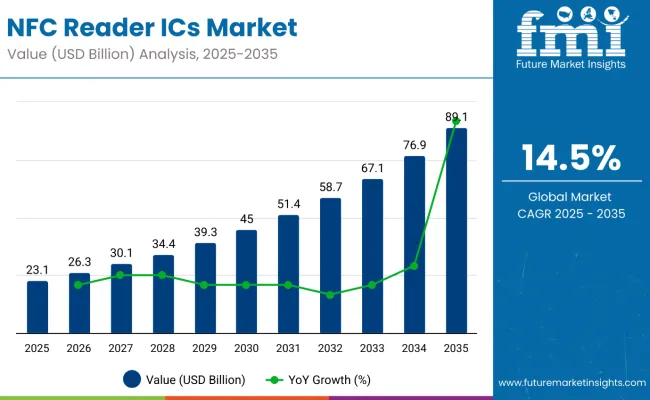

The global NFC reader ICs market is projected to expand from USD 23.02 billion in 2025 to approximately USD 89.21 billion by 2035, reflecting a CAGR of 14.5% over the forecast period. In 2024, the market was valued at USD 20.10 billion.

The rise in market size has been driven by the increasing deployment of contactless payment systems, the requirement for secure data communication, and the widespread adoption of connected devices. Enhanced demand for compact and energy-efficient NFC reader ICs has been observed across smartphones, wearables, and consumer electronics.

By 2025, extensive utilization of NFC reader ICs has been observed in public transport, retail environments, healthcare, and industrial automation. In retail applications, faster checkout and personalized service experiences have been enabled by NFC technology.

In the healthcare sector, secure access and real-time data handling have been supported through embedded ICs. Automotive manufacturers have embedded NFC chips for secure entry systems and cabin personalization. Multi-protocol compatibility and low power consumption have been prioritized in new IC designs to meet broader industrial needs.

Widespread adoption in Asia Pacific has been observed, particularly in China, Japan, and India, where transit digitization and mobile payments have been encouraged by governments. In North America and Europe, NFC technology has been adopted to enhance enterprise security and streamline identity verification processes.

Regulatory pushes toward data protection and biometric validation have reinforced market demand. Smart city initiatives and IoT infrastructure development have contributed further to the uptake of NFC reader ICs globally, with strong momentum expected throughout the forecast period.

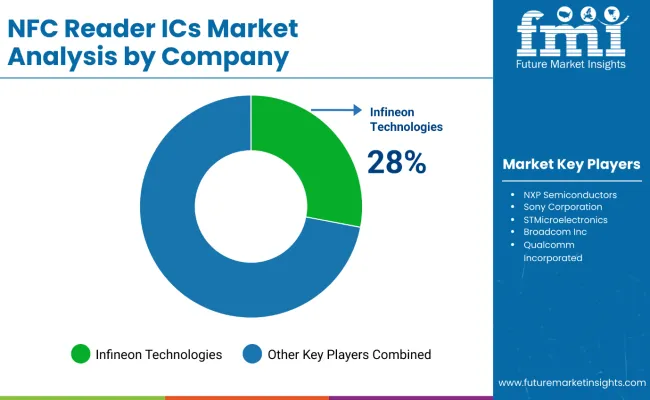

Key players in the market include NXP Semiconductors, STMicroelectronics, Infineon Technologies, Sony Corporation, Broadcom Inc., and Texas Instruments. Product innovation has been led by efforts in miniaturization, energy efficiency, and encrypted data exchange. Automotive-grade passive entry systems were introduced by NXP in 2025.

STMicroelectronics expanded secure transaction capabilities, while Sony enhanced reader IC performance for mobile applications. Infineon focused on delivering low-latency ICs for industrial contexts. A sustained upward trajectory has been anticipated as digital transformation continues to be accelerated across financial, retail, industrial, and healthcare sectors globally through the application of NFC reader ICs.Top of Form

| Attributes | Description |

|---|---|

| Historical Size, 2024 | USD 20,235.6 million |

| Estimated Size, 2025 | USD 23.02 billion |

| Projected Size, 2035 | USD 89.16 billion |

| Value-based CAGR (2025 to 2035) | 14.5% CAGR |

Companies in the NFC (Near Field Communication) reader IC market are leveraging smart technologies such as embedded AI, secure element integration, energy harvesting, and IoT connectivity to enhance contactless communication, security, and system efficiency. These innovations are widely used across industries like mobile payments, access control, transportation, healthcare, and smart retail.

The below table presents the expected CAGR for the global NFC Reader ICs market over several semi-annual periods spanning from 2025 to 2035. This assessment outlines changes in the NFC Reader ICs industry and identify revenue trends, offering key decision makers an understanding about market performance throughout the year.

H1 represents first half of the year from January to June, H2 spans from July to December, which is the second half. In the first half (H1) of the year from 2025 to 2035, the business is predicted to surge at a CAGR of 13.6%, followed by a slightly higher growth rate of 13.9% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1, 2024 to 2034 | 13.6% |

| H2, 2024 to 2034 | 13.9% |

| H1, 2025 to 2035 | 13.2% |

| H2, 2025 to 2035 | 14.2% |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 13.2% in the first half and remain higher at 14.2% in the second half. In the first half (H1) the market witnessed a decrease of 40 BPS while in the second half (H2), the market witnessed an increase of 30 BPS.

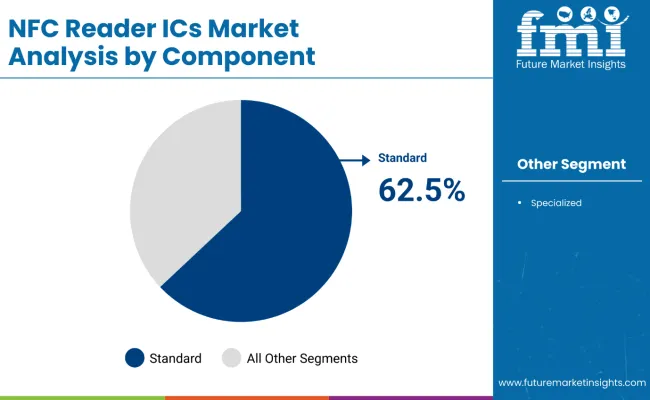

Standard NFC Reader ICs are projected to lead the component segment in 2025 with a dominant 62.5% share of the global NFC Reader ICs market. Their widespread integration into consumer devices such as smartphones, payment terminals, and access control systems is being credited for this position.

These ICs offer high compatibility across diverse platforms, contributing to cost-effective and scalable product designs. Products like NXP’s PN532 and Broadcom’s BCM2079x series are being widely adopted due to their robust support for various NFC standards, reliability in real-world conditions, and ease of integration. The demand for seamless, touch-based communication in everyday electronics is being addressed effectively through these standardized solutions.

Their implementation is being expanded across transportation, retail, and corporate sectors, supporting functionalities such as contactless ticketing, identity verification, and tap-to-pay systems. As digital transactions and connected devices become more prevalent, the reliability and interoperability of standard NFC reader ICs are being prioritized, securing their position as a top investment focus in the NFC ecosystem.

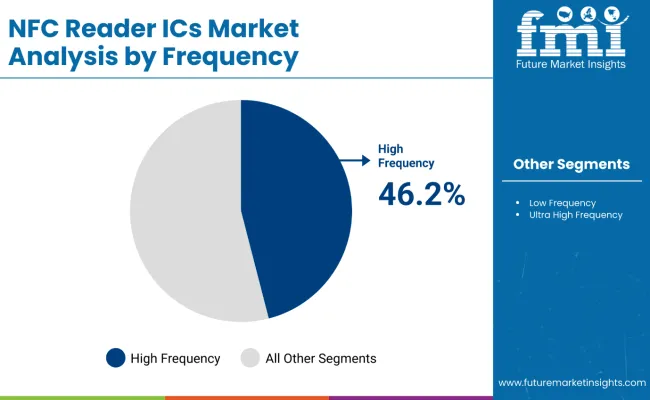

High Frequency (HF) NFC Reader ICs are expected to capture 46.2% of the NFC market by frequency segment in 2025, making them the most widely adopted frequency type. Operating at 13.56 MHz, HF NFC is being used extensively in mobile payments, smart cards, and secure access systems due to its superior communication range and universal protocol support.

The broad deployment of HF-based solutions in transport ticketing, retail payments, and identity authentication is driving this segment's growth. Leading manufacturers are incorporating HF NFC technology into smartphones, wearables, and smart terminals to enable fast, secure, and contactless interactions. The reliability and compatibility of HF NFC with ISO/IEC standards are being recognized by device makers and system integrators.

As consumer demand rises for fast and secure wireless transactions, HF NFC is being favored for its proven performance and seamless integration into smart infrastructure. With the global rollout of contactless systems and IoT expansion, the HF segment remains a key area of technological and commercial investment within the NFC reader ICs market.

Rising Demand for, Contactless Payments Fuels Business Growth

The rising scale of contactless payments is one of the major factor being witnessed in the NFC Reader ICs market. The increasing number of consumers availing mobile wallets and making payment through contactless credit and debit cards has fueled the demand for NFC technology.

For instance, in 2023, Visa stated that 60% of all in-person payments made in the USA were contactless., thus indicating the adoption of faster and secure payment alternatives.

NFC Reader ICs are a key enabler as they help devices wireless communicate with payment terminals so as to support secure and seamless transaction applications. These memory integrated circuits are embedded into smartphones, payment terminals, and other devices to enable secure transmission of information related to payments over short range.

With the rising adoption of contactless payments, companies are adopting NFC technology to ensure quick and safe transactions as requested by their customers.

Moreover, leading retail and transport businesses have started to use NFC enabled systems to serve their customers better apart from gaining operational efficiencies. The increase in adoption of NFC-enabled transactions will lead to further demand of NFC Reader ICs in the years ahead.

Enhanced Encryption and Authentication Elevate NFC Security Features

As NFC technology is being used for day to day transactions, security has also become one of the key concerns. To avoid fraud and any unauthorized access or usage, latest NFC Reader ICs are equipped with high end encryption and authentication mechanism to secure the sensitive information exchanged during the transaction.

For example, new NFC Reader ICs now supports AES (Advanced Encryption Standard) with 128-bit encryption; whereas earlier versions used an outdated less secured mechanism. This means that all the data transmitted between two NFC devices is now encrypted with highly complex encryption algorithm making it almost impractical for hackers to decode/decrypt that data in order to misuse it.

The high level of security has been recently adopted by companies such as Apple and Samsung in their smartphones and payment systems. In 2023, 75% of new NFC-enabled smartphones can now adopt this high-level security due to the increased attention given to security in mobile payment. Such enhancements will not only make consumer feel more secure but also promote increasing adoption of NFC technology across other applications such as contactless payments and secure access.

NFC-Enabled Smart Appliances Enhance User Experience with Seamless Mobile Integration

The rise in NFC-enabled smart appliances is a major driving force for the NFC reader ICs market. With the development of smart home technology, NFC Reader ICs have become essential for improving end user’s interaction with home appliances, as they provide simple setup and easy control of appliances through smartphones, thus making home automation more convenient and accessible to the general population.

NFC Reader IC manufacturers are increasingly integrating their solutions into modern appliances. For example, Samsung’s 2023 line of its NFC-enabled home appliance range including refrigerators and washing machines will be equipped with built-in NFC Reader IC. Users can easily connect their smartphones to these devices by simply tapping on them to avail functions such as remote diagnostics, software upgrade, and personalized device settings.

The company stated that its appliances that included NFC witnessed an increase in customer interactions by nearly 30%, owing to the high level of convenience offered by such technologies when used in tandem with mobile devices.

The NFC-enabled smart appliances market has gained momentum over the past few years with more and more people inclined toward using NFC technology to ease the connection as well as performance of any device in the household. This is projected to directly increase the application of NFC Reader ICs, thus boosting their demand and possible growth in the end-use industry.

Lack of Consumer Awareness Slowdown NFC Technology Adoption and Growth

Consumer awareness poses a major issue for the NFC Reader ICs market. A huge number of individuals are still unaware with NFC technology or how it can be useful in their day-to-day activities, which unfavorably affects its adoption rate.

Even though NFC is increasingly being used in mobile payments as well as smart devices and other applications, there is a reluctance among consumers to adopt or an outright unawareness regarding the effective use of these functionalities.

For example, in 2023 40% USA consumers were not aware of their smartphones’ ability to use NFC. This lack of knowledge results in a huge proportion of the population missing out on convenience and security offered by NFC technology as they might not have any knowledge about contactless payments benefits or the fact that they can easily connect their devices with smart appliances that are equipped with NFC capabilities.

Manufacturers and technology providers need to implement education campaigns, as well as providing clear and easy accessible information about the NFC technology. By increasing consumer knowledge and indicating the practical benefits of NFC, like faster transactions and improved device interactions, the industry for NFC Reader ICs can develop rapidly as users become more involved and assured in using these innovations.

The NFC Reader ICs market experienced significant changes due to evolving technology and economic factors. The market was valued at USD 12,089.4 million in 2020 and saw a CAGR of 13.7% from 2020 to 2024. The pandemic had disrupted the supply chain and brought economic instability that impacted the growth of the NFC Reader ICs market.

The demand for contactless solution had raised initially with lockdown and trade restriction in place because of increased concern over hygiene and safety. However, with the economy going down, budget constraint postponed investment on new technology hampering the market momentum.

After global conditions got stabilized, NFC Reader ICs market started recovering as economic activities began reviving coupled with fast expanding e-commerce driving demand up for contactless payment system and devices.

Majors in tech industry introduced several advancement including improved encryption & functionality to answer growing needs toward secure and efficient contactless transaction. The recovery is also backed by trend leading toward use of more sustainable & eco- friendly technologies.

Tier 1 vendors dominating the top market giants such as NXP Semiconductors, Broadcom Inc., and Qualcomm. Tier 1 vendors hold largest share around 40%-45% of the market due to various product portfolios, advanced technology and global reach. This vendor lead in innovation and have strong relationships with key various key industries which will significant advancements in NFC Reader ICs.

Tier 2 vendors include influential players such as Sony Corporation, Navitas Semiconductor, Texas Instruments among others which is catering 15%-20% of the market. Tier 2 vendors are prominent for specialized NFC Reader ICs and focused on particular sectors such as automotive and industrial applications and they are focused on contributing to the market through targeted innovations and partnerships.

Tier 3 vendors contains smaller and emerging vendors such as Infineon Technologies, ams AG, ON Semiconductor among others which caters around 30%-35% of the market. Tier 3 vendors provide niche NFC Reader ICs and cater to specific applications or regions and focused on contributing to various diversity and competitive dynamics of the market.

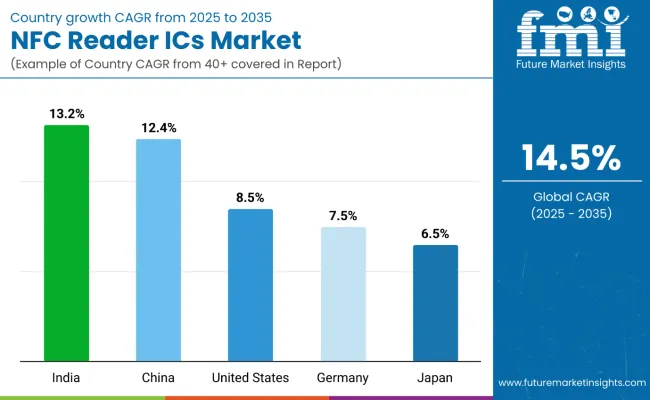

China, United States, Germany, Japan and India are countries growing internationally in the NFC Reader ICs market. China is holding highest CAGR with mass development in automotive and electronics sector utilizing fullest of NFC Reader ICs. Also with its robust research institutes and strong resources North America is among leading competitors in this landscape.

The section covers CAGRs, growth prospects, government support, company mergers and collaborations and recent advances in expanding countries.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 13.2% |

| China | 12.4% |

| Germany | 7.5% |

| Japan | 6.5% |

| United States | 8.5% |

The United States NFC reader ICs market is witnessing a major rise in the market owing to massive investments made towards fintech innovation and early adoption of NFC technology across various industries.

The country leads in the implementation of NFC solutions within consumer and retail segments, fueled by the rapid evolution of payment technologies and digital wallets. In fact, both Apple & Google have incorporated NFC technology within their respective mobile payments platforms, bringing about a surging traction. Foe example, in 2023, Apple Pay alone had registered over 500 million users globally its huge popularity evidently depicting the increasing penetration of users demanding NFC enabled solutions.

Besides this, renowned retailers like Walmart and Target have raised their investments towards incorporating NFC for seamless and contactless payment experience at stores. With an extensive environment to absorb new age technologies into existing systems with ease also facilitates the expansion of the NFC Reader ICs market in the country.

China is a major revenue generating country in NFC Reader ICs market owing to the rapid increase in urbanization, rise in mobile commerce and government initiatives for cashless economy and smart city projects. Chinese government has made heavy digital payments infrastructure resulting into increased adoption of NFC technology which can be seen by the fact that China had qver 1.2 billion mobile payment users as of 2023, there are platforms like Alipay and WeChat Pay through which consumers can complete transactions using near-field communications (NFC) technology.

both of these platforms alone processed USD 30 trillion worth of transactions annually and with countries pushed by central bank for unified digital currency China will continue working on similar lines driving demand for NFC Reader ICs. There is also increasing construction activities, hospital infrastructures, roads/bridges requiring contact less payments hence creating more demand.

India’s NFC Reader IC market is anticipated to grow at a fast pace on account of expanding financial inclusion coupled with growing mobile connectivity. Increasing government focus on improving digital financial services has resulted in the rapid adoption of contactless payment systems in the country. For instance, in 2023, Paytm collaborated with leading banks to integrate NFC technology in its mobile wallet for easier and secure transactions.

This aligns with Indian government’s broader goal of promoting digital payments which currently exceeds 1 billion digital transactions per month. Also, availability of affordable smartphones enabled with NFC features is contributing towards increasing the product demand owing to significant efforts undertaken by major smartphone manufacturer i.e., Samsung.

The firm has included NFC in its phones portfolio as it anticipates strong demand for contactless payment solution from India market. All these factors are fuelling the India NFC Reader ICs market growth owing to increasing government initiatives coupled rising consumer demand for convenient financial services.

Manufacturers of NFC Reader ICs are heavily investing in the research and development activities to improve the performance and cost effectiveness of their products, aiming for seamless and secure contactless communication for different applications.

A wide spectrum of opportunities is open for new entrants as well as for already established players if they can innovate technologically advanced products than what is available in the market currently. With more advancements, a large number of NFC based devices can be introduced in nearly all industry verticals.

Industry Update

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 23.02 billion |

| Projected Market Size (2035) | USD 89.16 billion |

| CAGR (2025 to 2035) | 14.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Components Analyzed (Segment 1) | Standard NFC Reader ICs, Specialized NFC Reader ICs |

| Applications Analyzed (Segment 2) | Consumer Electronics, Retail, Automotive, Healthcare, Public Transportation, Others |

| Frequencies Analyzed (Segment 3) | Low Frequency (LF), High Frequency (HF), Ultra High Frequency (UHF) |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players Influencing the Market | NXP Semiconductors, Sony Corporation, STMicroelectronics, Broadcom Inc., Infineon Technologies, Qualcomm Incorporated, Texas Instruments, Renesas Electronics Corporation, Microchip Technology Inc., Analog Devices Inc., Antenna Research Associates Inc. (ARA), Nordic Semiconductor, Maxim Integrated (Analog Devices), ON Semiconductor, IDEX Biometrics ASA |

| Additional Attributes | Growing integration in contactless payments, IoT-enabled device expansion, Demand for secure access and authentication systems |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of component, the segment is divided into Standard NFC Reader ICs and Specialized NFC Reader ICs.

In terms of application, the segment is segregated into consumer electronics, retail, automotive, healthcare, public transportation and others.

In terms of frequency, the segment is segregated Low Frequency (LF), High Frequency (HF) and Ultra High Frequency (UHF).

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global NFC Reader ICs industry is projected to witness CAGR of 14.5% between 2025 and 2035.

The Global NFC Reader ICs industry stood at USD 20,235.6 million in 2024.

The Global NFC Reader ICs industry is anticipated to reach USD 89.16 billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 13.9% in the assessment period.

The key players operating in the Global NFC Reader ICs industry NXP Semiconductors, Sony Corporation, STMicroelectronics, Broadcom Inc., Infineon Technologies, Qualcomm Incorporated, Texas Instruments, Renesas Electronics Corporation, Microchip Technology Inc. among others.

Table 1: Global NFC Reader ICs Market Value (US$ Mn) Forecast by Region, 2017-2032

Table 2: Global NFC Reader ICs Market Value (US$ Mn) Forecast by NFC Functionality, 2017-2032

Table 3: Global NFC Reader ICs Market Value (US$ Mn) Forecast by Host Interface, 2017-2032

Table 4: Global NFC Reader ICs Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 5: Global NFC Reader ICs Market Value (US$ Mn) Forecast by Industry, 2017-2032

Table 6: North America NFC Reader ICs Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 7: North America NFC Reader ICs Market Value (US$ Mn) Forecast by NFC Functionality, 2017-2032

Table 8: North America NFC Reader ICs Market Value (US$ Mn) Forecast by Host Interface, 2017-2032

Table 9: North America NFC Reader ICs Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 10: North America NFC Reader ICs Market Value (US$ Mn) Forecast by Industry, 2017-2032

Table 11: Latin America NFC Reader ICs Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 12: Latin America NFC Reader ICs Market Value (US$ Mn) Forecast by NFC Functionality, 2017-2032

Table 13: Latin America NFC Reader ICs Market Value (US$ Mn) Forecast by Host Interface, 2017-2032

Table 14: Latin America NFC Reader ICs Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 15: Latin America NFC Reader ICs Market Value (US$ Mn) Forecast by Industry, 2017-2032

Table 16: Europe NFC Reader ICs Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 17: Europe NFC Reader ICs Market Value (US$ Mn) Forecast by NFC Functionality, 2017-2032

Table 18: Europe NFC Reader ICs Market Value (US$ Mn) Forecast by Host Interface, 2017-2032

Table 19: Europe NFC Reader ICs Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 20: Europe NFC Reader ICs Market Value (US$ Mn) Forecast by Industry, 2017-2032

Table 21: Asia Pacific NFC Reader ICs Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 22: Asia Pacific NFC Reader ICs Market Value (US$ Mn) Forecast by NFC Functionality, 2017-2032

Table 23: Asia Pacific NFC Reader ICs Market Value (US$ Mn) Forecast by Host Interface, 2017-2032

Table 24: Asia Pacific NFC Reader ICs Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 25: Asia Pacific NFC Reader ICs Market Value (US$ Mn) Forecast by Industry, 2017-2032

Table 26: MEA NFC Reader ICs Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 27: MEA NFC Reader ICs Market Value (US$ Mn) Forecast by NFC Functionality, 2017-2032

Table 28: MEA NFC Reader ICs Market Value (US$ Mn) Forecast by Host Interface, 2017-2032

Table 29: MEA NFC Reader ICs Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 30: MEA NFC Reader ICs Market Value (US$ Mn) Forecast by Industry, 2017-2032

Figure 1: Global NFC Reader ICs Market Value (US$ Mn) by NFC Functionality, 2022-2032

Figure 2: Global NFC Reader ICs Market Value (US$ Mn) by Host Interface, 2022-2032

Figure 3: Global NFC Reader ICs Market Value (US$ Mn) by Application, 2022-2032

Figure 4: Global NFC Reader ICs Market Value (US$ Mn) by Industry, 2022-2032

Figure 5: Global NFC Reader ICs Market Value (US$ Mn) by Region, 2022-2032

Figure 6: Global NFC Reader ICs Market Value (US$ Mn) Analysis by Region, 2017-2032

Figure 7: Global NFC Reader ICs Market Value Share (%) and BPS Analysis by Region, 2022-2032

Figure 8: Global NFC Reader ICs Market Y-o-Y Growth (%) Projections by Region, 2022-2032

Figure 9: Global NFC Reader ICs Market Value (US$ Mn) Analysis by NFC Functionality, 2017-2032

Figure 10: Global NFC Reader ICs Market Value Share (%) and BPS Analysis by NFC Functionality, 2022-2032

Figure 11: Global NFC Reader ICs Market Y-o-Y Growth (%) Projections by NFC Functionality, 2022-2032

Figure 12: Global NFC Reader ICs Market Value (US$ Mn) Analysis by Host Interface, 2017-2032

Figure 13: Global NFC Reader ICs Market Value Share (%) and BPS Analysis by Host Interface, 2022-2032

Figure 14: Global NFC Reader ICs Market Y-o-Y Growth (%) Projections by Host Interface, 2022-2032

Figure 15: Global NFC Reader ICs Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 16: Global NFC Reader ICs Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 17: Global NFC Reader ICs Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 18: Global NFC Reader ICs Market Value (US$ Mn) Analysis by Industry, 2017-2032

Figure 19: Global NFC Reader ICs Market Value Share (%) and BPS Analysis by Industry, 2022-2032

Figure 20: Global NFC Reader ICs Market Y-o-Y Growth (%) Projections by Industry, 2022-2032

Figure 21: Global NFC Reader ICs Market Attractiveness by NFC Functionality, 2022-2032

Figure 22: Global NFC Reader ICs Market Attractiveness by Host Interface, 2022-2032

Figure 23: Global NFC Reader ICs Market Attractiveness by Application, 2022-2032

Figure 24: Global NFC Reader ICs Market Attractiveness by Industry, 2022-2032

Figure 25: Global NFC Reader ICs Market Attractiveness by Region, 2022-2032

Figure 26: North America NFC Reader ICs Market Value (US$ Mn) by NFC Functionality, 2022-2032

Figure 27: North America NFC Reader ICs Market Value (US$ Mn) by Host Interface, 2022-2032

Figure 28: North America NFC Reader ICs Market Value (US$ Mn) by Application, 2022-2032

Figure 29: North America NFC Reader ICs Market Value (US$ Mn) by Industry, 2022-2032

Figure 30: North America NFC Reader ICs Market Value (US$ Mn) by Country, 2022-2032

Figure 31: North America NFC Reader ICs Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 32: North America NFC Reader ICs Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 33: North America NFC Reader ICs Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 34: North America NFC Reader ICs Market Value (US$ Mn) Analysis by NFC Functionality, 2017-2032

Figure 35: North America NFC Reader ICs Market Value Share (%) and BPS Analysis by NFC Functionality, 2022-2032

Figure 36: North America NFC Reader ICs Market Y-o-Y Growth (%) Projections by NFC Functionality, 2022-2032

Figure 37: North America NFC Reader ICs Market Value (US$ Mn) Analysis by Host Interface, 2017-2032

Figure 38: North America NFC Reader ICs Market Value Share (%) and BPS Analysis by Host Interface, 2022-2032

Figure 39: North America NFC Reader ICs Market Y-o-Y Growth (%) Projections by Host Interface, 2022-2032

Figure 40: North America NFC Reader ICs Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 41: North America NFC Reader ICs Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 42: North America NFC Reader ICs Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 43: North America NFC Reader ICs Market Value (US$ Mn) Analysis by Industry, 2017-2032

Figure 44: North America NFC Reader ICs Market Value Share (%) and BPS Analysis by Industry, 2022-2032

Figure 45: North America NFC Reader ICs Market Y-o-Y Growth (%) Projections by Industry, 2022-2032

Figure 46: North America NFC Reader ICs Market Attractiveness by NFC Functionality, 2022-2032

Figure 47: North America NFC Reader ICs Market Attractiveness by Host Interface, 2022-2032

Figure 48: North America NFC Reader ICs Market Attractiveness by Application, 2022-2032

Figure 49: North America NFC Reader ICs Market Attractiveness by Industry, 2022-2032

Figure 50: North America NFC Reader ICs Market Attractiveness by Country, 2022-2032

Figure 51: Latin America NFC Reader ICs Market Value (US$ Mn) by NFC Functionality, 2022-2032

Figure 52: Latin America NFC Reader ICs Market Value (US$ Mn) by Host Interface, 2022-2032

Figure 53: Latin America NFC Reader ICs Market Value (US$ Mn) by Application, 2022-2032

Figure 54: Latin America NFC Reader ICs Market Value (US$ Mn) by Industry, 2022-2032

Figure 55: Latin America NFC Reader ICs Market Value (US$ Mn) by Country, 2022-2032

Figure 56: Latin America NFC Reader ICs Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 57: Latin America NFC Reader ICs Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 58: Latin America NFC Reader ICs Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 59: Latin America NFC Reader ICs Market Value (US$ Mn) Analysis by NFC Functionality, 2017-2032

Figure 60: Latin America NFC Reader ICs Market Value Share (%) and BPS Analysis by NFC Functionality, 2022-2032

Figure 61: Latin America NFC Reader ICs Market Y-o-Y Growth (%) Projections by NFC Functionality, 2022-2032

Figure 62: Latin America NFC Reader ICs Market Value (US$ Mn) Analysis by Host Interface, 2017-2032

Figure 63: Latin America NFC Reader ICs Market Value Share (%) and BPS Analysis by Host Interface, 2022-2032

Figure 64: Latin America NFC Reader ICs Market Y-o-Y Growth (%) Projections by Host Interface, 2022-2032

Figure 65: Latin America NFC Reader ICs Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 66: Latin America NFC Reader ICs Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 67: Latin America NFC Reader ICs Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 68: Latin America NFC Reader ICs Market Value (US$ Mn) Analysis by Industry, 2017-2032

Figure 69: Latin America NFC Reader ICs Market Value Share (%) and BPS Analysis by Industry, 2022-2032

Figure 70: Latin America NFC Reader ICs Market Y-o-Y Growth (%) Projections by Industry, 2022-2032

Figure 71: Latin America NFC Reader ICs Market Attractiveness by NFC Functionality, 2022-2032

Figure 72: Latin America NFC Reader ICs Market Attractiveness by Host Interface, 2022-2032

Figure 73: Latin America NFC Reader ICs Market Attractiveness by Application, 2022-2032

Figure 74: Latin America NFC Reader ICs Market Attractiveness by Industry, 2022-2032

Figure 75: Latin America NFC Reader ICs Market Attractiveness by Country, 2022-2032

Figure 76: Europe NFC Reader ICs Market Value (US$ Mn) by NFC Functionality, 2022-2032

Figure 77: Europe NFC Reader ICs Market Value (US$ Mn) by Host Interface, 2022-2032

Figure 78: Europe NFC Reader ICs Market Value (US$ Mn) by Application, 2022-2032

Figure 79: Europe NFC Reader ICs Market Value (US$ Mn) by Industry, 2022-2032

Figure 80: Europe NFC Reader ICs Market Value (US$ Mn) by Country, 2022-2032

Figure 81: Europe NFC Reader ICs Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 82: Europe NFC Reader ICs Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 83: Europe NFC Reader ICs Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 84: Europe NFC Reader ICs Market Value (US$ Mn) Analysis by NFC Functionality, 2017-2032

Figure 85: Europe NFC Reader ICs Market Value Share (%) and BPS Analysis by NFC Functionality, 2022-2032

Figure 86: Europe NFC Reader ICs Market Y-o-Y Growth (%) Projections by NFC Functionality, 2022-2032

Figure 87: Europe NFC Reader ICs Market Value (US$ Mn) Analysis by Host Interface, 2017-2032

Figure 88: Europe NFC Reader ICs Market Value Share (%) and BPS Analysis by Host Interface, 2022-2032

Figure 89: Europe NFC Reader ICs Market Y-o-Y Growth (%) Projections by Host Interface, 2022-2032

Figure 90: Europe NFC Reader ICs Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 91: Europe NFC Reader ICs Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 92: Europe NFC Reader ICs Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 93: Europe NFC Reader ICs Market Value (US$ Mn) Analysis by Industry, 2017-2032

Figure 94: Europe NFC Reader ICs Market Value Share (%) and BPS Analysis by Industry, 2022-2032

Figure 95: Europe NFC Reader ICs Market Y-o-Y Growth (%) Projections by Industry, 2022-2032

Figure 96: Europe NFC Reader ICs Market Attractiveness by NFC Functionality, 2022-2032

Figure 97: Europe NFC Reader ICs Market Attractiveness by Host Interface, 2022-2032

Figure 98: Europe NFC Reader ICs Market Attractiveness by Application, 2022-2032

Figure 99: Europe NFC Reader ICs Market Attractiveness by Industry, 2022-2032

Figure 100: Europe NFC Reader ICs Market Attractiveness by Country, 2022-2032

Figure 101: Asia Pacific NFC Reader ICs Market Value (US$ Mn) by NFC Functionality, 2022-2032

Figure 102: Asia Pacific NFC Reader ICs Market Value (US$ Mn) by Host Interface, 2022-2032

Figure 103: Asia Pacific NFC Reader ICs Market Value (US$ Mn) by Application, 2022-2032

Figure 104: Asia Pacific NFC Reader ICs Market Value (US$ Mn) by Industry, 2022-2032

Figure 105: Asia Pacific NFC Reader ICs Market Value (US$ Mn) by Country, 2022-2032

Figure 106: Asia Pacific NFC Reader ICs Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 107: Asia Pacific NFC Reader ICs Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 108: Asia Pacific NFC Reader ICs Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 109: Asia Pacific NFC Reader ICs Market Value (US$ Mn) Analysis by NFC Functionality, 2017-2032

Figure 110: Asia Pacific NFC Reader ICs Market Value Share (%) and BPS Analysis by NFC Functionality, 2022-2032

Figure 111: Asia Pacific NFC Reader ICs Market Y-o-Y Growth (%) Projections by NFC Functionality, 2022-2032

Figure 112: Asia Pacific NFC Reader ICs Market Value (US$ Mn) Analysis by Host Interface, 2017-2032

Figure 113: Asia Pacific NFC Reader ICs Market Value Share (%) and BPS Analysis by Host Interface, 2022-2032

Figure 114: Asia Pacific NFC Reader ICs Market Y-o-Y Growth (%) Projections by Host Interface, 2022-2032

Figure 115: Asia Pacific NFC Reader ICs Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 116: Asia Pacific NFC Reader ICs Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 117: Asia Pacific NFC Reader ICs Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 118: Asia Pacific NFC Reader ICs Market Value (US$ Mn) Analysis by Industry, 2017-2032

Figure 119: Asia Pacific NFC Reader ICs Market Value Share (%) and BPS Analysis by Industry, 2022-2032

Figure 120: Asia Pacific NFC Reader ICs Market Y-o-Y Growth (%) Projections by Industry, 2022-2032

Figure 121: Asia Pacific NFC Reader ICs Market Attractiveness by NFC Functionality, 2022-2032

Figure 122: Asia Pacific NFC Reader ICs Market Attractiveness by Host Interface, 2022-2032

Figure 123: Asia Pacific NFC Reader ICs Market Attractiveness by Application, 2022-2032

Figure 124: Asia Pacific NFC Reader ICs Market Attractiveness by Industry, 2022-2032

Figure 125: Asia Pacific NFC Reader ICs Market Attractiveness by Country, 2022-2032

Figure 126: MEA NFC Reader ICs Market Value (US$ Mn) by NFC Functionality, 2022-2032

Figure 127: MEA NFC Reader ICs Market Value (US$ Mn) by Host Interface, 2022-2032

Figure 128: MEA NFC Reader ICs Market Value (US$ Mn) by Application, 2022-2032

Figure 129: MEA NFC Reader ICs Market Value (US$ Mn) by Industry, 2022-2032

Figure 130: MEA NFC Reader ICs Market Value (US$ Mn) by Country, 2022-2032

Figure 131: MEA NFC Reader ICs Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 132: MEA NFC Reader ICs Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 133: MEA NFC Reader ICs Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 134: MEA NFC Reader ICs Market Value (US$ Mn) Analysis by NFC Functionality, 2017-2032

Figure 135: MEA NFC Reader ICs Market Value Share (%) and BPS Analysis by NFC Functionality, 2022-2032

Figure 136: MEA NFC Reader ICs Market Y-o-Y Growth (%) Projections by NFC Functionality, 2022-2032

Figure 137: MEA NFC Reader ICs Market Value (US$ Mn) Analysis by Host Interface, 2017-2032

Figure 138: MEA NFC Reader ICs Market Value Share (%) and BPS Analysis by Host Interface, 2022-2032

Figure 139: MEA NFC Reader ICs Market Y-o-Y Growth (%) Projections by Host Interface, 2022-2032

Figure 140: MEA NFC Reader ICs Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 141: MEA NFC Reader ICs Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 142: MEA NFC Reader ICs Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 143: MEA NFC Reader ICs Market Value (US$ Mn) Analysis by Industry, 2017-2032

Figure 144: MEA NFC Reader ICs Market Value Share (%) and BPS Analysis by Industry, 2022-2032

Figure 145: MEA NFC Reader ICs Market Y-o-Y Growth (%) Projections by Industry, 2022-2032

Figure 146: MEA NFC Reader ICs Market Attractiveness by NFC Functionality, 2022-2032

Figure 147: MEA NFC Reader ICs Market Attractiveness by Host Interface, 2022-2032

Figure 148: MEA NFC Reader ICs Market Attractiveness by Application, 2022-2032

Figure 149: MEA NFC Reader ICs Market Attractiveness by Industry, 2022-2032

Figure 150: MEA NFC Reader ICs Market Attractiveness by Country, 2022-2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Breakdown of NFC Reader ICs Market Share & Key Players

UK NFC Reader ICs Market Outlook – Size, Share & Trends 2025-2035

USA NFC Reader ICs Market Insights – Trends, Growth & Forecast 2025-2035

Japan NFC Reader ICs Market Trends – Growth, Demand & Forecast 2025-2035

Germany NFC Reader ICs Market Report – Size, Trends & Industry Growth 2025-2035

GCC Countries NFC Reader ICs Market Growth – Demand, Trends & Forecast 2025-2035

NFC Tag ICs Market Analysis by Memory, Connection, Application, Industry and Region Through 2025 to 2035

NFC Juice Market Analysis by Product Type, Product Claim, End-Use Application and by Region from 2025 To 2035

BRICS Tourism Industry Analysis Size and Share Forecast Outlook 2025 to 2035

BRICS Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

BRICS Disposable Hygiene Products Market Analysis – Size, Share & Trends 2025 to 2035

BRICS Oral Care Market Insights – Growth & Forecast 2014-2020

3D ICs Market

Nordics Executive Education Program Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

Robotics Welding Market Size and Share Forecast Outlook 2025 to 2035

Robotics-Assisted Telesurgery Market Size and Share Forecast Outlook 2025 to 2035

Robotics as a Service (RaaS) Market Size and Share Forecast Outlook 2025 to 2035

Genomics Market Size and Share Forecast Outlook 2025 to 2035

Plastics-To-Fuel (PTF) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA