustainability initiatives and rising urban consumption. Organized retail chains have been piloting reusable and refill-based packaging, while small-scale enterprises are innovating with dissolvable and home-compostable alternatives. A strong cultural emphasis on reducing waste is expected to complement this trajectory, creating fertile ground for scaling. Infrastructure improvements and digital commerce integration are projected to strengthen accessibility across urban and semi-urban regions.

The Zero-Waste Packaging Technologies Market in China is projected to achieve a CAGR of 19.9% through 2035, driven by government regulations and strong consumer acceptance of sustainable solutions. Leading domestic brands are aligning with zero-waste commitments, reinforcing large-scale adoption. Expansion is being powered by investments in circular supply chain systems and widespread availability of refill stations across metropolitan areas. E-commerce and subscription-based models are expected to integrate zero-waste packaging to meet sustainability demands. Continuous technological innovation in biodegradable and compostable materials is anticipated to accelerate market penetration.

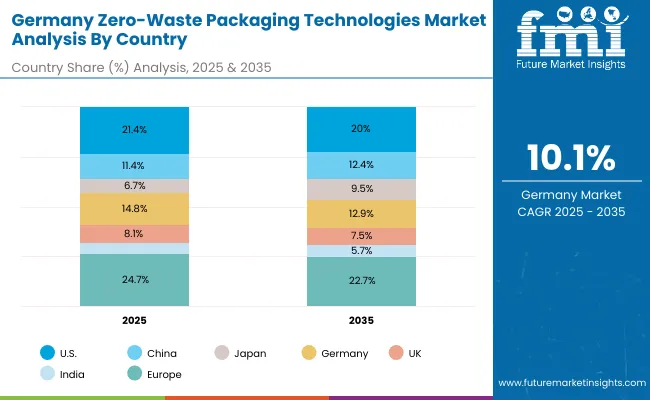

| Countries | 2025 |

|---|---|

| USA | 21.4% |

| China | 11.4% |

| Japan | 6.7% |

| Germany | 14.8% |

| UK | 8.1% |

| India | 5.1% |

| Countries | 2035 |

|---|---|

| USA | 20.0% |

| China | 12.4% |

| Japan | 9.5% |

| Germany | 12.9% |

| UK | 7.5% |

| India | 5.7% |

The Zero-Waste Packaging Technologies Market in Germany is expected to expand at a CAGR of 10.1% during 2025-2035, supported by stringent EU circular economy directives and consumer-driven sustainability preferences. Multinational consumer goods companies are adopting closed-loop packaging systems to comply with regulatory standards. Strong recycling infrastructure is anticipated to accelerate the integration of reusable packaging formats. Growth is being reinforced by widespread retailer participation in refill and return schemes. Collaboration between packaging innovators and manufacturing industries is projected to advance adoption of next-generation zero-waste technologies.

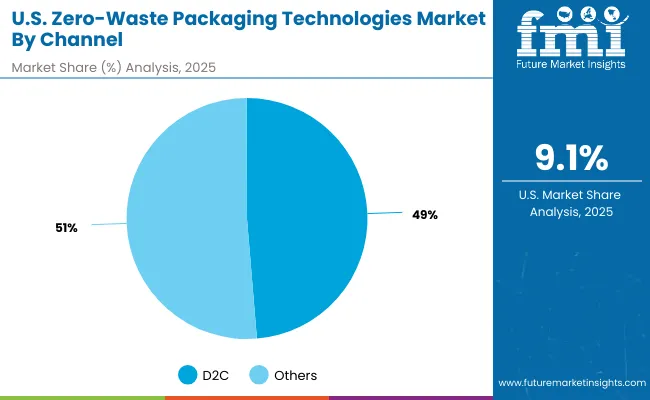

| Segment | Market Value Share, 2025 |

|---|---|

| D2C | 48.7% |

| Others | 51.3% |

The Zero-Waste Packaging Technologies Market in the United States is projected at USD 471.47 million in 2025. Others contribute 51.3%, while D2C holds 48.7%, which illustrates a nearly balanced channel distribution. This marginal dominance of Others reflects the embedded role of retail and third-party networks in scaling refill and reuse models across supermarkets, convenience stores, and specialty outlets. D2C has been positioned as a strong parallel channel, supported by subscription models and e-commerce-driven consumer engagement. As digital retail ecosystems mature, opportunities are anticipated for hybrid adoption, where direct brand control complements retail partnerships to accelerate mainstream zero-waste accessibility. Integration of digital traceability tools is expected to strengthen consumer confidence and further expand D2C adoption. Over the long term, the interplay between scale-oriented retail channels and innovation-led direct-to-consumer platforms is projected to define market leadership.

| Segment | Market Value Share, 2025 |

|---|---|

| Mass brands | 46.4% |

| Others | 53.6% |

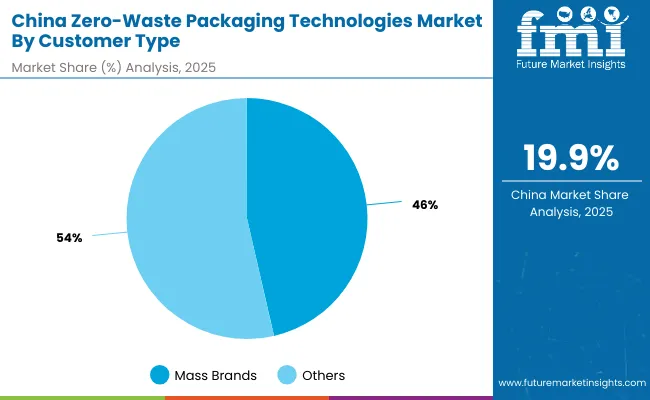

The Zero-Waste Packaging Technologies Market in China is projected at USD 251.50 million in 2025. Others contribute 53.6%, while Mass brands hold 46.4%, reflecting a slightly higher adoption among independent, niche, and premium players. This dominance of Others highlights the speed with which emerging brands are aligning with zero-waste values to attract environmentally conscious consumers in urban markets. Mass brands are nonetheless positioned strongly, with their scale expected to drive affordability and accessibility across diverse consumer bases. Policy mandates and government incentives for sustainable packaging are anticipated to further reinforce adoption across both groups. Over time, integration of smart packaging systems, digital traceability, and home-compostable materials is projected to strengthen customer confidence and accelerate adoption. The balance between scale-driven expansion by Mass brands and innovation-driven adoption by Others is expected to create a dynamic growth environment in China.

| Company | Global Value Share 2025 |

|---|---|

| TerraCycle Loop | 8.8% |

| Others | 91.2% |

The Zero-Waste Packaging Technologies Market is moderately fragmented, with global leaders, mid-sized innovators, and niche-focused specialists competing across regions. Prominent players such as Terra Cycle Loop, Unilever, L’Oréal, and Procter & Gamble are recognized as global leaders, leveraging scale, brand influence, and supply chain integration to accelerate adoption. Terra Cycle Loop, in particular, has emerged as the most dominant player, holding 8.8% global market share in 2024, while the remainder of the market is divided among diversified multinational corporations and emerging innovators.

Mid-sized innovators including Ethique, Lush, Albéa, and AptarGroup are strengthening their presence through product innovation and eco-centric brand positioning. These companies are introducing refill pods, dissolvable packaging, and reusable container solutions to align with evolving consumer expectations. Their strategies are increasingly built around affordability, accessibility, and customization, making them highly competitive in fast-growing segments.

Specialist providers such as Ecologic Brands and Beauty Kitchen are focusing on niche adoption models, particularly compostable containers and refill-based solutions, often gaining traction through strong regional partnerships.

Competitive differentiation is shifting from traditional packaging functionality toward closed-loop ecosystems, digital traceability, and circular logistics models. Over the forecast horizon, partnerships, innovation in compostable materials, and hybrid distribution strategies are expected to define long-term market positioning.

Key Developments in Zero-Waste Packaging Technologies Market

| Item | Value |

|---|---|

| Quantitative Units | USD 2,203.4 million (2025E) - USD 6,905.7 million (2035F) |

| By Channel | D2C (USD 1,022.2 million, 46.5% share in 2025), Others (USD 1,179.6 million, 53.5% share in 2025) |

| By Customer Type | Mass brands (USD 1,000.4 million, 45.5% share in 2025), Others (USD 1,201.9 million, 54.5% share in 2025) |

| By Format | Refill pods/cartridges (USD 977.8 million, 44.4% share in 2025), Others (USD 1,224.1 million, 55.6% share in 2025) |

| By Material | PCR/biopolymers, Paper-composite, Aluminum, Glass |

| By System | In-store refill stations, Mail-back/Loop systems, Home-compostable packs, Dissolvable sachets |

| End-use Industry | Food & Beverages, Personal Care & Cosmetics, Household Products, Hospitality, Retail Chains, Healthcare Packaging, Travel & Amenities |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TerraCycle Loop, Unilever, L’Oréal, Procter & Gamble, Albéa, AptarGroup, Ecologic Brands, Beauty Kitchen, Ethique, Lush |

| Additional Attributes | Dollar sales by channel, customer type, and format; adoption trends in refill/reuse systems; regulatory-driven demand for compostable packaging; growth in refill stations and mail-back systems; integration of digital traceability platforms; regional trends influenced by circular economy policies; innovations in dissolvable and home-compostable packaging materials. |

The global Zero-Waste Packaging Technologies Market is estimated to be valued at USD 2,203.4 million in 2025.

The market size for the Zero-Waste Packaging Technologies Market is projected to reach USD 6,905.7 million by 2035.

The Zero-Waste Packaging Technologies Market is expected to expand at a CAGR of 12.1% between 2025 and 2035.

The key product types in this market include refill pods and cartridges, dissolvable sachets, compostable packs, and reusable containers.

In terms of format, the “Others” category, which includes powders, dissolvable sachets, and reusable containers, is projected to command 55.6% share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Zero-Waste Packaging Market Report – Sustainable Growth & Trends 2023-2033

Zero-Waste Refill Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA