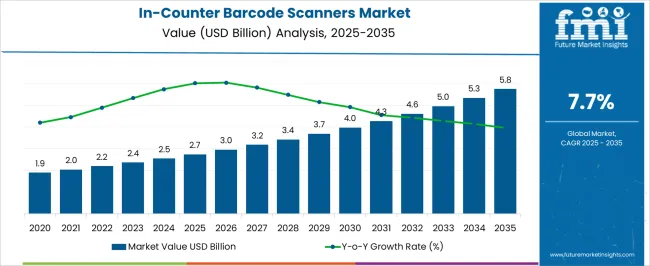

The In-Counter Barcode Scanners Market is estimated to be valued at USD 2.7 billion in 2025 and is projected to reach USD 5.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.7% over the forecast period.

| Metric | Value |

|---|---|

| In-Counter Barcode Scanners Market Estimated Value in (2025 E) | USD 2.7 billion |

| In-Counter Barcode Scanners Market Forecast Value in (2035 F) | USD 5.8 billion |

| Forecast CAGR (2025 to 2035) | 7.7% |

The in-counter barcode scanners market is gaining momentum as retail automation and real-time inventory tracking become critical to customer experience and operational efficiency. Retailers and packaged goods suppliers are increasingly investing in high-performance scanning systems embedded directly into checkout counters to optimize space utilization and transaction throughput. The adoption of multi-plane scanning and 2D image capture technologies is enhancing scan accuracy and reducing manual intervention.

With increasing integration of point-of-sale systems, loyalty platforms, and inventory software, in-counter scanners are serving as intelligent hubs within modern retail environments. The growing emphasis on contactless checkout, labor cost reduction, and queue management is also influencing deployment strategies.

Additionally, global retail chains are prioritizing scanners that support mobile wallet scanning and digital coupon redemption to align with evolving consumer preferences. Future growth is expected to be further shaped by cloud connectivity, AI-enabled anomaly detection, and retail analytics integration, as in-counter scanners evolve into multifunctional retail technology enablers.

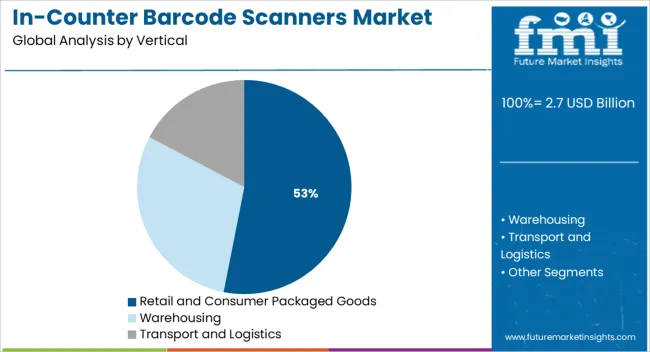

The market is segmented by Vertical and region. By Vertical, the market is divided into Retail and Consumer Packaged Goods, Warehousing, and Transport and Logistics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The retail and consumer packaged goods vertical is projected to account for 53.1% of the total market revenue in 2025, positioning it as the dominant sector in the in-counter barcode scanners market. This leadership has been supported by high-volume checkout demands, SKU density, and a focus on improving transaction speed. Supermarkets, hypermarkets, and convenience stores have adopted in-counter scanners to streamline customer flow while maintaining scan accuracy and minimizing cashier fatigue.

The embedded nature of these systems reduces counter clutter and enables integration with weighing scales, digital screens, and POS software. The emphasis on omnichannel retailing has further reinforced demand, with scanners being utilized for both in-store and fulfillment center operations.

The ability to read damaged or poorly printed codes, along with enhanced compatibility with loyalty apps and mobile wallets, has strengthened adoption across retail chains and CPG environments. This segment’s continued investment in frictionless checkout experiences and real-time inventory data is expected to sustain its market dominance.

There is a spate of improvements taking place on the product front in favor of bar-code scanners that keep it abreast of supply and product tracking thus adding to its popularity. Almost all products coming into the market have barcodes printed on them, paving the way for scanners to do the rest. With mobile penetration, the bar-code scanners make the check-out process acutely simple and hence are on a fast track to growth.

Today, in-counter barcode scanners are being heavily depended on for recording and managing product information without making any major manual effort. In-counter barcode scanners are also used to make quick check-outs at cash counters, for easy and precise account keeping, and for better inventory control for manufacturers and retailers.

The escalating need for reducing human errors in terms of keeping track of the inventory may serve as an important growth factor for the barcode readers market.

Public Distribution Systems are orienting at a fast growth rate in the in-counter barcode scanners market

The fast emerging technologies in the public distribution system are the primary growth drivers in the in-counter bar-code scanners market. Public distribution systems across various countries are also implementing barcode readers, thus boosting the growth prospects of the barcode readers market. A paramount growth factor for industries to rely on handheld scanners in remote settings is fuelling product development.

With the logistics arm of many multinational service providers working in the foreground, the growth of the in-counter bar code scanners market takes on immense proportions. In this errors are minimized grossly, and product inventory is on-track with infinite time savings, thus giving to the growth of the in-counter barcode scanners market.

The flourishing e-commerce sector may also enjoy expansive growth opportunities for the barcode readers market. Penetration of advanced technology such as AI (Artificial Intelligence) may help the barcode readers market to harness surplus growth

The significant cost of in-counter barcode scanners deterrent to market growth

The cost of in-counter barcode scanners does not help the growth of the market which acts as a market restraint coupled with its immobility, which makes a dent in the progress of the in-counter barcode scanners market. Furthermore, the lack of awareness among a considerable populace is also a prominent growth obstacle that may dampen the growth of the barcode readers market.

Any task from point of sale to backroom inventory is streamlined when associates have full-shift battery power, can read multiple codes at once, and are provided actionable insights to resolve issues faster. Scale this new scanning experience easily with remote fleet management and ongoing support from experts in the field.

The growing preference for online shopping and the concurrent growth in e-commerce and logistics is expected to drive the growth of the market.

Businesses in several industries and industry verticals, including retail and manufacturing, are steadfastly using barcodes and allied systems to keep a check on inventory and follow individual products or product batches remotely in a large facility. Thus, a barcode scanner becomes a vital component for decoding and interpreting the data stored by the barcode. Barcode scanners ensure transparent inventory control management with accuracy paramount.

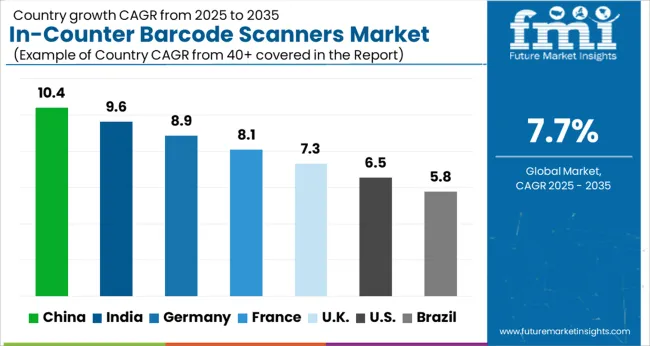

North American adoption of Public distribution system is rapid and instrumental to the growth

On a geographic basis, North America will be the largest market for In-counter barcode scanners market due to the rapid adoption of advanced technologies in the public distribution system.

E-commerce growth in North America has a robust flavor, particularly in the USA, due to a large number of Internet-abound shoppers there, as well as the world's prolific technical experts. The North American e-commerce boom has experienced an unprecedented level of funding, available from a variety of sources. Moreover, many analysts believed that the time savings offered by shopping online appealed to USA residents, who were considered more time conscious than individuals in other parts of the world, such as Europe or Asia.

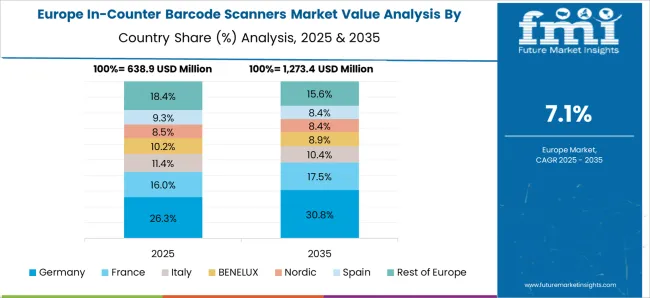

Europe's e-commerce industry growing at a fearsome pace to stake a claim in the in-counter barcode scanners market

Europe’s e-commerce industry is expanding at a fiery pace. Business to Business (B2B) dominated the e-commerce growth industry in Europe in terms of revenue in 2020, with an enormous share in the range of 60 to 70 % percent, and is predicted to grow at the quickest rate in the forecast period.

This can be due to businesses' increasing preference for online selling and purchasing of goods and services. Furthermore, the B2B e-commerce segment is expected to be driven by increased smartphone adoption and internet usage over the projection period. This provides explosive growth for the in-counter barcode scanners market.

Banks and other e-commerce businesses are mandating a safe and secure online platform for customers to transact with a payment gateway. In order to enable sellers and customers to trade online, market players are focusing on making innovative improvements to their business modules. The market's top retailers are attempting to supplement their traditional selling with e-commerce by partnering with other significant e-commerce companies. This brings the in-counter barcode scanners market into significant growth.

Warehousing segment to display linear growth in the industry with importance to streamlining of processes

The warehousing segment in the in-counter barcode scanner industry is expected to post impressive figures in its development. Even the smallest of retail companies will need to rely on the technology of some kind to streamline their warehouse processes. The larger you grow - and the faster the rate - the more vital your technology stack becomes.

Depending on your individual needs, you’ll likely want to invest in some level of heavy-duty equipment and machinery to better enable your warehouse team to physically move, store, and deliver products. As your inventory grows - and your warehouse processes grow more complex - you’ll also want to invest in technology that allows you to easily track your products from receipt to delivery. Here the in-counter barcode scanner has a large role to play.

Manufacturers are adopting various marketing strategies such as new product launches, geographical expansion, mergers and acquisitions, partnerships, and collaboration to identify the interest of potential buyers and create a larger customer base. For instance,

In Jul 2025, Socket Mobile Announces SocketScan S720, Linear Barcode Plus QR Code Reader. Socket Mobile, Inc. a leading provider of data capture and delivery solutions designed to streamline workplace productivity, is excited to announce the launch of their linear barcode and QR code reader, SocketScan S720. Socket Mobile is continuously inventing to provide data capture solutions that meet or expect altering market needs.

The prominent players in the In-counter barcode scanners market are Honeywell International Inc., Zebra Technologies Corporation, Cognex Corporation, SATO Holdings Corporation, Toshiba TEC Corporation, Wasp Barcode Technologies, Datalogic S.P.A, Scandit AG, and others.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 6.5% from 2025 to 2035 |

| Market Value in 2025 | USD 2194.5 Million |

| Market Value in 2035 | USD 4587.9 Million |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Vertical, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | United States of America, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, China, India, Japan, ASIAN, GCC Countries, South Africa |

| Key Companies Profiled | Honeywell International Inc.; Zebra Technologies Corporation; Cognex Corporation; SATO Holdings Corporation; Toshiba TEC Corporation; Wasp Barcode Technologies; Datalogic S.P.A; Scandit AG |

The global in-counter barcode scanners market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the in-counter barcode scanners market is projected to reach USD 5.8 billion by 2035.

The in-counter barcode scanners market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in in-counter barcode scanners market are retail and consumer packaged goods, warehousing and transport and logistics.

In terms of , segment to command 0.0% share in the in-counter barcode scanners market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Barcode Scanners Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Barcode Scanner Market Size and Share Forecast Outlook 2025 to 2035

Barcode Printers & Consumables Market Growth - Trends & Forecast 2025 to 2035

Barcode Printers Market Growth - Trends & Forecast 2025 to 2035

Barcode Labeller Machine Market

Barcode Label Market

2D Barcode Reader Market Size and Share Forecast Outlook 2025 to 2035

3D Scanners Market Size and Share Forecast Outlook 2025 to 2035

UK Barcode Printer Market Analysis – Demand, Growth & Forecast 2025-2035

USA Barcode Printer Market Trends – Size, Share & Industry Growth 2025-2035

ASEAN Barcode Printer Market Insights – Size, Share & Industry Growth 2025-2035

Japan Barcode Printer Market Growth – Innovations, Trends & Forecast 2025-2035

Germany Barcode Printer Market Analysis – Growth, Applications & Outlook 2025-2035

Micro-CT Scanners Market

Warehouse Barcode Systems Market

Image Based Barcode Reader Market Growth – Trends & Forecast 2020-2030

Handheld Retinal Scanners Market

Fixed 2D Industrial Barcode Scanner Market Size and Share Forecast Outlook 2025 to 2035

Ballistic Protection Scanners Market

Microfilm Readers and Scanners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA