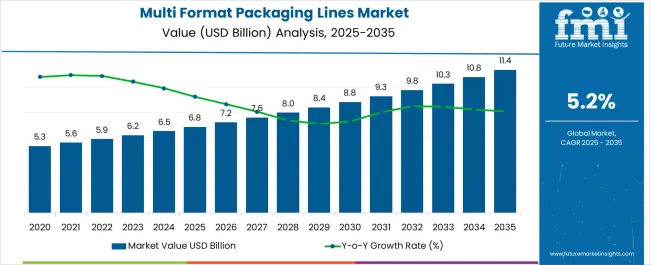

The multi-format packaging lines market, valued at 6.8 USD billion in 2025, is projected to reach 11.4 USD billion by 2035, reflecting a CAGR of 5.2% over the period. The market maturity curve shows early adoption during 2020–2024, with annual growth from 5.3 to 6.5 USD billion, as manufacturers experiment with flexible lines to handle varied packaging formats. By 2025, adoption begins scaling, driven by demand for efficiency and throughput across multiple product lines.

Between 2025–2030, the market grows from 6.8 to 8.8 USD billion, reflecting increased standardization, higher production volumes, and wider deployment. From 2030–2035, growth moderates as consolidation sets in, with established suppliers capturing a majority of new installations. The adoption lifecycle mirrors this trend. During 2020–2024, early adopters validate line versatility and operational reliability, creating reference cases for broader uptake. From 2025–2030, scaling occurs as mainstream manufacturers expand installations, supply chains stabilize, and contracts become standardized.

By 2030–2035, consolidation dominates, late entrants follow proven deployment models, mergers and strategic partnerships shape competition, and procurement emphasizes cost efficiency and operational consistency. The market transitions from experimental adoption, through rapid scale-up, to a structured phase characterized by predictable demand, optimized production workflows, and established supplier relationships.

| Metric | Value |

|---|---|

| Multi Format Packaging Lines Market Estimated Value in (2025 E) | USD 6.8 billion |

| Multi Format Packaging Lines Market Forecast Value in (2035 F) | USD 11.4 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

Data indicates that Q3 and Q4 account for 35–40% of annual orders, coinciding with peak production periods ahead of holiday seasons and promotional campaigns. Conversely, Q1 often records 10–15% lower activity, as manufacturers adjust inventory and plan line changes. Beverage, food, and personal care launches tend to cluster in specific quarters, producing temporary demand spikes of 10–15% above baseline.

Suppliers align installation, commissioning, and maintenance schedules with these seasonal peaks to maintain operational continuity and meet timely production requirements. Cyclicality reflects investment and equipment replacement patterns in manufacturing facilities. Packaging lines typically follow 5–7 year upgrade or expansion cycles, generating periodic surges in demand that can increase annual market size by USD 0.5–1 billion.

Regulatory changes or shifts in packaging standards may further accelerate procurement, producing temporary spikes of 5–10% above projected growth. Over the decade, these cycles overlay the underlying CAGR of 5.2%, creating alternating periods of rapid adoption and moderate stabilization.

Manufacturers are increasingly seeking adaptable solutions to meet evolving consumer preferences, shorter product lifecycles, and growing SKU variations. The integration of intelligent control systems, modular components, and rapid tool-free changeover capabilities is enhancing operational flexibility while reducing downtime.

Sustainability initiatives are also influencing adoption, with modern packaging lines designed to handle recyclable and eco-friendly materials efficiently. Growing investments in automation, coupled with the need for cost-effective yet high-output solutions, are pushing adoption across the food, beverage, pharmaceutical, and personal care industries.

The ability to accommodate multiple packaging formats on a single line is helping producers optimize floor space, improve return on investment, and respond quickly to market demands. As consumer expectations for packaging variety and speed intensify, multi-format packaging lines are set to play a pivotal role in global manufacturing competitiveness.

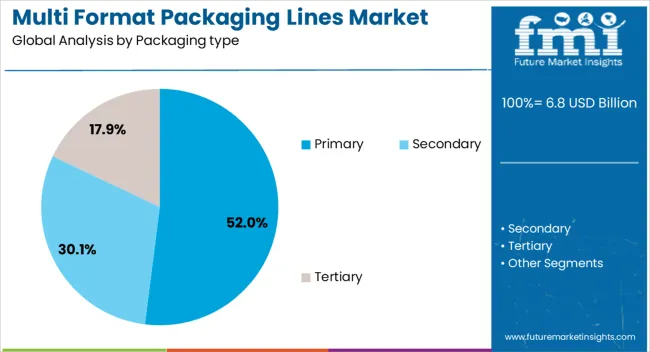

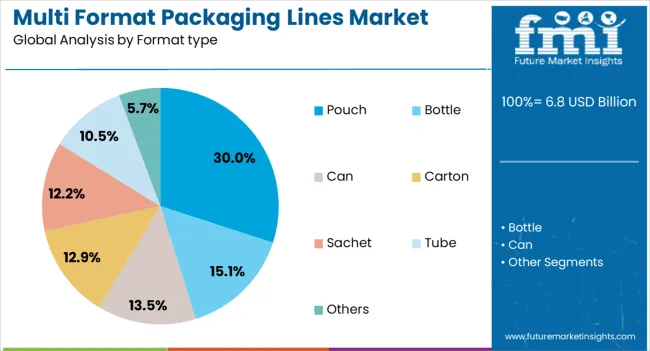

The multi format packaging lines market is segmented by packaging type, format type, automation, packaging material, end use, distribution channel, and geographic regions. By packaging type, multi format packaging lines market is divided into Primary, Secondary, and Tertiary. In terms of format type, multi format packaging lines market is classified into Pouch, Bottle, Can, Carton, Sachet, Tube, and Others.

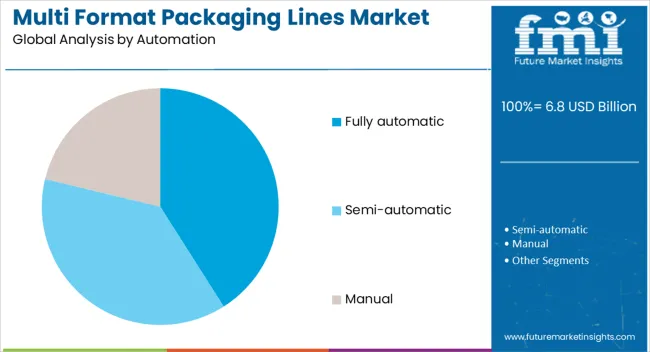

Based on automation, multi format packaging lines market is segmented into Fully automatic, Semi-automatic, and Manual. By packaging material, multi format packaging lines market is segmented into Plastic, Glass, Metal, Paper and paperboard, and Others (films, foils, etc.). By end use, multi format packaging lines market is segmented into Food and beverages, Packaged food, Dairy products, Bakery and confectionery, Pharmaceuticals, Cosmetics and personal care, Electronics and consumer goods, and Others (tobacco, stationery, etc.).

By distribution channel, multi format packaging lines market is segmented into Direct and Indirect. Regionally, the multi format packaging lines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The primary packaging type segment is projected to hold 52% of the multi format packaging lines market revenue share in 2025, making it the leading packaging type. Growth in this segment has been supported by the critical role primary packaging plays in preserving product quality, ensuring safety, and extending shelf life.

Manufacturers have favored primary packaging formats due to their direct contact with products, which demands high precision and compliance with regulatory standards. The segment has benefited from advancements in packaging line technology that enable rapid adjustments to accommodate diverse shapes, sizes, and materials without compromising sealing integrity or speed.

The increasing focus on product differentiation and branding through visually appealing and functional primary packaging has also contributed to this segment's dominance. As industries continue to expand production capacities and introduce varied product ranges, the demand for adaptable primary packaging solutions integrated with multi-format capabilities is expected to remain strong.

The pouch format type segment is expected to account for 30% of the multi format packaging lines market revenue share in 2025, emerging as a key format choice. The growing consumer preference for lightweight, portable, and resealable packaging has reinforced its popularity. Pouches offer significant advantages in terms of material efficiency, storage optimization, and reduced transportation costs compared to rigid formats.

Manufacturers have increasingly adopted pouch-compatible packaging lines due to their ability to handle both liquid and solid products across multiple industries. The integration of software-driven controls in modern equipment has allowed for faster switching between pouch sizes and styles, minimizing downtime and maximizing productivity.

Sustainability trends also support the segment’s growth, as pouches often require less raw material and generate lower carbon footprints during transportation. With brands focusing on convenience, shelf appeal, and flexible designs, pouch packaging within multi-format lines is expected to sustain its strong growth trajectory.

The fully automatic automation segment is anticipated to hold 41% of the multi format packaging lines market revenue share in 2025, positioning it as the leading automation level. This dominance is attributed to the efficiency, consistency, and scalability offered by fully automated systems. Businesses have increasingly adopted fully automatic solutions to reduce labor dependency, improve throughput, and ensure high-quality packaging output.

These systems are equipped with advanced sensors, vision inspection, and software algorithms that enable seamless format changes, precise product handling, and reduced wastage. The integration of predictive maintenance and real-time monitoring features has further enhanced operational uptime and cost efficiency.

Fully automatic lines are particularly valuable in high-volume production environments where accuracy, hygiene, and speed are paramount. As industries face rising production demands and workforce challenges, the preference for fully automated multi-format packaging lines is expected to strengthen, driving continued leadership for this segment.

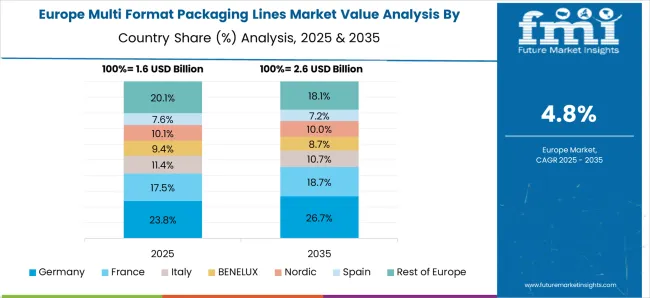

The multi-format packaging lines market is growing as consumer goods manufacturers demand flexible solutions capable of handling multiple product sizes, shapes, and packaging types. These lines enhance operational efficiency, reduce downtime, and support mass customization in food, beverage, pharmaceuticals, and personal care sectors. Europe and North America focus on automation and high-speed operations, while Asia-Pacific is driven by expanding FMCG production. Manufacturers emphasize modular designs, quick changeovers, and digital integration to support evolving packaging requirements and market competitiveness.

Manufacturers increasingly require packaging lines capable of handling diverse product formats, including bottles, cartons, sachets, and pouches. Multi-format lines allow rapid changeovers between sizes and packaging styles, enabling companies to respond quickly to consumer demand fluctuations and seasonal product variations. Flexibility reduces the need for multiple single-format lines, optimizing factory floor space and reducing capital expenditure. Until alternative modular or robotic packaging systems provide the same efficiency and adaptability, multi-format packaging lines remain essential for manufacturers aiming to enhance productivity and operational agility.

The food and beverage sector drives demand for multi-format lines due to frequent product launches, seasonal promotions, and varying pack sizes. Lines capable of handling liquids, powders, and solid foods with different packaging types enable manufacturers to maintain consistent output without extensive downtime. Hygiene compliance, speed, and precision are critical, especially for perishable items. Suppliers offering customizable, high-speed, and easy-to-clean packaging solutions gain a competitive advantage. Until alternative systems match the combination of speed, hygiene, and format versatility, multi-format packaging lines will continue to dominate the food and beverage industry.

Multi-format packaging lines are increasingly integrated with automation, robotics, and digital monitoring systems for process optimization, predictive maintenance, and real-time quality control. Sensors, vision systems, and programmable logic controllers enable accurate detection, alignment, and adjustment for various packaging formats. Integration with enterprise resource planning and manufacturing execution systems enhances workflow management and traceability. Manufacturers investing in smart, connected packaging lines gain operational efficiency and reduce manual intervention. Until alternative packaging approaches provide similar automation and data-driven benefits, multi-format lines remain crucial for modern production facilities.

By accommodating multiple product formats on a single line, manufacturers reduce the need for separate machines, minimizing capital investment and maintenance costs. Quick format changeovers and minimal downtime improve overall equipment effectiveness, enhancing productivity. Additionally, flexible lines help manufacturers adapt to market trends and reduce the inventory of redundant equipment. Until alternative packaging technologies match the same balance of versatility, cost efficiency, and production output, multi-format packaging lines will remain the preferred solution for manufacturers seeking operational optimization and competitive advantage across industries.

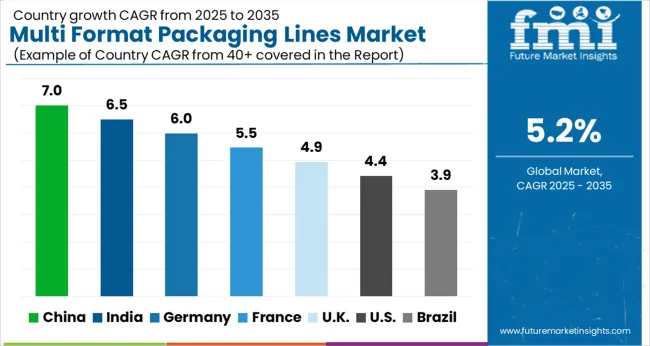

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The global multi format packaging lines market is projected to grow at a CAGR of 5.2% through 2035, supported by increasing demand across food and beverage, pharmaceutical, and consumer goods packaging applications. Among BRICS nations, China has been recorded with 7.0% growth, driven by large-scale production and deployment in automated packaging facilities, while India has been observed at 6.5%, supported by rising utilization in food, beverage, and pharmaceutical sectors. In the OECD region, Germany has been measured at 6.0%, where production and adoption for industrial and commercial packaging applications have been steadily maintained. The United Kingdom has been noted at 4.9%, reflecting consistent use in consumer goods and pharmaceutical packaging, while the USA has been recorded at 4.4%, with production and utilization across food, beverage, and industrial packaging sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The multi format packaging lines market in China is growing at a CAGR of 7.0%, driven by increasing demand for flexible packaging solutions across food, beverage, pharmaceutical, and consumer goods industries. Manufacturers are adopting multi format lines to efficiently handle multiple product sizes, shapes, and packaging types, improving operational efficiency and reducing downtime. Rising urbanization, changing consumer preferences, and e-commerce growth are further fueling market expansion. Technological advancements, such as automated changeovers, robotics integration, and smart sensors, enhance production flexibility and reliability. Investments in modern manufacturing facilities and government initiatives promoting industrial automation support adoption. The demand for sustainable, efficient, and versatile packaging solutions positions China as a leading market for multi format packaging lines.

The multi format packaging lines market in India is expanding at a CAGR of 6.5%, supported by growing demand in packaged food, beverages, and consumer goods. Multi format lines enable manufacturers to handle various product sizes, shapes, and packaging materials efficiently, reducing downtime and operational costs. E-commerce growth, changing lifestyles, and consumer preference for convenient packaging drive market adoption. Technological innovations, including automation, robotics, and smart sensors, improve productivity and line flexibility. Government initiatives supporting industrial automation and modern manufacturing further encourage adoption. India’s increasing industrialization, urbanization, and demand for efficient, sustainable packaging solutions position it as a promising market for multi format packaging lines.

The multi format packaging lines market in Germany is growing at a CAGR of 6.0%, driven by demand from food, pharmaceutical, and consumer goods industries. Multi format lines allow handling multiple product sizes and packaging types, reducing changeover times and increasing production efficiency. Germany’s focus on Industry 4.0, automation, and smart manufacturing supports adoption. Advanced technologies such as robotics, vision systems, and automated changeovers enhance operational performance. Sustainability and efficient resource utilization are key drivers, with manufacturers investing in versatile packaging solutions to reduce waste. Regulatory compliance and consumer preference for high-quality, flexible packaging further boost market growth. Germany’s established manufacturing base and technological innovation make it a key market for multi format packaging lines.

The multi format packaging lines market in the United Kingdom is expanding at a CAGR of 4.9%, driven by demand in food, beverage, and pharmaceutical industries. Manufacturers are adopting flexible lines to handle diverse product sizes, shapes, and packaging materials efficiently, reducing downtime and improving productivity. Technological innovations, including robotics, smart sensors, and automated changeovers, enhance line flexibility and reliability. Sustainability concerns and government initiatives promoting industrial automation further support market growth. The UK’s focus on modernizing manufacturing facilities and meeting consumer demand for high-quality, versatile packaging positions it as a growing market for multi format packaging lines.

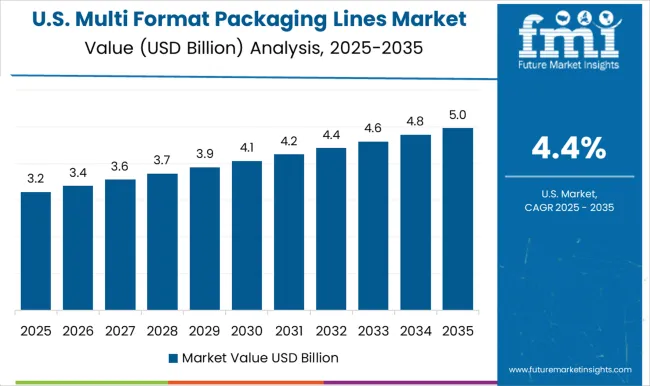

The multi format packaging lines market in the United States is growing at a CAGR of 4.4%, driven by the need for flexible, efficient, and versatile packaging solutions across food, beverage, and consumer goods sectors. Multi format lines allow handling multiple product types, sizes, and packaging materials, reducing downtime and operational costs. Technological advancements, such as robotics, automated changeovers, and vision systems, improve line efficiency and reliability. Sustainability concerns, e-commerce growth, and regulatory compliance drive adoption of flexible packaging solutions. The USA market benefits from high industrial automation levels, strong manufacturing infrastructure, and consumer preference for high-quality, convenient packaging, positioning it for steady growth in multi format packaging lines.

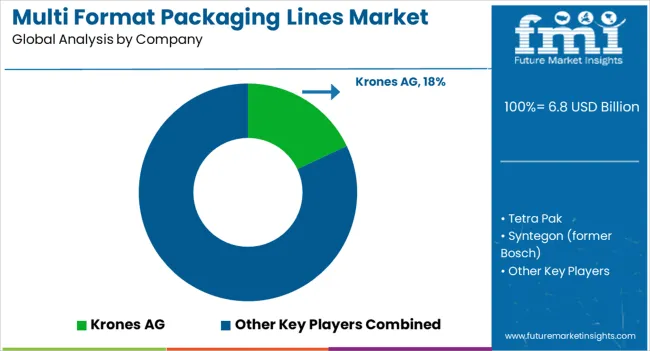

The multi-format packaging lines market is centered on flexible packaging solutions capable of handling a variety of product sizes, shapes, and formats within a single production line. These systems enable food, beverage, pharmaceutical, and consumer goods manufacturers to optimize efficiency, reduce downtime, and meet diverse market demands. Growing consumer preference for product variety, increasing automation, and the need for faster production cycles are key factors driving market growth. Krones AG is a leading player in this market, offering modular and highly adaptable packaging lines for beverages, food, and liquid products. Tetra Pak provides integrated multi-format solutions that combine filling, packaging, and processing capabilities, particularly in the dairy and liquid food sectors.

Syntegon, formerly part of Bosch Packaging Technology, delivers end-to-end flexible packaging systems with rapid format changeovers. Sidel specializes in complete bottling and packaging systems that support multiple formats, while IMA offers advanced automation and packaging solutions for pharmaceuticals and food products. Coesia provides innovative multi-format solutions across industries, integrating robotics, automation, and digitalization for efficiency and scalability. Other regional and specialized suppliers are also contributing to market expansion by offering modular, cost-effective, and customizable packaging lines tailored to small and medium enterprises. The increasing emphasis on sustainability, reduced material usage, and faster line changeovers is further encouraging adoption. As manufacturers seek flexibility and operational efficiency, multi-format packaging lines are becoming an essential component of modern manufacturing facilities, enabling companies to respond rapidly to evolving consumer demands and global market trends.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.8 Billion |

| Packaging type | Primary, Secondary, and Tertiary |

| Format type | Pouch, Bottle, Can, Carton, Sachet, Tube, and Others |

| Automation | Fully automatic, Semi-automatic, and Manual |

| Packaging material | Plastic, Glass, Metal, Paper and paperboard, and Others (films, foils, etc.) |

| End Use | Food and beverages, Packaged food, Dairy products, Bakery and confectionery, Pharmaceuticals, Cosmetics and personal care, Electronics and consumer goods, and Others (tobacco, stationery, etc.) |

| Distribution channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Krones AG, Tetra Pak, Syntegon (former Bosch), Sidel, IMA, Coesia, and Others |

| Additional Attributes | Dollar sales in the Multi Format Packaging Lines Market vary by type including filling, sealing, labeling, and cartoning lines, application across food & beverages, pharmaceuticals, and personal care products, and region covering North America, Europe, and Asia-Pacific. Growth is driven by demand for flexible packaging solutions, increasing product variety, and rising automation in manufacturing and packaging processes. |

The global multi format packaging lines market is estimated to be valued at USD 6.8 billion in 2025.

The market size for the multi format packaging lines market is projected to reach USD 11.4 billion by 2035.

The multi format packaging lines market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in multi format packaging lines market are primary, secondary and tertiary.

In terms of format type, pouch segment to command 30.0% share in the multi format packaging lines market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Multi Colored LED Beads Market Size and Share Forecast Outlook 2025 to 2035

Multi-Drug/Combination Injectable Market Forecast and Outlook 2025 to 2035

Multiplex Sepsis Biomarker Panels Market Size and Share Forecast Outlook 2025 to 2035

Multiplex Protein Profiling Market Size and Share Forecast Outlook 2025 to 2035

Multihead Weighers Market Size and Share Forecast Outlook 2025 to 2035

Multi-Cloud Networking Market Forecast Outlook 2025 to 2035

Multispectral Camera Market Size and Share Forecast Outlook 2025 to 2035

Multiplex Biomarker Imaging Market Forecast and Outlook 2025 to 2035

Multichannel Order Management Market Forecast and Outlook 2025 to 2035

Multiexperience Development Platform Market Forecast and Outlook 2025 to 2035

Multi Depth Corrugated Box Market Size and Share Forecast Outlook 2025 to 2035

Multi Attachment Loaders Market Size and Share Forecast Outlook 2025 to 2035

Multi Pocket Holders Market Size and Share Forecast Outlook 2025 to 2035

Multi-Screen Super Glass Market Size and Share Forecast Outlook 2025 to 2035

Multichannel Reagent Reservoir Market Size and Share Forecast Outlook 2025 to 2035

Multi-Functional Point Of Care Testing Market Size and Share Forecast Outlook 2025 to 2035

Multi-layer Film Recycling Market Size and Share Forecast Outlook 2025 to 2035

Multifunctional Household Robot Market Size and Share Forecast Outlook 2025 to 2035

Multistage Ring Section Pumps Market Size and Share Forecast Outlook 2025 to 2035

Multi-photon Microscopic System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA