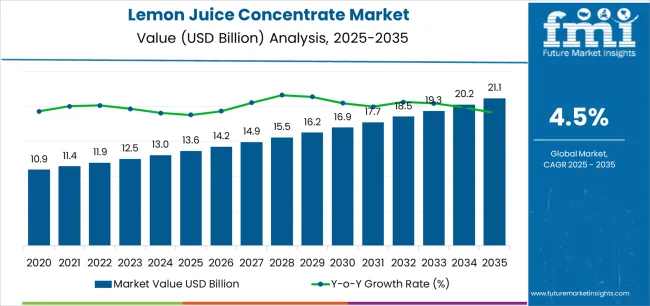

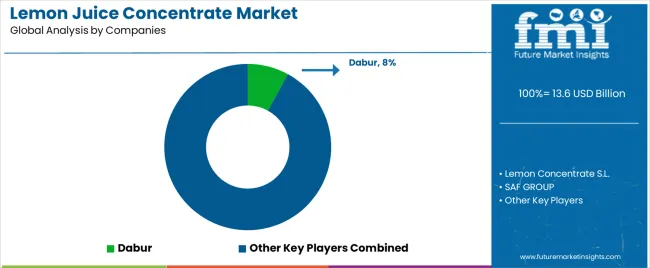

The lemon juice concentrates market stands at the threshold of a decade-long expansion trajectory that promises to reshape the citrus processing industry and beverage manufacturing solutions. The market's journey from USD 13.6 billion in 2025 to USD 21.1 billion by 2035 represents substantial growth, demonstrating the accelerating adoption of advanced concentration technology and flavor standardization across beverage facilities, food processing operations, and culinary sectors.

The first half of the decade (2025-2030) will witness the market climbing from USD 13.6 billion to approximately USD 17.1 billion, adding USD 3.49 billion in value, which constitutes 46% of the total forecast growth period. This phase will be characterized by the rapid adoption of liquid concentrate systems, driven by increasing beverage production volumes and the growing need for consistent flavor solutions worldwide. Enhanced processing capabilities and automated quality systems will become standard expectations rather than premium options.

The latter half (2030-2035) will witness continued growth from USD 17.1 billion to USD 21.1 billion, representing an addition of USD 4.03 billion or 54% of the decade's expansion. This period will be defined by mass market penetration of organic concentrate technologies, integration with comprehensive traceability platforms, and seamless compatibility with existing food processing infrastructure. The market trajectory signals fundamental shifts in how beverage facilities approach flavor standardization and quality management, with participants positioned to benefit from growing demand across multiple concentrate types and application segments.

Beverage manufacturing operations encounter supply chain consistency challenges between concentrate sourcing and finished product quality specifications. Production managers need lemon concentrate suppliers that provide consistent flavor profiles and acidity levels across seasonal variations, but procurement departments focus on cost optimization rather than quality consistency metrics. Quality control laboratories require concentrate batches that meet precise specifications for beverage formulation, while production schedulers prefer flexible delivery schedules that accommodate demand fluctuations. Food technologists coordinate concentrate specifications with flavor development requirements, but operations teams resist ingredient modifications that could affect production line efficiency or require reformulation validation.

Dairy processing facilities face product development conflicts between concentrate integration and existing production line capabilities. Plant engineers need lemon concentrate systems that integrate with existing dairy processing equipment without cross-contamination risks, while production supervisors prefer ingredient additions that minimize processing complexity and potential flavor interactions. Quality control laboratories require concentrate products with verified compatibility across different dairy formulations and processing conditions, while maintenance teams prefer ingredient systems that reduce cleaning requirements and equipment wear. Research and development coordinates concentrate specifications with new product launches, but operations management focuses on production efficiency over ingredient functionality.

| Period | Primary Revenue Buckets | Share (%) | Notes |

|---|---|---|---|

| Today | Bulk concentrate sales (liquid, commodity frozen) | 45% | Volume-led, pricing-driven |

| Private label & co-packing | 25% | Margin compression, specification-driven | |

| Foodservice & HORECA channels | 20% | Consistency & shelf-life critical | |

| Retail branded products | 10% | Premium positioning, convenience formats | |

| Future (3–5 yrs) | Value-added formulations | 30–35% | Functional blends, standardized acidity |

| Organic & clean-label | 20–25% | Sustainability premiums, traceability | |

| Direct-to-manufacturer | 15–20% | Supply chain disintermediation | |

| Ready-to-use solutions | 15–20% | Pre-diluted, flavor systems | |

| Specialty applications | 10–15% | Pharma, cosmetics, nutraceuticals | |

| Sustainability services | 5–10% | Carbon tracking, waste valorization |

At-a-Glance Metrics

| Metric | Value |

|---|---|

| Market Value (2025) | USD 13.6 billion |

| Market Forecast (2035) | USD 21.1 billion |

| Growth Rate | 4.5% CAGR |

| Leading Technology | Liquid Concentrate Form |

| Primary Application | Beverage Manufacturing |

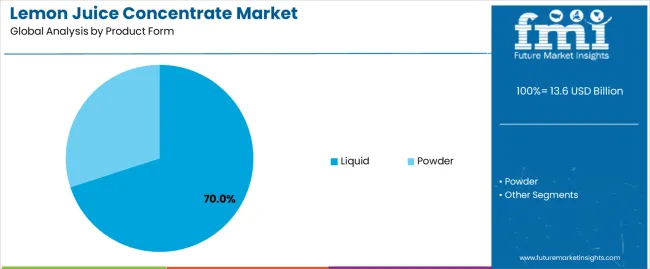

The market demonstrates strong fundamentals with liquid concentrate systems capturing a dominant 70% share through advanced processing capabilities and beverage optimization. Beverage manufacturing applications drive primary demand, supported by increasing drink production and flavor standardization requirements. Geographic expansion remains concentrated in developed markets with established food processing infrastructure, while emerging economies show accelerating adoption rates driven by urbanization initiatives and rising consumer demand for convenient beverage solutions.

Design for applications, not just concentration

Primary Classification: The market segments by form into liquid and powder concentrates, representing the evolution from basic citrus processing to specialized concentration solutions for comprehensive beverage and food manufacturing optimization.

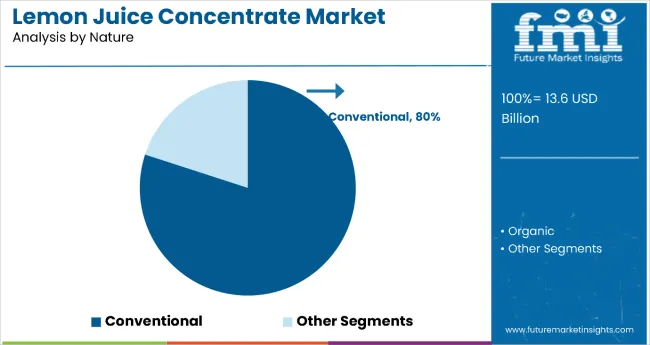

Secondary Classification: Nature segmentation divides the market into conventional and organic sectors, reflecting distinct requirements for processing standards, environmental compliance, and consumer preference alignment.

Tertiary Classification: Distribution channels include direct sales, distributors, and online platforms, while end-use applications span beverages, bakery and confectionery, dairy products, sauces and condiments, pharmaceuticals, and others.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by expanding food processing industries.

The segmentation structure reveals technology progression from standard concentrate production toward specialized processing systems with enhanced quality control and standardization capabilities, while application diversity spans from beverage facilities to pharmaceutical operations requiring precise concentration and purity standards.

Market Position: Liquid concentrate systems command the leading position with 70% market share (USD 9.53 billion in 2025) through advanced processing features, including superior flavor retention, operational flexibility, and manufacturing optimization that enable beverage facilities to achieve optimal product consistency across diverse industrial and commercial environments.

Value Drivers: The segment benefits from manufacturer preference for ready-to-use systems that provide consistent flavor performance, reduced preparation time, and operational efficiency optimization without requiring significant infrastructure modifications. Advanced processing features enable automated quality control, concentration consistency, and integration with existing beverage production lines, where operational performance and flavor reliability represent critical facility requirements.

Competitive Advantages: Liquid concentrate systems differentiate through proven operational stability, consistent concentration characteristics, and integration with automated manufacturing systems that enhance facility effectiveness while maintaining optimal quality standards suitable for diverse beverage and food applications.

Key market characteristics:

Powder concentrate systems maintain significant market position due to their specialized storage properties and logistical advantages. These systems appeal to facilities requiring extended shelf-life characteristics with reduced transportation costs for international distribution applications. Market growth is driven by expanding global trade, emphasizing reliable concentration solutions and operational efficiency through optimized logistics designs.

Market Context: Conventional concentrates dominate with 80% share (USD 10.89 billion in 2025) due to widespread adoption in cost-conscious markets and established processing infrastructure, particularly strong in Asia Pacific and Latin American regions where price sensitivity drives procurement decisions.

Appeal Factors: Conventional concentrate operators prioritize cost efficiency, consistent supply availability, and integration with existing processing infrastructure that enables coordinated production across multiple manufacturing operations. The segment benefits from established agricultural supply chains and processing facilities that emphasize acquisition of conventional concentrates for standard beverage and food applications.

Growth Drivers: Volume-based procurement programs incorporate conventional concentrates as standard ingredients for beverage operations, while expanding food manufacturing increases demand for cost-effective concentration capabilities that comply with basic quality standards.

Market Challenges: Growing consumer preference for organic and clean-label products may limit long-term growth potential in premium market segments.

Application dynamics include:

Organic concentrate applications capture growing market share through premium positioning in health-conscious markets, particularly in North America and Western Europe. These markets demand certified organic systems capable of meeting strict processing standards while providing traceable supply chain capabilities and environmental sustainability features.

Market Position: Beverage applications lead the market, representing the largest end-use segment due to extensive drink manufacturing and flavor standardization requirements across carbonated soft drinks, juices, and functional beverages.

Growth Drivers: Beverage sector expansion, product innovation initiatives, and consumer demand for consistent flavor profiles drive demand for concentrate solutions across commercial and industrial beverage production facilities.

Application Scope: Beverage applications span soft drinks, juice blends, cocktail mixers, and functional beverages requiring precise concentration levels and flavor consistency features.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Growing beverage industry & product innovation | ★★★★★ | Multi-category diversification requires consistent, scalable flavor solutions across production facilities. |

| Driver | Health consciousness | ★★★★★ | Clean-label trend turns natural citrus from “ingredient” to “feature”; organic certification allows premium positioning. |

| Driver | Supply chain | ★★★★☆ | Concentration standardization technology reduces procurement inefficiency, complexity, and variability of fresh fruit. |

| Restraint | Price volatility & agricultural dependency | ★★★★☆ | Crop uncertainties cause supply disruptions and raise procurement risks for manufacturers. |

| Restraint | Quality & regulatory variation | ★★★☆☆ | Lack of global processing standards and fragmented regulations restrict trade flows. |

| Trend | Functional enhancement | ★★★★★ | Vitamin-enriched, fortified, and immunity-boosting blends shift competition focus to health benefits. |

| Trend | Sustainability & circular economy | ★★★★☆ | Zero-waste processing, by-product valorization, and carbon tracking integration become critical differentiators. |

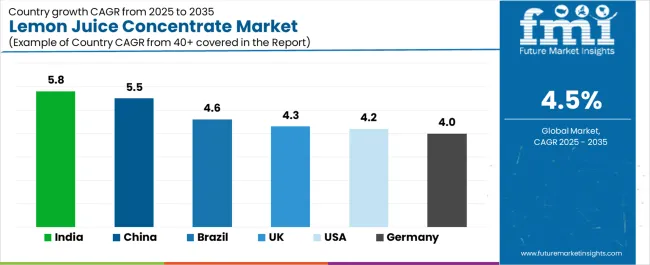

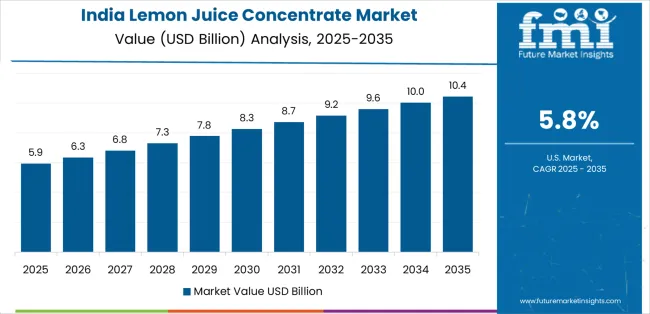

The lemon juice concentrate market demonstrates varied regional dynamics with Growth Leaders including India (5.8% growth rate) and China (5.5% growth rate) driving expansion through expanding beverage industries and increasing urbanization. Steady Performers encompass United States (4.2% growth rate), United Kingdom (4.3% growth rate), and developed regions, benefiting from established food processing industries and premium concentrate adoption. Emerging Markets feature Brazil (4.6% growth rate) and developing regions, where agricultural production capabilities and processing modernization support consistent growth patterns.

Regional synthesis reveals East Asian markets leading adoption through industrial expansion and beverage sector development, while North American countries maintain steady expansion supported by processing technology advancement and quality standardization requirements. European markets show moderate growth driven by organic applications and sustainability integration trends.

| Region / Country | Growth (2025–2035 CAGR) | How to Win | What to Watch Out |

|---|---|---|---|

| India | 5.8% | Focus on price competition; develop value-added blends | Quality variance across supply base |

| China | 5.5% | Lead with local preference changes | Regulatory shifts; standardization challenges |

| USA | 4.2% | Premium organic positioning | Margin pressure; retail consolidation |

| UK | 4.3% | Clean-label solutions | Brexit trade impacts; currency fluctuations |

| Brazil | 4.6% | Leverage crop production base | Logistics costs; production volatility |

| Germany | 4.0% | Technical excellence positioning | Over-specification; slow adoption cycles |

India establishes fastest market growth through aggressive beverage industry expansion and comprehensive food processing development, integrating lemon juice concentrates as standard components in drink manufacturing and culinary applications. The country's 5.8% growth rate reflects growing middle-class consumption and domestic manufacturing capabilities that drive demand for concentrate systems in beverage and food facilities. Growth concentrates in major metropolitan centers, including Mumbai, Delhi, and Bangalore, where beverage manufacturing showcases integrated processing systems that appeal to manufacturers seeking consistent flavor capabilities and quality management applications.

Indian processors are developing cost-effective concentrate solutions that combine agricultural advantages with processing capabilities, including standardized acidity levels and enhanced stability features. Distribution channels through beverage manufacturers and food processors expand market access, while growing health consciousness supports adoption across diverse beverage and functional food segments.

Strategic Market Indicators:

In Beijing, Shanghai, and Guangzhou, beverage facilities and food processing plants are implementing lemon juice concentrates as standard ingredients for flavor standardization and production efficiency applications, driven by increasing consumer beverage consumption and manufacturing modernization programs. The market holds a 5.5% growth rate, supported by expanding beverage industry and food processing development programs that promote concentrate adoption for manufacturing efficiency. Chinese operators are adopting concentrate systems that provide consistent quality performance and processing efficiency features, particularly appealing in urban regions where production consistency and quality standards represent critical operational requirements.

Market expansion benefits from growing processing technology capabilities and international quality certification programs that enable domestic production of standardized concentrate systems for beverage and food applications. Technology adoption follows patterns established in food processing equipment, where consistency and efficiency drive procurement decisions and operational deployment.

Market Intelligence Brief:

USA establishes market leadership through comprehensive beverage industry infrastructure and advanced processing technology development, integrating lemon juice concentrates across beverage and food applications. The country's 4.2% growth rate reflects established industry relationships and mature concentrate technology adoption that supports widespread use of standardized flavor systems in manufacturing facilities. Growth concentrates in major food processing centers, including California, Florida, and Texas, where processing technology showcases mature concentrate deployment that appeals to manufacturers seeking proven quality capabilities and operational efficiency applications.

American concentrate providers leverage established distribution networks and comprehensive quality capabilities, including organic certification programs and technical support that create customer relationships and operational advantages. The market benefits from mature food safety regulations and quality standards that support concentrate use while advancing technology development and processing optimization.

Market Intelligence Brief:

Germany's advanced food processing market demonstrates sophisticated lemon juice concentrate deployment with documented quality effectiveness in beverage applications and food facilities through integration with existing quality systems and processing infrastructure. The country leverages technical expertise in food technology and quality systems integration to maintain a 4.0% growth rate. Processing centers, including Bavaria, North Rhine-Westphalia, and Baden-Württemberg, showcase premium installations where concentrate systems integrate with comprehensive quality platforms and production management systems to optimize flavor consistency and processing effectiveness.

German processors prioritize quality reliability and EU compliance in concentrate development, creating demand for premium systems with advanced features, including traceability integration and automated quality control. The market benefits from established food technology infrastructure and willingness to invest in advanced processing technologies that provide long-term operational benefits and compliance with international quality standards.

Market Intelligence Brief:

Brazil's market expansion benefits from substantial citrus production capabilities, including major growing regions in São Paulo state, processing facility concentration, and export-oriented infrastructure that positions the country as a global concentrate supplier. The country maintains a 4.6% growth rate, driven by agricultural advantages and increasing processing sophistication, including advanced concentration technology and quality standardization systems.

Market dynamics focus on leveraging production advantages while addressing logistics challenges that affect export competitiveness and domestic distribution efficiency. Growing processing industrialization creates continued demand for modern concentration systems in facility upgrades and capacity expansion projects.

Strategic Market Considerations:

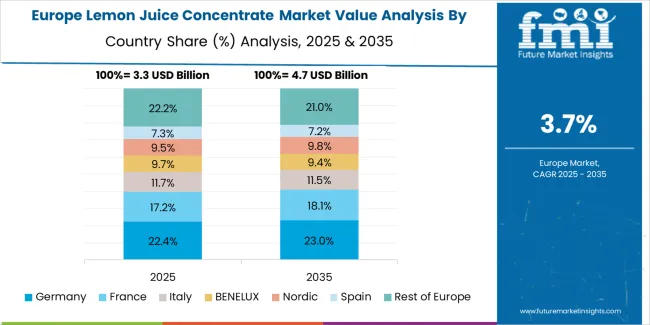

The European lemon juice concentrate market is projected to grow from USD 3.2 billion in 2025 to USD 4.8 billion by 2035, registering a CAGR of 4.1% over the forecast period. Germany is expected to maintain its leadership position with a 28.5% market share in 2025, supported by its advanced food processing infrastructure and quality standardization systems.

United Kingdom follows with a 25.8% share in 2025, driven by comprehensive beverage programs and premium concentrate initiatives. France holds a 22.3% share through specialized culinary applications and organic certification requirements. Italy commands a 15.2% share, while Spain accounts for 8.2% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 6.5% to 7.1% by 2035, attributed to increasing organic adoption in Nordic countries and emerging premium segments in smaller markets.

| Stakeholder | What They Actually Control | Typical Strengths | Typical Blind Spots |

|---|---|---|---|

| Global processors | Supply chain reach, deep processing capacity, quality labs, multi-region supply | Consistent quality, proven reliability | Crop dependency risk; climate vulnerability |

| Regional specialists | Local sourcing, custom formulations, quick response processing | Agricultural proximity, flexible processing | Scale limitations; export barriers |

| Organic pioneers | Certification chains, traceable sourcing, clean processing | Premium positioning, sustainability credentials | Yield pressures; conversion costs |

| Innovation leaders | Functional blends, fortification tech, application support | Higher margins, differentiation capability | Production complexity; shelf stability |

| Private label suppliers | Cost efficiency, bulk processing, flexible specifications | Volume economics, competitive pricing | Brand value erosion; margin compression |

| Item | Value |

|---|---|

| Quantitative Units | USD 13.6 billion |

| Product Form | Liquid, Powder |

| Nature | Conventional, Organic |

| Distribution Channel | Direct Sales, Distributors, Online Platforms |

| End Use | Beverages, Bakery & Confectionery, Dairy Products, Sauces & Condiments, Pharmaceuticals, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, China, Germany, India, United Kingdom, Japan, Brazil, Canada, France, Italy, and 20+ additional countries |

| Key Companies | Dabur India Ltd., Lemon Concentrate S.L., SAF Group, Döhler GmbH, CitroGlobe, Ingredion Incorporated, SunOpta Inc., Lakewood Organic, Louis Dreyfus Company (LDC Juice), and Kiril Mischeff |

| Additional Attributes | Dollar sales by form & nature categories; regional adoption trends (North America, East Asia, Western Europe); competitive landscape with food processors & beverage manufacturers; manufacturer preferences for quality consistency & supply reliability; integration with beverage production & quality systems; innovations in concentration technology & functional enhancement; sustainable processing solutions with traceability & quality optimization. |

The global lemon juice concentrate market is estimated to be valued at USD 13.6 billion in 2025.

The market size for the lemon juice concentrate market is projected to reach USD 21.1 billion by 2035.

The lemon juice concentrate market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in lemon juice concentrate market are liquid and powder.

In terms of nature, conventional segment to command 80.0% share in the lemon juice concentrate market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Juice Concentrate Market Analysis - Trends & Consumer Insights 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

Unconcentrated Orange Juice Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Concentrate Containers Market Size and Share Forecast Outlook 2025 to 2035

Lemon Compound Market Size and Share Forecast Outlook 2025 to 2035

Lemonade Market Size and Share Forecast Outlook 2025 to 2035

Concentrated Solar Power Market Size and Share Forecast Outlook 2025 to 2035

Concentrate Pods Market Analysis Size and Share Forecast Outlook 2025 to 2035

Juice Extraction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Lemongrass Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lemon Balm Extract Market Analysis by Powder, Liquid, and Capsule Forms Through 2025 to 2035

Lemon Salt Market Trends - Citrus-Infused Seasoning Demand 2025 to 2035

Concentrated Milk Fat Market – Growth, Demand & Forecast 2025 to 2035

Lemon Oil Market Analysis by Form, Application, End Use,Region through 2035

Market Share Breakdown of Lemongrass Oil Manufacturers

Juice Bottle Market Trends & Industry Growth Forecast 2024-2034

Concentrated Whey Market

NFC Juice Market Analysis by Product Type, Product Claim, End-Use Application and by Region from 2025 To 2035

Beef Concentrate Market Size, Growth, and Forecast for 2025 to 2035

Dill Juice Market Analysis by Application and Distribution Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA