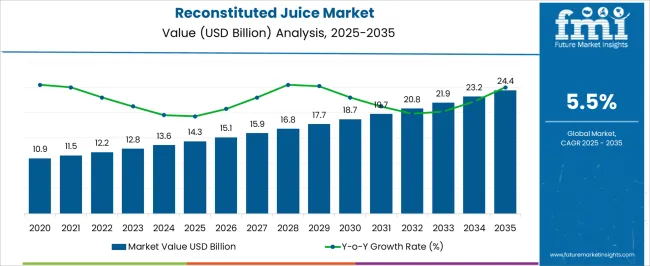

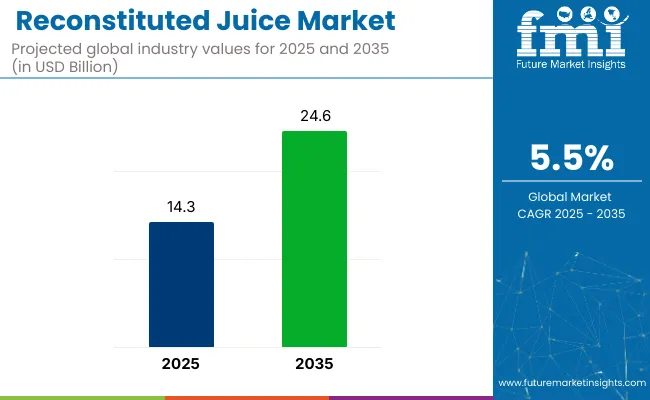

The global reconstituted juice market is worth USD 14.3 billion in 2025 and is expected to reach USD 24.6 billion by 2035, reflecting a CAGR of 5.5%. The market expansion will be driven by rising consumer demand for shelf-stable, nutritious, and convenient beverage options.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 14.3 billion |

| Projected Value (2035F) | USD 24.6 billion |

| CAGR (2025 to 2035) | 5.5% |

Increased urbanization, changing dietary habits, and growing health consciousness will continue to fuel interest in juice products that retain flavor and nutrition. Additionally, advancements in food processing and storage technologies have enabled longer shelf life and wider distribution, thereby supporting the market’s growth.

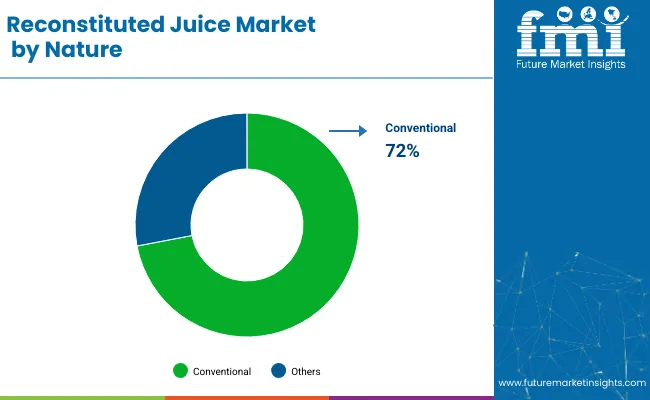

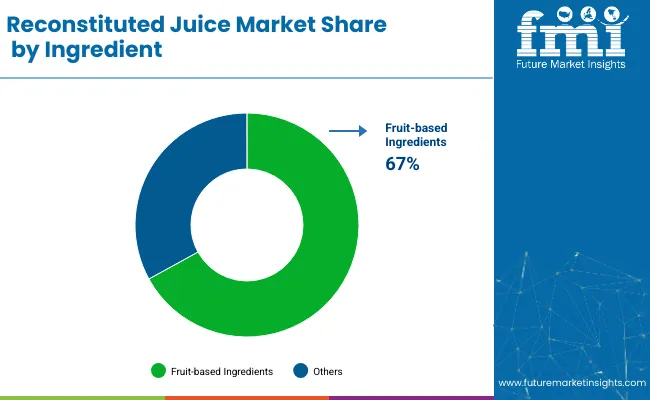

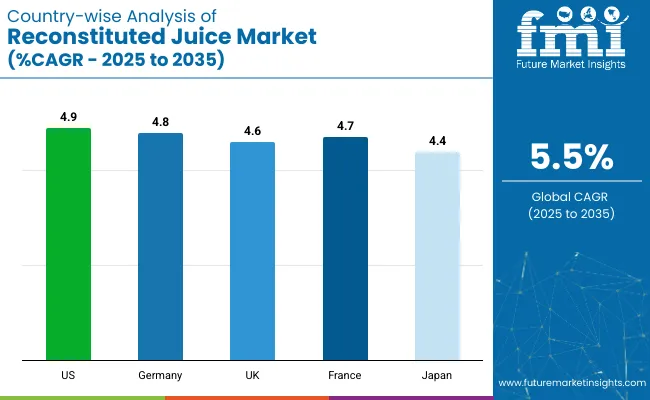

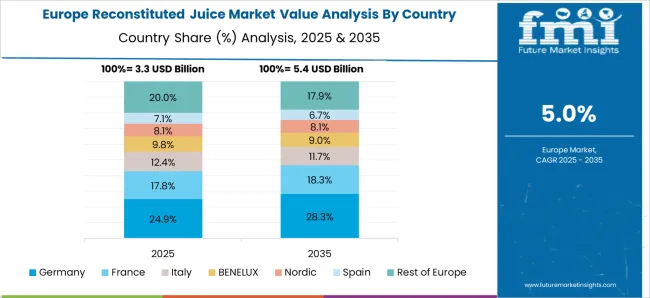

In terms of country performance, the USA will account for the largest share of global revenue, growing at a significant CAGR of 4.9%. Meanwhile, Germany and France are expected to emerge as the fastest-growing markets with projected CAGRs of 4.8% and 4.7% respectively. By nature type, the conventional segment is projected to lead with a 72% market share, while by ingredient, fruits are expected to dominate with a 67% market share in 2025.

The market holds a notable share within its parent markets, accounting for approximately 38% of the global fruit juice market due to its cost-effectiveness and long shelf life. Within the broader beverage market, it captures around 6%, while it constitutes roughly 12% of the non-alcoholic beverage segment.

In the packaged food and beverage market, reconstituted juice holds a 4% share, reflecting its consistent demand in retail and foodservice. It also comprises nearly 55% of the juice concentrate market, given its reliance on concentrates as raw material. In the functional beverage category, its share remains modest at 3%.

Going forward, innovation in sugar-free and vitamin-enriched reconstituted juice products will be emphasized to attract health-conscious consumers. Recent government regulations around clean-label products and reduced sugar content have influenced R&D priorities.

In addition, technological advancements such as aseptic packaging and water treatment used in reconstitution processes are helping companies offer safer, more appealing products. Regulatory support and shifting consumer preferences will shape the future growth trajectory of the reconstituted juice market.

The market is segmented by Nature, ingredient, end-use, packaging, distribution channel and region. By nature, it is segmented into organic and conventional. By ingredient, it includes fruit, vegetables, mixed fruits and vegetables. By end use, it is segmented into HoReCa and household/retail.

By packaging, it includes retail, bottle, can, tetra pak and bulk. By distribution channel, it is segmented into direct/B2B, indirect/B2C, hypermarkets/supermarkets, modern grocery stores, discount stores, specialty stores and e-retail. By region, it covers North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The conventional segment dominates the reconstituted juice market, projected to hold a 72% share in 2025, driven by affordability, mass-scale production, and global availability. Organic reconstituted juices are gaining momentum in niche consumer circles, especially in Europe and North America, owing to clean-label trends and perceived health benefits.

Fruit-based ingredients lead the market with a 67% share in 2025, owing to widespread consumer preference for orange, apple, and mixed fruit reconstituted juices. Vegetables and exotic fruit blends are seeing increased demand in functional beverages and detox formulations. Innovative combinations are also being introduced in sports and fitness drinks, targeting health-conscious urban demographics.

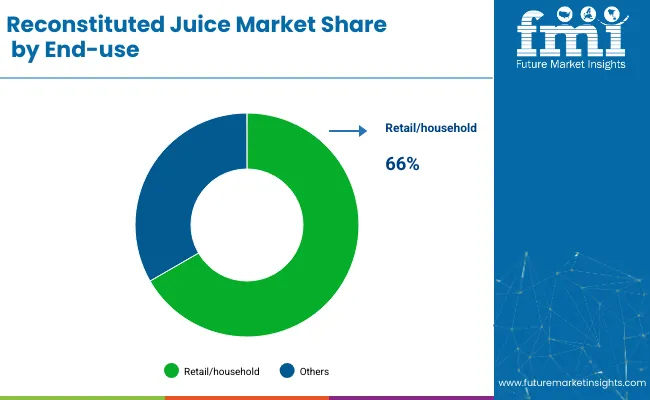

Retail/household consumption will dominate with a 66% market share in 2025, propelled by daily breakfast routines, rising disposable incomes, and health-focused lifestyles. The HoReCa segment is expanding steadily through hotels, restaurants, and catering services, offering juice-based cocktails and health beverages. Demand in food manufacturing remains consistent for use in flavored yogurts, confectioneries, and ready-to-drink mixes.

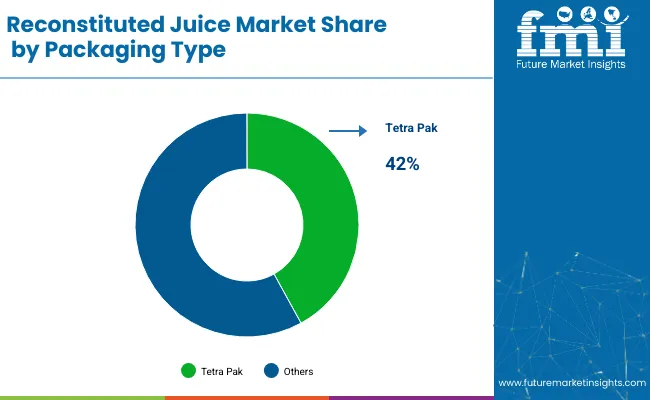

Tetra packs lead with a 42% share in 2025, due to their lightweight nature, long shelf life, and convenience in transport and storage. Bottles (PET and glass) are gaining share in premium and cold-pressed juice categories. Bulk packaging formats like drums or cans cater to industrial and institutional users. Recyclable and sustainable packaging formats are gaining interest due to eco-conscious consumer behavior.

Indirect/B2C sales channels such as supermarkets, hypermarkets, and e-Retail hold the majority, accounting for 58% of the market in 2025, due to broad accessibility and variety. Direct/B2B channels still account for a large portion, primarily for supply to restaurants, schools, and bulk food manufacturers. Online platforms are showing rapid growth, with personalized nutrition and subscription models leading the way.

Recent Trends in the Reconstituted Juice Market

Key Challenges in the Reconstituted Juice Market

Among the top five countries, the USA leads the reconstituted juice market with a projected CAGR of 4.9% from 2025 to 2035, driven by affordable, vitamin-enriched offerings. Germany follows closely at 4.8%, supported by a strong organic segment and institutional demand.

France and the UK show similar momentum with CAGRs of 4.7% and 4.6%, respectively, fueled by premium blends and functional beverages. Japan exhibits the slowest growth at 4.4%, though its market is driven by single-serve innovation and fortified juice formats. Overall, developed nations show steady uptake of functional, clean-label reconstituted juice options.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

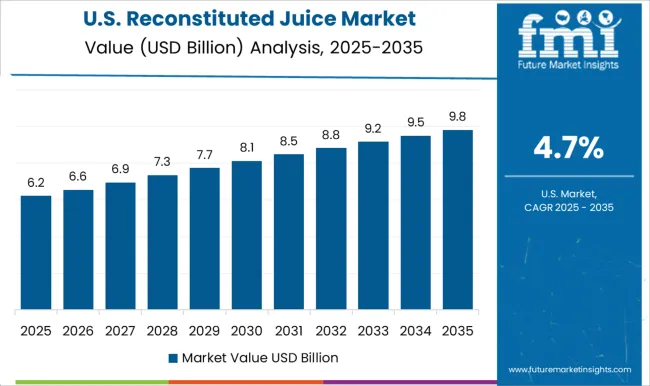

The reconstituted juice revenue in the USA is projected to grow at a CAGR of 4.9% from 2025 to 2035, driven by increasing consumer demand for cost-effective, shelf-stable juice products. Domestic beverage manufacturers are expanding their use of imported fruit concentrates to reduce costs and streamline production. The USA market is also seeing growth in fortified reconstituted juices targeting health-conscious segments.

The reconstituted juice market in the UK is expected to rise at a CAGR of 4.6% from 2025 to 2035, supported by consumer preference for low-sugar, functional beverages. Retailers are launching own-brand reconstituted juice lines with clean-label claims, while sustainability in packaging and sourcing is gaining importance.

The sales of reconstituted juice in Germany are forecasted to flourish at a CAGR of 4.8% from 2025 to 2035, owing to strong consumer preference for healthy, preservative-free juice options. Domestic production leverages European-grown fruits, and processors focus on cold-filled, ambient-stable packaging. Organic variants are also emerging.

The revenue from reconstituted juice in France is anticipated to grow at a CAGR of 4.7% from 2025 to 2035, fueled by demand for premium fruit blends and functional wellness beverages. French consumers continue to favor juice blends with botanical or probiotic additives. The foodservice sector contributes significantly to volume sales.

The reconstituted juice market in Japan is slated to grow at a CAGR of 4.4% from 2025 to 2035, driven by convenience, long shelf life, and expanding vending and retail networks. Japanese consumers prefer fruit juices with enhanced nutritional profiles, and imports from Brazil and ASEAN countries dominate concentrate sourcing.

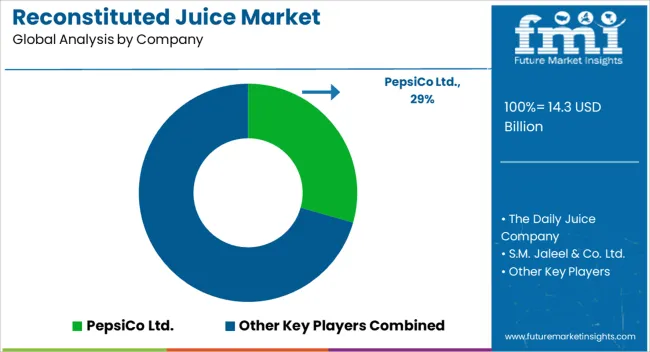

The reconstituted juice market is moderately consolidated, with major players like PepsiCo Ltd., Citrus World Inc., Citrosuco S.A., The Daily Juice Company, and Louis Dreyfus Company B.V. commanding a significant global share. These companies focus on leveraging economies of scale, global supply chain capabilities, and diversified juice portfolios to maintain competitive dominance. Innovation in flavor, clean-label positioning, and sustainability remain central to their strategies.

Top suppliers are competing through product differentiation, strategic regional expansions, private-label partnerships, and increased production of organic and reduced-sugar variants. Companies like PepsiCo are targeting health-conscious consumers with new functional juice offerings, while suppliers like Citrosuco and AGRANA are investing in sustainability initiatives, including carbon reduction in fruit concentrate production and recyclable packaging solutions. Meanwhile, Louis Dreyfus Company is strengthening its downstream integration to maintain pricing flexibility and control over quality standards.

Recent Reconstituted Juice Market News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 14.3 billion |

| Projected Market Size (2035) | USD 24.6 billion |

| CAGR (2025 to 2035) | 5.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions / Volume in metric tons |

| By Nature | Organic, Conventional |

| By Ingredient | Fruit, Vegetable, Mixed Fruits and Vegetables |

| By End-Use | HoReCa (Hotels, Restaurants, and Cafes), Household/Retail |

| By Packaging | Retail, Bottle, Can, Tetra Pak, Bulk |

| By Distribution Channel | Direct/B2B, Indirect/B2C, Hypermarkets/Supermarkets, Modern Grocery Stores, Discount Stores, Specialty Stores, e-Retail |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Middle East & Africa, Oceania |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ Countries |

| Key Players | PepsiCo Ltd., The Daily Juice Company, S.M. Jaleel & Co. Ltd., Citrus World, Inc., Citrosuco S.A., Louis Dreyfus Company B.V., Lemon Concentrate S.L., Frunutex Sp. z o.o., and AGRANA Beteiligungs-AG. |

| Additional Attributes | Dollar sales by value, market share analysis by segments, and country-wise analysis |

The global reconstituted juice market is estimated to be valued at USD 14.3 billion in 2025.

The market size for the reconstituted juice market is projected to reach USD 24.4 billion by 2035.

The reconstituted juice market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in reconstituted juice market are organic and conventional.

In terms of ingredient, fruit segment to command 48.9% share in the reconstituted juice market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Reconstituted Milk Market Size and Share Forecast Outlook 2025 to 2035

Reconstituted Wood Market Size and Share Forecast Outlook 2025 to 2035

Reconstituted Meat Market Size and Share Forecast Outlook 2025 to 2035

Juice Extraction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Juice Concentrate Market Analysis - Trends & Consumer Insights 2025 to 2035

Juice Bottle Market Trends & Industry Growth Forecast 2024-2034

NFC Juice Market Analysis by Product Type, Product Claim, End-Use Application and by Region from 2025 To 2035

Dill Juice Market Analysis by Application and Distribution Through 2035

Lemon Juice Concentrate Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Fruit Juice Packaging Providers

Fruit Juice Packaging Market Growth – Trends & Forecast through 2035

Celery Juice Market Size, Growth, and Forecast for 2025 to 2035

Competitive Overview of Orange Juice Market Share

Sugar Beet Juice Extract Market Analysis by Confectionery, Cosmetics & Personal care, Dietary supplements, Sports Nutrition, Biofuel Through 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

Fruit And Vegetable Juice Market Size and Share Forecast Outlook 2025 to 2035

Unconcentrated Orange Juice Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA