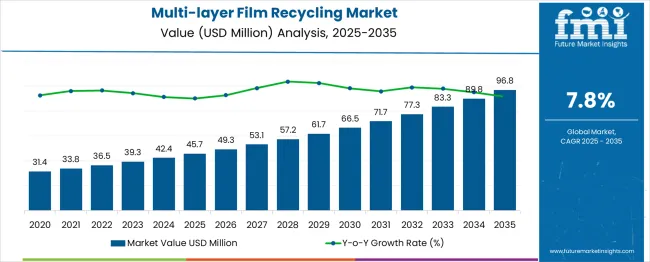

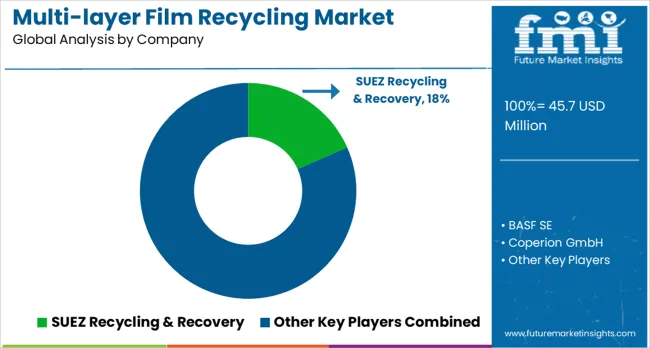

The global multi-layer film recycling market is forecasted to grow from USD 45.7 million in 2025 to approximately USD 96.8 million by 2035, recording an absolute increase of USD 51.11 million over the forecast period. This translates into a total growth of 111.9%, with the market forecast to expand at a CAGR of 8.0% between 2025 and 2035. The market size is expected to grow by nearly 2.12X during the same period, supported by increasing environmental consciousness, stringent plastic waste regulations, and growing adoption of circular economy principles in packaging industries.

Between 2025 and 2030, the multi-layer film recycling market is projected to expand from USD 45.7 million to USD 66.8 million, resulting in a value increase of USD 21.11 million, which represents 41.3% of the total forecast growth for the decade. This phase of growth will be shaped by increasing regulatory pressure on plastic waste management, rising corporate environmental commitments, and technological advancements in delamination and separation processes. Packaging manufacturers are investing heavily in recycling infrastructure to address growing demand for eco-friendly packaging solutions and closed-loop recycling systems.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 45.7 million |

| Forecast Value in (2035F) | USD 96.8 million |

| Forecast CAGR (2025 to 2035) | 8% |

The plastic recycling market contributes approximately 30-35%, as multi-layer films are often composed of various types of plastics that require processing and repurposing. Recycling technologies play a critical role in reducing waste and enabling the reuse of these films in industries such as packaging and construction. The flexible packaging market, accounting for 25-30%, is a significant driver, as multi-layer films are extensively used in food and pharmaceutical packaging due to their superior barrier properties. The push for sustainable packaging solutions is accelerating the recycling of these films.

The waste management and recycling market contributes around 20-25%, focusing on sorting, processing, and transforming multi-layer film waste into reusable materials like recycled plastic pellets. The chemical recycling market, which makes up 10-15%, is also growing, utilizing advanced technologies to break down complex multi-layer materials into their constituent chemicals, enabling polymer reuse. The packaging market, contributing 10-15%, is vital as the demand for environmentally responsible packaging solutions is driving the adoption of multi-layer film recycling technologies.

Market expansion is being supported by the increasing regulatory pressure to address plastic waste and the corresponding demand for effective recycling solutions for complex packaging materials. Modern packaging companies are increasingly focused on green practices that can reduce environmental impact while maintaining product protection and shelf life requirements. Multi-layer film recycling's proven potential to create closed-loop systems and reduce virgin material consumption makes it a preferred solution for achieving corporate environmental goals and regulatory compliance.

The growing focus on circular economy principles and extended producer responsibility is driving investment in advanced recycling technologies capable of processing complex multi-layer structures. Consumer awareness of plastic pollution and preference for brands demonstrating environmental commitment is creating market pressure for eco-friendly packaging solutions. The rising influence of environmental regulations and investor focus on ESG criteria is also contributing to increased adoption of multi-layer film recycling technologies across different industries and geographic regions.

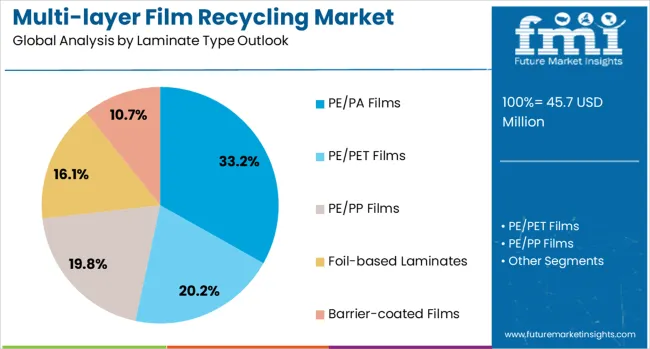

The market is segmented by laminate type, end use, and region. By laminate type, the market is divided into PE/PA Films, PE/PET Films, PE/PP Films, Foil-based Laminates, and Barrier-coated Films. Based on end use, the market is categorized into Food & Beverage Flexible Packaging, Personal & Home Care, Pet Food & Specialty, Industrial & Agriculture Films, and Other End Uses. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The food and beverage flexible packaging end use is projected to account for 55.9% of the multi-layer film recycling market in 2025, making it the dominant segment. This category generates the largest volume of multi-layer packaging waste due to the extensive use of complex barrier films in food preservation and beverage packaging. For example, packaging for items like snack foods, ready-to-eat meals, and beverages often rely on multi-layer films for moisture protection, extended shelf life, and oxygen barriers. These multi-layer materials are difficult to recycle using traditional methods. Regulatory pressure from food safety authorities, such as the FDA, and environmental agencies is pushing the development of recycling solutions designed for food-grade packaging. Consumer brands like Nestlé and Coca-Cola are increasingly focusing on recyclable packaging initiatives, creating strong demand for recycling technologies that can handle the complex material combinations found in flexible food packaging.

PE/PA films are expected to account for 33.2% of multi-layer film recycling demand in 2025. These films are commonly used in food packaging that requires excellent barrier properties against moisture and oxygen, while maintaining flexibility. Examples include vacuum-sealed packaging for meats, cheese, and pharmaceuticals, which rely on PE/PA films to extend shelf life and ensure product integrity. The significant use of PE/PA films generates large volumes of waste that require specialized recycling methods. Established recycling technologies can separate polyethylene and polyamide layers through mechanical and chemical processes, enabling more efficient recycling. Techniques like advanced delamination and solvent-based separation have made the recycling of PE/PA films more cost-effective. Companies such as Amcor and Sealed Air are continuously working to improve the recyclability of their PE/PA-based packaging, making this segment central to the growth of the multi-layer film recycling market and ongoing technological development.

The multi-layer film recycling market is advancing rapidly due to increasing regulatory pressure on plastic waste management and growing corporate commitments to eco-responsibility. The market faces challenges including technological complexity of separation processes, economic viability concerns, and limited infrastructure for collection and processing. Innovation in delamination technologies and development of scalable recycling processes continue to influence market expansion and adoption patterns.

Advanced chemical delamination processes, thermal separation methods, and solvent-based techniques are making it possible to break down complex multi-layer structures that were previously difficult to recycle. These methods not only enhance the purity of the recovered materials but also reduce processing time and energy consumption. By improving the separation of different polymer layers, these innovations make recycling more cost-effective, enabling waste management companies to extract higher-value materials from post-consumer waste. This progress is opening up new opportunities for the recycling of multi-layer films in various industries, including packaging and manufacturing.

The rising adoption of extended producer responsibility (EPR) regulations is accelerating the development of recycling systems for multi-layer films. These regulations require packaging manufacturers to assume responsibility for the collection and recycling of their products once they reach the end of life. By shifting the cost burden to producers, these policies are encouraging companies to invest in advanced recycling technologies and infrastructure. EPR-driven investments in recycling facilities are creating stable revenue channels for companies involved in the recycling process, while also establishing clear accountability for packaging waste management. This regulatory shift is motivating manufacturers to rethink their packaging designs and improve the efficiency of waste collection and processing systems.

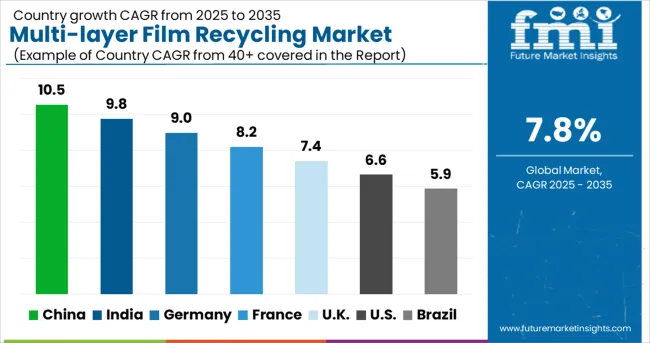

| Country | CAGR (2025-2035) |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9% |

| France | 8.2% |

| UK | 7.4% |

| USA | 6.6% |

| Brazil | 5.9% |

The multi-layer film recycling market is experiencing robust growth globally, with China leading at a 10.5% CAGR through 2035, driven by rapid industrialization, increasing environmental regulations, and growing investment in advanced recycling technologies. India follows closely at 9.8%, supported by expanding packaging industries, rising environmental awareness, and government initiatives promoting waste management infrastructure. Germany shows steady growth at 9%, emphasizing technological innovation and waste management practices. France records 8.2%, focusing on circular economy implementation and advanced recycling infrastructure development. The UK shows 7.4% growth, prioritizing eco-friendly packaging solutions and corporate environmental commitments. The USA demonstrates 6.6% growth, driven by regulatory compliance requirements and industry green initiatives.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

Revenue from multi-layer film recycling in China is expected to rise at a CAGR of 10.5% through 2035, driven by rapid growth in packaging industries and government efforts to improve waste management and adopt circular economy principles. The extensive production of consumer goods and food packaging generates substantial multi-layer film waste that demands specialized recycling solutions. Both local and international companies are investing in recycling technologies and building processing facilities to meet this growing demand. Government policies focusing on waste reduction and the promotion of circular economy practices are driving substantial investment in advanced recycling technologies. Developments in delamination and separation systems are enhancing the efficiency and affordability of recycling operations, making it easier to handle complex waste streams.

In India, the multi-layer film recycling market is expected to grow at a CAGR of 9.8% through 2035, driven by the expansion of the food processing, pharmaceutical, and consumer goods packaging industries. The growing middle class and the increasing consumption of packaged products are generating more multi-layer film waste that needs efficient recycling solutions. Both international and local companies are investing in recycling infrastructure to cater to this demand. Government initiatives aimed at reducing plastic pollution and promoting waste management are further boosting the market's growth. Additionally, the awareness about waste management among businesses and consumers is also increasing. Investments in recycling infrastructure are helping meet the rising demand for efficient waste management technologies. • Expanding middle class driving packaging and recycling needs. • Government emphasis on waste management technologies. • Investments in scalable recycling facilities.

Demand for multi-layer film recycling in Germany is set to grow at a CAGR of 9% through 2035, driven by a strong focus on environmental integrity and advanced manufacturing capabilities. German companies are leading the adoption of innovative recycling technologies aimed at maximizing material recovery from complex multi-layer packaging waste. The market benefits from a robust infrastructure, continuous investments in research and development, and an ongoing push to improve separation and recovery processes. Collaboration between engineering firms and packaging manufacturers is enhancing recycling efficiency and driving process optimization. With growing pressure on industries to meet environmental standards, Germany is positioning itself as a leader in waste management innovation, working towards a circular economy.

Revenue from multi-layer film recycling in France is projected to grow at a CAGR of 8.2% through 2035, supported by strong government commitment to circular economy principles and comprehensive environmental regulations. French companies value waste management practices and technological innovation, positioning multi-layer film recycling as a core component of eco-friendly packaging and waste management strategies. Growth in industrial recycling capabilities and environmental technology development is increasing processing capacity for complex multi-layer packaging waste across diverse application areas. Rising demand for eco-friendly packaging solutions and extended producer responsibility compliance is encouraging manufacturers to integrate advanced multi-layer film recycling into their waste management systems.

The multi-layer film recycling market in the UK is set to expand at a CAGR of 7.4% through 2035, driven by corporate environmental commitments and government initiatives promoting waste management and recycling. UK companies are incorporating multi-layer film recycling into their business strategies to meet regulatory standards and environmental expectations. There is an increasing demand for recyclable packaging alternatives and a rise in extended producer responsibility (EPR) requirements, driving investment in recycling technologies. Companies are focused on developing scalable recycling solutions to meet the growing needs of the market. Growth in environmental technology development and waste management infrastructure is increasing the accessibility of advanced recycling solutions across diverse industrial sectors.

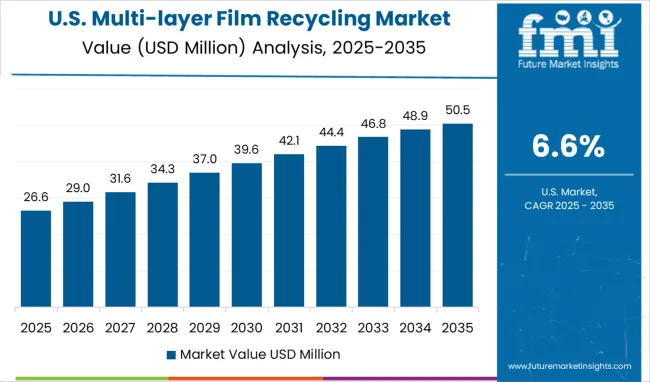

Demand for multi-layer film recycling in the USA is projected to increase at a CAGR of 6.6%, supported by increasing environmental regulations and environmental goals across packaging and consumer goods industries. American companies are increasingly focused on regulatory compliance, waste reduction, and eco-friendly packaging solutions to meet evolving environmental standards and consumer expectations. Environmental regulations and extended producer responsibility initiatives are driving investment in advanced recycling technologies capable of processing complex multi-layer packaging waste streams. Environmental goals and investor focus on ESG criteria are supporting adoption of multi-layer film recycling technologies throughout major industrial and retail sectors.

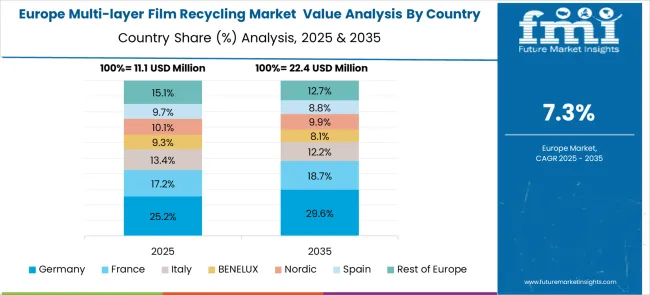

The multi-layer film recycling market in Europe demonstrates strong development across major economies with Germany showing leadership through its comprehensive waste management infrastructure and advanced recycling technologies, supported by companies leveraging engineering expertise to develop efficient delamination and separation systems that process complex multi-layer packaging waste from food and industrial applications.

France represents a significant market driven by its commitment to circular economy principles and stringent environmental regulations, with companies developing innovative recycling solutions that combine French industrial expertise with advanced polymer separation technologies for enhanced multi-layer film processing capabilities and waste management practices.

The UK exhibits considerable growth through its focus on eco-friendly packaging initiatives and corporate environmental responsibility, with companies leading the development of scalable multi-layer film recycling technologies and comprehensive consumer education about proper waste sorting and recycling practices. Germany and France show expanding investment in recycling infrastructure, particularly in advanced multi-layer film processing facilities targeting food packaging and industrial film waste streams.

BENELUX countries contribute through their focus on innovative waste management solutions and green packaging practices, while Eastern Europe displays growing potential driven by increasing environmental awareness and expanding investment in modern recycling infrastructure across diverse industrial applications and waste management channels.

The multi-layer film recycling market is highly competitive, driven by established waste management companies, specialized recycling technology providers, and emerging clean technology innovators. Companies are making substantial investments in advanced separation technologies, scalable processing infrastructure, and strategic partnerships to deliver effective, economically viable, and environmentally responsible recycling solutions. Technology development, process optimization, and market expansion are central to improving competitive positioning and increasing market share in this rapidly evolving sector.

Pluss Advanced Technologies stands out for its innovative recycling solutions that combine mechanical and chemical processing methods, optimizing the recovery of multi-layer film materials. Ingenia Polymers and APK AG provide specialized chemical recycling technologies aimed at recovering high-quality materials from complex multi-layer structures, enhancing the quality and efficiency of recycling operations. Waste Management Inc. invests heavily in advanced sorting and processing infrastructure, expanding its capabilities in the multi-layer film recycling space. KW Plastics specializes in plastic recycling and has deep expertise in multi-material processing and quality control. Companies like Plastipak Packaging and Enval Ltd. combine their packaging expertise with advanced recycling technology to create integrated solutions, further advancing sustainability efforts within the sector.

SUEZ Recycling & Recovery, with a 18.0% global value share, leads the market by offering comprehensive waste management services, focusing on advanced recycling technologies and circular economy solutions. The company’s global presence and expertise in waste recovery technologies make it a strong player in the multi-layer film recycling space. BASF SE, based in Germany, excels in chemical recycling, offering polymer separation technologies with a focus on renewable materials recovery. Their commitment to sustainability and chemical recycling positions them as a key contributor to the sector. Coperion GmbH delivers specialized processing equipment designed for multi-layer film delamination and material separation, helping improve the efficiency and effectiveness of recycling processes.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 45.7 million |

| Laminate Type | PE/PA Films, PE/PET Films, PE/PP Films, Foil-based Laminates, Barrier-coated Films |

| End Use | Food & Beverage Flexible Packaging, Personal & Home Care, Pet Food & Specialty, Industrial & Agriculture Films, Other End Uses |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | SUEZ Recycling & Recovery, BASF SE, Coperion GmbH, Pluss Advanced Technologies, Ingenia Polymers, APK AG, Waste Management Inc., KW Plastics, Plastipak Packaging, and Enval Ltd. |

| Additional Attributes | Dollar sales by laminate type and processing technology, regional waste generation trends, competitive landscape, technology preferences for mechanical versus chemical recycling, integration with circular economy initiatives, innovations in delamination processes, material recovery optimization, and processing practices |

The global multi-layer film recycling market is estimated to be valued at USD 45.7 million in 2025.

The market size for the multi-layer film recycling market is projected to reach USD 96.8 million by 2035.

The multi-layer film recycling market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in multi-layer film recycling market are pe/pa films, pe/pet films, pe/pp films, foil-based laminates and barrier-coated films.

In terms of end use outlook , food & beverage flexible packaging segment to command 55.9% share in the multi-layer film recycling market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Functional Multi-Layer Coextruded Film Market Size and Share Forecast Outlook 2025 to 2035

Film Wrapped Wire Market Size and Share Forecast Outlook 2025 to 2035

Film-Insulated Wire Market Size and Share Forecast Outlook 2025 to 2035

Film Forming Starches Market Size and Share Forecast Outlook 2025 to 2035

Film Formers Market Size and Share Forecast Outlook 2025 to 2035

Film Capacitors Market Analysis & Forecast by Material, Application, End Use, and Region Through 2035

Film Tourism Industry Analysis by Type, by End User, by Tourist Type, by Booking Channel, and by Region - Forecast for 2025 to 2035

Filmic Tapes Market

PC Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

PE Film Market Insights – Growth & Forecast 2024-2034

PET Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

VCI Film Market Forecast and Outlook 2025 to 2035

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

PSA Film Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

PBS Film Market Trends & Industry Growth Forecast 2024-2034

Microfilm Readers and Scanners Market Size and Share Forecast Outlook 2025 to 2035

Microfilm Reader Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA