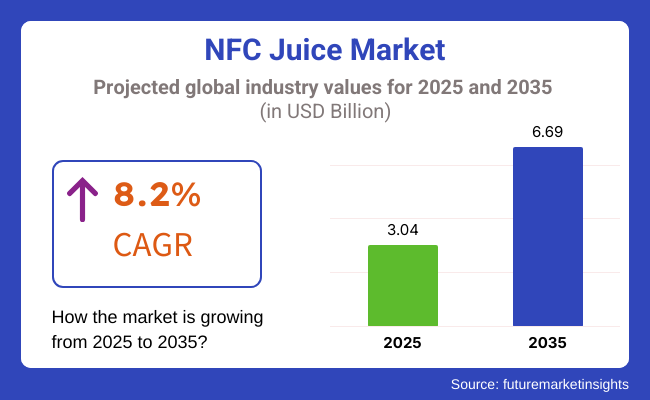

The NFC (Not From Concentrate) juice market is anticipated to have the highest growth rate in the global industry, with a value of USD 3.04 billion in 2025. The entire industry is projected to have a CAGR of 8.2% over the forecast period from 2025 to 2035. The industry's net worth is expected to be USD 6.69 billion in 2035.

Unlike other products that go through a long processing stage, the juice has its characteristics that are associated with being a more less processed product and leaving the actual fruit taste untouched. These are the primary factors for its popularity among health-aware consumers who are opting for natural and preservative-free liquid options.

Compared to juices made from concentrate, NFC juices have preserved a lot of the nutrients as well as the real fruit flavor, that is why they are the first choice for those who prefer premium and organic beverage drinks. The development of the industry is pushed by the demand for clean-label and minimally processed beverages that are considered healthy by the consumers.

The principal force behind the industry expansion is the growing number of customers who want natural and functional drinks. The more people realize that cold-pressed juices and freshly squeezed are healthier, the more they will want the juice. Also, the growing trend of plant-based diet and consumption of organic food are some of the other reasons for the growth of the juice.

The wider distribution channels from e-commerce, specialty stores, and the direct-to-consumer base that are currently being developed are a great boost for the juices. Beverage companies have set in motion the use of packaging technologies such as cold-pressed and high-pressure processing (HPP) that will increase product shelf life while preserving the nutritional quality and freshness of the juices.

Although there are industry hurdles like production costs being higher and shelf life being shorter than concentrate juices, this industry is also full of opportunities. The requirement for refrigeration and the need for specialized transport logistics lead to higher operational costs, making the juices costlier to consumers. Besides, the seasonal unavailability of fruit can affect the supply and also the prices.

With the increase of the demand for organic and fortified juices, with the addition of vitamins, probiotics, and functional ingredients, new possibilities spring up. As eating and drinking healthy become more of a priority for the public, the juice sector will be the most prosperous. Disruptive innovation, sustainable sourcing, and premiumization strategies dominate this space.

The industry is on its way to becoming trendy as health-focused individuals are choosing to largely drink the non-processed beverages. An exception to juices taken from concentrates, juices are the ones whose natural flavor, color, and nutrients are intact making them a first choice for premium beverages.

The juices in the beverage industry particularly cold-pressed and organic juice guys use it along with the clean-label movement. Integrating the food service sector is the placement of NFC juices in cafés, restaurants, and hotels, where the issue of freshness is paramount. The retail sector is now mostly dealing with the pre-made drink (RTD) juices, the brands stressing cold-chain logistics in the first place.

In addition, they are also being used in the pharmaceutical as well as dietary supplement sectors, where they are applied as the natural vehicles for the vitamins and functional ingredients. Sustainability is a major factor influencing the buying decision, with the package's environmental impact and fair trade affecting customers' preferences.

The industry experienced a skyrocketing growth at the start of the 2020s, fueled by increasing taste among consumers for natural, minimally processed drinks. Health-aware society tended to use juices that were seen as fresher, more natural, and without any added artificial constituents.

The industry responded with enhanced cold-pressing and pasteurization techniques to retain nutritional value and flavor without compromising shelf life. High production expense and the less-than-concentrate shelf life of the juices, however, posed challenges to manufacturers. Clean-label product development and ingredient transparency also influenced the direction of the industry.

As the industry enters the 2025 to 2035 era, technology will transform production and distribution. Packaging, preservation, and blending innovations will enhance product shelf life and efficiency. Sustainability will come into prominence, with producers increasingly moving towards environmentally friendly packaging and sourcing techniques to meet consumer aspirations.

Functional enhancements, such as the inclusion of vitamins, probiotics, and botanical nutrients, will be the strongest force for product differentiation. Direct-to-consumer and online stores will likely expand industry coverage, while AI-driven industry research and product recommendation based on personal preferences will optimize consumer targeting. Fluctuating raw material prices and ensuring consistent product quality in the face of variable agricultural production will continue to be challenges.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Preference for fresh, minimally processed juices | Growing demand for functional and health-oriented juices |

| Health awareness and clean-label trends | Sustainability, innovation, and personalized nutrition |

| Cold-pressing and pasteurization innovation | Advanced preservation and packaging technology to enhance shelf life |

| Increasing interest in sustainable packaging and source ingredients | Very strong emphasis on environmentally friendly practice and carbon-neutral manufacturing |

| Emphasis on retention of natural taste and nutritional quality | Improved product formulations with fortified vitamins, probiotics, and plant-based nutrients |

| High cost and reduced shelf life | Raw material price fluctuations and uniform upkeep of product quality |

The industry is growing quickly thanks to the strong consumer demand for fresh, less processed beverages. Nevertheless, there are legal barriers that can be related to food safety, labeling standards, and organic certification which can cause compliance problems. Corporations face the challenge of operating within global food regulations and keeping transparency in order to generate consumer trust and industry credibility.

The company is faced with supply chain challenges such as the short season for fruit availability, the impact of climate change, and the lack of logistics, which are a few of the main reasons that disrupt production consistency. Depending on particular fruit harvests raises the hazard of price changes and shortages in the supply chain.

The example of the business should be to promote alternative areas of sourcing, initiate the adoption of sustainable agriculture, and carry out advanced benefits of inventory management as practical measures for these risks. Quality control and shelf-life stability are two major issues in the industry that companies face.

Due to their nature they have both a longer time frame of consumption and the need for new and advanced methods of food preservation as compared to concentrated juices. The group of companies should focus on cold chain logistics, pioneering packages that yield higher output, and natural processes that help keep products fresh and reduce waste as the means for maintaining product quality and reducing wastage.

The NFC juice beverages are thrusted into the diversification of product portfolios since they have to compete with other healthy refreshments like plant-based drinks, flavored waters, and functional beverages which now poses a threat to pricing.

Contrarily to that business operators need to concentrate and seek other means of promotion such as the extraordinary taste, nutritional advantages, and originality of NFC drinks while they also create unique blends and fortified versions to attract health-conscious consumers.

Fresh fruits are anticipated to remain the most profitable segment, accounting for 63.4% share by 2025, fueled by increasing consumer demand for organic, minimally processed foods. Demand has been considerably supported by the growing popularity of plant-based diets, as well as functional beverages, including cold-pressed juices and smoothies.

Foods such as apples, bananas, citrus, and berries are high in vitamins, fiber, and antioxidants and are common staples of health-conscious eating. Dole, Fresh Del Monte, and Naturipe Farms are among companies expanding sustainable farming efforts and cold chain logistics investments to reduce food waste and prolong shelf life.

On top of that, retail e-commerce for fresh items added fuel to the fire, with Amazon Fresh and Walmart leading the charge. The fresh vegetable segment, which is projected to account for 36.6% of the industry by 2025, is expected to be driven by increasing demand for nutrient-dense whole foods.

Leafy greens, tomatoes, bell peppers, and carrots are still among the top picks for salads, meal kits, and plant-based meat substitutes. Hydroponic and vertical farming has become the focus of companies from Taylor Farms and Bonduelle to Grimmway Farms that seek to increase year-round supply and free themselves from dependency on the seasons.

As retailers widen their selections, they strengthen consumer confidence in the segment. Both organic & non-GMO labels are also being adopted more widely. As a result of the move to healthier eating, both fresh fruits and veggies will grow steadily, with fruits holding a bigger industry share due to greater application in beverages and

The organic segment is likely to account for 59.2% of the industry share in 2025 on account of growing consumer consciousness regarding chemical-free and sustainably sourced products. Increasing awareness regarding the health benefits of organic food and strict government regulations to promote organic farming are driving the demand.

Organic fresh produce, especially apples, berries, leafy greens, and carrots, is common in premium juices, salads, and meal kits. Top brands like Earthbound Farm, Nature’s Path, and Whole Foods Market are putting out more organic products. At the same time, e-commerce titans like Amazon Fresh and Instacart have opened up organic goods to shoppers in a more plentiful way.

More importantly, because of the lower price of the traditional segment and the relatively standardized technologies of the processing plants, all of which are available in the industry, it would take 40.8% industry share in 2025.

In conventionally grown fresh fruits and vegetables, price-sensitive consumers are increasingly visiting mass retail and food service sectors. This includes Dole, Fresh Del Monte, and Taylor Farms, the big AGC businesses that are investing closely in new farming techniques to increase yield and reduce manufacturing costs.

Conventional produce is also a primary staple in ranger most food-processing facilities, where it is turned into frozen meals or fast-casual restaurant menus. There is a growing desire amongst consumers for healthier, sustainably grown food, and organic produce is well positioned to take a larger percentage share of the food industry. Yet traditional products will retain their grip based on their economy and scalability.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

| UK | 4.2% |

| France | 4.5% |

| Germany | 4.3% |

| Italy | 4.1% |

| South Korea | 5% |

| Japan | 4.6% |

| China | 5.3% |

| Australia | 4% |

| New Zealand | 3.9% |

The industry is expected to register a CAGR of 4.8% during the forecast period of 2025 to 2035. The increasing demand for natural and organic drinks triggers industry growth. More consumers require more juice products free from additives and preservatives, which drives the consumption of the juice.

Increased availability of high-end juice brands like Simply Orange and Naked Juice also drive the industry forward. The trend towards functional drinks with another health advantage also drives demand. Large retailers such as Walmart and Whole Foods keep these products widely available, thereby giving them high priority. The industry influence of healthy millennials and Gen Z and the cold-pressed juice trend supports the industry appeal. Package innovations, such as the use of eco-friendly and recyclable packaging, also drive the growth of the industry.

Growth is projected to be 4.2% CAGR through 2035, driven by rising health consciousness and clean-label product innovation. There is a demand for these juices as consumers seek minimally processed juice products, and thus the demand is on the rise.

Top British brands like Innocent Drinks are taking over the industry through the theme of sustainability and natural ingredients. Government controls on the intake of sugar in drinks promote the use of these juice as a healthy option. The expansion of high-end supermarkets and specialty health food stores that stock a variety of these juices contributes to the industry. Convenience provided by the expansion of e-commerce also boosts sales.

The industry is likely to grow at a CAGR of 4.5% on account of France's long-time penchant for premium foods and beverages. French buyers prefer low-processed, quality foods and so opt for these juices too. Companies such as Pressade and Tropicana (regionized) are availing themselves of this preference with premium organic juice offerings.

The industry is further supported by the massive concentration of local fruit producers, which presents an on-site source of new raw materials in juice making. Rising demand for juice bars and small juice producers in towns triggers consistent growth of the industry. In addition, an increase in organic and biodynamic farming activity in France expands the supply base of NFC production of juice.

The industry is set to register a CAGR of 4.3% due to robust organic food culture and sustainability trends. The top priority for German consumers is high-quality, environmentally friendly products, which supports the trend of increasing demand for these juices. Established industry players like Voelkel and Alnatura make this possible by providing organic, naturally made juices.

Retailers actively industry these juices in organic food specialty departments. The growing popularity of plant-based diets is also a contributing factor, as these juices are easily integrated into vegan and vegetarian diets. Germany's sophisticated recycling infrastructures and eco-friendly packaging trends also contribute to making these juices trendy among green consumers.

With a predicted CAGR of 4.1%, Italy's industry flourishes due to its rich agrarian heritage and demand for natural products. Italian people prefer the original food and beverage, so these juices are the natural choice. Local companies like Yoga and Zuegg capitalize on this by providing natural, fresh, quality fruit juices.

The Mediterranean diet, consisting of fresh fruits and natural foods, encourages consumption. In addition, tourism and hospitality industry growth provides additional opportunities as hotels and cafes increasingly provide premium juices to health-conscious tourists. Locally produced citrus-based juices are also propelling industry growth.

The industry is likely to grow at 5% CAGR, the fastest among advanced economies. Western diets and functional drinks demand drive industry growth. Market participants like Pulmuone and Nongshim take advantage of this by innovative combinations of these juices with added health benefits.

Convenience stores and internet malls are also significant sales channels for these juices. Success with the K-health trend, focusing on natural and holistic well-being, adds to industry demand. In addition, partnerships between juice companies and K-beauty companies provide hybrid products that cater to health-conscious consumers.

The industry is likely to register a CAGR of 4.6%, driven by the age-old tradition of fine food and drink consumption. Japanese consumers appreciate purity and craftsmanship, and hence, leading players like Kagome and Ito En are providing superior quality options.

Growing demand for health beverages, like these juices and probiotic-vitamin-fortified NFC juice, fuels innovation in the industry. Chains of convenience stores control the distribution of juice, so it is made easily accessible everywhere. In addition to that, the government's promotion of healthy eating encourages the consumption of NFC juice, stimulating the industry's growth.

The industry is likely to grow at an average CAGR of 5.3%, owing to the nation's rapidly expanding middle class and rising health consciousness fuel demand for natural, premium drinks. Major local players like Huiyuan and Nongfu Spring invest in manufacturing these juices to ride this change in consumer taste.

eCommerce and online grocery platform expansion add further thrust to industry expansion with easy access to these products. Support for NFC juice consumption is also offered by expanding Western-style food influence in metropolitan areas. Government campaigns encouraging the consumption of fruit and vegetables also drive the strong expansion of the category.

The industry is likely to expand at a CAGR of 4%, driven by strong demand for fresh and organic products. Locally made, high-quality beverages are in favor among Australians, and companies such as Nudie and Grove Juice are meeting this need with premium offerings.

The pleasant climatic conditions in the nation for fruit growing provide unlimited raw material to support the production. Further, an enhanced desire to eliminate artificial additives from drinks compels consumers towards healthier choices, promoting industry growth.

New Zealand's industry is likely to register 3.9% CAGR, which shows slower growth rate than its Australian counterpart. The strong farm economy of the nation, as well as its emphasis on sustainability, fuel sustained growth in the industry. Firms such as Charlie's and Simply Squeezed utilize locally sourced fruits to manufacture improved juices.

The increasing popularity of farm-to-bottle processing follows consumer demand for minimally processed drinks. The expanding scale of the tourist industry also underpins juice volumes from cafes and health-oriented restaurants targeting overseas travelers. New Zealand's clean-label trend also provides impetus toward the shift to healthier juice variants.

This industry is primarily focused on NFC juice, aiming for significant growth, as consumers consistently desire fresh, uncompromised juices free from preservatives. The industry certainly has grown as consumers are now showing demand for clean-label premium-quality juices with higher nutrition, leading to rampant competition among key players.

The industry is well dominated by major players like Tropicana (PepsiCo), The Coca-Cola Company (Innocent Drinks), Eckes-Granini, Suja Life, and the AMC Group, among others, which offer an array of fruit and vegetable-based NFC juices. However, more niche startups and brands have also picked up steam in their pursuit of health-conscious consumers through organic, cold-pressed, and functional juices.

Orange, apple, berry, and tropical fruit NFC juices are among the key offerings as innovation soars in functional blends, probiotic-infused variants, and plant-based wellness drinks. HPP and cold pasteurization are examples of advanced technologies used to extend shelf life while preserving freshness and nutrients.

Industry evolution is driven by changing consumer preferences, stricter food safety regulations, and advancements in juice extraction and packaging technologies. In North America and Europe, there is a significant demand for organic as well as premium beverages, leading to high growth in these regions. Conversely, emerging markets in the Asia-Pacific as well as Latin America present opportunities for expansion, primarily fueled by increasing disposable incomes and urbanization.

Key strategic factors influencing competition include the sustainable sourcing of raw materials, investments in eco-friendly packaging, and the expansion of distribution channels, such as e-commerce and direct-to-consumer sales. To increase the industry share and adapt to the growing demand for natural, nutritious, and minimally processed NFC (not from concentrate) juices, companies are forming strategic partnerships with retailers and food service providers.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Tropicana Products (PepsiCo) | 18-22% |

| The Coca-Cola Company (Innocent Drinks) | 14-18% |

| Eckes-Granini Group | 10-14% |

| Suja Life, LLC | 8-12% |

| AMC Group | 6-10% |

| Other Players (Combined) | 25-35% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Tropicana Products (PepsiCo) | Provides a diverse portfolio of these juices, ranging from orange and apple to fruit blends, driven by premiumization and eco-packaging. |

| The Coca-Cola Company | Compares on the basis of Minute Maid and Innocent Drinks with a thrust for organic NFC juices, functional formulations, and cold-pressed forms. |

| Eckes-Granini Group | It has a niche in these juices from Europe, concentrating on local procurement of fruits and innovative glass packaging to maintain freshness. |

| Suja Life, LLC | A market leader in cold-pressed organic NFC juices, making an investment in HPP (High-Pressure Processing) technology for longer shelf life. |

| AMC Group | Provides high-end NFC juices and fruit-based drinks, diversifying into private-label brand customized formulations. |

Key Company Insights

Tropicana (18-22%)

Leader of the industry, Tropicana is also marketing premium and functional juice lines with new options enriched with vitamins, probiotics, and plant-based nutrients.

The Coca-Cola Company (14-18%)

Through Minute Maid and Innocent Drinks, Coca-Cola has spread innovations in a blend of organic and functional juices, especially in Europe and North America.

Eckes-Granini (10-14%)

A European industry leader emphasizing natural NFC juices with robust branding and environmentally friendly packaging.

Suja Life, LLC (8-12%)

A disruptor in the Indsutry, Suja invests heavily in HPP technology to get a greater shelf life without compromising on fresh taste and nutrients.

AMC Group (6-10%)

Excercises expertise in proprietary offerings, distributing private-label stores and supermarkets in the USA and Europe.

By product type, the industry is classified as fresh fruits, fresh vegetables, and blends.

By product claim, the industry is classified as organic and conventional.

By end use application, the industry is classified as non-alcoholic beverages, alcoholic beverages, bakery & confectionery, dairy & frozen desserts, and others.

By region, the industry is divided as North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East & Africa.

The industry is expected to generate USD 3.04 billion in revenue by 2025.

The industry is projected to reach USD 6.69 billion by 2035, growing at a CAGR of 8.2%.

Key players include Tropicana Products (PepsiCo), The Coca-Cola Company, Eckes-Granini Group, Suja Life, LLC, AMC Group, Hain Celestial Group (BluePrint Juices), Natalie's Orchid Island Juice Company, SunOpta Inc., Hooper’s Juice, and Raw Pressery.

North America and Europe, driven by growing consumer preference for cold-pressed and preservative-free juices, along with increasing awareness of health and wellness trends.

Citrus-based NFC juices, such as orange and lemon juices, dominate due to their high nutritional value, refreshing taste, and strong consumer demand for vitamin-rich beverages.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Claim, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Product Claim, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Claim, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Product Claim, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Product Claim, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Product Claim, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Product Claim, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Product Claim, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: East Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Product Claim, 2018 to 2033

Table 38: East Asia Market Volume (MT) Forecast by Product Claim, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 40: East Asia Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 41: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 45: South Asia Market Value (US$ Million) Forecast by Product Claim, 2018 to 2033

Table 46: South Asia Market Volume (MT) Forecast by Product Claim, 2018 to 2033

Table 47: South Asia Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 48: South Asia Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 49: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: Oceania Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 53: Oceania Market Value (US$ Million) Forecast by Product Claim, 2018 to 2033

Table 54: Oceania Market Volume (MT) Forecast by Product Claim, 2018 to 2033

Table 55: Oceania Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 56: Oceania Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 57: Middle East & Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East & Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: Middle East & Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East & Africa Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 61: Middle East & Africa Market Value (US$ Million) Forecast by Product Claim, 2018 to 2033

Table 62: Middle East & Africa Market Volume (MT) Forecast by Product Claim, 2018 to 2033

Table 63: Middle East & Africa Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 64: Middle East & Africa Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Claim, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Product Claim, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Product Claim, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Product Claim, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Product Claim, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Product Claim, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Product Claim, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Product Claim, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Product Claim, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Product Claim, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Product Claim, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Product Claim, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Product Claim, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Product Claim, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Product Claim, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Product Claim, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Product Claim, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Product Claim, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Product Claim, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Product Claim, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Product Claim, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Product Claim, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Product Claim, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Product Claim, 2023 to 2033

Figure 95: Europe Market Attractiveness by End Use Application, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: East Asia Market Value (US$ Million) by Product Claim, 2023 to 2033

Figure 99: East Asia Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: East Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) Analysis by Product Claim, 2018 to 2033

Figure 110: East Asia Market Volume (MT) Analysis by Product Claim, 2018 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Product Claim, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Product Claim, 2023 to 2033

Figure 113: East Asia Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 114: East Asia Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Product Claim, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End Use Application, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by Product Claim, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by Product Claim, 2018 to 2033

Figure 134: South Asia Market Volume (MT) Analysis by Product Claim, 2018 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Product Claim, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Product Claim, 2023 to 2033

Figure 137: South Asia Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 138: South Asia Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia Market Attractiveness by Product Claim, 2023 to 2033

Figure 143: South Asia Market Attractiveness by End Use Application, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: Oceania Market Value (US$ Million) by Product Claim, 2023 to 2033

Figure 147: Oceania Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 148: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: Oceania Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: Oceania Market Value (US$ Million) Analysis by Product Claim, 2018 to 2033

Figure 158: Oceania Market Volume (MT) Analysis by Product Claim, 2018 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Product Claim, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Product Claim, 2023 to 2033

Figure 161: Oceania Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 162: Oceania Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 166: Oceania Market Attractiveness by Product Claim, 2023 to 2033

Figure 167: Oceania Market Attractiveness by End Use Application, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East & Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East & Africa Market Value (US$ Million) by Product Claim, 2023 to 2033

Figure 171: Middle East & Africa Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 172: Middle East & Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East & Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East & Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: Middle East & Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East & Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East & Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East & Africa Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East & Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East & Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East & Africa Market Value (US$ Million) Analysis by Product Claim, 2018 to 2033

Figure 182: Middle East & Africa Market Volume (MT) Analysis by Product Claim, 2018 to 2033

Figure 183: Middle East & Africa Market Value Share (%) and BPS Analysis by Product Claim, 2023 to 2033

Figure 184: Middle East & Africa Market Y-o-Y Growth (%) Projections by Product Claim, 2023 to 2033

Figure 185: Middle East & Africa Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 186: Middle East & Africa Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 187: Middle East & Africa Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 188: Middle East & Africa Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 189: Middle East & Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East & Africa Market Attractiveness by Product Claim, 2023 to 2033

Figure 191: Middle East & Africa Market Attractiveness by End Use Application, 2023 to 2033

Figure 192: Middle East & Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

NFC Reader ICs Market Analysis - Size, Share, and Forecast 2025 to 2035

NFC Tag ICs Market Analysis by Memory, Connection, Application, Industry and Region Through 2025 to 2035

Competitive Breakdown of NFC Reader ICs Market Share & Key Players

UK NFC Reader ICs Market Outlook – Size, Share & Trends 2025-2035

USA NFC Reader ICs Market Insights – Trends, Growth & Forecast 2025-2035

Japan NFC Reader ICs Market Trends – Growth, Demand & Forecast 2025-2035

Germany NFC Reader ICs Market Report – Size, Trends & Industry Growth 2025-2035

Automotive NFC Market Growth – Trends & Forecast 2025-2035

GCC Countries NFC Reader ICs Market Growth – Demand, Trends & Forecast 2025-2035

Anti-Counterfeit NFC Packaging Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Not From Concentrated (NFC) Puree Market Share & Industry Leaders

Juice Extraction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Juice Concentrate Market Analysis - Trends & Consumer Insights 2025 to 2035

Juice Bottle Market Trends & Industry Growth Forecast 2024-2034

Dill Juice Market Analysis by Application and Distribution Through 2035

Lemon Juice Concentrate Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Fruit Juice Packaging Providers

Fruit Juice Packaging Market Growth – Trends & Forecast through 2035

Celery Juice Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA