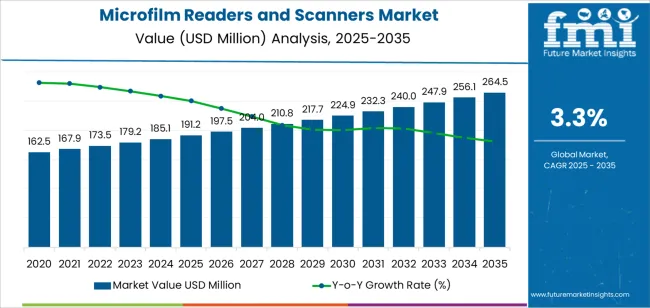

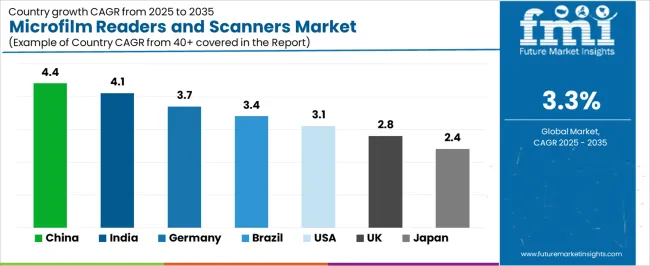

The microfilm readers and scanners market is expected to expand from USD 191.2 million in 2025 to USD 264.5 million by 2035, at a CAGR of 3.3%, supported by the continuous digitization of archival records across government, library, museum, university, and corporate repositories. Regional patterns define much of the market’s trajectory, with Asia Pacific leading expansion as China and India accelerate national digitization programs. China grows at a 4.4% CAGR due to large-scale modernisation of state archives, health record systems, and academic libraries, strengthening demand for high-throughput scanners capable of converting extensive microfilm holdings. India follows at 4.1%, driven by government e-governance initiatives, digital record mandates, and the greater use of microfilm digitization solutions in public institutions and financial regulators.

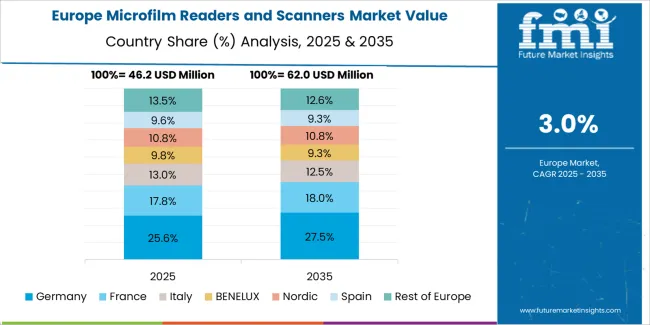

Europe remains a mature but active region, led by Germany at 3.7% CAGR, as public archives, legal institutions, and museums continue structured digitization of cultural records. The United Kingdom is growing at 2.8%, reflecting the steady adoption of microfilm scanning across public archives, libraries, and healthcare compliance workflows. North America shows stable demand, with the United States ata 3.1% CAGR supported by the ongoing modernization of legal, government, and medical record repositories, where microfilm collections remain extensive and require high-fidelity digital conversion. Latin America, anchored by Brazil at 3.4%, gains momentum as public institutions digitize legacy administrative files and historical archives. Japan grows at 2.4% as institutions maintain large microfilm libraries and upgrade to hybrid reader-scanner systems for long-term preservation. Across all regions, demand is reinforced by the stability of microfilm as an archival medium and by advancements in high-resolution scanning, OCR-enabled workflows, batch-processing automation, and cloud-integrated digital preservation systems.

From 2025 to 2030, the microfilm readers and scanners market will grow from USD 191.2 million to USD 224.9 million, reflecting a 5-year increase of USD 33.7 million. This growth will occur at a steady rate, driven by continued demand for document preservation and digitization across various sectors. Over this period, the market will see incremental growth due to the ongoing digitalization trends, where businesses and organizations continue to transition old archives into digital formats for easier management and access.

During this 5-year block, the market is expected to experience consistent growth, with the archiving and document management sectors being the primary drivers of demand. From 2025 to 2027, the market will expand from USD 191.2 million to approximately USD 204 million, marking a gradual increase of USD 12.8 million. The demand for microfilm scanning devices will continue to grow, albeit slowly, as the process of converting older analog records into digital formats remains essential for long-term preservation. From 2027 to 2030, the market will experience continued growth, reaching USD 224.9 million. This later phase will see steady adoption in historical document preservation and library services, where microfilm remains a critical medium for archival storage. This 5-year growth phase will be characterized by stable yet consistent demand, ensuring that the market expands without significant volatility.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 191.2 million |

| Market Forecast Value (2035) | USD 264.5 million |

| Forecast CAGR (2025 to 2035) | 3.3% |

The microfilm readers and scanners market is growing as organizations across government, education, legal, and archival sectors seek reliable long-term document preservation and digital access solutions. Microfilm equipment remains critical where records must be stored securely and accessed over decades while meeting retention and compliance requirements. The transition from analog microfilm formats to digital archives is driving demand for scanners that convert film into searchable digital files, while readers continue to provide access to physical microfilm collections.

Another key driver is technological innovation in scanning hardware and software integration. Modern microfilm scanners now support higher resolution capture, automated image processing, optical character recognition (OCR), and cloud-based archiving, enabling organizations to digitize large volumes of microfilm efficiently and make them retrievable through contemporary systems. Despite the growing shift toward digital-native workflows, many institutions continue to rely on microfilm for its durability, cost-effective storage footprint, and resistance to format obsolescence. Challenges for the market include aging microfilm infrastructure in some regions, budget constraints for equipment upgrades, and growing competition from purely digital archival strategies. Nonetheless, the readers and scanners market remains essential for converting and maintaining legacy records while meeting modern accessibility and preservation demands.

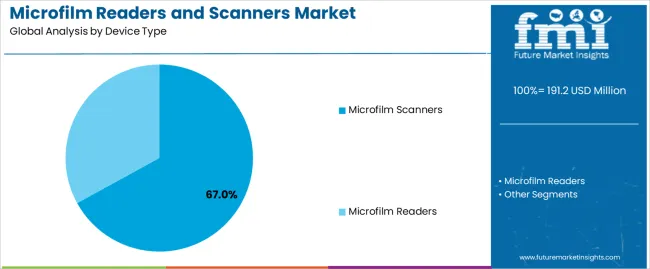

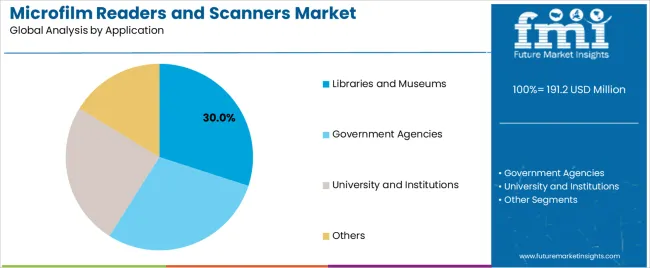

The microfilm readers and scanners market is segmented by device type and application. The leading device type is microfilm scanners, which hold 67% of the market share, while the dominant application segment is libraries and museums, accounting for 30% of the market. These segments are key drivers of the market, supported by the ongoing need for digitization and the preservation of historical documents and records across various institutions.

The microfilm scanners segment leads the microfilm readers and scanners market with a significant share of 67%. Microfilm scanners are preferred for their ability to convert physical microfilm archives into digital formats, making them easily accessible and searchable. Scanners provide high-resolution digital images, enabling users to preserve and retrieve documents more efficiently, which is essential for organizations aiming to digitize large volumes of historical and archival content.

The growing demand for digital archives and the need to improve document retrieval efficiency in libraries, museums, and other institutions drive the popularity of microfilm scanners. These devices enable the seamless transition from physical to digital media, ensuring long-term preservation of documents and providing easier access for research, education, and historical analysis. As organizations continue to prioritize digitization efforts, the demand for microfilm scanners is expected to maintain its leadership position in the market.

The libraries and museums application segment is the leading segment in the microfilm readers and scanners market, accounting for 30% of the market share. Libraries and museums play a critical role in preserving historical records, manuscripts, and documents, many of which are stored in microfilm format. The increasing need for digitization to safeguard these valuable materials and make them accessible to a wider audience is a major factor driving the demand for microfilm readers and scanners in these institutions.

The need for preservation, combined with the growing importance of digital archives for research, education, and public access, ensures that libraries and museums remain a dominant application sector in the microfilm readers and scanners market. As more institutions focus on improving accessibility and reducing the physical wear and tear on archived materials, the demand for both microfilm readers and scanners will continue to rise, reinforcing the sector’s leading role in the market.

The microfilm readers and scanners market is experiencing steady growth as organisations seek to preserve, digitise and access archival documents, newspapers and legacy records held on microfilm and microfiche. Continued demand from sectors such as libraries, government archives, legal and healthcare institutions supports the requirement for specialised reader and scanner equipment. Advancements in scanning resolution, automation, and integration with digital workflows are increasing the value and relevance of these tools. At the same time, budget pressures, the shifting focus toward fully digital systems and variability in adoption across regions influence market dynamics.

What Are The Primary Growth Drivers For the Microfilm Readers and Scanners Market?

Several factors are driving the growth of the microfilm readers and scanners market. First, there is an ongoing need for document preservation because many organisations maintain large collections of historical records on microfilm and microfiche formats and need reliable equipment to digitise or review these collections. Second, the rise of digitisation initiatives and regulatory or archival mandates in governments, libraries and archives is increasing investment in scanning equipment that converts analog microforms into searchable digital formats. Third, improvements in scanner technology, such as higher resolution imaging, faster throughput, automated batch scanning and easier integration with digital asset management systems, make it more efficient and cost-effective to upgrade older reader devices and adopt scanning solutions. These drivers combined support growth in both reader and scanner segments.

What Are The Key Restraints In the Microfilm Readers and Scanners Market?

Despite the favourable drivers, there are notable restraints in this market. The transition from microfilm to fully digital systems is well underway, and in some institutions, the legacy tools are being phased out, which limits new reader equipment purchases. Secondly, the cost of acquiring high-end scanning equipment, integrating it into existing workflows, training staff and managing the large data volumes generated by high-resolution scans may deter some organisations, especially those with limited budgets or smaller archival holdings. Thirdly, compatibility issues can arise because microfilm formats, such as 16 mm, 35 mm, microfiche, aperture cards, vary, meaning that scanner or reader devices may need to support multiple formats or may become obsolete if not kept up to date. These factors restrict more rapid market expansion.

What Are The Emerging Trends In the Microfilm Readers and Scanners Market?

Several important trends are shaping the future of this market. One trend is the increasing focus on hybrid reader-scanner systems that not only allow users to view microfilm but also capture and digitise content in a single device, blending legacy access with digital conversion. Another trend is the improvement in automation and workflow support, such as batch scanning, automatic image correction, indexing, metadata capture and integration with cloud services, which enables large-scale archival digitisation projects to proceed more efficiently. A further trend is the geographic shift: while mature markets such as North America and Europe continue to maintain large installed bases, emerging regions in Asia-Pacific and Latin America are beginning to invest in archival infrastructure, creating new opportunities for readers and scanners. Finally, there is a growing interest in offering value-added services, such as archival consulting, digitisation outsourcing and integrated software licences, alongside hardware sales, as equipment alone is no longer sufficient to meet customer demands for complete document-management workflows.

The microfilm readers and scanners market is steadily growing, driven by the continued demand for digitization and archiving solutions in sectors such as government, education, healthcare, and business. Microfilm, used for preserving documents for long-term storage, remains relevant as organizations look to digitize historical records, documents, and media for easier access and management. Countries like China and India are experiencing rapid growth due to their expanding digitalization efforts and increasing need for efficient document storage solutions. Meanwhile, developed economies such as the USA and Germany are witnessing steady demand driven by modernization initiatives in archival systems and ongoing need for document preservation. This analysis explores the key drivers contributing to the growth of the microfilm readers and scanners market across various countries.

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.4% |

| India | 4.1% |

| Germany | 3.7% |

| Brazil | 3.4% |

| USA | 3.1% |

| United Kingdom | 2.8% |

| Japan | 2.4% |

China leads the microfilm readers and scanners market with a CAGR of 4.4%. The country’s increasing emphasis on digitization and modernization of archival systems is a key factor driving market growth. As China continues to expand its digital infrastructure, especially in sectors like government, healthcare, and education, the need to digitize historical records and documents is becoming more prevalent. Microfilm, as a medium for storing vast amounts of data in a compact format, remains a useful tool for archival purposes, making microfilm readers and scanners indispensable in these digitization efforts.

The growth of China’s economy, rapid urbanization, and increasing government initiatives to modernize record-keeping systems also contribute to the demand for microfilm readers and scanners. The government’s focus on creating digital archives and improving data access further accelerates the adoption of scanning and digitization technologies in China. As industries continue to prioritize the conversion of physical records into digital formats, the market for microfilm readers and scanners will continue to grow.

India’s microfilm readers and scanners market is growing at a rate of 4.1%. As one of the fastest-growing economies, India’s demand for document digitization solutions is increasing in various sectors such as government, banking, education, and healthcare. The government’s initiatives to digitize public records and streamline access to historical data are driving the adoption of microfilm readers and scanners. India’s expanding infrastructure and focus on improving archival processes in both public and private sectors contribute to the market’s growth.

Additionally, the increasing demand for secure data storage and disaster recovery solutions in India is also pushing the need for efficient document scanning and digitization. The country’s rising digital literacy rates, along with the growing adoption of digital record-keeping in businesses and government organizations, will continue to drive the growth of the microfilm readers and scanners market.

Germany’s microfilm readers and scanners market is projected to grow at a CAGR of 3.7%. As a leader in technological innovation and digital transformation in Europe, Germany is focused on improving its archival and record-keeping processes. The demand for microfilm readers and scanners is driven by the need to digitize a large volume of historical and administrative documents in various sectors, including government, law, and healthcare.

Germany’s well-established industrial and technological infrastructure, along with its emphasis on data preservation and management, ensures steady demand for document scanning and archiving solutions. Additionally, the government’s initiatives to promote the digitization of public records and documents further contribute to the market growth. As industries and government bodies increasingly turn to digital solutions, the demand for microfilm readers and scanners in Germany will continue to grow.

Brazil’s microfilm readers and scanners market is expected to grow at a CAGR of 3.4%. As one of the largest economies in Latin America, Brazil is experiencing increased demand for document digitization solutions in government, healthcare, and education sectors. The government’s efforts to modernize its record-keeping systems, improve public services, and make historical records more accessible to citizens are driving the market for microfilm readers and scanners.

Brazil’s growing digital economy and increased focus on digitization in both public and private sectors contribute to the rising adoption of microfilm readers and scanners. The need for efficient archival solutions and the desire to improve data management in large organizations further drive market growth. As Brazil continues to invest in digital infrastructure and technology, the demand for microfilm readers and scanners will increase.

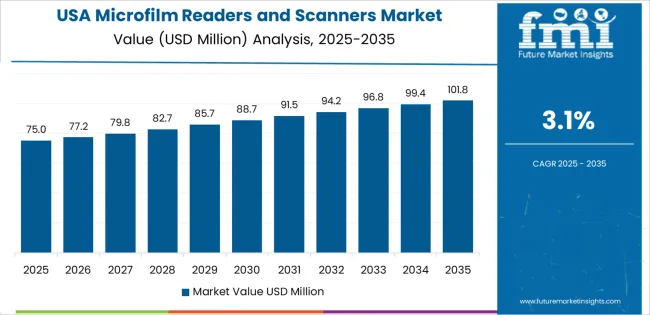

The United States has a projected CAGR of 3.1% for the microfilm readers and scanners market. The USA is home to a large number of industries that rely on the digitization of historical records and documents, including government, healthcare, finance, and law. As these industries increasingly focus on transitioning from paper-based systems to digital formats, the demand for microfilm readers and scanners remains strong.

The USA government’s efforts to preserve historical records and the growing need for secure and accessible digital archives contribute to the market’s steady demand. Additionally, industries such as legal, financial services, and healthcare, which handle large volumes of sensitive data, require efficient scanning and storage solutions for historical records, further supporting the market for microfilm readers and scanners. The ongoing push toward digital transformation in the USA economy will ensure continued growth in the market.

The United Kingdom’s microfilm readers and scanners market is projected to grow at a CAGR of 2.8%. The UK has a strong demand for document scanning and archiving solutions in sectors such as government, healthcare, law, and education. The need to digitize public records and improve data accessibility is a key factor driving the market’s growth. The UK government’s digitalization efforts, along with the increasing number of organizations adopting digital solutions for record-keeping, are contributing to the adoption of microfilm readers and scanners.

As more organizations in the UK focus on enhancing document management systems and adopting digital storage solutions, the demand for efficient scanning technologies will continue to rise. Additionally, the growing focus on data security and reducing paper-based systems is expected to support the continued expansion of the microfilm readers and scanners market in the UK.

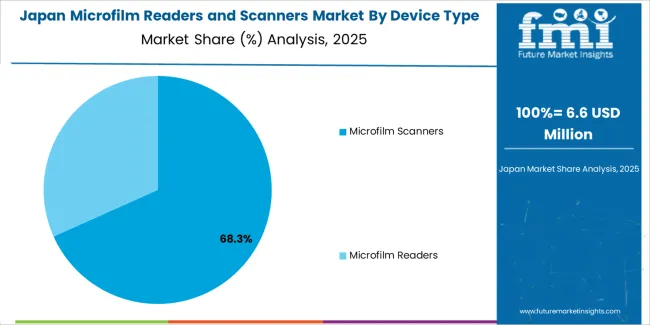

Japan’s microfilm readers and scanners market is expected to grow at a rate of 2.4%. Japan has a well-developed infrastructure and a long history of using microfilm for document storage, making the demand for microfilm readers and scanners steady, although at a slower pace compared to emerging markets. The Japanese government’s ongoing efforts to digitize public records and the country’s focus on data preservation are key drivers of market growth.

While Japan is adopting more advanced digital solutions, the country continues to require efficient scanning and archival technologies to convert historical records into digital formats. The market will continue to grow as Japan’s aging population and increasing demand for digital accessibility drive further digitization efforts. The country’s focus on maintaining high standards for data management and accessibility will ensure continued, if moderate, growth in the microfilm readers and scanners market.

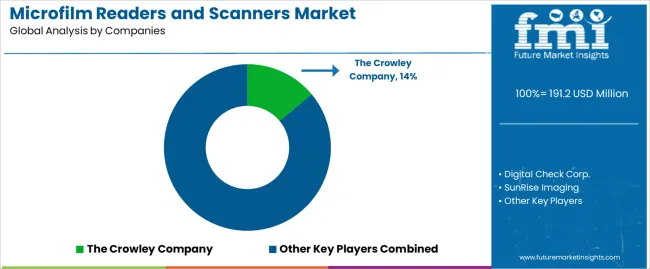

In the microfilm readers and scanners market, companies such as The Crowley Company (holding about 14% share), Digital Check Corp., SunRise Imaging, Eastman Park Micrographics, Konica Minolta, e-ImageData, SMA Electronic Document, Indus International, Microbox, FujiFilm, and Dashengfenghua are competing for position. Growth is being driven by the continued demand for preservation of archival documents, government records, and library collections, as organisations modernise access to microfilm content and convert to digital workflows. The microfilm equipment market is expected to grow from roughly USD 943 million in 2023 and reach about USD 1,342 million by 2032.

Competitors are deploying several distinct strategies to gain advantage. One focus is on product upgrade and digitisation capabilities: newer scanner models offer higher resolution imaging, faster throughput, and improved software integration for conversion of microfilm to digital formats. For example, one manufacturer emphasises seamless conversion of microfiche and roll film to searchable digital archives. Another strategy emphasises total solution propositions: firms bundle scanning hardware, digitisation software, archive management support, and after sales service to appeal to archives and large scale users. A third strategic axis is cost and usability optimisation: manufacturers aim to reduce footprint, simplify operation, and lower training burden so smaller libraries or institutions can adopt systems more easily. Brochures of these products tend to highlight features such as resolution (dpi), scanning speed (pages or frames per minute), media compatibility (microfilm reel, microfiche sheet, aperture card), image enhancement tools (OCR, de skew, blur correction), and ecosystem support (software, archive integration, conversion service). By aligning their product messaging with the evolving requirements of digitisation, long term preservation, and improved access, companies aim to secure market share in the competitive microfilm readers and scanners market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Device Type | Microfilm Scanners, Microfilm Readers |

| Application | Libraries and Museums, Government Agencies, University and Institutions, Others |

| Key Companies Profiled | The Crowley Company, Digital Check Corp., SunRise Imaging, Eastman Park Micrographics, Konica Minolta, e-ImageData, SMA Electronic Document, Indus International, Microbox, FujiFilm, Dashengfenghua |

| Additional Attributes | The market analysis includes dollar sales by device type and application categories. It also covers regional adoption trends across major markets. The competitive landscape focuses on key manufacturers in the microfilm readers and scanners market, with innovations in scanning technology and archival solutions. Trends in the growing demand for digitization of records in libraries, museums, government agencies, and academic institutions are explored, along with advancements in microfilm preservation and document management solutions. |

The global microfilm readers and scanners market is estimated to be valued at USD 191.2 million in 2025.

The market size for the microfilm readers and scanners market is projected to reach USD 264.5 million by 2035.

The microfilm readers and scanners market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in microfilm readers and scanners market are microfilm scanners and microfilm readers.

In terms of application, libraries and museums segment to command 30.0% share in the microfilm readers and scanners market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Microfilm Reader Market Size and Share Forecast Outlook 2025 to 2035

RFID Readers Market Analysis – Growth & Forecast 2017-2027

Rapid Test Readers Market Size and Share Forecast Outlook 2025 to 2035

Microplate Readers Market

Access Control Readers Market

Magnetic Stripe Readers Market Size and Share Forecast Outlook 2025 to 2035

Wet Fertilizer Spreaders Market

3D Scanners Market Size and Share Forecast Outlook 2025 to 2035

Micro-CT Scanners Market

In-Counter Barcode Scanners Market Size and Share Forecast Outlook 2025 to 2035

Industrial Barcode Scanners Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Ballistic Protection Scanners Market

Mobile Computed Tomography Scanners Market Size and Share Forecast Outlook 2025 to 2035

The Positron Emission Tomography (PET) Scanners Market is segmented by Full-ring PET Scanner and Partial-ring PET Scanner from 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Candle Filter Cartridges Market Size and Share Forecast Outlook 2025 to 2035

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA