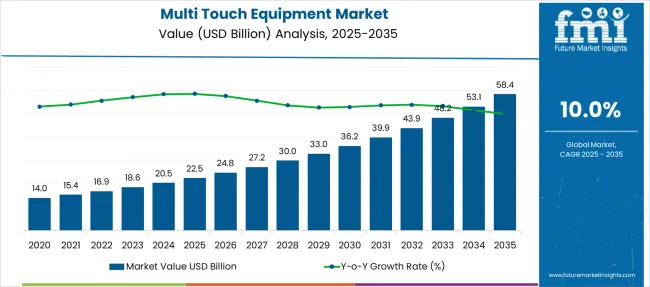

The Multi Touch Equipment Market is estimated to be valued at USD 22.5 billion in 2025 and is projected to reach USD 58.4 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period.

| Metric | Value |

|---|---|

| Multi Touch Equipment Market Estimated Value in (2025E) | USD 22.5 billion |

| Multi Touch Equipment Market Forecast Value in (2035F) | USD 58.4 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The multi touch equipment market is advancing steadily, fueled by the widespread integration of touch interfaces across consumer electronics, commercial displays, and interactive retail systems. Demand for intuitive and seamless human-machine interaction has led to continuous innovation in capacitive, resistive, and infrared touch technologies.

Increased adoption in smartphones, tablets, point-of-sale systems, and self-service kiosks is driving investments in higher durability, faster response times, and multi-user capabilities. Shifts in customer engagement strategies—especially in sectors like retail, education, and healthcare—are encouraging deployment of multi-touch panels that enable collaborative and real-time interactions.

Additionally, developments in AI integration, gesture recognition, and embedded touch controllers are expected to enhance product functionality across enterprise and industrial domains. The market is poised for sustained growth, supported by rising digital transformation budgets and increased focus on user experience optimization across applications..

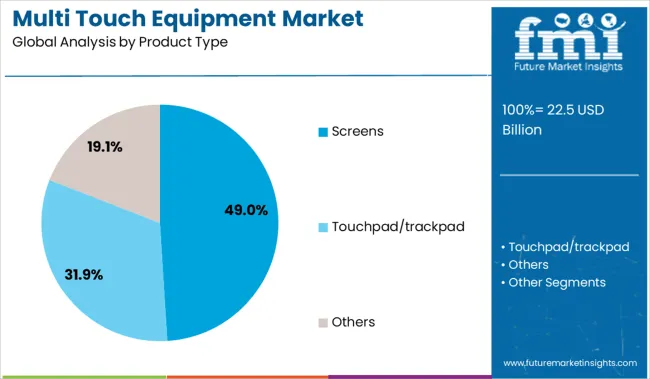

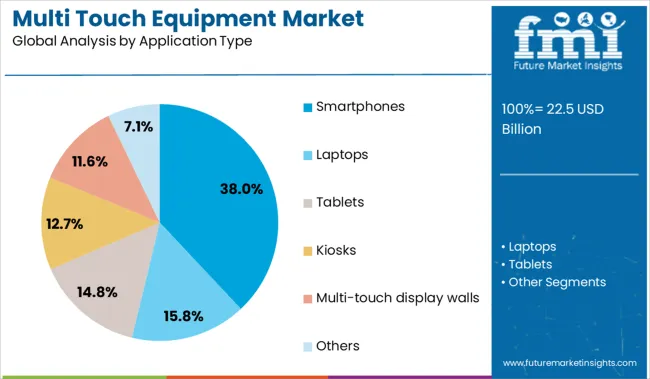

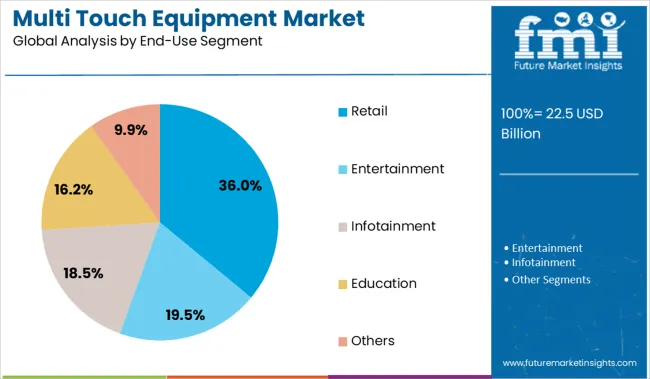

The multi-touch equipment market is segmented by product type, application type, and end-use segment and geographic regions. The multi-touch equipment market is divided by product type into Screens, touchpads/trackpads, and Others. In terms of application type, the multi-touch equipment market is classified into Smartphones, Laptops, Tablets, Kiosks, Multi-touch display walls, and Others. The end-use segment of the multi-touch equipment market is segmented into Retail, Entertainment, Infotainment, Education, and Others. Regionally, the multi-touch equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Screens are projected to account for 49.0% of total revenue in the multi touch equipment market in 2025, making them the most dominant product type. Their dominance is being reinforced by increasing demand for responsive, high-resolution displays in both consumer and commercial devices.

As touch interfaces become standard in personal electronics and public information systems, screens equipped with multi-point touch sensitivity are being widely adopted. Continuous improvements in screen materials, anti-glare coatings, and durability under high-frequency use have enhanced their appeal in high-traffic environments.

The ability to support larger sizes with minimal latency and seamless multi-user input has positioned screens as essential components for interactive signage, conference systems, and retail installations. Strong OEM integration and backward compatibility with legacy systems have further accelerated their replacement and upgrade cycles..

Smartphones are forecast to represent 38.0% of the total market share by 2025, leading the application segment. This leadership is attributed to the ubiquity of mobile devices and the demand for fluid, gesture-based navigation.

Manufacturers are increasingly embedding advanced multi-touch capabilities that support zooming, swiping, and gaming responsiveness with precision. Compact design requirements and the preference for bezel-less displays have driven significant investments in touch sensor miniaturization and screen-to-body ratio enhancements.

As smartphone usage becomes more central to productivity, entertainment, and commerce, the need for tactile accuracy and high-frequency responsiveness continues to rise. Integration with biometric sensors and foldable screen formats is also contributing to sustained R&D in this segment..

Retail is projected to contribute 36.0% of overall revenue in 2025, leading all end-use segments in the multi touch equipment market. This position is being supported by the transformation of brick-and-mortar stores into digitally enhanced shopping environments.

Retailers are investing in interactive product displays, digital catalogs, and self-checkout kiosks that rely on responsive multi-touch technology to streamline customer engagement. Enhanced personalization, inventory transparency, and visual merchandising are being enabled through touch-integrated interfaces.

As omni-channel strategies evolve, touchscreens in retail are being used to bridge online and in-store experiences. Additionally, increased emphasis on contactless interactions and customer empowerment is expected to sustain the retail sector’s leadership in multi-touch deployment..

Demand for multi touch equipment is growing steadily as interactive technology becomes central to customer engagement, classroom learning, and workplace collaboration. Sales of multi touch displays are increasing with widespread deployment in kiosks, control rooms, and medical facilities across key global regions.

Multi touch equipment demand in the education sector surged 31% year over year in 2024, supported by government-led digital classroom initiatives. More than 58% of secondary schools in East Asia now operate smart boards with multi touch features. In 2025, public institutions across Europe added over 22,000 interactive kiosks in libraries, transportation hubs, and cultural centers. These multi-user systems helped reduce service desk wait times by 19%. Urban municipalities increased spending on touch-enabled navigation tools by 14%, while 68% of new retail developments included interactive wall-mounted installations to enhance wayfinding and brand engagement.

Sales of large-format multi touch displays above 55 inches grew by 24% in 2025 and now contribute 39% of overall market value. Retail adoption, such as product finders and digital ordering stations, rose 35% as brands enhanced immersive shopping experiences. In utility and defense control rooms, multi touch tables and curved screens accounted for 18% of unit volume, with users reporting a 27% improvement in operational decision-making speed. Demand for ruggedized displays with more than 20 simultaneous touch points also grew, especially in oil and gas and aviation monitoring applications, pushing average selling prices up 16% year over year.

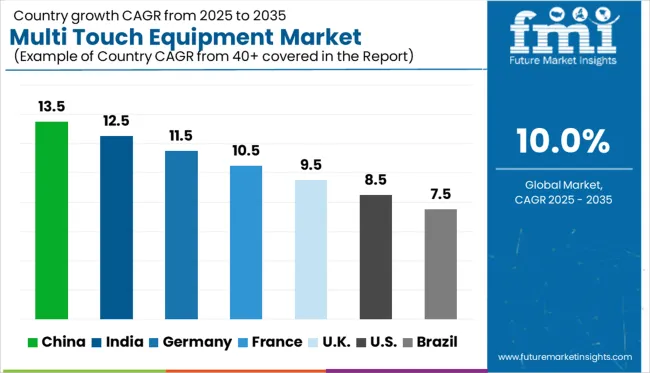

| Country | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

The global market is expected to expand at a CAGR of 10.0% from 2025 to 2035. China (BRICS) leads the surge with a projected CAGR of 13.5%, outpacing the global average by 3.5 percentage points, driven by strong domestic demand in education and retail technology. India (BRICS) follows closely at 12.5% (+2.5 pp), fueled by growing digitization in public services and touchscreen adoption in mobile ecosystems. Germany (OECD) is forecast to grow at 11.5% (+1.5 pp), backed by innovation in automotive display systems and smart factory interfaces. The UK is set to grow at 9.5% (–0.5 pp), slightly below global momentum due to saturation in the consumer electronics segment. The USA trails at 8.5% (–1.5 pp), as enterprise-level upgrades slow despite consistent commercial demand. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is expected to lead with a CAGR of 13.5% from 2025 to 2035, maintaining momentum from aggressive infrastructure digitization between 2020 and 2024. Investments in smart classrooms, interactive kiosks, and commercial touch displays continue to expand. The country's smart city initiatives and AI integration are pushing demand across education, retail, and government verticals. Local tech manufacturers are also making rapid strides in multi-touch panel R&D, especially for high-resolution displays.

India is forecast to post a CAGR of 12.5% during 2025–2035, driven by digital learning reforms and rising corporate tech adoption. Between 2020 and 2024, initial demand was seen from private schools and offices. Now, interactive display panels and touch-based kiosks are expanding into banking, government, and transportation hubs. Startups are offering cost-effective capacitive panels for budget-conscious sectors. Regional demand is rising due to smart city and BharatNet infrastructure rollouts.

Germany is projected to grow at a CAGR of 11.5% through 2035, after a strong foundation in industrial automation and digital classrooms during 2020–2024. The country’s push toward Industrie 4.0 continues to encourage adoption of multi-touch interfaces in manufacturing and logistics. Corporate boardrooms are shifting to advanced touch-enabled conferencing tools. The museums and public exhibitions are adopting interactive tables and walls to modernize visitor engagement.

The UK is set to record a CAGR of 9.5% between 2025 and 2035, following moderate growth during 2020–2024 across education and public service sectors. Future expansion will be driven by demand in hybrid work environments and interactive government facilities. Touch-enabled voting kiosks, museum panels, and NHS interactive directories are gaining adoption. Innovation hubs are also driving R&D in multi-touch sensors and responsive surfaces.

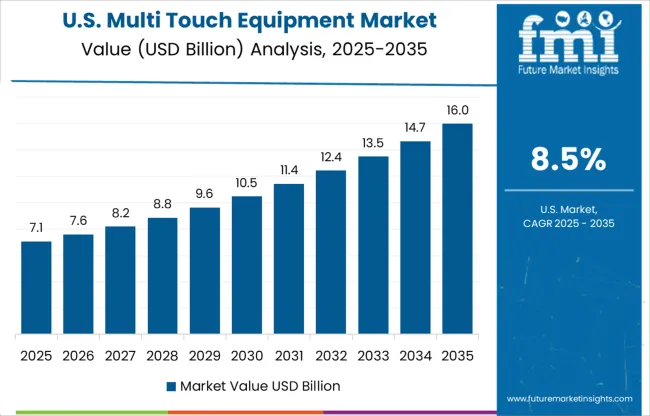

The USA market is projected to expand at a CAGR of 8.5% from 2025 to 2035. Between 2020 and 2024, demand was largely fueled by educational smart boards and interactive retail displays. Moving forward, museums, libraries, and corporate lobbies will further accelerate multi-touch adoption. Innovation in haptic touchscreens and 3D multi-touch surfaces is receiving strong VC backing. Furthermore, universities are transitioning to immersive touch-led instructional technologies.

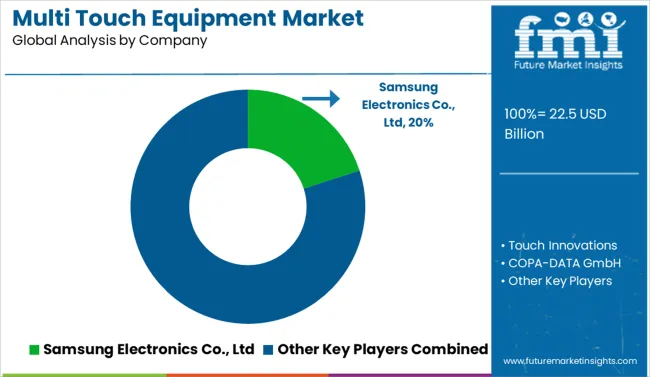

Samsung Electronics holds a leading share, attributed to its expansive range of consumer and commercial display solutions. Apple accounts for 15.4%, driven by demand for multi touch mobile and tablet devices. Microsoft holds 13.7% through its Windows touch ecosystem and Surface product line. FlatFrog Laboratories controls 9.2%, known for in-glass touch innovations in high-end conference equipment. Companies such as Perceptive Pixel, Touch Innovations, and COPA-DATA GmbH together account for over 12%, supplying niche solutions in creative and industrial applications. The top five players command over 65% of global market value, indicating moderate consolidation.

In February 2025, Microsoft unveiled new Surface Laptop models with 13.8 and 15-inch screens. These devices offer AI-powered performance, native 5G support, and enterprise-grade multi-touch capability targeting business professionals.

| Item | Value |

|---|---|

| Quantitative Units | USD 22.5 Billion |

| Product Type | Screens, Touchpad/trackpad, and Others |

| Application Type | Smartphones, Laptops, Tablets, Kiosks, Multi-touch display walls, and Others |

| End-Use Segment | Retail, Entertainment, Infotainment, Education, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Samsung Electronics Co., Ltd, Touch Innovations, COPA-DATA GmbH, IntuiLab SA, MultiTraction, Perceptive Pixel, Microsoft Corporation, Apple, Inc, FlatFrog Laboratories, and Touch Corporation |

| Additional Attributes | Dollar sales by equipment type (screens, touch tables, trackpads) and end-user segment (commercial, residential, industrial), demand dynamics across retail, hospitality, education and kiosks, regional growth leadership in Asia‑Pacific and North America, innovation in gesture recognition, haptic feedback and proximity sensing, and emerging AR/VR‑integrated interfaces |

The global multi touch equipment market is estimated to be valued at USD 22.5 billion in 2025.

The market size for the multi touch equipment market is projected to reach USD 58.4 billion by 2035.

The multi touch equipment market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in multi touch equipment market are screens, touchpad/trackpad and others.

In terms of application type, smartphones segment to command 38.0% share in the multi touch equipment market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA