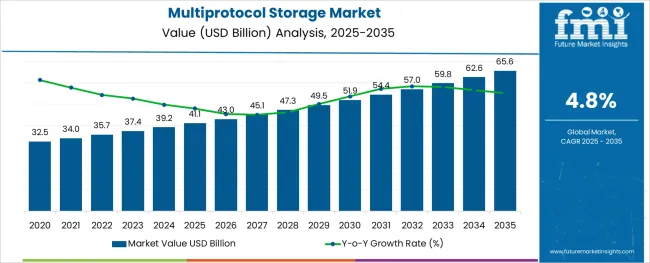

The Multiprotocol Storage Market is estimated to be valued at USD 41.1 billion in 2025 and is projected to reach USD 65.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The multiprotocol storage market is expanding rapidly as organizations seek flexible, scalable, and efficient data storage solutions to manage increasing data volumes. The growth of cloud computing and digital transformation initiatives has driven widespread adoption of multiprotocol storage architectures that support diverse data access methods. Technological developments in storage networking and data management have improved performance and integration capabilities.

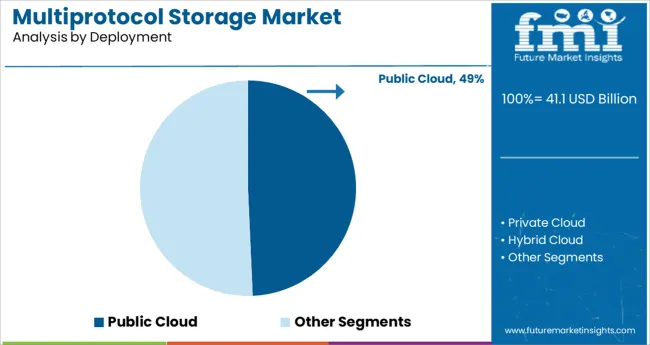

Public cloud deployment models have become highly preferred due to their scalability, cost efficiency, and ease of access. Increasing reliance on data analytics, artificial intelligence, and enterprise applications is pushing demand for storage solutions that provide reliability and speed.

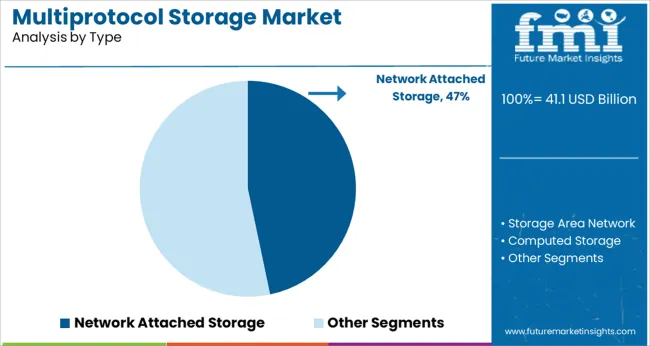

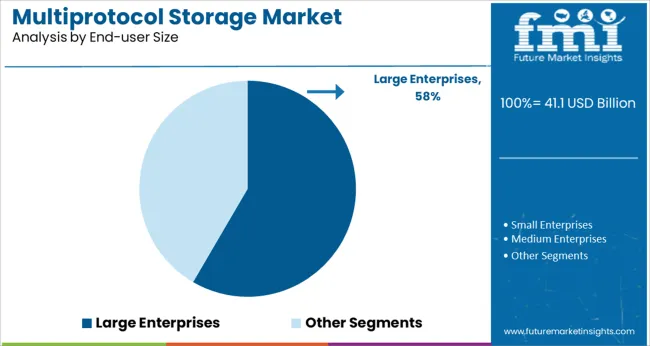

Additionally, large enterprises with complex IT infrastructures are adopting multiprotocol storage systems to simplify management and enhance data availability. Future growth is expected to be fueled by advances in hybrid cloud solutions and edge computing. Segmental growth is projected to be led by Public Cloud deployment, Network Attached Storage type, and Large Enterprises as the key end-user segment.

The market is segmented by Deployment, Type, End-user Size, and Vertical and region. By Deployment, the market is divided into Public Cloud, Private Cloud, and Hybrid Cloud. In terms of Type, the market is classified into Network Attached Storage, Storage Area Network, and Computed Storage. Based on End-user Size, the market is segmented into Large Enterprises, Small Enterprises, and Medium Enterprises.

By Vertical, the market is divided into IT and Telecommunications, BSFI, Transportation and Logistics, Manufacturing, Government and Defence, E-commerce, Healthcare, Energy and Utilities, Retail, Media and Entertainment, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Public Cloud segment is forecasted to account for 49.3% of the multiprotocol storage market revenue in 2025, maintaining its leading position. Growth in this segment is driven by the agility and scalability public cloud services provide, enabling enterprises to dynamically allocate storage resources based on demand.

Public cloud storage offers flexible access protocols, facilitating seamless data sharing and collaboration across distributed teams. The pay-as-you-go pricing model has made it attractive for organizations aiming to optimize IT costs.

Moreover, the rise of remote work and digital collaboration has amplified reliance on cloud storage solutions. Enhanced security measures and compliance standards have increased confidence in public cloud deployments. Given these benefits, public cloud storage is expected to remain the dominant deployment model in the multiprotocol storage market.

The Network Attached Storage (NAS) segment is projected to hold 46.7% of the market revenue in 2025, making it the leading storage type. NAS systems provide centralized storage accessible over standard network protocols, making them ideal for file sharing and collaborative workflows.

Their ease of deployment, scalability, and compatibility with multiple data protocols have contributed to widespread adoption. Organizations have leveraged NAS to simplify data management and improve access speed, especially for unstructured data.

The continuous integration of NAS with cloud platforms and virtualization environments has further boosted its appeal. NAS solutions are favored for their balance of performance, cost, and flexibility, driving consistent growth in this segment.

The Large Enterprises segment is expected to contribute 58.4% of the multiprotocol storage market revenue in 2025, retaining its dominance among end-users. Large enterprises require robust storage infrastructures to manage vast and diverse data sets generated from multiple business units and operations.

Their investments in digital transformation and big data analytics have accelerated the deployment of multiprotocol storage systems. The need for high availability, disaster recovery, and compliance with data regulations has made multiprotocol storage solutions indispensable.

Enterprises have prioritized storage solutions that support hybrid and multi-cloud environments to maintain flexibility and control. Given their extensive IT budgets and complex data requirements, large enterprises are projected to continue driving demand and innovation in this market segment.

The upsurge in the consumption of goods over the past decade and the consumption trends are expected to be the important factors positively impacting the growth of the global multiprotocol storage market from 2025 to 2035.

Multiprotocol storage market growth is being driven by factors such as reduced hardware requirements, lower capital expenditures for the enterprise, easier and more centralized management of storage administration tasks, and more stable operational processes.

Several factors are hindering the growth of the multiprotocol storage market. These include operational control limitations, which cause reduced or variable storage performance, and backup strategies that are required to avoid performance issues.

North America region is the largest market for multiprotocol storage due to the presence of a wide variety of end-user enterprises and the competitive environment between them.

Due to rapid advancements in multiprotocol storage, North America is expected to capture the largest market share based on the current market scenario. It is likely to hold 37.8% of the total market share during the forecast period.

The multiprotocol storage business is growing at a significant pace due to changing technology and industry landscape.

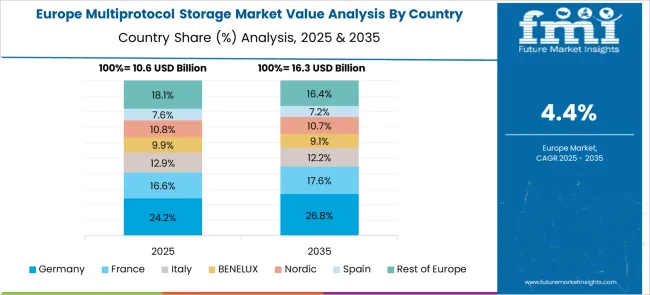

The European regions are expected to have favorable growth, accounting for 24.1% of the global market share for the multipurpose storage market.

Multiprotocol storage market growth in the Asia-Pacific region is at a considerable pace due to the large-scale outsourcing of data storage services in this region. Latin America and the Middle East's multiprotocol storage market is at an emerging stage due to a rise in business demands and IT needs.

How is the Start-up Ecosystem in the Multiprotocol Storage Market?

In 2024, Fungible acquired the assets of Cloudistics, a cloud-software platform startup. In the long run, Fungible has overcome two major obstacles that are inefficient execution of data-centric computations within server nodes and the inefficient interchange of data among nodes.

NetApp pioneered multiprotocol systems with all its arrays adding Fibre Channel and then iSCSI connectivity options.

Pillar Data Systems, newcomer Pranah Storage Technologies and Reldata also offer NAS, Fibre Channel, and iSCSI in the same box.

Some of the key players in the multipurpose storage market are IBM Corporation, Cisco, NetApp, NTT Communications Corporation, EMC Corporation, Avere, Hewlett-Packard, and Zadara Storage.

The key companies are channelizing their capital towards the development of new products through intrinsic research and development activities. In addition to this, established players are promoting the use of multiprotocol storage by providing platforms for the development of IP SANs and NAS Systems.

IBM Storage Networking has designed a solution to scale to large enterprise deployments through scale-out server architecture with automated failover capability. These capabilities provide a resilient management system that centralizes infrastructure and path monitoring across geographically dispersed data centers.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.8% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | By Type, By Segment, By Application, Region Forecast till 2035 |

| Countries Covered | North America; Europe; Asia Pacific Excluding Japan; Latin America; Middle East and Africa |

| Key Companies Profiled | IBM Corporation; Cisco; NetApp; NTT Communications Corporation; EMC Corporation; Avere; Hewlett-Packard; Zadara Storage |

| Customization | Available Upon Request |

The global multiprotocol storage market is estimated to be valued at USD 41.1 billion in 2025.

It is projected to reach USD 65.6 billion by 2035.

The market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types are public cloud, private cloud and hybrid cloud.

network attached storage segment is expected to dominate with a 46.7% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Storage Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Storage Tank Equipment Market Size and Share Forecast Outlook 2025 to 2035

Storage And Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Storage Area Network (SAN) Market Analysis by Component, SAN Type, Technology, Vertical, and Region through 2035

Storage as a Service Market Trends – Growth & Forecast 2020-2030

Storage Virtualization Market

Oil Storage Market Size and Share Forecast Outlook 2025 to 2035

LNG Storage Tank Market Growth - Trends & Forecast 2025 to 2035

Toy Storage Market Insights - Trends & Forecast 2025 to 2035

Lab Storage Container Market

Fuel Storage Tank Market Size and Share Forecast Outlook 2025 to 2035

Cold Storage Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Storage Container Market Size and Share Forecast Outlook 2025 to 2035

Kids Storage Furniture Market by Type, Material, End-Use, and Region - Growth, Trends, and Forecast through 2025 to 2035

Tire Storage Rack Market Growth - Trends & Forecast 2025 to 2035

Food Storage Bags Market Trends - Demand & Forecast 2025 to 2035

Cold Storage Tape Market Analysis – Trends & Forecast 2024-2034

Shoe Storage & Organizers Market

Cloud Storage Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Energy Storage Sodium Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA