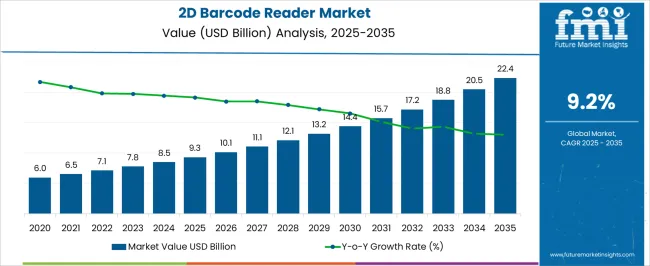

The 2D barcode reader market is projected to reach USD 9.3 billion in 2025 and anticipated to expand to USD 22.4 billion by 2035, advancing at a CAGR of 9.2%. A peak-to-trough analysis of this trajectory shows how growth momentum builds and moderates across cycles during the forecast period. In the initial phase, from USD 6.0 billion in 2024 to USD 9.3 billion in 2025, the market experiences a steady climb driven by retail adoption, logistics upgrades, and digital payment integration.

The subsequent years leading up to 2030 highlight stronger upward momentum as warehouses, healthcare, and transport hubs integrate advanced scanning for inventory accuracy and regulatory compliance, pushing the market past USD 13.2 billion. The peak of acceleration is observed between 2030 and 2033, where CAGR trends slightly higher due to widespread e-commerce expansion, adoption of omni-channel retail systems, and government initiatives promoting digital traceability. The trough, or relative moderation, emerges beyond 2033 as markets mature, procurement shifts to replacement demand, and efficiency gains stabilize.

By 2035, with the market reaching USD 22.4 billion, growth consolidates as barcode readers evolve into broader automation ecosystems tied with AI and IoT frameworks. The peak-to-trough cycle reveals how retail digitization and industrial automation deliver early acceleration, while technological maturity moderates growth toward the later years, balancing expansion with replacement cycles and long-term sustainability of adoption.

| Metric | Value |

|---|---|

| 2D Barcode Reader Market Estimated Value in (2025 E) | USD 9.3 billion |

| 2D Barcode Reader Market Forecast Value in (2035 F) | USD 22.4 billion |

| Forecast CAGR (2025 to 2035) | 9.2% |

The 2D barcode reader market is strongly influenced by multiple parent markets, each contributing uniquely to adoption and expansion. The retail and e-commerce market holds the largest share at 34%, as barcode readers are essential for checkout systems, inventory tracking, and omnichannel logistics, driving efficiency in high-volume consumer environments. The logistics and supply chain market contributes 28%, with barcode scanning enabling real-time shipment tracking, warehouse automation, and distribution accuracy, making it indispensable for global trade and fulfillment operations.

The healthcare and pharmaceuticals sector accounts for 16%, relying on 2D barcode readers for patient identification, medication tracking, and regulatory compliance in clinical and hospital environments. The manufacturing and industrial automation segment represents 12%, where 2D scanners are embedded into production lines to verify parts, track assemblies, and enhance quality control processes. Finally, the government and public services market holds a 10% share, leveraging barcode readers in identity management, postal services, and regulatory inspections.

Retail, logistics, and healthcare account for 78% of overall market share, underscoring how consumer-facing industries, global supply chains, and compliance-driven medical systems remain the central growth drivers, while manufacturing and government applications provide complementary opportunities that ensure broader and long-term adoption worldwide.

The 2D barcode reader market is experiencing robust growth as industries prioritize data accuracy, real time tracking, and inventory optimization. The expansion of e commerce, retail automation, and warehouse digitization is accelerating demand for efficient scanning solutions capable of handling dense data codes.

2D barcode readers offer the advantage of reading both linear and matrix codes, even when printed on curved or damaged surfaces, which has made them indispensable across high throughput environments. Technological advancements in optical sensors, image processing algorithms, and wireless connectivity are further enabling seamless integration into enterprise systems.

The market outlook remains strong as sectors such as logistics, healthcare, education, and manufacturing increasingly adopt smart identification technologies to streamline operations and enhance productivity.

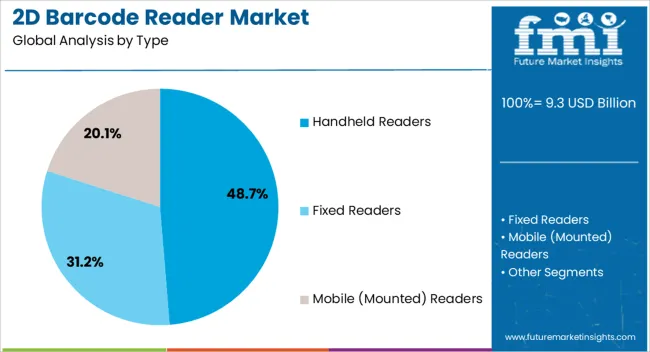

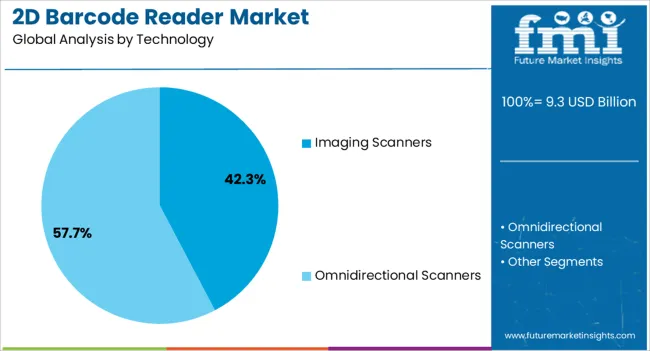

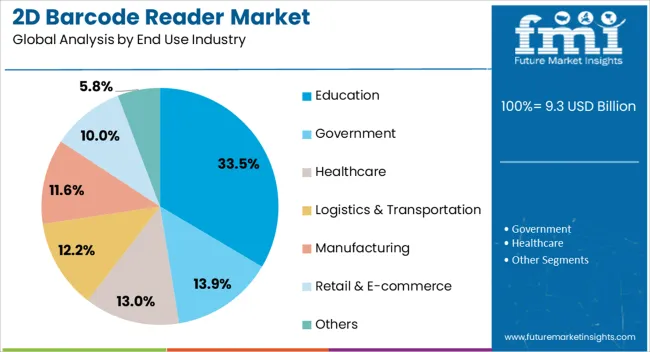

The 2D barcode reader market is segmented by type, technology, end-use industry, and geographic regions. By type, the 2d barcode reader market is divided into Handheld Readers, Fixed Readers, and Mobile (Mounted) Readers. In terms of technology, the 2D barcode reader market is classified into Imaging Scanners and Omnidirectional Scanners. Based on end-use industry, the 2D barcode reader market is segmented into Education, Government, Healthcare, Logistics & Transportation, Manufacturing, Retail & E-commerce, and Others. Regionally, the 2D barcode reader industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The handheld readers segment is projected to account for 48.70% of total market revenue by 2025 within the type category, positioning it as the leading segment. This dominance is supported by the flexibility, portability, and ease of use these devices offer across retail counters, warehouses, libraries, and clinics.

Handheld readers enable quick scanning without fixed installation, making them ideal for dynamic workspaces. Their ergonomic designs and durability further contribute to user convenience and extended operational life.

The widespread use of handheld devices in point of sale systems and inventory management tasks has reinforced their market preference. As demand continues to grow for mobile and decentralized data collection tools, handheld readers remain the most practical and widely adopted solution.

It is expected that imaging scanners will contribute 42.30% of total revenue within the technology category by 2025, reflecting their expanding role in the 2D barcode reader market. These scanners are capable of capturing and decoding complex barcodes with greater speed and accuracy compared to traditional laser based systems.

Imaging technology allows users to read codes from screens, curved surfaces, and poor quality labels, which enhances its versatility across retail, logistics, and healthcare. Furthermore, the non contact nature and high depth of field of imaging scanners support hygienic and safe operations in sensitive environments.

As industries seek higher scanning performance and reduced operational error, the adoption of imaging scanners continues to rise steadily.

The education segment is expected to represent 33.50% of the total market revenue by 2025 under the end use industry category, establishing it as a key growth contributor. This uptake is being driven by the integration of barcode systems for asset management, student tracking, library automation, and examination monitoring.

Educational institutions are increasingly turning to 2D barcode readers to improve administrative efficiency and secure access systems. The ability to scan ID cards, documents, and equipment tags quickly has streamlined internal processes and enhanced security on campuses.

The cost-effectiveness and ease of implementation of barcode readers have further supported widespread deployment across schools, colleges, and universities. With growing digitization in education and the push toward automated data collection, this segment is set to remain a prominent end user in the market.

The 2D barcode reader market is shaped by retail integration, logistics efficiency, healthcare compliance, and industrial-government applications. Collectively, these dynamics emphasize accuracy, traceability, and reliability as central growth catalysts.

The retail and e-commerce sector has become a primary driver of demand for 2D barcode readers. With the rapid expansion of online shopping and omnichannel sales, retailers are adopting advanced scanners for seamless checkout, real-time inventory management, and quick returns processing. These devices provide faster scan speeds, higher accuracy, and compatibility with digital codes used in mobile payments. E-commerce warehouses deploy 2D scanners to improve fulfillment accuracy, reduce manual errors, and handle high-volume parcel sorting. Retailers also benefit from integration with customer loyalty programs and self-service kiosks that rely heavily on barcode scanning. This dynamic reflects how retail growth and evolving consumer behavior reinforce the importance of 2D barcode readers in maintaining efficiency.

Logistics and supply chain operations are adopting 2D barcode readers to improve shipment tracking, warehouse efficiency, and real-time visibility across distribution networks. These devices are increasingly deployed in automated storage and retrieval systems, ensuring error-free operations and faster order fulfillment. Logistics providers benefit from durability and versatility of scanners that can read damaged or poorly printed codes, common in shipping environments. Supply chains rely on barcode readers to improve accuracy in loading, unloading, and dispatch operations, minimizing costly delays. Cross-border trade regulations further accelerate adoption by requiring transparent and traceable product labeling. This dynamic demonstrates how barcode readers have become essential in driving global supply chain resilience.

The healthcare and pharmaceutical industries are emerging as critical adopters of 2D barcode readers due to stringent compliance requirements. Hospitals, pharmacies, and laboratories rely on scanners for patient identification, prescription validation, and tracking of medical supplies. Barcode readers improve accuracy in drug administration, reducing errors and ensuring adherence to safety standards. In pharmaceuticals, global mandates such as serialization and traceability of medicines enhance the importance of 2D barcode technology. These devices also support real-time inventory management of vaccines, surgical tools, and lab samples. With rising emphasis on data integrity and regulatory oversight, healthcare facilities are increasingly deploying barcode readers as part of digital transformation strategies.

The use of 2D barcode readers in manufacturing and government applications is steadily rising. Industrial plants rely on scanners for part verification, quality assurance, and real-time production monitoring. Barcode-enabled systems minimize downtime by automating traceability of components across assembly lines. Government sectors adopt these devices for identity verification, postal services, and inspection processes that demand accuracy and speed. Adoption in transportation ticketing systems, border control, and administrative services further underlines their utility. Vendors are offering ruggedized scanners tailored to withstand industrial conditions while meeting compliance standards. This adoption beyond retail and healthcare highlights the versatility of 2D barcode readers across critical sectors worldwide.

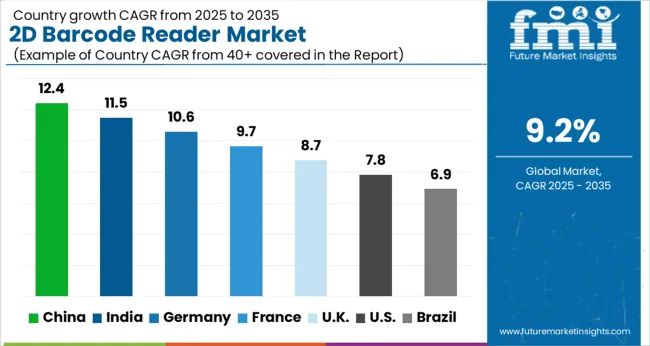

| Country | CAGR |

|---|---|

| China | 12.4% |

| India | 11.5% |

| Germany | 10.6% |

| France | 9.7% |

| UK | 8.7% |

| USA | 7.8% |

| Brazil | 6.9% |

The global 2D barcode reader market is projected to grow at a CAGR of 9.2% from 2025 to 2035. China leads growth at 12.4%, followed by India at 11.5% and Germany at 10.6%, while France records 9.7%, the UK posts 8.7%, and the USA trails at 7.8%. Expansion in Asia, particularly China and India, is driven by large-scale retail digitization, logistics optimization, and e-commerce fulfillment operations. Germany and France emphasize advanced automation in manufacturing, compliance in healthcare, and seamless integration in supply chain visibility. The UK and USA show steady but comparatively slower growth as adoption focuses on modernization of legacy systems, institutional upgrades, and high compliance environments. Collectively, Asia continues to dominate due to rapid industrial expansion and digital infrastructure development, while Europe and North America sustain demand with emphasis on quality, compliance, and sector-specific applications. The analysis spans over 40+ countries, with the leading markets shown below.

The 2D barcode reader market in China is projected to expand at a CAGR of 12.4% from 2025 to 2035, supported by retail digitization, express logistics, and high-throughput fulfillment centers. Deployments are being prioritized in supermarkets, convenience chains, and pharmacy networks where scan accuracy and queue time reduction are required. Warehouses and parcel hubs are adopting fixed-mount imagers for conveyor tracking and put-to-light stations, while handhelds serve cycle counts and reverse logistics. Hospitals and clinics are standardizing bedside scanning for medication administration and specimen tracking. It is assessed that domestic vendors will compete on durability, decoding speed, and total cost of ownership, while international brands focus on cybersecurity, encryption, and device management. Broader ERP and WMS integrations are expected to reinforce purchasing decisions through 2035.

The 2D barcode reader market in India is expected to grow at 11.5% CAGR between 2025 and 2035, encouraged by grocery modern trade, quick-commerce fulfillment, and GST-driven compliance. Retailers are scaling POS imaging for coupons, mobile wallets, and loyalty codes, while DCs and dark stores favor rugged scanners for rapid pick rates. Pharma distributors and hospitals are expanding serialization checks for packs and vials. Government programs that digitize public distribution and postal services create incremental demand for entry-level readers. The view here is that value-engineered models with reliable service networks will gain share, as buyers prioritize uptime, battery life, and simple device management. Cloud dashboards for fleet health and firmware updates are being evaluated by large operators through 2035.

Germany is anticipated to post a 10.6% CAGR from 2025 to 2035, led by factory automation, regulated healthcare, and precise warehouse operations. Automotive and engineering plants are embedding fixed imagers at stations for part verification, traceability, and error-proofing. Hospitals and labs are enforcing bedside and specimen scanning to protect data integrity. Retail chains adopt self-checkout and kiosk formats that require tolerant decoders for crumpled labels and screens. Buyers emphasize MDR and GDPR readiness, encrypted data paths, and device certificates. Preference is shown for readers with disinfectant-ready housings, wide temperature ranges, and long warranty coverage. It is believed that open APIs and validated connectors into MES, LIMS, and WMS will remain decisive in enterprise tenders.

The UK market is projected to rise at 8.7% CAGR from 2025 to 2035, supported by grocery refits, courier depots, and NHS procurement. Retailers deploy scanners that read on-screen vouchers and damaged labels, reducing exceptions at tills. Parcel networks expand wearable and ring scanners to improve pick accuracy in high-mix environments. NHS trusts prioritize bedside scanning, asset tracking, and pharmacy verification to reduce medication errors. Procurement frameworks continue to weigh total lifecycle cost, service SLAs, and cyber posture. In this assessment, IP-rated devices with strong decode libraries and remote fleet tools will see preference as estates migrate from linear lasers to imaging.

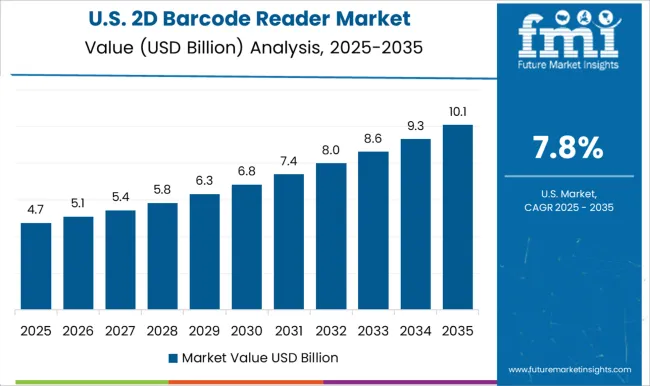

The USA market is expected to grow at 7.8% CAGR from 2025 to 2035, anchored by big-box retail, third-party logistics, and healthcare providers. Chains roll out self-checkout and curbside pickup lanes that demand fast decoding of paper and screen-based codes. 3PLs adopt vehicle-mounted and long-range imagers for pallet identification and yard operations. Health systems emphasize unit-dose and UDI scanning, reinforcing accuracy in pharmacy and OR workflows. Buyers look for UL-listed, FIPS-capable, and enterprise-managed devices that integrate with EMR, WMS, and OMS platforms. Replacement cycles favor lighter, more ergonomic form factors with hot-swappable batteries. It is judged that integration depth and analytics on scan success rates will differentiate leading vendors through 2035.

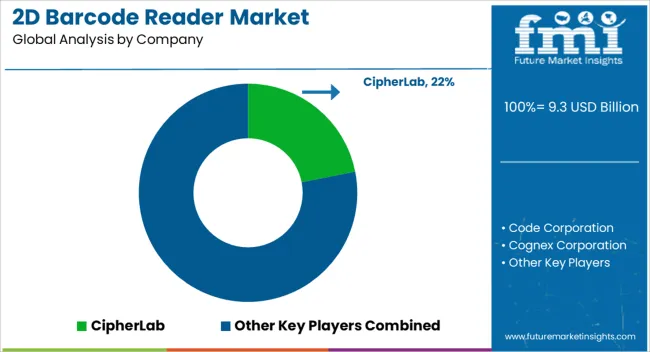

Competition in the 2D barcode reader market is defined by scanning accuracy, integration with enterprise systems, and durability across industrial and retail environments. Zebra Technologies and Honeywell International lead the market with extensive portfolios spanning handheld, fixed-mount, and mobile scanning solutions, emphasizing rugged designs, advanced decoding algorithms, and enterprise software integration. Cognex Corporation competes strongly in manufacturing and logistics with machine vision-based readers optimized for high-speed, high-precision industrial applications. Datalogic and Keyence provide advanced imaging systems tailored for retail, healthcare, and automation, highlighting compact form factors and high read rates. Denso Wave and Omron strengthen the competitive space with innovations in QR code and multi-symbology scanning, focusing on automotive, electronics, and industrial automation sectors. Panasonic and Sato Holdings target specialized applications, offering barcode readers integrated with labeling and printing systems, particularly for supply chain and retail operations. Mid-tier players such as CipherLab, Code Corporation, Socket Mobile, Unitech Electronics, and Marson Technology focus on cost-effective, reliable handheld solutions with strong appeal to SMEs in retail, warehousing, and field service. JADAK and Juniper Systems differentiate by addressing healthcare and rugged field applications, emphasizing disinfectant-ready designs and durable enclosures. Strategies emphasize seamless connectivity with ERP, WMS, and POS platforms, alongside mobile compatibility for workforce efficiency. Vendors market high-resolution imaging, omnidirectional scanning, and robust data capture from damaged or distorted codes as critical differentiators. Product brochures highlight technical specifications including scan range, symbology support, environmental resistance, and power efficiency. Accessories such as charging cradles, mobile sleds, and software toolkits are detailed to enhance user convenience. Overall, competition revolves around reliability, integration, and adaptability, reflecting the central role of barcode readers in digital commerce, industrial traceability, and healthcare compliance.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.3 Billion |

| Type | Handheld Readers, Fixed Readers, and Mobile (Mounted) Readers |

| Technology | Imaging Scanners and Omnidirectional Scanners |

| End Use Industry | Education, Government, Healthcare, Logistics & Transportation, Manufacturing, Retail & E-commerce, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CipherLab, Code Corporation, Cognex Corporation, Datalogic, Denso Wave, Honeywell International, JADAK, Juniper Systems, Keyence, Marson Technology, Omron, Panasonic, Sato Holdings, Socket Mobile, Unitech Electronics, and Zebra Technologies |

| Additional Attributes | Dollar sales by product type, share by sector (retail, logistics, healthcare, manufacturing), regional adoption trends, pricing benchmarks, competitive positioning, and integration opportunities with enterprise systems. |

The global 2d barcode reader market is estimated to be valued at USD 9.3 billion in 2025.

The market size for the 2d barcode reader market is projected to reach USD 22.4 billion by 2035.

The 2d barcode reader market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in 2d barcode reader market are handheld readers, fixed readers and mobile (mounted) readers.

In terms of technology, imaging scanners segment to command 42.3% share in the 2d barcode reader market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

2D Transition Metal Carbides Nitrides Market Size and Share Forecast Outlook 2025 to 2035

2D Bar Code Marketing Market Analysis by Technology, Code Types, Applications, and Region Through 2035

2D Electronics Market

Fixed 2D Industrial Barcode Scanner Market Size and Share Forecast Outlook 2025 to 2035

Barcode Scanner Market Size and Share Forecast Outlook 2025 to 2035

Barcode Printers & Consumables Market Growth - Trends & Forecast 2025 to 2035

Barcode Printers Market Growth - Trends & Forecast 2025 to 2035

Barcode Labeller Machine Market

Barcode Label Market

UK Barcode Printer Market Analysis – Demand, Growth & Forecast 2025-2035

USA Barcode Printer Market Trends – Size, Share & Industry Growth 2025-2035

ASEAN Barcode Printer Market Insights – Size, Share & Industry Growth 2025-2035

Japan Barcode Printer Market Growth – Innovations, Trends & Forecast 2025-2035

Germany Barcode Printer Market Analysis – Growth, Applications & Outlook 2025-2035

Warehouse Barcode Systems Market

In-Counter Barcode Scanners Market Size and Share Forecast Outlook 2025 to 2035

Industrial Barcode Scanners Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Image Based Barcode Reader Market Growth – Trends & Forecast 2020-2030

NFC Reader ICs Market Analysis - Size, Share, and Forecast 2025 to 2035

Competitive Breakdown of NFC Reader ICs Market Share & Key Players

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA