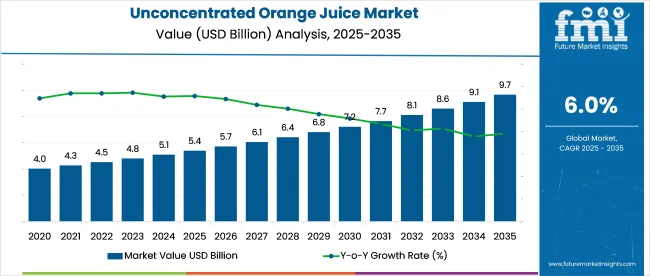

Global demand for unconcentrated orange juice was valued at USD 5.4 billion in 2025 and is forecast to reach USD 9.7 billion by 2035, growing at a 6% CAGR.

It is argued that bottlers investing in high-pressure processing, aseptic PET, and blockchain-based provenance will capture retailer shelf space and defend margin. Competitive intensity is expected to rise as private-label chains integrate vertical squeezing facilities, leaving mid-tier exporters vulnerable unless direct-sourcing contracts are negotiated with growers.

In January 2024, Monica McGurk, CEO of Tropicana Brands Group, emphasized the company’s ongoing commitment to providing high-quality, natural orange juice, stating, “Our limited-edition run of 'Tropcn' orange juice bottles represents our ongoing commitment to delivering the highest quality 100% orange juice to Americans.”

This statement was made during the introduction of Tropicana’s “Tropcn” packaging at CES 2024, designed to showcase the brand’s focus on purity and authenticity. By removing the letters "AI" from its branding, Tropicana reinforced its message that its product contains no artificial ingredients, reflecting its dedication to transparency in the industry.

The industry holds a specialized share within its parent markets. In the fruit juice market, it accounts for approximately 10-12%, as orange juice is one of the most consumed fruit juices globally. Within the broader beverages market, its share is around 3-5%, given the large variety of both alcoholic and non-alcoholic drinks. In the organic food and beverages market, unconcentrated orange juice contributes about 2-3%, particularly as organic variants gain popularity among health-conscious consumers.

Within the packaged food market, its share is around 2-4%, reflecting the widespread availability of prepackaged juices. In the healthy and functional beverages market, the share is approximately 5-7%, as orange juice is often advertised for its health benefits, particularly its high vitamin C content.

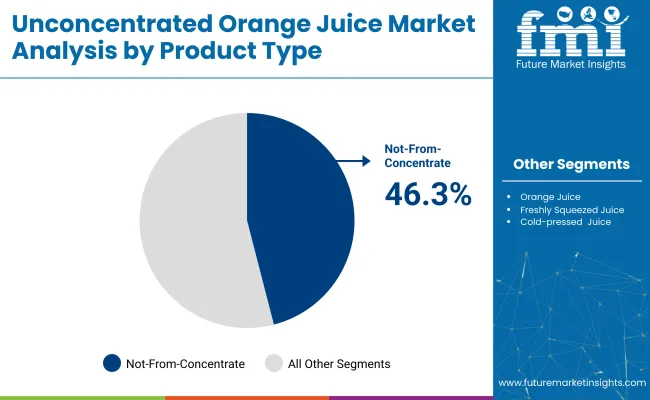

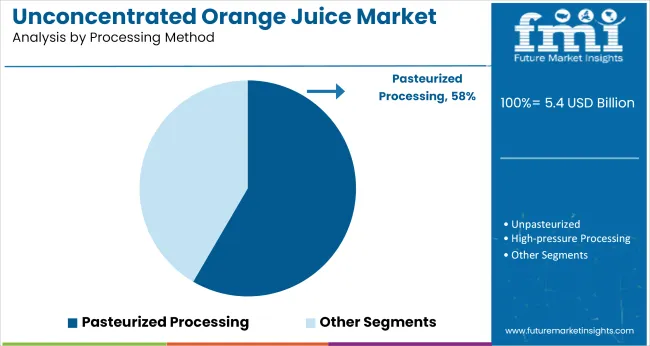

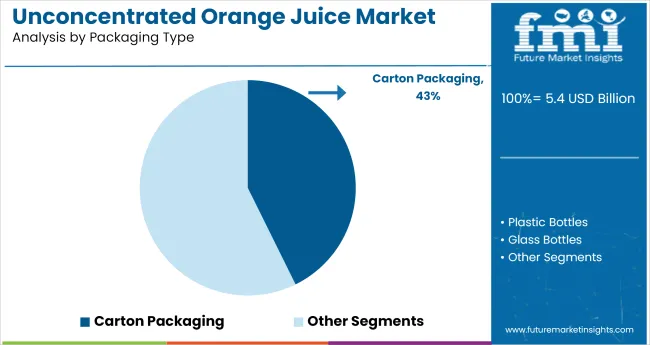

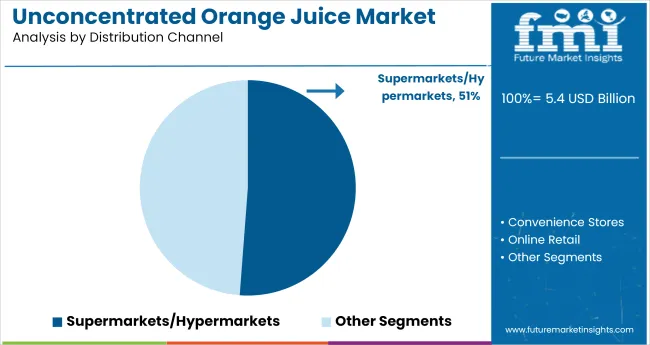

The industry is set to grow with NFC products leading the way at 46.3% industry share in 2025. Pasteurized processing will dominate at 58.4%, carton packaging will capture 42.7%, and supermarkets/hypermarkets will be the primary distribution channel with 51.2% share.

NFC orange juice is expected to dominate the industry, holding 46.3% of the share in 2025. It is preferred for its natural taste, aroma, and nutritional content, particularly among health-conscious consumers. Freshly squeezed and cold-pressed variants are seeing rising demand in premium and organic categories. NFC’s clean-label and unprocessed appeal makes it popular in both retail and foodservice sectors. Increasing demand from cafes and organic specialty stores further supports this trend. The ongoing premiumization of beverages is also expected to sustain the demand for NFC orange juice across global industries.

Pasteurized orange juice is projected to hold 58.4% of the industry share in 2025. This method remains the most common due to its ability to ensure microbiological safety and extend product shelf life, making it suitable for mass-market and specialty juice products. High-pressure processing (HPP) and pulsed electric field (PEF) techniques are increasingly being used in premium and organic juices for better flavor and nutrient retention, but pasteurization still dominates due to its scalability and cost-effectiveness. Pasteurized juice remains the industry standard for large-scale operations and supermarkets.

Carton packaging is expected to lead the packaging segment, capturing 42.7% of the industry share in 2025. The demand for cartons is driven by the growing consumer preference for sustainable and recyclable materials. Carton packaging, such as Tetra Pak and Pure-Pak, is lightweight, cost-effective, and provides excellent protection for orange juice.

While plastic bottles (PET and HDPE) remain popular for their convenience and portability, and glass bottles serve the premium segment, cartons are increasingly favored for their eco-friendly appeal. This trend is influencing major beverage manufacturers to adopt carton packaging worldwide.

Supermarkets and hypermarkets are projected to hold 51.2% of the distribution channel industry share in 2025. These retail giants offer a broad selection of the products, competitive pricing, and frequent promotions, making them the preferred choice for consumers. Convenience stores are also significant, particularly in urban areas where accessibility is key.

The growing popularity of online retail platforms and health-focused beverage subscriptions is contributing to rapid growth in e-commerce. The foodservice and HoReCa sectors remain important contributors due to the high demand for fresh, high-quality orange juice in cafes and restaurants.

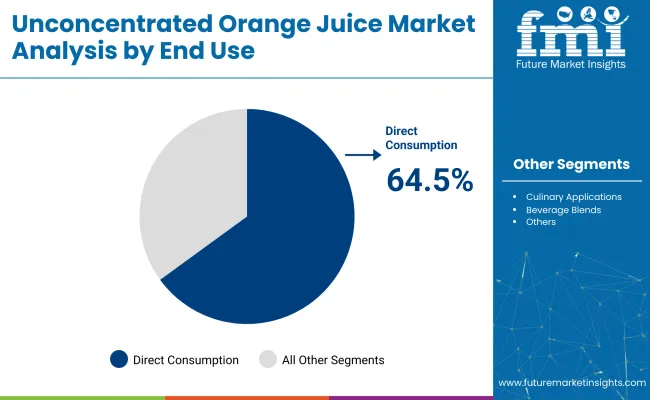

Direct consumption is expected to dominate the end-use segment, capturing 64.5% of the industry share in 2025. The orange juice is a popular choice as a health drink or breakfast staple due to its natural flavor and high nutrient content. The growing trend of beverage blends, such as smoothies and energy drinks, is also utilizing NFC and cold-pressed juices for better taste and functionality.

While culinary applications like sauces and marinades are growing, they represent a smaller industry segment. The focus on functional beverages incorporating orange juice for its vitamin C content further supports direct consumption as the largest revenue contributor.

The industry is growing due to rising demand for fresh, nutrient-rich beverages. Challenges such as supply chain disruptions, crop diseases, and price volatility for juice-grade oranges are impacting availability and pricing, prompting producers to enhance resilience.

Increasing Demand for Fresh and Nutrient-Rich Beverage Options

The industry is growing due to increasing consumer preference for fresh, "not from concentrate" juices. Consumers are drawn to the natural taste, vitamin C, and immune-boosting benefits of these juices. Registered dietitians promote the health advantages of vitamin C, potassium, and phytonutrients found in 100% orange juice. Fresh-squeezed options are favored for vitamin retention, while innovations in packaging help preserve flavor. At-home consumption for culinary uses like marinades and dressings is on the rise, with food-service operators incorporating unconcentrated juice into their offerings.

Supply Chain Disruptions and Commodity Price Volatility Impact Availability

The industry faces challenges due to supply chain disruptions caused by crop diseases and weather-related events. Issues like citrus greening disease and hurricanes in Florida and Brazil have resulted in significant supply shortages, affecting production schedules and retail pricing. Volatile prices for juice-grade oranges impact overall industry stability. In response, producers are adjusting sourcing strategies, blending varieties, and investing in cold storage and juicing capacity to enhance supply chain resilience and reduce the impact of these disruptions.

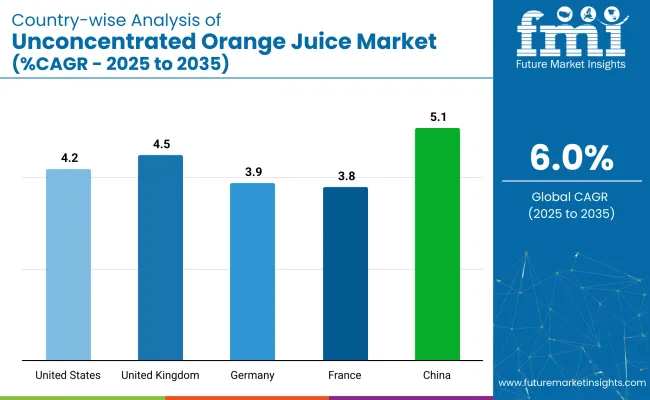

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.2% |

| United Kingdom | 4.5% |

| Germany | 3.9% |

| France | 3.8% |

| China | 5.1% |

Global Industry demand is projected to rise at a 6% CAGR from 2025 to 2035. Of the five profiled countries out of 40 covered, China leads at 5.1%, followed by the United States at 4.2%, and the United Kingdom at 4.5%, while Germany posts 3.9% and France records 3.8%.

These rates translate to a growth premium of -15% for China, -30% for the United States, and -32% for the United Kingdom versus the baseline, while Germany and France trail with more moderate growth. Divergence reflects local catalysts: growing demand for fresh and health-focused beverages in China, while mature markets in Europe and the USA show slower growth due to industry saturation and shifting consumer preferences towards newer beverage trends.

The sales in the United States are forecast to grow at a CAGR of 4.2% from 2025 to 2035. This growth aligns with evolving consumer preferences for natural, clean-label beverages with minimal processing. Strong demand originates from the breakfast category, reinforced by innovations in cold-pressed and organic variants that appeal to wellness-conscious shoppers. National brands continue to launch fortified juices enriched with vitamin D and antioxidants to capture demand in health-focused retail channels.

The demand in the United Kingdom is estimated to grow at a CAGR of 4.5% between 2025 and 2035. Consumer preference for low-sugar, natural beverages is driving consistent demand across supermarkets, health-food chains, and subscription models. Sustainability messaging-centered on recyclable packaging and emissions reduction-reinforces buyer trust. Retailers categorize not-from-concentrate juice alongside functional drinks and whole-food snacks.

The industry in Germany is set to record a CAGR of 3.9% from 2025 to 2035. A preference for organic and authentic food options underpins juice segment expansion. Bio-focused grocery outlets and organic retail chains offer cold-pressed orange juices sourced through eco-certified supply chains. Consumer advocacy for sugar-free beverages contributes to low-acid, unfiltered product innovations.

The industry in France is projected to expand at a CAGR of 3.8% from 2025 to 2035. Fresh juice aligns with France’s gastronomic preferences, particularly among cafes, hotels, and upscale grocers. Minimal processing, no added sugar, and transparent sourcing are valued by consumers, particularly in metropolitan regions. Government-endorsed health frameworks encourage natural beverage consumption to reduce lifestyle-related disorders.

The demand in China is expected to grow at a CAGR of 5.1% from 2025 to 2035. Rising income levels, combined with consumer interest in wellness, are driving NFC juice sales across modern trade and e-commerce platforms. Cold-chain expansion allows fresh juice delivery in tier-one and tier-two cities. Local and international brands emphasize zero additives, sugar reduction, and quality assurance certifications.

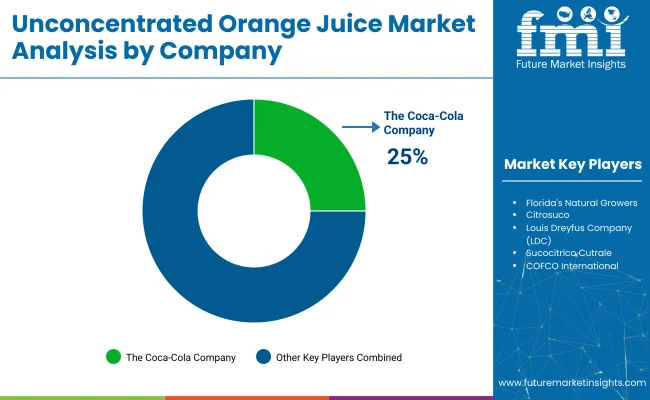

Leading Company - The Coca-Cola Company (Minute Maid, Simply Orange)

Industry Share - 25%

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as The Coca-Cola Company (Minute Maid, Simply Orange), PepsiCo, Inc. (Tropicana), and Florida's Natural Growers lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across North America, Europe, and Latin America. Key players including Citrosuco, Louis Dreyfus Company (LDC), and SucocitricoCutrale offer specialized solutions tailored to specific applications and regional industries.

Emerging players, such as Uncle Matt's Organic, Rauch Fruchtsäfte GmbH & Co OG, and Huiyuan Juice Group Limited, focus on innovative technologies and cost-effective solutions, expanding their presence in the global industry.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025E) | USD 5.4 billion |

| Projected Industry Size (2035F) | USD 9.7 billion |

| CAGR (2025 to 2035) | 6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value & thousand liters for volume |

| By Product Type (Segment 1) | Not-From-Concentrate (NFC) Orange Juice, Freshly Squeezed Orange Juice, Cold-pressed Orange Juice, Premium Unconcentrated Orange Juice |

| By Processing Method (Segment 2) | Pasteurized, Unpasteurized, High-Pressure Processing (HPP), Pulsed Electric Field (PEF), Others |

| By Packaging Type (Segment 3) | Carton Packaging (Tetra Pak, Pure-Pak, Others), Plastic Bottles (PET Bottles, HDPE Bottles, Others), Glass Bottles, Bulk Packaging (Bag-in-Box, Aseptic Tanks, Drums, Others) |

| By Distribution Channel (Segment 4 ) | Supermarkets & Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Foodservice (HoReCa: Hotel, Restaurant, Café; Institutional; Other Foodservice), Others |

| By End Use (Segment 5 ) | Direct Consumption, Culinary Applications, Beverage Blends, Functional Beverages, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | USA, Canada, Germany, UK, France, Spain, Italy, Netherlands, Rest of Europe, China, India, Japan, Australia, South Korea, Rest of Asia Pacific, Brazil, Mexico, Argentina, Rest of Latin America, Saudi Arabia, South Africa, UAE, Rest of Middle East and Africa |

| Key Players Influencing the Industry | The Coca-Cola Company (Minute Maid, Simply Orange), PepsiCo, Inc. (Tropicana), Florida's Natural Growers, Citrosuco, Louis Dreyfus Company (LDC), Sucocitrico Cutrale, COFCO International, Uncle Matt's Organic, Rauch Fruchtsäfte GmbH & Co OG, Trade Winds Citrus Limited, Ventura Coastal LLC, Nestle S.A., ITC Limited, Sumol + Compal Marcas S.A., Huiyuan Juice Group Limited |

| Additional Attributes | Dollar sales, share, NFC demand growth, premiumization trends, innovations in cold-pressed and clean-label juices, expansion of online and HoReCa distribution, sustainability-focused packaging developments |

The segmentation includes not-from-concentrate orange juice, freshly squeezed orange juice, cold-pressed orange juice, and premium unconcentrated orange juice.

Processing methods cover pasteurized, unpasteurized, high-pressure processing, pulsed electric field, and others.

Packaging formats include carton packaging, plastic bottles, glass bottles, bulk packaging, and others.

Distribution occurs through supermarkets & hypermarkets, convenience stores, online retail, specialty stores, foodservice, and others.

End-use categories include direct consumption, culinary applications, beverage blends, functional beverages, and others.

The industry spans North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry value of the in 2025 is USD 5.4 billion.

The industry is projected to reach USD 9.7 billion by 2035, with a 6% CAGR.

Direct consumption will lead the industry with a 64.5% share in 2025.

The United States will lead the industry with a 4.2% CAGR from 2025 to 2035.

The Coca-Cola Company (Minute Maid, Simply Orange) is the leading company in the industry with a 25% share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Orange Juice Market Share

Orange Compound Market Size and Share Forecast Outlook 2025 to 2035

Juice Extraction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Orange Terpenes Market Size and Share Forecast Outlook 2025 to 2035

Juice Concentrate Market Analysis - Trends & Consumer Insights 2025 to 2035

Market Share Insights for Orange Extract Suppliers

Juice Bottle Market Trends & Industry Growth Forecast 2024-2034

NFC Juice Market Analysis by Product Type, Product Claim, End-Use Application and by Region from 2025 To 2035

Dill Juice Market Analysis by Application and Distribution Through 2035

Acid Orange Market

Lemon Juice Concentrate Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Fruit Juice Packaging Providers

Fruit Juice Packaging Market Growth – Trends & Forecast through 2035

Celery Juice Market Size, Growth, and Forecast for 2025 to 2035

Sugar Beet Juice Extract Market Analysis by Confectionery, Cosmetics & Personal care, Dietary supplements, Sports Nutrition, Biofuel Through 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Reconstituted Juice Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

Demand for Fruit Juice Packaging in Japan Size and Share Forecast Outlook 2025 to 2035

Fruit And Vegetable Juice Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA